1. Summary of Industry Dynamics

first level title

1. Summary of Industry Dynamics

1. Industry dynamics

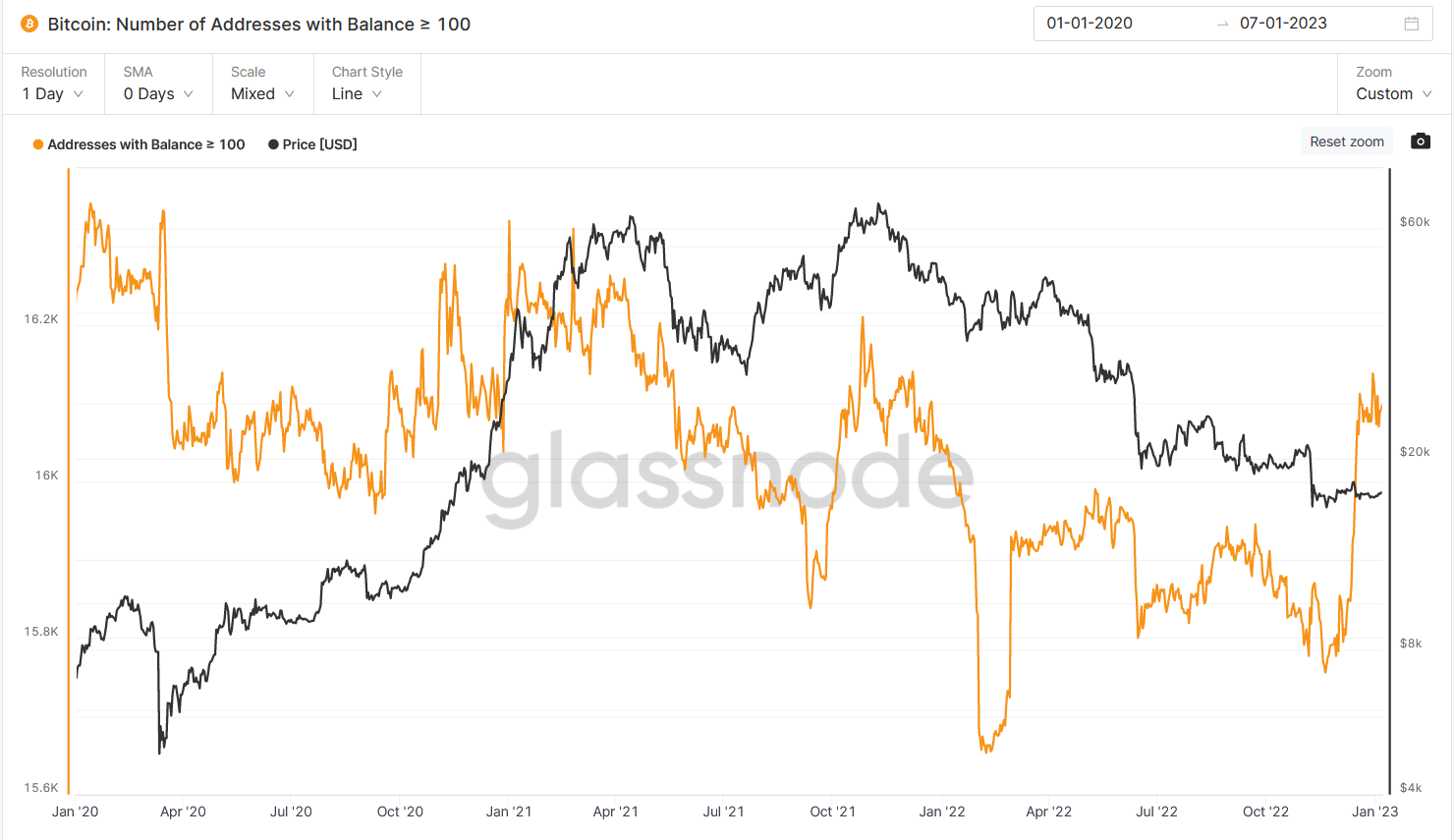

Last week, the crypto market continued to fluctuate sideways with signs of a slight recovery. On Friday, U.S. stocks rose but the crypto market performed flat. In terms of trading volume, the decline in centralized exchanges has stabilized but there is no upward trend. Stablecoins also continue to outflow. As of writing, Bitcoin closed at 16937.48, up 1.96% during the week, with an amplitude of 2.95%; Ethereum performed relatively strongly, rising 5.49% within the week, with an amplitude of 7.25%.

