Original compilation: 0x11, Foresight News

Original compilation: 0x11, Foresight News

DeFi stablecoins have been hit hard amid the UST crash, but DAI, FRAX and LUSD remain strong. Now, GHO and crvUSD are preparing to join the field with new innovations.

As regulators crack down on BUSD, DeFi stablecoins will usher in new opportunities for development. Here are some bullish cases: 🐂

DAI should be the winner because DAI has a monetary premium (extra value beyond its price) thanks to:

spot liquidity

Proven Dollar Peg

Support a large number of DeFi protocols

Widespread Adoption in the Real World

By the same token, currency premiums apply to all centralized stablecoins. The premium depends on their adoption, compliance, liquidity and trust. Now, the SEC's accusation against BUSD is breaking BUSD's currency premium against USDC and USDT, but it is mainly a premium for DeFi stablecoins.

This articleThis article)

DeFi stablecoins like FRAX and LUSD are building their monetary premiums to catch DAI. They appear to be substitutes, but each serves a purpose.

DAI has shifted its focus to earning income from RWA (Real World Assets), where regulation allows. It aims to be a decentralized, resilient collateral-backedUnbiased World Currency。

Liquity (LUSD) has the same mission: to be "the most decentralized stablecoin that is censorship-resistant of all kinds." However, it achieves this with minimal governance, no RWA exposure, only uses ETH as collateral, and does not give up its USD peg (unlike DAI).

Due to design and immutable smart contracts, LUSD may not be able to surpass DAI in market capitalization. However, it is a niche dollar-pegged stablecoin for those concerned about centralization and censorship risks.

