On January 18, when the U.S. Department of Justice announced a major law enforcement action against an international encryption company jointly with the Treasury Department and the Federal Bureau of Investigation (FBI), the encryption market was on the verge of a formidable enemy. Many people speculate that the company may be the American encryption group Digital Currency Group (DCG), which is in the midst of public opinion, is in deep liquidity crisis, and is frequently rumored to be about to go bankrupt. Some encryption investors even cleared their positions in advance to avoid risks.

Although it turned out to be a false alarm in the end-the target of the sanctions was Russia's "third-line" encryption trading platform Bitzlato, and the market rebounded quickly, but there is no doubt that DCG has been defaulted by the encryption market as a time bomb. The reason why many people wait and see with short positions and did not catch up with the market at the beginning of the year is probably because of concerns about the future of DCG.

From the suspension of withdrawals by Genesis, a subsidiary of DCG and an encrypted lender, in November last year, to the early this year, Gemini Lianchuang, an encrypted exchange, issued a document accusing DCG of requesting the repayment of US$1.675 billion in loans, and the subsequent actions of regulators - the US SEC accused Genesis of issuing and selling unsecured funds. Registered securities, US prosecutors and SEC investigated DCG's internal fund transfer issues, and Genesis officially filed for bankruptcy protection today. DCG seems to have reached the end of the road now.

Will the debt-ridden and regulatory DCG fall because of this? How will DCG save itself? Will Grayscale Trust under DCG be affected and dump BTC, ETH and other encrypted assets, causing the encryption market to fall again?

1. DCG-Genesis and Gemini are constantly entangled

After nearly three months of suspension, encryption lender Genesis officially filed Chapter 11 (Chapter 11 of the US Bankruptcy Code) bankruptcy application documents with the US Bankruptcy Court for the Southern District of New York today. According to Odaily statistics, the total debts of the top 50 creditors that have been registered so far are 3.8 billion US dollars. The most notable of these is Gemini, which is the largest creditor of Genesis, with a total debt of 765 million US dollars-slightly lower than the 900 million US dollars of debt stated in the previous Gemini Lianchuang open letter.

In the past few months, the disputes surrounding Genesis, DCG, and Gemini have continued, and the founders of several parties have sent "small essays" to each other in the air, stirring up the entire encryption market.

The cause of the incident was that Gemini had launched a wealth management product called "Earn" with an annualized return of 8%, and the raised funds were managed by Genesis; in November last year, Genesis was affected by the bankruptcy of FTX, and some deposits failed to cash out, resulting in a liquidity crisis . As a result, Genesis suspended all lending services and banned cash withdrawals. Then the media broke the news that the parent company DCG had a debt relationship with Genesis, amounting to more than 1.5 billion US dollars, and DCG also confirmed the authenticity of the debt.

Gemini, the largest creditor of Genesis, began to form a creditor committee with other parties to try to negotiate with DCG to solve the problem, with little success. At this time, due to the suspension of “Earn” redemption, Gemini and the two founders were also filed a class action lawsuit by users, alleging fraud and violation of trading laws. The Winklevoss brothers (the two founders of Gemini) decided to fight back.

To start the new year, Cameron Winklevoss sent a letter to DCG founder Barry Silbert on behalf of the more than 340,000 users of his Earn productOpen Letter (click to read), demanding that he repay the more than $900 million owed. In the open letter, Winklevoss stated that DCG owes Genesis approximately $1.675 billion, and accused Barry Silbert of refusing to cooperate and maliciously adopting delaying tactics.

Barry Silbert then responded, saying: "DCG did not borrow $1.675 billion from Genesis. DCG has never defaulted on Genesis' interest and is currently repaying all outstanding loans; the next loan is due in May 2023." According to According to Barry Silbert, there is a short-term debt between DCG and Genesis (due in May 2023), only $575 million - $447.5 million in cash and 4550 BTC; another $1.1 billion in promissory notes due in Ten years later, in June 2032, this is the debt between Genesis and Three Arrows Capital voluntarily assumed by DCG. At that time, DCG believed that once the market stabilized, there would continue to be a large demand for institutional prime brokerage services, and Genesis's huge brand influence had great competitive advantages and was worth protecting.

