1. Summary of Industry Dynamics

secondary title

industry data

1) Public Chain & TVL

industry data

1) Public Chain & TVL

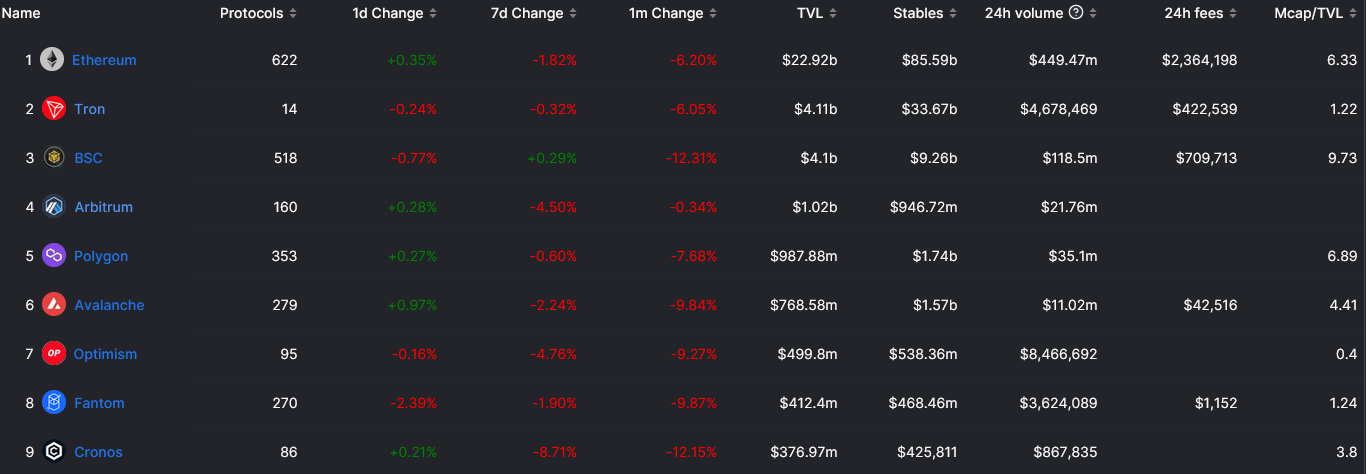

The TVL of each public chain has declined to varying degrees this week, and Cronos has a larger decline, and its ranking is surpassed by Fantom.

2) Stablecoins

This week, the Fantom Foundation announced that it will use foundation funds (FTM) to repurchase ecological tokens on the chain, including DeFi applications such as BOO and BEETS. After Andre Cronje returned, Fantom began to take action, announcing that in 2023 it will focus on creating a sustainable environment for DApp developers, including Gas subsidies, new middleware, optimized throughput, and financial support for developer training teams. Cronos’ decline was largely driven by a drop in stablecoin deposits on its main on-chain lending protocol, Tectonic.

2) Stablecoins

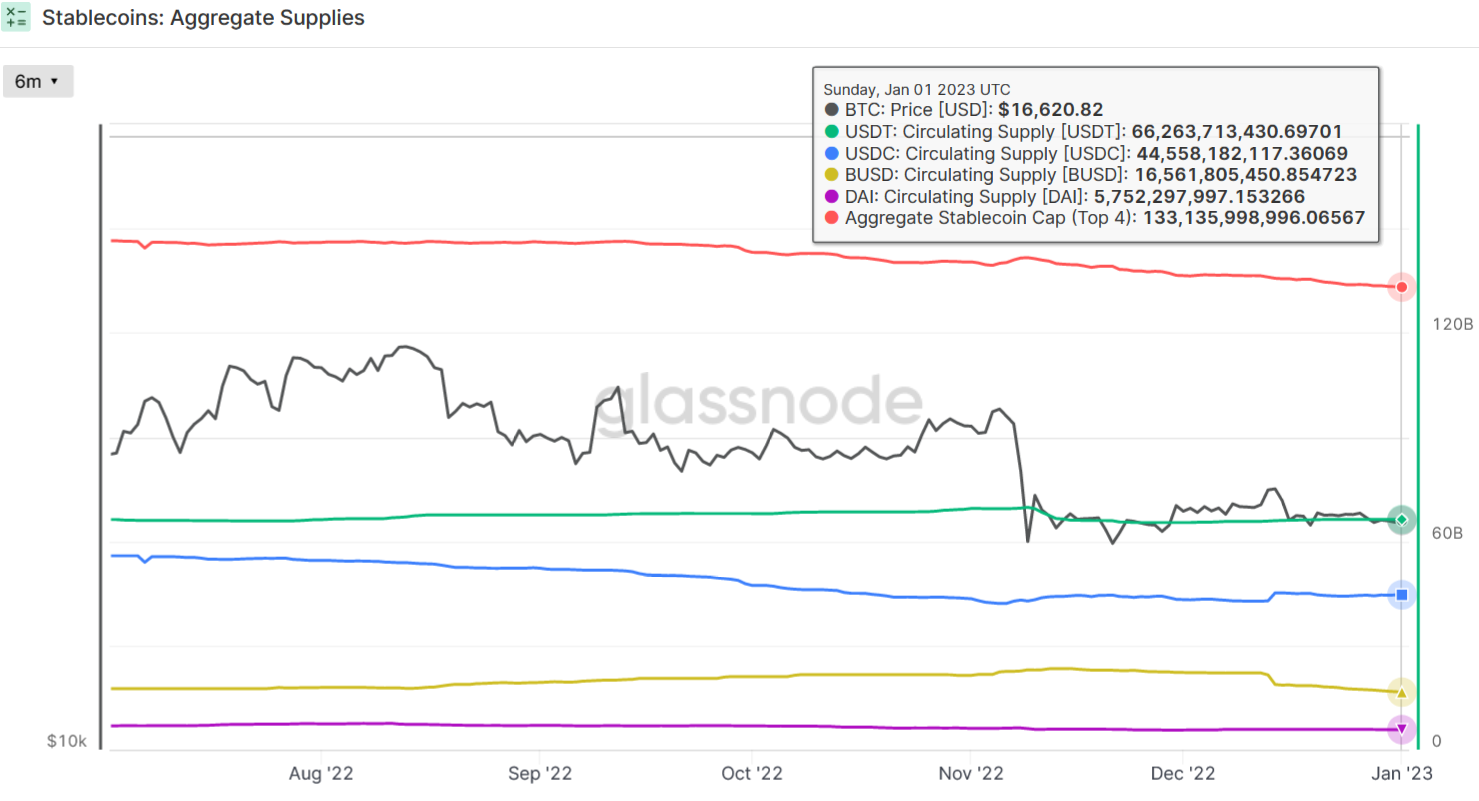

As of January 1, 2023, the total supply of the top four stablecoins (USDT, USDC, BUSD, DAI) is about 133.135 billion, which is another decrease of about 695 million (-0.52%) from 133.831 billion a week ago. The supply of stablecoins has fallen for seven consecutive weeks, and the funds are showing a continuous outflow trend, and the willingness to enter the market is not high.

