About AvatarDAO

1. Introduction to AvatarDAO

AvatarDAO is the first venture capital community without GP. It is 100% owned, governed and driven by the DAO community. It is committed to creating a Web3 decentralized venture capital fund that is borderless and benefits more people. AvatarDAO was initiated by encrypted VCs, investors, entrepreneurs, and OG. Members include ConsensusLab, BTXCapital, MintVenture, K 24 Ventures, Dahuzi, Lodar, CryptoJames (former overseas CEO of OKX), etc., and has 50+ member institutions and 8000+ community members . We use active independent researchers and investment managers to discover more early project opportunities, a diverse and extensive resource network to support the development of startups, and automated contracts for fund and investment management.

2. Participants of this report

Information collection and writing: @HarlanMix, @Chai_ 1520, @Xxxxxxiaoya, @catlaoshi, @huluwa 66, @JJJ 8677, @0 xlodar, @LyndaDa 19450145, @K_Arcpearl, @cchungccc

Overall architecture and integration: @HarlanMix

Layout and typography: @giraffe_qzq

Both names are Twitter IDs

I. Introduction

Official website:https://www.avatardao.me/

Twitter:https://twitter.com/avatar_dao

Discord:https://discord.gg/avatardao

Table of contents

I. Introduction

2. Definition of GameFi

2.1 What is GameFi

2.2 How does GameFi work?

2.3 What are the types of GameFi?

2.4 The Development Stage of GameFi

3. The era of blockchain games

3.1 What is a blockchain game?

3.2 What are the types of blockchain games?

3.3 Introduction to technical solutions and economic models

3.5 Summary

3.5 Summary

4. GameFi 1.0

4.1 What is GameFi 1.0?

4.2 What are the types of GameFi 1.0?

4.3 Introduction of technical scheme and economic model

4.4 Market Performance

4.5 Summary

5. GameFi 2.0

5.1 What is GameFi 2.0?

5.2 What are the types of GameFI 2.0?

5.3 Introduction to technical solutions and economic models

5.4 Market Performance

5.5 Summary

6. The Development Trend of GameFi X.0

6.1 Diverse X to Earn

6.2 Technical scheme and economic model analysis

6.3 Chuanyou manufacturers set foot in Web3

6.4 The Return of Gaming

references

references

Investment Risk and Disclaimer

I. Introduction

I. Introduction

When does investment behavior become engaging and group? It usually weakens the investment logic and meets the needs of most people to make a living.

When most of the investment behavior still occurs in the primary and secondary markets, a miracle door has been opened, and it will release huge potential in 2021. It is GameFi.

GameFi has gradually died down with the development speed and popularity of the DeFi sector. On the basis of DeFi, GameFi has expanded the game to the financial field. Players from different corners of the world converge on this brand-new track built with blockchain technology with stronger property rights needs + entertainment needs + profit needs. GameFi has become an investment tool for some encrypted users.

At the same time, the ever-emerging GameFi and NFT projects have become a bright spot in the crypto market. This is a carnival for encrypted users, and a large number of GameFi projects that investment institutions participated in during the sector's outbreak period have not yet been concentrated in the market, and the residual temperature is still there.

GameFi projects in the current market can be integrated into DeFi, NFT and other conceptual products at the same time, satisfying encrypted users and players with various investment preferences, and blockchain games are still a relatively small field, with billions of players compared to traditional games The numbers still have a lot of room to grow.

Therefore, this special research report will focus on the definition of GameFi, the development history of early blockchain games, the 1.0 and 2.0 stages of GameFi, and the future development trend of GameFi X.0, etc., to sort out the development process of the GameFi track in an all-round way. Summarize.

This special research report does not require you to have in-depth GameFi industry knowledge, and the professional researchers of AvatarDAO will organize the content and insights for you. A closer look at GameFi's past and present.

2. Definition of GameFi

2.1 What is GameFi

GameFi is a visual blockchain finance that expresses DeFi as a game. Simply put, it is to realize the realization of money (finance) in the game. GameFi is the concept of "gamified finance" under the fusion of DeFi and NFT. It presents decentralized financial products in the form of games, gamifies the rules of DeFi, and transforms game props and derivatives into NFT. The NFT attribute of GameFi makes the in-game All assets, props, and characters of the game are unique and collectible. Combined with the property settings of chain games, players can fully own the ownership of these assets in decentralized games. In a sense, GameFi breaks the convention that game assets only belong to game development companies, allowing players to realize wealth gains through games. GameFi enhances the entertainment and interactivity of blockchain finance and NFT. And other playing methods allow participants to benefit from it.

2.2 How does GameFi work?

Rewards in GameFi come in a variety of forms, including cryptocurrencies and in-game assets such as virtual land, avatars, weapons, clothing items, etc., which gamers earn through gameplay and can trade them on the NFT market for profit or exchange them for Cryptocurrencies, models and game economies vary for each GameFi project. Most in-game assets are NFTs on the blockchain, which can be traded directly on the NFT marketplace. In some other projects, in-game assets need to be converted into NFT before they can be sold or traded. In-game assets often create benefits for players, allowing them to earn more rewards. The avatars and skins in some games can only present visual effects, and have no impact on gameplay and rewards. It varies according to the gameplay of different games. Players can typically earn rewards by completing quests, playing against other players, or building monetized structures on owned plots. In some games, players can pledge or lend game assets to other players, earning passive income without playing the game.

2.3 What are the types of GameFi?

2.3.1 Classification by Token Design Type

single currency

Features: All economic output and consumption activities in the game are linked to the same token, which is easy to control; death spirals are prone to occur later. That is, it is difficult to cope with extreme market conditions, such as large households selling coins and the price plummets, and cannot return to the original price after the plunge

Representative game: spaceship

Focus: consumption mechanism design, choice of value anchor

dual currency

Features: Most games adopt the form of main currency (value currency) + auxiliary currency; in general, the consumption and output of the main currency are linked to the auxiliary currency; sometimes the output of the main currency and the auxiliary currency are linked to the PVP system and the PVE system respectively; in general The following is "diamond" changed to the main currency, "gold coin" changed to auxiliary currency; the main currency can be applied to most application scenarios in the game

Representative game: Axie and its imitation disk

Focus: The supply ratio of the main currency and the auxiliary currency; the correlation design of the consumption method of the main currency and the auxiliary currency; the ratio of consumption and output; subsequent adjustments are related to the diversification of consumption channels

multi currency

Features: Often used in games with more resources: SLG, open world

Representative games: farmers world; Star sharks

Focus: the activity relationship represented by each currency, the output consumption relationship between different tokens

2.3.2 Gamefi upstream and downstream classification

Engine: UE, Unity, Cocos, etc.

At present, there is no need to develop an engine from scratch for Gamefi, or in other words, a gamefi-specific engine does not make much sense.

Lightweight game development tools: mainly in the form of SDK to provide on-chain solutions for light games.

Rendering: cloud rendering platform

Game application chain: Ronin, Defi kingdoms, etc.

It is mainly suitable for games with large user groups, high DAU and long life cycle

But there are asset cross-chain and cross-chain bridge security issues

Game-specific chains: Immuatable X, WAX, Klaytn, etc.

Among them, the operation of WAX is very successful, and the current active users have always maintained a high level. Head games include Alien Worlds, R-PLANET, PROSPECTORS, Kolobok Adventures, and Farmers World.

Immuatable X is constantly in motion, working with Starkware to make more attempts at the base layer. But the problem is that there are still no active game projects with a large user base.

Decentralized cloud platform:

The core is to build nodes and use decentralized computing power to provide computing support

For now, decentralized cloud platforms are still in their early stages, with high development costs and delay issues that may not yet be resolved

The future will be a development direction that can be expected

Decentralized Computing: Fluence, LivePeer

To a certain extent, it solves some problems of real-time computing on the chain

Content Distribution Platform: Gala, Come 2 Us, P 12

Compared with traditional games, the operation mode of the content platform is obviously different, mainly in the utility of the platform token and the relationship between the platform and CP. Some platforms choose to use their own tokens as the exit and entrance of CP, that is, they need to exchange platform tokens for CP native tokens before entering the game, and the withdrawal of funds also needs to be converted into platform tokens, which is disguised as an endorsement for CP tokens; through platform tokens and The exchange of CP currency participates in the investment of CP;

There is still an independent destruction and production mechanism for platform tokens, which can control the CP token to a certain extent.

IGO platform/content incubation platform:

resource driven

Whether it will be integrated with the content distribution platform to form an oligarch that connects the upper and lower industrial chains is the future that needs to be paid attention to

Goldsmithing Guild: YGG, MC, Guildfi, etc.

It has very obvious regionality, does not have obvious head aggregation effect, and the business barrier is not high;

Mostly distributed in countries and regions with high demographic dividend but low per capita income;

Starting from September and October 2021, the association's financing will gradually increase in number;

Existing problems: The valuation logic is close to a DAO with a profit model. The first-level valuation of "heavy assets" targets is expensive, but the second-level is issued with governance tokens. The token value capture is weak, and the second-level premium is small.

