This article comes fromcryptoslate, Original Author: James Van Straten

Odaily News | Moni

At the beginning of the new year 2023, Cameron Winklevoss, co-founder of cryptocurrency exchange Gemini, sent an open letter to Barry Silbert, founder of digital currency group Digital Currency Group (DCG) on behalf of its platform users. Repay over $900 million owed. Cameron Winklevoss also disclosed in the open letter that DCG owes Genesis approximately US$1.68 billion, and the growing crisis of DCG has aroused great concern in the encryption community.

secondary title

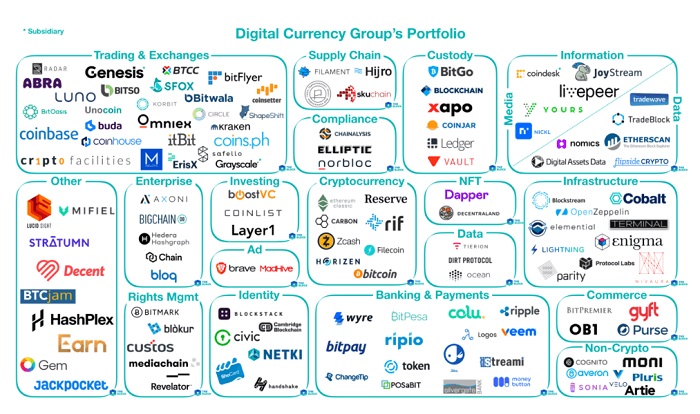

Barry Silbert founded DCG in 2015 and went on to create the "DCG Empire" by investing in hundreds of projects and companies.

image description

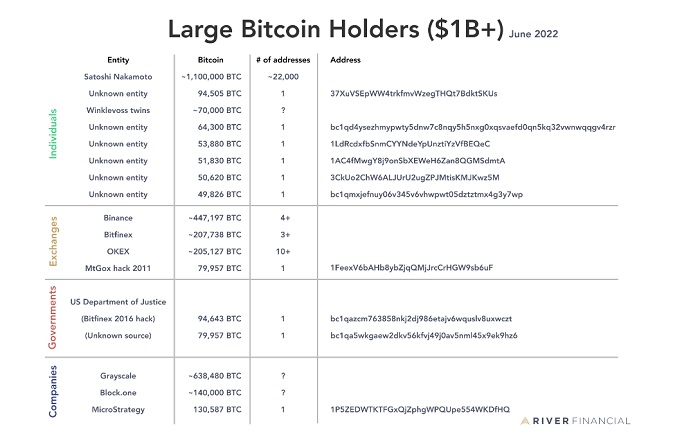

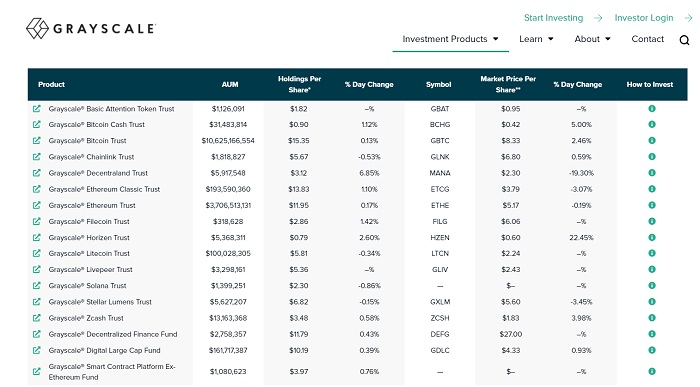

DCG Investment MapAnd the most important companies in DCG's portfolio areGrayscale Grayscale Investments, the company is the world's largest bitcoin holder outside of Satoshi Nakamoto (as shown in the chart below). GBTC currently holds approximately 633,000 bitcoins, a little over 3% of bitcoin's circulating supply.

Grayscale claims that its Bitcoin holdings are held in custody by Coinbase Custody. As a listed company in the United States, Coinbase has high credibility and needs to be audited, so Grayscale's BTC is likely to be stored in accordance with standard compliance practices.

secondary title

How does DCG make money?DCG charges a 2% management fee on the underlying Bitcoin held in the Bitcoin Trust Fund GBTC. According to documents submitted by DCG to the US Securities and Exchange Commission in the third quarter of 2022,The company gets about $230 million in annual revenue from the fee and makes $68 million in profit from it. This revenue represents a significant portion of DCG's total annual revenue of approximately $800 million

, and Barry Silbert confirmed these figures in his November 22 letter to shareholders.

