Compilation of the original text: Bai Ze Research Institute

Compilation of the original text: Bai Ze Research Institute

DeFi (decentralized finance) took off in the summer of 2020, becoming synonymous with the last cryptocurrency bull market and the massive speculative activity since. DeFi was born to a certain extent to solve the problem of banks and institutions failing to provide a transparent and inclusive financial system.

ReFi (regenerative finance), rooted in the theory of regenerative economics, aims to deal with climate change, support environmental protection and protect biodiversity in a more inclusive and sustainable way through cryptocurrencies, introduce incentive mechanisms, and contribute to green development Reward behaviors that make contributions to promote sustainable social development. I predict that in 2023, ReFi will be hotter than DeFi, especially at the intersection of cryptocurrency and climate change.

Aside from bear markets and crypto corporate scandals, Ethereum consolidation dominates most of the Crypto narrative in 2022. Among the merger events, the most debated in the crypto community is that Ethereum's new Proof-of-Stake (PoS) consensus mechanism results in a significant reduction in carbon emissions, especially when compared to Bitcoin's energy-intensive consensus mechanism Proof-of-Work (PoW).

However, this is just the tip of the iceberg of the relationship between cryptocurrencies and the climate. As we move into 2023, we can already see dozens of ReFi projects leveraging cryptocurrencies to accelerate users’ path to a low-carbon economy, as well as the emergence of new venture funds focused on investing in ReFi projects.

ReFi blockchain, projects are emerging

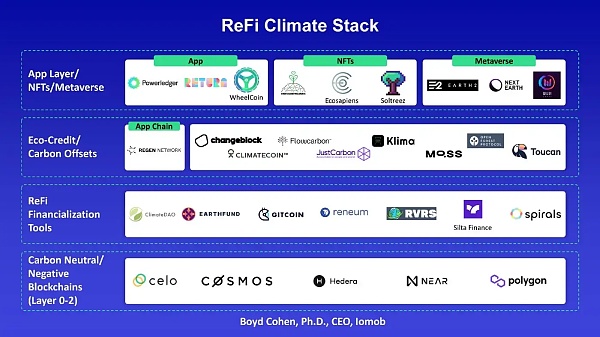

Currently, there are a lot of Layer-1 and Layer-2 blockchains that explicitly promote and support a low-carbon economy, and even create bounties to encourage ReFi projects to deploy on their blockchains. Including Cosmos, Internet Computer, Hedera, Topl, Polygon, Celo, Near, Algorand, etc.

More interesting to me, however, is exploring ReFi projects deployed on these blockchains, as they emerge, enabling cryptocurrencies to hopefully have a more immediate impact on people and the planet.

The primary use case for ReFi is climate, aiming to bring more transparency to the $270 billion global carbon offsetting market. The carbon offset market has long been questioned about its credibility on both the supply and demand sides.

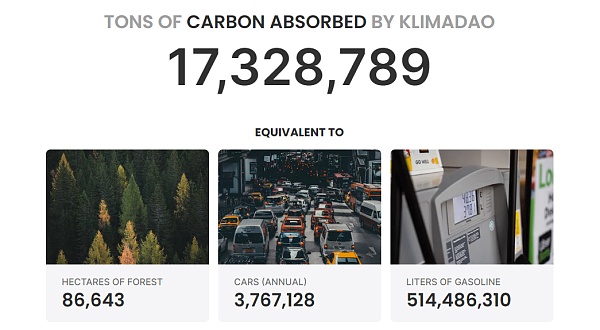

The Cosmos blockchain-based Regen Network focuses on helping companies purchase, trade and recycle carbon credits on-chain. Meanwhile, Klima DAO has created a tokenized carbon offset solution that, at the time of writing, has supported the transparent removal of more than 17 million tons of CO2 from the global atmosphere.

What excites me even more is that we can see the germs of ReFi grow outside of the realm of blockchain and carbon offsetting. Every industry and consumer activity has some impact on the climate, and ReFi projects are emerging to address these challenges.

Similar to introducing carbon offsets on-chain, Reneum is using blockchain technology to create greater transparency in the field of renewable energy credits (RECs). Meanwhile, Powerledger has been an early player in facilitating peer-to-peer (P2P) and decentralized renewable energy transactions since its founding in 2016.

