Web3ExampleExamplereal estatereal estateToken) and other vertical fields.

first level title

focus

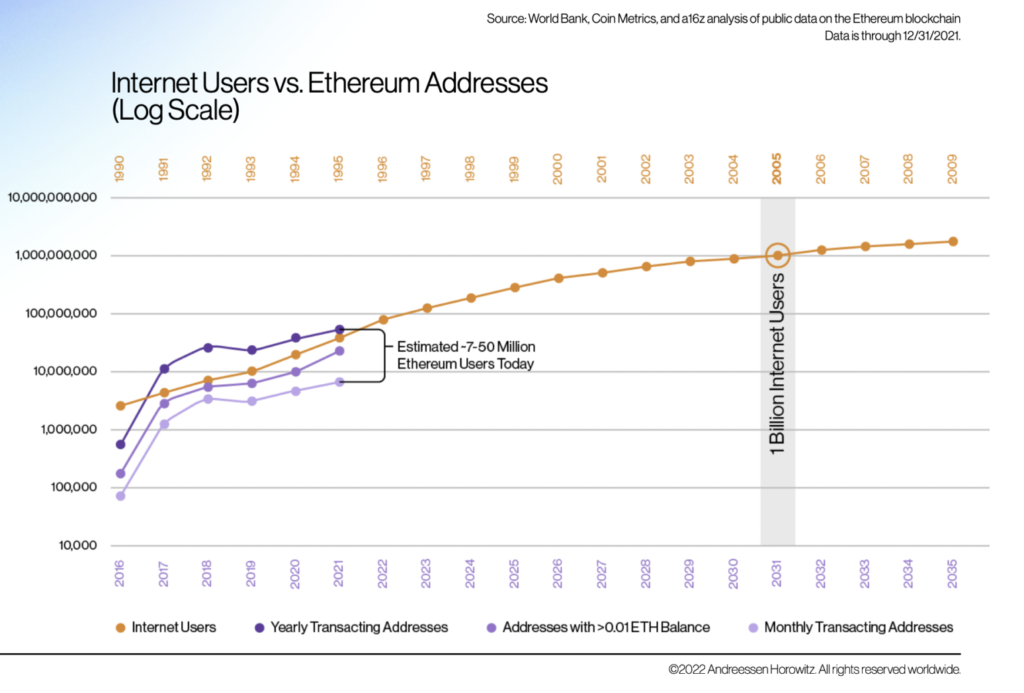

On current trends, Web3 users will reach one billion by 2031.

The value generated by Web3 systems is expected to reach $827 trillion.

first level title

How are Web3 metrics changing?

It is true that existing Web3 metrics can effectively track ecological growth, but ecosystem members may rely too much on these indicators. Since the market will motivate project parties based on indicators such as total lock-up volume (TVL), project parties will pay more attention to such indicators instead of focusing onproduct-market fitand landing applications. Therefore, we need to establish a more robust set of metrics, such as dApp revenue, daily active users, and transaction value realized (TVE), which can better measure the fundamentals of the protocol.

Various innovative metrics have now emerged, allowing us to better observe the dynamic Web3 ecosystem. To cover the development of Web3 in an all-round way, a series of different measurement indicators must be adopted, spanning various dimensions such as investment, developers, users and the overall ecology.

Here are a few megatrends driving changes in Web3 metrics:

Capital—As the Web3 ecosystem matures and interest rates continue to rise, capital begins to focus on economically sustainable indicators such as revenue, cost-effectiveness, and overall value capture.

Developers—The emergence of developer tools can better help Web2 developers enter the Web3 ecosystem.

Users—The development of various expansion solutions is about to reach an inflection point, and transaction fees will be greatly reduced, enough to compete with more Web2 services.

Ecology——ChainlinkAnd other core Web3 infrastructures are connecting the Web3 ecology to real-world assets.

first level title

secondary title

Total Locked Volume (TVL)

Total lockupRepresents the dollar value of a digital asset locked in an agreement. Different from the "number of users" and other metrics usually used to measure application usage and growth rate, TVL measures the total value of assets managed by the protocol, including the huge amount of liquidity contributed by "giant whales" to the protocol.