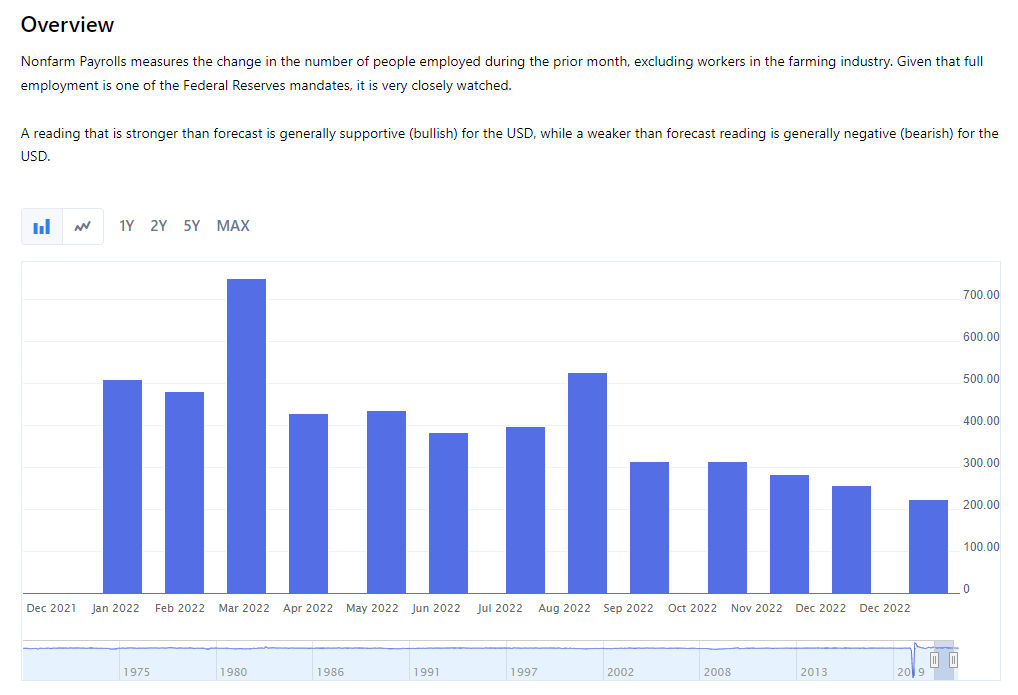

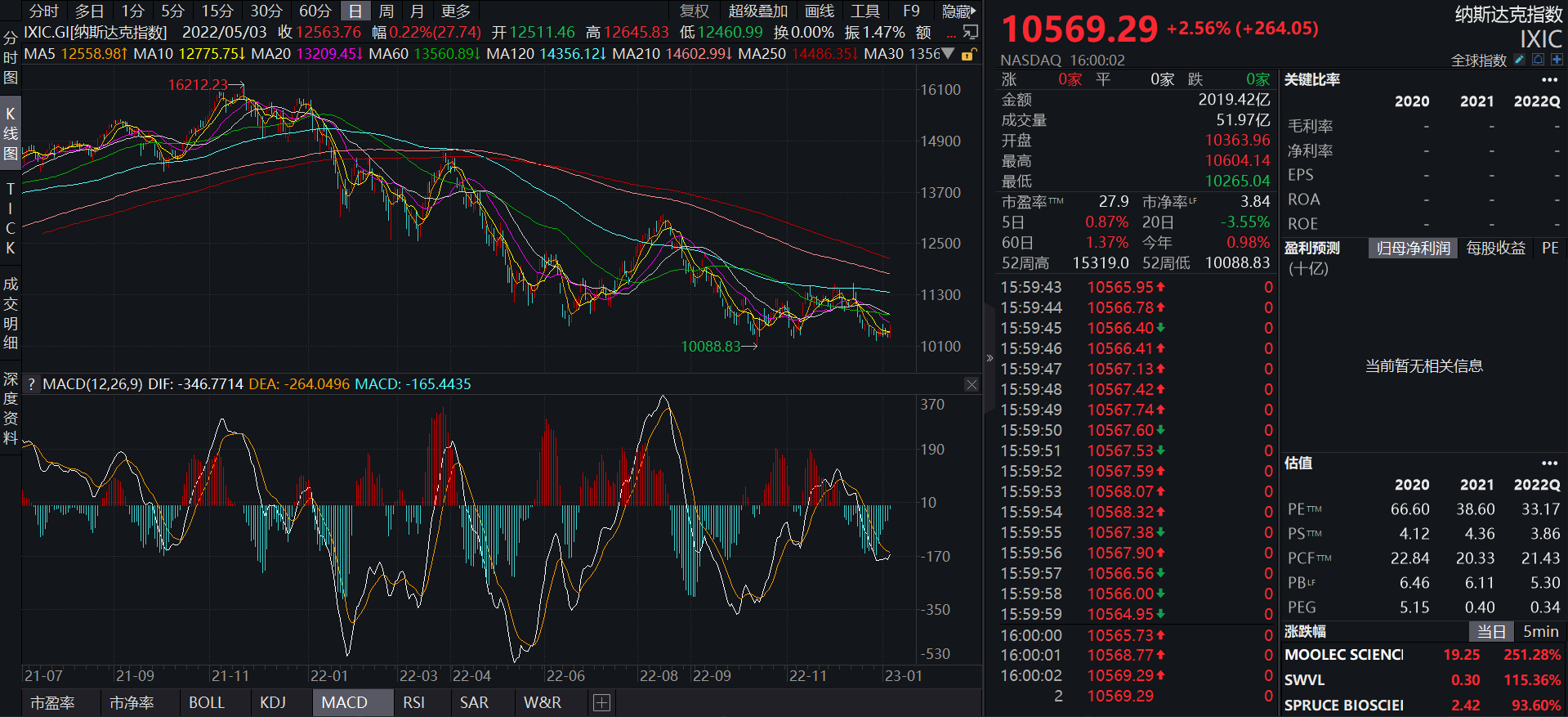

In contrast, U.S. stocks rose sharply on the last trading day of last week. Both the S&P and the Nasdaq rose by nearly 2% in a single day, which took the price out of the bottom range graphically. The non-agricultural data released on Friday exceeded expectations, but the chain slowed down and the pace of wage growth slowed down. In December, the number of non-agricultural employment rose by 223,000 in a single month, and the forecast value was 200,000. The unemployment rate was 3.5%, which was lower than 3.7% in the previous month. , but miraculously on Friday, U.S. stocks did not fall but rose. If you want to find a reason from the non-agricultural data, it may be that wage growth was lower than expected. It is expected that the major media have also given positive judgments on the narrowing range of wages. At the same time, the yield of U.S. bonds has also decreased, which also reflects the market’s judgment that the 2/1 interest rate hike seems to be favorable. Currently, the 2/1 interest rate hike is 25 The 10 basis point argument became popular, and the CME's forecast of 25 basis points also came to 75%. Under the expectation of stopping interest rate hikes in 2023, the overall market seems to be developing in a relatively optimistic direction, but the U.S. manufacturing PMI in December fell to the lowest since May 2020, and the demand from large enterprises was lower than expected. The reality of recession is also becoming more and more obvious, so the future direction of the market still needs to be carefully judged.

