News that the SEC will ban the Paxos stablecoin continues to hit market sentiment.

Earlier this morning, people familiar with the matter revealed that the New York State Department of Financial Services (NYDFS) is investigating Paxos, the issuer of Pax Dollar (USDP) and Binance USD (BUSD) stablecoins, the scope of which is unclear. And the US SEC law enforcement officers have issued a "Wells notice" to Paxos.

The regulatory stick was dropped this afternoon, with the New York State Department of Financial Services ordering Paxos Trust Co. to stop issuing any more BUSD tokens. A Paxos spokesman declined to comment, and the SEC did not respond to a request for comment.

Binance said Paxos Trust Co. informed Binance that it had been instructed to stop minting new stablecoin BUSD. A Binance spokesperson said: “BUSD is a stablecoin wholly owned and managed by Paxos, and as such, the market capitalization of BUSD will only decline over time. Paxos will continue to service the product, manage redemptions, and will Additional information is required. Paxos also warrants that the funds are safe and fully covered by the bank's reserves."

For the majority of users, people are more concerned about whether the BUSD in their hands can still maintain a 1:1 value anchor with the US dollar.secondary title

text

According to information disclosed by Paxos, BUSD is approved and regulated by the New York State Department of Financial Services (NYDFS).

It is worth noting that the issuers of USDC and BUSD are under the supervision of New York State, which has complete and strict financial supervision. Therefore, in our long-standing understanding, compared with USDT, which is not transparent enough, the reserves of BUSD and USDC should be rigidly redeemable.

According to the latest Paxos reserve report, as of the end of January 2023, the BUSD reserve assets are 16,155,717,896 US dollars (approximately 16.2 billion) in net assets. If all BUSD is destroyed and the reserves are real, Paxos is sufficient to complete the redemption of all BUSD.

secondary title

Here comes the question: Is your BUSD the BUSD you thought it was?

In the statement, Binance stated that BUSD is issued and owned by Paxos, and Binance only licenses its brand.However, users need to pay attention to that the BUSD in your hand may not be the same as that mentioned above.

With the advent of the multi-chain era, the free flow of assets between multiple chains has become common. However, cross-chain nodes have become a security risk for assets (whether stolen or actively doing evil) due to their large number of original assets.

Focus on BUSD,The native asset of the token is only issued in Ethereum,image description

(Source: Paxos official website)

This also means that only BUSD on Ethereum is provided with a 1:1 anchor guarantee by Paxos under the supervision of NYDFS for users. Paxos official website also specifically pointed out that Binance-Peg BUSD deployed on Polygon, BNB Smart Chain, and Avalanche has nothing to do with Paxos and is not under the management of NYDFS.

According to DeFiLlama data, BUSD is currently in circulation on 31 chains, of which 11.3 billion are in circulation on Ethereum and 4.8 billion are in circulation on BNB Chain.

Where does the circulating BUSD come from in the 30 chains other than Ethereum?

