Original Author: Jelly

secondary title

Original source:Redline DAO

introduction

What are Ordinals?

Since the end of December 2022, the emergence of Ordinals and Inscriptions (ordinal numbers and inscriptions) has surprisingly introduced NFTs to this most fundamentalist Bitcoin network. Casey Rodarmor, the creator of Ordinals, said that through this protocol, arbitrary content, such as text, images, videos and even applications, can be added to sequentially numbered "sats" (the smallest unit in Bitcoin) to create unique "digital artificial intelligence". products" and can be transmitted through the Bitcoin network.

Despite the myriad narratives, innovations, and events that the Bitcoin network and asset have endured throughout its turbulent 14-year history, the emergence of BTC NFTs and the pace of their development has been somewhat unexpected. According to Dune's data, as of February 21, more than 153,000 inscriptions have been created, of which the OTC price of Ordinal Punks once reached 9.5 bitcoins, worth $238,000.image description

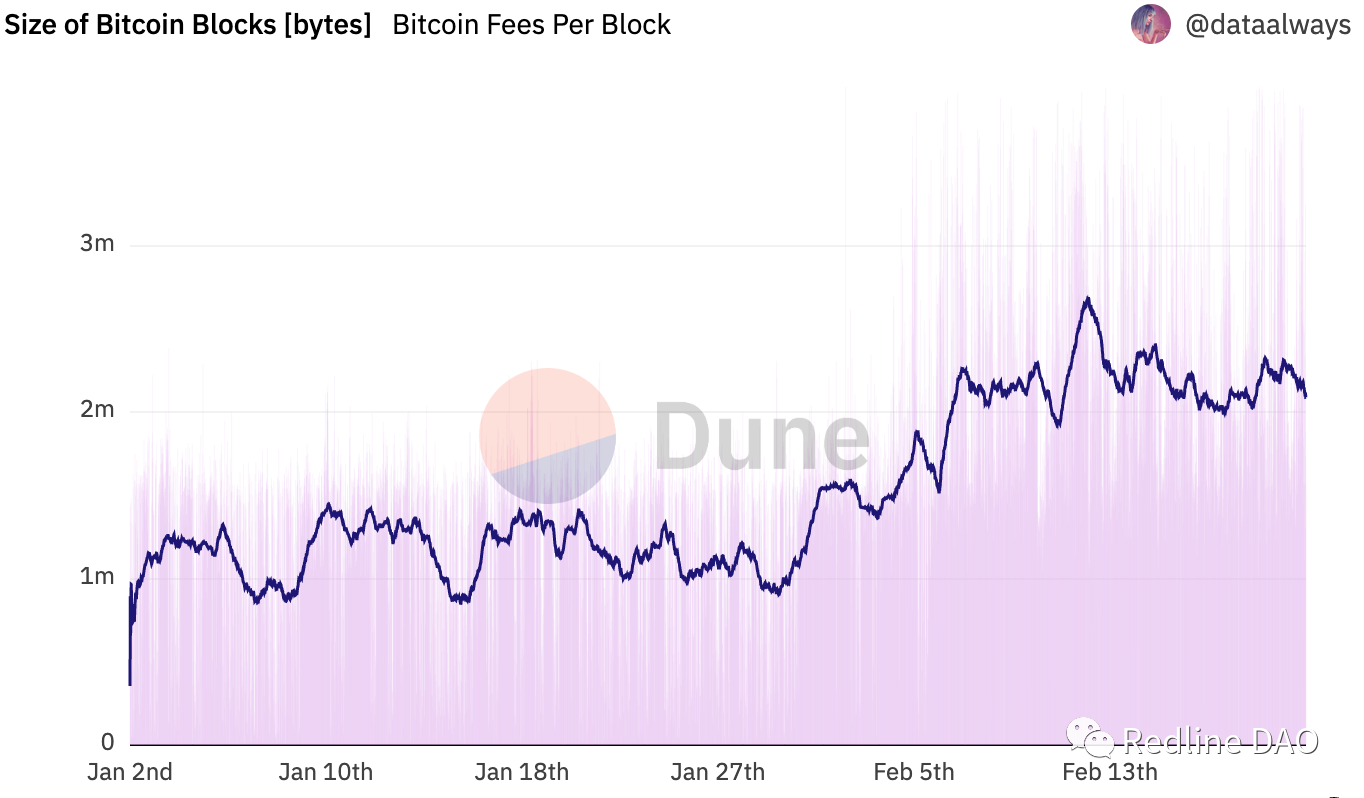

Bitcoin Block Space Requirements Significantly Increased

image description

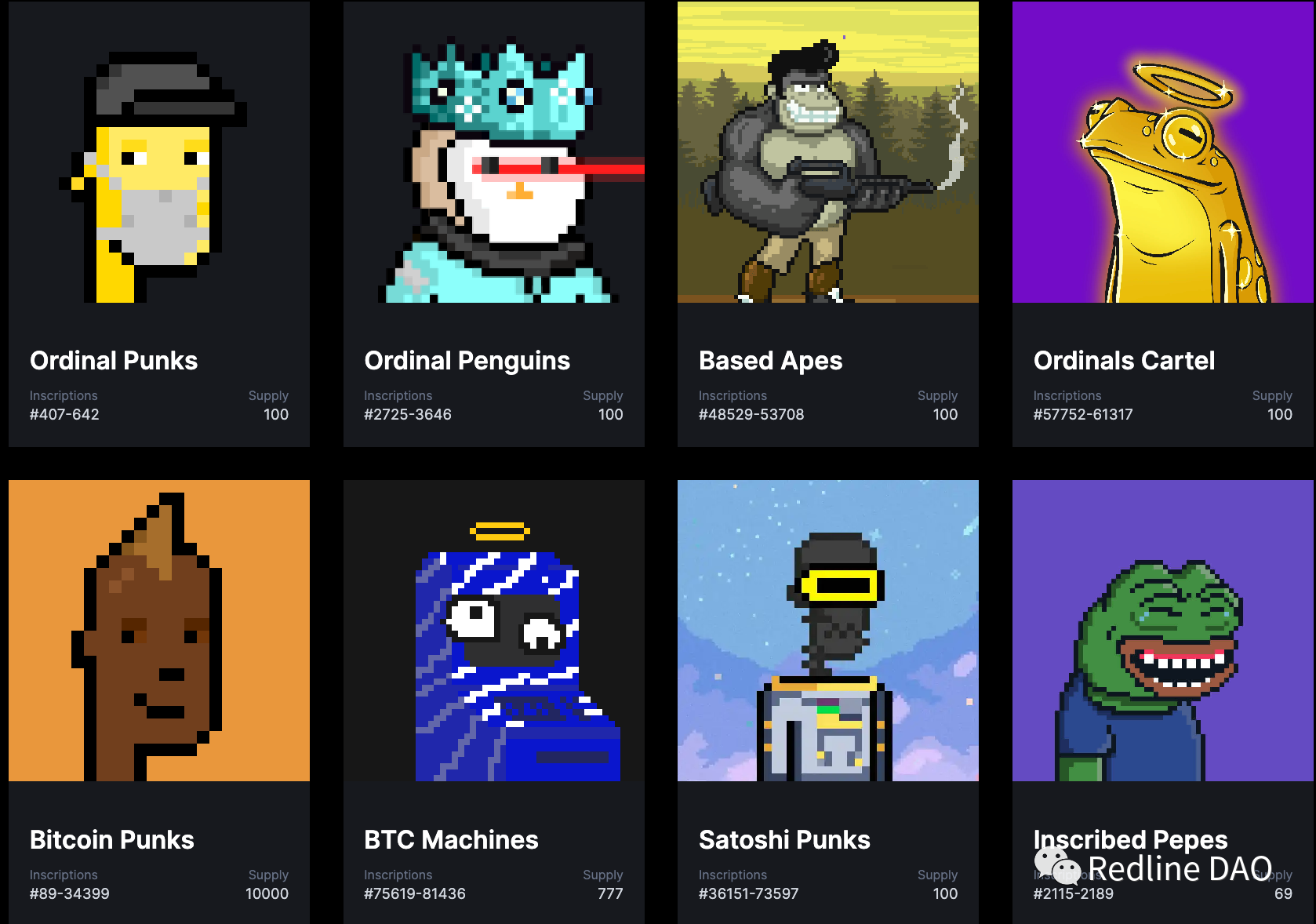

Some NFT Collections on the BTC network