Although GBTC is regarded as a security, it does not have the self-custody risk caused by holding Bitcoin keys. As market demand grows, the scale of assets under management is also rising, even reaching 400 during the bull market in 2021. over US$100 million.

secondary title

GBTC Premium and Discount Issues

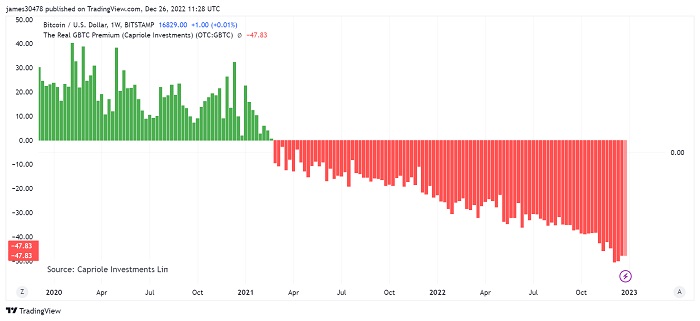

GBTC trades at a premium when shares in the Grayscale Bitcoin Trust change hands at a premium to the underlying bitcoin price. Conversely, if GBTC shares are trading below NAV, it is considered to be trading at a discount (negative premium).

On February 24, 2021, GBTC's net asset value (NAV) shifted from a premium to a discount. Unfortunately, it has never returned to premium levels since then, and the discounts have continued to deepen.The reason for this situation is largely due to the launch of Bitcoin futures ETF, which has led to intensified market competition.

The Valkyrie Bitcoin Strategic Futures ETF (BTF) launched during the November 2021 bull market and the Purpose Bitcoin exchange-traded fund held in Canada are the two most important competitors of the Grayscale Bitcoin Trust Fund. It often provides lower management fees than Grayscale, causing customers to switch to Bitcoin exchange-traded funds, and the market demand for GBTC has also declined accordingly.The current discount rate of GBTC is in the 48% range, and the previous decline was as low as 50%, setting the largest discount rate on record.

Previously, there was another problem with holding GBTC: GBTC shares would be locked for 6 months, resulting in extremely illiquidity, which means that when the discount rate rises, investors cannot redeem their GBTC shares at all. Additionally, holders of GBTC shares do not own actual Bitcoins, as GBTC is essentially a paper derivative of Bitcoin.

One might ask, is this different than FTX issuing FTT tokens and trying to use leverage to secure the tokens? In fact, FTT and GBTC account for a significant portion of FTX and DCG's balance sheets, respectively. Grayscale offers other similar trusts for alternative crypto assets, such as the Ethereum Trust Grayscale Ethereum Trust (ETHE) is also currently trading at a huge discount. As of January 3, the Grayscale Ethereum Trust NAV The discount rate fell to a record 60%.

secondary title

Genesis and Lending Platforms Create a Ripple Effect

Even more frightening is that several failed crypto companies, including Three Arrows Capital (3AC) and BlockFi, also have significant exposure to GBTC stocks.

During 2021, Three Arrows Capital holds a large number of GBTC shares, close to 40 million shares, worth approximately US$1.3 billion. In addition, "Sister Wood" Cathie Wood's Ark Invest now owns about 1% of the supply, equivalent to 6.5 million shares, and is also the largest shareholder outside of DCG (as shown in the figure below).

Since the previous GBTC premium rose as high as 40%, companies such as Three Arrows Capital and BlockFi began to use leverage to hype the market, and BlockFi began to provide customers with high-yield encrypted lending products. Since Grayscale's lock-up period expires every six months, these companies have also allowed these companies to continue to be profitable, and Genesis is happy to continue to provide loans to companies such as Three Arrows Capital.

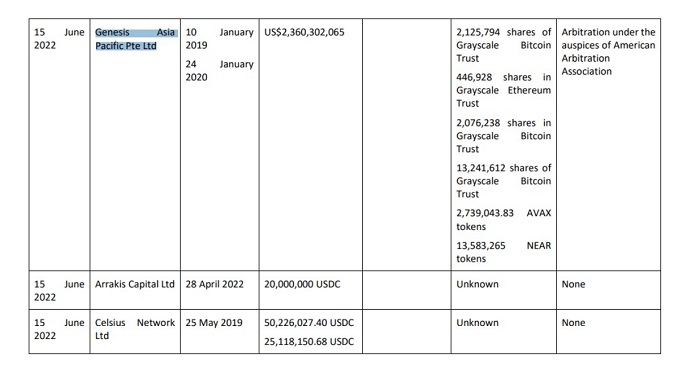

According to the data, the loans provided by Genesis to Three Arrows Capital have been supported by about 17 million shares of Grayscale Bitcoin Trust for several years. Grayscale is a subsidiary of DCG and has 446,000 shares of Grayscale Ethereum Trust, 2 million AVAX and 13 million NEAR.

