Original compilation: aididiaojp.eth, Foresight News

Original compilation: aididiaojp.eth, Foresight News

The Layer 2 war is getting more and more intense, and Bankless is judging who is the winner by in-depth research on on-chain indicators? We analyzed Arbitrum last week, now let's look at its close competitor: Optimism.

Both Optimism and Arbitrum are optimistic rollup solutions, which have become one of Ethereum's leading scaling solutions.

The concept of Layer 2 has existed for a long time, but in recent months due to the emergence of the first rollup token OP, Layer 2 has received attention again.

source:

source:TradingView

This begs some questions, is Optimism's high valuation justified? Do the fundamentals support the OP's stellar performance? Where does Optimism fit in the competitive L2 circuit?

This article will attempt to answer these questions through three aspects:

Key Performance Indicators

Main DApps of Optimism Ecosystem

Upcoming Growth Catalysts and Risk Factors

Key Performance Indicators

TVL

image description

Optimism DAA - Source:Artemis

The proportion of Optimism's TVL in all public chain lock-up values has continued to rise in the past year, from 0.2% to 1.2%. Its share in Layer 2 has also grown substantially, from 13.5% to 35.2% over the period.

user

user

image description

Optimism DAA - Source:Artemis

This growth could be attributed to the usage of DApps on the network, such as projects in the Synthetix ecosystem, and the aforementioned incentive programs.

Digging a little deeper, we can see that DAA surged towards the end of the year, growing 152.7% quarter-over-quarter from Q3 to Q4. The surge in users is due in large part to the launch of Optimism Quests, an Arbitrum Odyssey-like program where users can claim NFTs by interacting with dApps on the network.

Trading volume

Trading volume

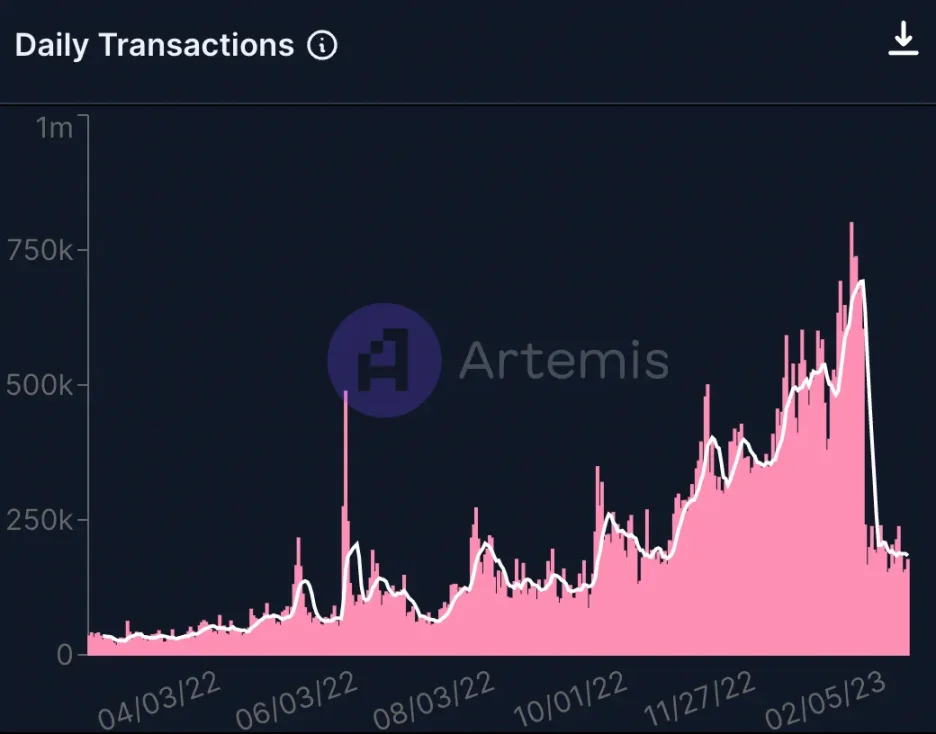

image description

Optimism Daily Transactions - Source:Artemis

While some of these transaction metrics can be attributed to dApp usage, such as active addresses, this number appears to be inflated by Optimism Quests. Transaction volumes fell in the first quarter immediately after Quests ended on January 18.

Popular DApps

While not as widespread as other L2 ecosystems such as Arbitrum, Optimism has a growing number of dApps across multiple domains in general and application-specific rollups built using the OP Stack. Let's talk about some popular reps below:

Velodrome

Velodrome is the largest dApp by TVL in the Optimism ecosystem with a value of $178 million. Velodrome began to emerge after Optimism conducted an OP airdrop to users who staked veVELO in July 2022. VELO holders can obtain NFT after staking veVELO as a certificate to obtain airdrop rights on the platform.

