This article was written in Tokyo on December 31, 2022 by PlatON CTO James QU

2022 is a year of ups and downs for the cryptocurrency industry. As this year is coming to an end, I would like to talk about Japanese stablecoins. I wish the cryptocurrency industry a stable and healthy development in the coming year! I wish you all a Happy New Year!

We are in the midst of a huge transformation from Web2.0 to Web3.0. The real world has established a sound legal framework for Web2.0, but it is not yet ready for the arrival of Web3.0. When carrying out actual business based on Web3.0, business operators often feel powerless with regulatory issues, for example, due to lack of legal support, they cannot finalize their business model and reach a deal. Today, the integration of Web2.0 and Web3.0 has become the only way for organic growth, which means that enterprises should not only rely on Web2.0 platforms and tools to ensure compliance, but also introduce Web3.0-based business models to reduce costs ( Faster and cheaper billing methods).

In general, the Web2.0 platform mentioned in this article refers to the current regulatory system covering licensing system, customer identification system (KYC), anti-money laundering (AML), investor protection, regulatory reporting and legal documents, etc. These are the statutory requirements that companies must follow to complete any actual transaction under the current regulatory framework.

Throughout Japan, the country is gradually strengthening the construction of Web3.0 infrastructure:

Introduce regulations to define a compliant crypto-token as a financial product that can be traded through a regulated (licensed) financial transaction service provider that determines the value of each token fair value of

Legalize the trading of security tokens (STOs) backed by real assets

Issue regional functional tokens, stable coins, asset tokens

Open to the global stablecoin market in 2023

Amendments to institutional tax policy for start-up STOs (ICOs) to foster innovation in crypto

Overall, Japan’s legal framework for cryptocurrencies is mature and is constantly being adjusted to advances in crypto technology.

What I want to share with you today is my post-reading experience on Progmat, a stablecoin platform. This platform is a typical example of the integration of Web2.0 and Web3.0.

Stablecoins (SC) are divided into different types according to the form of the chain (consortium chain/public chain), issuance method (whether licensed, or based on actual assets, or based on algorithms), etc. Some examples are as follows:

Based on the public chain, issued by the central bank

Based on the alliance chain, issued by the central bank

Based on the public chain, issued by licensed institutions

An algorithm-based, non-licensed institution-based stablecoin based on a public chain

A stablecoin based on the alliance chain, based on real assets, and licensed institutions

Elements of Security Tokens (ST)

Clarify the definition of assets and confirm that there is asset support;

Reflect existing assets or interests;

Have perfect asset governance (private key management);

There are feasible and verifiable transaction mechanisms and settlement mechanisms

The following is a discussion on the stable currency platform Progmat as an example.

Progmat is an infrastructure utilizing distributed ledger technology (DLT) that aims to advance market transformation and new market creation, digitally transform the value chain of financial transactions, and create new markets. DCC, the Digital Asset Co-Creation Alliance, is led by MUFG and has more than 134 members (as of the end of September 2022). Its purpose is to innovate the cross-industry digital asset ecosystem on the Progmat platform.

Progmat has achieved the following expansions and innovations:

Platform Expansion: Seamless collaboration between organizations enables execution automation and reconciliation-free, and "investment x utilization" integration of Security Tokens (ST) and Utility Tokens (UT).

Expansion of market and settlement functions: through digital securities pass-through securities (PTS), stable coins (SC) / digital currencies and decentralized exchanges (DEX), improve liquidity, reduce settlement risks and intermediary costs.

By removing existing physical barriers and expanding the new investor base, leverage the above advantages to create an unprecedented product market and diversify investment in security tokens (ST).

Participants and related financial instruments:

Investors, Trustees, Agents, Beneficiaries.

Financial Institutions. Such as PTS exchanges and other financial service providers; custodians; asset management companies.

The Progmat platform that supports program currency runs the alliance chain.

Central bank digital currency issued by the central bank.

Issuers of stablecoins, issuers of utility tokens as part of the financial infrastructure.

Security token issuers, etc. Institutions that provide financial products.