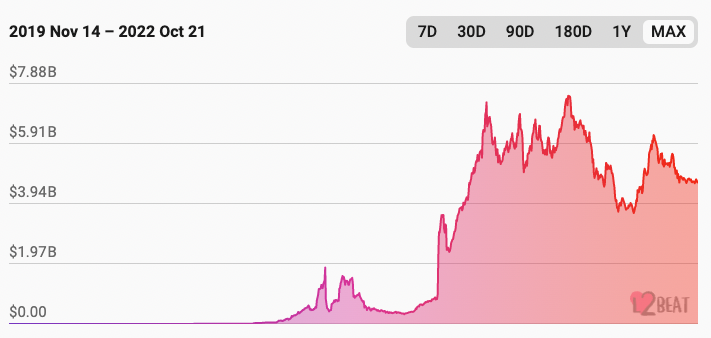

Yield farming emerged in the 2020 DeFi Summer and made TVL the main criterion for comparing various Web3 projects. For example, on October 21, 2020,Aaveimage description

Aave's TVL has increased by more than 20 times in DeFi Summer.source.

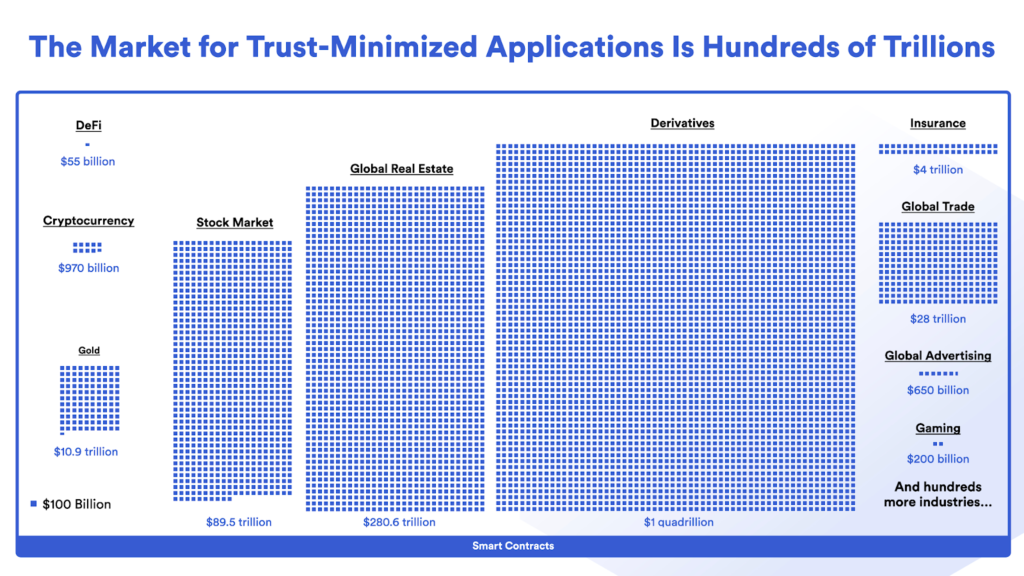

With the continuous development of Web3, more and more assets in the real world are stored on the chain, and this indicator also effectively reflects the degree of integration of Web3 and the off-chain economy. "real worldValue” represents the total value of all assets stored on-chain in the global economy, including real estate, stablecoins backed by USD, carbon credits, and commodities.

estimateestimateimage description

Web3 will realize hundreds of trillions of value on the chain.secondary title

TVL of Ethereum L2

image description

The total amount locked in the Ethereum L2 networksecondary title

dApp revenue

dApp revenue refers to user fees earned by a protocol. dApp revenue can be used to measure L1 blockchain, infrastructure services, and dApps.

While dApp revenue is not a critical metric for early Web3 startups and growth projects, many mature projects are now focusing on this metric. Kain Warwick, founder of Synthetixhas said: "In my opinion, crypto user fees are the key indicator for the next stage."

dApp revenue is becoming a key measure of the Web3 ecosystem for the following reasons:

dApp revenue directly reflects end-user demand for Web3 services, and can identify long-term sustainable business use cases.

The L2 scaling solution introduces extremely low transaction fees and aims to compete with Web2 services, so dApp revenue is a key metric when making comparisons.