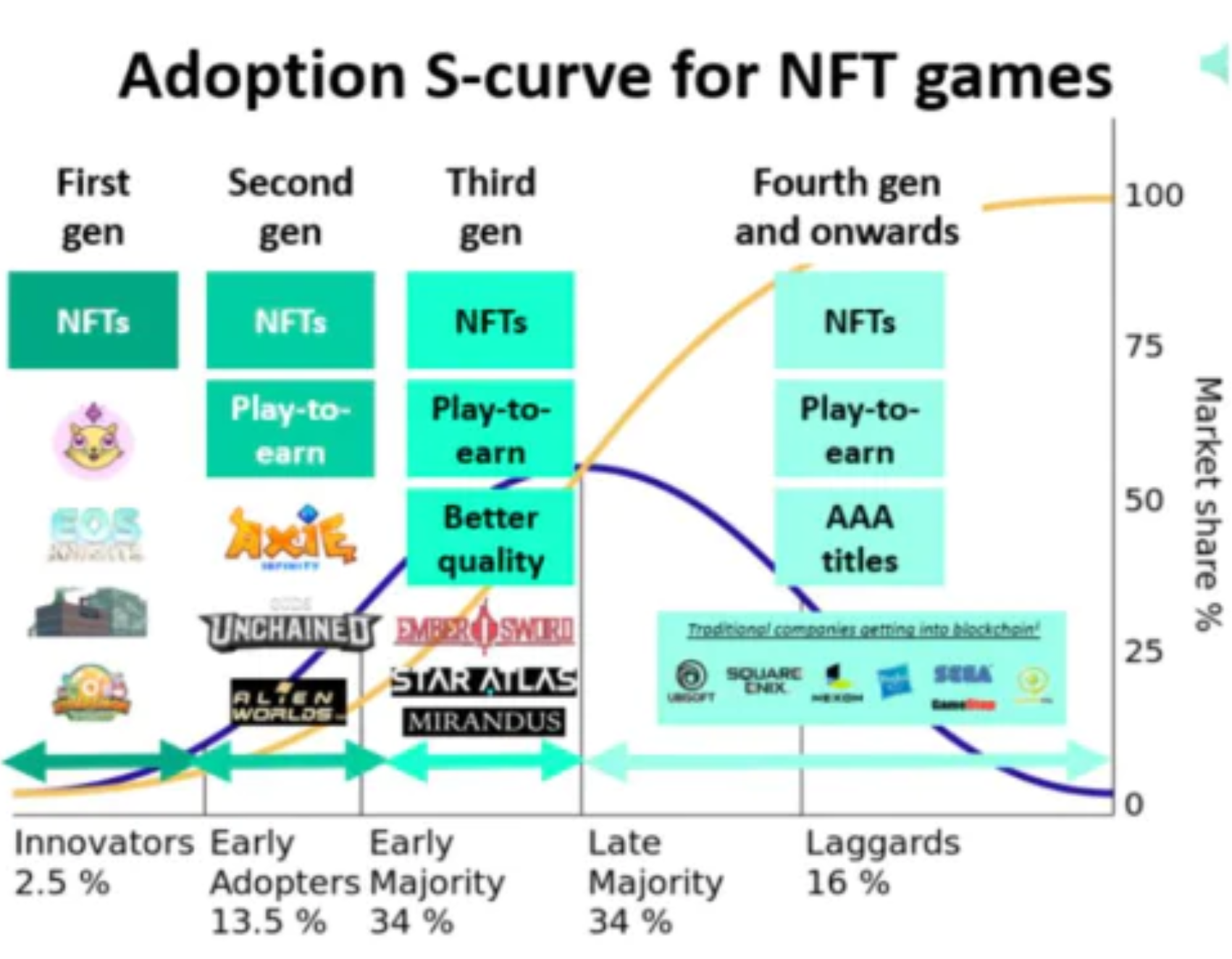

2.4 The Development Stage of GameFi

2.4.1 The Era of Chain Games

As early as 2015, the first blockchain card game "Spells of Genesis" came out, which opened the curtain of blockchain games. In 2017, "CryptoKitties" represented the integration of NFT games, combining the "financial attributes" of the blockchain and "NFT" with gameplay. On December 9, 2017, there were 14,000+ active users in a single day. At one point, the Ethereum network was blocked due to the soaring gas fee. At that time, there was no token economic model, only simple games and graphics, and the gameplay was weak, but NFT assets began to appear. Since then, more and more chain games have appeared, and the content of the games has become more diversified, opening the era of chain games. Chain game era: The market is dominated by innovative NFTs mini-games and nurturing mini-games. The game playability is not strong, but this opens up the chain game market. The continuous innovation of Crypto native projects has also caused market chaos. During the same period, there were widespread game funds, and they formed the illusion of the market through violent pulls, so as to harvest.

2.4.2 Gamefi 1.0

From 2019 to 2020, GameFi was proposed for the first time, NFT assets occupy an important position, and at the same time, the graphics/playing methods of the game have been improved. GameFi has changed the game economic model. From a closed monopoly to an open market, the blockchain endows chain games with open transaction agreements and asset distribution agreements, forming a game economy composed of countless games, which greatly increases the depth of the market. In particular, the integration of NFT enables gamers to obtain not only the application value of the game, but also financial value. However, GameFi 1.0 also faces many problems. For example, new players need to purchase in-game items or assets before they can play the game. Although they can earn back from the game, as more and more tokens are circulated in the game, if they can Poor playability, unplayable, and unstable economic model, tokens will fall, and it will be difficult for players to get back their money. In addition, most of the GameFi 1.0 projects need new players to enter the market to maintain, but the chain games in the 1.0 stage are basically a single scene and NFT props, which cannot attract new players at all. GameFi 1.0 stage: PC games and mobile games with Play To Earn and NFT as the main highlights and attributes. This type of chain game has certain game attributes. Compared with traditional games, the playability is insufficient, the development difficulty and cycle are shorter, and more attention is paid to Its asset value does not focus on gameplay. Due to its short development cycle, a variety of small games with mixed quality quickly seize the market. How to increase the application scenarios to extend the chain game life cycle/sustainable income model is the main goal of GameFi 2.0.

2.4.3 Gamefi 2.0

GameFi 2.0 does not yet have a unified definition, but in terms of thinking and content, the game will have higher playability and involve metaverse scenes, making it truly a bridge between the real world and the metaverse, enhancing players' sense of participation. As the entrance of metaverse economy traffic, the scene design of GameFi 2.0 will be more suitable for the combination of metaverse scenes and NFT assets, DAO and DeFi, which is different from the application scenarios that are more biased towards DeFi in the 1.0 era. GameFi 2.0 is like standing on the shoulders of the metaverse, perfectly solving the problems faced by GameFi 1.0 such as life cycle/sustainability. If the game itself encounters financial mechanism problems, DAO also plays a very critical role at this time. They need to maintain the stability of tokens in the secondary market through their treasury or repurchase tokens from the market through bond mechanisms to maintain healthy liquidity. . Based on the previous stage, GameFi 2.0 will solve the economic problem of a single game and avoid looping in a single game. The higher-quality game products developed almost at the same time are also independent game teams with the blockchain as the main background. The quality has been greatly improved. A small number of traditional gamers with a curiosity-seeking mentality are attracted by relatively high-quality games and join the chain game player group. Chain games gradually enter the public eye, and GameFi will become a normal attribute of games.

2.4.4 Gamefi X.0

According to the current development of GameFi, GameFi that has reached the X.0 stage will try to integrate with the Metaverse. This stage is an important attempt for human beings to move from reality to virtuality, and games happen to be the best tool to introduce users into the Metaverse. The metaverse can give GameFi many unexpected capabilities. First, GameFi enables interoperability in the Metaverse. That is to say, all games can complete linkage, in other words, different characters and props can appear in other game worlds. For example, the hero skin of "League of Legends" can be applied to the hero of "Glory of the King". Secondly, after Metaverse achieves interoperability, GameFi's liquidity problem will also be easily solved. At that time, players will not have to spend again to purchase new characters and props before playing a new game. By using the original NFT assets, players can easily participate in brand new games. As the metaverse develops, universal NFTs will emerge. With these universal NFTs, players can buy and play most of the games in the Metaverse. This means that GameFi will have immediate access to initial liquidity upon launch. If the game is high enough, the subsequent liquidity will also be resolved. Therefore, more high-quality GameFi projects will appear in the Metaverse world, and more liquidity will flow into the Metaverse one after another, forming a virtuous circle.

3. The era of blockchain games

3.1 What is a blockchain game?

Chain games are blockchain + games, referring to game products built on the basis of blockchain technology. The biggest difference between it and traditional games is that the decentralized nature of the blockchain has a natural right to the player's assets, so the player's assets in the blockchain game exist as the player's personal assets. Compared with GameFi, the scope of chain games is wider, that is, as long as the game products with data uploaded to the chain are completed, they can be called chain games.

In addition, another interpretation of the blockchain game era is governance tokens + games. Deposit via stablecoins or mainstream currencies to purchase characters or buildings. Obtain the governance tokens of the project within a certain period to make a profit. The essence is similar to mining behavior, but it has a complicated membership system, rebate conditions, and super high profit margins, so it has a strong driving force for attracting new users.

3.2 What are the types of blockchain games?

The era of chain games is the early stage of exploring the combination of blockchain and games. In this era, chain games are mainly represented by dApp and spinach games. The game attributes of chain games are relatively weak. There are four main types: card games (Spells of Genesis), lottery (Fomo 3D), development (CryptoKitties), construction (giant business).

3.3 Introduction to technical solutions and economic models

3.3.1 Economic Model

CryptoKitties is an early work that combines NFT and games. It initially released 50,000 encrypted cat NFTs generated by smart contracts, that is, the first generation of cats. Each NFT has different attributes. The core gameplay of CryptoKitties is incubation. By incubating two NFTs, a brand new NFT can be generated. This NFT inherits some of the original NFT features and randomly generates new features. The developers of CryptoKitties mainly make profits by charging players for interacting with the game, while players can make profits by circulating their NFTs in the market through functions such as incubation and leasing. The economic model of CryptoKitties is not complicated, but it takes full advantage of the underlying characteristics of the blockchain.

Fomo 3D is an early spinach game platform built using blockchain technology. Similar to CryptoKitties, developers mainly earn money by charging fees.

Compared with the above games, Spells of Genesis is more game-oriented. Its economic model is similar to that of WEB2 card games. The difference is that tokens are used for economic circulation in the game. Spells of Genesis is more durable than the above-mentioned types of games because it pays more attention to gameplay.

An alternative project of the same era - "Giant Merchant", its economic model is that the deposit is ETH, and the withdrawal is the governance token EGT. "Giant Merchant" adopts the platform governance token EGT single-token governance model. Players consume EGT in the game to build buildings and generate continuous income. The secondary market uses market-making to sharply increase the price of governance tokens, providing continuous benefits for participants. Provide the confidence to take orders and increase positions, so that the fake ones can be confused with the real ones. The generation of income under this economic model depends on the surplus between the inflow of external funds and the amount of internal release. When the inflow of external funds continues to be less than the internal income, a downward spiral may occur. The essence of "Giant Merchant" is a fund project, which is expressed in the form of a game. Therefore, there is no such thing as "economic balance" for the economic model of this type of project. In fact, future generations pay for the predecessors, which is a naked harvest.

3.3.2 Technical solution

As for gamefi technical solutions and economic model thinking, the general idea is to modify the game itself, expand and continue the external value, and transform the irreconcilable contradictions between different interests, so as to prolong the life of the chain game as much as possible Cycle, get rid of the Ponzi scheme. In the first half of this year, the entire game financing scale reached more than 12 billion games. In 2022, there will be thousands of games on the market. Due to the turmoil in the encryption market, most chain games try to avoid the impact of the market environment on chain game projects, and choose to postpone the coin issuance plan and game launch. . The following specific analysis

Changes in playability and economy:

① In terms of playability:

♢ Improve the picture quality of the game, the game is well-made, and it is more attractive to players than the rough-made game. There is not much discussion here.

♢ The diversification of scenes increases the difficulty of game content and tasks, improves the fun, satisfies the sense of accomplishment and satisfaction of game players, opens up the differentiated treatment between free players and krypton gold players to a certain extent, and increases the demand for free players to pay .

♢ Cultivation of game user habits, such as taking incentives, sign-in benefits and other behaviors. They are treated the same in front of free and krypton gold players. Just like the behavior of stealing vegetables on the QQ farm back then, someone once set the alarm clock at 3 o'clock in the middle of the night to steal vegetables. At that time, the mantra that people used the longest was "Have you stolen vegetables today?" Cultivate the player's viscosity, retention and daily activity. Precipitate as many customers as possible.

② In terms of economy:

♢ The opening of the free mode: This approach has several advantages. On the one hand, it can attract more players, expand the player base, and make the game more resilient and expandable. Another aspect is to lower the threshold, allowing players to enter and experience the game. Often free is the most expensive, attracting players to enter, and attracting players to become krypton gold users during the game session.

