1. Summary of Industry Dynamics

first level title

1. Summary of Industry Dynamics

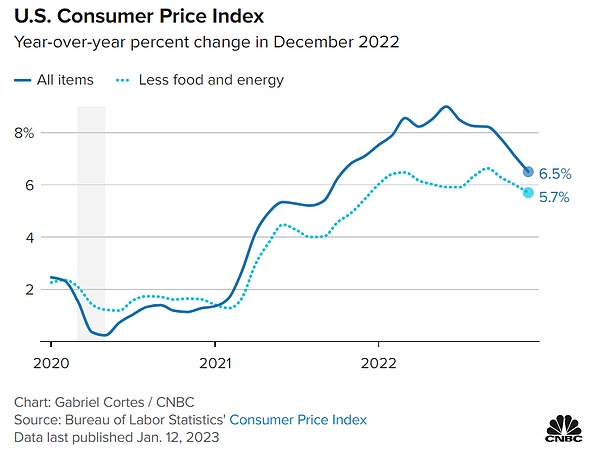

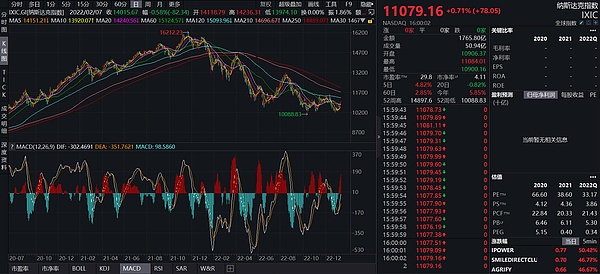

On the other hand, U.S. stocks rebounded strongly last week. They closed positive for four consecutive trading days on Tuesday. With the rise last two weeks, the Nasdaq has risen by 8.53% from its low point at the end of last year, and the S&P has also risen by 5.7%. , and is about to touch the major pressure on the annual line, the point is at 4067 points, the annual line is a downward sloping curve, the stock price has been consolidated for a long time after a sharp drop, and it will be easier to stand on the annual line when the annual line goes down. After the annual line goes down, if the S&P can successfully stand up and stand firm on the annual line, then the bear market will see the hope of ending technically. The most important news last week was that the CPI data showed a negative month-on-month growth rate of 6.5% year-on-year, and the core CPI annual rate was 5.7%. In the future, positive factors that support bulls' confidence will gradually form. Yellen, former chairman of the Federal Reserve and current Treasury Secretary, also recently made remarks saying that inflation has been relatively benign in the past six months, but rents are still rising. She expects the rent index to drop sharply in the next six months, and said she has seen signs of a soft landing for the U.S. economy Prospects, although the Federal Reserve has always upheld independence, and what the Treasury Department says does not affect the Fed's decision-making, but from Yellen's speech, we can still see that she is optimistic about the prospects of the US economy.

industry data

1) Public Chain & TVL

secondary title

industry data

1) Public Chain & TVL

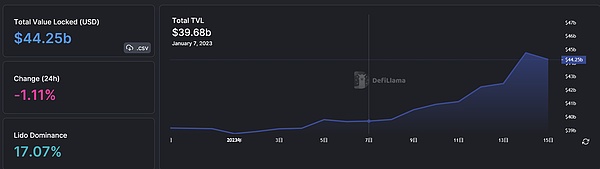

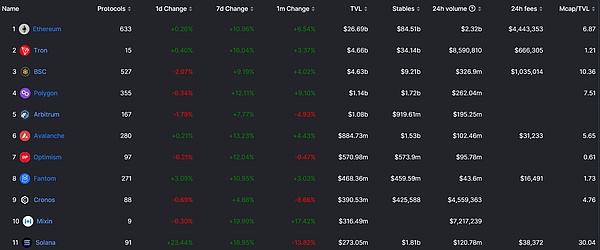

The TVL of all public chains has risen to a large extent this week, with Tron, Avalanche, and Solana leading the way.

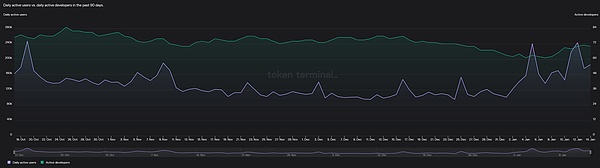

2) Stablecoins

Solana’s rebound continued this week, continuing to rise by more than 50% in a single week, and the price of SOL has increased by more than 180% since its lowest point. After the FTX incident, the Solana ecology was hit hard, token prices fell, NFT projects left, and daily active users and active developers all declined. However, affected by V God’s Twitter “calling orders” and the popularity of the new project Bonk (a Shiba Inu-themed meme coin), the Solana chain has basically returned to the state before the FTX thunderstorm.

