Original Author: Tiga, W3.Hitchhiker

Original Author: Tiga, W3.Hitchhiker

2022 Year in Review

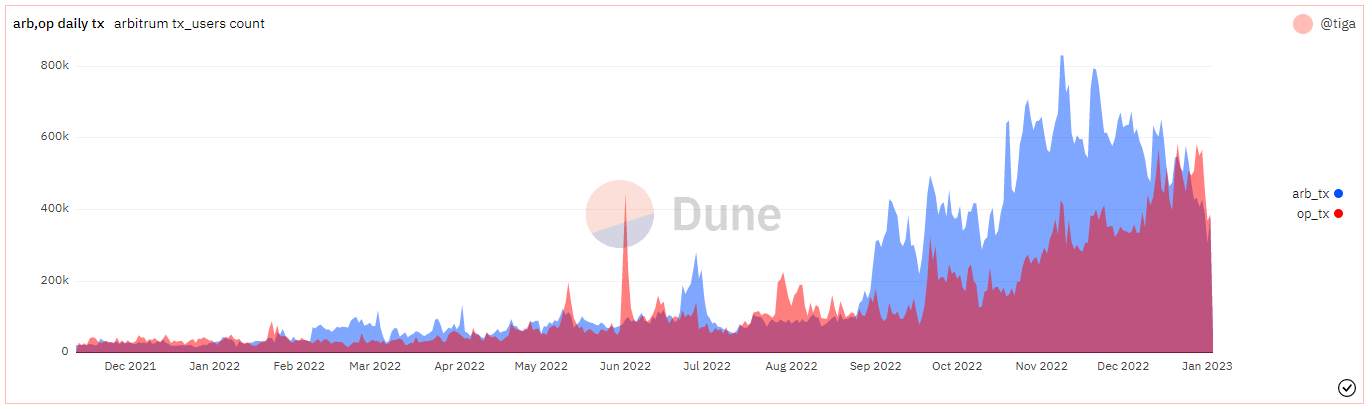

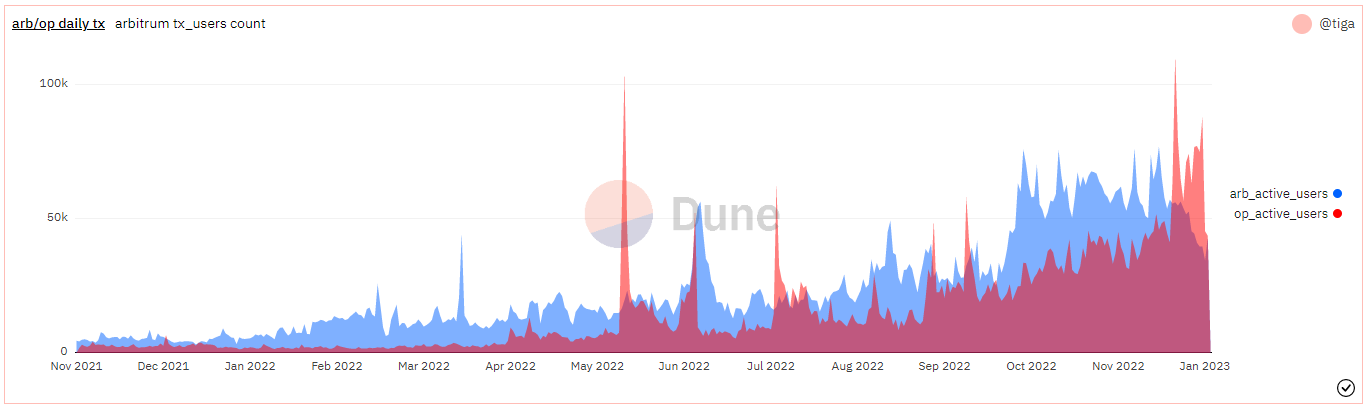

2022 is the year when L2, represented by OP and Arbitrum, will take off. During this year, OP launched the OP token in May, and launched a wave of OP Little Summer this summer in conjunction with the OP ecological airdrop. Arbitrum started the hot Odyssey event at the end of June. Due to the lack of performance of Arbitrum due to its popularity, the event was suspended after a week. After that, Arbitrum completed the Nitro upgrade at the end of August, in which performance, gas fee and other aspects have been greatly improved. It is also the Nitro upgrade that makes Arbitrum far better than OP in various data dimensions.