♢ The boundary between free players and krypton gold players; the free mode is a way to expand the number of players. The number of game players can expand the gameplay and various scene tasks of the game to a certain extent. For free players, it is an entertainment nature, and for krypton gold players, it is a consumption nature. At the same time, it is necessary to prevent free players from participating in the internal economy of the game, and not to destroy the token economic model in the game. In the game, free players can pay krypton gold players to pay for some time-consuming and laborious game tasks such as game tasks, so that a cooperative and mutually beneficial relationship exists between free game players and krypton gold players, and at the same time open up the transition from free players to krypton gold players aisle.

♢ Economic model optimization: A good token economic model is of great significance to the extension of the life of the game to a certain extent. Including the way to adopt multiple tokens, token distribution ratio and unlocking time, supply and demand balance, token utility, incentives like staking, etc.

Continuation of external values and external approaches

① Scene Realization: Connect the game with real-life interaction, such as the previous stepN game, rope skipping game, singing game, treasure hunting game, etc. Connect the game with the real world, making the game look more than just a game. Let daily life be integrated into the game, and games can be everywhere. The value of the game is realized. For example, free players in the game can obtain rewards in the real society through the game, such as completing tasks to obtain Simbucks coffee points.

② Product attribute upgrade: Let the single product attribute of the game upgrade the social attribute. Human social needs are a big need that accompanies people throughout their lives. In-game social activities such as guilds and team games. Social communication outside the game For example, in the previous game case, many exchanges and greetings in the qq farm game are: Did you steal food today. For example, in the glory of the king, a few people make an appointment to open a black spot. It is the further improvement of the use value of the game.

③ Expansion of the metaverse: Gamefi is a part of the metaverse. With the advancement of infrastructure such as VR/AR, the diversification of usage scenarios has more playability.

paradoxical transformation

Benefit distribution of investment institutions, project teams, players (free players and Krypton gold players, new users and old users), etc.

① Balanced profit distribution between investment institutions and project parties: The distribution of tokens is more reasonable, and the proportion should not be too high, which will hurt the investment enthusiasm of players. At the same time, realize the realization of value and profit in multiple ways. For example, to a certain extent, the profits of investment institutions can be realized through the game carrier. For example, the advertising behavior of investors is embedded in the game.

② The game between the project team and the players: In the previous model, the players realized the cost return or income by continuously digging and selling. Regardless of the price of the tokens, they would throw them as soon as they were dug out. They wanted to make as much profit as possible. Players and project parties are like irreconcilable contradictions. Moderately change the contradiction, let players play games with players, what player A loses is what player B gets, so that tokens can play more use value and exchange value.

③ Transformation of player roles: As mentioned above, it is a transition channel from free players to krypton gold players, allowing new players to enter the game. The continuous operation of the game is a constant need for fresh blood. Let the player's game character change cost threshold become lower. Taxes are used in the treasury to incentivize free users and new users.

3.4 Market Performance

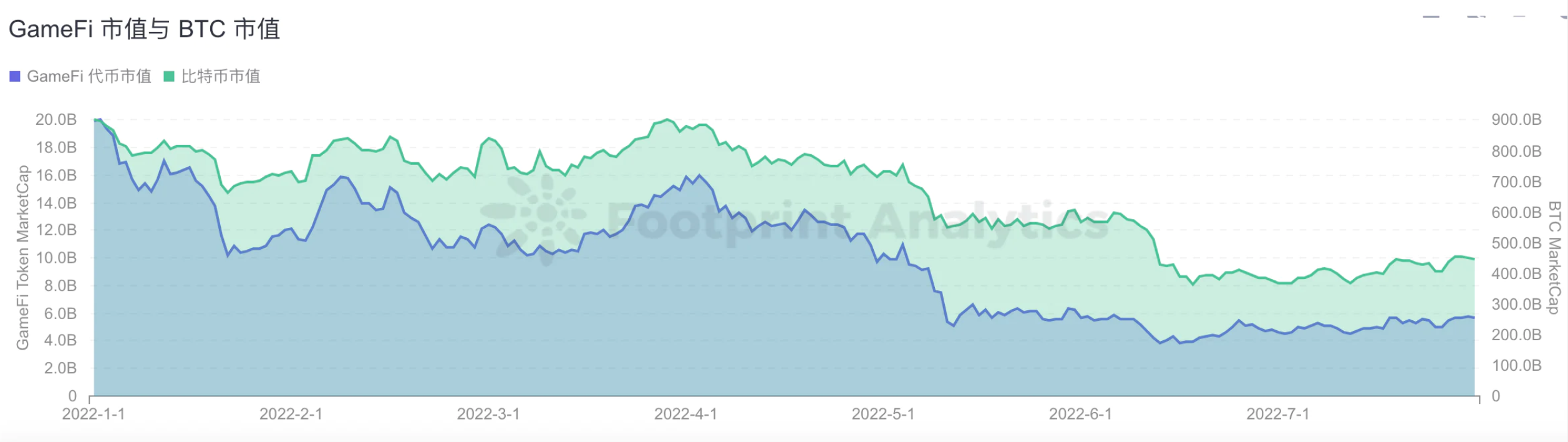

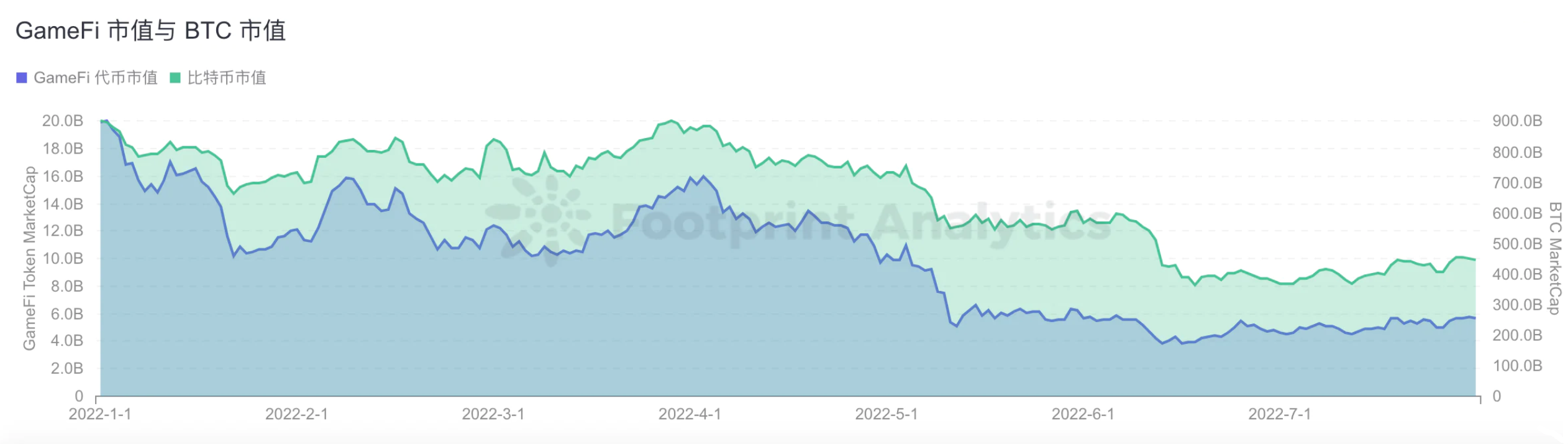

In 2022, with the Federal Reserve raising interest rates and shrinking its balance sheet to deal with inflationary decisions, the U.S. dollar index will continue to strengthen, which will be transmitted to the lack of liquidity in the cryptocurrency market. Keeping the entire market in a bear market has poured cold water on blockchain games. The chart below shows the change in Gamefi market cap versus BTC market cap. It is not difficult to find that as the market goes bad, the market for chain tours has been going down all the way.

3.4.1 Chain game market scale and financing situation:

In the case of a downward trend in the encryption market environment, financing for various tracks has become extremely difficult. In 2021, the financing amount of chain games accounted for 8.45% of the market, and by 2022, the proportion increased to 11.89%. Thanks to the outbreak of the metaverse concept, it indirectly drives some chain games market, and chain games play an important role in the metaverse. Up to now, there are as many as 1400+ chain games on the market. According to incomplete statistics, the financing amount of chain games in 2021 is 1.4 billion US dollars, and so far in 2020 is 1.36 billion US dollars. To obtain financing chain games on the Internet, postpone the plan to varying degrees, and postpone the game release to the fourth quarter of 2022 or Q1 of 2023, so as to avoid the adverse effects of the crypto market downturn, and at the same time have more Time to develop optimized games, benefit from improved economic models.

3.4.2 Changes brought about by the encryption market and the attitude of investment institutions:

3.5 Summary

3.5 Summary

In the era of chain games, the development of P2E chain games is in full swing, but there are still a small number of P2E chain games that can stand the precipitation of time. As the cryptocurrency market is going bearish, the current chain game market is in a downturn, but the concept of chain games has become popular over time. More funds and players participate in the exploration of chain games, and the concept and model of chain games will be closer to players and players. The market will surely become an important part of the encryption world in the future.

4. GameFi 1.0

4.1 What is GameFi 1.0?

There is currently no precise definition of what GameFi 1.0 is. It is generally believed that the characteristics of the GameFi 1.0 era are Defi in the cloak of Game. Compared with traditional games, chain games that have only been developed for a few years are still relatively immature. Most chain games have some characteristics of P2E: Lack of playability, most players play the game with the purpose of earning. The P 2 E (Play to Earn) mode, as the new darling of traffic under the outbreak of chain games, is not only sought after by capital and giants, but also seems to be a standard configuration in the chain game market. Although the high income of real money in the earning mode has its own fan effect, overall, the playability of this type of chain game is still not comparable to that of traditional games, and "profitability" is still the main driving force for development force. Summary: The game experience is more inclined to "moving bricks on the construction site". GameFi 1.0 lacks sustainable development momentum and ecological derivatives as a whole, just like a huge capital game.

4.2 What are the types of GameFi 1.0?

Although GameFi 1.0 lacks playability, it is undeniable that chain games absorb the essence of traditional games and empower them with unique blockchain advantages. At the same time, in the era of GameFi 1.0, there have been many attempts of game types.

Card games:

Alien World——Token ;

TLM ALCHEMY TOYS——Token;

GAT RPG battle game;

Cryptoblades——Token;

SKILL PIXEL ADVENTURE GAME:

Crusaders Of Crypto ——Token;

Crusader pet battle game:

My Defi Pet——Token;

DPET Radio Caca——Token;

RACA Axie Infinity——Token;

AXS business simulation game:

Town Star——Token:GALA

4.3 Introduction of technical scheme and economic model

4.3.1 Technical solution

GameFi is a combination of Game and Finance, so how to guarantee user assets must be a key issue. At present, there are usually two ways to store cryptocurrency assets, one is Onchain Wallet and Offchain Wallet, which are commonly known as hot wallets and cold wallets. Offchain Wallet can be an idle electronic device with wallet software and not connected to the Internet. [Such as: computers, mobile phones, U disks, hardware wallets, etc.], Offchain Wallet is a relatively safe asset storage method that can avoid Trojan horse viruses and external hacker attacks. Onchian Wallet, contrary to Offchain Wallet, is a wallet stored on the Internet, often in an online form, and it is relatively convenient for depositing and withdrawing assets. But the risk is higher and it is easy to be hacked. Project parties in the GameFi 1.0 era often use the highly secure Offchain Wallet solution to store encrypted assets. For some project parties with weak technical capabilities, there will also be a multi-chain asset management system (Multi-chain Asset Management System), such as Istring (string ice). The system provides mature and credible technicians who will choose to build a centralized hot wallet system and manage private keys by themselves.