However, the rhetoric failed to impress the Winklevoss brothers, and Cameron Winklevoss posted again a week later.Long text (click to read). Cameron alleges that Barry Silbert and other key personnel misled everyone through false statements, convincing all parties that Genesis had recovered from losses from the Sanjian bankruptcy, thereby inducing lenders to continue to provide loans. Cameron believes that the US$1.1 billion promissory note provided by DCG has not been cashed in, and it is a financial fraud, and its actual value will be greatly reduced-a 70% discount, and the market price may only be sold at US$300 million.

In addition, Cameron also revealed to the DCG board of directors that its executives jointly manipulated GBTC with Genesis and Three Arrows Capital in violation of regulations, but the plan failed in the end, resulting in the high debt of Genesis and the deep liquidity crisis of DCG Group. Cameron also suggested that DCG's board of directors remove DCG's current CEO, Barry Silbert, and appoint a new CEO.

In response to Cameron's request, Barry Silbert and DCG officials stated that this is another desperate and non-constructive publicity stunt by Cameron, with the purpose of transferring the dissatisfaction of Earn users on the Gemini platform to DCG. Also, Barry Silbert wrote anShareholder Letter (click to read), to clarify that the loan with Genesis was carried out "in the normal course of business", and to clarify the relationship with Three Arrows Capital, FTX, and Terra (Luna).

Under the "efforts" of the Winklevoss brothers, US authorities began to investigate the internal financial transactions of Barry Silbert's encryption company. Bloomberg reported that investigators were "examining transfers between DCG and Genesis." In addition, the US SEC also stepped in, accusing Genesis Global Capital and Gemini Trust Company of providing and selling unregistered securities to retail investors through encrypted lending schemes.

In the end, Genesis, which DCG was trying to keep, inevitably filed for Chapter 11 bankruptcy. It is worth noting that the companies currently filing for bankruptcy are Genesis Global Holdco and its two loan business subsidiaries Genesis Global Capital, Genesis Asia Pacific, other subsidiaries involved in derivatives, spot trading and custody business, and Genesis Global Trading excluding In the application file, continue to engage in customer trading business.

"Genesis filing for bankruptcy is the first step in Gemini's ability to recover the assets of Gemini Earn users. While Gemini has been working hard to negotiate with Genesis, DCG and its CEO have been refusing to provide a fair deal. This situation will be resolved after Genesis files for bankruptcy protection. Change, forced by judicial scrutiny, Genesis will have to release information to let everyone know how things got to where they are today." Cameron Winklevoss commented.

2. The bull market expands blindly, and the bear market suffers heavy losses

DCG's troubles are not limited to Genesis. At present, DCG is also in deep liquidity crisis and has debts to many companies.

Dutch cryptocurrency exchangeBitvavo says, the company had deposited 280 million euros in assets in DCG, but since December last year it has been unable to withdraw cash due to liquidity problems. existlatest statementAmong them, Bitvavo said that DCG had previously proposed to the company to repay only 70% of the debt; Bitvavo believed that DCG had enough funds to repay the entire debt, so it rejected the proposal.

In addition, British investment group Eldridge conducted a debt financing for DCG in November 2021, with a total loan of 600 million US dollars. According to Barry Silbert, $350 million is still owed.

In the past few months, DCG, which has been hit hard, has begun to actively cut costs in response to current market conditions, including cutting operating expenses and layoffs. It also closed HQ, a wealth management subsidiary that DCG incubated in 2020, at the beginning of this year. It is reported that the company previously managed more than US$3.5 billion in assets. "While we continue to believe in the HQ concept and its excellent leadership team, the current downturn is not conducive to the near-term sustainability of the business," wrote Barry Silbert.

In addition, DCG also stated in the shareholder letter that it suspended dividends. "In response to the current market environment, DCG is focused on strengthening its balance sheet by reducing operating expenses and maintaining liquidity. As a result, we have decided to suspend DCG's quarterly dividend distribution until further notice." Just a month ago, DCG also It is said that it is expected to achieve an annual income of 800 million US dollars.