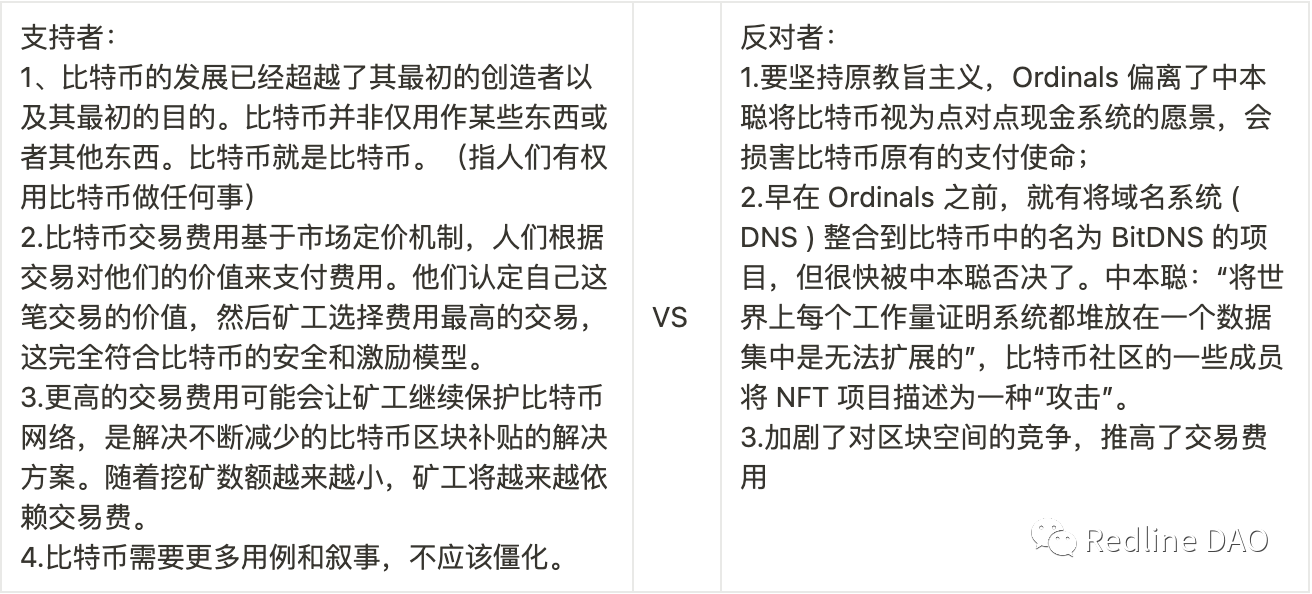

But similar to many events that have happened in the history of BTC, the emergence of Ordinals has once again sparked controversy in the Bitcoin community about whether the Bitcoin network should be used for non-financial purposes and the vision of Bitcoin. A brief summary of the two controversial opinions is as follows:

first level title

Features, advantages and challenges of BTC NFT

On January 21, the Ordinals protocol created by Bitcoin core contributor Casey Rodarmor released version 0.4.0. NFTs on the Bitcoin network finally began to attract attention, and the amount of minting began to soar.

