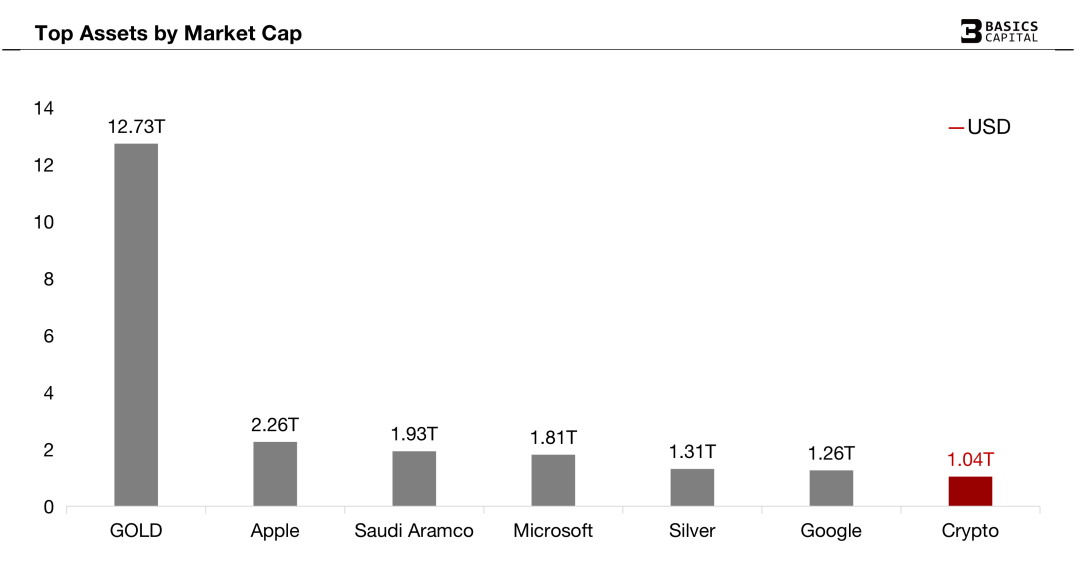

In January 2023, BTC regained the decline in the past six months with a monthly-level big positive line, and stood strongly above 2W USD, becoming the best performing asset in 2023. The total market value of encryption regained its position of 1W billion. Crypto surpassed Amazon with a total market capitalization of US$1.04T, ranking seventh in the global risk asset category after Google.

# Bitcoin

The market value of BTC returned to 440 billion U.S. dollars, accounting for 42.4% of the Crypto market, ranking 17th in the global risk asset class. Compared with gold with a market value of 12.73 tons, BTC still has nearly 30 times the space; the market value of ETH reached 190 billion U.S. dollars , accounting for 18.5%, and together with BTC, accounted for 60.9% of the entire Crypto market value.