4.3.2 Economic Model

The core of the Gamefi field is the Play-to-Earn economic model. Different from the Free to Pay (free game) model in the traditional game industry, players in blockchain games can earn real money through encrypted assets and participate in the construction of virtual economy And game players earn rewards through their own participation behaviors, and then sell them in the market for income. So, what is the core of chain games, the economic model? Simply put, the economic model is the supply and demand of chain game tokens, that is, the matching of token production and token consumption. However, the economic model of GameFi 1.0 has a major flaw, that is, it cannot escape the "death spiral". Basic economics tells us that when supply exceeds demand, prices fall; when supply exceeds demand, prices rise. The same is true for the economic model of GameFi 1.0. When Token consumption is greater than Token production, the price of Token can remain unchanged or even rise.

Ideally, new players work hard to "level up" and become veterans. After becoming an old player and possessing a certain level and equipment, more resources will be required for upgrading, so the old player will be guided to "reinvest" accordingly to maintain the demand for tokens, and the price of tokens will increase accordingly. An increase in the price of tokens will attract more people to participate in the game, which in turn stimulates demand again, thus entering a positive cycle.

But ideals are full, but human nature is very realistic, and players are not fools. Most players come for short-term "quick money". They rarely re-invest, and more often "digging, raising, and selling" in the later stage. Most of the sales of old players are undertaken by new players. Once the growth rate of new players decreases, the demand will decrease and the price of tokens will drop. The drop in token prices will not only trigger "panic selling" by more old players, but also further reduce the attractiveness to new players. Finally fell into a "death spiral" Next, some basic economic models are introduced: We divide all economic models into two categories, namely: single-token economic model and dual-token economic model.

Single Token Economic Model

① Gold standard in + currency standard out

Defi for mining is basically this model.

Features: The entry threshold is fixed, and the income fluctuates with the currency price.

Judgment: The initial increase is high, and the life cycle is short. It is recommended that players focus on digging and selling, and resolutely sell once the price declines.

A positive cycle tends to generate strong FOMO emotions, but when the death spiral comes, it is also thunderous and devastating

② Gold standard in + gold standard out

Assuming that you get 100 U for gold mining every day, and the currency price was 1 U yesterday, then yesterday’s reward is 100 TokenA; today’s currency price drops to 0.5 U, then today’s reward is 200 TokenA

In the rising trend of the currency price, due to the reduction of the corresponding output quantity, the payback period is basically stable; while in the downward trend of the currency price, the gold standard income that players get every day in a short period of time remains unchanged.

The income is stable, not easy to rise and fall, and the life cycle is long. Players can store a part in the early stage, and then sell after the currency price is high, perhaps the income is more objective; after seeing that the entry speed of newcomers has slowed down significantly, switch to mining and sell.

③ Currency standard in + currency standard out

On the first day, the price of TokenA is 1:1, and the threshold is 100 TokenA. Players only need to spend 100 U to enter, and 10 TokenA can be played in one day; on the second day, the currency price rises to 2 U, and old players still get 10 TokenA , worth 20 U, but the entry threshold for new players has also been raised to 200 U!

It is easy to rise and fall, and the life cycle is short, unless the basic market is large enough. It is recommended that players only rush to mine, and at the same time judge whether the project party still has the ability to continuously bring in new ones, and if they do not have it, they will be out immediately.

Typical example RACA

④Coin standard in+gold standard out

So almost no games currently use this mode.

Dual Token Economic Model

Dual Token Economic Model

In addition to the single-token economic model, AXIE also innovatively refers to the dual-token model.

In the dual-token model, it is usually divided into mother currency and sub-token.

The mother currency is generally related to the long-term development of the game, and is usually the governance token in the game, while the child currency is generally designed to withstand the huge selling pressure of old players, and is generally an economic token in the game in an attempt to maintain the price of the mother currency, or The long-term development of the game.

When classifying the dual-token model, it is through the minting of NFTs.

① Reproductive consumption type

That is, all NFTs are derived from the reproduction of Genesis NFTs, and the official will no longer sell NFTs. The breeding process consumes a certain amount of tokens to mint new NFTs [this method is the main means of token consumption]

This type of game mainly observes which tokens the selling pressure falls on, and then consumes the tokens mercilessly.

② Sell blind box type

♢ U Blind Box: The U blind box method will bring relatively free funds to the project party and have the opportunity to create explosive models. Of course, the risk is relatively greater for players [the project party is more likely to run away with rugs] , This is also the way most local dog chain games adopt.

High risk and high return, small and big

♢ Blind box of mother currency: It brings an upward driving force to the price of mother currency, and the project side can control the market more easily: when the price of mother currency is too high, it is not conducive to newcomers to enter the market, and some mother currency can be sold to let the price return.

It may be better to speculate in the mother currency in the short term than to make gold in the game.

③ Blind box of sub-coins: A large amount of consumption of sub-coins is produced. This model is a bit similar to the consumption type of reproduction. The project side hopes to balance the price of sub-coins from within the game, and extend the life cycle of the game as much as possible to develop and update Introduce more game mechanisms to promote the inner loop.

Play gold with peace of mind, and be happy steadily until the number of people entering the game decreases significantly.

4.4 Market Performance

4.4.1 Overall Performance of GameFi 1.0 Market

In the GameFi 1.0 stage, there have been many star projects, such as: AXIE RACA SANDBOX, etc. The most prominent f! is Axie Infinity, which drove the gamefi 1.0 boom. Axie is a gamefi@n based on pet battle + NFT

Star Project Introduction

① In the era of gamefi 1.0, AXS, the native governance token of the blockchain game Axie Infinity, soared from $3 to $156 in just 6 months. This impressive growth has brought Axie's total r, yfddd value to nearly $30 billion, making it the world's most

② One of the most valuable game companies.

③ Such numbers may be unbelievable, but what many people really want to ask is why: In the Axie Infinity game, players can raise, breed and trade a digital pet called Axie. Qualified tokens) exist. Players can also be rewarded with SLP tokens by using themselves to fight other players. Players need to consume SLP tokens when they use their Axies to breed new Axie pets.

④ It is worth noting that when playing the Axie Infinity game for the first time, users need to go to the Axie market to buy at least 3 Axies pets before they can start playing the game. It is based on NFTs of varying rarity and utility generated by a genetic algorithm. Each Axie is an ERC 20 token with unique characteristics affecting its rarity and in-game utility. The characteristics of each Axie depend on the characteristics of its parents, and when a new Axie is born, it is combined in a probabilistic manner according to the genetic algorithm.

⑤ The game is supported by a Token system, including two utility Tokens: in-game currency (LPT) and governance Token (AXS). In the design of the dual-token model, the market-based SLP and the governance-based AXS have clearly separated their responsibilities and cooperated in an orderly manner, avoiding the systemic risk and rigidity of a single token system to a certain extent. Ecological economic operation and management have more flexible room for fault tolerance. Among them, SLP is destroyed according to the rate of combat generation and reproduction. While maintaining a stable supply and demand, it can bring long-term supply capacity to emerging growth sectors.

Overall, the market value and the proportion of star projects (mainly Axie)

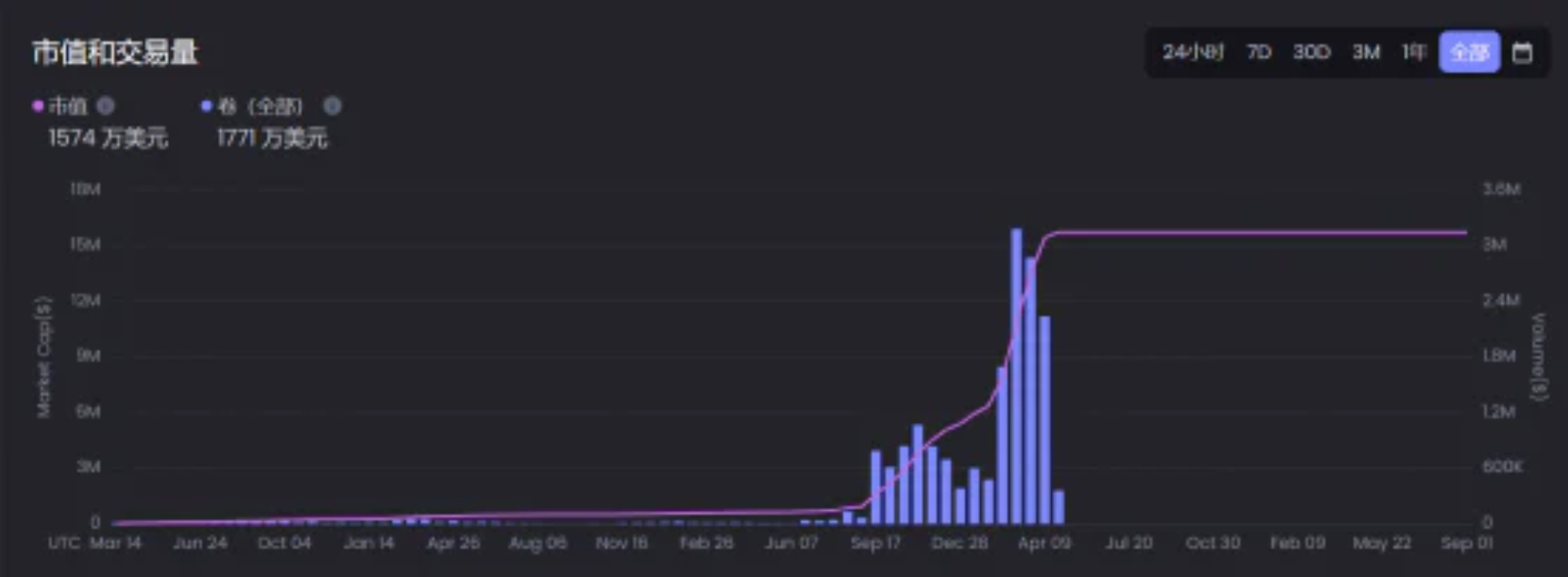

image description

Data source-NFTgo

② Taking the above data as an example, the entire data reached its peak value in July 21. The cumulative trading volume of Axie Infinity in 30 days exceeded 600 million US dollars, reaching 604 million US dollars, a month-on-month increase of 449.5%. The historical cumulative trading volume of Axie Infinity increased to 7.58 billions of dollars, many projects sprung up like mushrooms after a rain, with uneven levels and scattered markets, and then a death spiral channel began to appear in November, with a rapid decline.

③ The profitability of most GameFi 1.0 models is very obvious in the early days, but after the number of players increases, it starts to decline. Taking BHB Hero as an example, its profitability was indeed very strong at the beginning of its launch, but it gradually turned into 10 days, 2 weeks, 3 weeks, and then directly lost all money. The overall project cycle for some major manufacturers to develop and obtain financing will show a death spiral trend within 3 months.

