What is Liquidity Provision?

LP Token (liquidity provision certificate) is the corresponding certificate obtained by the liquidity provider after providing liquidity to the decentralized exchange (DEX) running on the automatic market maker (AMM) agreement. The provided liquidity is generally a combination of two or more assets, and acts as the counterparty of the trader in such a decentralized exchange to obtain transaction fee income from it.

Different decentralized exchanges will have different types of LPs, among which:

The provision of liquidity on DEXs such as Uniswap V2 and Curve requires liquidity providers to provide bilateral tokens for trading pairs, and become buyers and sellers at the same time. In most cases, the value of tokens on both sides is 1: 1

Balancer's liquidity guide pool will need to provide bilateral tokens, but it can be configured in various proportions

The LP of Uniswap V3 determines the composition of LP tokens based on the current price and the upper and lower price ranges laid by liquidity

GMX's GLP is composed of assets of the types and proportions specified in the package agreement, and the proportion of assets is anchored as much as possible through the arbitrage mechanism

LP features:

Passive liquidity - LP is a special kind of Maker, which cannot actively make a quotation, but passively waits for Taker to trade at the current price

Value fluctuation/impermanent loss - LP acts as a fund pool, users directly point to the pool to execute transactions and the assets in the fund pool are exchanged according to the algorithm, and the proportion and quantity of tokens in the fund pool will change accordingly. Compared with simply holding tokens in LP, the assets settled after the liquidity provider withdraws liquidity will have a certain value loss. This loss is called impermanence loss

Comprehensive risk exposure - LP is often composed of a series (more than two) assets, so holding LP is equivalent to holding a series of asset portfolios and need to bear impermanent losses

Web3 is a value exchange network, and transactions are the underlying needs of the network. As a provider and supporter of transaction liquidity, LPs can generally obtain relatively generous fee returns. After Uniswap V3 proposes centralized liquidity, LP’s static fee income can even Reach the level of hundreds of APR.

LP Token is a very good interest-earning asset. Holding LP Token directly can allow investors to have exposure to multiple token combinations at the same time, and due to the existence of impermanent losses, the volatility of LP Token's value will lower. At the same time, because LP can capture direct transaction fee income, as long as the decentralized exchange can operate stably, LP Token can bring continuous benefits to investors. To sum up, many investors directly hold LP as long-term asset allocation.

However, due to the high volatility of LP itself, and investors prefer low-risk income products, combined with the simplicity of GLP itself compared to other LPs, many derivative financial products have emerged in the GMX ecosystem. This article will take four projects in the GMX ecosystem that try to use GLP as the underlying asset to realize on-chain risk-neutral investment products as examples, and explore from the perspective of mechanism principles and on-chain data:

(Dynamic) Composability of DeFi Assets

The hedging schemes are fully realized on the chain and openly operated. At the same time, multiple DeFi projects such as GMX (GLP as the underlying interest-generating asset), Aave, Uniswap, and Mycelium (TracerDAO) are combined

On-chain risk hedging scheme

Technical implementation issues of on-chain derivatives

Hedging options and capital efficiency

Long-term viability of LPs as underlying assets

first level title

Introduction to GMX/GLP

GMX is a spot and futures exchange, and futures trading is essentially leveraged trading in essence. Similar to Uniswap and other AMM-based DEXs, GMX adopts an AMM-like PMM mechanism, uses Chainlink's oracle machine to provide input prices, and uses GLP fund pools as liquidity, allowing traders to achieve up to 50 times leveraged transactions on the platform , with no slippage. Among them, each transaction will set the maximum transaction amount according to the liquidity of the fund pool, and the transaction fee ratio will increase from 0.2% to 0.8% according to the increase in the offset degree of the fund pool ratio and the increase in transaction volume.