Among the three major legal currency stablecoins this week, the supply of USDT has not changed much this week, with a slight increase of about 16 million pieces, which is relatively stable; USDC’s decline has slowed down, and this week’s supply has increased by about 392 million (+ 0.89%); while BUSD The downward trend has not improved, and this week there has been a sharp decrease of about 1 billion (-5.72%). The supply of USDC and BUSD once again appeared to ebb and flow. It is speculated that the funds exchanged BUSD for USDC for fiat currency withdrawal. From this point of view, the situation of declining supply of stablecoins and continuous outflow of funds is unlikely to improve in the short term.

DAI, as an ETH leverage, returned to decline this week after a short-term upward momentum, with a supply reduction of about 100 million pieces (-1.71%). The long-term funds in the market took profit and exited after a small rebound, and the market is unlikely to improve.

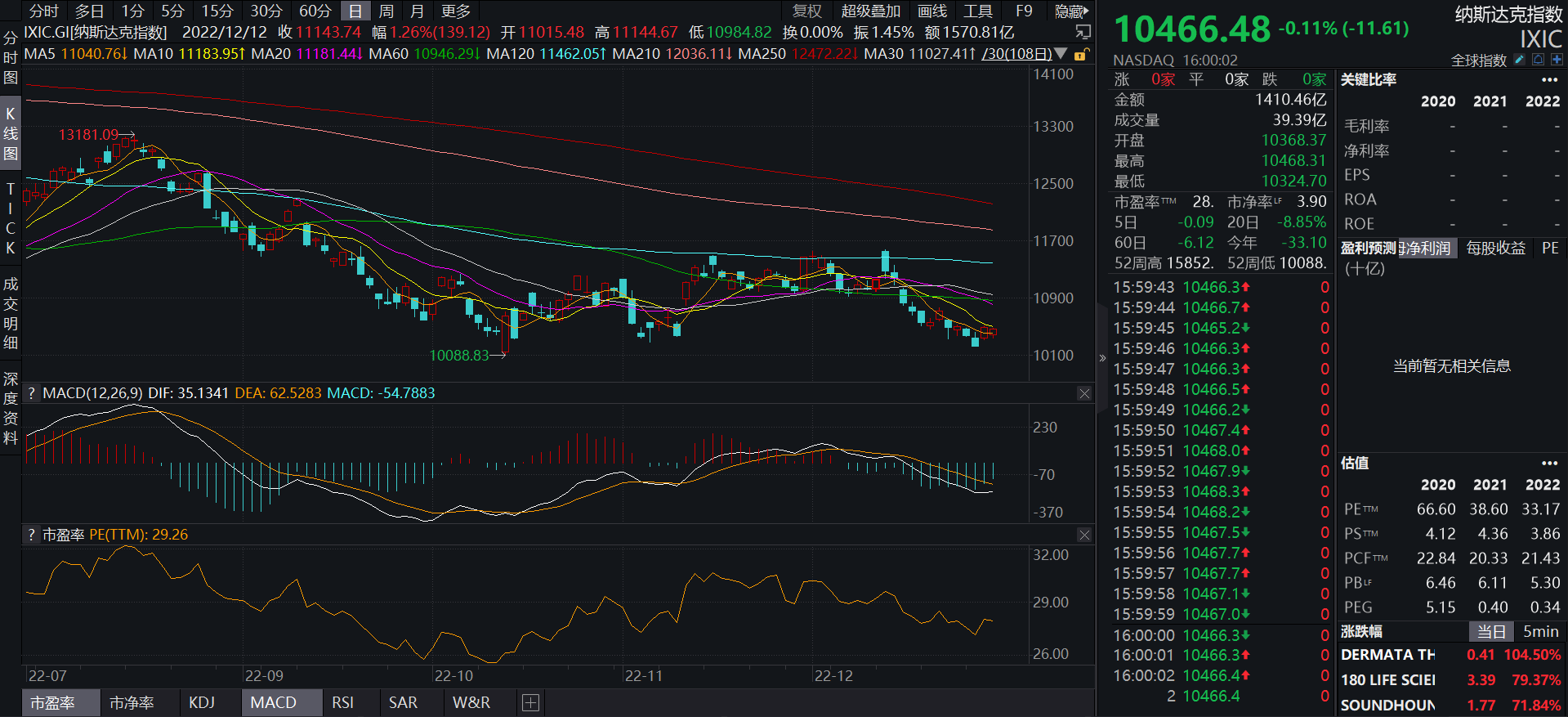

On the other hand, the U.S. stock market last week was in line with expectations in the four days. There was no disturbance in terms of trading volume or volatility. At the same time, the three major indexes also maintained their lows for the year and did not hit new lows. The Nasdaq index reached 10207, the same The year's low of 10088 is still a certain distance away. For U.S. stocks, 2022 will be a once-in-a-lifetime bear market in 30 years. The Nasdaq will drop by 26.69% in 2022, which is the largest drop in history in both percentage and absolute value. In fact, the probability of two consecutive declines in the 100-year history of the market is very small. The only time in the past 30 years is that the index fell for three consecutive years from 2000 to 2002. This is the stock market after the burst of the Internet bubble that we know. Although it is less likely that there will be another annual crash in 2023, the bull market in the U.S. stock market in the past 10 years has accumulated enough profit margins for the market, which is also the energy of high-level smashing, so there may still be some in 2023. Pessimistic forecasters take profits and leave the market. The ups and downs of the stock market are cyclical. We judge that the first half of the year will be a time window for changes. The Fed is very likely to stop raising interest rates after raising interest rates twice in the first half of 2023 , Control the federal base interest rate at 5% - 5.25%. When Powell starts to stop raising interest rates to the market, the U.S. stock market will be at the bottom, and there is no need to wait until the real start of stopping raising interest rates.

