first level title

Original source: IOSG Ventures

first level title

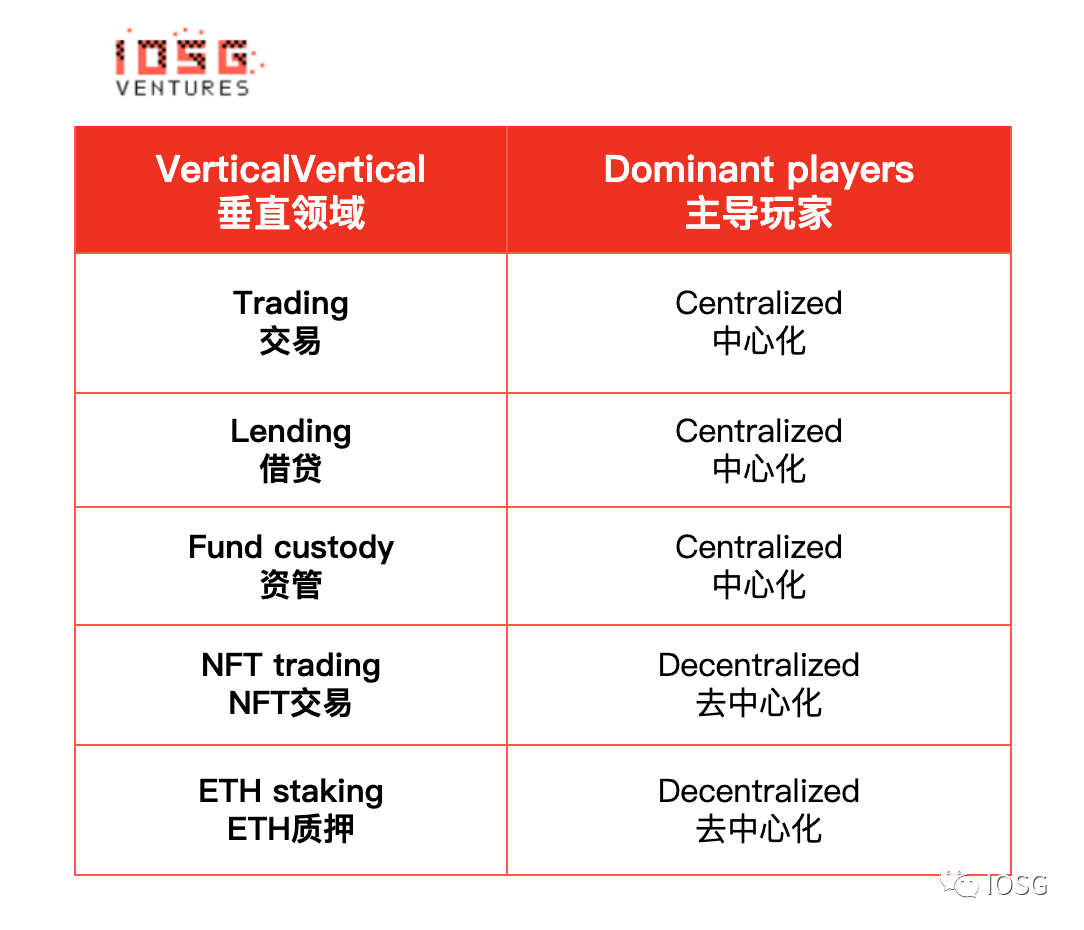

Is liquid staking a winner-take-all market?