Typically, traditional investors also measure valuations in terms of revenue. A high-income ecology will attract more capital.

first level title

secondary title

Number of GitHub stars

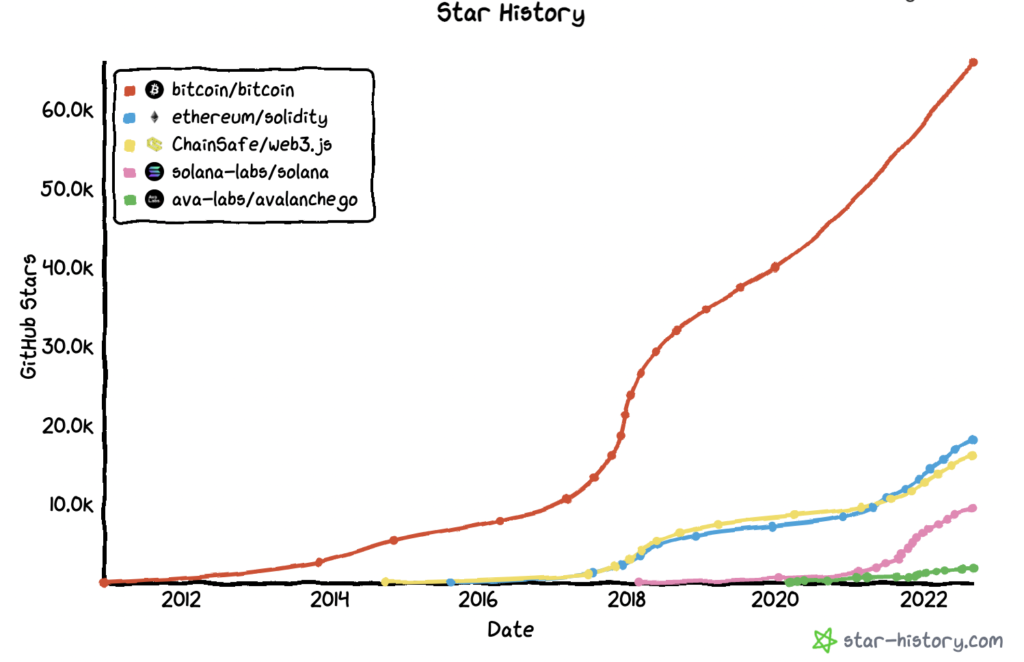

GitHub users can "star" repositories to bookmark a repository for later use or simply to show support for a project. In addition to star ratings, the number of branches and contributors in the GitHub code base can also effectively reflect the influence of the project.

Bitcoin was the first blockchain to emerge, and its GitHub codebase has the most stars, three times as many as other projects, which speaks volumes about Bitcoin's reputation. Recently, there have been many other blockchains that have gained a lot of attention as well. For example, the Solana code base has 9,300 stars. The project has developed rapidly in the past year, and the number of stars in its code base is currently half that of the Solidity code base (the Solidity code base has 18,100 stars).

image description

Number of stars on GitHub repositories for Bitcoin, Solidity, Web3.js, Solana, and AvalancheGo.secondary title

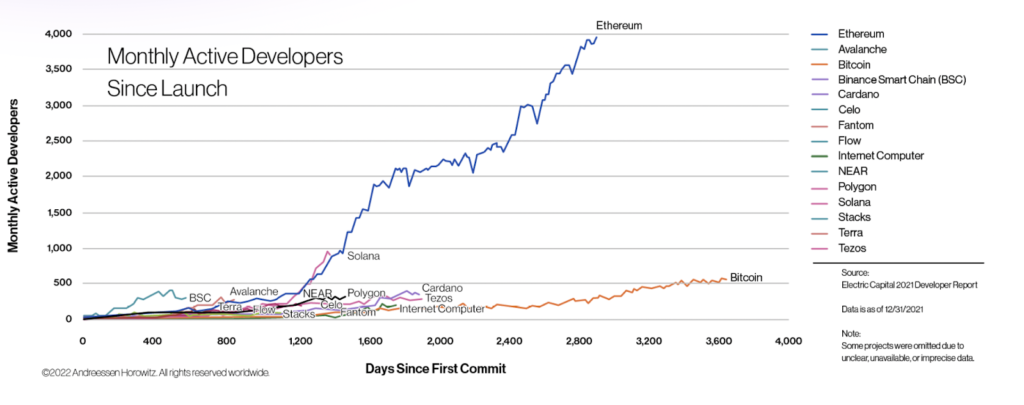

Number of active developers per month

total number of developersRefers to the number of programmers actively participating in the development of a blockchain network.