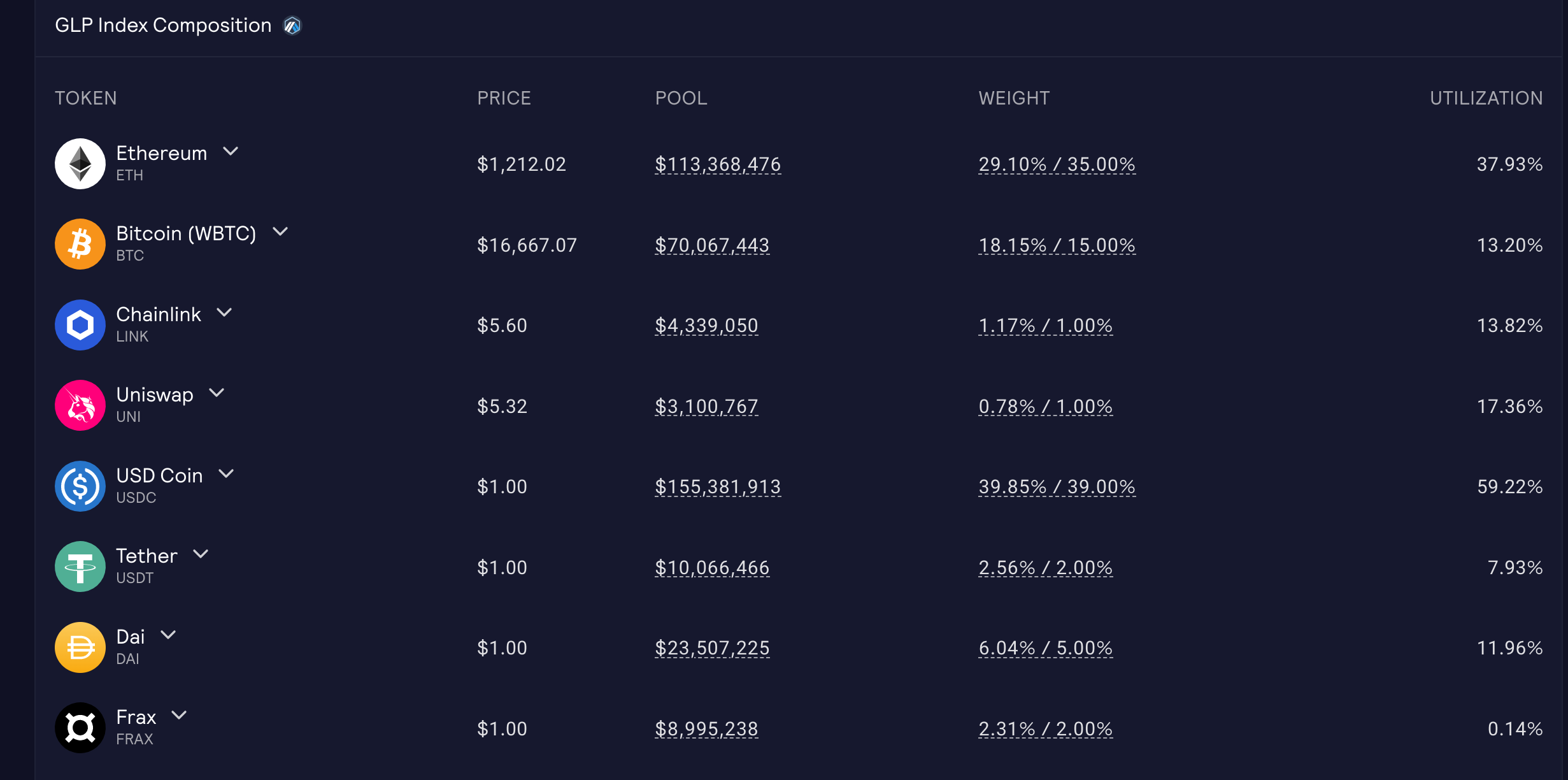

GLP is the liquidity provision token of the platform fund pool. GMX provides liquidity for mutual leverage and spot transactions between multiple currencies on the GMX platform, so GLP is composed of assets supported by a package of agreements, and can be minted and destroyed by any component asset; as the platform continues to have users In transactions with the fund pool, the asset composition of GLP is dynamic. GLP adjusts the asset composition through the handling fees in the casting and destruction process, so as to anchor the set ratio as much as possible and prevent large-scale deviation of the asset ratio of the fund pool. .