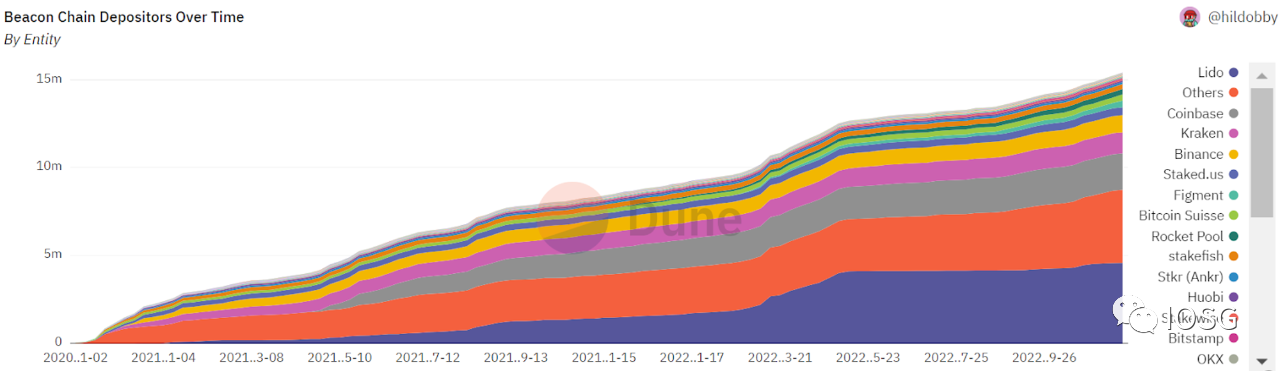

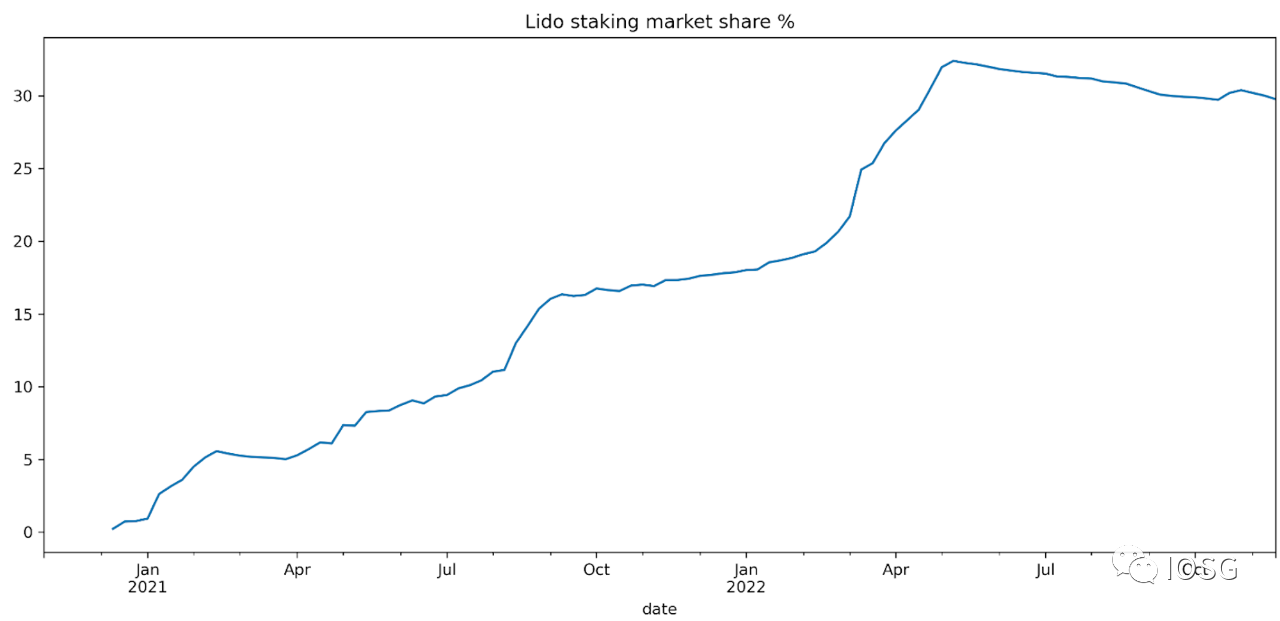

If centralized exchanges dominate the ETH staking market, it would defeat Ethereum’s goal of building a decentralized network. As shown in the figure below, Lido is the leading project in the field of ETH staking, occupying about 30% of the market share.