2. Macro and technical analysis

first level title

2. Macro and technical analysis

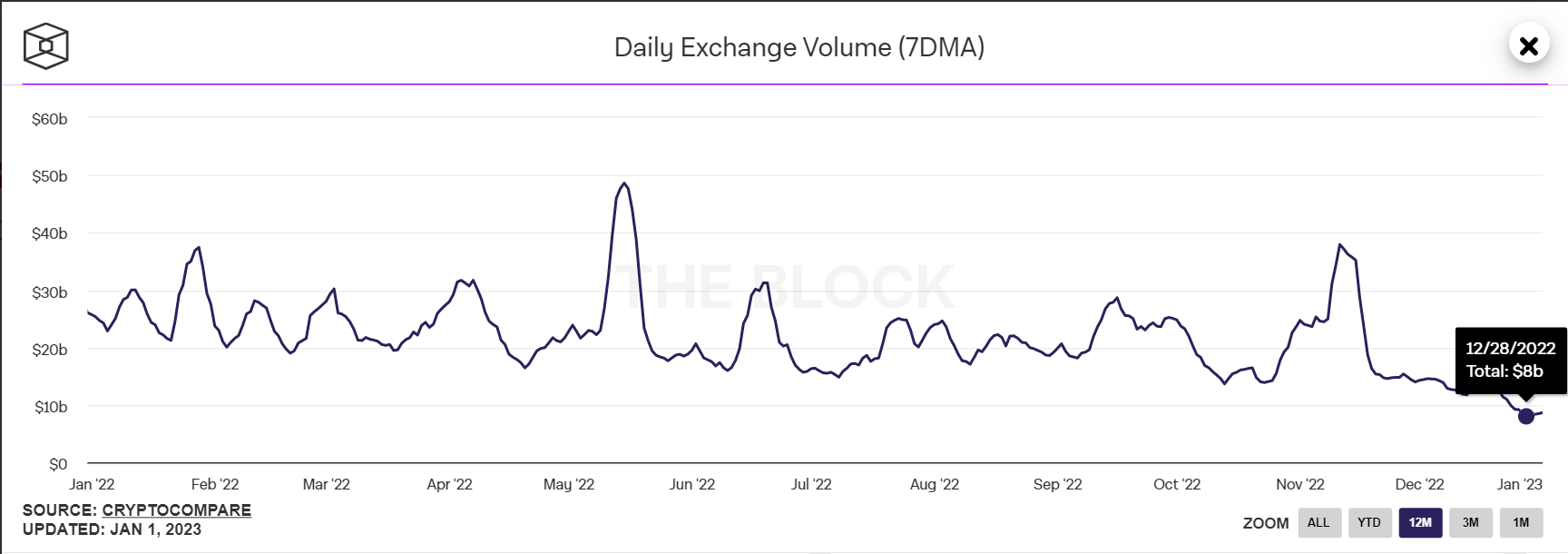

The overall trading situation is subject to the trading volume, which is basically in a sideways state, and the overall trading volume is gradually decreasing.

Nasdaq is in a rebound mode, but it will probably touch the previous low in the future

Two-Year Treasuries Change to 4.43

Two-Year Treasuries Change to 4.43

Nasdaq is in a rebound mode, but it will probably touch the previous low in the future

1. Ahr 999: 0.31, you can make fixed investment

1. Ahr 999: 0.31, you can make fixed investment

3. Summary of investment and financing

3. Summary of investment and financing

Investment and financing review

secondary title

Investment and financing review

Affected by the Christmas and New Year holidays, during the reporting period, 8 investment and financing events were disclosed, with a cumulative financing amount of approximately US$88.32 million;