image description

Figure: The current composition of GLP on Arbitrum

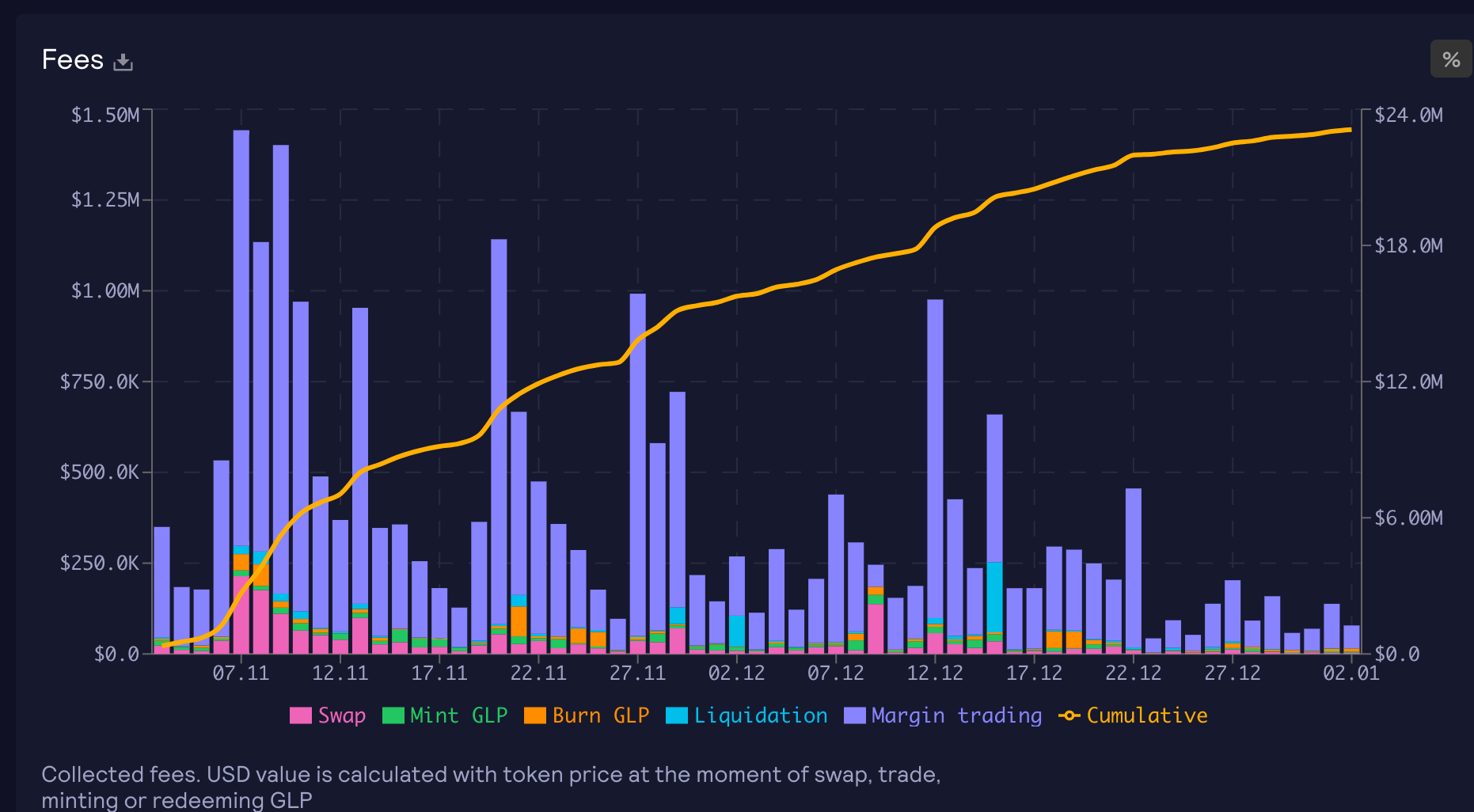

image description

first level title

GLP Hedging Program

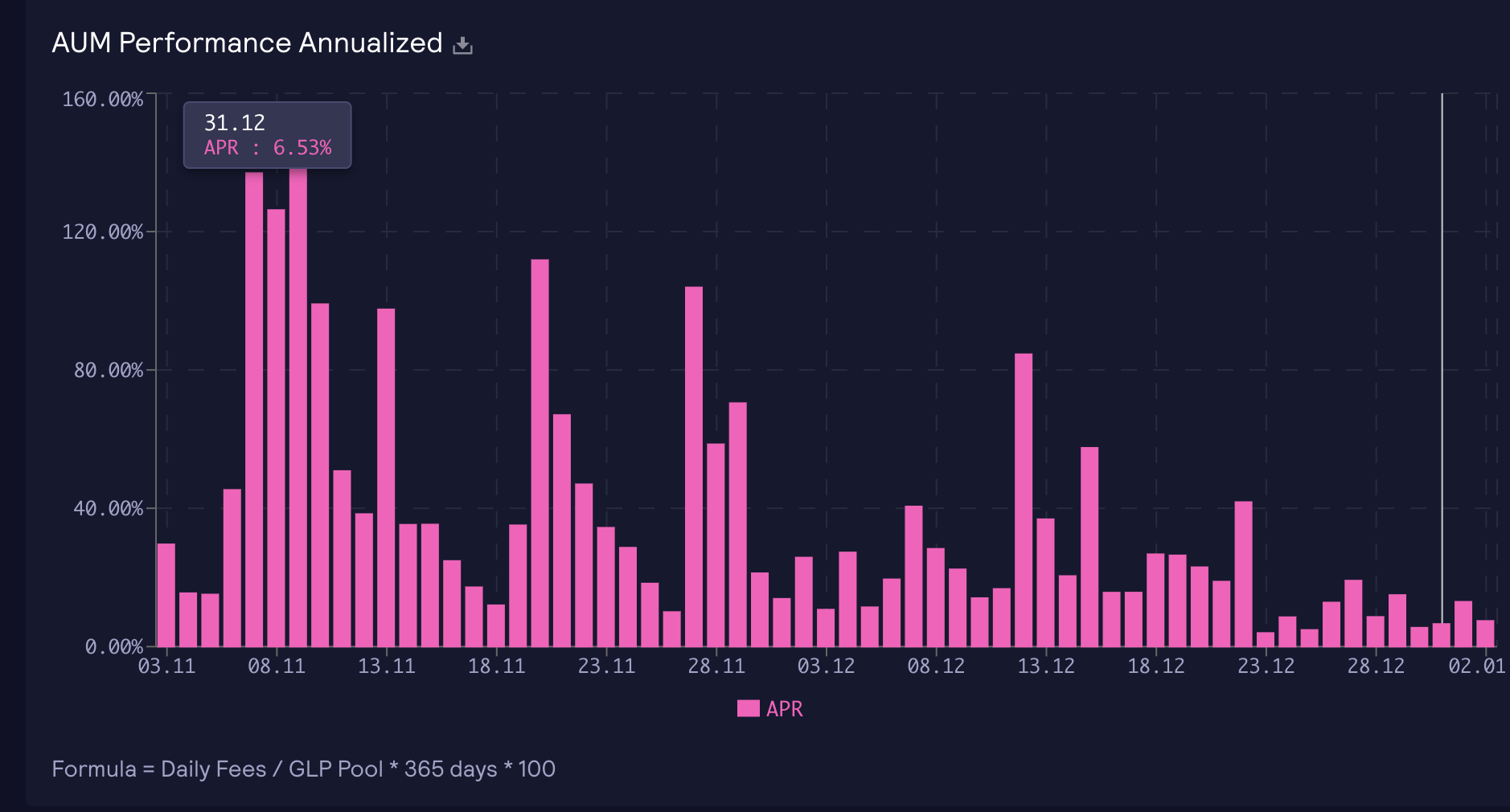

image description

Figure: APR corresponding to GLP daily income

At present, GLP is an excellent interest-earning asset. Since it is composed of a basket of assets, the volatility is relatively low, but it is still an unstable asset, and its value will deviate greatly under extreme unilateral market conditions. Compared with DEX LPs such as Uniswap, GLP will be easier to hedge multi-asset risk exposure due to its fixed composition ratio, and investors will be more interested in Delta-neutral investment portfolios, which can be traded at the lowest possible risk Therefore, many GMX ecological projects try to achieve Delta neutrality through various on-chain asset portfolios, so as to bring USD-based or BTC/ETH-based investment products to users. Among the projects we have observed (some are not yet online):