Avalanche also rebounded significantly this week. Affected by the good news, the price of AVAX rose by more than 30% in a single week. According to TechCrunch reports, Amazon Cloud (AWS) and Avalanche development company Ava Labs exclusively told TechCrunch that the two companies have reached a cooperation to help expand the adoption of blockchain by enterprises, institutions and governments. Mainly for the convenience of starting and managing nodes on Avalanche, and providing developers with more flexibility and other support.

2) Stablecoins

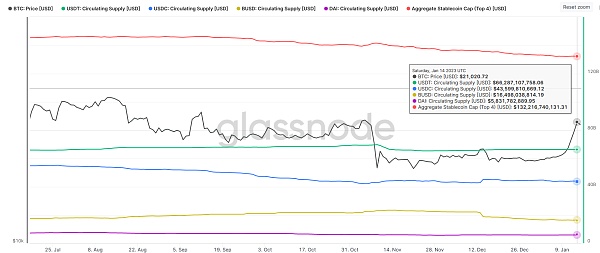

It is worth noting that DAI, which is leveraged by ETH, rose rarely this week, and the supply increased by about 86 million pieces (1.5%), and funds on the market began to enter the market to do long.

2. Macro and technical analysis

first level title

Two-year U.S. Treasuries traded sideways.

2. Macro and technical analysis

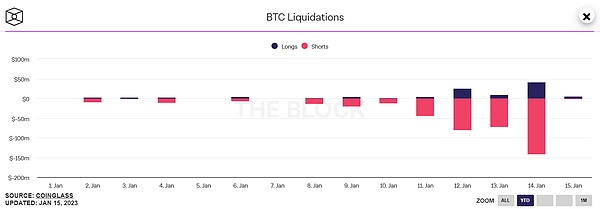

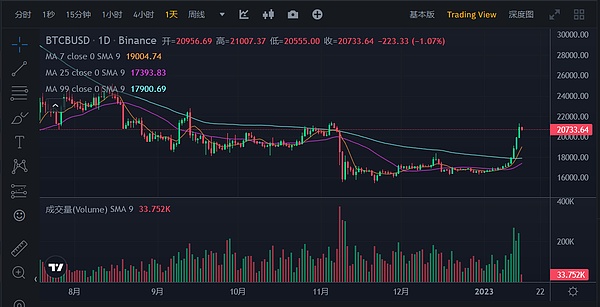

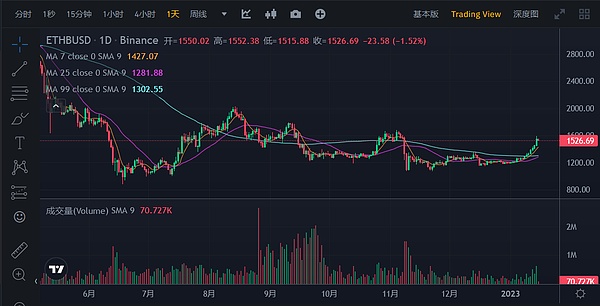

The violent rebound in the market has little to do with the overall macro in essence, and is more of an endogenous rebound demand in the market. BTC and ETH have already rebounded to the previous sideways position, and a certain amount of energy is still needed for an upward breakthrough. At the same time, it has rebounded for 8 consecutive days, and the market has a certain demand for callbacks, so beware of funds borrowing callbacks to ship goods.

Two-year U.S. Treasuries traded sideways.

Nasdaq in rebound to around 11000

first level title

3. Summary of investment and financing

Investment and financing review

3. Summary of investment and financing

secondary title

During the reporting period, Cyber X completed a US$15 million strategic round of investment (equity investment) exclusively participated by Foresight Ventures: this financing will help Cyber X expand its teams in Asia and North America, and increase cooperation with exchanges and decentralized Integration of financial (DeFi) protocols and establishment of their trading infrastructure. CyberX will use the funds to expand its teams in Asia and North America, add more integrations with exchanges and decentralized finance (DeFi) protocols and build out its trading infrastructure.