1) Public Chain & TVL

2. Industry data

1) Public Chain & TVL

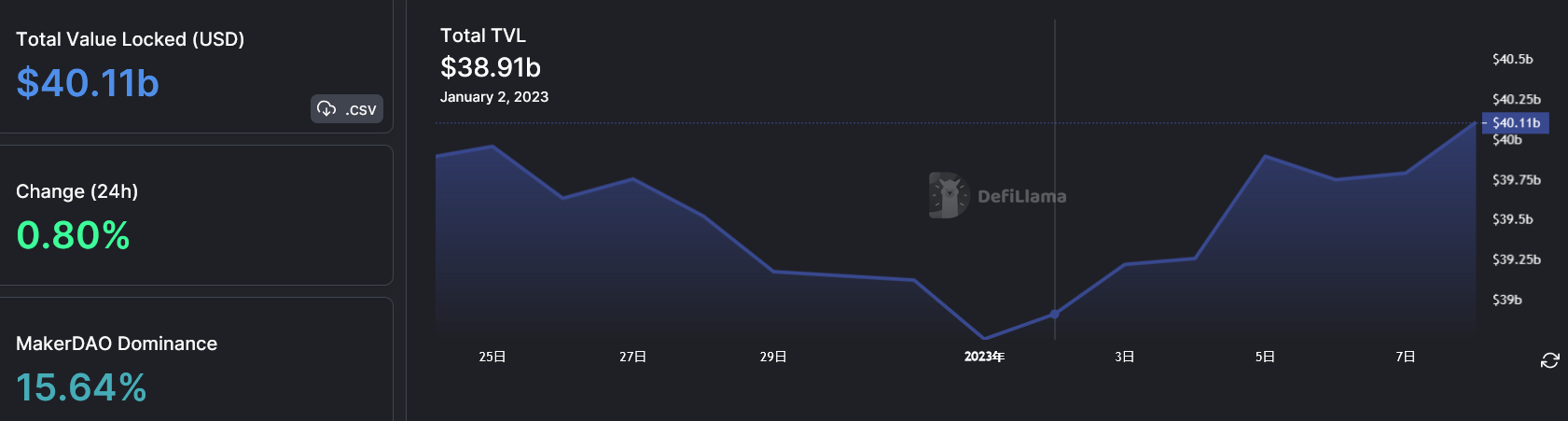

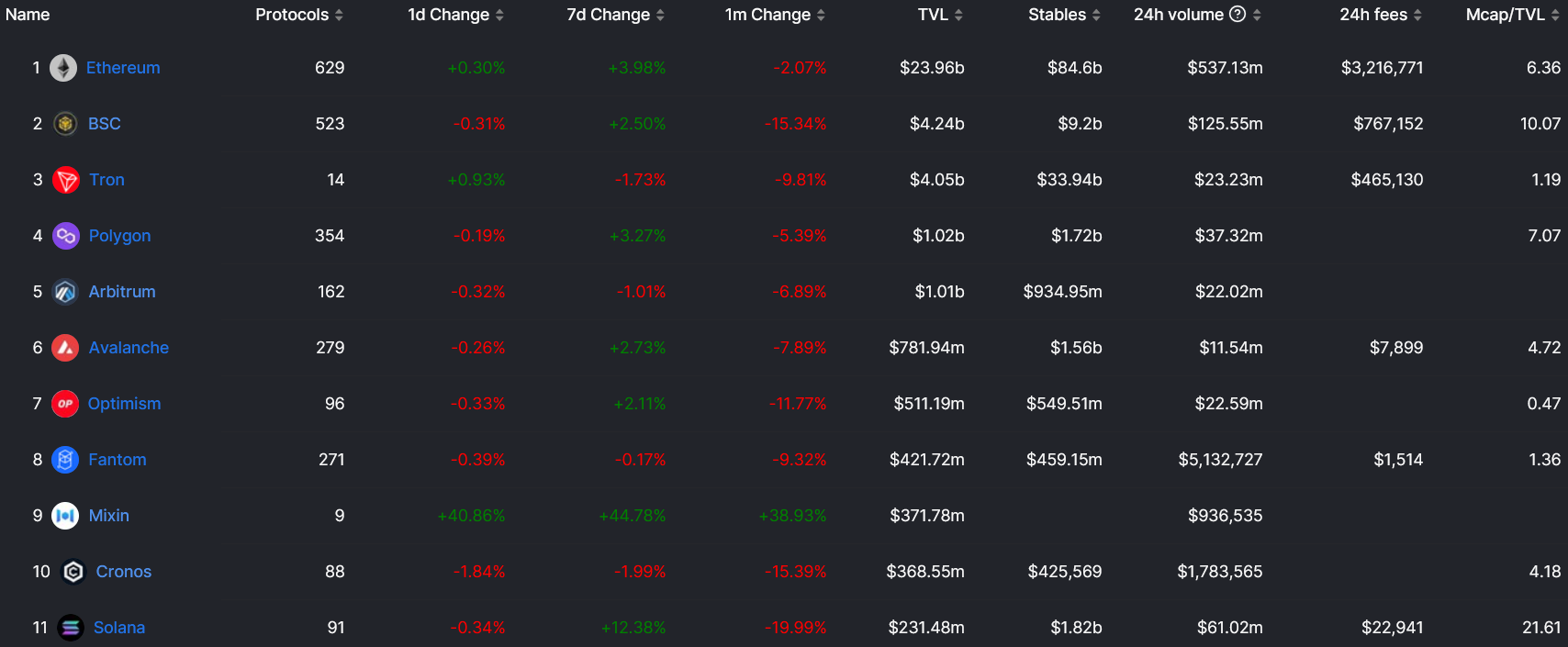

As of January 8, the overall lock-up volume of all public chains denominated in US dollars rebounded slightly, rising to 40.1 B from 38.9 B last week, an increase of 1.2B.

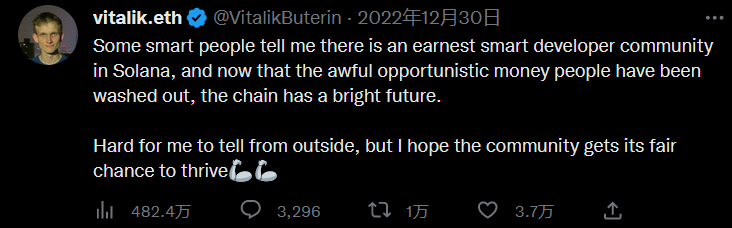

The TVL of each public chain has risen and fallen this week. Solana rose by 12%, ETH, BSC, Polygon, etc. rose slightly, and Tron and Cronos continued to fall slightly.

As soon as this remark came out, the price of SOL immediately rebounded. As the short-selling funds accumulated in the previous decline began to close positions or stop losses, this further boosted the violent rebound of the price of SOL.

2) Stablecoins

Tron’s TVL has continued to decline since January, and the deposit scale of JustLend, the mainstream lending agreement on the chain, has fallen by more than 12%, mainly due to the recent continuous de-anchoring of the algorithmic stable currency USDD (USDD in the USDD-3 pool on Curve accounts for 84%) ; At the same time, affected by Huobi FUD this week (including runs, layoffs, and market maker withdrawals, etc.), the native token TRX once fell by more than 10%.

