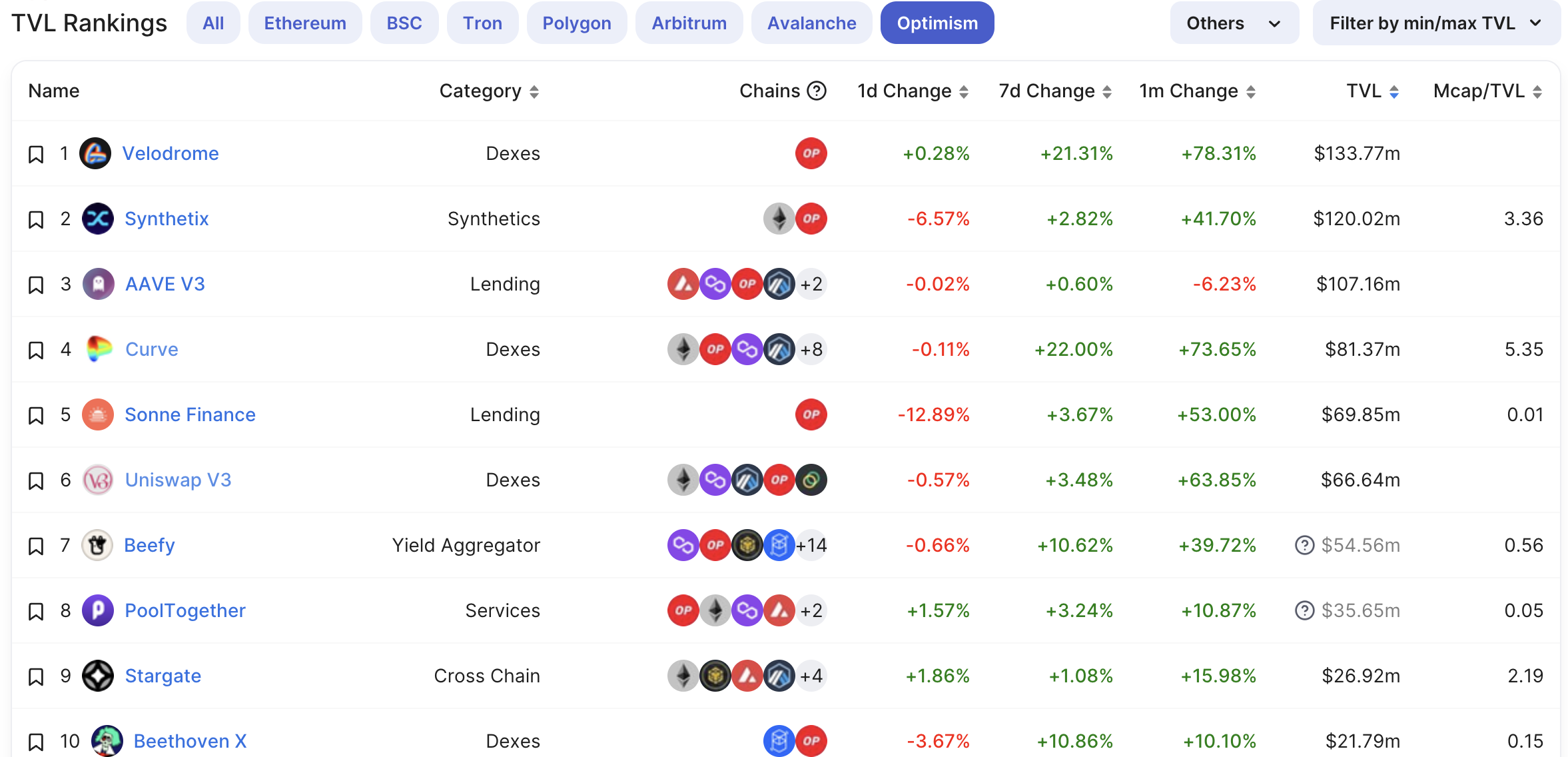

Velodrome, as a native DEX on the second-layer Optimism of Ethereum, had a TVL of $133 million as of January 29, an increase of 78.31% in the past month. Both in terms of the number of TVL and the growth rate, it has surpassed the leading multi-chain DeFi projects such as Aave, Curve, and Uniswap on Optimism. When the top project has a moat, it is becoming more and more difficult for native projects to develop, so what makes Velodrome gain such an advantage?