During the year, the monthly trading volume of Arbiturm and OP both achieved an average high-speed growth of 38.8% and 26.32%. The monthly trading volume of Arbiturm and OP also remains in the order of tens of millions.

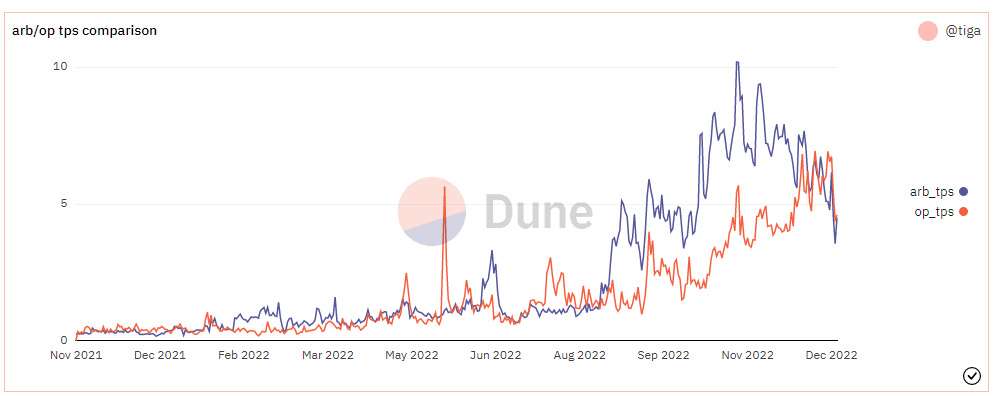

It can also be seen from the chart above that before Arbitrum's Nitro upgrade, OP and Arbitrum were relatively evenly matched. After Arbitrum completed the Nitro upgrade, Arbitrum has far surpassed OP in terms of transaction volume and daily active users. However, since mid-November, Arbitrum’s daily transaction volume and daily active users began to decline slowly, while OP’s continued to maintain rapid growth. The same result can be seen with the TPS metric.

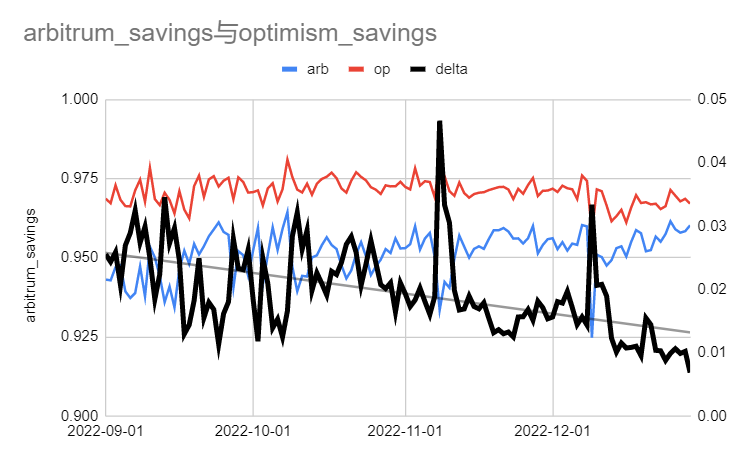

In terms of performance index L2 gas compression rate, the compression rate of Arbitrum after the Nitro upgrade fluctuates around 97%, while the gap between the compression rate of OP and the compression rate of Arbitrum is gradually decreasing, from the black line and the gray line in the figure below This trend can be seen in the trend line of .