Exchange Market Maker

Defi Liquidity Provider

Prime Broker: Margin Financing & Asset Management

Labs: Research & Ventures

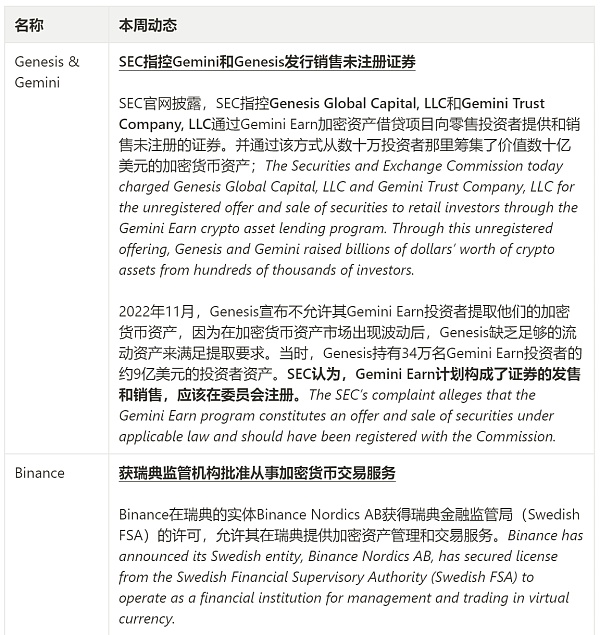

Institutional dynamics

secondary title

4. Encrypted ecological tracking

4. Encrypted ecological tracking

1. NFTs & Metaverse

(1) NFT market this week

secondary title

1. NFTs & Metaverse

(1) NFT market this week

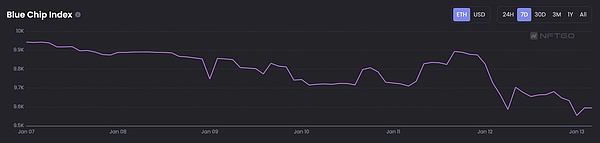

Total market capitalization of NFT: The total market capitalization of NFT also continued to maintain an upward trend this week, up 0.37%. The total transaction volume has also increased by 9.16% compared with last week, and overall it has remained at a relatively stable position. The trading volume has also shown an upward trend in the last 30 days, with an increase of 64%.

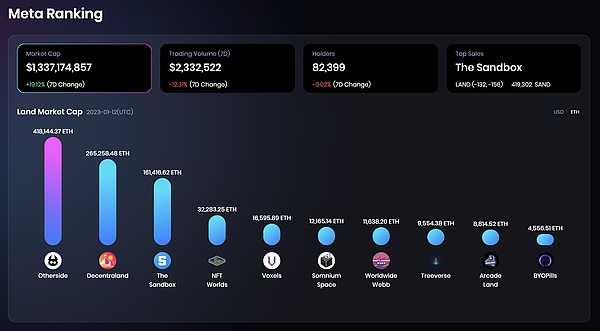

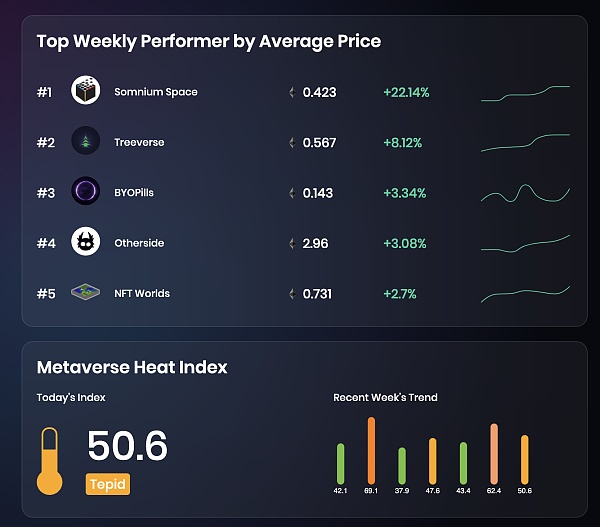

This week's Metaverse project overview:

Market activity: The holders of the NFT market have not changed much this week. The activity of traders has increased significantly compared with last week, with an increase of 16.97%. Buyers have increased by 10.59% compared to last week, and sellers have increased year-on-year 21.25%.