secondary title

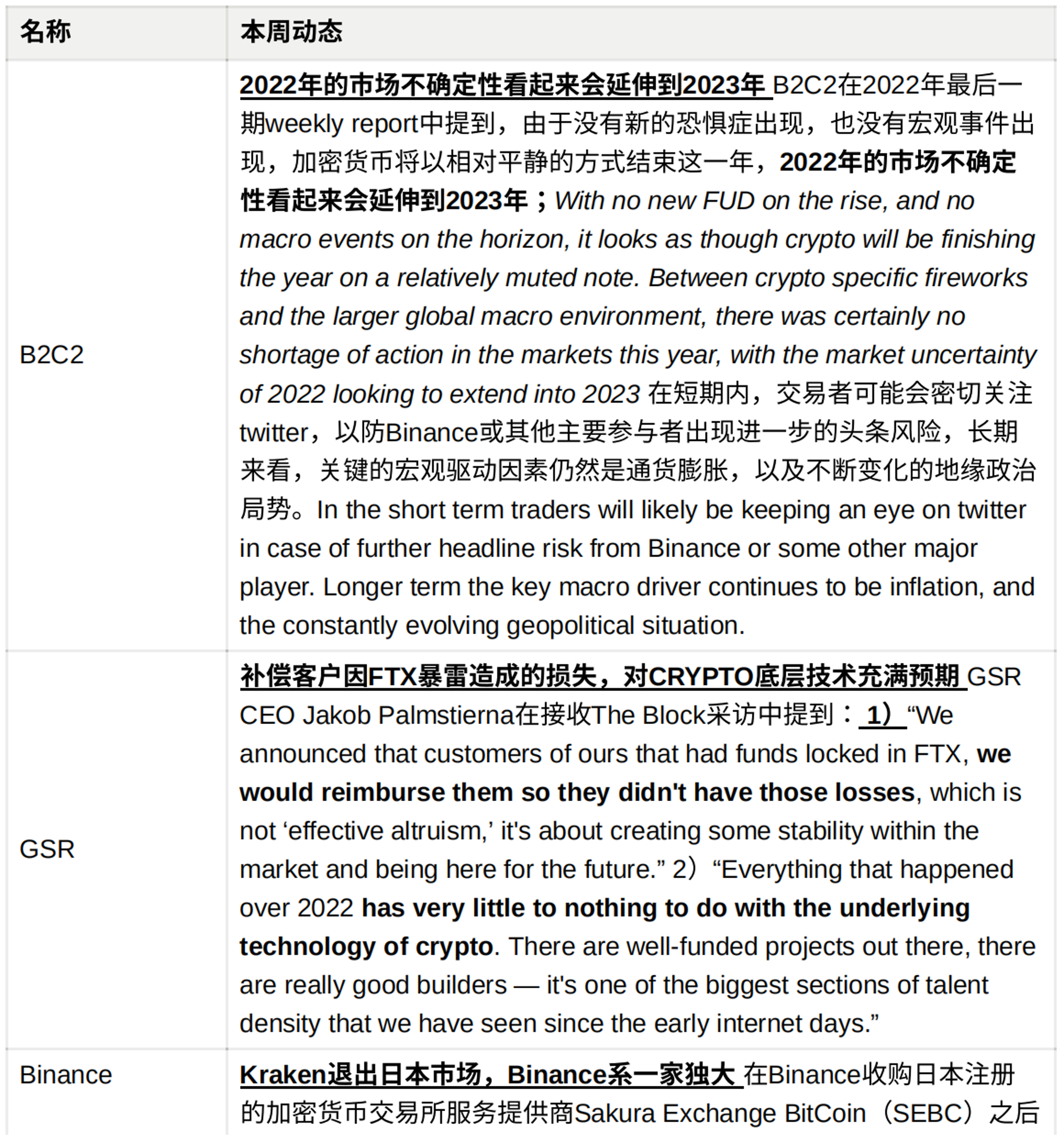

Institutional dynamics

4. Encrypted ecological tracking

1. NFTs & Metaverse

(1) NFT market this week

1. NFTs & Metaverse

(1) NFT market this week

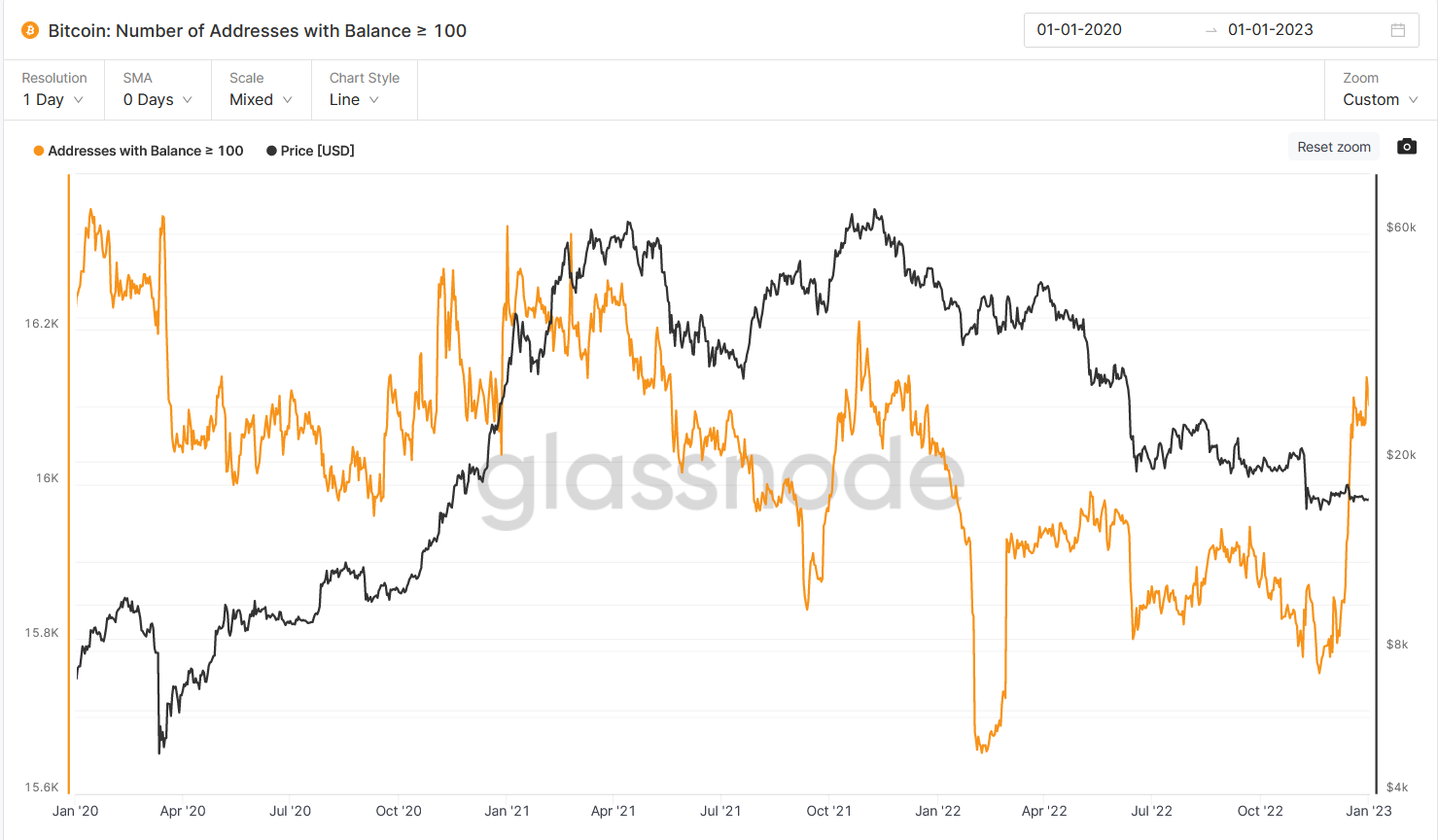

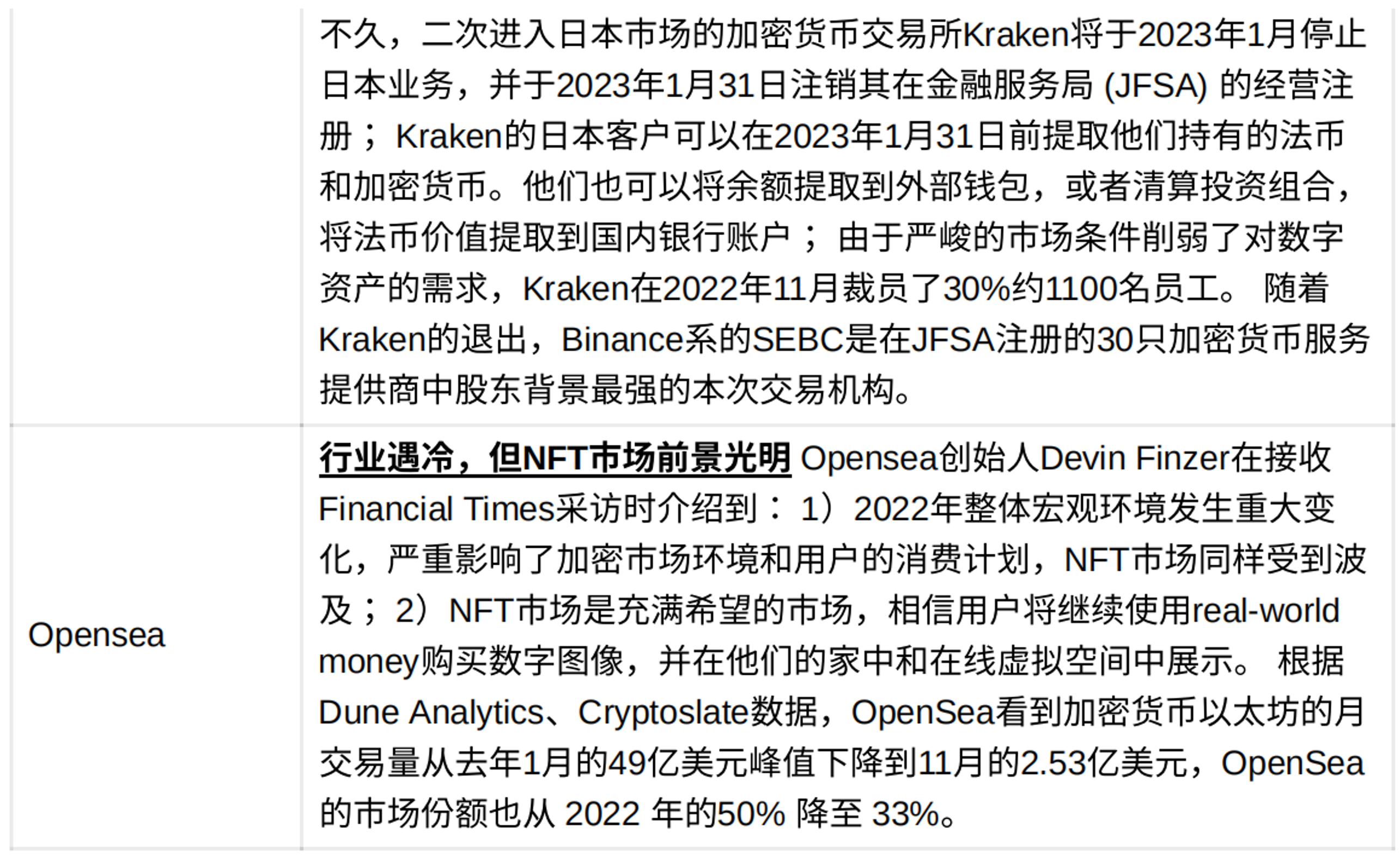

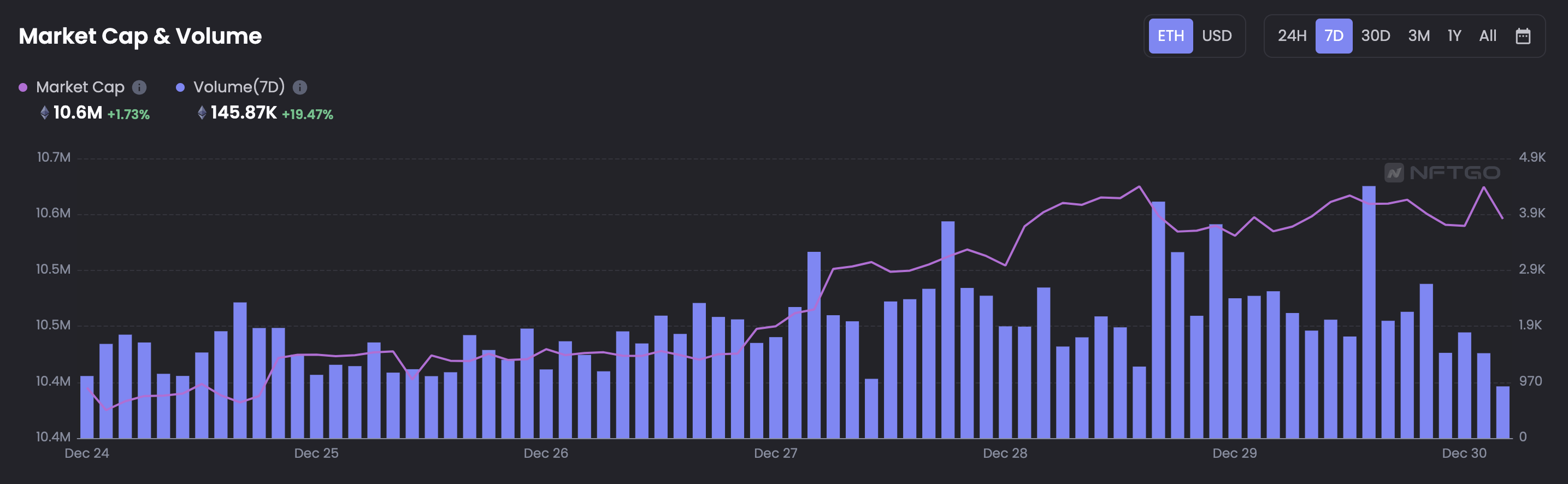

Market overview: This week, the NFT blue chip index has risen to a certain extent compared to last week. As of December 30, the nft blue chip index has risen significantly after Christmas, and the market as a whole continues to pick up. Looking