In March 2015, there was a vigorous bear market. It had been a year since Bitcoin fell from a high of $1,100, and it was gradually bottoming out in the range of $200. At that time, the northern hemisphere was still cold and the Ethereum mainnet had not yet launched. After nearly a year of discussion and development, the early Ethereum team divided the development of Ethereum into four major stages, code-named Frontier (frontier), Homestead (homestead), Metropolis (metropolis) and Serenity (tranquility).

Since then, an ethereum march that interprets the gold diggers in the western United States to expand their territories, build their homes, and develop cities began to play. Unexpectedly, it was this plan back then that led the development of Ethereum in the next 8 years. Now, with the Shanghai upgrade approaching, the last step of Serenity will come to an end in March 2023, returning to tranquility.

secondary title

1. The current state of pledge in the ETH 2.0 market

The LSD protocol is a DeFi derivative track that has grown up with the upgrade of ETH 2.0. It has not officially entered the mainstream DeFi field of vision before. As Lido’s TVL surpassed MakerDAO and jumped to the top of the DeFi list, the assets of RocketPool, Stakewise and other products are also expanding. It seems that LSD has become a booming track and is in the ascendant.

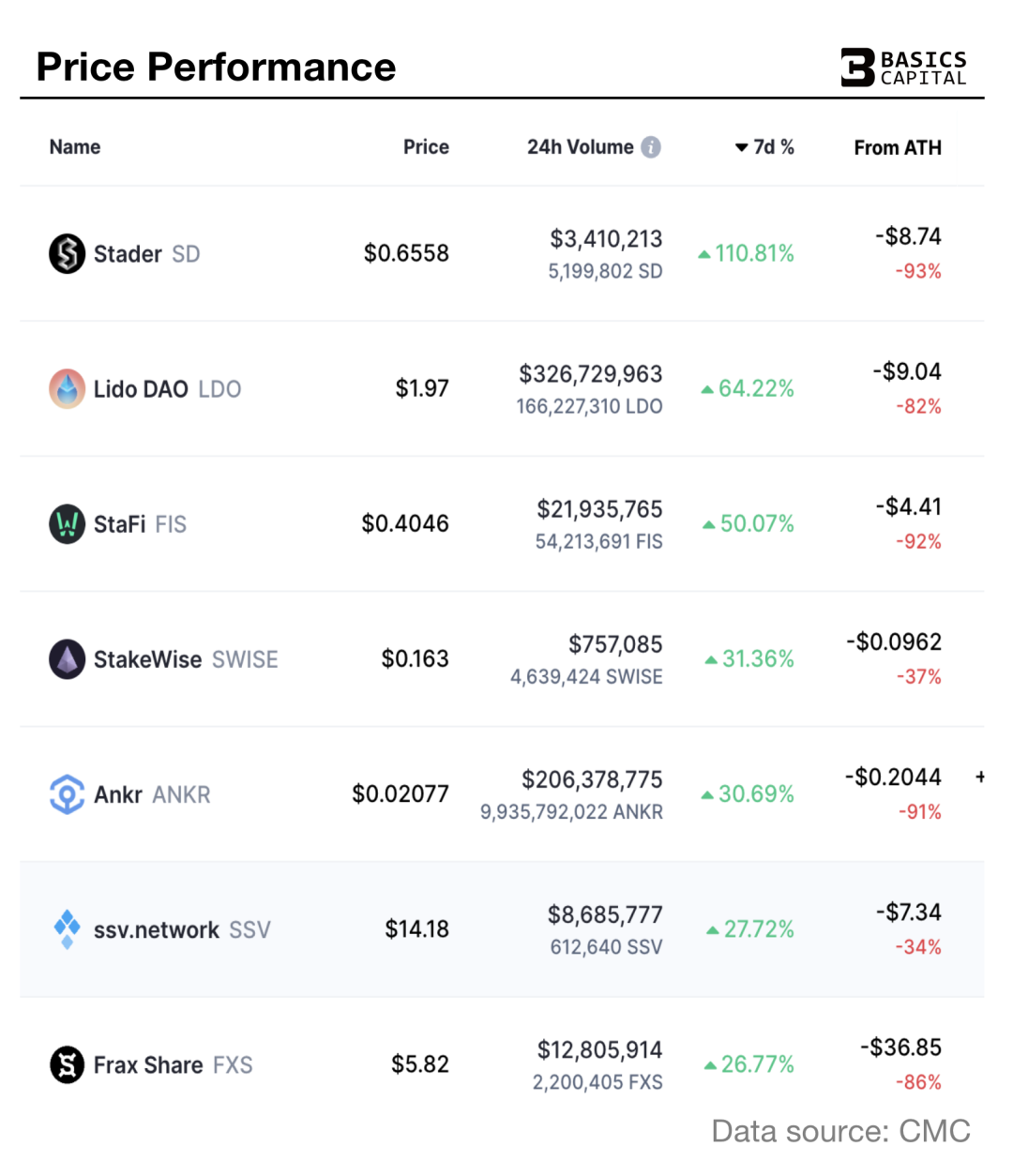

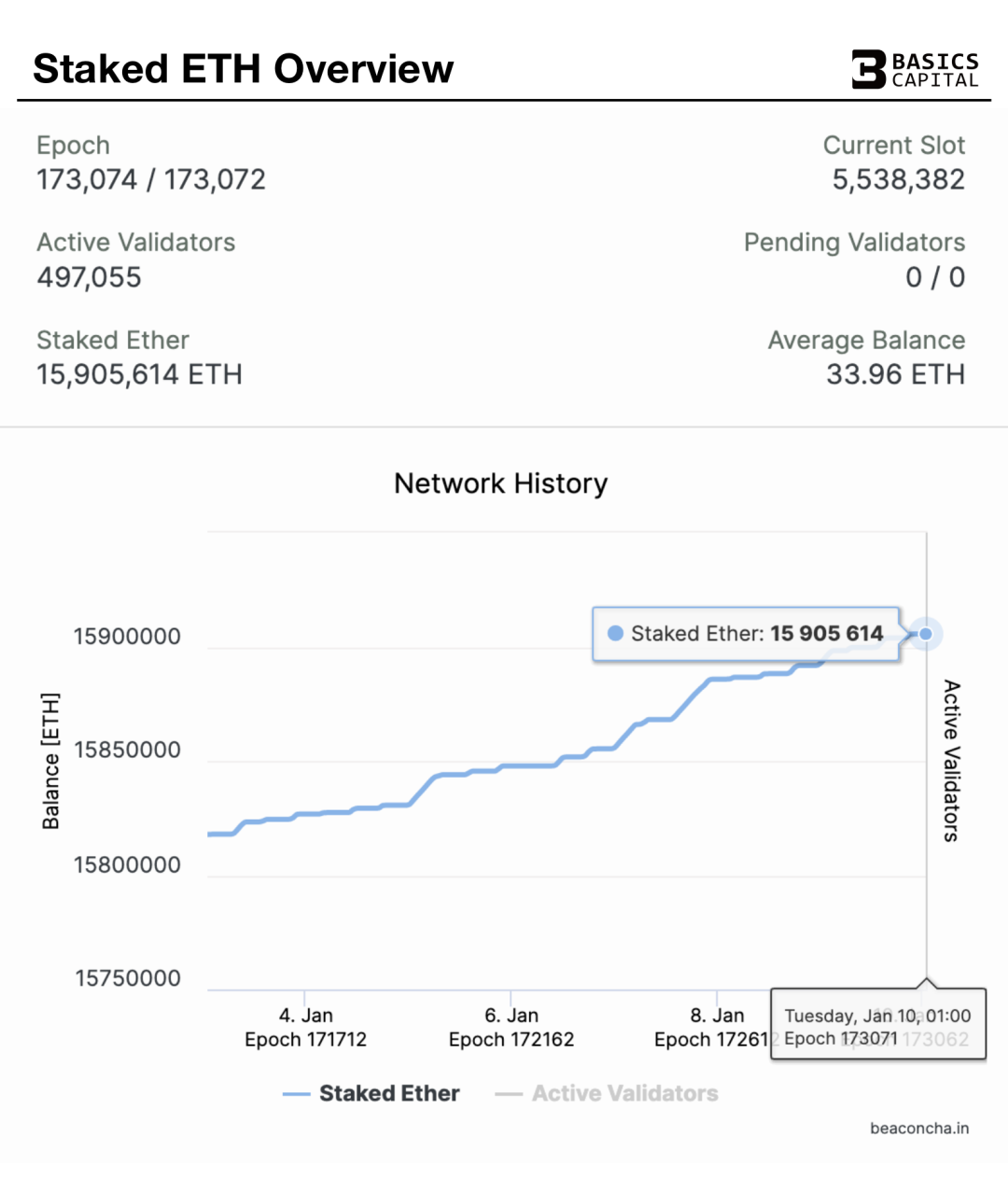

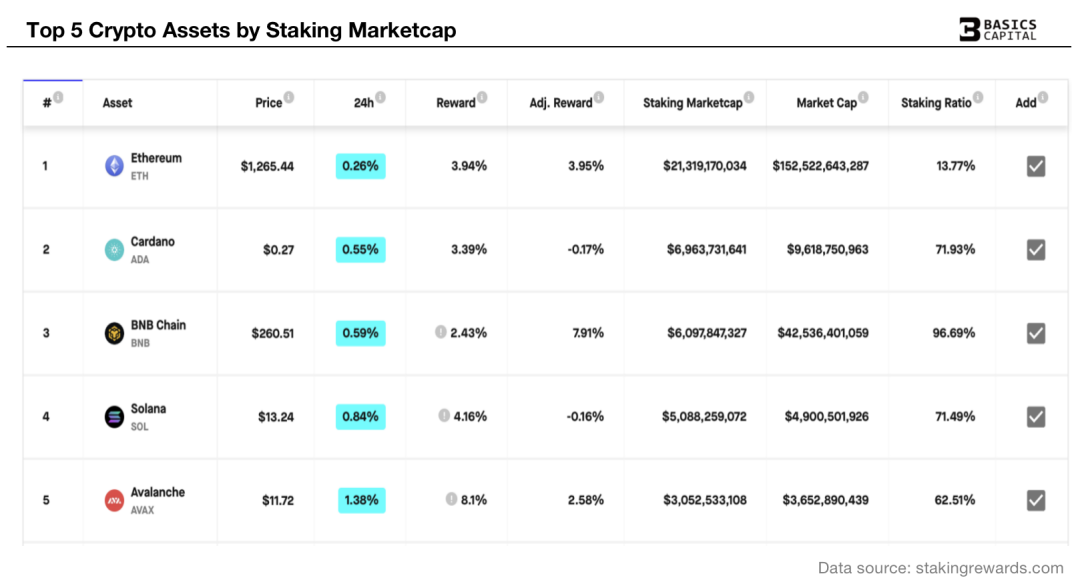

Since the launch of the ETH beacon chain pledge on December 1, 2020, more than 16 million ETHs have participated in the pledge, the locked assets have exceeded 22 billion US dollars, and the number of verification nodes is close to 500,000. It has become the largest locked assets and the most verified nodes. However, comparing the pledge rate of the top 5 PoS chains by market capitalization, the result of ETH 13.28% is still very early.

In addition to ETH, the top 5 PoS public chains by market value all have a pledge rate of more than 60% -70%. The pledge rate affects the stability and security of the public chain. Ethereum will never lack narratives in this regard. I believe After the upgrade in Shanghai, with the release of ETH tokens, the drive of arbitrage and the development of the LSD protocol, the pledge rate of ETH will definitely continue to rise.

secondary title

2. Working principle of LSD protocol

The LSD protocol allows ordinary users to participate in staking without any threshold and get rewards without maintaining the staking infrastructure. In addition, the design of bill assets also releases the liquidity of ETH during the staking period, so a large number of users and assets are captured in a short period of time, and developed into an independent track.

The LSD protocol allows ordinary users to participate in staking without any threshold and get rewards without maintaining the staking infrastructure. In addition, the design of bill assets also releases the liquidity of ETH during the staking period, so a large number of users and assets are captured in a short period of time, and developed into an independent track.