The Ordinals protocol has a numbering scheme that supports tracking and transferring the smallest unit of a single Bitcoin, Satoshi, numbering different Satoshi in the order in which they were mined, and transferring them from transaction input to transaction output in a first-in-first-out order.

After each Satoshi has a unique number as an identity, it can be tracked or traded individually. On this basis, write data (such as images, texts, Video, HTML, etc.) into each Satoshi to complete the transformation of Satoshi from a "bitcoin minimum unit" to a "bitcoin NFT".

The difference between BTC NFT and NFT on other chains:

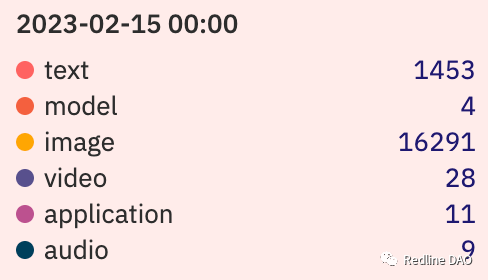

image description

Distribution of BTC NFT volume by category (February 15)

At present, some related ecology of BTC NFT:

Overall, OrdinalsCurrent strengths and challengesfirst level title

The Argument: Bitcoin Scalability

On February 1, 2023, Bitcoin dug up nearly 4 M of the largest block in history, which contained a nearly 4 M largest transaction in history. " Issued, the main data is an NFT, not a hash.

For a while, Blockstream CEO Adam Back, Bitcoin Core developers and others accused the behavior of an attack on Bitcoin. And they are also the witnesses of the famous block size war in the history of BTC. The main objections are as follows:

Blockchain Bloat:This will cause the size of the Bitcoin blockchain to expand rapidly, and the equipment requirements for running full nodes will increase significantly, resulting in a decrease in the number of full nodes in the entire network and a decline in censorship resistance. This is the main reason for rejecting Vatalik's smart contract in OP_RETURN in 2014 and rejecting hard fork expansion in 2017.

Ecological impact:Unexpected huge transactions and huge blocks impacted ecological facilities such as wallets, mining pools, and browsers, causing abnormalities in some facilities. For example, the transaction in the BTC.com browser could not be parsed normally.

Reduced security:In order to reduce the time for synchronizing and verifying huge transactions and blocks, mining pools or miners may choose not to download and generate blocks without verifying the transactions and blocks, which brings security risks.

Before we understand the controversy of this BTC NFT, we might as well briefly review the relevant controversies in the history of BTC:

The past ten years have revolved aroundScalability of BTC(Scalability refers to the ability of the network to handle the growth of the number of users and the number of transactions) The controversy has been chattering, and it has triggered well-known series of events such as the "block war".

Although the Bitcoin network is recognized as the most decentralized and most secure blockchain network, it has also been attacked as the network with the slowest transaction throughput and one of the most conservative networks due to poor scalability. This is due to the existence of the impossible triangle of the blockchain, the block size of Bitcoin is limited, each block can only accommodate so many transactions, and the speed of block generation is limited (a new block is generated about every ten minutes), so Compared with the current popular L2 narrative, the ability of the Bitcoin network to process transactions is very limited.

On October 31, 2008, based on decades of learning and research by those who preceded it in computing, and against the backdrop of a fiat currency-triggered economic crisis (“subprime mortgage crisis”), the perfect The concept of decentralized currency was born with the publication of Satoshi Nakamoto's paper. In fact, he started working on a project called "Bitcoin" in 2007. The subsequent story opened a magnificent blockchain chapter:

On January 3, 2009, the first Bitcoin block was mined: In this block, Satoshi Nakamoto wrote:

image description

Front page of The Times, 3 January 2009

On July 28, 2010, Satoshi Nakamoto presided over a soft fork that fixed a bug in OP_RETURN, which itself is an opcode that can be used to add up to 100 bytes of data.

On September 12, 2010, Satoshi Nakamoto hosted another soft fork that added a 1 MB block size limit, but this was largely a consensus at the community level; but at the database level, it was invalid , so it may be refused to execute, which will bury some hidden dangers in the future.