2) Stablecoins

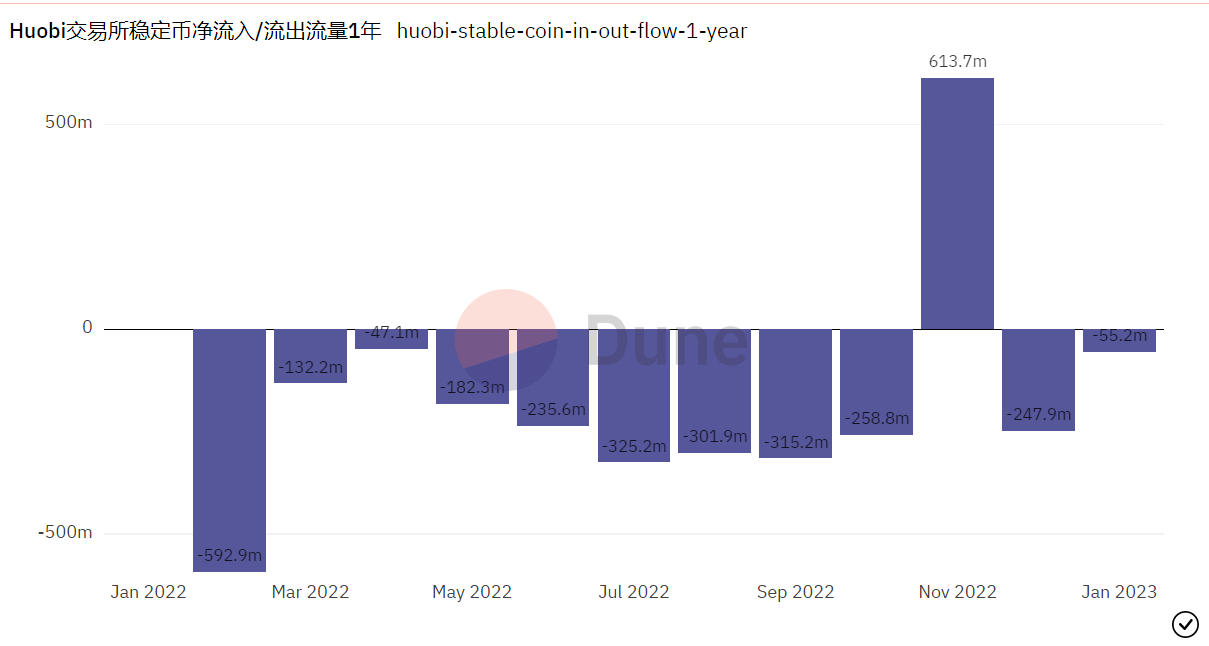

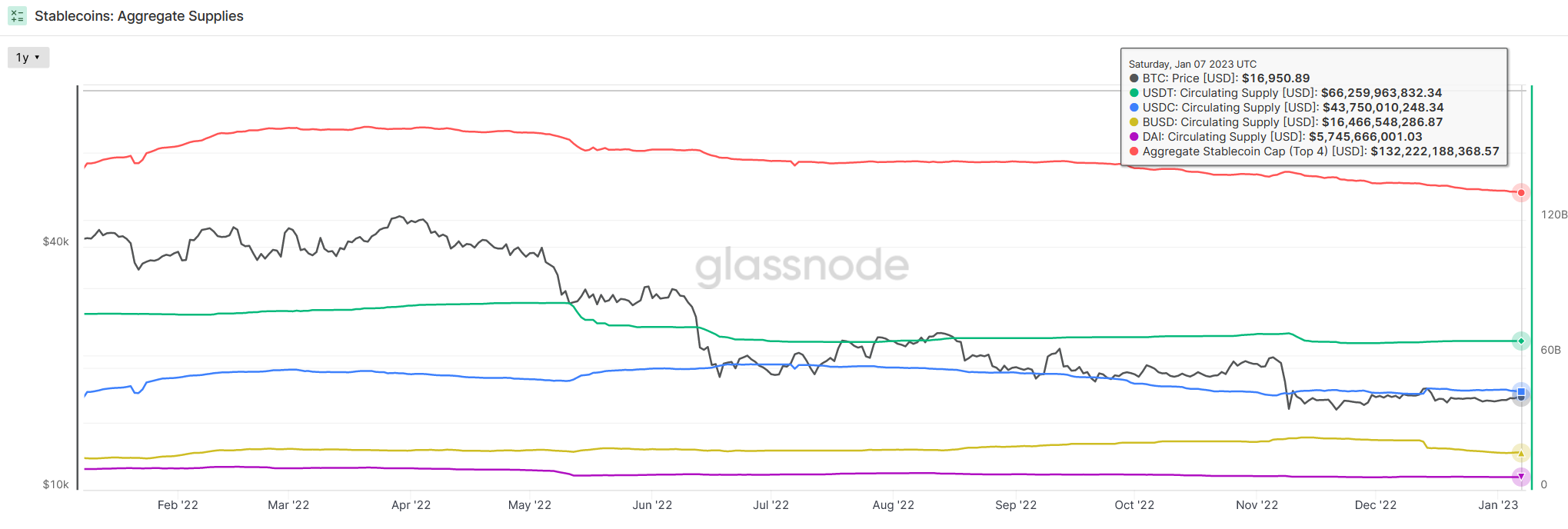

As of January 7, 2023, the total supply of the top four stablecoins (USDT, USDC, BUSD, DAI) is about 132.2 billion, a decrease of about 900 million (-0.67%) from 133.1 billion a week ago. The supply of stablecoins has fallen for eight consecutive weeks, and funds have continued to flow out without any improvement.

Compared with the end of October (the eve of the FTX thunderstorm), the supply of the top four stablecoins has decreased by about 8.12 billion (-5.8%); compared with the end of April (the eve of the LUNA thunderstorm), the supply of stablecoins has decreased by 26.8 billion ( -16.86% ).

On the whole, the shortage of liquidity in the market has not improved. Altcoin has rebounded after the year, while the fluctuations of BTC and ETH are not large, which also reflects the lack of funds in the currency market: in the case of insufficient liquidity, it can only pull up the super For small currencies that have fallen, obtain the liquidity needed to rise through a short squeeze. We maintain the view that the bottom of the shock remains unchanged.

2. Macro and technical analysis

first level title

2. Macro and technical analysis

The market rebounded slightly following the macro. BTC is still dominated by sideways trading. Most currencies led by ETH have rebounded greatly. In the short term, there is a news vacuum, and the market is more likely to go up.

The trading volume has been enlarged compared with last week, and the room for upward operation depends on whether it can break through the upper pressure level.

Two-year U.S. Treasuries fell after the release of non-farm payrolls and wage inflation.

Nasdaq is in a rebound mode, but it will probably touch the previous low in the future