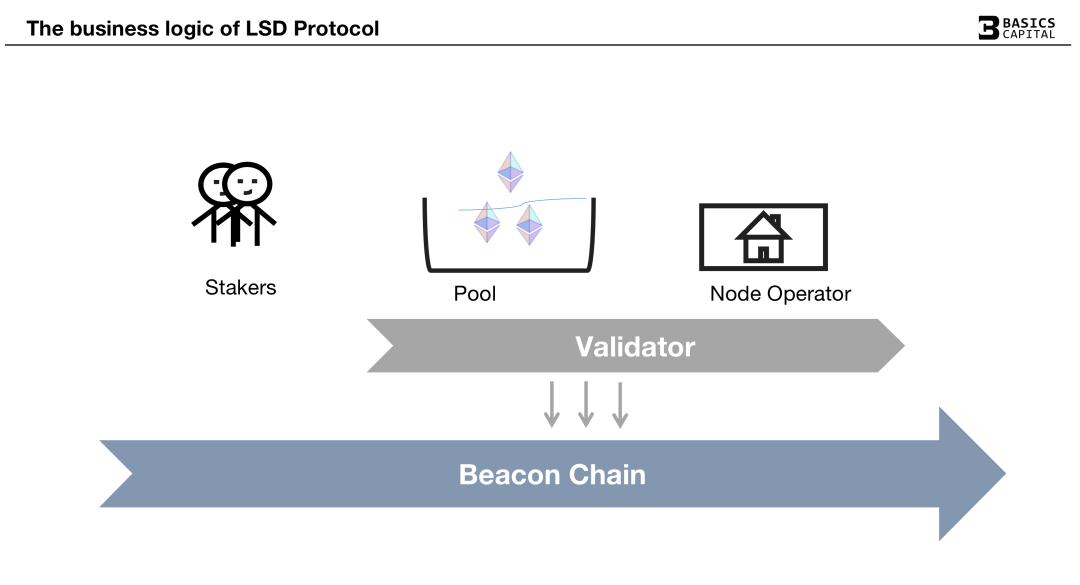

The business logic of LSD contains three roles: ETH Stakers, Pools and Node Operators.

Stakers are responsible for providing ETH, Pools are responsible for collecting, managing and distributing revenue, and Node is responsible for performing signature, verification and block generation of the beacon chain.

secondary title

3. The development of the LSD track

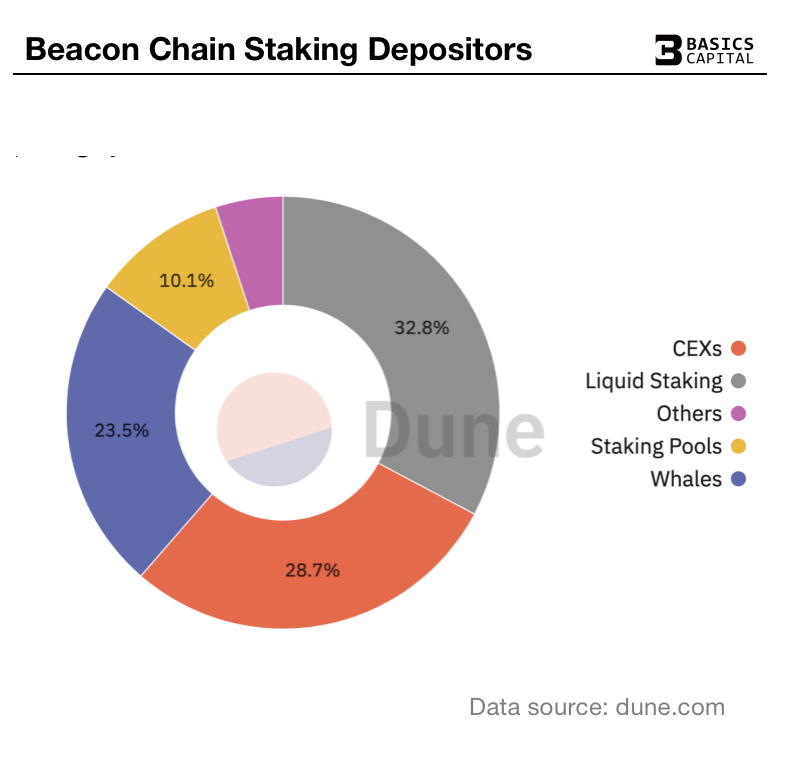

Currently, in the ETH 2.0 pledge market, 16,006,711 ETHs have participated in the pledge of the beacon chain (2023/1/12 data), and the number of ETHs captured by the LSD protocol accounts for 32.8% of the share. The amount of ETH accounted for 28.7%, the amount of ETH pledged by Whales accounted for 23.5%, the DeFi protocol of Staking Pools pledged 10.1%, and other individual pledged nodes accounted for 4.9%. CEX already has a natural advantage. It can be pledged on a centralized exchange with one click, but the LSD protocol can overtake CEX and rank first, which shows its future development potential.

