Authors: Mia Bao, Di Jin, Hakan Sezikli, Jacktheguy

With the rapid development of the encryption industry and the refinement of business, DAO has also accelerated its evolution in recent years. It is not as lively as NFT and Gamefi. Since Vitalik Buterin proposed the concept in the Ethereum white paper in 2013 to the birth of the first DAO in 2016 and its death in the same year, the development of DAO seems to be full of twists and turns from the beginning, but things develop by themselves. After affirmation and negation to a new affirmation, sometimes it seems to be a return to the starting point, but in essence it is an advancement through tortuous forms in order to break through the advanced stage. Design productivity and changes in production relations, DAO's "slow and fast" speed may be the cornerstone of long-term development.

text

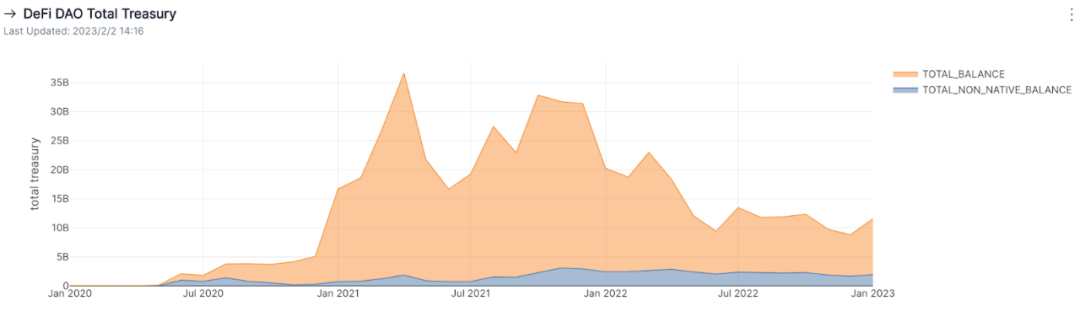

The "bottom-up" management mechanism of the DAO organization determines its open and transparent core and its necessity. In the past few years, the bull market has led to the rapid expansion of the DAO treasury, which will grow to nearly 35 billion US dollars in mid-2021, peaking. Since the proportion of native token assets of treasury funds is higher than 80% all year round, the total value of treasury assets and cryptocurrency market trends are similar. As of the end of January 2023, the total value of treasury assets was 12.4 billion US dollars, of which DeFi-related DAO treasury assets accounted for 82%, and NFT-related DAO treasury assets accounted for 18%. Below we will use this as a classification to briefly analyze the industry situation from the perspective of data.

Looking at the data of DeFi DAO, from mid-2020 to mid-2021, the total value of the national treasury will develop rapidly, increasing from 1 billion US dollars to 35 billion US dollars, an increase of more than 3500% within one year. From the middle of 2021 to the end of 2021, the total value of the national treasury fluctuates from time to time with the market, maintaining between 15 billion and 30 billion. However, from the beginning to the middle of 2022, the total value of the DAO treasury will continue to decline, reaching a minimum of 7 billion US dollars. From late 2022 to 2023, the total value of the treasury will pick up. At present, the total value of the DeFi-related DAO treasury exceeds 10 billion US dollars (https://thepass.to/leaderboard). Although the total value of the national treasury is greatly affected by the market, the total value of non-native tokens (Non-Native Token) is relatively stable, maintaining at around 2 billion US dollars.

DeFi DAO total treasury change chart

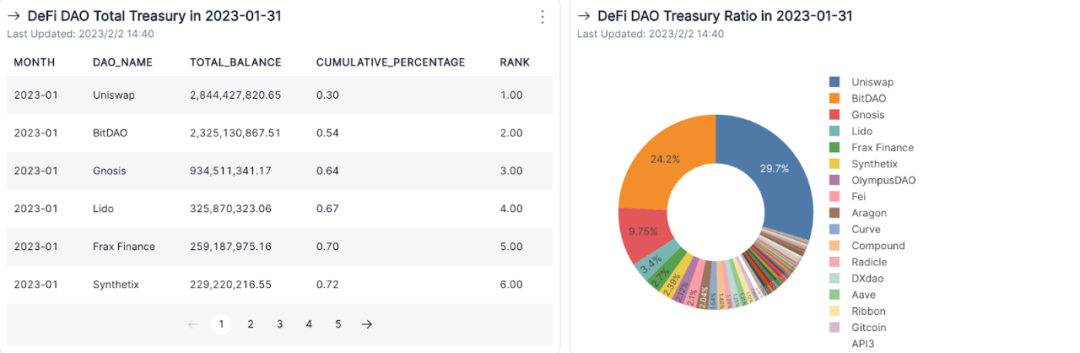

Among these top treasuries, the total treasury of the top 20 protocols exceeds $8.616 billion, including Uniswap, BitDAO, Gnosis, Lido, FraxFinance, Synthetix, OlympusDAO, Fei, Aragon, Curve, Compound, Radicle, DXdao, Aave, Ribbon, Gitcoin, API 3, Euler Finance, DAOSquare, KeeperDAO account for more than 90% of the total treasury assets.

