Recently, Ordinals inscriptions (also known as Bitcoin NFTs) have become a new trend for NFT creators to follow.

Even though Bitcoin fundamentalists continue to say that NFT violates the "original scenario" of "peer-to-peer electronic cash" and will put too much pressure on this veteran blockchain, the creators will obviously not give up any " opportunities to broaden the narrative.

Today, Yuga Labs, the creator of the strongest IP in the NFT field, officially announced a plan: to launch the NFT series TwelveFold on the Bitcoin blockchain based on the Ordinal protocol.

TwelveFold: New Custom Design from Yuga Labs

Unlike previous series by Yuga Labs, TwelveFold is an original and experimental 300-piece collection of generative art inscribed into Bitcoin's smallest unit, the satoshi, to which an inscribed satoshi can be tracked When was minted via the Ordinal protocol. Inspired by this, "Yuga Labs explored the relationship between time, mathematics and mutability for the TwelveFold collection".

Yuga Labs says TwelveFold is based on a 12 x 12 sized grid, a visual allegory for Bitcoin blockchain data mapping. Also, unlike this column of PFPs such as BAYC, the pieces that make up the TwelveFold collection were produced in-house by Yuga Labs' art team using 3D modeling, algorithmic construction, and high-end rendering tools to pay homage to the serial number inscriptions that are currently done by hand.

The sale of the TwelveFold series will be in the form of an auction, and all bids will be made in Bitcoin. To participate in this auction, buyers will need an empty Bitcoin address to receive this NFT. Because each Bitcoin NFT must be minted individually in its own transaction, with its own fee. If the user's Bitcoin NFT is stored with other Bitcoin assets, the user may face the risk of the original assets being transferred when the NFT is minted.

In fact, Yuga Labs had already spoiled the news to everyone as early as February 24, but at that time only announced the name of "TwelveFold", which was too mysterious and no one could understand it, leaving some easter eggs.

For example, someone discovered a new incubation organization named "TwelveFold". The logo of this organization is exactly the same as that of Yuga Labs, but it has nothing to do with Yuga Labs.

There are also speculations that TwelveFold and the already launchedlicking toad gamerelevant.

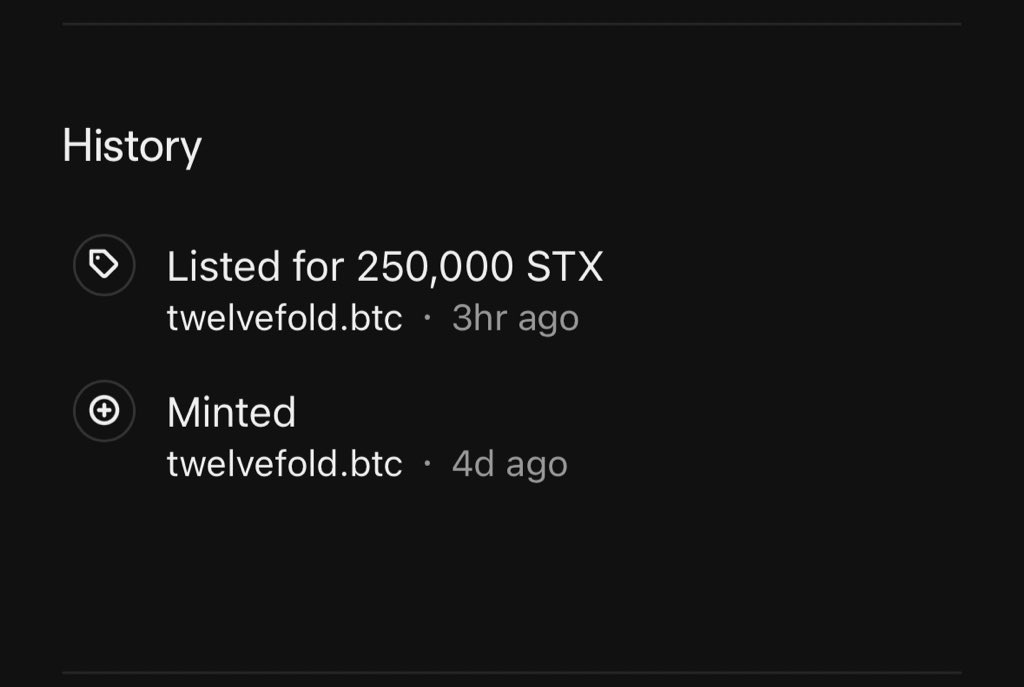

What's more interesting is that some netizens found that "twelvefold.btc" was minted when Yuga Labs mentioned "TwelveFold", and it was listed with 250,000 STX. Could it be that someone had figured out the intention of the questioner at that time?

Although many people have expressed curiosity about "TwelveFold", the specific auction time and details of the TwelveFold series have not yet been announced. Yuga Labs said it will be released through its social media and official news blog 24 hours before the auction.