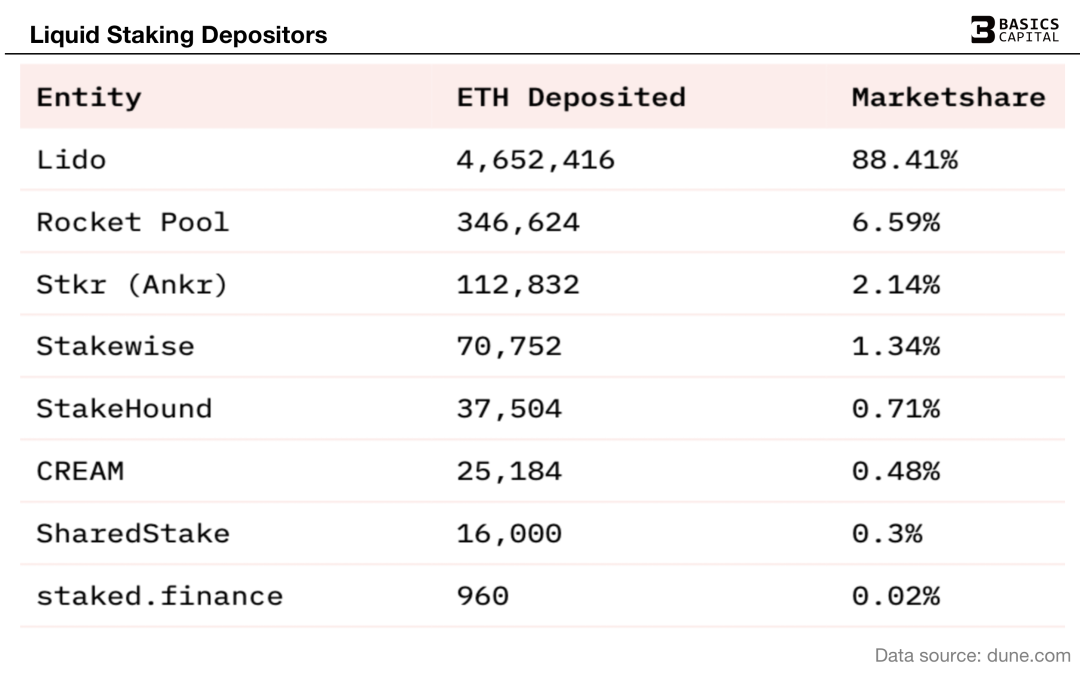

In the LSD protocol section, there are currently 9 projects that can be counted, including Lido, Rocket Pool, Stkr (Ankr), Stakewise, StakeHound, Cream, SharedStake, Staked Finance, and Frax Finance. Lido won 465 W ETH tokens by himself, accounting for 88.41% of the market share of the LSD section, accounting for 29% of the pledge market share of the entire beacon chain, surpassing the sum of all CEX pledged ETH.

