On February 2, the Coinbase NFT Marketplace announced on Twitter that it was suspending the Creator Drops feature on the NFT Marketplace to focus on other features and tools requested by creators, while emphasizing that it would not shut down the Coinbase NFT Marketplace.

In addition to the suspension of some product functions, the suspension of content production, the reorganization of the product team and the resignation of the chief product officer, as well as the unsatisfactory performance of the transaction volume and number of users, the development prospects of the Coinbase NFT market have been drawn with huge question marks. Although it is backed by the big tree of "the first encrypted stock" Coinbase, its NFT market has not"good cool"first level title

16,000 users complete only 50,000 transactions

As the leading platform of centralized exchanges, Coinbase covers a large user base and has a high degree of market attention, which also lays a solid foundation for business expansion. In October 2021, after Coinbase announced that it would launch the NFT trading platform Coinbase NFT, it did arouse FOMO sentiment in the market. By May 2022, the number of users who applied for registration exceeded 4 million, and this number far exceeded OpenSea, the leading NFT trading platform at the time. The total number of historical interaction addresses.

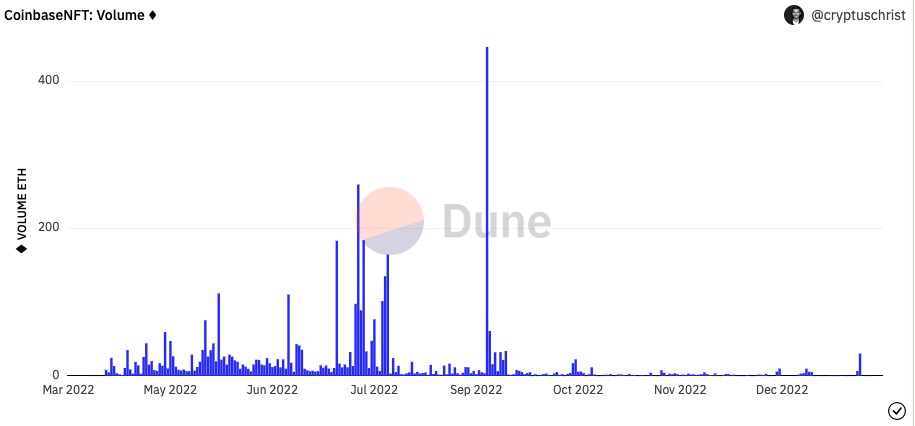

Although Coinbase NFT had a good start, in about 8 months after the platform was officially launched, the business performance was unexpectedly mediocre, the usage rate was very low, and it was even "beaten" by many latecomers. According to data from Dune Analytics, as of February 3, the total transaction volume of Coinbase NFT was about 7.347 million US dollars, and more than 16,000 users only facilitated about 50,000 transactions. The average daily transaction volume was less than 200, and the average daily transaction volume was insufficient. $30,000. In the past 24 hours, the number of transactions was only 20, with a transaction volume of $306. On the same day, OpenSea’s Ethereum transaction volume reached 5.5 million, accounting for 74.8% of the total historical transaction volume of Coinbase NFT.

first level title

What is the reason behind the weak performance?

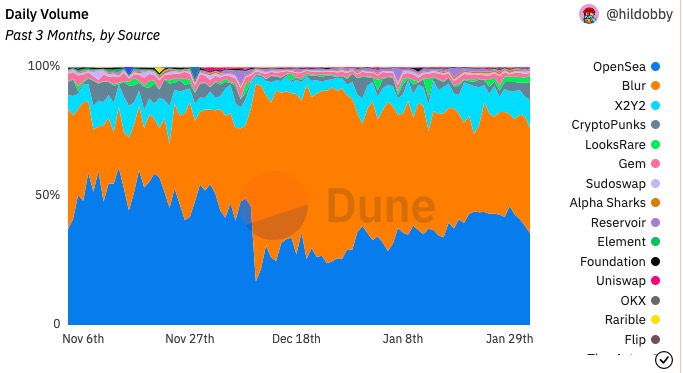

The NFT market is no longer a monopoly. Although OpenSea once firmly occupied the throne of the market, many NFT platforms have shaken their status and seized a certain market share by virtue of their unique and innovative gameplay. Dune Analytics data shows that as of February 3, OpenSea’s cumulative trading volume in the last three months accounted for 35.7% of the entire NFT market share, while Blur’s was 40.6%, and X2Y2’s was 11%.

secondary title

1. The bear market is on the line, and the overall market is bleak

Whether a new product can open up the market or not depends on the timing of its launch. It took Coinbase half a year from announcing the launch of the NFT market in October 2021 to its public availability in May 2022, but it faced a cooling of the NFT market after its official debut. According to data from NFT data aggregator CryptoSlam, since April 2022, global NFT sales have continued to decline, and are currently down by more than 89.9% from the peak transaction volume of over US$4.9 billion a year ago. In the sluggish market environment, investors' interest in NFT has greatly decreased, resulting in a sharp slowdown in its trading volume.

secondary title

2. The Web2 product team does not really understand Web3

“Executives at Coinbase come from a previous generation of companies, like Facebook and Netflix, and they don’t understand this emerging market,” the above-mentioned employee pointed out.