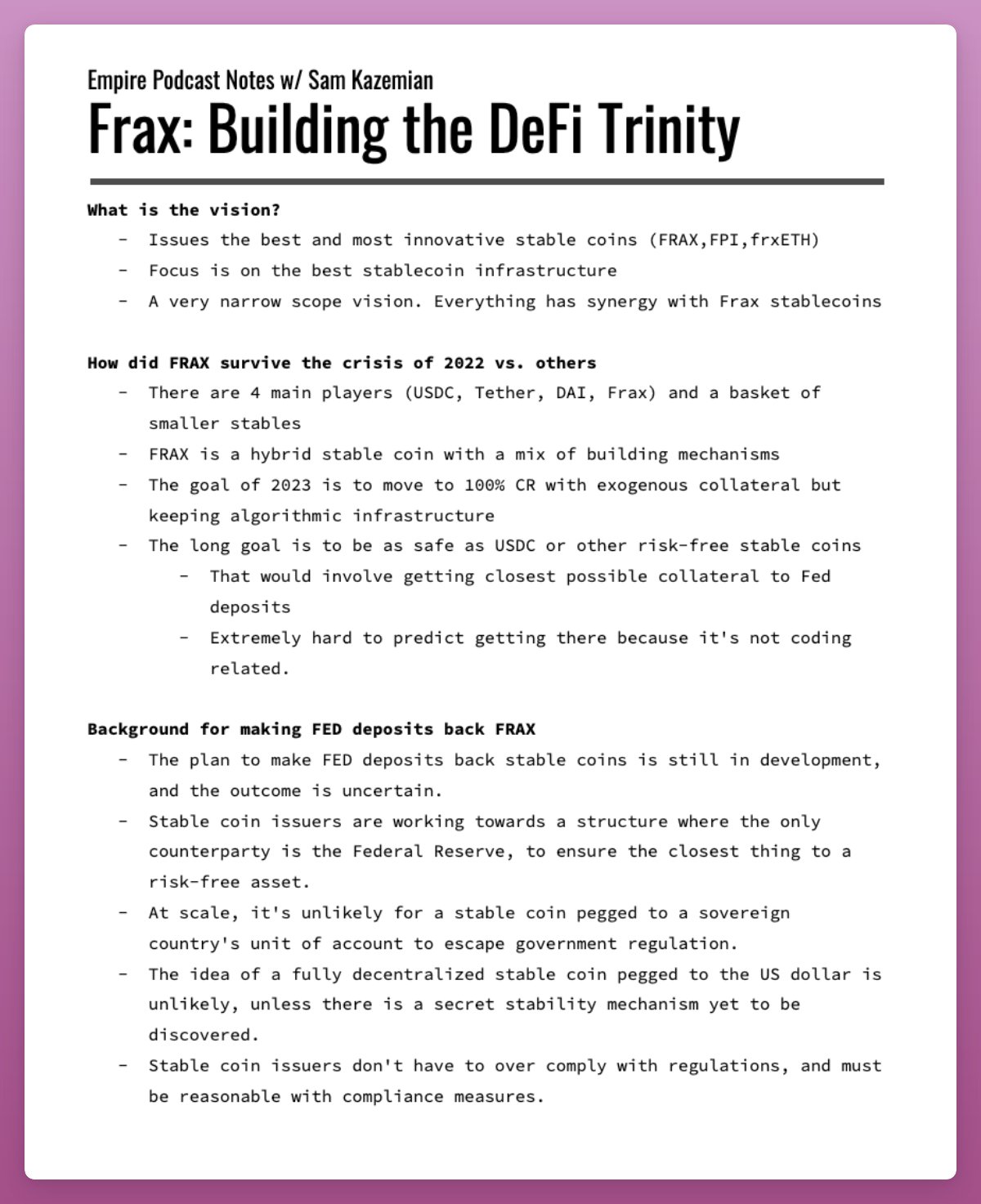

Frax's strategy is different. In an interview with Blockworks, S. Kazemian stated that “dollar-pegged stablecoins do not evade regulation on a massive scale ‘through false or real decentralization’.” They even applied for a Fed master account in order to be as close to the Fed as possible .

The Fed Master Account will allow holding USD and transacting directly with the Fed, making FRAX the closest stablecoin to a risk-free USD. This allows FRAX to get rid of the limitation of USDC as collateral and expand the market value to hundreds of billions of dollars.