smart contractsmart contractimage description

Monthly active developer growth from December 2020 to December 2021.first level title

secondary title

Unique on-chain address

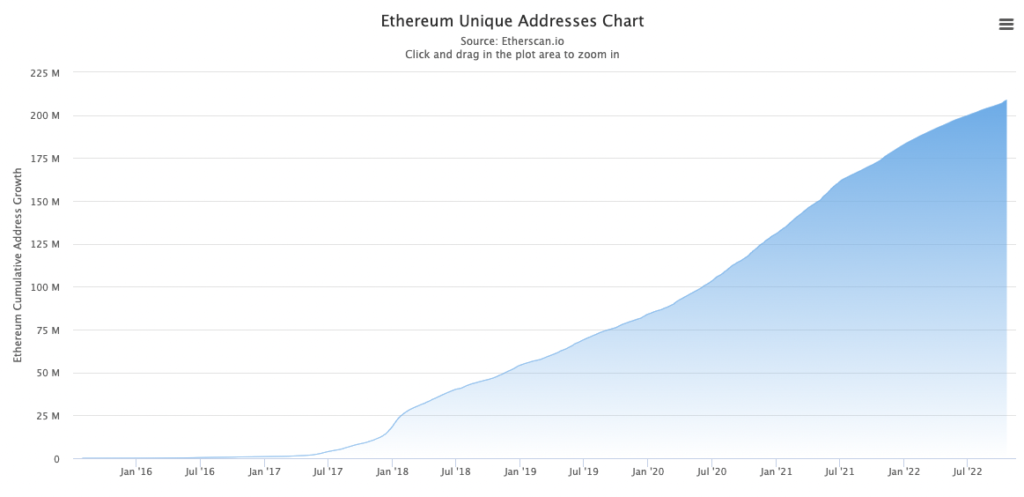

Unique on-chain addresses refer to the total number of unique addresses on the blockchain. This is a very important metric because it reflects the network effects that drive the rapid development of Web3 and how many people are empowered by blockchain technology.

image description

The growth of unique addresses on Ethereum.source.Alternatively, we can compare unique on-chain addresses to the number of Internet users. Since Web3 is an upgraded version of the Internet, participants can compare the current number of active on-chain addresses with the number of users in the early days of the Internet.

a16z is named“ 2022 State of Crypto”image description

The adoption rate of Web3 is very similar to that of the early Internet.secondary title.

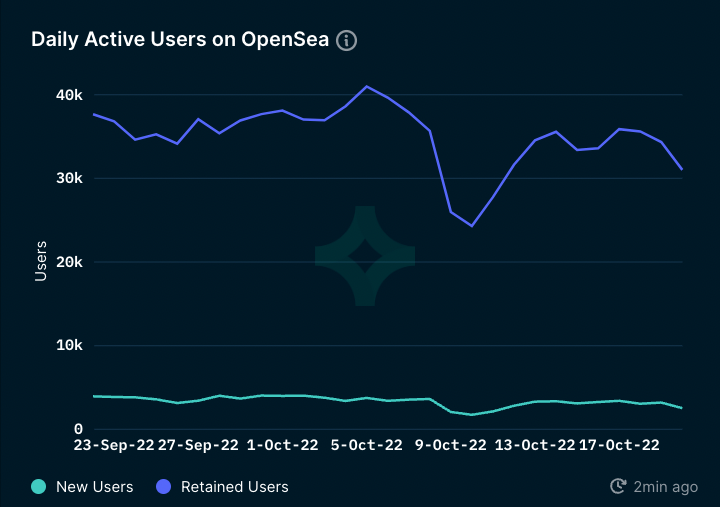

Daily active users

Daily active users refer to the number of daily active users of an app. Active addresses on the chain can reflect the growth of the entire network, and daily active users can effectively measure the success of an application.