On October 4, 2010, the developer Jeff Garzik removed the restrictions introduced by Satoshi Nakamoto in his new client, because he was worried that the 1 MB block size limit would affect the future of Bitcoin. Transaction throughput, but was opposed by the community and Satoshi Nakamoto himself (avoid bifurcation, if it affects throughput in the future, it can be changed in a controlled and gradual manner in the future)

On March 11, 2013, during the process of upgrading the Bitcoin protocol from the Berkeley DB data block to the LevelDB database, serious confusion occurred. Some nodes began to accept 0.9 / 1 MB blocks, while those nodes that had not yet upgraded blocks will be rejected.

In May 2013, Peter Todd released the keepbitcoinfree.org website, and said that the block size limit is essentially a moral choice, which corresponds to two values: one is to give miners the opportunity to control the entire network, thereby allowing Bitcoin to be centralized (large Blockists); the other is to hope that Bitcoin is free and everyone can verify independently (small blockists).

In October 2014, the white paper on Bitcoin sidechains was completed, and there was a heated debate in the circle about the combination of privacy, speed and scalability of Bitcoin.

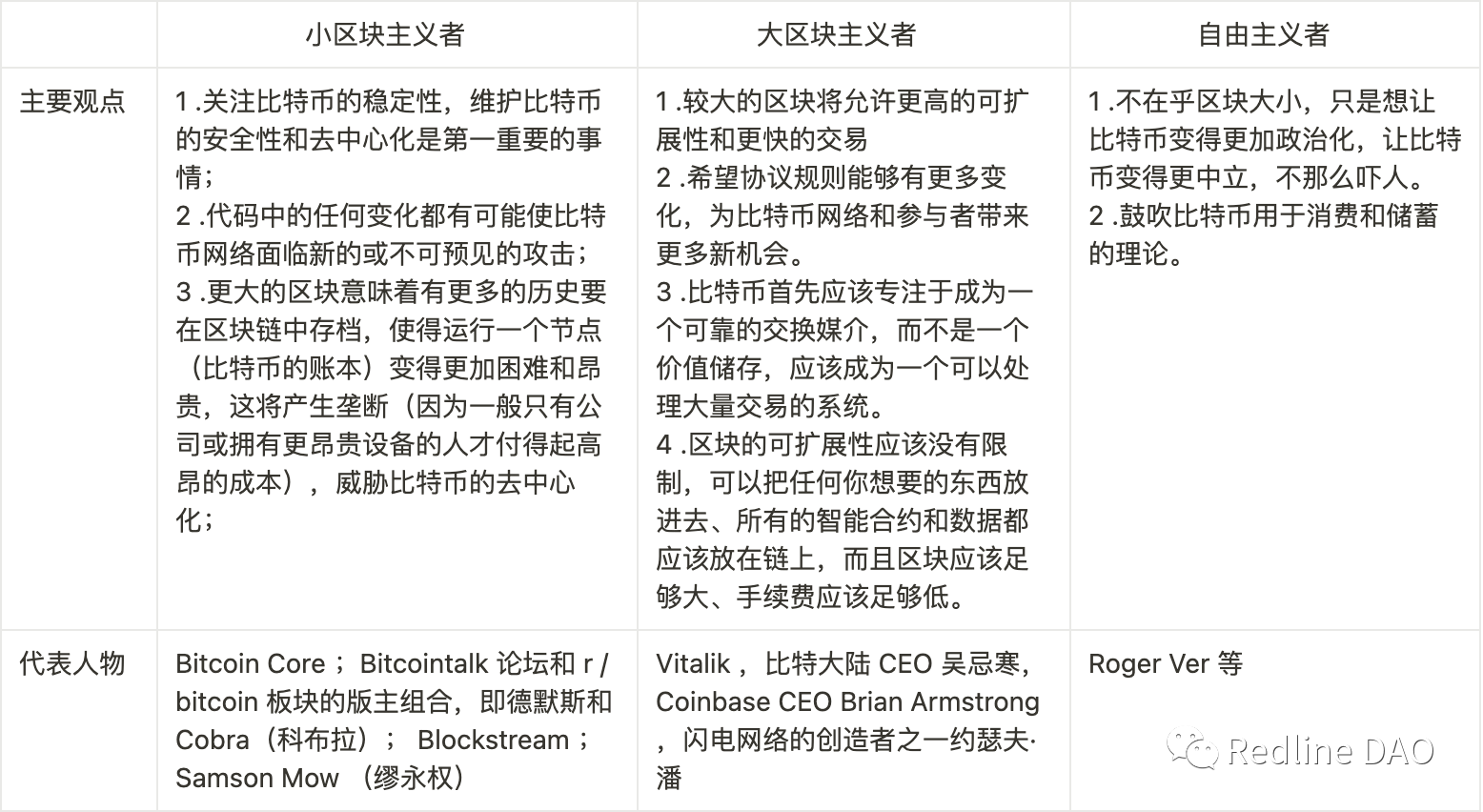

Then in 2015, the block wars surrounding the scalability issue of Bitcoin block space size began to really take place. In a series of debates at that time, we can divide people with obvious tendencies into three factions according to their positions:

At present, some related ecology of BTC NFT:

It was later proved that these debates had a profound impact on Bitcoin and even the blockchain world at that time, and the debate on BTC NFT also originated from this to some extent:

First of all, the tendency of small-block advocates has been retained. They have long been concerned about the decentralization, security and stability of Bitcoin. Many proposed improvements and upgrades also failed to materialize. It is not difficult to understand,The same controversy happened with the Ordinals agreement.