④ Looking back on 2021, GameFi's trading volume peaks are concentrated in early August and early November. In terms of trading volume, the first week of August and the first week of November both reached about 220 million US dollars, of which 90% The above are all from Axie Infinity. Other games with the highest trading volume include Alien Worlds, Sorare, Aurory, Gods Unchained and Crypto Kitties. The transaction volume of these games has continued to decline after November. By the first week of 2022, the GameFi transaction volume will be around 44 million US dollars, which has dropped by more than 80% compared to the highest point. The transaction volume of Axie Infinity is only 35 million US dollars. About 16% of the highest point.

4.4.2 Overall Performance of GameFi 1.0 Users

User Growth Data

Let’s take a look at the data of the chain game market. From the following data, we can see that although the transaction volume has dropped sharply, the number of active users of chain games has been fluctuating and rising. It has risen from 470,000 at the end of July last year to 1.53 million at the beginning of January this year. The number of users increased by more than 3 times within half a year. It can be seen from this that although the transaction volume has dropped sharply after the market calmed down, there are still new users participating in GameFi.

Active GameFi users

distribution data

Many chain games are distributed on different chains

It can be seen that Harmony, Ronin, and BSC are the chains with the most chain games.

BSC has the largest number of online games

Chain game trade union

① There is another participant in GameFi 1.0 that cannot be ignored, and that is the game guild.

gamegameother means of communication, having a website orBBS, crooked channel,QQ groupetc., have specific names and logos, have strict rules and regulations and division of powers and responsibilities, and gather people for the main purpose of playing games.

③ But in the era of GameFi 1.0, the purpose of the establishment of the trade union is more to discuss how to maximize the benefits and put it into practice. In addition, the trade union also conducts free Training, hand-to-hand guidance, and finally draw a share with the players. Because of this, instead of calling it a guild, more people like to call it a "chain game studio"

④ The more famous union is YGG, and YGG was first grown up by Axie. Back then in the Philippines, everyone knew about this game, and everyone knew about it. Taking advantage of the enthusiasm, YGG trained a large number of ordinary people to make money

⑤ After YGG earned a lot of wealth through Axie, it participated in investing in several chain games, and issued its own governance token, and later attracted investment from a16z.

⑥ Under the influence of YGG, more people founded their own game studios, attracting more players to generate income.

Activity rate

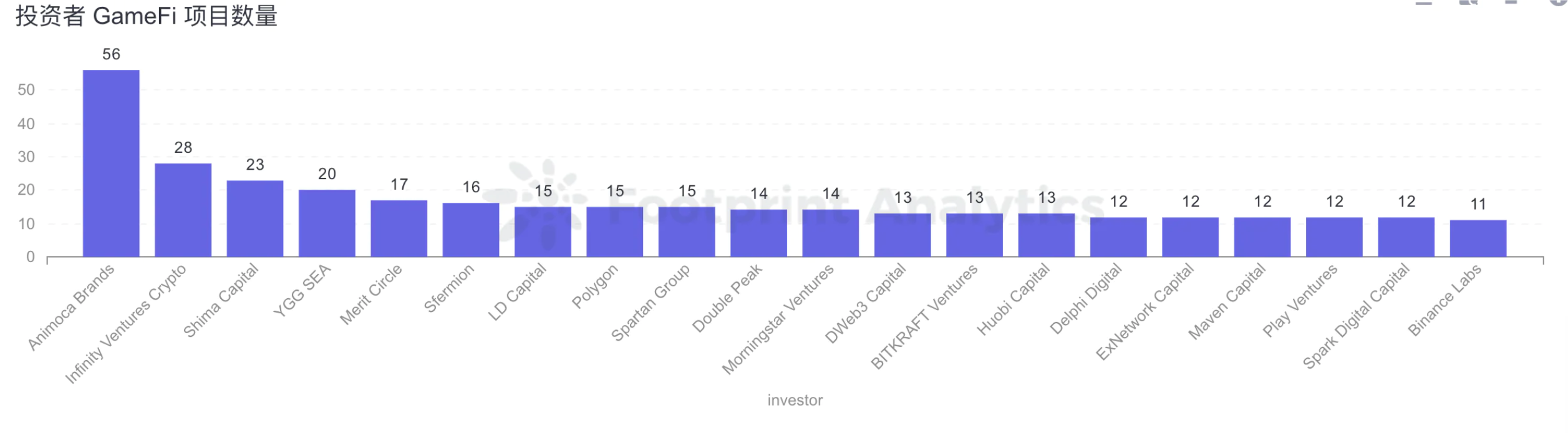

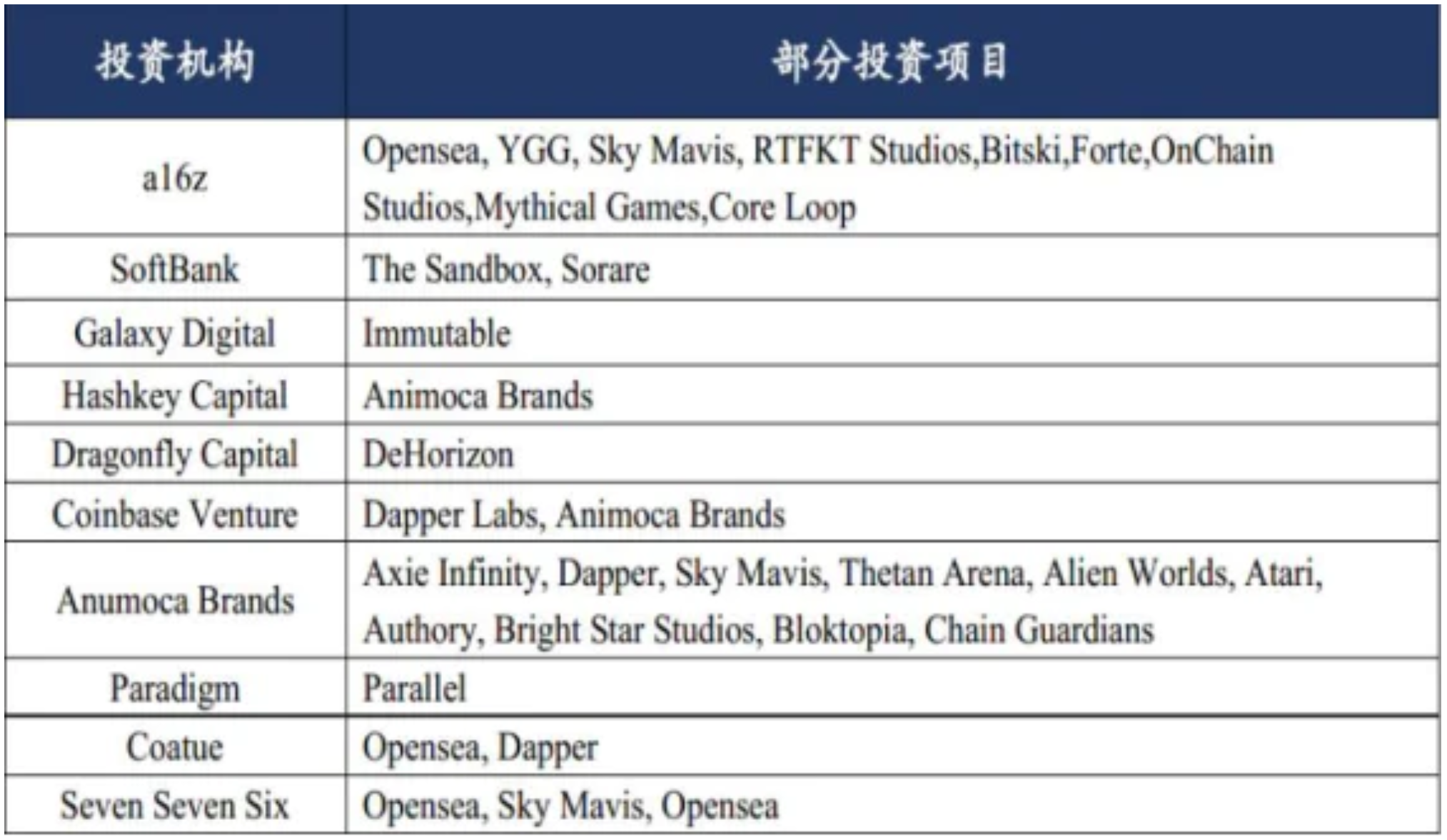

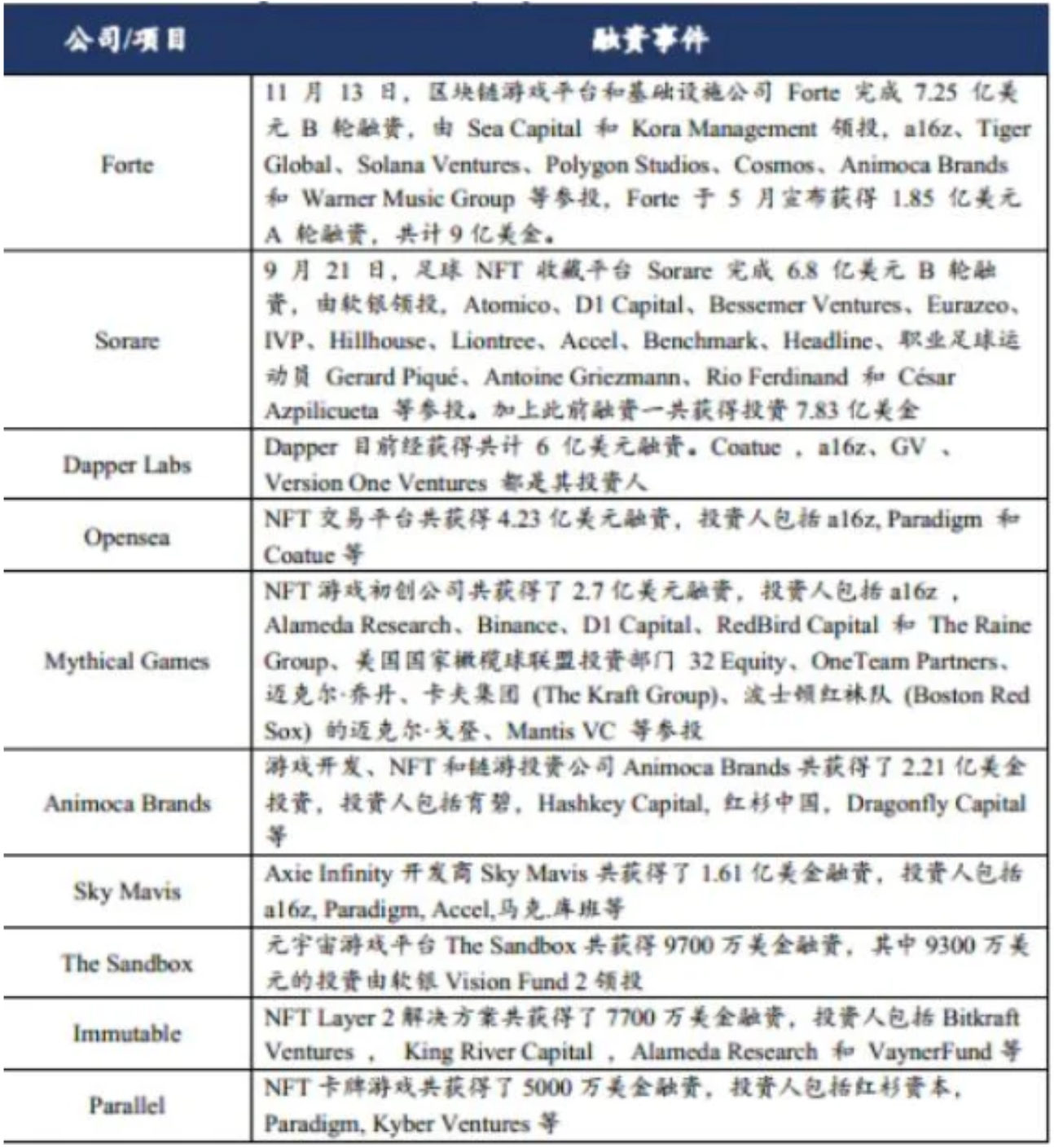

The following are some active events of investment institutions.