1. Ahr 999: 0.33, you can make fixed investment

first level title

3. Summary of investment and financing

Investment and financing review

3. Summary of investment and financing

4. Encrypted ecological tracking

Institutional dynamics

4. Encrypted ecological tracking

1. NFTs & Metaverse

(1) NFT market this week

1. NFTs & Metaverse

(1) NFT market this week

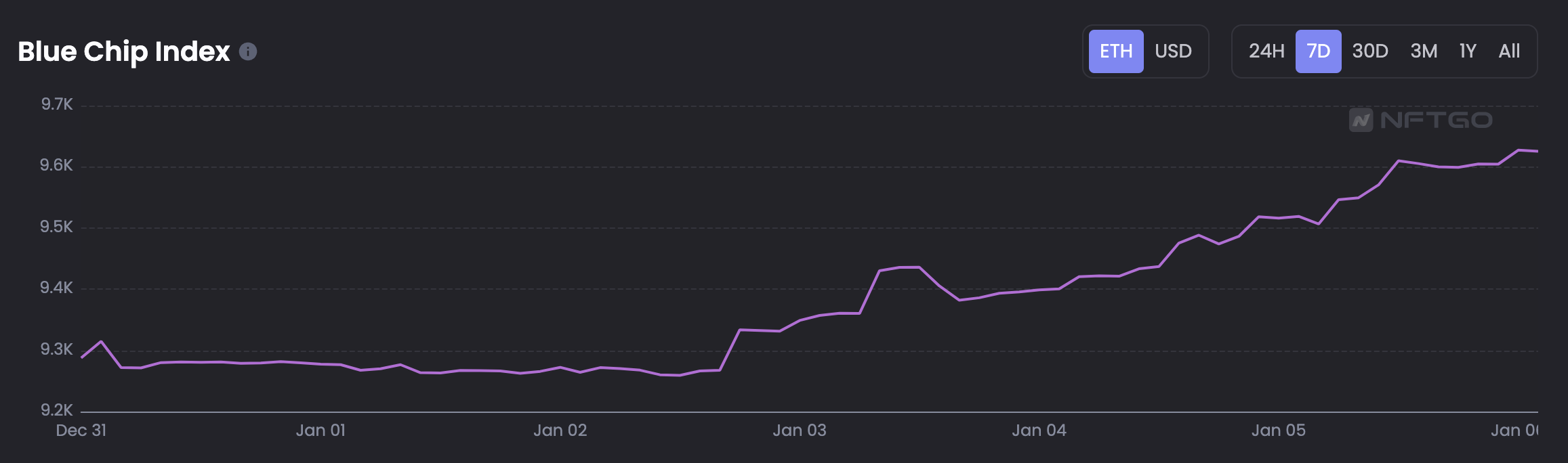

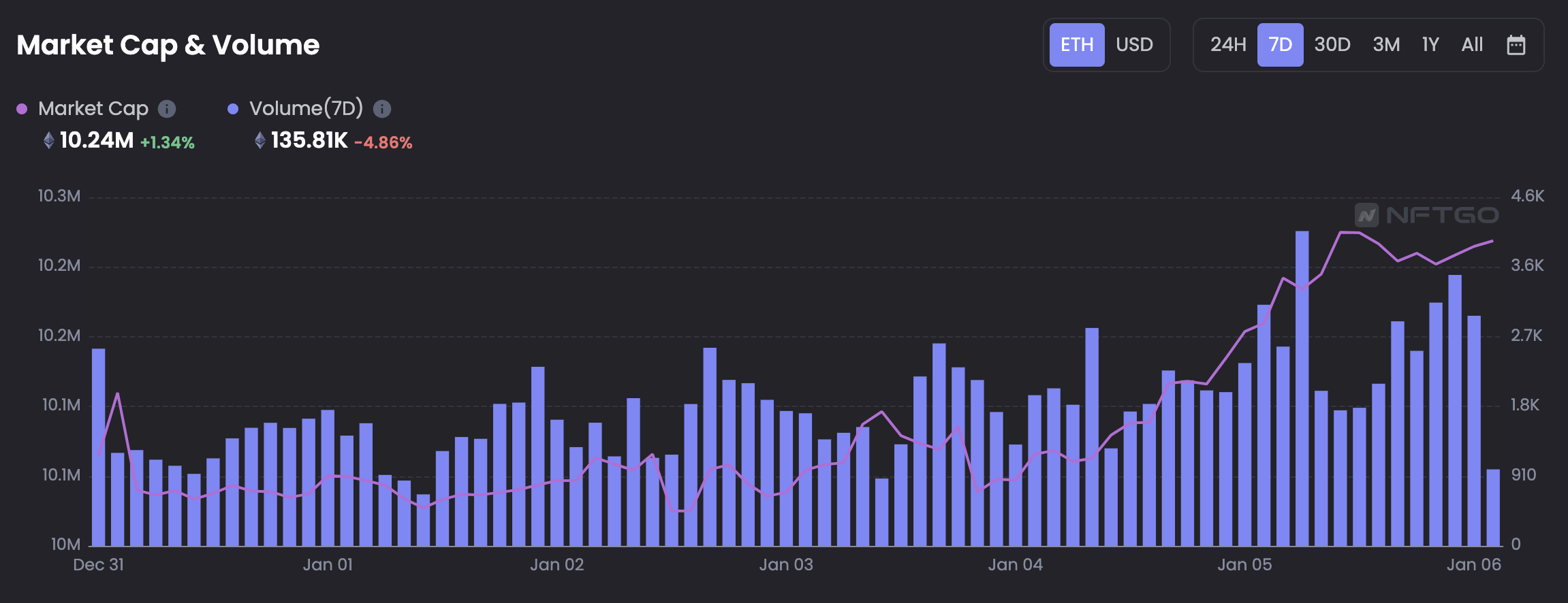

Market overview: This week, the NFT blue chip index has risen significantly compared to last week. As of January 6, the market as a whole continues to pick up steadily. Although the current market is still at the freezing point of the bear market, judging from the blue chip index within 30 days, NFT has rebounded to a certain extent from the lowest point in November last year, and has shown a steady upward trend for two consecutive weeks.

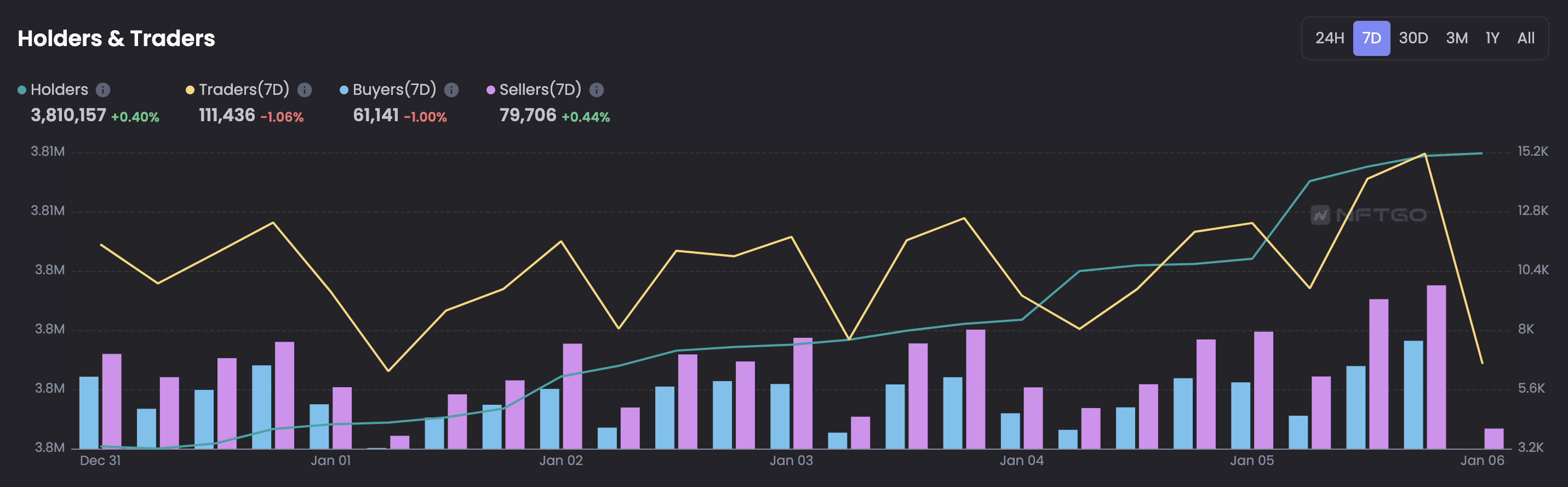

Market activity: The holders of the NFT market have not changed much this week, the activity of traders has decreased compared to last week (-1.06%), buyers have decreased by -1.00% compared to last week, and sellers have increased by 0.44% year-on-year.

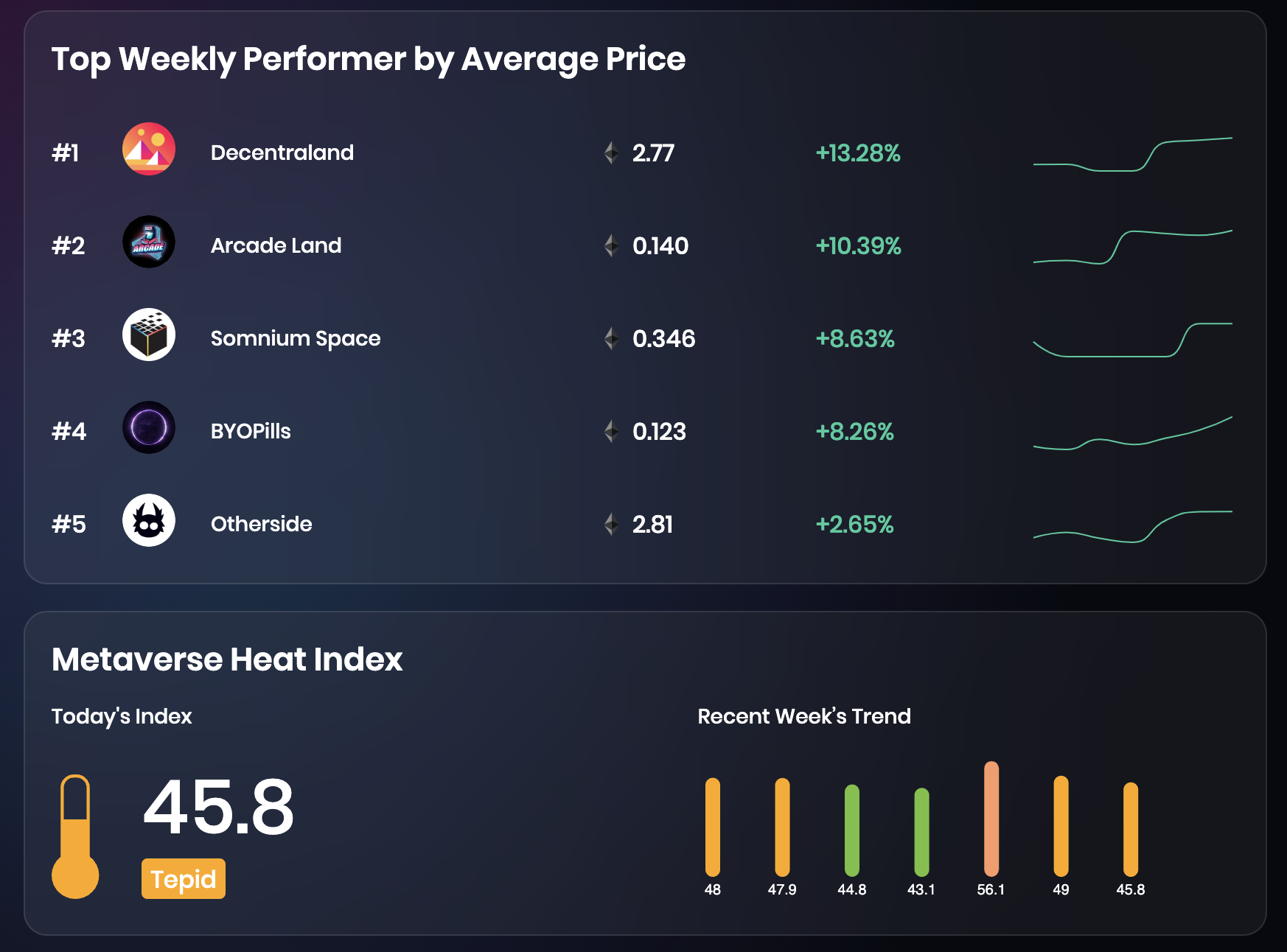

This week's Metaverse project overview:

This week's Metaverse project overview:

(2) NFT & metaverse dynamic focus this week:

Yuga Labs Announce Details of The Otherside Metaverse Second Trip

The total transaction volume of the 10 leading blue-chip projects in the Metaverse sector fell by 10.8% this week (mainly due to the otherside -16% and the sandbox -38.5%). In terms of total market value, due to the addition of the new project nftworld, there is no reference value compared to last week, and the holders have dropped by 21.29%. The top three Metaverse projects are Otherside, The Decentraland, and the sandbox. It is worth mentioning that the transaction volume of the treeverse project has reached the fourth place. The transaction volume of several leading metaverse real estate projects has increased this week. The floor price remains in the range of 0.9-1.4 ETH.