Current Regulatory Framework:

Financial Instruments and Exchange Act

Payment Services Act Enforcement Order

"Foreign Exchange and Foreign Trade Law"

Prevention of the Transfer of Proceeds of Crime Act

Note:Name of laws and regulations of the Financial Services Agency of Japan

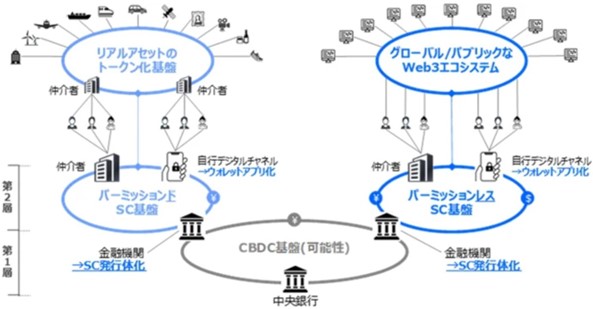

two-tier architecture

Business Process

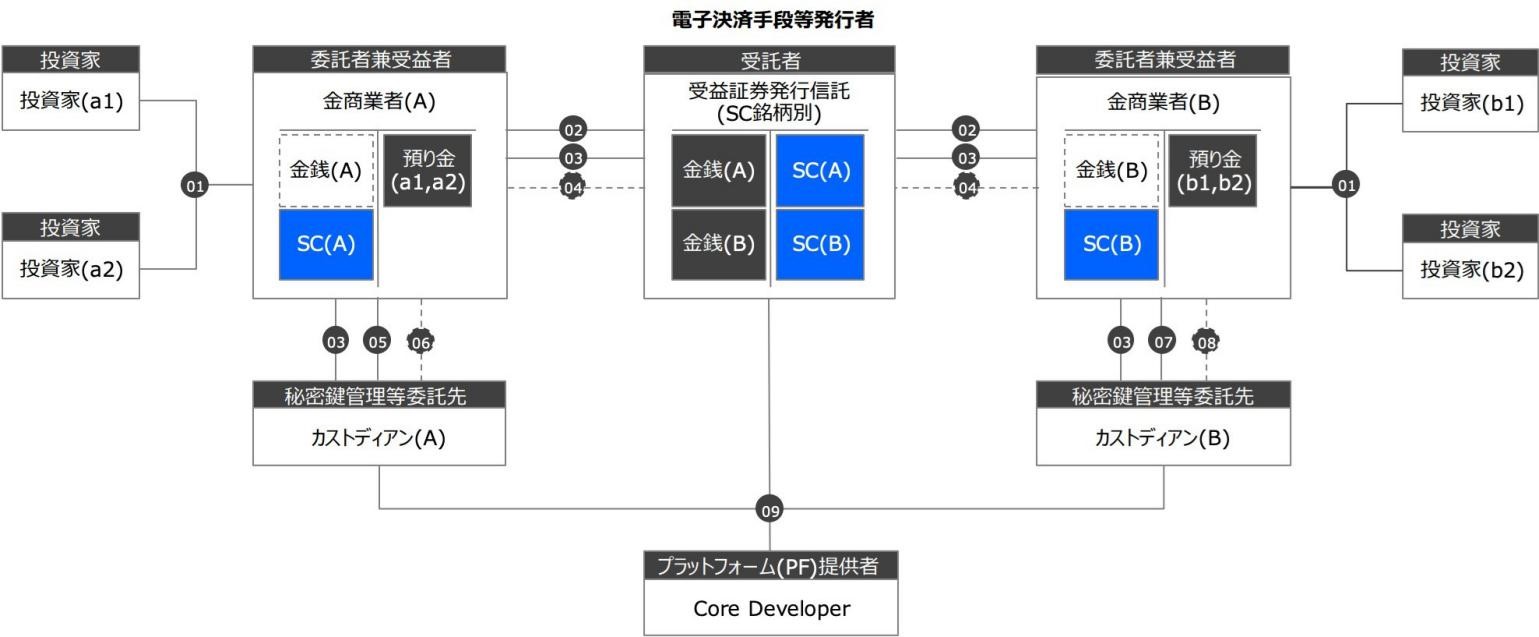

Stablecoin Issuer Flowchart

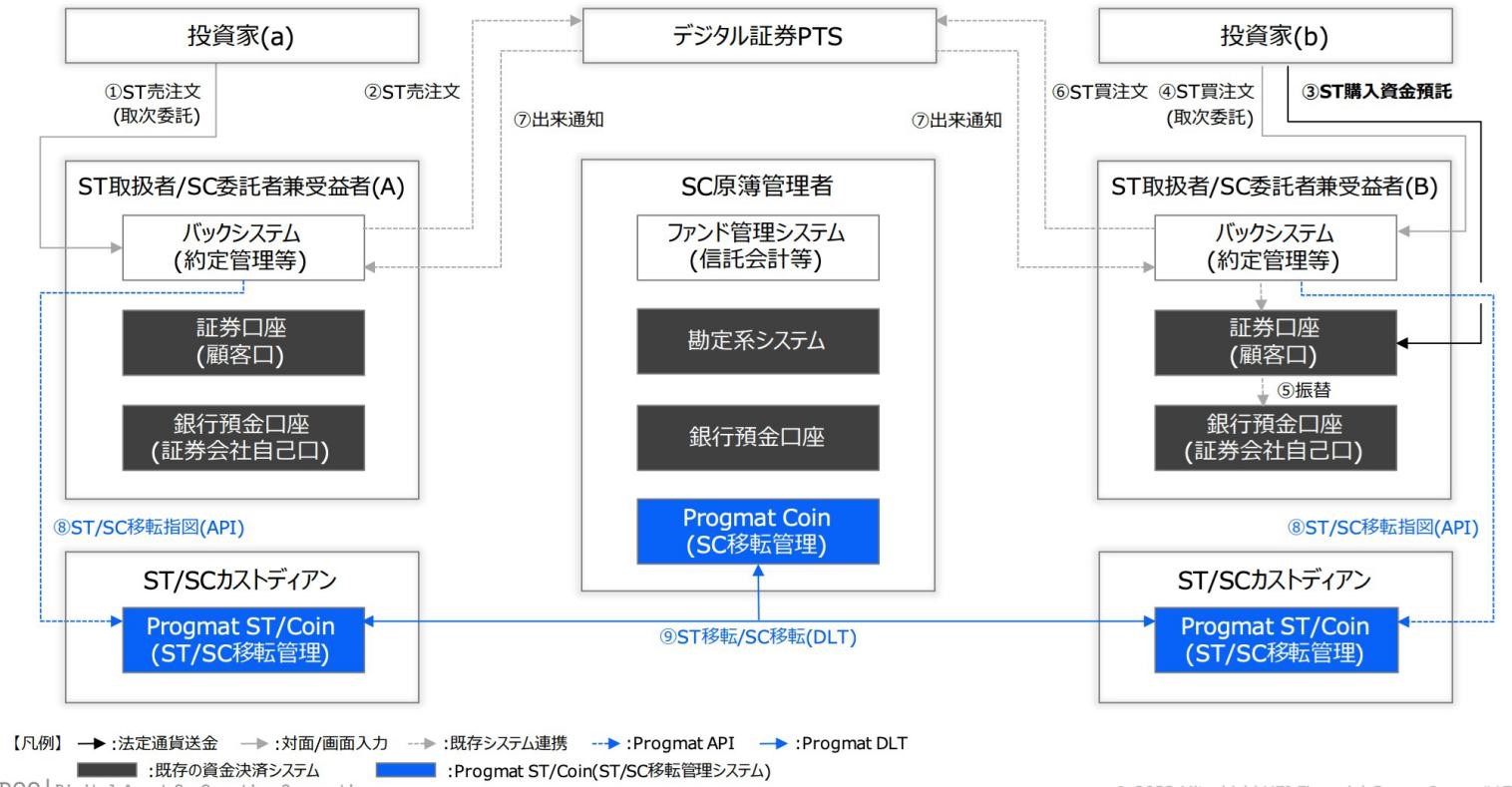

Common Security Token Transaction Flowchart

There are many examples, so I won't list them one by one.

Regarding the common problems of cross-chain transactions, Progmat solves them as follows:

Cross-chain connection and authentication: After verifying the trusted third party (TTP), hash time-locked contract (HTLC), and relay, the Progmat platform will use the relay mode as the main cross-chain transaction mode;

Cross-chain architect: use the IBC protocol-based TEE proxy to execute on Corda;

Complete the cross-chain transaction test between Quorum and Corda.

From the perspective of the development of the Progmat platform, only regulated institutions can become stable currency issuers and service providers; investor protection and personal information protection are still the top priorities; stable currency transactions must have asset reserves, that is, A Web2.0-style proof of asset reserve.