back at the overall trend of the blue-chip index in 2022, the market has been declining since April this year, and reached its lowest point in November. However, overall, the market has not shown much signs of rebounding, and it will take some time for the market to recover.

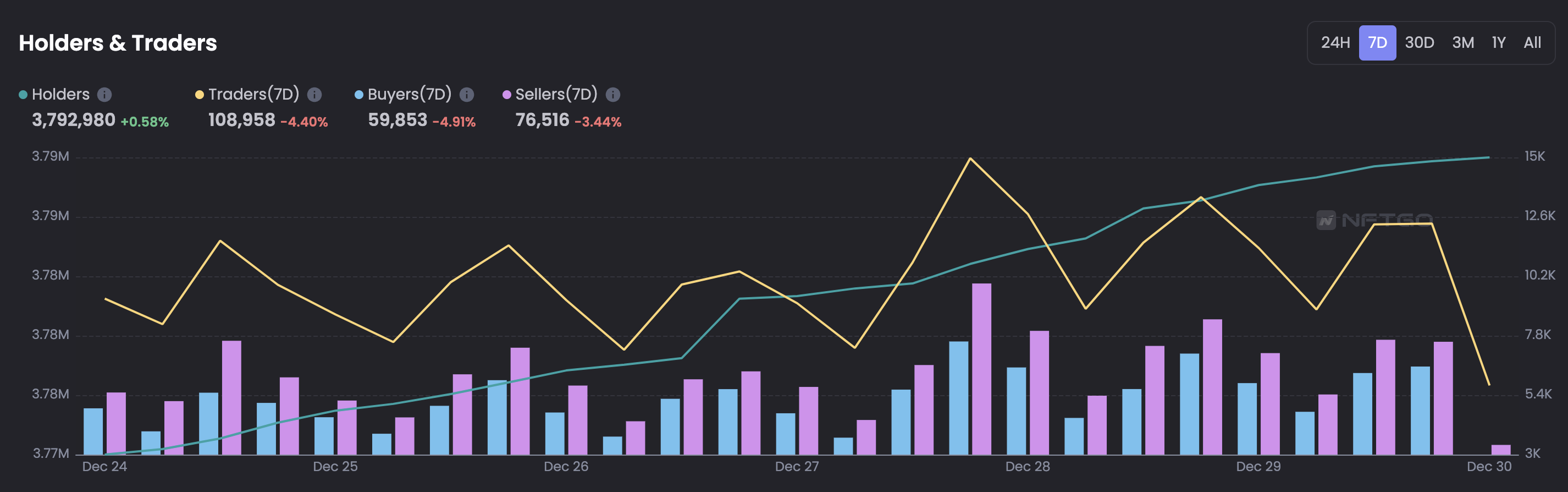

Market activity: The holders of the NFT market have not changed much this week, the activity of traders has decreased compared to last week (-4.4%), buyers have decreased by 4.91% compared to last week, and sellers have decreased by 3.44% year-on-year.