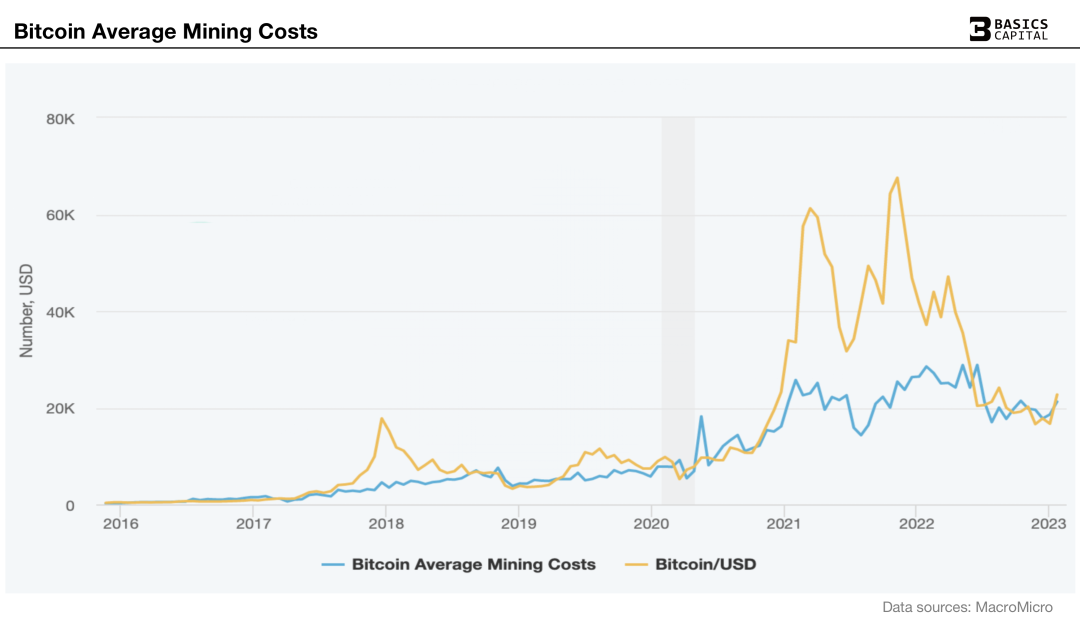

Looking at the price support of BTC from the perspective of the cost of computing power, the price of BTC has hovered around the cost of mining for several months, and now it is showing signs of coming out. The bear market in history has bottomed out along with this phenomenon.

# Ethereum

Since the Merge of Ethereum last year, the total number of ETH tokens has decreased by 4624, and it is experiencing the second deflation since the merger. Merge blocked the issuance of about 161 W ETH tokens, and the original annualized inflation rate of ETH was 3.53%. down to -0.01%.

More than 1646 W ETH participated in the pledge of the Ethereum beacon chain, the pledge rate reached 13.66%, more than 51 W pledged nodes, Lido pledged more than 481 W, accounting for 29.25%, firmly sitting at the top of the LSD section.

More than 580 W pieces of ETH participated in DeFi lock-up, and the lock-up rate exceeded 4.83%.

In January, a total of 63,735 ETHs were burned based on the EIP 1559 proposal, of which 1.8 W were burned in the NFT section, 1.76 W in the DeFi section, nearly 1.4 K in MEV, and 1.8 K in L2.

The total market value of the ETH ecosystem is 444.8 billion US dollars, of which the market value of ETH tokens is 193.9 billion, the total market value of Erc 20 Token is 229.4 billion, and the total market value of NFT assets on the Ethereum chain is 21.5 billion.

