Original Author: Mary Liu

Original source: BitpushNews

Original Author: Mary Liu

Original source: BitpushNews

Rumors that the U.S. Securities and Exchange Commission (SEC) may ban crypto staking by retail customers have sparked debate in the community. On February 9, the SEC announced a settlement with the encryption exchange Kraken. Kraken agreed to "immediately" stop providing on-chain staking services for US customers and pay a $30 million fine to settle the SEC's charges of providing unregistered securities.

It is nothing new for U.S. regulators to focus on encrypted pledges: Coinbase disclosed in August last year that securities regulators were investigating Coinbase’s pledge services specifically, but found no results. Yesterday, Coinbase CEO Brian Armstrong tweeted that there were rumors that the SEC wanted to ban encrypted pledges for US customers, which once again aroused market concerns.

In the settlement announcement, Kraken neither admitted nor denied the SEC's allegations. The SEC emphasized: “Whether through staking-as-a-service, lending, or otherwise, cryptocurrency intermediaries must provide the appropriate disclosures and safeguards required by our law. Today’s action should show the market that staking-as-a-service providers must register and Provide full, fair and truthful disclosure and investor protection”.

first level title

Decentralized platform or further diversion of the pledge market

Staking is a way of securing a network and earning rewards by holding a specific token for a certain period of time. In return for staking, users will receive yield or additional rewards in exchange for holding their tokens to secure the network. The Ethereum Foundation's ethereum.org website explains that staking is "the act of depositing 32 ETH to activate validator software." But crypto exchanges like Coinbase allow ETH holders to participate in staking and earn rewards without meeting the 32 ETH minimum requirement.

According to the Galaxy Digital report, at least 75% of the staked Ethereum on Ethereum is controlled by intermediaries, such as Coinbase/Kraken exchanges, or DeFi platforms such as Lido or Rocketpool.

Staking has become the main business line of centralized crypto exchanges, and the platform hopes to diversify its income sources through transaction fees.

According to the Kraken website, Kraken’s staking service offers up to 20% APY and promises to reward customers twice a week. As of April last year, U.S. investors had put more than $2.7 billion worth of crypto assets into the company’s staking program, which has generated approximately $147 million in net income for Kraken since its launch. 10.8% of Coinbase’s total revenue last quarter came from crypto staking.

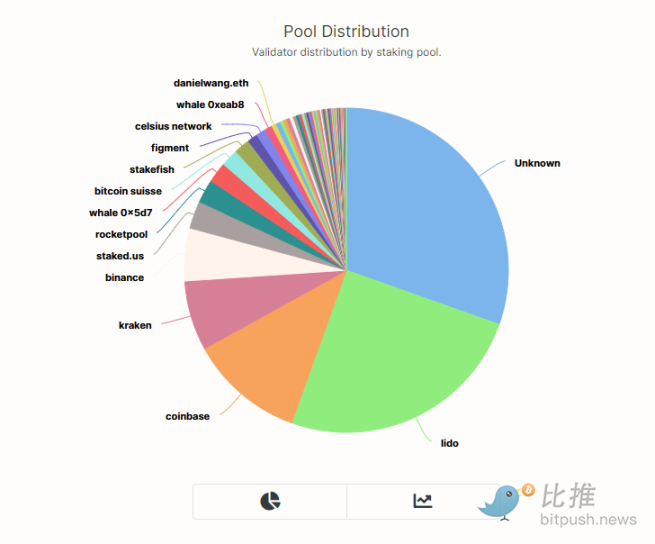

As Ethereum is about to usher in a major upgrade after the merger, data provided by DeFiLlama shows that the total value locked (TVL) of Lido has soared by 33% in the last month. Currently, Lido's TVL is $8.56 billion. On-chain data shows that Lido has 25% of the staking pool market, while Coinbase has 11.5%. Coinbase is the second-largest stakeholder in Ethereum staking, even as competitors such as Kraken and Binance have entered the track.

As a decentralized protocol, Lido is unlikely to be subject to securities rules like a centralized entity registered in the United States like Coinbase. If the SEC does succeed in banning staking schemes, it would be a boon for decentralized alternatives such as Lido, allowing it to steal the market that Coinbase and other US-registered exchanges have.

Henry Elder, head of decentralized finance at Wave Financial, said Kraken’s case is “a huge gift to decentralized staking providers like Lido, RocketPool, and StakeWise, making it harder for regulators to rein in them.”

What do people in the industry think?

Whether the SEC will block all future crypto staking remains unknown.

SEC Commissioner and "Crypto Mom" Hester Peirce publicly condemned the agency's approach. She wrote: “I disagree with the SEC shutting down Kraken’s staking program and seeing it as a win for investors... yet another familiar settlement by a paternalistic and lazy regulator Solution: don't start a public process to develop a viable registration process that provides valuable information to investors, just order it to close... Do we need a unified regulatory solution, and does that regulatory solution It is not clear that it would be best delivered in the form of an enforcement action by a crypto-hostile regulator.”

Blockchain Association Chief Policy Officer Jake Chervinsky believes: "The judgment is not the law. Their decision is that it is better to solve the problem with money than to tear your face, that's all. The SEC believes that pledge-as-a-service is a security. Kraken neither admits nor denies it. This can be a tricky question, and one that the SEC hasn't answered in any way today... I strongly agree with Brian Armstrong that attacking staking would be an egregious mistake in US policy. Thankfully, we are A country ruled by law, even if the SEC wants to completely ban cryptocurrencies (I am only saying one possibility), the law and the courts will not allow it.”

Coindesk deputy editor-in-chief Daniel Kuhn believes that the SEC's claim may be correct -- that incentivizing people to pay to secure crypto networks -- does satisfy the "Howey test" to determine whether an asset is a security, but this should not be determined by the SEC alone. . It’s also worth noting that staking is not like “crypto lending,” which requires exchanges to seek yield to pay depositors, such as the Gemini “Earn” platform. Staking has its risks -- protocols can be hacked, companies can cheat -- but it's part of the open-source process baked into blockchain security, making it far less risky than rehypothecation-driven yield schemes, the U.S. exchange's Crypto-staking products aren’t exactly comparable to crypto lending, and it’s unclear whether the SEC should unilaterally cut off retail participation just because staking generates yield.

Marcus Sotiriou, market analyst at digital asset broker GlobalBlock, commented: "Obviously, from the perspective of the United States, this would be a huge mistake, because it will lead to the rest of the world in the important encryption and blockchain technology revolution. take the lead".