(2) NFT & metaverse dynamic focus this week:

BAYC metaverse project Otherside announced that it will start its second metaverse travel in late March 2023. The first Otherside trip introduced all monkey holders into their Metaverse, with over 5,000 people logging in at the same time. They also face giant Koda with BAYC mascots Curtis and Blue. Yuga Labs also announced that Voyagers will continue into the other side with more travel opportunities and lasting metaverse experiences.

The first trip to the other side of BAYC:

The second trip to the other side of BAYC:

According to the official news released by Yuga Labs, the second trip to the other side will see new environments, new mechanisms, and even bring more gameplay updates than users who traveled for the first time. The team promises to provide more gamification options and high-energy entertainment mechanisms to project holders. In Phase 2, users will be able to access Otherside, connect their wallets, and start spending their NFTs immediately. Holders of BAYC, MAYC or Meebits should have no trouble playing as their own unique avatar in the near future. The next itinerary will most likely be held on a desert map of a Bonedeed. The adventure will follow Curtis, Blue and Voyager in search of the "glowing, pulsating stone". In addition, new residents of the metaverse are also on their way to the other side.

Additionally, Yuga Labs has partnered with Improbable to enhance their Avatar experience on their Otherside Development Kit (ODK). The new toolkit will not just allow creators to build and customize their avatars, it will allow users to modify, create and interact with environments in innovative ways. The toolkit is also planned to be built on a number of different types of games. The introduction of these new mechanisms and tools will make Otherside usage even higher.

Although more details on how to use a custom NFT to enter the metaverse have not yet been announced, Yuga pointed out that the tour of the metaverse will have the function of flying, which will also raise the holder's expectations very high.

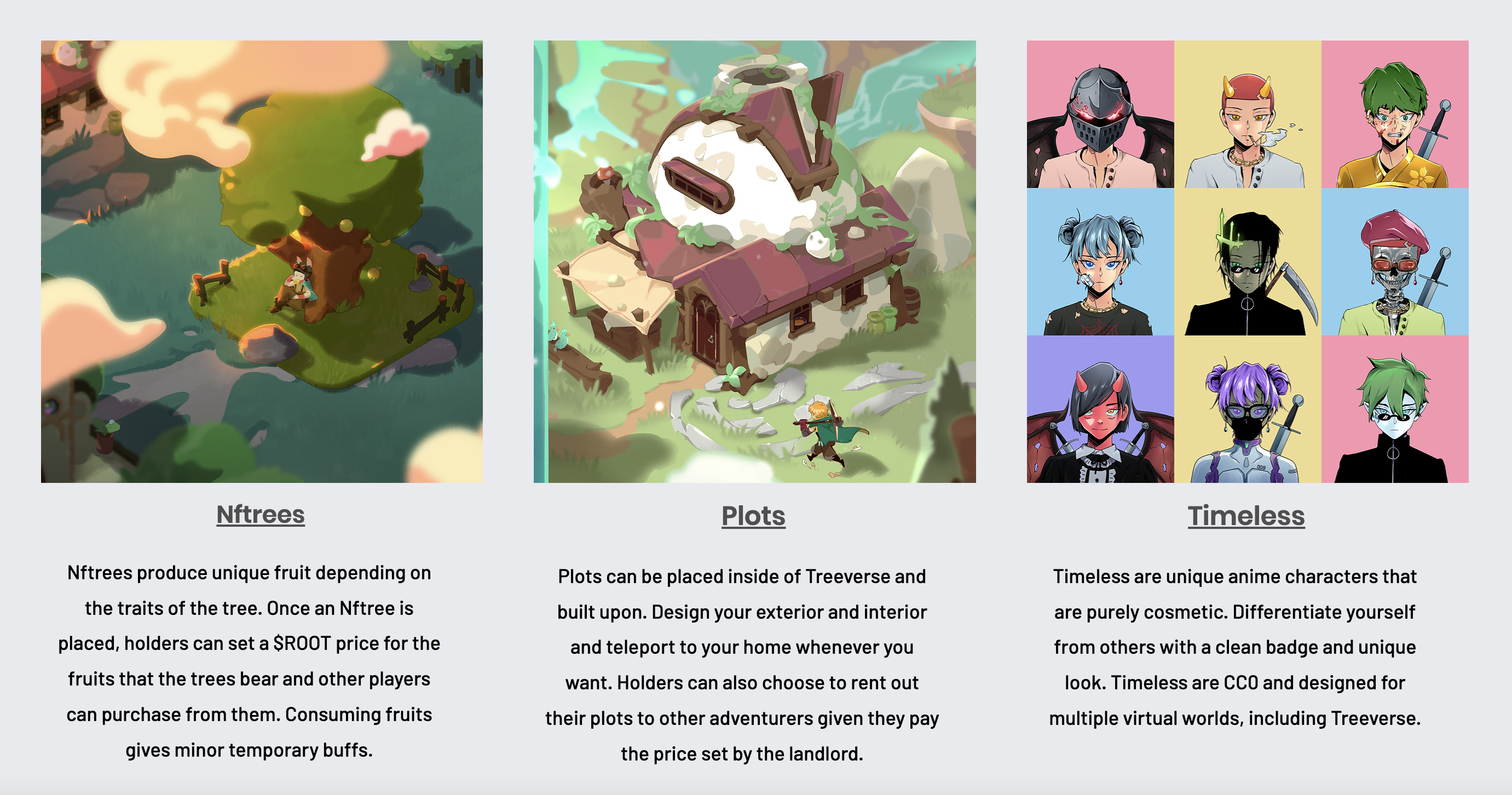

(3) Key project introduction: Treeverse

Treeverse is an open-world social game developed for NFT collectors. Players can complete various tasks to build their own houses, display their NFT works here, and view other people's collections NFT, and visit their houses, or explore new lands with your own third-person perspective.

It is worth noting that "Treeverse" has a category-free "knowledge tree" system that allows players to upgrade characters and attributes according to their preferences, thus shaping their own metaverse adventure experience. This is to attract different types of players and help everyone find their role in the ever-growing Treeverse, and there are no preset restrictions in the treeverse's metaverse. Players can mine, chop trees, fish, craft upgraded weapons and enjoy social functions, and adventurous players can explore many side quests on the map. Every character and resource plays a role in the game and its economy.

According to the founder Loopify, Treeverse is committed to becoming an NFT chat place that replaces social platforms such as Discord, Clubhouse, and Twitter, and at the same time gamifies the online social experience, integrating social and games.

The Treeverse Metaverse adopts a dual-token model. Currently, three types of NFTs have been officially released: Treeverse PLOT (land, floor price 0.8 ETH), NFTrees (tree, floor price 12 ETH), Timeless Characters (avatar, floor price 0.5 ETH).

The team will regularly update the progress and new features of the Metaverse project in the form of a monthly magazine.