Market activity: The holders of the NFT market have not changed much this week, the activity of traders has decreased compared to last week (-4.4%), buyers have decreased by 4.91% compared to last week, and sellers have decreased by 3.44% year-on-year.

This week's Metaverse project overview:

This week's Metaverse project overview:

The top three NFTs in terms of trading volume in the NFT market this week are MAYC, BAYC, and Otherdeed. The floor price of BAYC has rebounded to 73 ETH in the last week.

This week's Metaverse project overview:

This week's Metaverse project overview:

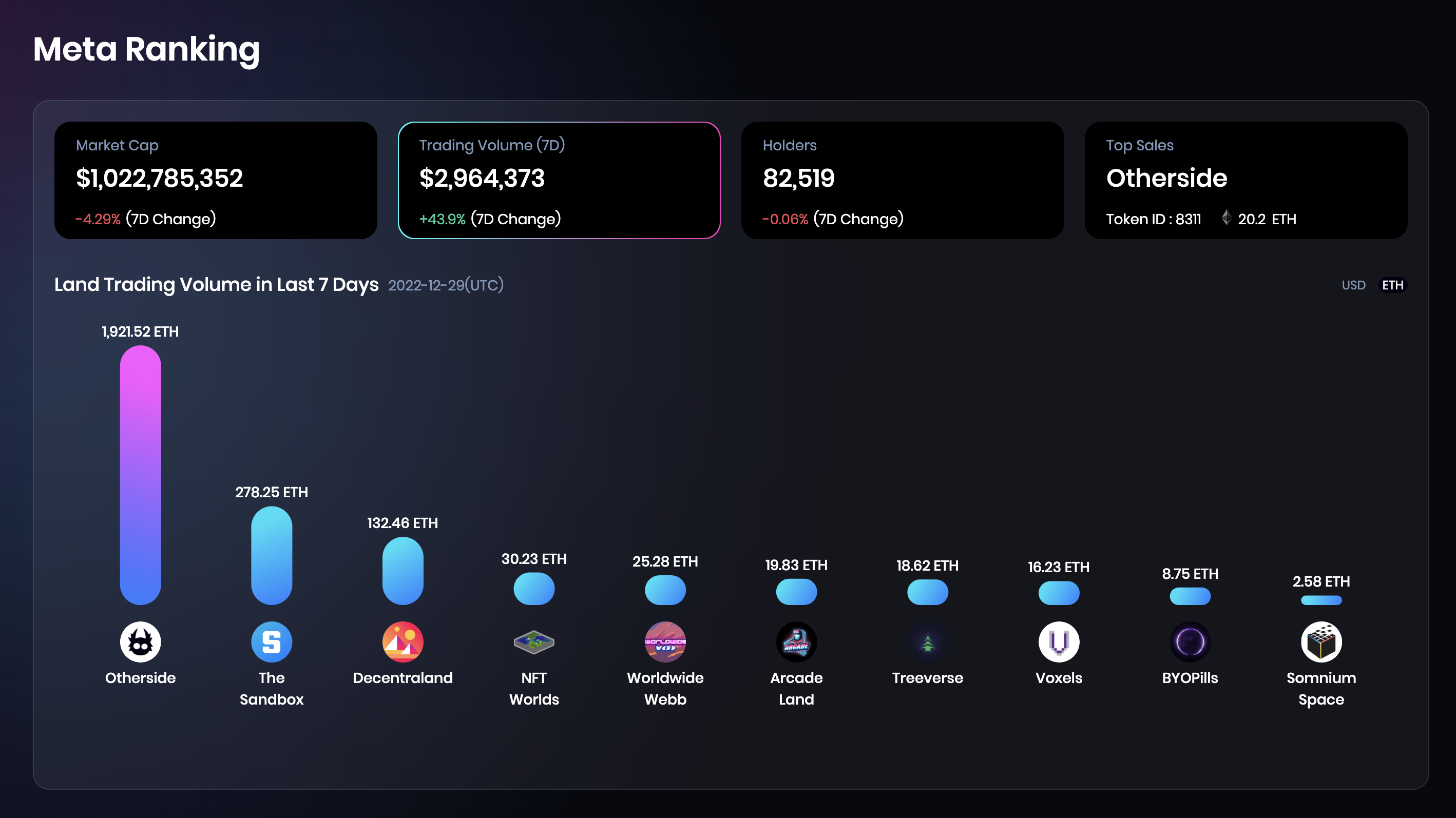

This week, the total market value of the Metaverse sector dropped by 4.29%, and the trading volume increased significantly compared to last week, up 43.9%, with little change in holders. The top three metaverse projects are Otherside, The Sandbox and Decentraland. The transaction volume of several leading metaverse real estate projects has increased this week. The floor price remains in the range of 0.8-1.5 ETH.

(2) NFT dynamic focus this week:

National Geographic Partners with Snowcrash to Release NFT

National Geographic Partners with Snowcrash to Release NFT

National Geographic and NFT platform Snowcrash will launch a new series of National Geographic-themed NFTs in January next year. The series will bring together the work of 16 National Geographic photographers and digital artists from around the world. The theme of the first issue is "Daybreak Around the World", (dawn breaks dawn), the content of the release is to publish on the snowcrash platform the scene photos of 16 photographers around the world at dawn and dawn, and the nft works will be brand new The form shows the photographer's composition techniques and colors, and depicts various scenes when the dawn comes. We also know that National Geographic magazine has been at the forefront of photography and innovation throughout the century. This attempt to enter the NFT field also hopes to boldly explore new nft narrative models, make art more accessible, and open up new horizons. Audience groups.

A total of 1,888 were issued. 1,888 is also the founding year of National Geographic. Buyers can purchase NFTs with a credit or debit card without using a crypto wallet. The project party also hopes to encourage mainstream consumers to participate. The project will be launched on the Polygon chain. "National Geographic" also stated that it will continue to invest in and support creative NFT and digital collection projects in 2023, injecting new creativity into the field of photography.

Snowcrash platform

Snowcrash is an NFT platform built on the Solana chain, and it is also a Web3 studio. They hope to build Web3 software and services through their own platform, so that outstanding artists, publishers and brands can realize their community value and ownership.