image description

Daily active users of the NFT platform OpenSea.first level title

secondary title

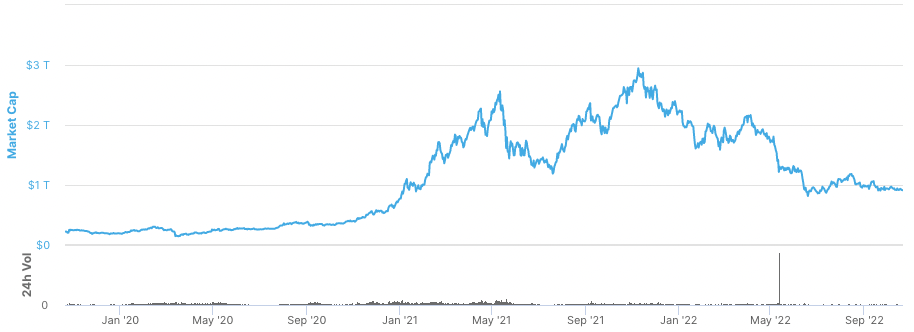

market value

Cryptomarket valueimage description

Crypto market capitalization since September 2019.secondary title

Bitcoin dominance

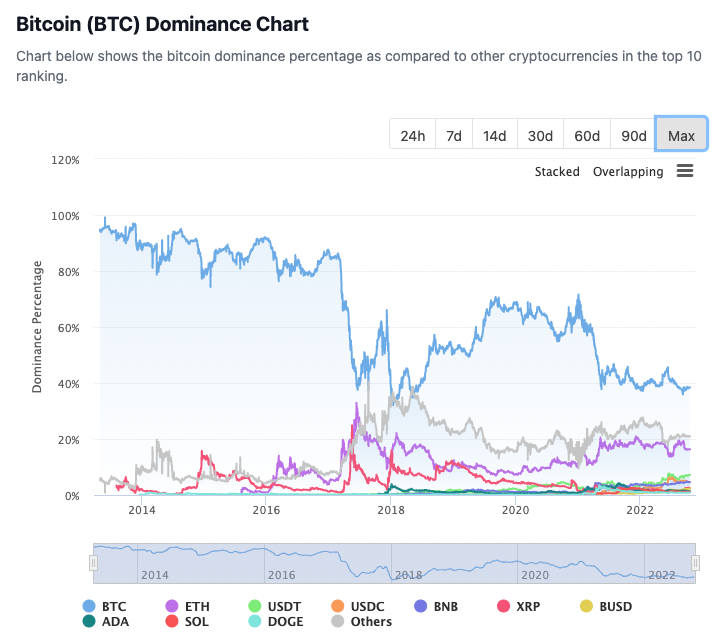

belowBitcoin Dominance ChartCross-chainCross-chainimage description

While Bitcoin still holds the largest market share, its dominance is slipping.secondary title.