Rage Trade

GMD Protocol

Umami Finance (the first phase of the product is closed, the second phase of the product is not yet online)

Neutra Finance (not yet online)

first level title

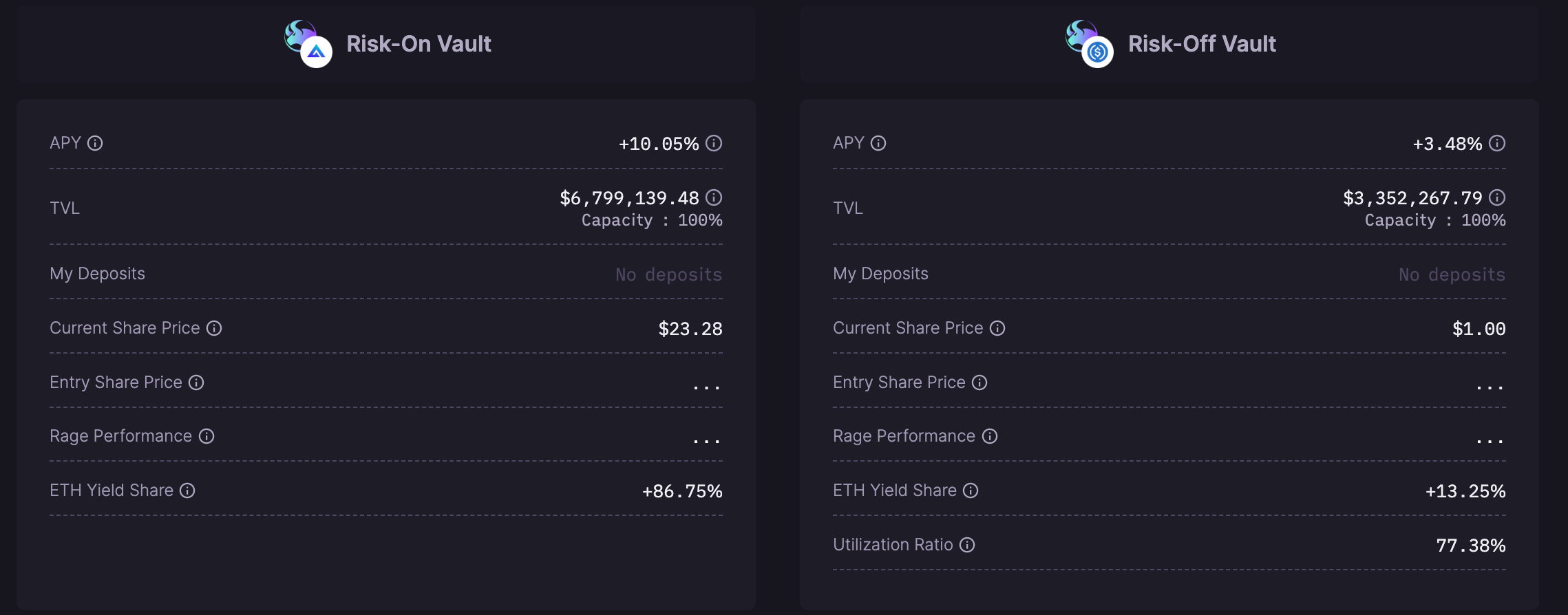

Rage Trade - Delta Neutral Vault

Rage Trade provides a dynamic hedging solution that splits the entire product into two parts: Risk-on vault with high risk preference and Risk-off vault with low risk preference. There is a lending relationship between the two vaults (high risk preference The treasury is the borrower, and the low-risk preference treasury is the lender), forming a Delta neutral strategy as a whole. Users use USDC to invest in two vaults, among which the low-risk preference vault is based on USDC, and the high-risk preference vault uses sGLP as the share. There will be certain value fluctuations, but the goal of the vault design is to achieve Delta neutrality in the long run.

The high-risk preference vault quickly lends BTC and ETH from Balancer, converts it to USDC on Uniswap, and then borrows USDC from the additional low-risk preference pool, mortgages USDC on Aave, lends ETH/BTC and returns the flash loan, so that the treasury can hold ETH/BTC The short position of the GLP hedges the price risk of ETH and BTC in GLP, and the amount of hedging is based on the target ratio set by GLP. The vault will maintain a health factor of 1.5 on Aave (borrow 2/3). High risk appetite vaults charge 86.6% of GLP fees as income.