As more problems surfaced, more and more celebrities and dignitaries began to separate from DCG and distance themselves from the relationship. Larry Summers, a professor at Harvard University and former chief financial adviser of the Obama administration, joined DCG in 2016 as a consultant on macroeconomic affairs. He recently announced that he had left DCG and deleted his resume related to DCG from his personal website profile.

Glenn Hutchins, one of the three directors of the DCG board and co-founder of Silver Lake, also resigned from the DCG board in November last year. Glenn Hutchins is also a fellow of AT&T, Nasdaq, Federal Reserve Bank of New York, Brookings Institution, Economic Club of New York York and director of the Center for American Progress.

Founded in 2015, DCG, which has a portfolio of more than 200 companies in 35 countries, appears to have entered a growth rut today due to blind expansion by the bull market.

Take the money DCG has borrowed from its subsidiary Genesis - DCG borrowed $500 million between Jan 2022 and May 2022 at an annualized rate of 10%-12% initially held in a vault , in order to meet the occasional need. But in the end DCG decided to use the funds to repurchase DCG shares from one of the earliest venture investors and invest in liquid tokens and public stocks (Note: DCG did not explain the specific content of this part).

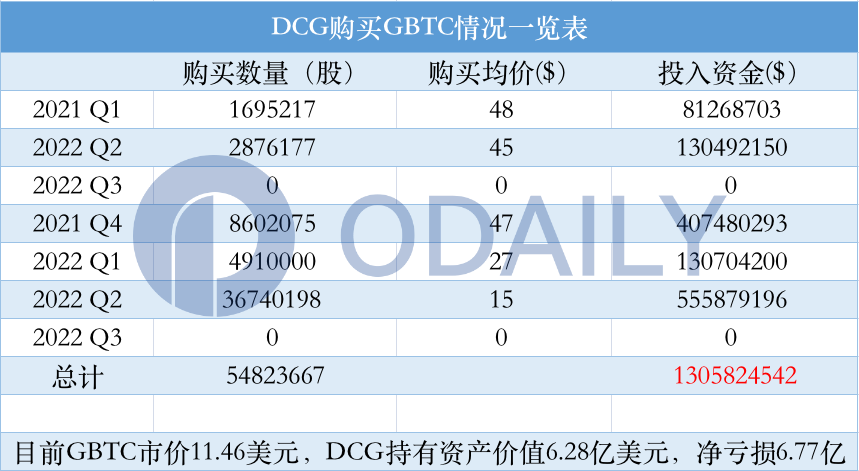

In addition, DCG also used the funds obtained from the British investment group Eldridge for expansion, mainly investing in GBTC (Grayscale Bitcoin Trust). According to Odaily statistics, starting from the first quarter of 2021, DCG has spent a total of US$1.305 billion to purchase 54,823,667 GBTC shares at an average unit price of US$23.8 per share. According to the latest market price ($11.46), DCG has a loss of $677 million; if it can repurchase at the real value ($19.24) in the future, DCG will still lose $250 million. Such a huge loss is due to the fact that DCG misjudged the situation and continued to increase its positions in a bear market. Especially in the second quarter of last year, DCG invested US$550 million to buy 36.74 million GBTC shares, and its assets have been cut in half as the market fell; secondly, due to the rising discount rate of GBTC, it is currently reported at 40.4%.

However, DCG gave an explanation, saying that the GBTC invested did not lose money and had been hedged with the bitcoin borrowed from Genesis. "DCG's investment entity hedges long GBTC positions using BTC borrowed from Genesis Capital to maintain market neutrality in such positions. DCG buys GBTC on the open market when GBTC is trading at a significant discount to NAV Yes, and like all other investments, these decisions are based on an assessment of likely return-weighted risk."

In the end, it was the two major "black swan" events last year that crushed DCG. First, Sanjian Capital went bankrupt, Genesis lost US$1.1 billion and passed on the debt to DCG, and then DCG continued to invest US$340 million in new equity for Genesis to provide additional funds; second, FTX and Alameda were insolvent, Genesis accounts receivable are difficult to collect. If this bad debt is really as "small" as Genesis said, it will not go to the point of filing for bankruptcy today. according to twitter users@AP_AbacusIt was revealed that Barry and DCG had pressured Alameda to repay a $2.5 billion loan owed to Genesis.

