Today, the rumors about "SEC banning encrypted pledge services" were confirmed, and Kraken, an American encrypted exchange, became the first "target of sanctions".

According to the official website documents, Kraken reached a settlement with the US SEC and paid a fine of 30 million US dollars to resolve the accusation against it of providing unregistered securities; at the same time, two subsidiaries of Kraken will immediately end the encryption pledge service provided to US customers - ETH It will be lifted after the Ethereum network "Shanghai Upgrade" takes effect. Afterwards, U.S. clients will not be able to pledge new assets, and Kraken will set up an independent subsidiary to provide staking services for non-U.S. clients.

As soon as the news came out, Kraken’s Ethereum pledged tokens were slightly discounted. The current exchange ratio between its Staked ETH (ETH 2.S) and ETH is 1: 0.9757; while Coinbase’s Ethereum pledged tokens (cb ETH) and ETH exchange ratio 1: 0.9985, basically no big discount.

secondary title

After Kraken, will Coinbase be the next "victim"?

Coinbase Chief Legal Officer Paul Grewal emphasized that Coinbase's staking program is not affected by Kraken's termination of US staking services. He said that Kraken is essentially providing income products, while Coinbase's on-chain pledge service is fundamentally different from it, not securities. However, the capital market did not buy this explanation, and Coinbase's stock price plummeted by about 14% at the close, the largest single-day drop since July 26, 2022.

Odaily query found that Kraken previously provided 16 kinds of cryptocurrency chain pledge services, including: ETH, ALGO, ADA, ATOM, Flare (FLR), FLOW, KAVA, Kusama (KSM), MINA, MATIC, DOT, SCRT, SOL , Tezos (XTZ), The Graph (GRT), Tron (TRX).(Note: Affected by today’s cessation of pledge announcement, the above-mentioned tokens generally fell by more than 5%, among which KAVA, KSM, SCRT, and GRT all fell by more than 10%.)

The token pledge service currently provided by Coinbase involves currencies, which completely overlap with Kraken, and there are five in total: ETH, ADA, ATOM, SOL, and XTZ.

In terms of operation process, both collect funds from users and pledge on the chain to obtain income, which is exactly the same.(Note: Coinbase's 2022 Q3 financial report shows that pledge revenue was $62.8 million, accounting for about 11% of its net revenue.)

Therefore, from a qualitative point of view, Coinbase's pledge service, which highly overlaps with Kraken, meets the standards of the SEC's sniping target, and is likely to be charged with the common crime of "involving securities transactions". “Cryptocurrency intermediaries who offer investment contracts in exchange for investors’ tokens, whether through collateral-as-a-service, lending, or otherwise, are required to provide the appropriate disclosures and safeguards required by our securities laws,” the SEC announcement read. Crypto-staking services are likened to securities.

However, from a quantitative point of view, Coinbase’s token staking service does not seem to involve as much risk as Kraken. The data shows that among the selected currencies of Kraken, the highest annualized return is 21%, while that of Coinbase is only 6.12%. The SEC will use the U.S. federal benchmark interest rate (currently 4.5% to 4.75%) as a reference indicator when supervising, and products that are higher than the federal benchmark interest rate are considered high-risk. This is also reflected in the SEC announcement: "Investors transfer crypto assets to Kraken in exchange for an advertised annual return on investment of up to 21%...Kraken provides investors with excess returns unconstrained by any economic reality."

Therefore, from this point of view, Coinbase is currently less risky and may not be targeted by the SEC in a short time. In fact, in its quarterly report in August last year, Coinbase disclosed that its staking service product had been investigated by the SEC, but it ended up being nothing. In the opinion of the CEO of Coinbase, this time he also couldn't help himself. “We will continue to fight for economic freedom, which is also the philosophy of Coinbase. Being the most trusted brand in the cryptocurrency space means protecting our customers from excessive official interference.”