Vaults with low risk appetite will borrow funds to Aave to collect income. At the same time, because they provide USDC for hedging for high risk appetite vaults, they will charge 13.4% of the GLP income as their own treasury income.

Every 12 hours, the treasury will automatically settle the income, update its hedging position according to the price change, and compound the interest after withdrawing the income from the GLP procedure. On the whole, the APY of high-risk appetite vaults is as high as 10.05%, and the APY of low-risk appetite vaults reaches 3.48%.

first level title

Umami Finance

Umami Finance previously launched USDC Vault, a scheme based on Mycelium leveraged tokens to hedge GLP risk asset positions.

Mycelium builds a long-short bilateral fund pool, uses leveraged tokens to represent the share of the fund pool, and triggers the contract every 8 hours to transfer the funds of the two pools according to the real-time price. When the price rises, the funds are transferred from the short-side fund pool to the multi-party fund pool. vice versa. In theory, holding leveraged tokens is equivalent to holding a corresponding proportion of perpetual leverage. However, the transfer of funds in this mechanism is realized through external robot arbitrage, and the spillover of funds and the adjustment curve can only be approximated.

Umami uses Mycelium's ETH/BTC leveraged tokens to hedge the ETH and BTC positions in GLP, so it cannot accurately help Umami's Vault to achieve hedging when the market fluctuates violently.

However, because Mycelium leveraged tokens could not be accurately hedged, and eventually irreparable losses occurred on the hedging side under severe market fluctuations, the team finally decided to close the strategy and turn to research on other strategies.

first level title

GMD protocol

The main idea of GMD is to split GLP into single currency for sale, which is suitable for impermanent loss-averse users to invest in BTC, ETH and USDC in single currency. The GMD platform will collect part of the income as a reserve to absorb the risk of fluctuations in the proportion of GLP assets and generate losses in the treasury Compensation will be given when the time comes, and the agreement will adjust the ratio once a week, including:

The pool entry fee rate, higher rates are charged for pools with high demand

APY, adjusted weekly for GLP performance

The upper limit of the three capital pools

Overall, a pseudo-Delta neutral strategy is formed. At the same time, the platform will take part of the GLP revenue as its own platform income to reward token holders.

After purchasing and investing in the fund pool, users will get corresponding gmd tokens, such as gmdBTC, to represent the share of the fund pool. The ratio of gmdBTC to WBTC will increase with the accumulation of GLP income, but the ratio is relatively stable. Users can provide liquidity on Uniswap V3 to earn additional income, and also allow other users to purchase shares in the secondary market through transactions after the fund pool reaches the upper limit.

At present, the three vaults of the GMD platform have all reached the upper limit of scale. Obviously, this product is very attractive to users. The current data are:

Pseudo - delta - neutral protocol $GLP

GLP TVL: 2.67 M

BTC 27 $ 455, 866.62

Current GMD proportion: 14.98%

Current GLP ratio: 18.13%

GMX Target Rate: 15%

Current APY: 10%

USDC $ 1, 500, 482.09

Current GMD ratio: 58.30%

Current GLP ratio: 39.86%

GMX Target Rate: 39%

Current APY: 9%

ETH 650 $ 980, 470.98

Current GMD proportion: 26.63%

Current GLP proportion: 29.12%

GMX Target Rate: 35.00%

first level title

Neutra Finance

Neutra Finance, after five months of testing, users invest in stable coins, and the platform can stably achieve an annualized return of about 10%. The core of the solution adopted by Neutra Finance is off-chain strategy and on-chain operation. It adopts the tolerance band-volatility model (Tolerance Band -Volatility Model). When users invest in USDC, part of it will be converted into GLP to generate income, and part of the funds will be held on GMX Open BTC/ETH short orders for hedging, using 5.5 - 6 times leverage.