# AltChains

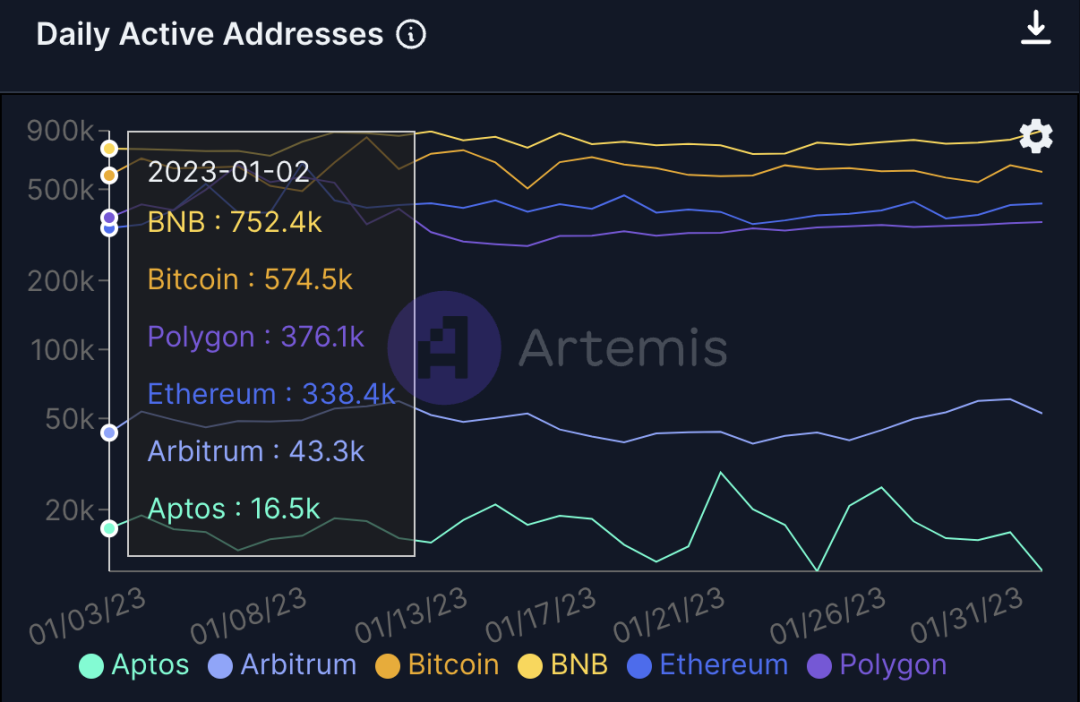

The activity on the overall chain has recovered, and BNB is still the most active public chain, with an average daily active address of about 75 W, a daily average active address of BTC of about 60 W, an average daily active address of Polygon of about 40 W, and an average daily active address of Ethereum Around 33 W, the active addresses on the Arbitrum chain have risen significantly, reaching around 5 W, and the price of Aptos has increased by 6 times in the past month, but the daily active addresses on the chain have not changed much, and are still within 2 W.

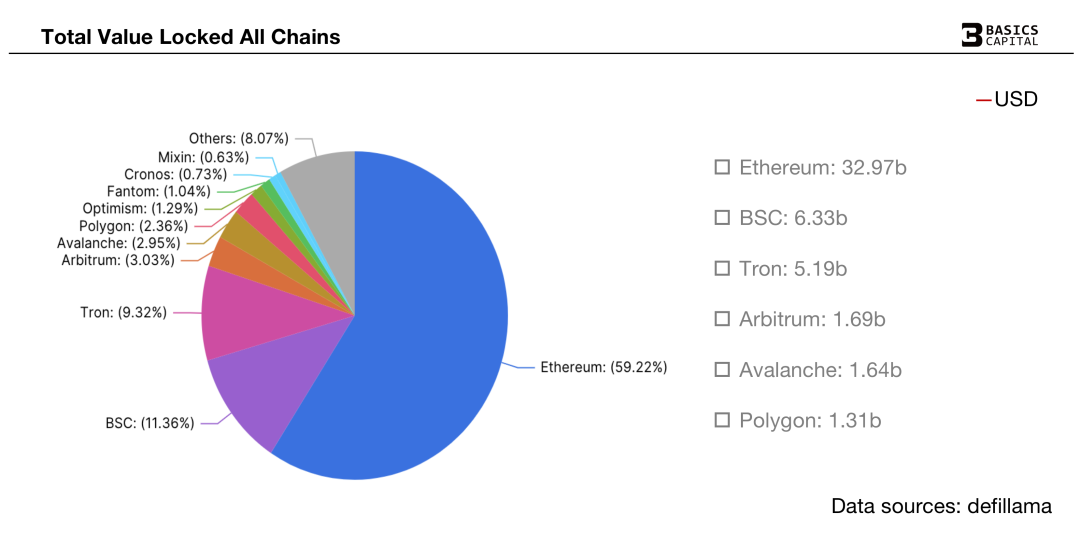

This month, the market value of locked assets on the chain reached 55.673 billion U.S. dollars, the TV L3 on the Ethereum chain was 2.9 billion U.S. dollars, accounting for 59.22%; the TVL on the BNBChain chain was 6.33 billion U.S. dollars, accounting for 11.36%; the TVL on the Tron chain was 5.19 billion U.S. dollars, accounting for 9.32%; the TV L1 on the Arbitrum chain is 690 million US dollars, surpassing the assets on the Avalanche chain, ranking fourth.

# Volume & Inflows

In January 2023, the average daily transaction volume of the entire Crypto network returned to the level of 100 billion US dollars, and the cumulative transaction volume of the whole chain of Dex for the entire month was 70.6 billion US dollars, which is still less than the daily level of the entire network's transaction volume. According to Defillama data, on February 1, the transaction volume of all Dex chains was 2.9 billion US dollars, and the ratio of Volume(Dex)/Volume(Cex) was 7.57%.