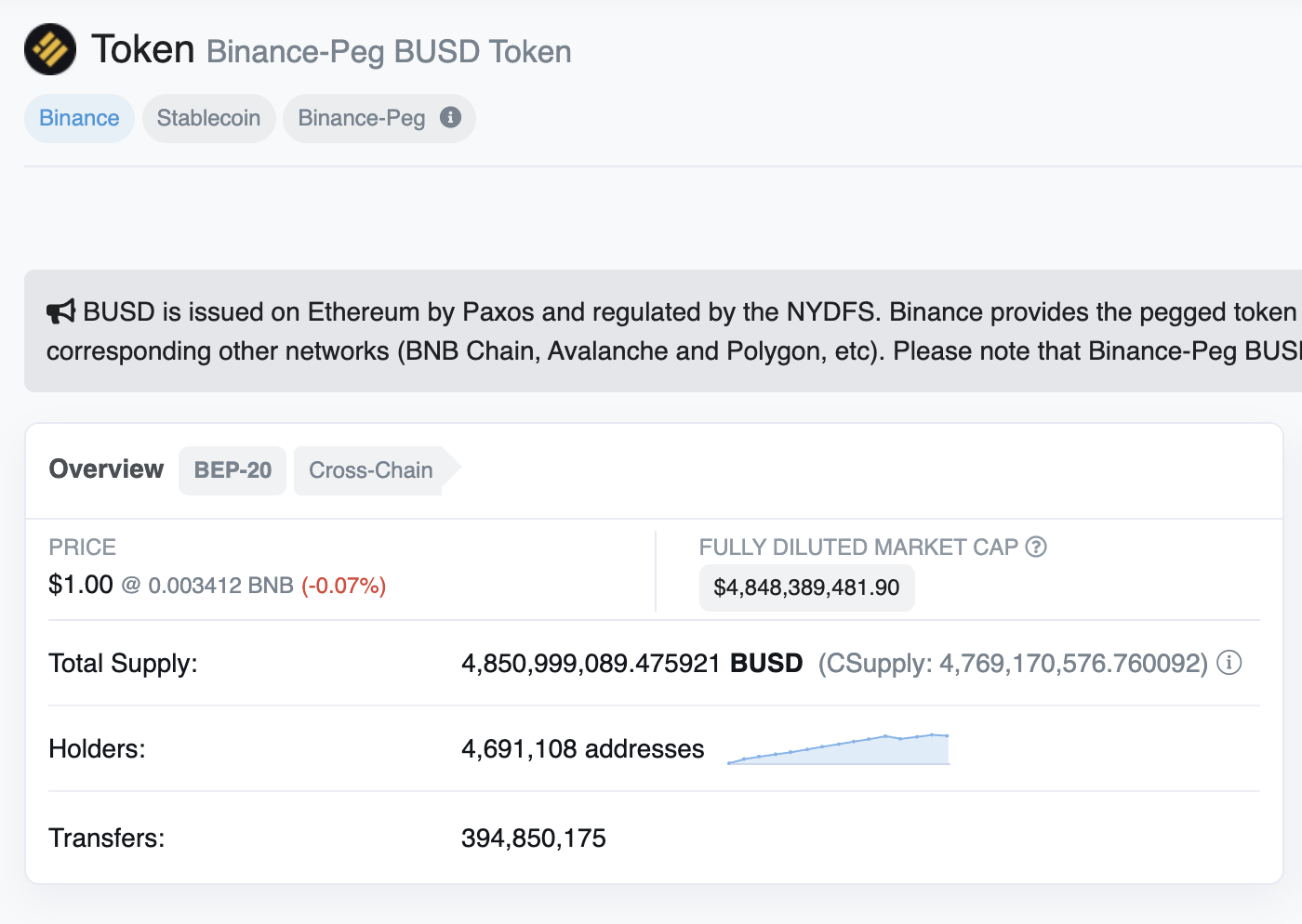

image description

(Approximately 4.85 billion "BUSD" has been issued on the BNB Chain)

The difference between the two can also be found through the blockchain browser. On Ethereum, the full name of BUSD is Binance USD, while on BNB Chain it is Binance-Peg BUSD.