Velodrome's ve(3, 3) mechanism

Velodrome is adapted by the veDAO team from Andre Cronje's teamSolidly, some modifications have been made on this basis, and the token design also refers to Solidly’s( 3,3) Mechanism。

There are two types of tokens in Velodrome: VELO is an ERC-20 token rewarded to liquidity providers; VELO is locked to get veVELO (also known as veNFT), which is an NFT governance token . The ve prefix comes from vote-escrowed in Curve veCRV, which means vote escrowed. Designing veVELO in the form of NFT also solves the problem that pledged tokens cannot be traded, but veVELO NFT has no liquidity in the secondary market.

The ve mechanism was first adopted by Curve to strengthen the incentives for long-term token holders; (3, 3) the game theory was designed by Olympus DAO. When everyone pledges tokens instead of selling them, everyone’s income is more high.

Among the main participants of Velodrome, the transaction fee for traders in Velodrome is only 0.02% to 0.05%. Even without the liquidity accumulation of Uniswap V3, they may have a better experience because of the lower handling fee.

For liquidity providers, there is no transaction fee income in the common AMM, and they completely rely on Velodrome’s mining reward VELO.

Holders of veVELO can obtain four rights and interests: governance rights, which determine the weight of VELO allocated to each liquidity pool; all transaction fees; all bribery rewards; and reduce the dilution of voting rights through rebase.

Then, the more bribes and transaction fees in Velodrome, the higher the income of veVELO holders, the price of VELO may rise, and the increased income of liquidity providers will attract more liquidity, and better liquidity will further increase Transaction fee income forms a flywheel effect.