The top three NFTs in terms of trading volume in the NFT market this week are MAYC, BAYC, and BAKC, which are once again taken over by the Boring Ape family. The floor price of BAYC has dropped in the past week and is currently around 79 ETH.

This week's Metaverse project overview:

This week, the total transaction volume of the 10 leading blue-chip projects in the Metaverse sector still showed a downward trend, falling by 12.31% within 7 days, (more than 10% for two consecutive weeks), mainly due to the otherside -4.74% and the sandbox - 13.64%, decentraland - 48.9%. There was a 19% rise in total market capitalization with little change in holders. The top three metaverse projects are still Otherside, The Decentraland and the sandbox, and the floor price of land prices remains in the range of 0.9-1.5 ETH.

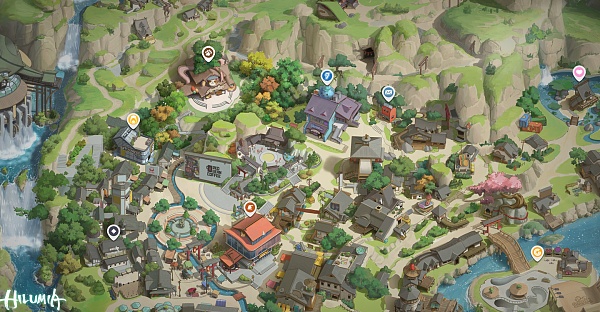

Azuki also released the news of entering the metaverse last Friday, officially launching the virtual city "Hilumia" built by their own community. Azuki's NFT holders or community participants can now directly enter the city to participate in various exploration activities. The project has not yet released a formal roadmap, but the project may be an immersive version of Azuki.

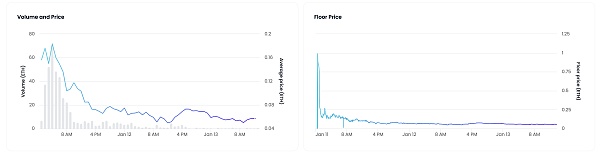

This week's NFT & metaverse dynamic focus:

The NFT platform Nifty's has established a partnership with Warner Bros. and HBO, and plans to jointly launch a series of NFT digital collections related to "Game of Thrones" this year. The project released in this issue is called "Game of Thrones: Build Your Realm, Build Your Hero Box", and it was released on January 10. The first-level sale price is $150, a total of 5,000 (3,450 pre-sales, 1,500 public sales, and 50 community giveaways), deployed on the eth chain. It was sold out in the primary market 7 hours after the release. Currently, the trading volume of Opensea is not very active. The total trading volume is 280 ETH, and the floor price has dropped to 0.045 ETH.

The project gameplay is to upgrade the user's avatar by collecting different resource cards. Specifically, each Series 1 Hero Box contains a hero portrait, nine resource cards that can be used to build your empire, and three story cards featuring iconic scenes, characters, and locations from the American show. The Game of Thrones NFT, released in January, is just the first chapter of the digital collection experience. Warner Bros. will also release related themed events, live engagements and other digital collections in the future.

The project party mentioned that the transformation of web2-web3 is to create more interactive collection experience for fans, and the team also hopes to create a new narrative method and gameplay to allow more die-hard fans to introduce digital collections and Web3 industry. However, some details after the release of the project have also received complaints from netizens. For example, the hands of the character cards designed by the project party are rough in workmanship and have no proportion or beauty at all.

In terms of future development: Warner Bros. also plans to continue to expand the fan base and franchise rights of "Game of Thrones" in 2023, and will also use different methods to attract fans on a deeper level and enhance the overall fan experience.

(2) Key project: Memeland - CaptainZ

Project Introduction:

9 Introduction to GAG:

9 GAG is a social platform that uses secondary creation to share interesting pictures and funny videos. The meme elements in its platform are loved by many users. Currently, there are more than 200 million global users on Instagram, with an average daily active user of more than 800 million people. 9 The success of GAG in web2 is inseparable from users, and the team has been working hard to explore an effective incentive mechanism. Connecting the Web2 and Web3 communities empowers creators.