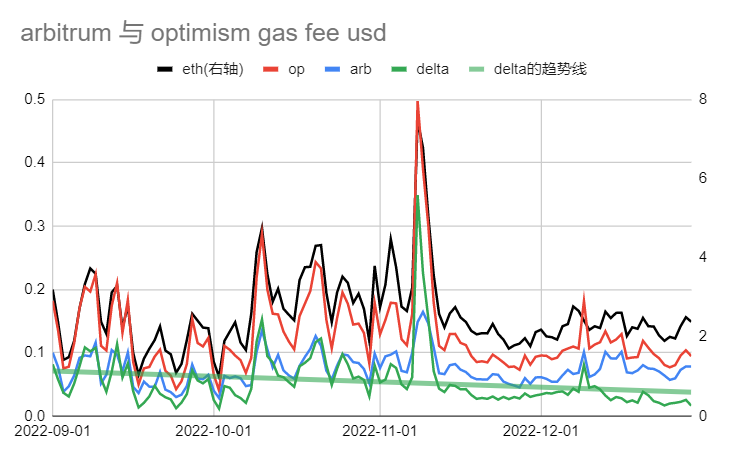

On the other hand, taking Arbitrum as a reference indicator, the OP's gas fee is also getting cheaper and cheaper in USD. At present, the gas gap between Arbitrum and OP is very small.

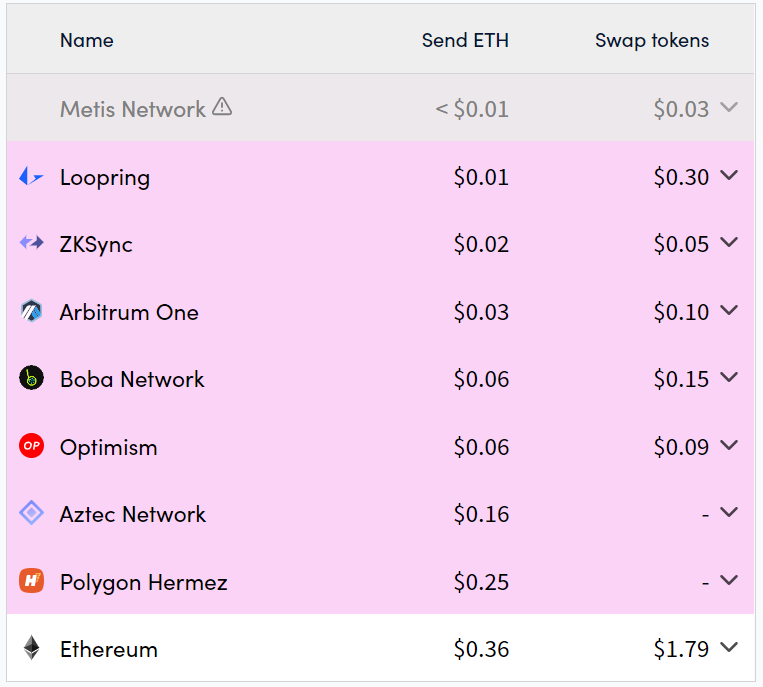

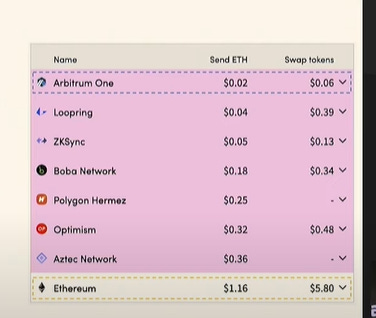

According to the data of l2fees, when the gas fee of the ETH main network is not too expensive, the swap tokens gas fee on the OP network is even lower than that of the Arbitrum network. In terms of transfer fees, Arbitrum is cheaper than OP.

Compared with the screenshot 2 months ago (the picture below is the PPT screenshot of offchain labs at SmartCon 2022 2 months ago), the OP's fee is much cheaper.