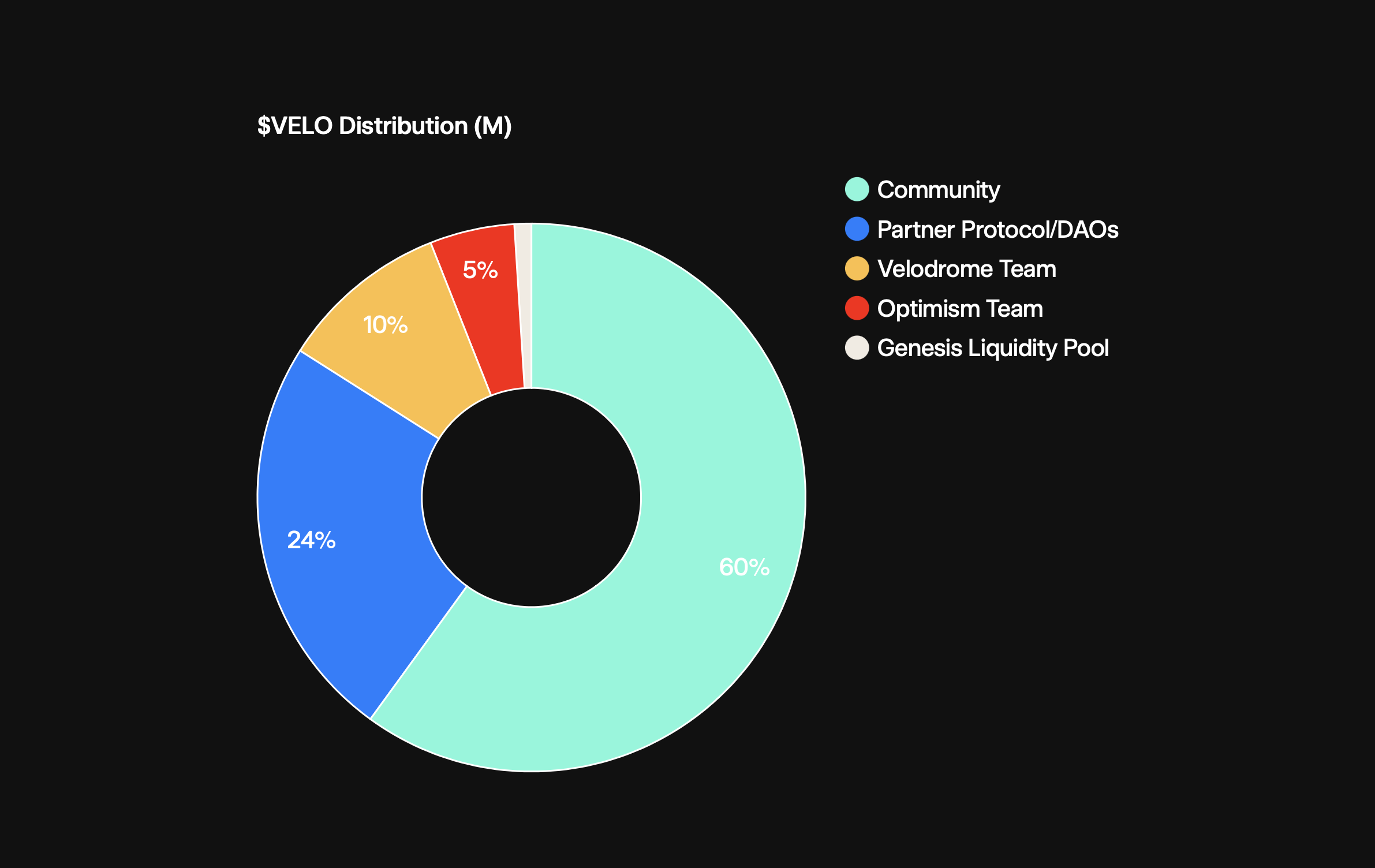

The initial supply of VELO tokens is 400 million, of which 60% is allocated to the community, including WEVE holders, Optimism users and other DeFi users on the chain. The remaining 40% is allocated to partner projects, the Velodrome team (some tokens are used to lock and vote for VELO trading pairs), the Optimism team, and the initial liquidity pool.

first level title

VELO Staking and veVELO Holding Status

From the above, we can know that both VELO and CRV are long-term inflationary assets. Curve is critical to stablecoins, liquid collateralized tokens, anchor coins, and yield aggregator projects, so each project competes to accumulate CRV to form a "Curve War". If the participants’ demand for VELO is insufficient, Velodrome will inevitably go into a death spiral, but judging from the current situation, Velodrome is still the project with the highest TVL on Optimsim, and there is a tendency to form a "Velodrome Race".