Velodrome discovered PMF from protocols such as stablecoins and LSD, hoping to control token release and incentivize liquidity by rewarding veVELO lockers. Currently, veVEL can provide holders with four-year lockups an annualized rate of return higher than 52%.

Although the Solidly AMM architecture is not competitive with Uniswap V3, Velodrome still seems to have captured the heart of the community and carved out a liquidity-focused niche.

Synthetix

Synthetix is not only one of the OG DeFi protocols on Ethereum, but also one of the first major protocols to migrate to L2, deployed on Optimism in July 2021.

Over $193 million of SNX is currently staked on Optimism, including $48 million of the sUSD supply. Many protocols have chosen to build projects on top of Synthetix in order to take advantage of sUSD liquidity, including Kwenta, a perpetual contract exchange, Lyra, an option AMM protocol, and Thales, a Parimutuel market protocol.

Synthetix has been facing a number of challenges over the past few months, most notably a sharp decline in fee revenue, but there are several notable catalysts on the horizon, such as continued adoption of its V2 perps and the upcoming launch of Synthetix V3.

Lattice

Lattice is a developer that builds on-chain games based on OP Stack. OP Stack is a framework for creating custom modular rollups that can be combined with each other if they use the same sequencer.

Lattice makes two games: OP Craft, a Minecraft-like game where users build in an open world, and Sky Strife, a fighting game.

future outlook

future outlook

growth catalyst

Optimism will have some significant catalysts emerging that will help sustain its growth in the months ahead.

The first of these is an upcoming airdrop of 10 million OP tokens ($26.4 million at current prices) in February. The airdrop will be distributed to various stakeholders within the ecosystem through the Retroactive Public Goods Fund (RPGF), which will be voted on by members of the Optimism Citizen House. Citizen House is one of two governance bodies within Optimism, membership is determined through soulbound NFTs.

The OP allocated to projects via RPGF is an important user incentive, and if the market continues to move higher, this will help guide the entry of users and liquidity on the network. In the long run, Optimism's use of the RPGF and experimental governance model can help attract idealistic and long-term oriented developers to join.

Another catalyst on the horizon for Optimism is Bedrock. Bedrock is a major network upgrade designed to reduce transaction costs and increase transaction speed. Bedrock will also help improve the modularity of Optimism by allowing rollups to more easily transition from optimistic rollups to zk-rollups. The vote to approve Bedrock to run is currently going through the Layer 2 governance process.

risk

risk

Optimism has certainly carved out a niche market and spawned many growth catalysts. Its ecosystem is growing, but it also faces increasing competition.

Optimism’s incentives have proven successful in attracting users, liquidity, and application protocols to the network, but there is reason to be skeptical that they are distributing them in a way that maximizes their long-term ROI.

Optimism has awarded $69.9 million in awards to date. Since November 2022, Optimism's share of TVL in L2 has declined from 46.6% to 35.5%.

This loss turned into a gain for Arbitrum, as despite having no tokens, their market share increased from 49.8% to 62.1% during this period.

Optimism still has plenty of gunpowder in its vaults. But Optimism airdropped a ton of tokens at a time when no new users or capital was coming into crypto and when DeFi wasn’t dominating L2.

Competition in the L2 space will intensify as networks like StarkNet, Fuel, Polygon's zkEVM, Scroll, and of course Arbitrum go live or launch their own tokens. The benefits of other use cases have yet to be identified, but there is reason to suspect that Optimism will face challenges.

However, competition is not the biggest risk Optimism faces today.

Like Arbitrum and other Layer 2s, the biggest threat to Optimism's long-term success is the network's tendency to centralize. According to the Layer 2 beat, Optimism has several key centralization trends, such as not yet supporting fraud proofs, having a centralized sorter, upgradable contracts, and no mechanism to propose blocks when validators fail, etc.

Most Layer 2s have guardrails in place to minimize the risk of loss of user funds. Rollups are still an emerging technology in the grand scheme of things, although many projects have been in development for years.

summary

summary

The Optimism ecosystem is growing rapidly, and there are many catalysts on the horizon that could help keep it on a growth trajectory. Even though only ~5% of OP supply is released into circulation and its FDV could be inflated in the short term, Optimism usage seems to warrant comparable valuations to other non-Ethereum L1 and L2 networks.

Apart from the centralization problem, Optimism's panacea may be OP Stack. If the OP Stack becomes the standard for developing custom L3s, Optimism should benefit greatly from the composability between rollups using this framework.

Apart from the centralization problem, Optimism's panacea may be OP Stack. If the OP Stack becomes the standard for developing custom L3s, Optimism should benefit greatly from the composability between rollups using this framework.

Original link