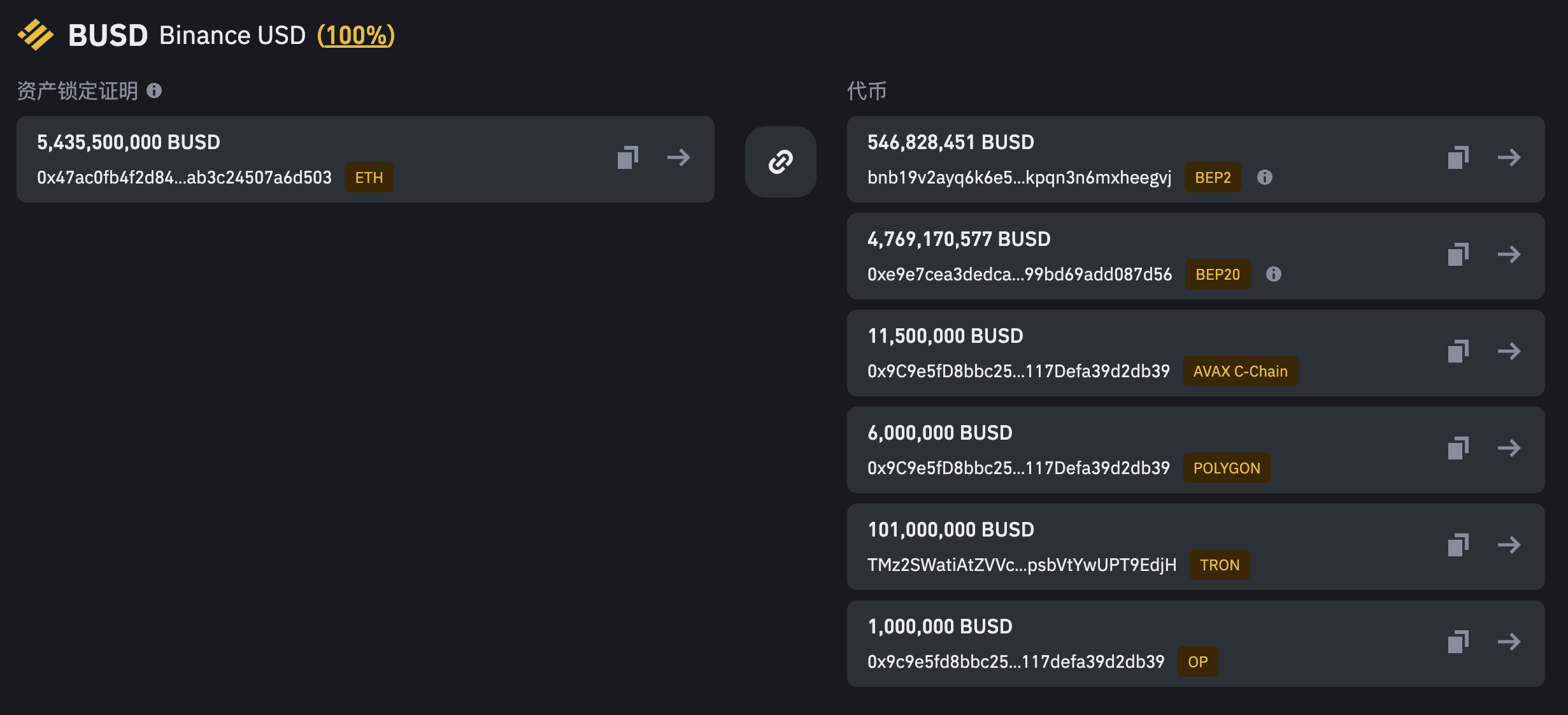

image description

(Binance-Peg Proof of BUSD Reserves)

This model is named B-Tokens, and 97 types of tokens including BTC, ETH, USDT, and BUSD are issued in multiple chains through this model.

This means that the BUSD held by users on other chains is not directly backed by a 1:1 reserve of fiat currency.Instead, it is indirectly supported by the fiat currency reserve through the chain of "fiat currency-Ethereum native BUSD-Binance-Peg BUSD".

All B-Tokens reserve assets are stored at Ethereum address: 0x47ac0fb4f2d84898e4d9e7b4dab3c24507a6d503. Users can check on the chain by themselves.

Although this reserve model has achieved transparency, it is still a "coin-to-coin" reserve support model. This model does not involve legal currency. Odaily asked Binance whether Binance will actively seek supervision of this reserve model.

Binance responded: Binance is ready to assist regulators from around the world in finding the best way to level the playing field - consumer protection is important to all of us. We hope to create a sustainable ecosystem around blockchain technology.

secondary title

Strong market reaction

After the BUSD regulation was implemented, the market reacted fiercely. CZ did not make a clear statement, but responded sideways to this.

This afternoon, CZ reposted an old tweet of his own, implying that the public opinion turmoil against BUSD and Binance is FUD, fake news or attacks, etc.

Curve data shows that as of the publication of this article, the busd v2 pool has tilted, of which the number of BUSD is about 14.09 million, accounting for 88%, and the total of DAI, USDC, and USDT accounts for 12%. BUSD: USDT exchange rate is about 1: 0.9966.

BUSD took a big hit, but this may just be the prelude to the regulatory storm in the United States.

The Editor-in-Chief of TheBlock says the U.S. Securities and Exchange Commission (SEC) is waging an absolute fight. Paxos will stop issuing BUSD after the SEC threatened to sue. Binance censors other assets under U.S. jurisdiction for delisting. I wouldn't be surprised if they were scrutinizing USDC specifically. A few days ago, a senior executive at an exchange told me that the SEC was actually embarking on its own crypto version of “Night of the Long Knives.”

Messari founder Ryan Selkis was emotional, publicly stating, “I will stand with Brian (Coinbase CEO Brian Armstrong), Jesse (Kraken founder Jesse Powell) and dozens of others. I will spend what I have every ounce of energy, financial and political capital to fight the morally immoral and corrupt enemies of cryptocurrency."