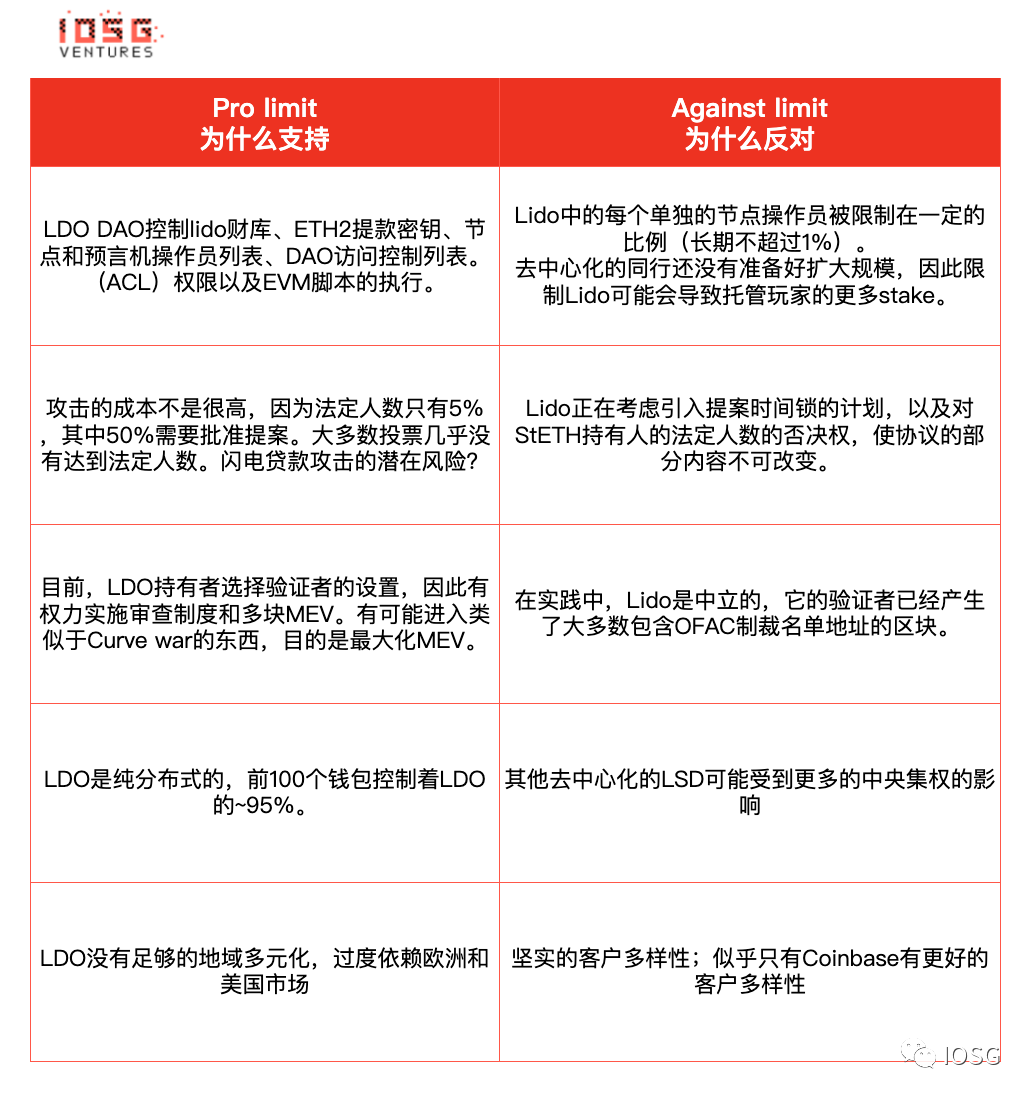

Still, there are voices in the community that limit Lido's market share. For example, Vitalik believes that staking projects (both centralized and decentralized) should self-limit the amount of staking they control, and he suggests 15% as their upper threshold.

first level title

How much market share can Lido capture?