secondary title

ETFs Can't Save DCG

For some time now, Barry Silbert and DCG have been petitioning the SEC to convert GBTC into an exchange-traded fund (ETF), because ETFs can directly track the underlying product and there will be no premium or discount. At the same time, if GBTC can be converted into ETF, they can redeem assets, and the management fee will be greatly reduced. Not only that, but any investor who buys at a discount after GBTC is converted to a spot ETF will profit as it trades against NAV.ETFs based on Bitcoin spot have been approved in Europe, Canada and Africa, however, while ETFs based on Bitcoin futures have been approved, ETFs are safer, more transparent than closed-end funds and have no premiums or discounts, fees also lower, butSEC Still Refuses to Approve Spot Bitcoin-Based ETF on Investor Protection Reasons

, so far the regulator has rejected applications from Grayscale, NYDIG, Wisdom Tree and others.

Simply put, DCG is struggling as GBTC faces deep discounts and increasing competition from other ETFs.

secondary title

US SEC failed to effectively help investors

We’ve seen GBTC lose its premium, the crypto ecosystem explode after crypto lending platforms crashed, and these funds and lenders had to stretch the risk curve even further to make a profit.

If the U.S. Securities and Exchange Commission approves GBTC’s spot ETF application, a series of market risks can be prevented, leverage may also be eliminated, the GBTC premium will no longer exist, the scale of these companies will not expand, and the crisis will also disappear. won't break out.

Grayscale has been doing everything it can to get an ETF based on bitcoin spot approved, but the SEC rejected Grayscale's application on the grounds that spot bitcoin is vulnerable to market manipulation. The problem is that the CME Group bitcoin futures ETF, which does not track the underlying spot price, is equally vulnerable to manipulation and fraud, yet has regulatory approval.This has undoubtedly led to capital outflows from the US and into other jurisdictions。

secondary title

Where is the encryption industry headed in 2023?

If DCG enters bankruptcy proceedings, the company could be forced to liquidate its assets and see sizeable sales in GBTC and ETHE, which would put considerable selling pressure on spot Bitcoin and Ethereum.

However, according to Ryan Selkis, CEO of blockchain research firm Messari, Grayscale Bitcoin Trust’s controlling shareholders Genesis Global and Digital Currency Group cannot simply “dump” their holdings to raise more funds because according to Section 144A of the U.S. Securities Act of 1933 mandates that issuers of over-the-counter or over-the-counter entities be notified of a proposed sale in advance, with a sales cap or weekly trading volume of only 1% of shares outstanding. "

On December 28, 2022, investment consultant Valkyrie proposed to become the sponsor and manager of a new GBTC fund, and also launched a fund to purchase discounted GBTC.

On January 2, 2023, Cameron Winklevoss published an open letter to DCG CEO Barry Silbert questioning Barry's delaying tactics as Genesis owed $900 million to Gemini Earn users. Additionally, Cameron Winklevoss accused Barry Silbert of using equity trading strategies to personally benefit him. However, the letter does not say whether DCG and Barry Silbert have responded; a likely prevalent scenario is that DCG has already filed for bankruptcy. As rumors continue to circulate, DCG/Genesis is under active investigation by the SEC. Multiple whistleblowers have come forward, sources confirmed.

Barry Silbert promised a solution on January 8th, but that time has now passed.

The current DCG situation is:

Genesis is currently considering bankruptcy;

DCG closes wealth management subsidiary;

DCG owes $2.025 billion;

Genesis Owes Gemini $900M…

secondary title

What can we learn from all this?

Bitcoin is a digital asset with no counterparty risk and, when properly and compliantly self-custodyed, generates no leverage or returns. However, investors have personal responsibility for managing their finances.

But humanity's number one problem is often greed, which, as history has taught us, often leads to fraud, manipulation, and centralization. By escrowing your own bitcoins, you are holding bitcoins, not IOUs or paper derivatives.

As we’ve seen in 2022, there’s dire counterparty risk as money chases yield and chases yield with Bitcoin. The crypto industry should learn from this, due diligence is always crucial.Not your keys, not your coins”。