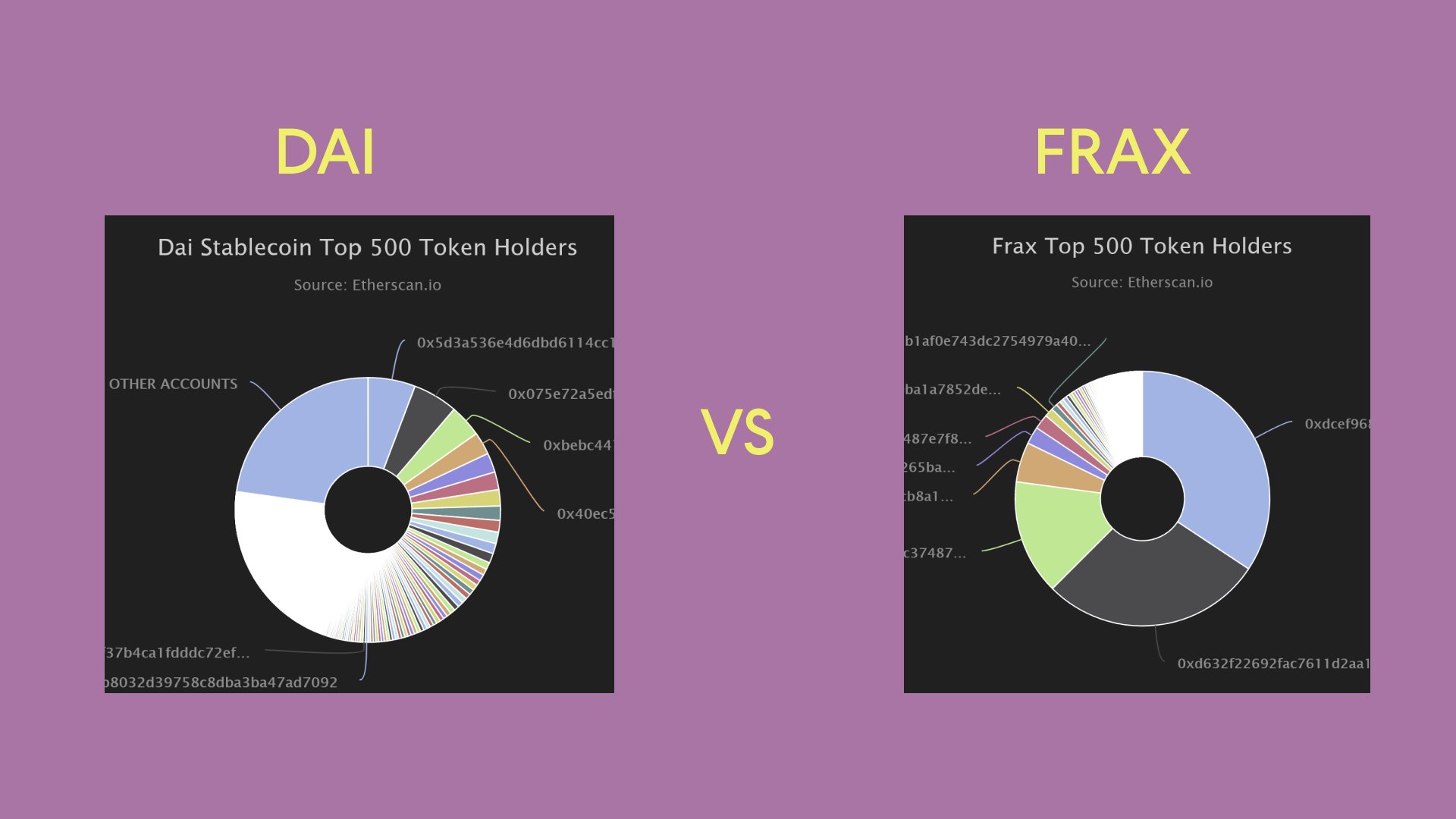

FRAX is not a stable currency in the true sense, it does not have the currency premium of DAI. Currently, FRAX is being used to squeeze every profit out of its cleverly designed flywheel ecosystem. In contrast, most of DAI’s supply is held in wallets as a store of value against market volatility.