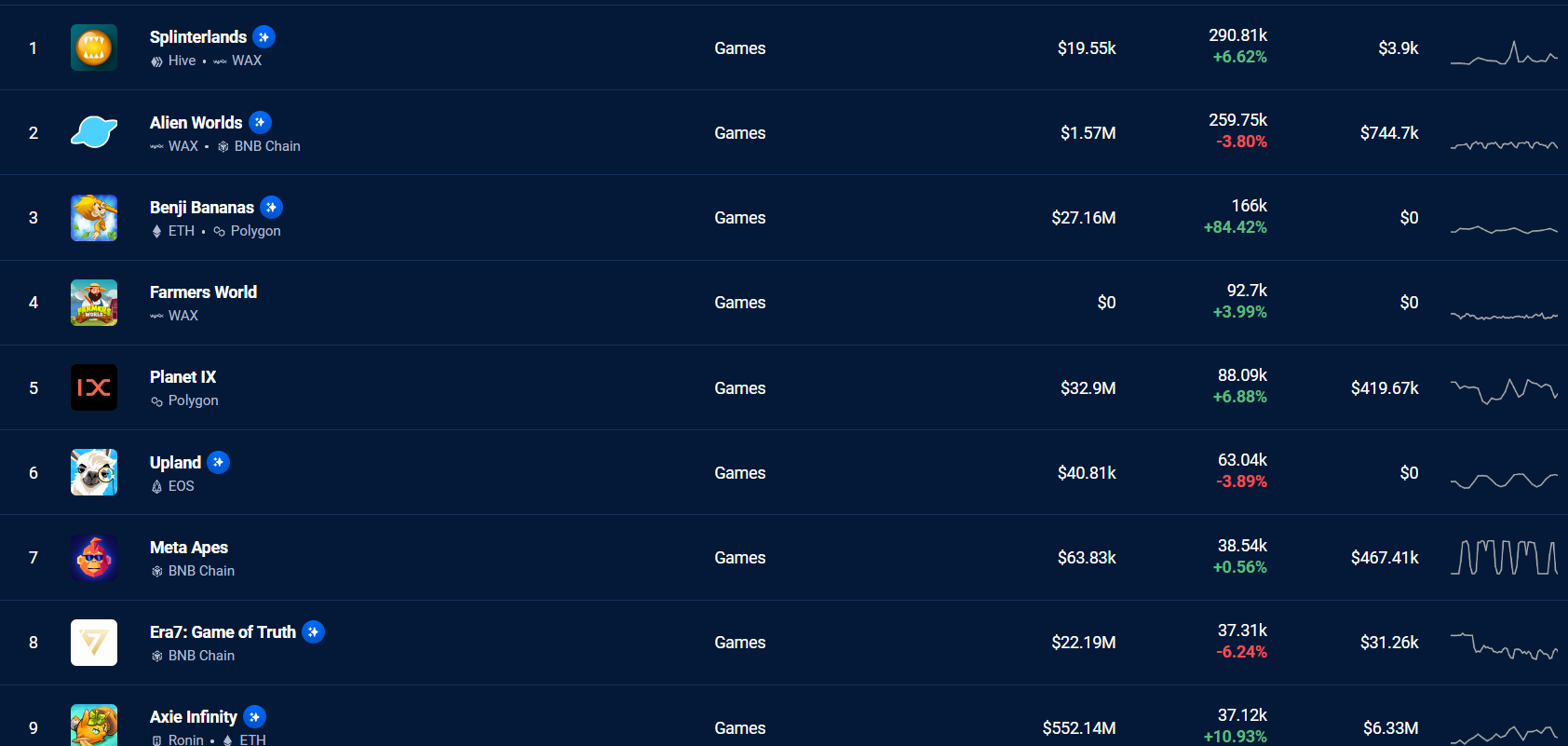

2. GameFi blockchain games

overall review

2. GameFi blockchain games

overall review

On the whole, it has picked up. According to the contract interaction volume on the chain, 80% of the top ten chain games have a positive year-on-year growth, of which Benji Bananas has increased by 84% (at the end of the season, more addresses receive P2E rewards);

Matr 1 x:https://twitter.com/Matr 1 xOfficial

From the perspective of Token price performance, 60% of the top ten market capitalization chain games have risen, and Gala Game has risen by 41.04% in the past week (the utility of Gala coins has been updated, the destruction mechanism has been added, and tokens have further deflated; the release is good, and a user with 20 M has been acquired studio)

Matr 1 x is an FPS chain game. In the future, there will be three games on the Matr 1 x official website: Matr 1 x FIRE (FPS), Matr 1 xWAR (Shooting+MMORPG), and Matr 1 xEVOLUTION (SOC).

Token Economics:

The game is well-made, highly playable, and unique in category. It is expected to become the first excellent FPS game on the chain. Matr 1 x FIRE, is a PVP multiplayer fair competition shooting game, providing PVE mode, 5 V 5, battle royale, etc. The game world view is based on the cyberpunk world, with more than 100 w-word story backgrounds. The game provides more than 30 different weapon props including: rifles, pistols, sniper rifles, submachine guns, shotguns, melee weapons, etc. Players will initially get ordinary characters for free and can play the game freely. If you need to make money, you need rare NFT characters, which can be upgraded to improve attributes.

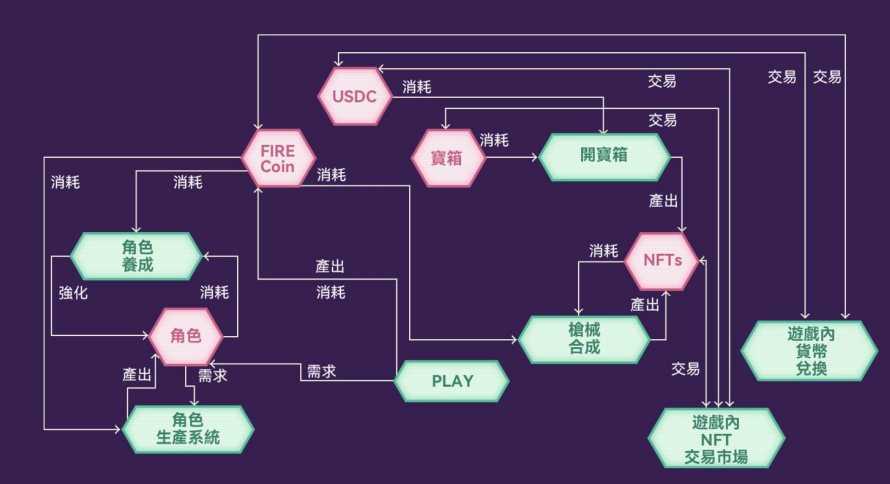

Token Economics:

FIRE Coins: used for various in-game use cases such as avatar upgrades, box opening, and weapon minting

Stablecoin: USDC, as a widely used stablecoin, is used as an in-game transaction currency.user:

team:Matr 1 x Fire opened for pre-registration on September 15, 2022, and recorded nearly 28,000 users in less than 96 hours. It is currently in the internal testing stage, and the pre-registration is close to 60,000 people.

team:More than ten years of experience in the game industry, a well-known game producer such as Tencent, participated in the creation of well-known FPS products such as CF

It has successfully raised 10 million US dollars and is about to complete a new round of financing. Past investors include Hana Financial Investments, a major Korean financial holding company; HashKey Capital; Amber Group; SevenX, etc.