Project Introduction:

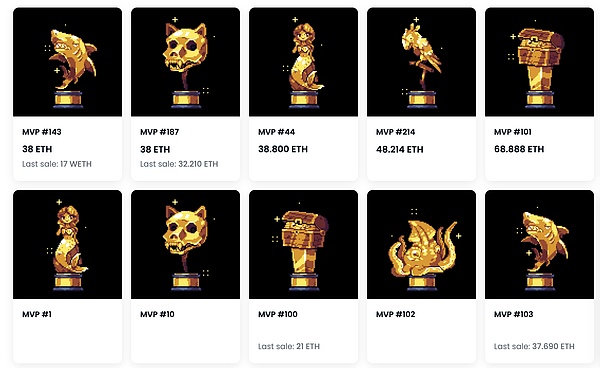

Memeland is the first NFT project launched by 9 GAG. As the NFT market continues to slump, the recent rise in the nft blue chip index is inseparable from the release of CaptainZ. This project has also boosted the popularity of the NFT market in a short period of time. The CaptainZ opened the mint window on January 5th at a price of 1.069 ETH. The whitelist is only open to holders of Memelist and PotatoZ. The Captainz received over 9999 deposits in just 669 seconds after opening mint. The team's income exceeds 9800 ETH, and the current floor price is 5.6 ETH.

The overall gameplay of the project: #Build Creator Economy: Launch different levels of NFT membership cards

Memeland is one of the strong narrative projects of NFT. It also introduces the Web3-style membership card gameplay. The three series of NFT projects "YOU THE REAL MVP", "Potatoz" and "The Captainz" issued by Memeland correspond to different levels of members. Holders can hold different NFT products are used to unlock the membership of different levels of clubs, as well as the whitelist of the future 9 GAG projects, short positions and qualifications for some on-site activities. This access method allows holders to enjoy different rights and interests through different types of NFT.

Item Breakdown:

All in all, although 9 GAG is a "novice" in the NFT field, this social platform with top-level traffic and outstanding operational capabilities has achieved the success of its Web3 transformation with its strong team lineup and huge user base. Li continues to promote their meme culture and their mission of "Make the world happier".

2. GameFi blockchain games

(1) Overall review

secondary title

2. GameFi blockchain games

(1) Overall review

Overall, the industry continues to recover. Judging from the performance of Token prices, the Token prices of the top ten chain games by market capitalization all achieved positive growth, and the increases exceeded 20%.

Gala: After leading the rise last week, Gala continued to rise by 102.95% in the past week, and rose by more than 188% in 14 days. consume tokens)

Oasys:

Stepn: The increase of more than 106% in the past week (the first monthly STEPN Town Hall in 2023 was held, and a series of activities were announced; it may also be that the industry is recovering and market making drives up token prices)

According to the contract interaction volume on the chain, 70% of the top ten chain games have a small positive growth year-on-year, but the top 20 chain games have hardly changed, and the old games in the past still occupy the list;

(2) Items of the week

Oasys is a global game company invested by top global game companies such as Bandai Namco, SEGA, and Gumi, and three exchanges, Huobi, Kucoin, and bitbank, are jointly created for game developers. By combining the best public L1 and private L2 blockchain technology solutions , to provide users with a high-speed, zero-gas GameFi public chain.

Technical solution:

Oasys uses the EVM-compatible protocol of the Oasys architecture. This unique architecture consists of multiple layers:

(1) Hub-Layer: High scalability, high data availability, and high network stability.

Hub-Layer is specifically designed to store and exchange data in a secure and stable manner, so it does not allow applications to run directly. This layer maintains high data availability since all data on Oasys is stored. Block generation is set to every 15 seconds, with the same level of network stability as Ethereum.

Its nodes implement a forked version (Go Ethereum) based on geth, and adopt PoS as the consensus algorithm. In order to maintain the stability of the blockchain network, the Hub-Layer will in principle leave the execution of the application to the Verse-Layer. The Hub-Layer is limited to limited uses such as batch transactions, FT/NFT management, and management of bridge information.

(2) Verse-Layer: Oasys Layer-2 technology. Verse-Layer is Oasys' layer 2 blockchain, and the current solution is a custom Optimistic rollup.

Users only need to deposit more than 1 million OAS on the verse contract to build verse. On Verse-Layer, Verse Builder is responsible for node operations and is required to properly operate the server. Additionally, it is possible to configure which smart contracts can be deployed and which transactions can be executed without using any gas. All data on Oasys is stored in the Hub-Layer and can be recovered even if the Verse-Layer is lost.

Token Economy: Oasys’ token system consists of OAS Tokens (as the native token of the Oasys ecosystem infrastructure), Verse Tokens (tokens used to create an ecosystem for each Verse), and game and Dapps tokens (The main token for games and Dapps).