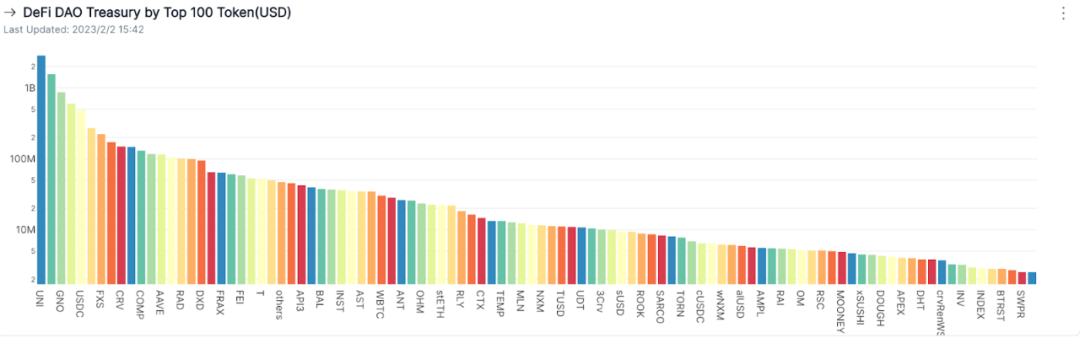

DeFi DAO is based on treasury ranking

Almost all of the top fiscal institutions have balance sheets in their own native tokens and do not hold a significant percentage of stablecoins, Ethereum or Bitcoin (see DAO native token ratio data:https://thepass.to/leaderboard). But it is worth mentioning that after removing the proportion of Native Token, BitDAO, OlympusDAO, Aragon, Fei, Synthetix, Gnosis, Lido, KeeperDAO, Frax Finance, and API 3 are among the best in asset reserves.

DeFi DAO is based on treasury ranking (remove native tokens)

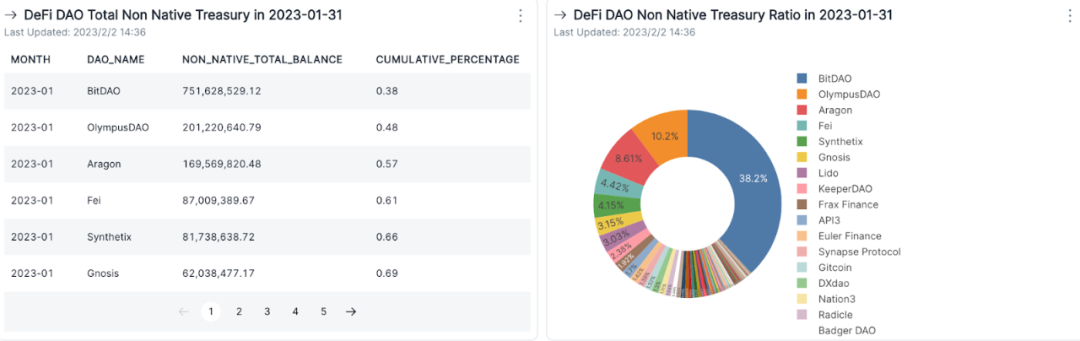

Taking BitDAO as an example (at the end of January), its native token (BIT) accounted for 76.9%, and USDT and USDC accounted for 22%. Due to the high proportion of its own tokens, the treasury will fall by 72.07% in the first half of 2022 due to the impact of the market, and it will recover in the second half of the year, but it will continue to decline due to the impact of the FTX thunderstorm in November.