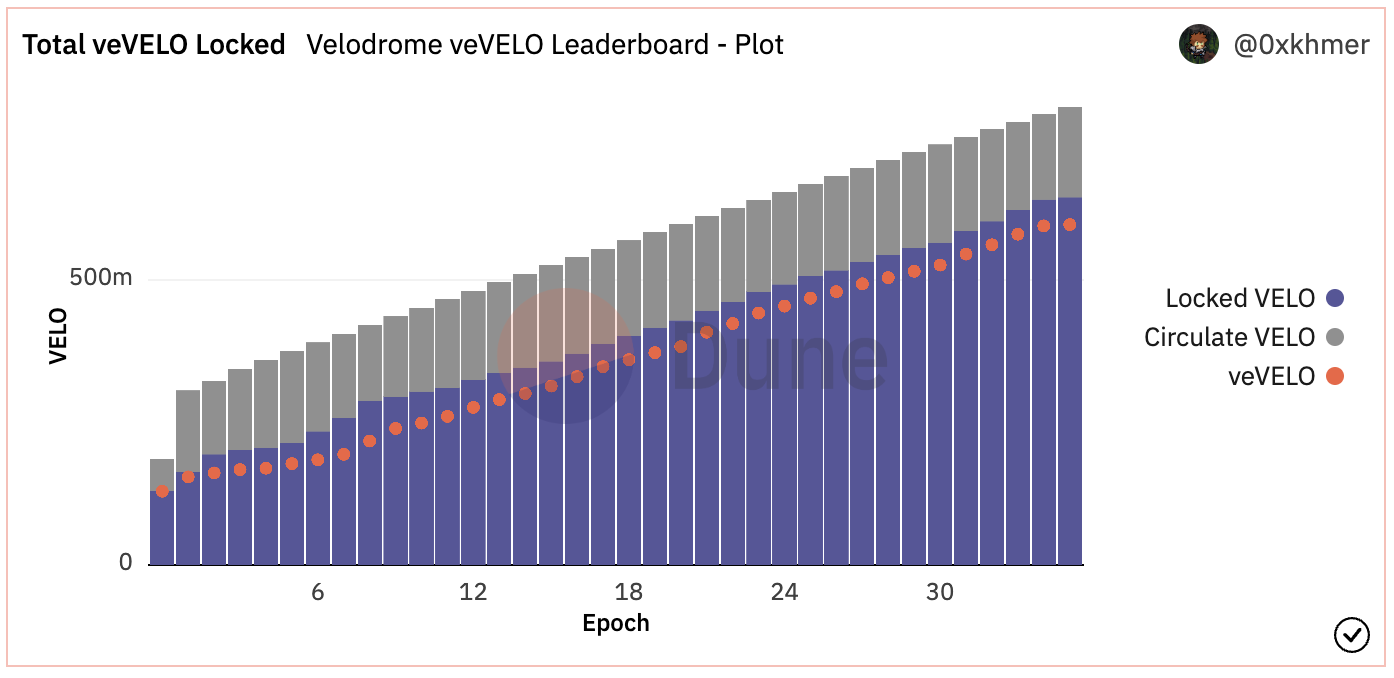

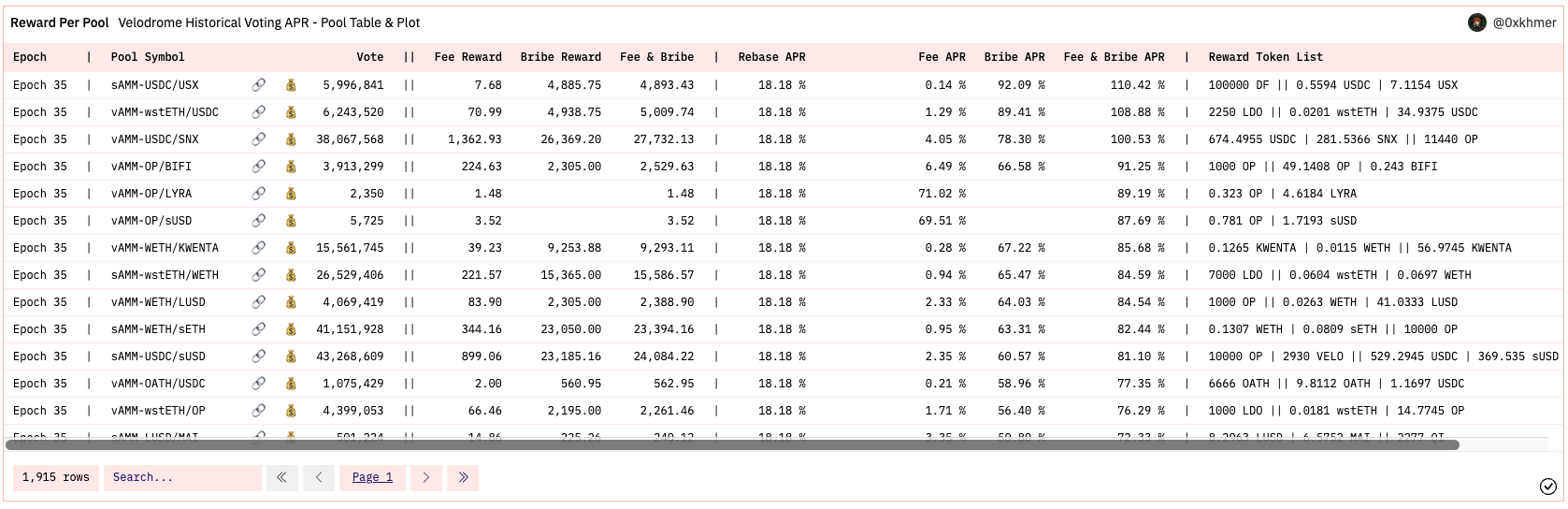

According to the statistics of Dune Analytics @0x khmer, from Epoch 1 to the current Epoch 35 (one Epoch per week, each Epoch starts at 8 am Beijing time every Thursday), although the supply of VELO is constantly Almost all of the newly added VELO is used for lock-up, and the number of VELO in circulation has hardly changed. At Epoch 1, 163 million VELOs were locked and 141 million VELOs were in circulation; currently, in Epoch 35, 645 million VELOs are locked and 157 million VELOs are in circulation.