Roadmap

Roadmap

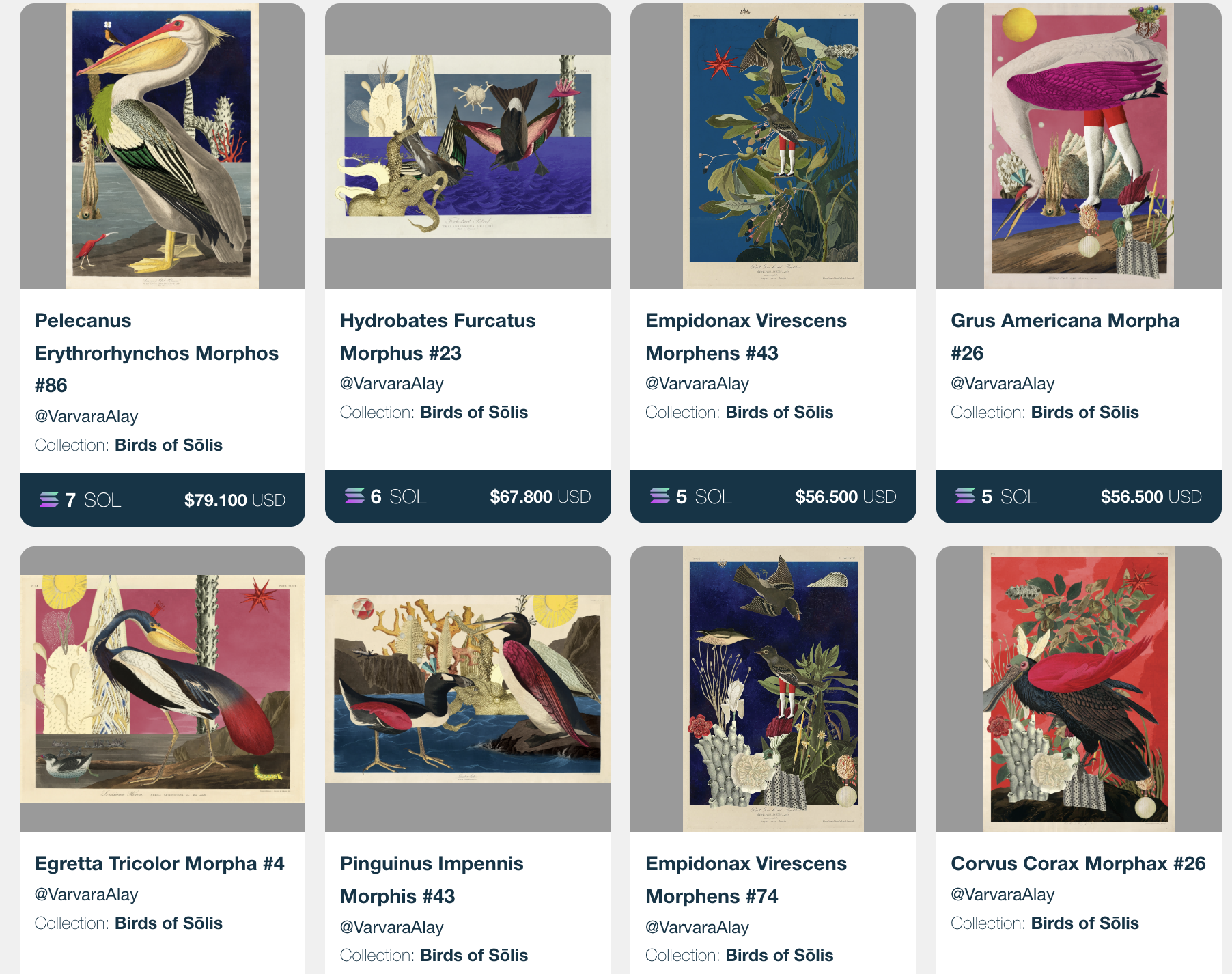

Project Introduction: Birds of SōlisBirds of Sōlis is a collaborative project between well-known illustrators Varvara Alay and Snowcrash, a collection of 2,022 NFTs that recreate historical illustrations from the Encyclopedia of Birds of America by renowned naturalist and painter James Audubon, and hope to In the form of nft, some beautiful and rare species of birds are presented to the public. Varvara Alay's style belongs to surrealism with bright abstract colors. She has been fascinated by birds throughout her career, she is also a muse, and some of her other works have been published in Foundation and SuperRare.The project uses

Ecological protection + bird migration

Hope to bring all designed Sōlis back to nature (released) in the future.

Dawn

20 Sōlis birds will appear in various forms in 2,002 static PFP images (including 2 extremely rare ones) posted on the Snowcrash platform. There is a 24 hour window for whitelist members to go to mint.

Sunrise

Shortly after launch, the project will begin making non-profit donations. Next, 20 NFTs of animated birds, each with a unique animation, will be released to holders of all 2,002 PFP images.

Sōlar Noon

When all 2,002 PFP images and 20 GIFs are sold out, all holders will enter a weekly sweepstakes where one holder will be drawn each week to receive a 1/ 1 Animated version. The campaign lasts for 20 weeks.

sunset

When all birds have been released back into the wild, the 20 holders with the most birds in their wallets will receive a custom 1/1 bird collection animation featuring all of their birds in a new piece gather.

Hope for Haiti15% of primary sales and 10% of secondary sales of the project will be donated to Nia Tero, a Native American non-profit organization dedicated to protecting indigenous ecology in North America.

The artwork of six Haitian artists was minted into NFTs with the aim of bringing together Haiti’s past and future, with a total of 900 unique pieces released.

The artwork of six Haitian artists was minted into NFTs with the aim of bringing together Haiti’s past and future, with a total of 900 unique pieces released.

2. GameFi blockchain games

2. GameFi blockchain games

Lord of Dragons:

Most of the proceeds from the project's release will be donated to support the rebuilding of two schools in southern Haiti that were severely damaged by last year's devastating earthquake in Haiti. All six Haitian artists will also receive royalties from primary sales and a portion of future royalties. The project itself is one of the most acclaimed NGOs in the area, working to improve the quality of life for Haitians, especially children in southern Haiti. This project also hopes to use the influence of nft and web3 platforms to draw more people's attention to social issues in Haiti, such as the epidemic, continuous civil unrest and political turmoil, and increasingly serious water and food shortages.