Unlike other platforms that use fixed-time hedging solutions, Neutra Finance will measure the volatility of half of the risk asset exposure in GLP, as shown in the strategy name "tolerance zone", only when the predicted price fluctuations calculated based on historical prices Only when the offset between the ratio of the interest rate and the GLP asset ratio reaches a certain value will the adjustment of the hedging end be triggered, and the cost of hedging in this way will be lower. According to the current testing situation, the product is running well. The strategy will be launched in Q1 of 2023. Considering the fund operating costs and expenses, the overall APR will be slightly lower than 10%.

Summarize

Summarize

LP tokens are very high-quality on-chain assets that provide liquidity for traders in the web3 trading network and provide fee income for LP investors. Compared with GMX's GLP with 317 M TVL, among the GLP-based products currently on the line, Rage Trade and GMD Protocol only hold 10 M and 3 M GLP respectively, accounting for only 3% of the total GLP. Most of the GLP is still "Naked holding", the holder bears the risk exposure.

Some of the main reasons are:

Insufficiency of on-chain hedging tools

In the current hedging plan, GMD adopts splitting and uses part of the GLP income as a reserve to avoid excessive impermanent losses. In fact, it loses investors' income to balance risks and achieve "pseudo-Delta neutrality".

Rage Trade uses Aave, but the leverage ratio that Aave can achieve is low, which actually sacrifices the efficiency of capital use. In the end, Rage Trade chose to split the overall plan into two pools of high and low risk funds.

Other unlaunched plans consider directly opening positions on GMX for hedging. In fact, GMX, as a perpetual contract platform, is not suitable for long-term holding positions. The annual cost of directly holding positions is about 20%, and there will be additional handling fees for opening positions. Each time the agreement balances the assets on the hedging side, it brings additional costs.

If there are more hedging tools on the chain, such as options and other assets suitable for long-term holding, LP-based hedging products will be more abundant.

Considering risk control and liquidity reasons, the amount of each treasury in the early days was very limited

Since the first GLP-based Umami USDC Vault came out, the GLP-based product was only five months old, and the USDC Vault was shut down shortly after it was operational. The multiple factors that make up the volatility of GLP make hedging relatively complicated, and various strategies still need enough time to run and test before they can scale up.

Instability of GMX itself

As a project that has been active on Arbitrum for just one year, GMX still has many risk factors. These include: the single-point manipulation of the oracle, only the project party has the authority to write the price, compared with other parts of the product, the price factor is very centralized; for the design of GLP, there have also been many improvements, including the GLP routing Improvement, resulting in a vault migration by GMD Protocol.

In addition, GMX itself has a natural threshold due to the use of oracle machines as price inputs. PMM LP similar to GMX/GLP uses an external oracle machine to introduce prices, which can achieve higher LP usage efficiency, but in fact, "second-hand prices" cannot realize price discovery, and even use the same PMM mechanism due to the lag of the price feeding mechanism The Dodo’s most traded pairs on Ethereum are stablecoin pairs.

The innovative design of GMX allows GLP to have sufficient capital utilization efficiency, and at the same time, by setting the target ratio and arbitrage mechanism, the LP structure is simple and easy to achieve hedging. But there are also flaws: price discovery is not possible and the execution price is poor (the "second-hand" price provided by the Chainlink oracle), which also sets a ceiling for its future transaction size.

In addition, on-chain transactions are also prone to unfair information arbitrage by linking traders and network nodes to obtain information in advance. Compared with Lp, which is a passive liquidity provider, it provides benefits to traders with information advantages. The Toxic Flow mentioned by few DeFi researchers will reduce the credit rating of the market in the long run. Whether it is an AMM or a traditional financial exchange, the trader (Taker) has an information advantage over the liquidity provider (Maker), and each transaction is made because of the information obtained and the prediction of the future. This is even more prominent in the AMM mechanism since LP is lazy liquidity.

But on the whole, LP is still the high-quality assets native to the chain at present. It is the most likely to drive the demand for derivatives on the chain and build a stable income product that is more recognized by the mass market. At present, due to its relative stability, GMX's GLP has derived an ecology of LP-based financial derivatives on the chain faster than Uniswap and other AMM DEX LPs. In addition to the problems of GMX itself that need to be solved, how to better realize on-chain hedging requires more products and attempts of derivatives/short-selling tools. It is not technology that solves the problem, but a complete set of solutions. iZUMi is also actively exploring LP financial derivatives and looks forward to trying more financial products on the chain.