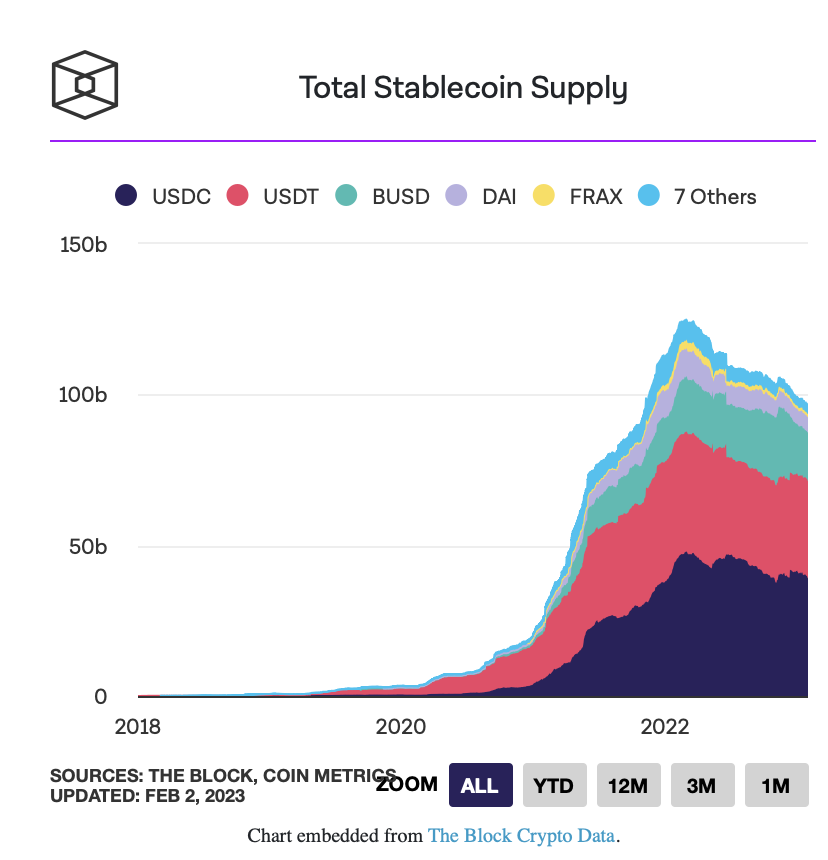

total stablecoin supply

Stablecoin is a crucial on-chain financial primitive that supports the growth of the entire DeFi ecosystem. The token that anchors the fiat currency can allow users on the chain to obtain assets with stable prices, which can be used as a trading medium in the entire Web3 ecosystem and used as collateral foryield farmingTrading volume

Trading volume

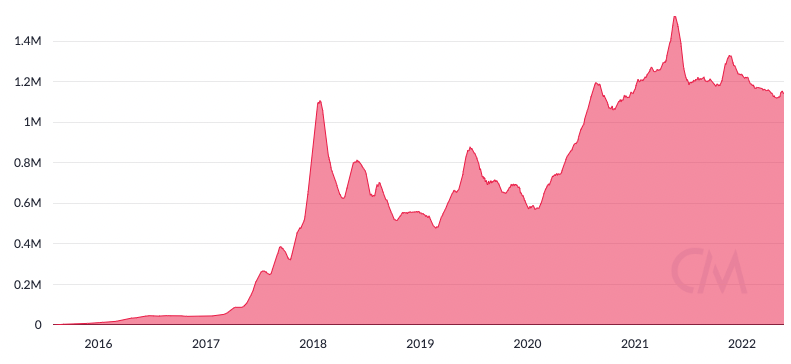

Transaction volume refers to the number of transactions concluded at a certain stage. The daily transaction volume of the Ethereum ecosystem has increased from 500,000 in early 2020double1 million by August 2022.

image description

Total Ethereum transaction volume has roughly doubled over the past two years.secondary title

Total Value of Coverage (TVS)

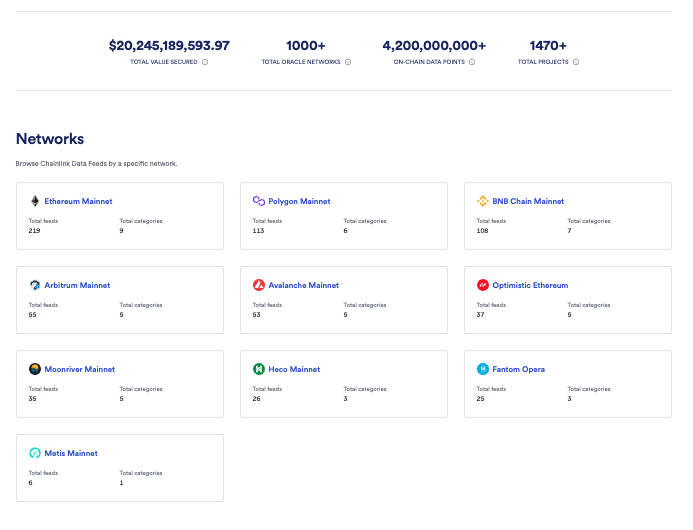

TVS refers to the total value of US dollar-denominated assets deposited in the market secured by critical infrastructure such as oracles. Chainlink oracles provide data such as price feeds, weather data, sports statistics, and proof of reserves to on-chain smart contracts. For example, as of October 17, 2022, Chainlink Price Feeds secures value for Compoundover $1 billionstablecoin, and these amounts are counted into Chainlink’s TVS.

image description

Chainlink’s TVS grew 300% from $7 billion in December 2020 to $20 billion in October 2022.secondary title.