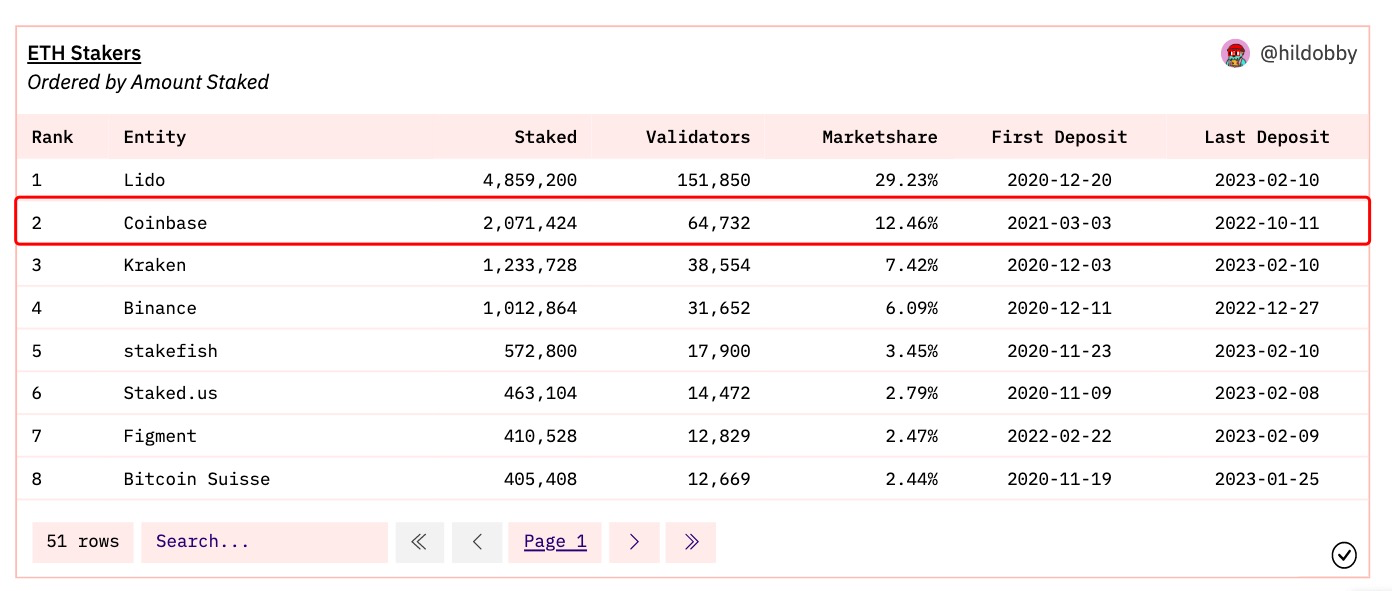

Data on the chainData on the chainLooking at it, it has not increased the amount of ETH pledged for four months, and the information behind it is intriguing (predicted that the regulation will be tightened?).

In addition, as Kraken releases its pledge, and Coinbase may repeat the same mistakes in the future, the outflow of funds will most likely flow into decentralized protocols such as Lido and Rocket Pool.secondary title

Will the SEC expand its crackdown?

As early as last year after the merger of Ethereum Merge, SEC Chairman Gary Gensler has repeatedly emphasized that pledged cryptocurrencies may be subject to federal securities regulations.

“When investors provide tokens to staking-as-a-service providers, they lose control over those tokens and assume the risks associated with these platforms with little protection. Today’s action should signal to the market that Staking-as-a-Service providers must register and provide full, fair and truthful disclosure and investor protections. said Gary Gensler in today's announcement.

However, the SEC's behavior has also attracted a lot of criticism. SEC commissioner and "encrypted old godmother" Hester Peirce posted on the SEC's official website that he raised objections to the SEC's closure of Kraken's US pledge service.

Hester Peirce said that the SEC believes that Kraken's pledge plan should have been registered with the SEC as a securities offering product. Whether or not you agree with that analysis, the more fundamental question is whether registration with the SEC is possible. In the current environment where cryptocurrency-related products cannot pass through the SEC's registration pipeline, a controversial staking service product like this raises a series of complex questions, including whether the staking program is registered as a whole, or whether each token is staking Whether the program will be registered separately, what are the important disclosures, and what are the accounting implications for Kraken.

Peirce believes that the SEC should issue guidance on encrypted pledges instead of choosing to speak through enforcement actions again. "Using enforcement actions to tell people what the law is in an emerging industry is not an effective or fair way to regulate." Additionally, she noted that staking services are not uniform, so one-off enforcement actions and cookie-cutter analysis won't solve the problem. Peirce raised his concerns that the way the SEC currently handles incorrectly registered solutions risks shutting down a program that is serving people well. Enforcement actions like the SEC's are a "paternalistic and lazy" approach to regulation.

Miles Jennings, general counsel of a16z Crypto, commented that Kraken's settlement with the SEC will not affect other compliant exchanges. “We don’t think this settlement will have any impact on exchanges that already have plans to avoid being involved in securities laws. It’s been four years since the SEC last issued guidance related to cryptocurrencies, and its chairman continues to focus on headlines instead of protecting investors according to the SEC's core mission. Now is the time for him to prioritize rules and guidance that will bring clarity to the markets and proactively protect the public."

Now that Kraken’s service has been “exited”, the first shot has been officially fired, and more encryption companies will gradually enter the SEC’s sniping range in the future. Especially as FTX, Genesis, and Gemini are in deep trouble, regulators have once again aroused the attention of encryption risks, and tightening pockets is inevitable.