The Ordinals protocol continues the madness

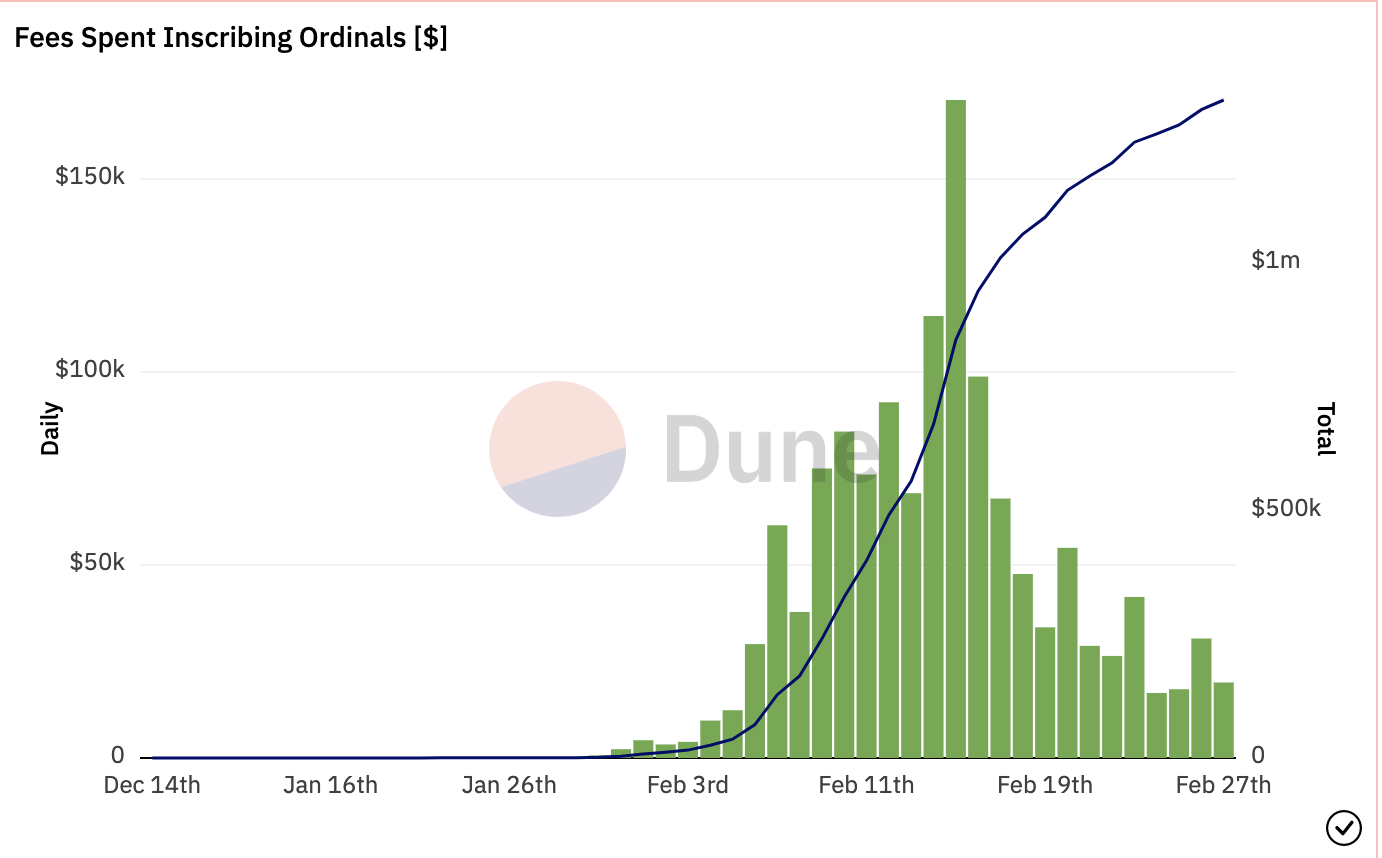

Bitcoin NFT has gradually come into people's sight since the end of January this year. Up to now, the cumulative minting volume of Ordinals has exceeded 200,000 pieces, and the highest single-day minting volume occurred on February 9th, when the NFT minting volume was 21,824 pieces; on February 15th, miners were paid more than $1.31 million in fees.

The surge in over-the-counter transactions of Bitcoin NFTs that were launched early, such as Ordinal punk, has excited more and more NFT enthusiasts. In addition, some blue-chip projects such as DigiDaigaku stated that Digi Genesis collectors will be able to get a Free Bitcoin NFT. DeGods will also mint 535 NFTs based on Ordinals on the Bitcoin chain.

On February 19, software engineer Anthony Guerrera launched the Litecoin Ordinals project on GitHub after forking the GitHub repository for Bitcoin Ordinals.

Although the ecology and infrastructure of Bitcoin NFT are constantly increasing and improving, like other ecological NFT trends, after the heat and passion have cooled, it has gradually become a topic after dinner.

From a data point of view, the daily fee paid to Bitcoin miners has steadily decreased since February 15th and is currently just over $11,000 at the time of writing.

Bitcoin transaction fees depend on the amount of data in the transaction and how quickly the user wishes to complete the transaction. Users wishing to transact during periods of high traffic can decide to pay more to facilitate transactions. Fees rise when the demand to process transactions exceeds the supply of miners. Obviously, the decline in miners' transaction fees further indicates that the demand for Bitcoin NFT is also gradually declining. Compared with the initial enthusiasm, everyone seems to be more rational at present.

Related Reading

Related Reading

Inventory of 16 projects in the Bitcoin NFT protocol Ordinals ecology