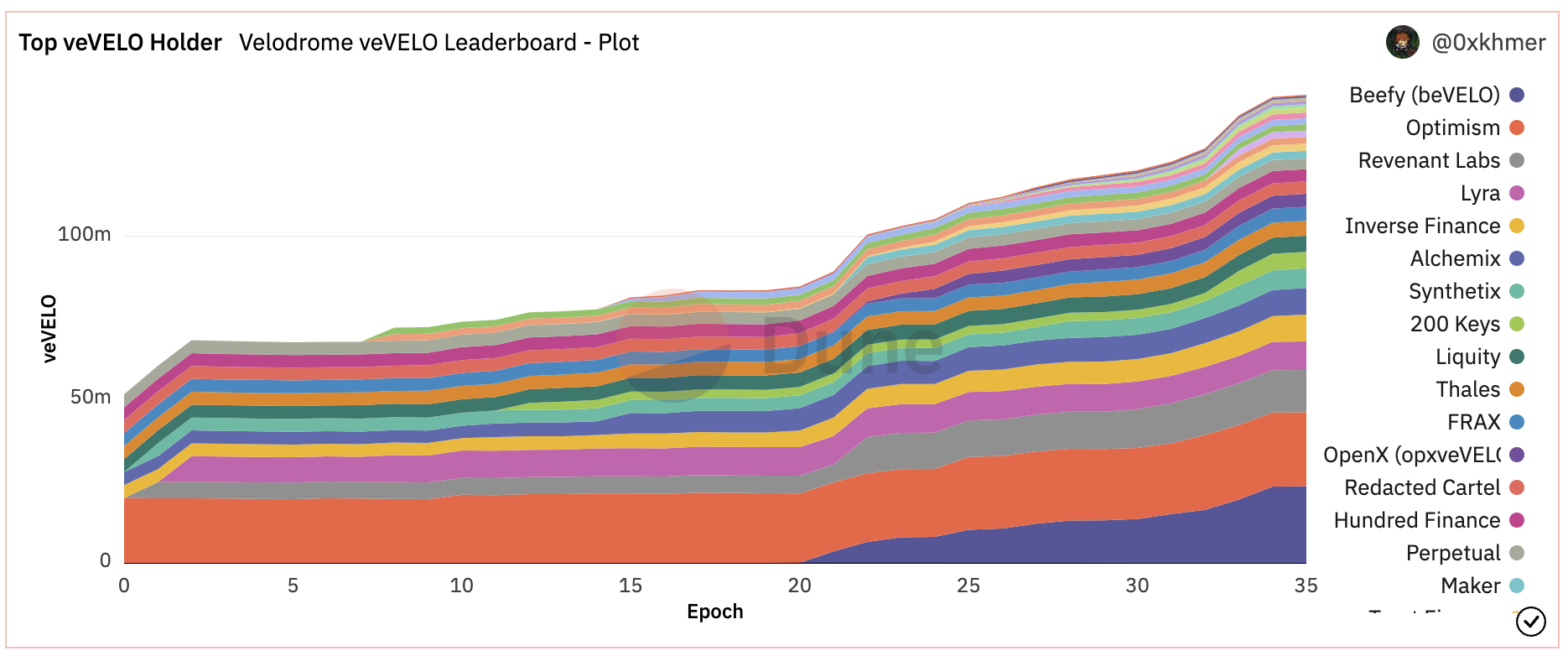

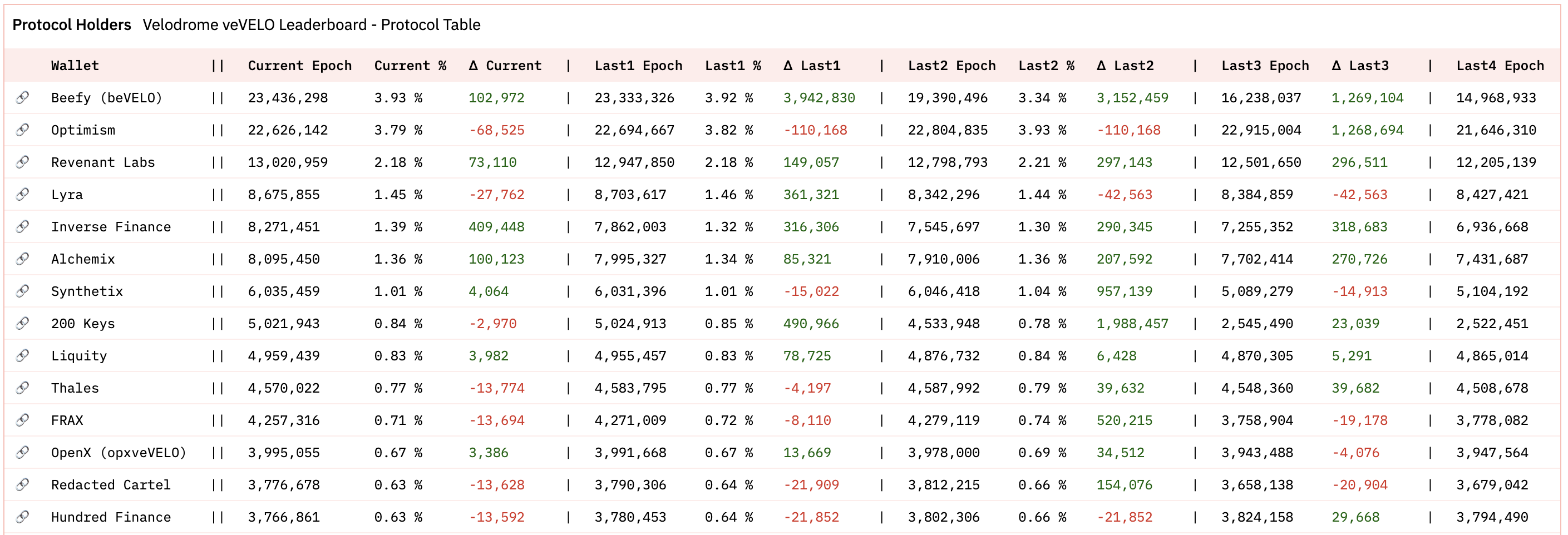

Apart from the Velodrome team, Beefy, which is a multi-chain yield optimizer, holds the most veVELO. Beefy started accumulating veVELO around Epoch 20. Its beVELO vault helps users automatically obtain VELO rewards and reinvest, and charges a certain fee from it. After staking VELO, users can obtain tradable beVELO tokens, which can be traded in the secondary market. Beefy usually reserves a part of VELO for the convenience of users to withdraw. The staking APY of beVELO is usually higher than 100%.