In fact, Coinbase employees have anonymously posted a petition calling for the removal of Coinbase’s top executives. Although Coinbase CEO Brian Armstrong thought this idea was stupid and even said that he would fire the employees who filed the petition, soon, Coinbase plans to reorganize its product team. The reorganized team will be divided into four departments, composed of four The principal reports directly to Chief Executive Officer Brian Armstrong. Surojit Chatterjee, the chief product officer and head of the NFT market that Coinbase hired from Google with a huge salary of US$646 million, also proposed to resign at the end of October 2022, and finally officially resigned on February 3 this year.

secondary title

3. Lack of unique style of play

In order to break the monopoly position of OpenSea, many platforms have emerged in the market to grab market traffic through different vampire tactics. The Coinbase NFT market, on the other hand, cuts into the NFT track with a social focus, and made it clear that it will build a platform that promotes "creators, collectors, and fans." But for NFT traders, they are more concerned about whether the platform can better support the secondary market and whether it has liquidity capabilities.

In addition, compared to other NFT trading markets, which have launched trading mining, airdrops, cancellation of royalties, pending order rewards and other incentives to acquire users, the Coinbase NFT market has fewer features. Its suspension of new series of NFTs will make it harder to attract users. For example, the aggregator platform Blur has seized a lot of market share from OpenSea by relying on strategies such as airdrops, zero handling fees, and optional royalties.

secondary title

4. Business is bound by compliance

Coinbase, which stands out by virtue of compliance, also puts a shackle on its business expansion due to compliance, which makes Coinbase too "rule-abiding" and lacks innovation in NFT business gameplay.

For example, after releasing the first part of the "The Degen Trilogy" short film series themed on Bored Ape Yacht Club (BAYC), the Coinbase NFT market was widely criticized by the community. For this reason, Coinbase suspended the plan to produce the BAYC NFT short film trilogy. "We are continually refining our content strategy and have decided to pause production on the remaining two short films while we determine the best path forward creatively. We will continue to focus on more immediate creative endeavors."

In fact, due to the strict financial regulatory system in the United States, the development of Coinbase’s business needs the approval of the regulatory authorities. A small number of users, and the NFT marketing plan is also quite satisfactory. For example, Coinbase was strongly intervened by the SEC when it announced that it wanted to promote account lending to generate interest. For this reason, Brian Armstrong sent an unprecedented 21 tweets to complain about the regulatory authorities, but they were ignored. In addition, the 2021 prospectus submitted by Coinbase also hinted at the business constraints brought about by regulation, arguing that unregulated trading platforms will create "unfair" competition for it.

The above factors have caused the weak performance of various data in the Coinbase NFT market. For Coinbase, which has suffered huge losses, the NFT market is an important layout for it to try to improve its predicament through income diversification. You know, Coinbase is facing a plight of a sharp drop in revenue. In the past year, multiple thunderstorms by encryption institutions have caused the trading volume of the encryption market to drop sharply, which has caused Coinbase's revenue in 2022 to drop sharply. There was also a sharp drop, with credit ratings agency Moody's even downgrading the long-term credit rating of Coinbase (COIN) and its secured senior unsecured notes, citing a "substantial weakening in revenue and cash flow generation." There have also been several major layoffs to reduce expenses.

Most of Coinbase's revenue comes from encrypted transaction fees. The instability of this part of revenue makes it try to reduce this dependence through business diversification, which is why the Coinbase NFT market plans to start following the industry after adopting zero handling fees in the future. The reason for the standard handling fee. In fact, the rapid increase in the transaction volume and transaction value of the NFT market has also led to a sharp increase in the industry's profits. For example, the current total transaction volume of OpenSea reaches 15.3 billion US dollars, so the total transaction fee income obtained by the platform is 382 million US dollars. For this reason, Brian Armstrong even optimistically predicted that the scale of Coinbase NFT, a new business, "may be as large as its core cryptocurrency trading business, or even larger."

Just like the battle between Yahoo and Google in the Web2 world back then, in order to compete with Google, Yahoo, the old search engine leader at that time, attempted to counter the competitive pressure by upgrading its technology and directly inserting information such as maps, yellow pages, and weather forecasts into search results. However, " Just because Yahoo has a search box doesn't mean they're Google." In the encryption world, although Coinbase occupies a dominant position in CEX and even took an important step in the mainstream market, this does not add points to its diversified encryption business expansion. Instead, its operating strategy and technical path become the key to competition.