I think that at the user level, ReFi projects can use gamification, such as through Move-to-Earn (M 2 E), linking M 2 E with low-carbon emission reduction, allowing personalization, transparency and tokenization of carbon offsets will become a reality in 2023.

ReFi Gaming: Influence the Environment While Playing

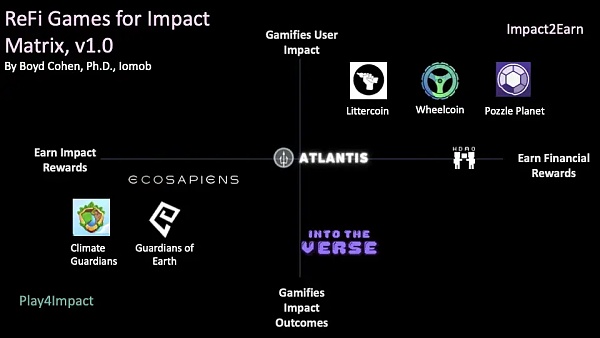

Dozens of games in the ReFi space have already been released or are expected to be released in early 2023. I created a graph to try and understand the diversity of the ReFi gaming landscape and the types of rewards users can earn.

reward type

Reward types are reflected on the x-axis. On the left is Earn Impact Rewards and on the right is Earn Financial Rewards.

Earn Impact Rewards: The primary reward for users playing ReFi games are impact rewards (e.g. earning trees planted on the user's behalf).

Earn Financial Rewards: The main rewards for users playing ReFi games are cash or rewards with cash value (e.g. cryptocurrency, prizes with cash value, etc.).

game mechanics

The game mechanics on the y-axis reflect the primary role of the game in the application, with Gamifies User Impact on the top and Gamifies Impact Outcomes on the bottom.

Gamification of user influence: Attempts to gamify user influence over ReFi focus areas such as garbage collection.

Gamification of Influencing Outcomes: Aiming at making fun games more like traditional Web2 or Web3 games, but somehow embedding influence into the outcome of how users play the game (e.g. winners who win games and earn points, Rewards are distributed to influential organizations).

2 different types of ReFi games

There are currently two main different types of ReFi games, "Play 4 Impact" (play the game to get impact) and "Impact 2 Earn" (make money while impacting).

The main feature of Play 4 Impact is that the game allows players to earn impact rewards by playing interesting games, but it does not require players to have an impact in real life, just like Alipay Ant Forest.

Impact 2 Earn often allows players to have an impact on their own lifestyle through the game, and at the same time receive financial rewards, such as uploading photos of themselves collecting garbage in their daily lives, and get certain rewards.

The items in Play 4 Impact seem to have a more advanced game design than most of the items in Impact 2 Earn. This is logical because in this category, players are not driven to win rewards, so the game has to be sticky and engaging.

Play 4 Impact game inventory

Climate Guardians: Climate Guardians bills itself as a "play for the environment" game, and they clearly fall into the Play 4 Impact category. Players participate in the game and join a tribe to combat climate change by protecting the rainforest. Players pay to obtain in-game assets, and part of the earned rewards will be automatically donated to the tropical rainforest protection fund managed by the user community.

Ecosapiens: Even though Ecosapiens bills itself as an Impact 2 Earn category, I would classify it as a Play 4 Impact category. However, it's like a hybrid of both categories. In the initial version, Ecosapiens did not have much obvious gameplay, but users contributed through the carbon NFT built by Ecosapiens, allowing users to "automatically buy carbon at the global carbon market price and mint carbon as NFT".

Guardians of Earth: While the project is still a long way from a game, it was recommended to me by a colleague of mine who works in the ReFi space. Guardians of Earth blends gaming and real life to raise players' awareness of environmental issues. From what I understand, players get impact bonuses for nature conservation.