4.4.3 Overall Performance of GameFi 1.0 Project Operation

Community growth strategy and effect

① Gamefi 1.0 Most of the users participating in chain games on the market are also players in the currency circle, and the quality of the games is uneven. The content of the game is more emphasis on strategy and games, and the economic model is maintained for a short period of time. Some players outside the circle even regard this type of chain game as "online gambling". At this stage, many high-risk GameFi speculators also appeared.

② The author believes that the GameFi track is one of the most effective means to attract non-currency users to enter the crypto field. The development of GameFi cannot be completely dependent on crypto native players. It is crucial to attract traditional game players to join. High-quality chain games with stronger gameplay and playability will become the future

Media Growth Strategies and Effects

① The promotion of GameFi 1.0 in the traditional world mostly relies on social software and self-media applications such as Twitter, FaceBook, Youtube, etc. Compared with many Web1.0 projects through traditional media promotion methods, GameFi 1.0 is easier to attract attention among young people, but at the same time, many middle-aged and elderly people have shown great confusion.

② For example, Radio Caca, which was endorsed by Musk's mother Maya mask at the time, gained a huge influence through Twitter marketing and forwarding of various media and social software in just a few months. Within a month, it rose 1000 times.

③ In addition, most projects carry out fission propagation through RT+Tag Fren lottery and other methods. The prizes are generally game NFT, USDT, or the White List of some projects. This has also attracted the attention of a large number of outsiders to a large extent.

market capitalization management style

① Looking at the market value of chain games from the perspective of token prices, chain game projects in the GameFi 1.0 era basically experienced a “positive spiral” and a “death spiral”

② For example, the chain game Radio Caca, in just 2-3 months, the currency price increased by nearly 1,000 times, from a minimum of 0.000042106 to around 0.1215, an increase of 129629%. After the market value reached its peak, it took a sharp turn and entered a death spiral. So far, it has fallen by more than 96%.

For another example, Axie, a chain game that was popular before, adopted a dual-token model to reduce the selling pressure of the main currency, but it still cannot avoid it from falling into a death spiral, and can only prolong its vitality as much as possible.

So far, the price of Axie’s main currency, AXS, has dropped 91% from its peak.

Project cycle situation (the currency price weekly line shows a downward trend as a cycle)

Gamefi 1.0 The entire chain game market is more inclined to be fast, accurate and ruthless. From the initial game development, to major media announcements, investment and financing, and then attracting most players to enter the market from the income, as the number of users increases, the chain game The overall intervention of the tour union pushed the game to a climax, and then began to spiral downward.

4.5 Summary

GameFi 1.0: Generally refers to blockchain games that are less playable than 4399, but it is possible to earn huge economic profits by playing games and selling reward tokens obtained. It also refers to the time period when most of the blockchain games on the market are such games. At the heart of this revolution is the idea that players should have ownership over the content they earn (in-game assets), or at least more ownership in the digital world where they spend a lot of time and money. This creates two immediate advantages:

The lifespan of in-game assets is extended as those assets continue to exist in the player's wallet, even after the game is closed

The interoperability and composability of assets enables them to interact with other games, applications or blockchains. It is undeniable that blockchain gaming has experienced a watershed moment - a historic shift on which future development depends.

People’s perception of blockchain games has changed due to the success of games such as Axie Infinity, the explosion of NFT secondary sales, the broad growth of crypto users, and more specifically, the expansion of blockchain game users. In turn, this has facilitated further financing of various core infrastructures in the blockchain gaming space, as well as many new games and studios.

The metaverse tailwind also benefits the games industry, which accounts for a large portion of web activity today, and could be an important area of growth and user acquisition for companies established in the metaverse.

Blockchain ecosystems such as Ethereum are growing at an increasing pace, but scalability challenges and user experience issues remain. Still, there are many teams developing solutions for users and game developers to enhance the experience of building and playing blockchain games. While a common monetization model in blockchain games has yet to emerge, experiments around issuing NFTs, vertical marketplaces, in-game currencies, and other cryptoeconomic primitives still have a bright future.

5. GameFi 2.0

5.1 What is GameFi 2.0?

I think GameFi 1.0 must improve the four major problems

To lower the entry barrier for new users, it is not necessary to spend first, as in the past, so it will definitely be hyped, and it will not be long before there is hype.

A sustainable economic model, avoiding the dead cycle of internal funds, and the role of DAO.

Pay more attention to the intrinsic value of people.

In addition to players, people who do not play games can also make money through "investment".

GameFi 2.0 must create a new wave of long-term investable economies around in-game digital assets. Investing is for the potential use of funds to channel early funding, create additional buying pressure for tokens, fund future development that extends the game's lifespan, and financially incentivize players and game developers.

5.2 What are the types of GameFI 2.0?

Referring to the past success of Axie, GameFi 2.0 can be roughly divided into three possible functions.

Related to gambling (Gambling), including Casinos (Slot machine), Card Games (Poker, Blackjack) and eSports (NBA/MLB betting).

Related to the community (Community), including Sports Manager (Football team), Simulators (Metaverse), City Builder (Farmville) and Battle Games (MMORPG, 3 A).

Related to trading (Trading), including NFTs (BAYC, NBA Top Shot), Augmented Reality (Pokemon Go) and Battle Cards (Top Trumps).

5.3 Introduction to technical solutions and economic models

This article uses external (CryptoStream) and internal (StepN) as examples.

CryptoSteam

Take CryptoSteam, an encrypted game publishing platform founded by former vice president of Blizzard Aaron Pulkka, as an example. He puts all the income of the platform, including the income from the game DeDragon, into the Vault of DAO, which is controlled by the agreement. When the governance token is lower than the set price Repurchase, while the liquidity of the governance token is the bond repurchased from the market through this mechanism. Cryptosteam combined this model with "Play To Earn" to create the new Gamefi 2.0. In addition, CryptoSteam also uses Token and NFT to connect the economic model of all games. Its purpose is not to participate in the sharing of game developers, but to allow developers to become the managers of CryptoSteam through DAO.

StepN

Improve the offline scalability and social attributes of the virtual space to achieve the integration of virtual and real. StepN enhances its sociability through several points. First, good culture, climate warming is an important topic, and StepN also uses virtual shoes to echo the low-carbon lifestyle. Second, the inner character of the characters puts more emphasis on the personal situation. What the reality cannot satisfy, the virtual world can satisfy. Third, PW 2, through exercise and exercise, users can continue to give themselves value, which in turn motivates themselves to exercise, a benign flywheel.

In short, in addition to the game itself, it needs to echo the inner body of the human body, and this will be a sustainable model.

5.4 Market Performance

Although GameFi has been quiet for a long time, there has been a lot of financing in GameFi recently. In addition, this year, A16Z and Mechanism Capital also have a dedicated Fund to invest in the GameFi field. It can be seen that they are very optimistic about this track.

GameFi is a product of the transformation of the game industry to "new rentier capitalism", which adopts a fully capitalized business model to obtain profits. In GameFi 1.0, because the entertainment of the incentive mechanism is greatly reduced, players are also forced to transform into ruthless "gold machines" driven by the temptation of capital; this also intensifies in a sense In order to eliminate the collective anxiety of players and users in the identity of the virtual world, the game has changed from an entertainment product (or has deeper learning and sociality) to a mechanical operation-like bondage in disguise. Different from GameFi 1.0, with the most representative STEPN, GameFi 2.0 games are starting to improve the offline scalability and social attributes of virtual space, and the intercommunication between virtual and physical spaces. Through the embodiment of spiritual value, the trio of sports concepts and social attributes, STEPN users satisfy the long-neglected psychological demands of dual identity anxiety in the virtual world and the physical world in the context of GameFi 1.0, so as to complete the integrity of consensus culture and landing building. STEPN tries to solve the conflict and contradiction symbolized by traditional GameFi entertainment and investment. GameFi 1.0, with return on investment as the primary purpose, has long had the following problems:

① The capital market generally lacks an economic model that can run for a long time. After the value of NFT and the number of users experience a peak, they cannot avoid the result of a long-term slow decline.

② The core value of game experience and innovation, cultural construction and community are ignored, and become a short-term profiteering speculative tool for economic gains, causing a break with the value of the physical world. Through the marketing of attitude towards life, STEPN provides users with the possibility to obtain satisfaction through actual sports in the real world, instead of passively obtaining pleasure through consumption - making money and exercising, both economic and spiritual satisfaction. This also reminds GameFi 2.0 that in addition to the richness of games and economic rewards, it also pays attention to the establishment of community value and feelings.

X to earn, core value X

① Socialization: long-term multi-level consumption

The long-term and good operation of GameFi needs to rely on multi-level consumption based on a benign community culture, rather than just providing an investment product as a short-term speculative tool

② Value projection: the anxiety of the common cultural background and the spiritual needs of the body consciousness

GameFi 2.0 does not forget to accurately turn the spearhead to the inside of the characters—a postmodern anxiety and spiritual desert with a common cultural background. People no longer believe in a bright future, and their personal state is more inclined to nihility and suspension. In order to deal with this unpredictable sense of postmodern crisis, people regard the only body in the physical world that can prove their subjectivity as their last bastion.

③ Spiritual value creates higher happiness: from play-to-earn to play-with-earn

The sense of gain gained by GameFi 2.0 (letmespeak is also a good example) is deeper and richer in the spiritual core, and this value is reflected in the body, symbols, web3.0 and web2.0 worlds. . In the process of exercise, users take the initiative to master the body and create spiritual value, gain profits and resist the sense of post-modern crisis.