2. GameFi blockchain games

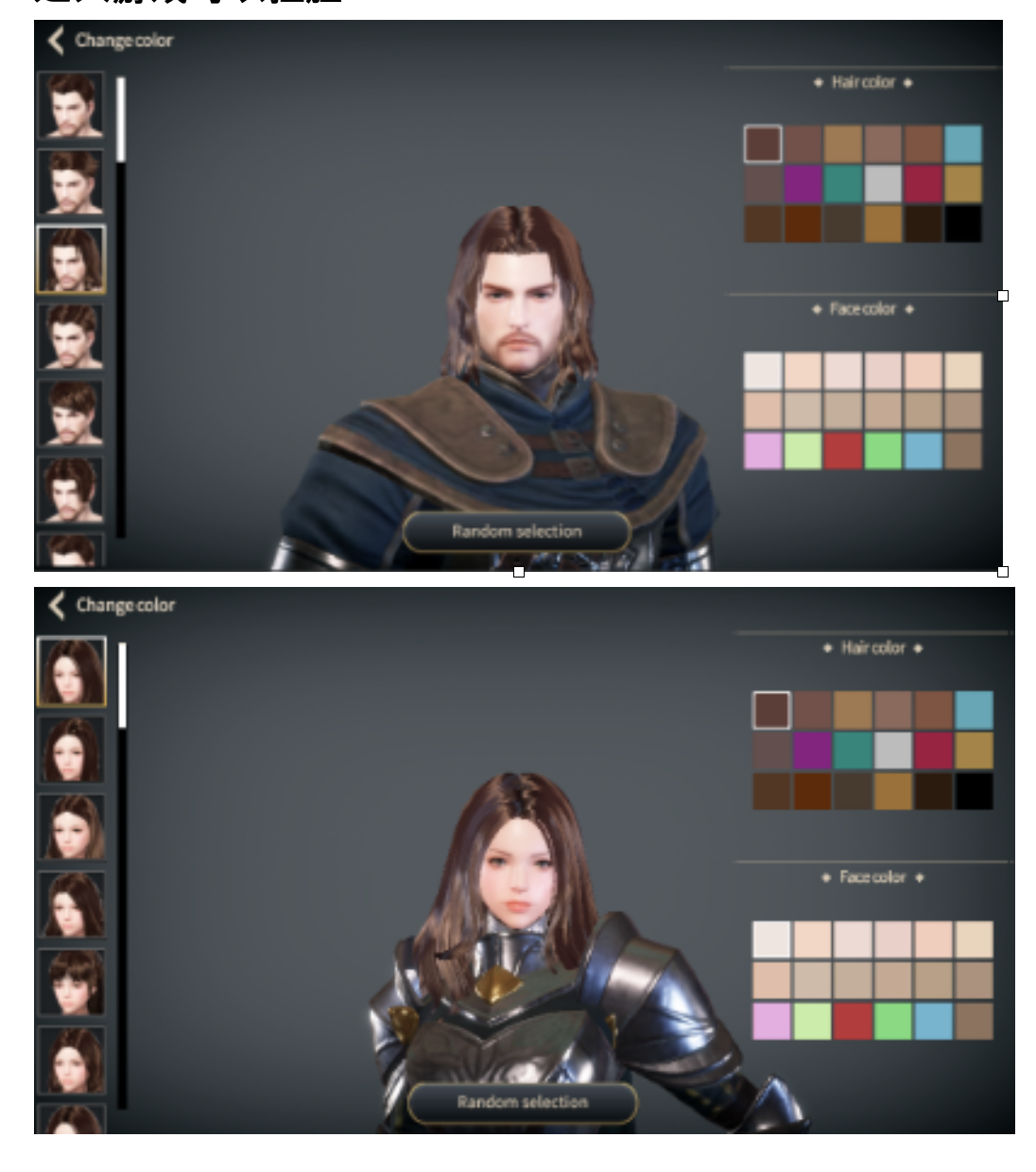

The game screen, the specific gameplay is similar to Legend 4

Team background:

Stage: Public beta on December 26th, props may be deleted at present, but tokens will be retained

Team background:

onface, a listed company in South Korea; its onface game, composed of several senior game OGs (including Moon Jae-sung, the former CEO of Crossfire)

Token economy:

Dual Token Model

Unlimited issuance of token LORT (BNB), which can be obtained by daily tasks

The upper limit of LOGT is 1 billion (ERC 20). It will be rewarded to the character with a particularly high growth rate or the winner of the ranking

Props: non-NFT props, NFT props, improve the efficiency of making money

evaluate:

3. Defi

The picture effect is not good, but it is a step higher than other web3 web games. We need to pay attention to whether it has higher playability and continues to attract new users.

It is relatively early at present, and if the attention continues to rise, the early stage of the P2E model is worthy of attention

(The following views come from Messari’s inventory of DEFI’s top ten future trends, https://twitter.com/TheDeFinvestor/status/1608111465504083968?utm_source=substack&utm_medium=email)

Revenge of DApps: Three apps on Ethereum now collectively generate more monthly transaction fees than Ethereum L1: Uniswap, Lido, OpenSea. Meanwhile, Ethereum’s flagship dApps are quickly conquering other competing public chains. We have seen AAVE and Uniswap launch on other public chains and come out on top in their niches.

The last DeFi unicorn Uniswap: Uniswap’s centralized liquidity has greatly improved the efficiency of liquidity. There is not much work to do to significantly improve the current AMM design. However, AMM can still provide dynamic fees and their reference pricing Oracles compete;

Real World Collateralized DeFi: DeFi lenders who have shown interest in real world assets (RWA) are doing extremely well, such as MakerDAO adding $500 million in US Treasury exposure, DeFi lenders seem to be better able to manage risk.

Under-collateralized DeFi lending: The industry has been hit hard this year. For example, Maple has been severely affected by FTX, but without non-full mortgage DeFi lending, the encryption industry cannot compete with banks. Smart contracts, SBT, and decentralized identities may make it more feasible and decentralized, but it is now predicted that the final How it will work is still too early;

Liquidity staking: Liquidity staking protocols have played an important role in convincing ETH holders to stake their ETH. Earning a 5% annualized return on an almost deflationary liquid asset is extremely attractive. Lido and Rocket Pool seem to be the most promising liquid staking providers, however, stETH and rETH may lose their peg at some point until ETH can finally be unstaked;

dYdX moves to Lisk: The upcoming dYdX V4 release on its own Cosmos chain will solve the centralization problem. dYdX took a risk when it decided to migrate from Ethereum L2 to Cosmos. However, migrating to your own chain will bring many benefits, including increased customizability and scalability.

On-chain asset management: While ETFs are very popular in TradFi, indices customized for cryptocurrencies have yet to gain any traction, and dApps that allow for the rapid creation of on-chain funds are expected to shine in 2023;

first level title

5. Team news

JZL Garden Progress

On December 30, the last working day of 2022, JZL Garden held the first session of the JZL Garden half-monthly talk. The theme is "Give you 50 ETH, how will you invest in NFT now?", and invited many professionals in the industry to share. This event was equally full of enthusiasm and dry goods, with a total of 9,000+ online visitors, and it was included in the Chinese Space Hot List at the end of 2022. Thank you for your support. JZL Garden will continue to hold the second half-monthly talk event in the next two weeks, so stay tuned.

about Us

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment. The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.