Transaction Value Realized (TVE)

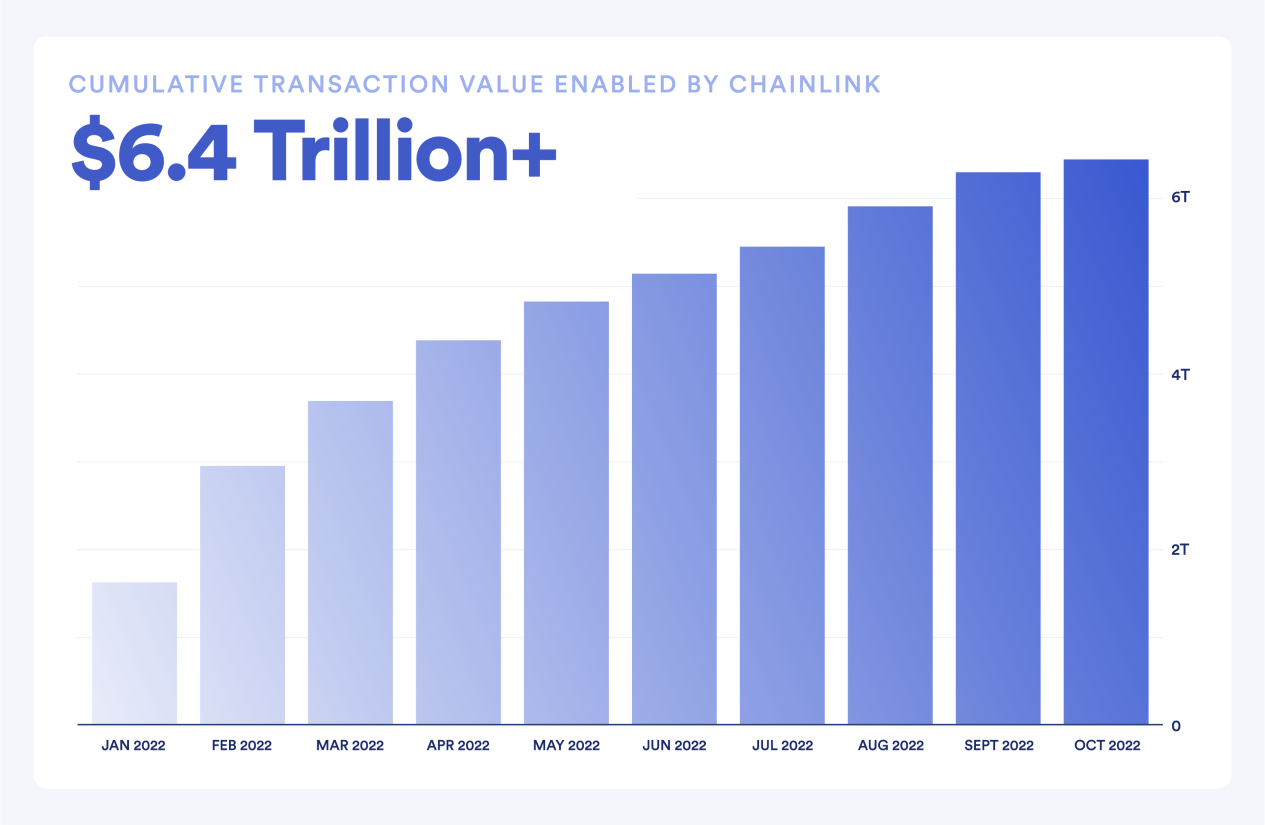

TVE is a Web3 metric that measures the cumulative monetary value of transactions realized by a protocol over a period of time. TVE is calculated by adding up the dollar value of every transaction that passes through the protocol over a certain period of time. For example, if someone borrows $100 worth of ETH on Aave and uses the Chainlink Price Feed to discover the price, then the TVE of the transaction is $100.

image description

first level title

Emerging Web3 Economy

As Web3 continues to develop, the project uses various incentive mechanisms to attract developers and activate growth, so as to create next-generation applications, attract more users, and ultimately achieve more value. In this positive cycle, the Web3 ecology can continue to develop. In a broader sense, the development path of Web3 is similar to that of emerging economies. The Web3 industry builds core infrastructure and increases productivity by attracting capital. Now, the entire industry is ready to expand into new markets.

ChainlinkDecentralized oracle networkIt has played a key role in connecting smart contracts to the real world safely and smoothly, enabling the Web3 ecosystem to conduct transactions with mature industries in developed markets around the world. As Chainlink’s trust-minimized services continue to cover more of the Web3 economy, Chainlink’s realized transaction value (TVE) will also become a key Web3 metric, giving us a better understanding of the overall impact of Web3 on the world economy.

If you are a developer and want to develop with Chainlink, pleaseCheck out the Chainlink documentationStartup with Chainlink ProgramStartup with Chainlink Program. If you want to join the Chainlink community, pleaseJoin our Discord group。