④ Post-epidemic era: sports, low threshold, real world value

STEPN encourages users to walk, jog and run to earn tokens and participate in transactions. It not only caters to people's needs for sports in the post-epidemic era, but also further participates in users' spiritual pursuit of health and self-discipline. The extremely low participation threshold also makes STEPN a game mechanism that everyone needs and everyone can use

⑤ Externalization of symbolic value, conspicuous consumption, and social class needs

GameFi 2.0 has opened up a new possibility: that is, to give players a sense of satisfaction that can be infinitely pursued and value projected, real, and actively created in real life and themselves. In both the physical world and the virtual world, the player's needs for social interaction, the increase of intangible assets and the affirmation of self-worth can be met.

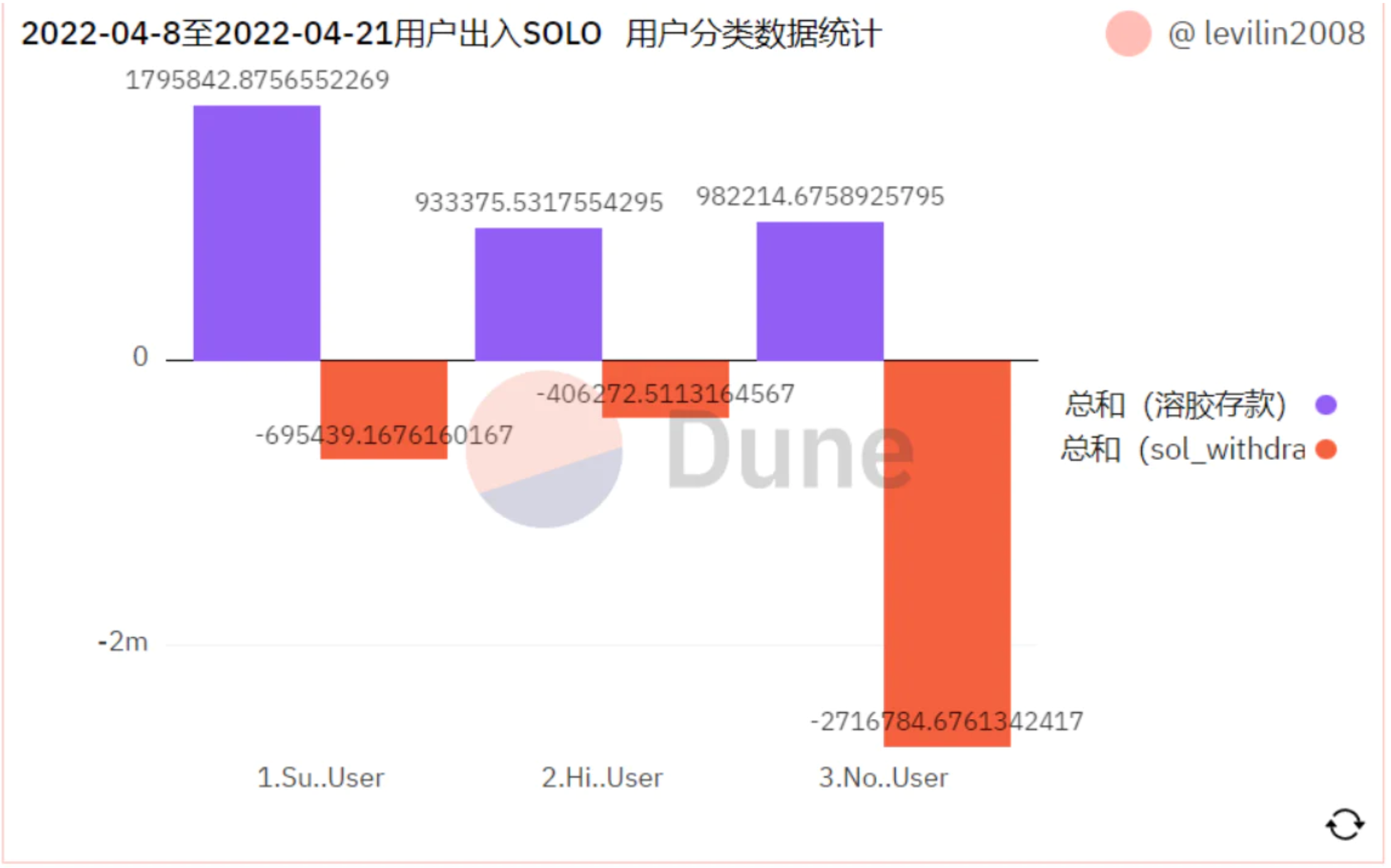

The entire gamefi 2.0 is basically dominated by stpen, let's look at a set of data:

User data

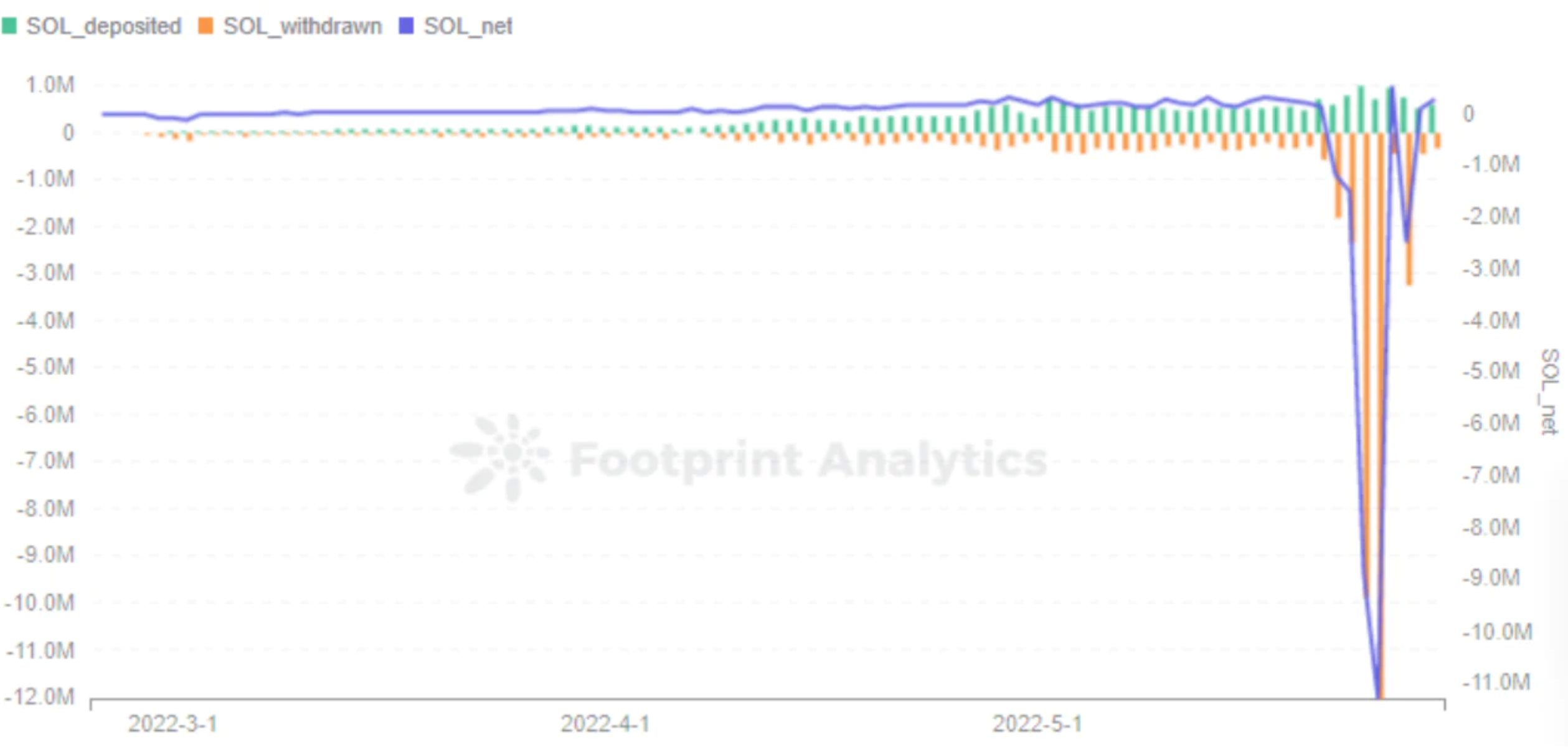

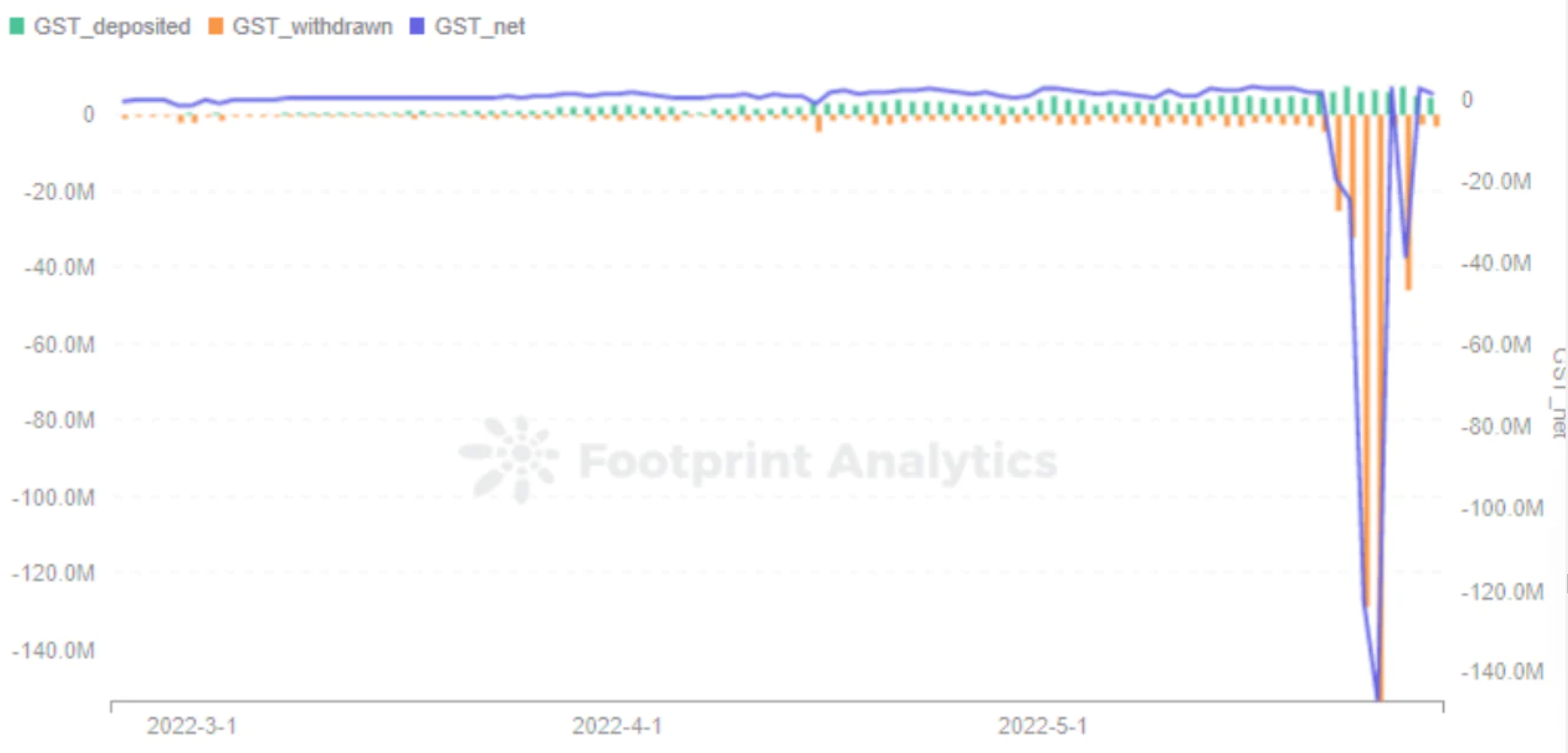

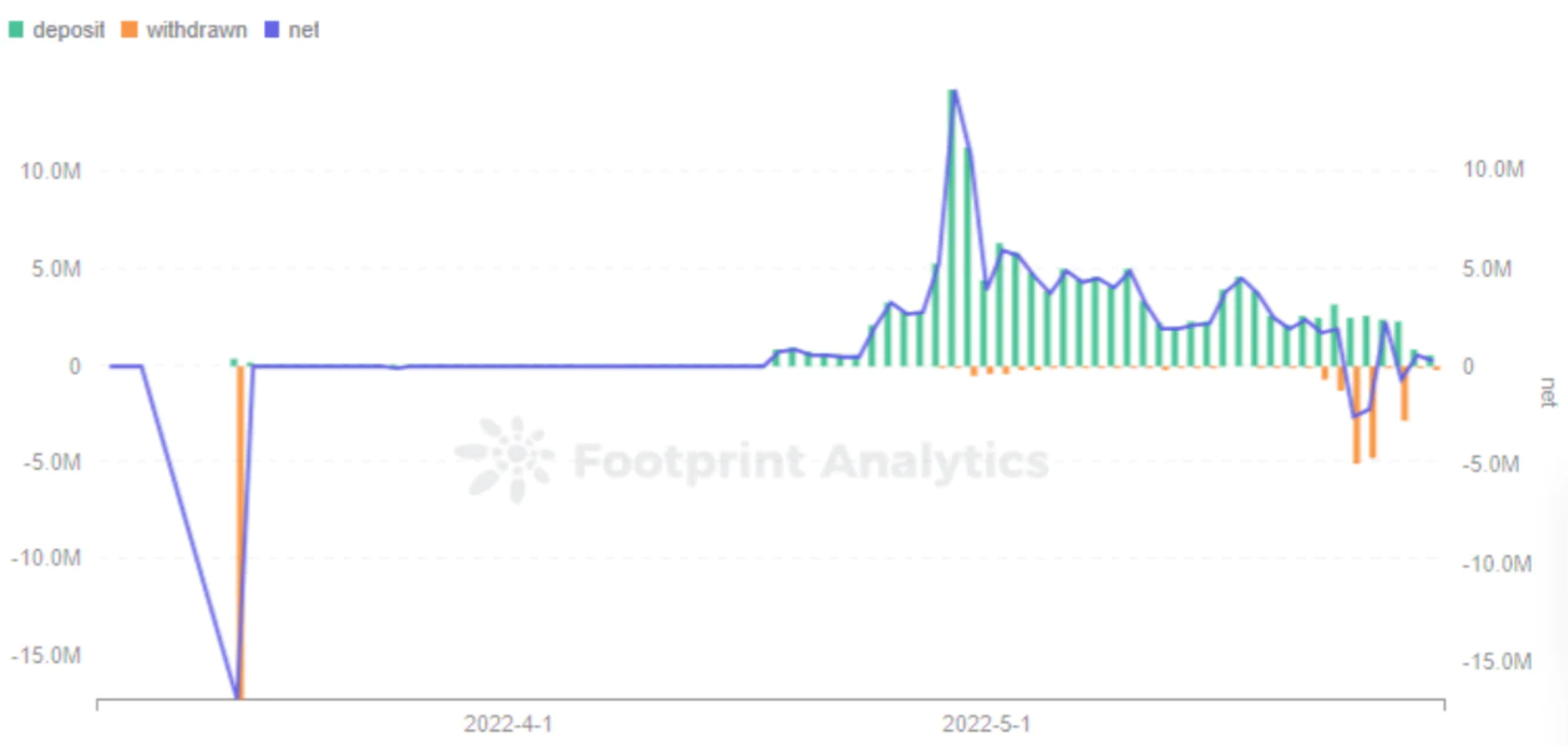

This is one of the hottest weeks on stepn, with 10.7% of super users, and only 1.79 million super users who have settled in SOL, which is almost the sum of all deposits, so the real strong contribution of this project is 39% of advanced users settled in SOL has 920,000 users, which is almost the same as ordinary users. This amount of data is particularly amazing. In just a few months, it has achieved a user base of one million. Projects will always have highs and lows, throughFootprint AnalyticsAccording to the data, the overall SOL deposits and withdrawals of early users on Solana are basically balanced. However, since May 22, the withdrawal has gradually exceeded the deposit, which means that users have begun to sell more shoe NFTs. Especially since the 24th, the selling pressure of SOL, GST and GMT has increased significantly. After the project party conducted an AMA, the data has been pulled back, but after the release of the statement on the 27th to clear China's usage, it faced selling pressure again.

The transaction volume of GMT and GST is also very active, with more than tens of thousands of transactions. Although the total transaction volume does not fluctuate much, it can be seen from the average number of transactions per address that it has increased significantly after mid-May. Then there are policy reasons, the withdrawal of mainland users, the entire data volume plummeted, the consensus collapsed, everyone is selling, and a run has occurred. Caught in gamefi's death spiral.

The reason why StepN is out of the circle

Background

StepN's team and advisors have backgrounds in blockchain, gaming, and sports. The project won one of the winners of the Solana IGNITION hackathon in October last year, and in January 2021, it won a $5 million investment co-led by Sequoia and Folius Ventures.

At the same time, the vice president of Adidas also promoted StepN on social media, and the strong background added more power to it.

start a new mode

GameFi's play-to-earn model is languishing, and the market is missing a blockbuster project. And users have become more savvy, and the market lacks an innovative project that can jump out of the homogeneous gameplay and surprise users.

Keep up with the global theme

With the improvement of global health awareness, people pay more attention to healthy life. Running is one of the easiest exercises that anyone can do.

not just about making money

Games will bring instant pleasure to users, but in the long run they will make people feel guilty. Although P2E makes users feel that they have earned money in the game through token revenue, the uncertainty of currency prices may eventually make users waste time enduring boring games and lose the cost of getting started with NFT.

If changing X from play to something that makes more sense, transfer the item's value from earn to X. Users will not care too much about whether to earn, so they will no longer just focus on currency price fluctuations to decide whether to stay or not.

StepN provides users with another value besides profit-seeking, whether it is a healthy body, a good mentality, or making friends who also love sports.

Strengthen anti-cheating and reject guilds

StepN's strict anti-cheating mechanism prevents speculation from disrupting the balance within the project. Although the guild can bring a considerable number of users, it will also cause unfair competition for retail investors. At the same time, the guild usually accelerates the process of the death spiral for the project, making the supply and sales of tokens out of control.

StepN's out-of-the-circle integration has many factors, and there are certain reasons for user positioning. Although it is inevitable that there are speculative users who are chasing profits, it has also attracted some users who are looking for other values (such as health). But it is easier for the project to adjust the release of risks in the early stage, and a large number of profit-seeking users will only accelerate the death of the project.

5.5 Summary

Unlike GameFi 1.0, which emphasized the value of external assets, what GameFI 2.0 harvests is a deeper level that is reflected in the spiritual core. That is to say, instead of extrinsic value tempting players to invest, we should pay attention to intrinsic value. This is what drives players' emotional investment, and this is the long-term economic model.

6. The Development Trend of GameFi X.0

6.1 Diverse X to Earn

In a broad context, X to Earn can generally refer to all behaviors that obtain income in Web3, but the X to Earn we mentioned includes: Play to earn (representative project: Axie Infinity), Move to earn (representative project: StepN), Learn to earn, Drive to earn, Write to earn, in addition, there are more novel and diverse forms, such as Sing to Earn, Sleep to Earn, Eat to Earn, Meditate to Earn, etc. After Axie’s play to earn (earn while playing) and StepN’s move to earn (earn while running) modes came out, the x mode gradually evolved into a state where “everything can make money”. Compared with play, x to earn to earn has a wider narrative space.

How does the x to earn model innovate? If the x to earn model wants to break through and enter the next stage, the following elements must be considered: According to the project stage, the project party needs to make breakthroughs and innovations:

The radical expansion of x to earn at the early stage of the project is worth trying. The way of radical expansion may be to provide a short payback period, or even burn money to create enough gimmicks to attract users to perform x behavior. For example, Paypal in the early days of entrepreneurship Give users a reward of 5 dollars, thus ensuring an exponential growth of more than 2% per day.

In the stage of project development, there will inevitably be a stage of shrinking market value and screening participants, but this is not equivalent to a "death spiral". Although the token price of Axie Infinity has dropped by more than 90%, new users are still appearing. Fang is also insisting on building in the bear market, so it seems that the fair value of this game is continuously accumulating/discovering.

No matter what kind of development model PAKA Labs mentioned in the article-raising "playing" with "krypton", "working" with "lazy", "check-in mode", raising "points" with "network", and cashing in traffic, x to earn needs to find sustainable economic sources to achieve the second growth curve. From a macro point of view, the project should build an ecosystem around x, and there may be sponsors, advertisers, traders, collectors, loyal fans, gamers, gold diggers, etc. in this ecosystem. Through the production and exchange of multiple parties in the ecology, a closed-loop economic system is realized.

On the other hand, we are seeing some Web2 companies take x to earn as a new business model and marketing concept, opening the door to Web3 exploration. Just because x to earn interestingly connects off-chain behaviors and on-chain economic models, x to earn forms a bridge connecting Web2/Web3. We found that traditional Web2 companies are making bold attempts to take advantage of their own x advantages, use the x to earn model to attract users, and promote their own product iterations. At its core, in the x to earn mode, x is the starting point of the project narrative, the value of the cold start of the project, and the solution to the real needs of human beings; while earn is a universal selling point that can attract users to enter the Web3 field, a benign A profit model and a stable economic cycle are some of the necessary conditions for the long-term development of the project. earn should not be the target of x; instead, x and earn, which cannot be stripped independently, should be done in parallel. In other words, only when users can feel fun and attractive in the x mode, can earn be the icing on the cake and provide vitality for the long-term operation of the project.

6.2 Technical scheme and economic model analysis

It is foreseeable that gamefi is the application closest to the "entity" in the crypto world. Judging from the proportion of gamefi's market value in the overall market value, its market value still has room to grow. At the same time, the application layer is still in the early stage of exploration, regarding the evolution of the future development direction of Gamefi:

Follow the progress of Defi direction

Introduce more defi designs to refine the design of the in-game economic model. At the same time, pay attention to the innovative projects of defi.

Use business fee income as staking rewards

Use some governance tokens for staking rewards

Ve model in the game classic