first level title

Founders of Ordinals: SegWit, Taproot

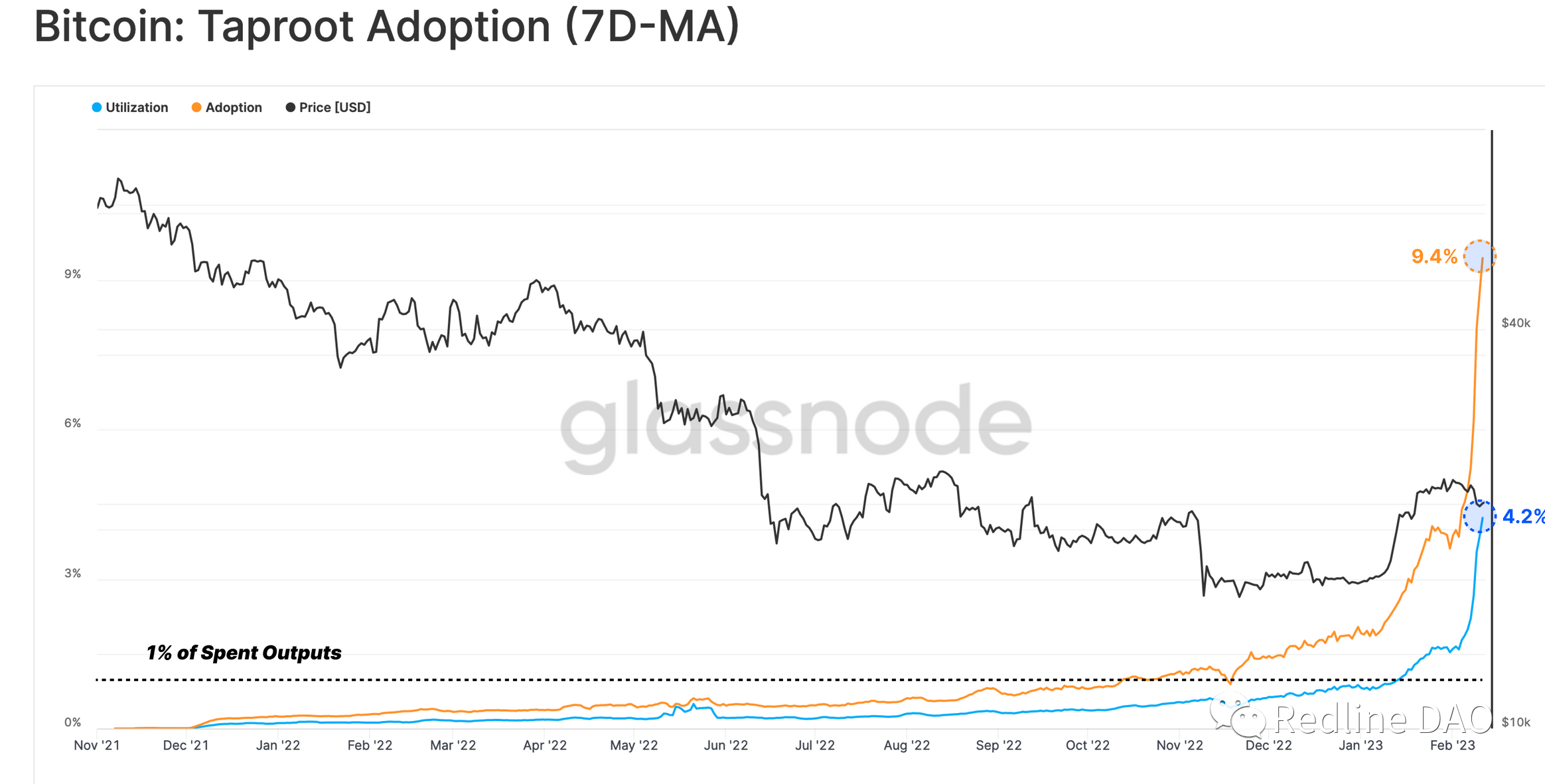

Although the block wars surrounding Bitcoin have gradually subsided, the new narratives and debates surrounding Bitcoin have never stopped. During the debate and in the years that followed, there were two major upgrade events that laid the groundwork for Ordinals.

On August 24, 2017, the SegWit upgrade was activated, which first fixed the transaction's indeterminate vulnerability. Preventing the ID of transactions that have not been confirmed on the chain may change due to changes in the included script or signature itself, making the transaction ID an identifier that unconfirmed transactions can rely on, and it solves the problem caused by the block size limit. caused scalability challenges. After SegWit is enabled, the upper limit of the block size is changed from 1 M to a maximum of 4 MB of data, and more transactions can be inserted into the block, which will reduce the level of handling fees.

image description

Taproot adoption soars

epilogue

epilogue

For investors, on the one hand, they canPay attention to the trading opportunities of high-value and scarce NFTs with "genesis" attributes such as Ordinal Punk,on the other hand canWatch for blockchains such as Litecoin and Bitcoin-like networks to introduce fresh narratives into Ordinals.But at the same time, it should alsoPay attention to the risk of asset prices falling after speculators leave the market after the short-term boom.

After the birth of BTC NFT, it may bring difficult choices again. The first option is to allow NFT to freely enter Bitcoin, "Bitcoin is Bitcoin", no one can stipulate what can be done or not to do based on it; the second option is to implement a hard fork upgrade, and the data of isolated witness The size limit for writing to the consensus. However, because the hard fork is of great importance and requires all nodes to be updated, it is very difficult; the third option is for opponents to reach a partial consensus and reject huge blocks and huge transactions, but this will damage the decentralization of Bitcoin.

references:

references:

1.Bitcoin 101: past, present and future

2.Fidelity: Why Is Bitcoin Irreplaceable?

3.SegWit and its legacy: Taproot, UASFs and Lightning

4.Post-Taproot Era: Re-examining Bitcoin's positioning and narrative in the multi-chain landscape

6.Innovate or attack? The NFT Huge Block on the Bitcoin Chain