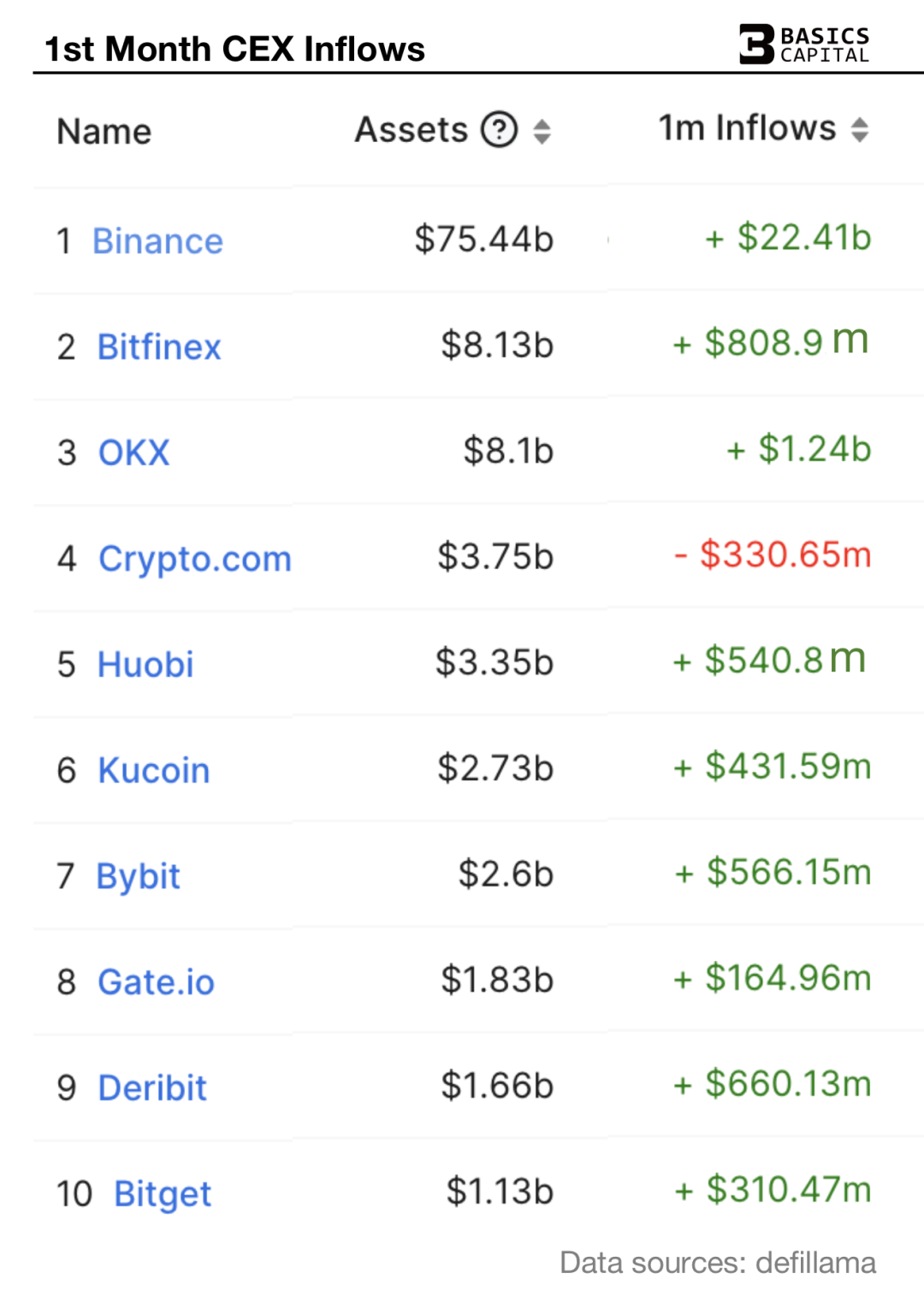

The net inflow of exchange funds in January exceeded 25 billion US dollars, of which Binance captured 22.4 billion US dollars of Inflows, accounting for nearly 90% of the entire market share, the second-ranked OKX inflows of 1.24 billion US dollars, and the assets of other exchanges The net inflows were all less than US$1 billion.

recommended reading

recommended reading

Basics Capital|Our Crypto Market Predictions for 2023 and Beyond

Data source reference:

https://defillama.com/

https://ultrasound.money/

https://coinmarketcap.com/

https://dune.com/hildobby/eth 2-staking

About Basics Capital

Basics Capital is a global blockchain industry fund, focusing on the primary market and helping the development of early application layer projects. The investment projects come from more than 30 countries around the world, including Southeast Asia, the Middle East, Europe, the United States, Canada, Australia, Vietnam and Russia and regions, covering various sections of the application layer such as Wallet, NFT, DeFi, GameFi, DID, SocialFi and LaunchPad.