Impact 2 Earn game review

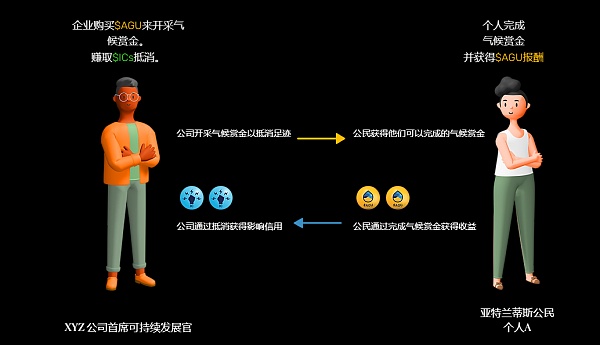

AtlantisDAO: AtlantisDAO very neatly incorporates all the themes covered in the chart. Companies seeking to offset their carbon emissions purchase reward tokens $AGU, which can be offset by carbon-offset $IC in the game's Atlantis "mining", and players can choose to help companies earn $IC. In return, players will receive $AGU from the company.

HumanDAO: HumanDAO aims to use cryptocurrency to help meet the needs of the nearly 2 billion people around the world who have access to the internet and earn less than $20 a day. HumanDAO offers two avenues to enable their target audience community to generate additional revenue. One is Learn 2 Earn (earn while learning), and the other is Play 2 Earn (earn while playing).

Into the Verse: Into the Verse is a metaverse platform based on the Celo blockchain, where players live in virtual cities and own virtual banks and farms. Into the Verse is harder to classify because their rewards include both tokens with cash value and impact rewards for donations to Universal Basic Income (UBI) projects, suggesting it is a mix of impact rewards and financial rewards.

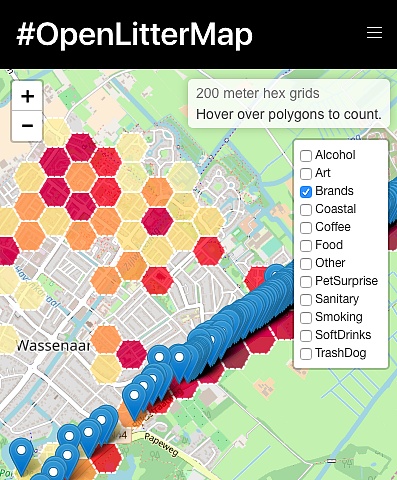

Littercoin: Littercoin aims to raise awareness about trash, encourage players to geotag and take pictures of trash, and help collect trash. In return, players get Littercoin, which I thought was a tradable on-chain token, but I only learned after the project was officially launched that Littercoin can only be exchanged for fiat currency with "climate merchants".

Pozzle Planet: Like Littercoin, Pozzle Planet encourages users to participate in activities that are good for the planet. In return, users will receive $POZ (a virtual currency for the pozitive world).

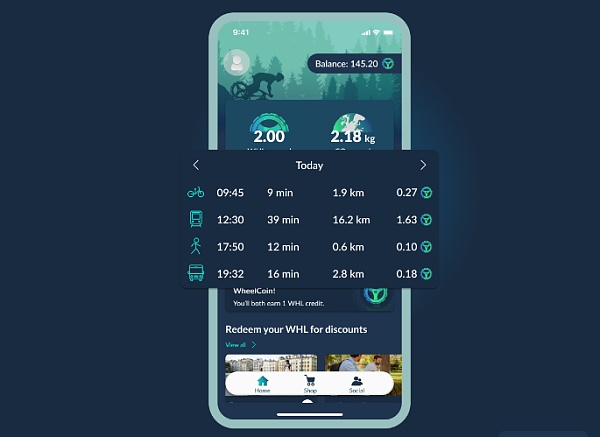

WheelCoin: WheelCoin is a Move 2 Earn game that promotes green mobility for players. Players will be rewarded with $WHL tokens, 1 WHL = 1 kg to avoid carbon emissions. WHL can already be exchanged for discounts on green transportation, and will soon be available to acquire NFTs.

Venture Capital and Global Initiatives

In December 2022, the World Economic Forum launched the Crypto Sustainability Alliance to focus on accelerating the adoption of ReFi. The well-known project X Prize, originally founded by Elon Musk to reward innovative solutions to climate change, is now entering the ReFi space as well.

Summarize

Summarize

As ReFi heats up in 2023, ReFi projects are emerging that aim to engage companies and users to participate in solving many of the world's problems, while leveraging cryptocurrencies to tokenize their contributions and financial rewards.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.