BitDAO treasury historical changes and distribution

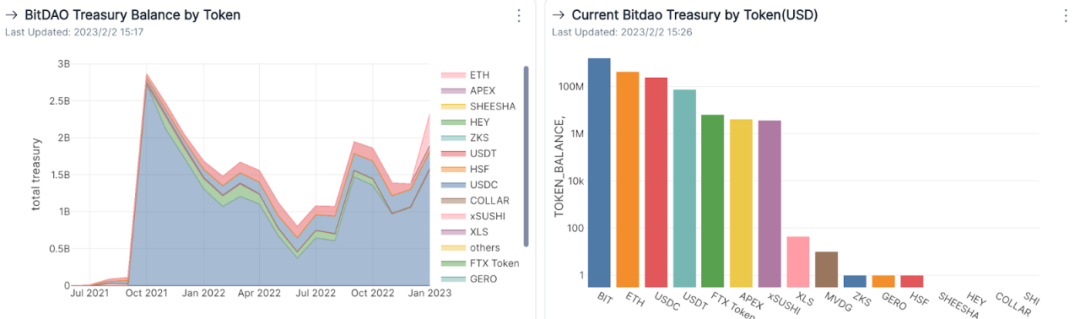

Among the treasury assets of all DeFi DAOs, the top 10 assets with the largest proportion are UNI, BIT, GNO, ETH, USDC, LDO, FXS, DAI, CRV, SNX.

Assets with the most reserves in DeFi DAOs

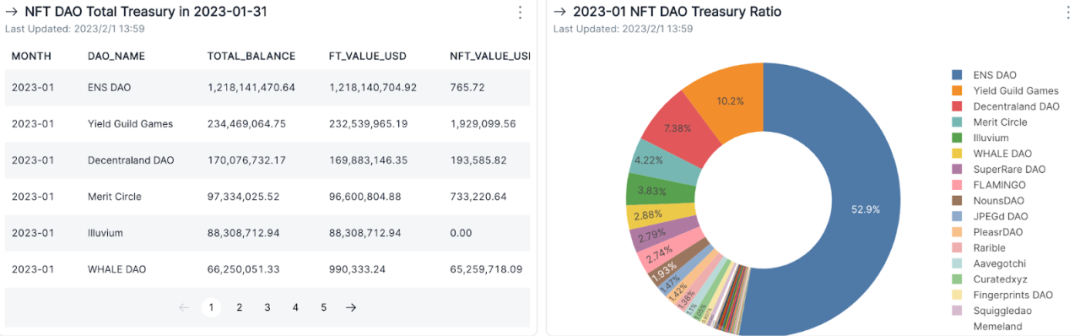

With the rise of the NFT track from 2020 to 2021, NFT-related DAO organizations are also booming. Compared with the volume of DeFi, although the overall volume of NFT DAO accounts for 20% of the total value, the momentum is still not to be underestimated. As shown in the figure below, the overall size of NFT-related DAO organizations is 2.3 billion US dollars, of which the top 15 are ENS DAO, Yield Guild Games, Decentraland DAO, Merit Circle, Illuvium, WHALE DAO, SuperRare DAO, FLAMINGO, NounsDAO, JPEG' d DAO, PleasrDAO, Rarible, Aavegotchi, Curatedxyz, Fingerprints DAO account for more than 95% of the total value.

Ranking and proportion of NFT DAOs treasury assets

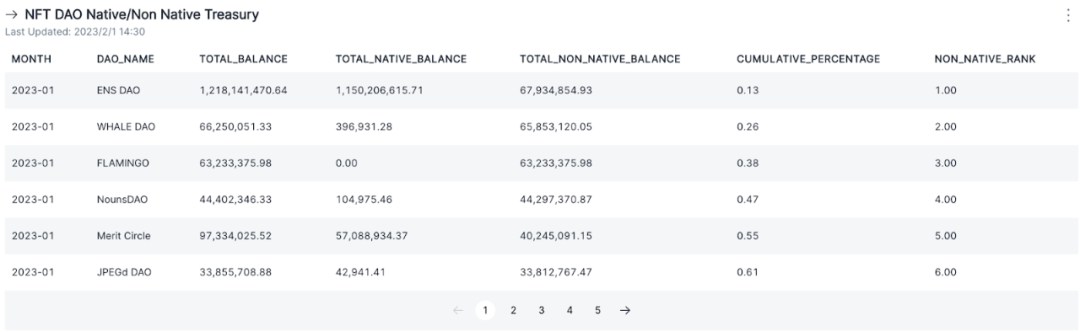

Similar to DeFi DAO, there are also a large number of Native Tokens in NFT DAO organizations. Apart from Native Tokens, WHALE DAO, ENS DAO, FLAMINGO, Merit Circle, and NounsDAO hold more assets.