In terms of ecology, Arbitrum is the absolute number one. This summer has witnessed the popularity of GMX and the absolute attraction of the Arbitrum ecology. If I want to go to Arbitrum, it will bring huge traffic and attention to the project side, and even directly pull offers . From GNS, HEGIC, and the recent Magic ecology, it can be seen that the Arbitrum team's operational level, ecological support, ecological attractiveness, ecological cohesion, and ecological innovation are currently the strongest ecology. For the ecology of Arbitrum, 2023 is very worth looking forward to.

As for the OP, the OP selected 6 dapps of the year, which is not really eye-catching.

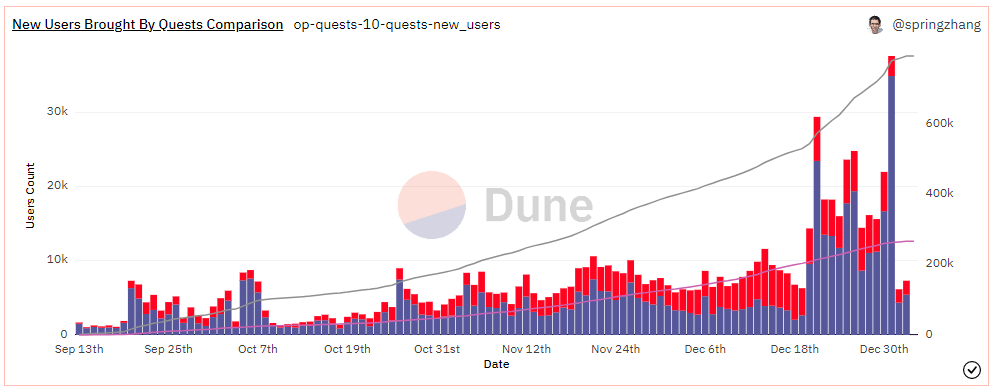

OP relied on the OP Quests event this year to attract a considerable number of new and old users. Of course, the more important reason is that 14% of OP's token airdrops have not yet been distributed.

On the whole, there is very little difference between Arbitrum and OP in terms of transaction volume, daily active users, gas fee, and TPS. Arbitrum's biggest advantage at present is its ecology. Of course, OP will also try its best to develop its own ecology. From the OP stack and OP Quests activities, it can be seen that OP has the ambition to strengthen its own ecology. However, judging from the results, the effect is not obvious, and the gap with the Arbitrum ecology is still very obvious.