The reason for adopting a multi-token economy rather than a single-token economy is to give Verse Builders and game developers the opportunity to freely create their ecosystem, designed to be used to deploy many different types of games and Dapps. Games on each verse include a variety of genres, from light casual games to heavy FPS and MMORPG. The differences in content and business types of these verses and games require developers to have flexibility in token design. Under the multi-token economic structure, each Verse Builder can build its own token utility ecosystem, total token issuance amount, distribution amount, etc. according to the characteristics of Verse.

OAS Tokens:

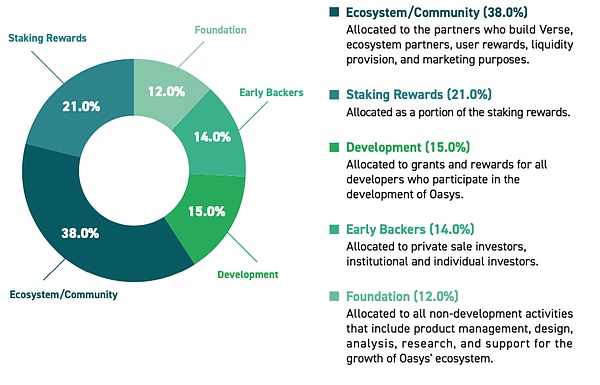

Quantity and usage: The total supply at launch is 10 billion. Has the following uses:

Pay the gas fee

Decentralized governance: including changing the inflation rate through staking, fund use, voting to decide which contract to build on the Hub-Layer, etc.

Token distribution:

Staking: Anyone who stakes 10 million or more OAS through the validator contract can become a validator.Payments: Can be used for many micropayments in and out of the game.

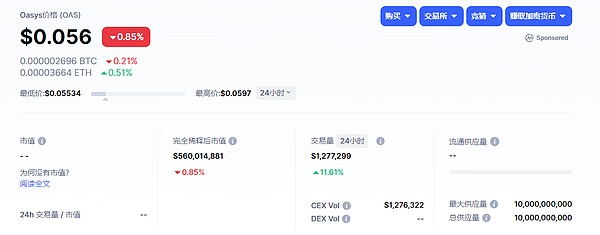

Token Price Performance:

3. Web3 Social & DID & DAO

Virtualness

Currently on OKX, Kucoin, Bybit, Gate, Huobi

Financing: Oasys completed a $20 million financing on July 7, led by Republic Capital, with participation from Jump Crypto, Cryptocom, Huobi, Kucoin, bitbank, and Mirana Ventures. 1 February Announced the completion of a new round of strategic financing, Galaxy Interactive, Korean game giant Nexon, popular game franchise MapleStory and Dungeon Fighter Online, as well as Presto Labs, MZ Web3 Fund, Hyperithm, Jets Capital, Jsquare, AAG, YJM Games and ChainGuardians and others participated in the vote. A core goal of Oasys’ strategic funding round is to strengthen its network of validators while expanding its pool of gaming partners to enhance the Oasys ecosystem.

secondary title

Products (waitlisting):

team background

Creator: One-click coin issuance & NFT, including but not limited to pictures, videos, music

Fans: buy, trade NFT, and share NFT on web2 platforms (ins, tt) and other places

Founding Team: Employee 001 of Facebook India, Partner of Softbank

summary:

Advisory team: Randi Zukerberg (Mark Zuckerberg's sister) and other leading figures in the content Internet industry

Investors: Blockchange led the seed round with USD 8 million, others include polygon ventures, better capital ventures;

In the very early stage, with 2000+ Twitter fans, the Chinese circle basically did not pay attention;

5. Team news

The business model make sense is currently a typical web3-based gameplay of the fan economy, with the help of IP traffic to attract users to settle in;

first level title

5. Team news

JZL Garden Progress

The "Khmer Girl in Dreamland-Willow Leaf" project has been officially launched last week and is expected to be launched soon. Welcome everyone to continue to pay attention.

JZL Garden half month talk

The content of the document includes: 1) JZL team's weekly crypto market review since March 2022; 2) JZL team's research reports on stablecoins, top quantitative institutions, NFT platforms and projects, and infrastructure tracks. Welcome everyone to discuss and exchange together, thank you!

about Us

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment. The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.