Project Introduction

https://twitter.com/eigenlayer

3. Infra Infrastructure

Project Introduction

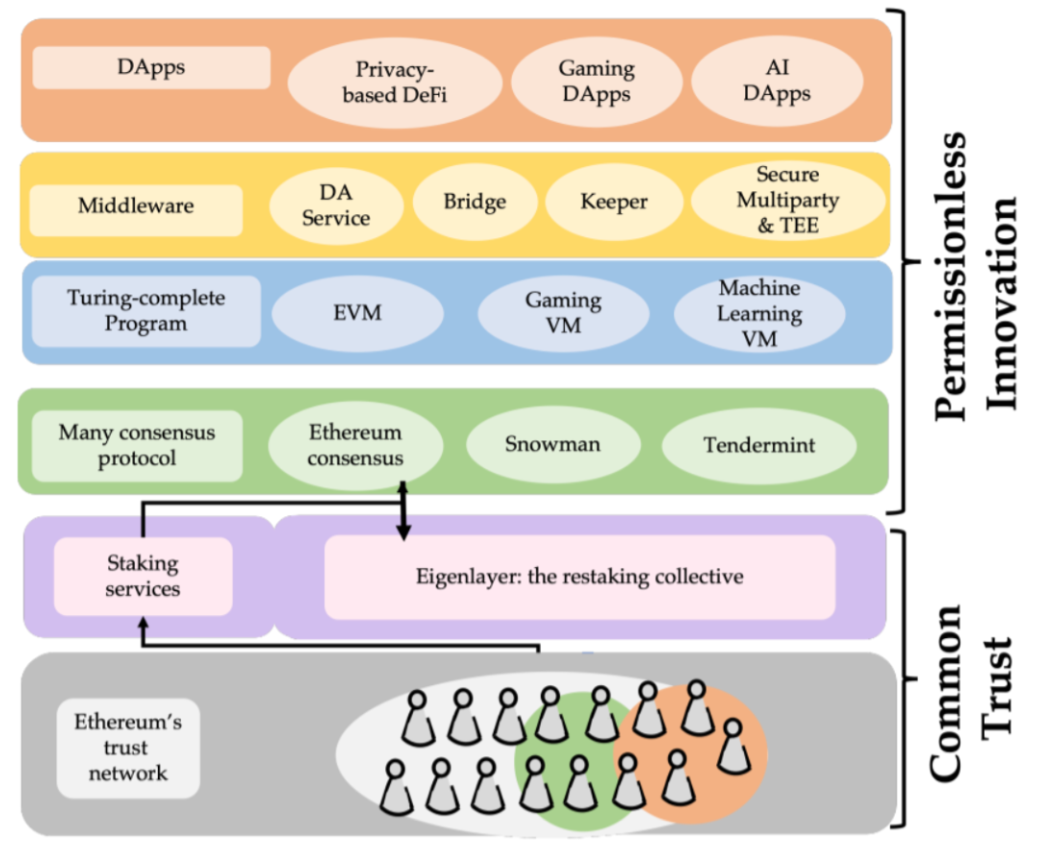

EigenLayer passes the security of Ethereum to the upper-layer middleware by re-pledging the ETH of the Ethereum validator network (such as re-pledging to the upper-layer middleware), so that a wider infrastructure can be shared Ethereum-level security.

Originally, staking on Ethereum can only get block rewards, and once it does evil, it will lead to Slash of its pledged assets.

Now through EigenLayer, they can re-stake the ETH that has been pledged at the bottom layer to the middleware on the upper layer to get more incentives (as shown in the figure below). In this way, the verifier can pass the security of the bottom layer to the middleware of the upper layer. If it is evil, it will be Slash's original ETH collateral.

The specific implementation method of Restake is: the pledger can set the withdrawal address in the Ethereum network as the EigenLayer smart contract, which is to give it the power of Slashing.

In addition to directly restaking $ETH, EigenLayer provides two other options to expand the Total Addressable Market, namely, LP Token that supports pledged WETH/USDC and LP Token that pledge WETH/USDC.

necessity:

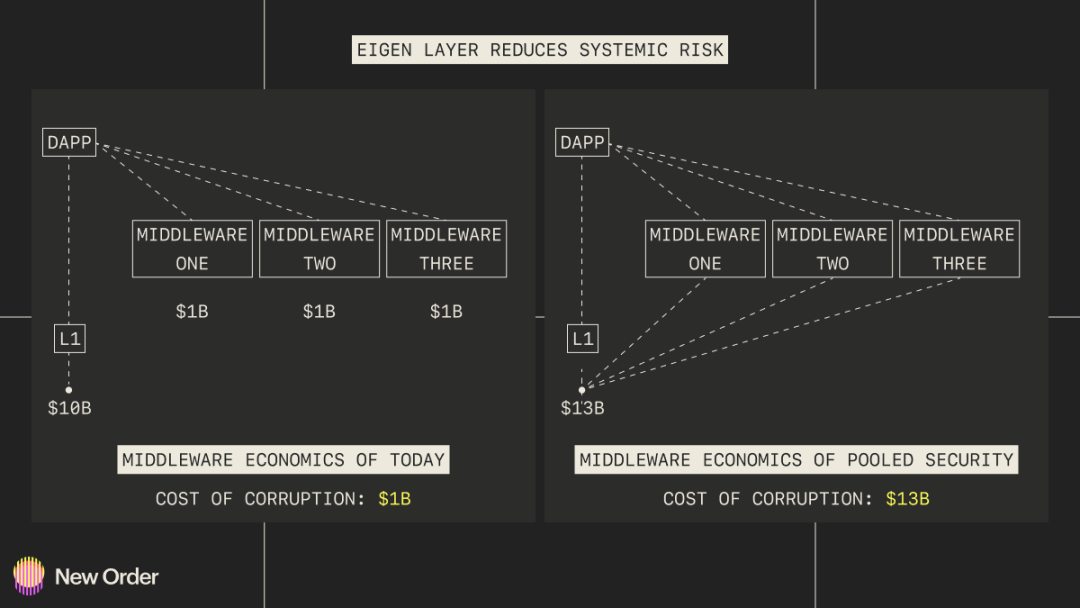

team background

The modular feature will lead to a prominent short-board effect. Some dApps (such as derivatives that require price feeds from oracles) actually depend on the security of Ethereum and middleware at the same time. Assume that a highly composable DeFi application A involves billions of TVL, while the trust of oracle machine B only depends on hundreds of millions of pledged assets. Then, once a problem occurs, due to the risk transmission and nesting brought about by the association between protocols, the loss caused by the oracle machine may be infinitely magnified. System security depends on its shortcomings, and seemingly insignificant shortcomings may lead to systemic risks.

Eigenlayer founder Sreeram Kannan is the director of the Blockchain Lab at the University of Washington (UW). Chief Strategy Officer calvin previously served as Head of Strategy at Compound. The rest of the team are primarily gigabrain Go developers and researchers from the University of Washington. Most of the other members are PhD candidates at the University of Washington.

token economy

token economy

Summarize

The white paper has no relevant information about the token economy, but the interview with the founder stated that the expectation of token issuance is clearly expressed.

Summarize

5. Team news

5. Team news

JZL Garden Progress

The "Khmer Girl in Dreamland-Willow Leaf" project has been officially launched last week and is expected to be launched soon. Welcome everyone to continue to pay attention.

JZL Garden Progress

The content of the document includes: 1) JZL team's weekly crypto market review since March 2022; 2) JZL team's research reports on stablecoins, top quantitative institutions, NFT platforms and projects, and infrastructure tracks. Welcome everyone to discuss and exchange together, thank you!

The content of the document includes: 1) JZL team's weekly crypto market review since March 2022; 2) JZL team's research reports on stablecoins, top quantitative institutions, NFT platforms and projects, and infrastructure tracks. Welcome everyone to discuss and exchange together, thank you!

about Us

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment. The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.