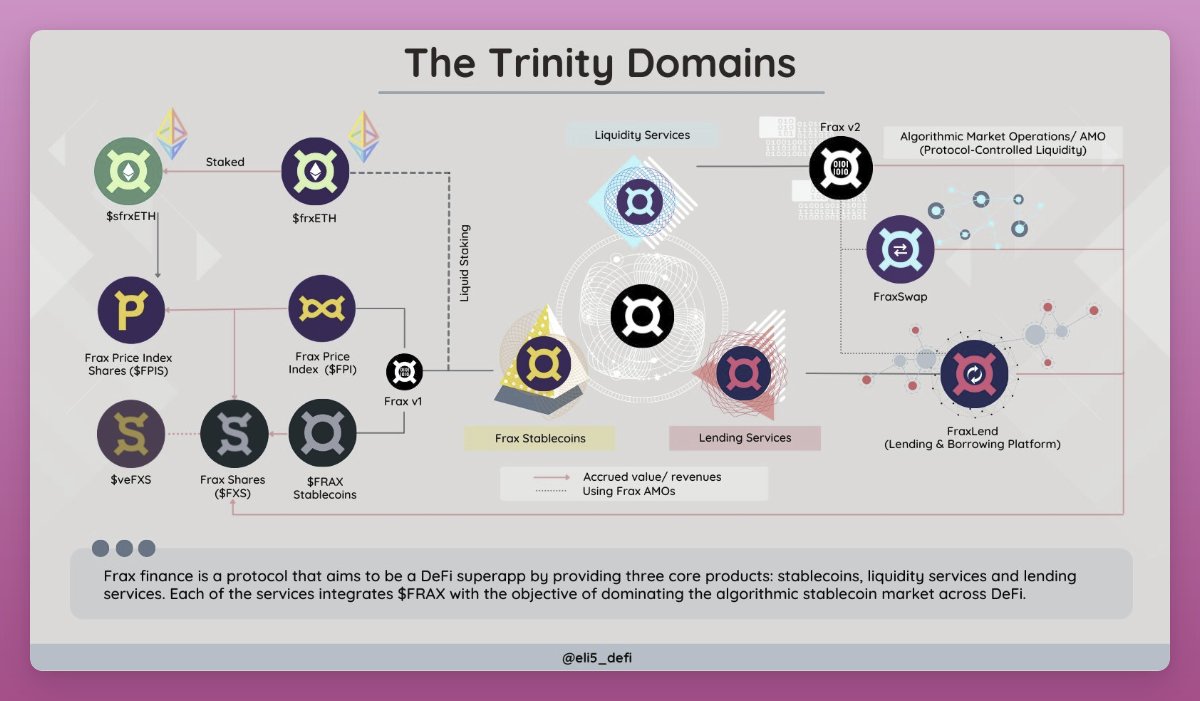

Maximizing revenue and efficiency for Frax is its differentiating factor. Frax has built a complete all-in-one DeFi ecosystem centered on FRAX:

Fraxswap

Fraxlend

Fraxferry (bridge)

frxETH

Every feature helps to enhance the usefulness of FRAX.

Synthetix's sUSD is also pragmatic and closely related to its DeFi ecosystem:

Kwenta - Exchange

Lyra - Options

Polynomial - Structured Vault

Thales - Binary Options

The adoption of sUSD depends on the growth of its DeFi products, but its monetary premium is low.

Maker is moving in an interesting direction, it hopes to build its own DeFi ecosystem like Frax. Maker is building a lending protocol and a synthetic LSD - EtherDAI to create more use cases and demand for DAI.

My initial thought was that the Spark protocol was an obvious competitor to Aave, a counter to $GHO, but that doesn't mean Maker and Aave won't work together in the future.

In fact, I think cooperation can achieve mutual benefit. Let me explain:

Everything at Frax is focused on powering the FRAX stablecoin. Likewise, Maker's new protocol will help increase the utility of DAI. For Maker, DAI as an unbiased world currency is the ultimate goal, and the new agreement is also to achieve this goal.

But Aave's mission is different: it seeks to become the #1 money market protocol, and GHO is the vehicle to achieve that goal.

In short: DAI is the mission, the Spark protocol is a tool; for Aave, the money market is the mission, and GHO is the tool.

The Venus stablecoin VAI is a good example. It is a successful lending protocol on BNB Chain with a TVL of $855 million. At its peak market capitalization of $250 million, the supply of VAI was greater than that of FRAX. But now it is trading below the peg ($0.94) with a 24-hour volume of just $60,000.

VAI is not at the core of Venus, its mission is to serve the lending protocol Nevertheless, $VAI has helped Venus grow to where it is today.

Regardless, all stablecoins can co-exist and even support each other if the founders really think so. Making DAI available on Aave means the protocol can mint more GHO, and GHO can also be supported on the Spark protocol.

The same logic applies to Curve's crvUSD. Curve is the backbone of spot liquidity in DeFi, and crvUSD will help improve the capital efficiency of the protocol. Therefore, crvUSD will not pose a threat to FRAX or DAI, it can actually increase the spot liquidity of all DeFi stablecoins.

Therefore, I am bullish on DeFi stablecoins as they offer unique differentiation. They recognize the importance of regulation, but approach it differently:

DAI and LUSD are censorship resistant, while Frax is as close to the Fed as possible.

Original link