"You take this money to fuel greedy stock buybacks, illiquid venture capital, and "kamikaze" grayscale NAV transactions, which makes your fund's fee-generating AUM (Fee-GeneratingAUM) fast swell. All this at the expense of creditors, all for your own personal gain. Now is the time for you to take responsibility and do the right thing. " Cameron Winklevoss commented on DCG founder Barry Silbert, "The idea in your mind is-you can hide quietly in your ivory tower, and all this will magically disappear; or, this will be someone else's problem. This is pure fantasy! To put it bluntly, this mess is entirely of your own making. "

3. Subsequent impact: Will DCG go bankrupt?

According to today's press release, Genesis currently has only $150 million in cash on hand. Paul Aronzon, Independent Director of Genesis, said: "We look forward to advancing our dialogue with DCG and creditor advisors as we seek to implement a path that maximizes value and provides our business with the best opportunity to position itself for the future."

With Genesis filing for bankruptcy, there is not much time left for DCG, and the next goal of the creditors will be to recover DCG's arrears. Haseeb Qureshi, a partner at Dragonfly Capital, said Genesis creditors may ask DCG to redeem Genesis' $1.1 billion worth of 10-year notes, which would trigger DCG's liquidity to dry up and cause it to go bankrupt.

according to

according toFinancial TimesAccording to reports, people familiar with the matter revealed that DCG is considering selling some of its venture capital assets, including 200 cryptocurrency-related projects in at least 35 countries, such as exchanges, banks and custodians, worth about $500 million. In addition, DCG's encrypted media CoinDesk also expressed its intention to sell part or all of its business; Cardano co-founder Charles Hoskinson said he was considering acquiring CoinDesk, planning to bid $200 million (Note: CoinDesk was originally acquired by DCG in 2016 for about 500,000 to 600,000 US$, current annual revenue is approximately US$50 million).

Of course, in addition to selling subsidiaries, another option for DCG is to sell part of its equity. In November 2021, DCG completed a financing of US$700 million at a valuation of US$10 billion. Although the valuation will shrink after entering a bear market, it is not a big problem to sell some shares to raise hundreds of millions of US dollars. according toThe BlockAccording to reports, creditors of Genesis negotiated with DCG to develop a pre-packaged bankruptcy plan, agreeing to repayment grace for one to two years; in exchange, creditors will receive cash payments and equity in Genesis parent company DCG.

In addition, the market was generally worried that the bankruptcy of Genesis would lead to the bankruptcy of DCG, which would trigger a huge GBTC liquidation. have to be aware of is,AshDegree itself is not involved in any of DCG's debts, is a completely independent third-party entity, and will not be shut down suddenly. In addition, even if all subsidiaries are sold at a low price, DCG will most likely not sell Grayscale Trust. As DCG’s flagship business and its cash cow, Grayscale is the most stable part of all businesses, contributing about 300 million US dollars in fee income every year ——Grayscale Fund has a total holdings of US$16.191 billion and charges a management fee of 2% per year.

And DCG owns GBTC, and it will not be thrown into the market suddenly. According to Grayscale CEO Michael Sonnenshein, subject to Section 144 of the Securities Exchange Act of 1933, DCG, Genesis, Coindesk and a number of affiliates are only allowed to sell 1% of the total outstanding shares to the open market every three months . In other words, companies such as DCG need to wait for more than two years if they want to realize the GBTC in their hands through the secondary market. Moreover, GBTC is currently heavily discounted, and DCG is even less likely to sell in large quantities at this node. It only needs to wait for the Grayscale Bitcoin Trust (GBTC) to be converted into a Bitcoin ETF, and then the funds can be recovered according to the net value(Note: All digital assets of Grayscale are stored in Coinbase Custody, not by DCG).

To sum up, whether it is the sale of some subsidiaries or the equity of the parent company, there is no big gap in DCG's short-term debt, so the market does not need to worry too much. As for the next ten years, can DCG repay the $1.1 billion promissory note? As long as DCG does not fall and the encryption market is still there, I think the possibility of repayment is still very high.