In addition to Beefy, 200 Keys, Synthetix, Frax, Inverse Finance, Revenant Labs, etc. have seen more veVELO holdings in the last two Epochs. But so far no project has obtained a relatively large proportion of veVELO voting rights.

veVELO's Revenue Composition

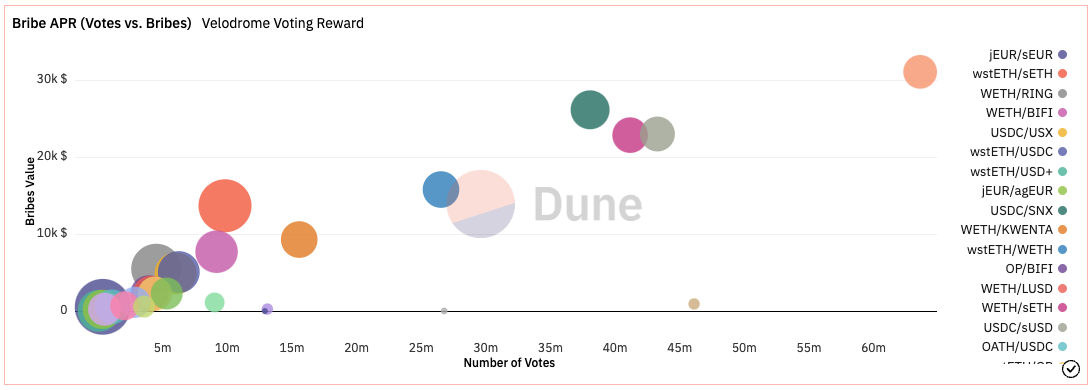

Among the three incomes of veVELO holders, the highest source of income is bribery, and transaction fees and rebase income are relatively small. Why are more and more projects willing to adopt the form of bribes instead of initially adopting governance tokens issued by themselves as mining rewards? Because the form of bribery is more effective, according to Velodrome's calculations, every $1 in bribes will generate approximately $1.5-2 in VELO rewards for the corresponding trading pair.