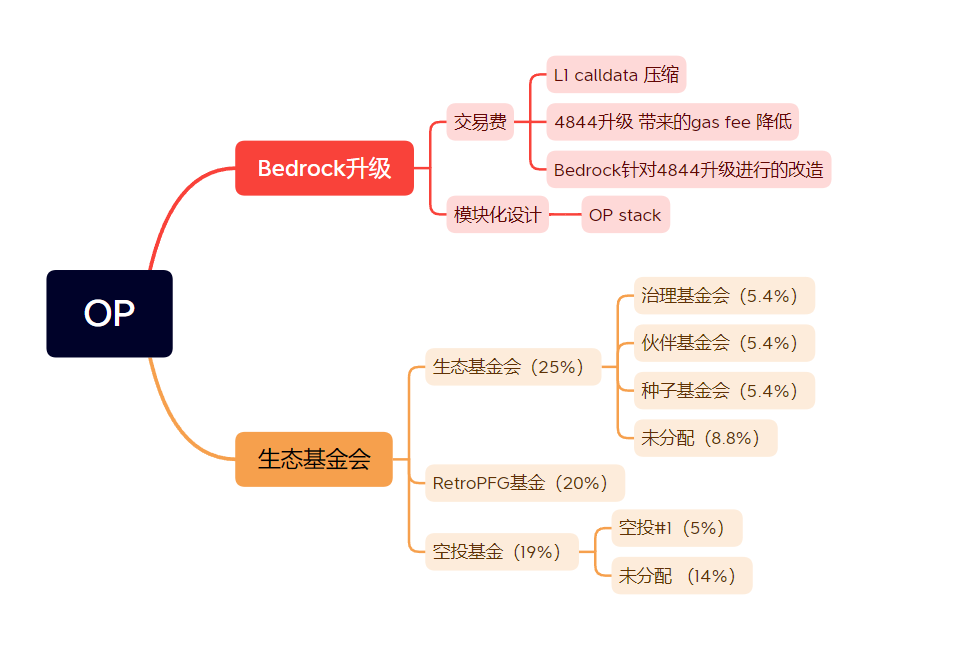

Outlook for 2023 According to the report, Arbitrum's future plans are: Continue to reduce fees and increase tps: use pipeline to add 0 to gas fee and performance. [The pipeline and Bedrock here use the same word, and the technical background and results should be quite different] Decentralization of validators Decentralization of validators sequencer decentralization sequencer decentralization It is expected that Arbitrum will have other actions in 2023: Restart Odyssey Event Issue coins, establish ecological funds, strategic investment funds, etc. Incubate the ecology (social + game) on Nova fromfromOP's Annual Outlook Report It can be seen from the above, where is the focus of the OP next year: Complete the Bedrock upgrade Driving the development of the OP Stack Assist ETH team with EIP-4844 upgrade The Bedrock upgrade is the top priority of the OP in 23 years. Recently, the OP has also published several articles about Bedrock, but the market response is mediocre, and no one discusses it or introduces it. The OP's PR and marketing skills are inferior to Arbitrum's. It can also be seen from the text in the OP's annual report that the OP has full confidence in Bedrock, saying that the upgraded OP of Bedrock can provide the lowest L1 data costs, improve the security of cross-chain assets, and increase throughput. The official Twitter account of OP Labs also confidently posted that there is no Rollup with a lower cost than the upgraded OP of bedrock. Bedrock has sufficient latecomer advantage over Arbitrum Nitro upgrades. After all Bedrock upgrades, the performance of OP will be better than the current Arbitrum One. At that time, the OP network with better performance will attract more users, more transaction volume, more developers and move towards a positive cycle. Just like the Arbitrum that completed the Nitro upgrade in the summer of 22, the upgraded OP of Bedrock will have a siphon effect on users and developers in many aspects. In addition to the cost, the bedrock upgrade includes: Support multiple execution clients new proof system Assets can be bridged in two steps, making cross-chain bridges safer@kelvinfichterbedrock in july 22intro tweetintro tweet Medium (which has blown ingredients): bedrock is very modular and ETH compatible Very saving gas fee Bedrock uses ETH Engine API to create a consensus layer and separate execution clients Bedrock is also the basis for other functions, and Bedrock is also very flexible and modular. The fraudulent structure of the L2 derivation pipeline and bedrock means that bedrock can be easily plugged into a new DA layer. This is why the OP is actively involved in 4844. Once ETH completes 4844, OP can seamlessly send data to data blobs The flexibility of bedrock is reflected in: bedrock is a Rollup client, not an Optimistic Rollup client. Bedrock does not target a specific Rollup proof. When zk matures in the future, Bedrock can also quickly switch to zk proofs. In general, the Bedrock upgrade is the cornerstone of many future actions of the OP, and the significance and influence of Bedrock to the OP are very significant. Bedrock's upgraded OP has a leading technology-providing platform on the left hand, multiple funds on the right hand to support the ecology, and a variety of airdrops are expected to attract and reward users and developers. In the face of OP's strong all-round attack, it is expected that Arbitrum will very likely restart the Odyssey event in Q1 of 23 (there are still 7 weeks of activity), and issue tokens at the end of Q2-Q3 of 23, conduct airdrop activities and establish corresponding ecological funds .