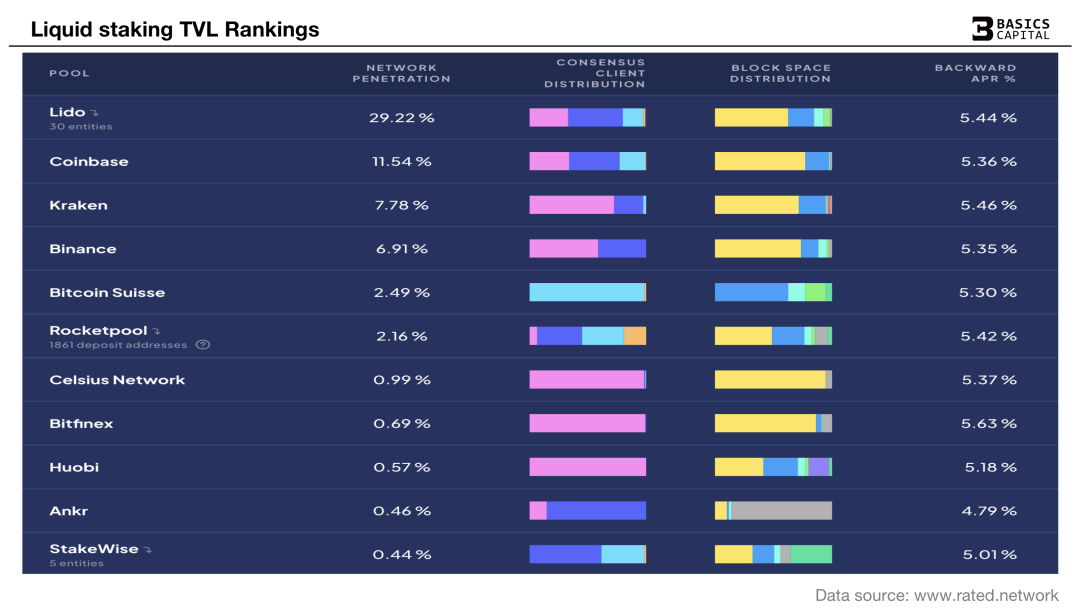

Comparing the returns of various LSD protocols, StakingPool and CEX comprehensively, according to the return test data of the past 30 days, there is not much difference in the performance of each platform in this regard, and the average level is between 5% and 5.5% , so APR is not an important factor causing the business gap.

secondary title

4. Ecological opportunities of the LSD track

We mentioned earlier that the node operator needs the private key of the validator to complete the verification, but if the private key of the validator is directly handed over to the node, there may be various risks of doing evil, so the distributed validator technology DVT (Distributed-Validator-Technology) came into being.

1. DVT section

DVT splits the verifier's key into multiple fragments and distributes them to multiple different nodes. The verification work is completed by multiple node operators, and a single node operator has no right to independently complete signature verification. In this way, it not only reduces the risk of nodes doing evil, but also solves the problem of single point of failure, and the robustness of the system is also improved. At present, there are mainly two solutions on the market, Obol and SSV.

SSV Network

SSV (ssv.network) uses Secret Shared Validator technology to encrypt, split the validator key into 4 KeyShares between untrusted nodes, if one of them goes down or fails, the other 3 can operate the node, The centralization of validator keys is solved, and the Ethereum network becomes more decentralized as a result.

Obol Network

Obol (obol.tech) is a trust-minimized staking ecosystem focused on scaling consensus by providing permissionless access to distributed validators, enabling users to create, test, run and coordinate distributed validators, it creates A distributed verification cluster has been established, allowing different verification nodes to gather together as a single entity to pledge, and a single pledger who joins the cluster does not have to worry about a single point going offline, which makes the normal operation of the validator more competitive and the largest Minimize the risk of centralized evil.

2. Re-Staking section

EigenLayer is a Re-Staking protocol built on Ethereum. Users do not need to pledge directly on Ethereum, but pledge in Eigenlayer's smart contract, and then they can re-stake to other protocols, such as side chains, cross-chains bridges and oracles, etc. This will make the application more secure, because many different entities in the ETH ecosystem have their own trust network, and the collapse of some of these trust layers may lead to exploits and hacking attacks, while those who want to attack through the Eigenlayer shared Network security requires greater costs.

In addition, when users provide Re-Staking, they can also obtain the pledge income of application layer projects, which not only improves network security, but also improves the efficiency of capital use. EigenLayer will support ETH, ETH's LP tokens and stETH's LP Token Re-Staking of three assets.

V. Conclusion

V. Conclusion

About Basics Capital

references:

https://dune.com/hildobby/ETH 2-Deposits

https://ethereum.org/en/staking/pools

https://twitter.com/Maia_Zhao/status/1595983351671795713? s= 20&t=ktcTIA 6 _eVAjbFO 5 psbvXA

https://docs.ssv.network/

https://docs.obol.tech/

https://www.eigenlayer.com/research

https://www.panewslab.com/zh/articledetails/lj 7 plnf 0.html

About Basics Capital

Basics Capital is a global blockchain industry fund, focusing on the primary market and helping the development of early application layer projects. The investment projects come from more than 30 countries around the world, including Southeast Asia, the Middle East, Europe, the United States, Canada, Australia, Vietnam and Russia. and regions, covering various sections of the application layer such as Wallet, NFT, DeFi, GameFi, DID, SocialFi and LaunchPad.