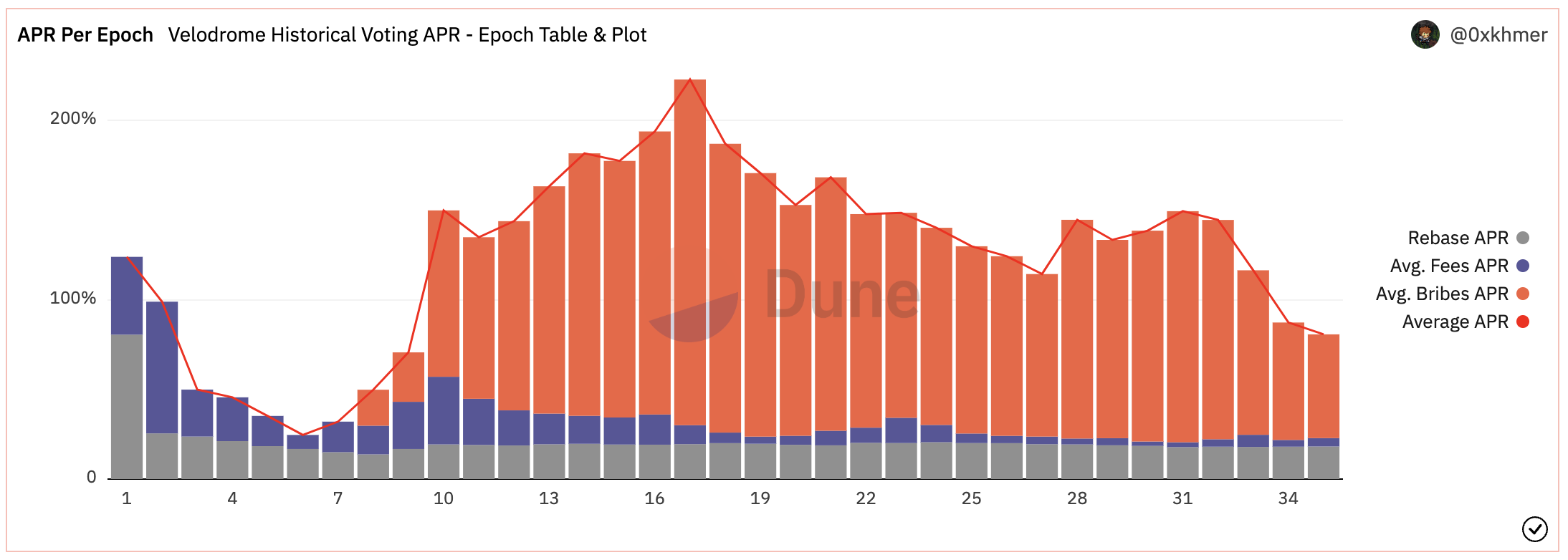

In the ended Epoch 34, the rebase APR was 18.06%, the average bribe APR was 65.47%, the average transaction fee APR was 3.76%, and the total APR was 87.29%.

As shown in the figure below, during the period from Epoch 10-Epoch 33, the average APR was above 100%. Epoch 34 because the VELO price rose too fast relative to the bribe funds, so the APR fell. Since the transaction fees and bribes collected come from the voting pairs, different veVELO holders will receive different bribes and transaction fees due to different votes, while the rebase rewards are the same.

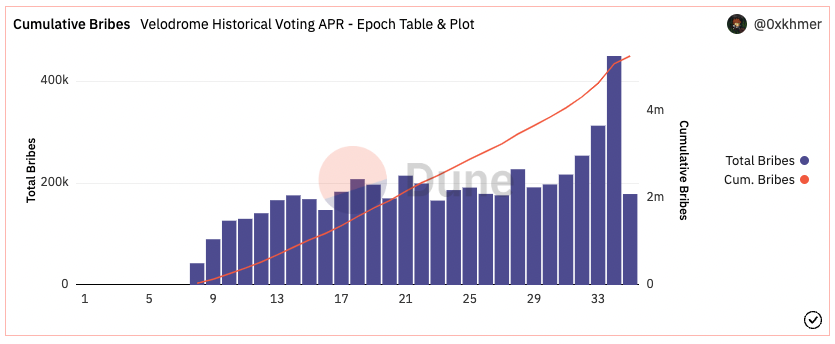

It can be seen that Velodrome’s bribery funds set a historical record on Epoch 34, with a bribe of $449,104 for the week, and a total historical bribe of approximately $5.1 million.

Synthetix is one of the important sources of bribes for Velodrome, and multiple trading pairs including SNX/USDC, USDC/sUSD, WETH/sETH need to attract liquidity on Velodrome. The bribery funds given by Synthetix are the OP officially rewarded by Optimism. In addition, Liquity’s WETH/LUSD, Beefy’s WETH/BIFI, Alchemix’s alETH/WETH, Inverse Finance’s DOLA/USDC, etc. all use OP as bribery funds , almost no projects use stablecoins for bribery, and OP prices have risen more recently, which explains why bribery funds have hit new highs in the near future. However, the OP tokens that Optimism gives to ecological projects are limited, which also paves the way for whether Velodrome's mechanism can continue.

It is worth noting that recently Lido, the top liquidity staking track, has also started to bribe in Velodrome. The weekly bribe fund of wstETH/WETH is 7000 LDO, and the weekly bribe fund of wstETH/OP is 1000 LDO. This generates new revenue streams for veVELO holders.

summary

Velodrome adopts Solidly's (3, 3) mechanism. Although the supply of VELO has been increasing, in the past half a year, almost all of the newly added VELO has been used for lock-up. The number of VELO in circulation is basically equal to that of Epoch 1. Similarly, it shows the effectiveness of this mechanism, and projects such as Beefy are actively accumulating more veVELO.

The main income of veVELO holders comes from bribery, which makes the project more efficient in attracting liquidity. Recently, bribery funds have hit a record high, but part of the reason is due to the price increase of bribery tokens. Synthetix, Liquity, Beefy, Alchemix, Inverse Finance, etc. have all used OP tokens officially given by Optimism for bribery, which also makes the prices of Velodrome and OP tokens, the number of OP tokens given to ecological projects by Optimism and other factors highly bound.