Ranking of NFT DAO's total non-native assets

In addition to the atypical financial project attributes of NFT DAO, its treasury assets often also contain a certain amount of NFT assets. However, most asset tracking platforms or aggregation platforms do not include the value of NFT assets. The author feels that as the importance of NFT increases year by year, it should be included in the total treasury. The interesting thing brought by NFT DAO is that it enriches the diversity of assets, and in the process of studying its NFT assets, we also found some interesting dimensions for reference.

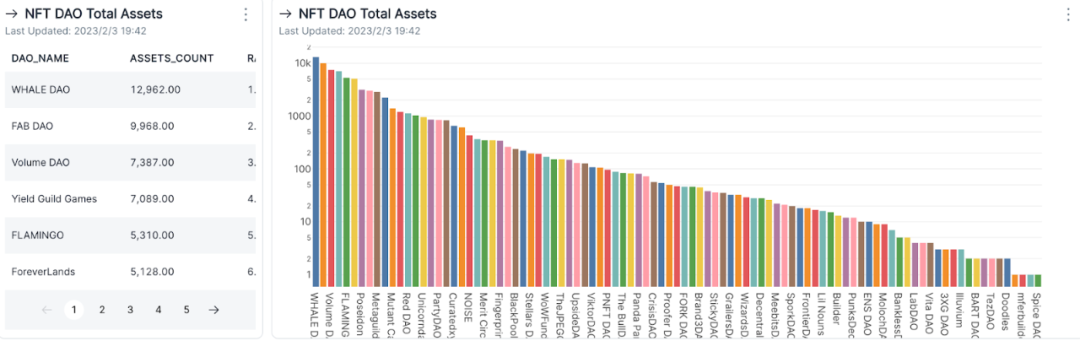

The top 10 assets collected by NFT DAO are WHALE DAO, FABDAO(Tezos), Volume DAO(Tezos),, Yield Guild Games, FLAMINGO, Foreverlands, Poseidon DAO, Bright Moments, of which WHALE DAO has collected nearly 13,000 pieces Collection, ranked first.

Number of NFT Favorites DAO Ranking

Among them, the most popular assets (breadth) of DAO are ENS, ArtBlocks, Foundation assets, Otherdeed, SuperRare assets, Moonbirtds. The most collected assets in terms of value are SuperRare assets, Art Blocks, Cryptopunks, Autoglyphs, etc. Most of the most held assets in terms of quantity are DAO membership cards or PASS cards (most of which are kept in the treasury).

Most Liked Assets by NFT DAOs

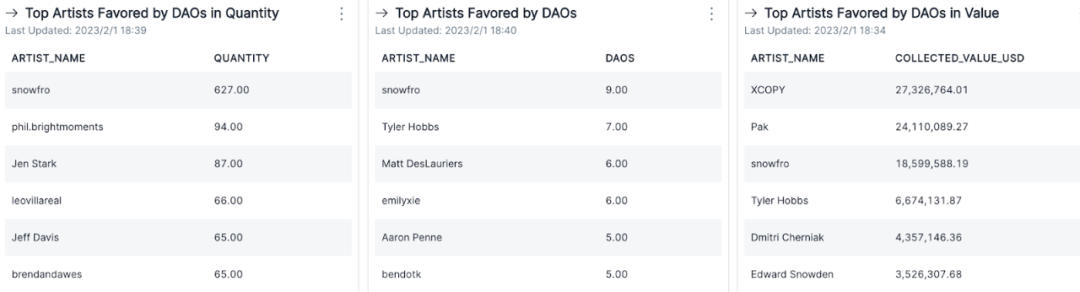

Among NFT DAOs, we have also seen the rise of many DAO organizations that specialize in collecting NFTs, such as WHALE DAO, FLAMINGO, Curatedxyz, Fingerprints DAO, Squiggledao, Bright Moments, Raw DAO, Jenny Metaverse DAO, Poseidon DAO, NEON DAO, etc., and the most The top 10 artists favored by these DAOs are XCOPY, Pak, Snowfro, Tyler Hobbs, Dmitri Cherniak, Edward Snowden, Hackatao, Golid, Emilyxie, Torproject, Williamapan, Josh Katzenmeyer (value perspective).

Favorite Artists of NFT DAOs

The transparency and diversity of DAO assets are essentially the outer layer of DAO. Except for the marketing part, the thickness and growth space of assets determine the strength of the next stage. With the recovery and improvement of the market, the total value of treasury assets is also growing. From the bottom to now, it has rebounded by 40%, and the more and more solid infrastructure and more and more applications are also providing for the next DAO. A solid foundation is laid in stages. If you have any questions about the report please go to www.thepass.to contact us.