Summarize:

Summarize:

1: Lido will not impose any self-limiting measures.

2: IMO thinks Lido fork is inevitable, but how much market such a fork can occupy is hard to predict, it depends on many factors. Such as LDO governance actions, timing, governance innovations from forks, etc.

3: Due to competition from decentralized and centralized players, and pressure from the community, Lido is expected to capture 50% of the staking market in the best case.

4: The most realistic scenario is that Lido maintains the status quo with about 30%market share. Part of the reason why many Lido depositors choose Lido is for mining rewards, and there may also be a non-negligible part of ETH staked on leverage. These two types of users may withdraw money first after the withdrawal function is enabled.

5: At the same time, when the withdrawal function is enabled, we also expect the inflow of new depositors. The rationale is that in this case, the trading of ETH LSD (Liquidity Collateralized Derivatives) should be closer to the anchor value, and there will be less concern about the market liquidity of LSD, because users can convert back to ETH within 27 hours.

Therefore, the withdrawal function will:

- Allows speculators (yield farmers, leveraged users) to withdraw their deposits, but can increase overall market confidence and make staking more attractive.

- The dominant LSD will lose some advantage over other solutions due to the lower opportunity cost of staking.

- CEX has the potential to offer products that allow instant withdrawals (without waiting for 27 hours), winning users over convenience.

Using the following formula we can roughly calculate the market's implied expectations.

*(1/aave_earn * stETH_discount) 365

first level title

Rapidly growing market

Among the POS chains, Ethereum currently has the lowest pledge rate. This is most likely due to the following reasons:

It is not possible to directly pledge at the protocol level, and users need to accept the additional risks brought by smart contracts or escrow solutions

Staked Ethereum cannot be redeemed

Ethereum is a more mainstream asset with a more decentralized community than any other POS token, but also more attention from speculators such as hedge funds

Over time, as new smart contracts are battle-tested, and as withdrawals become more certain, we can expect a larger share of ETH to be staked. However, I would be surprised to see over 50% of all ETH staked.

first level title

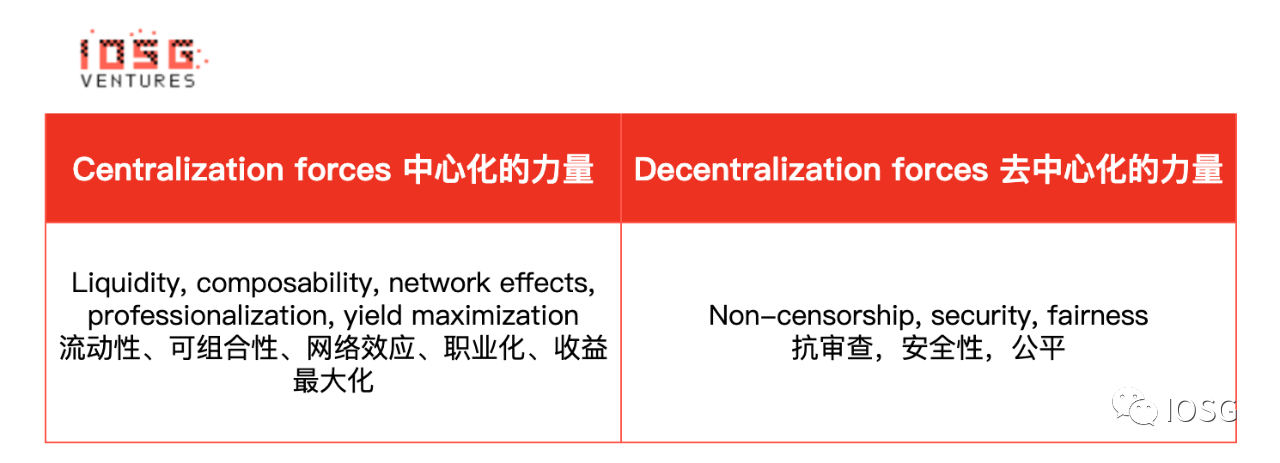

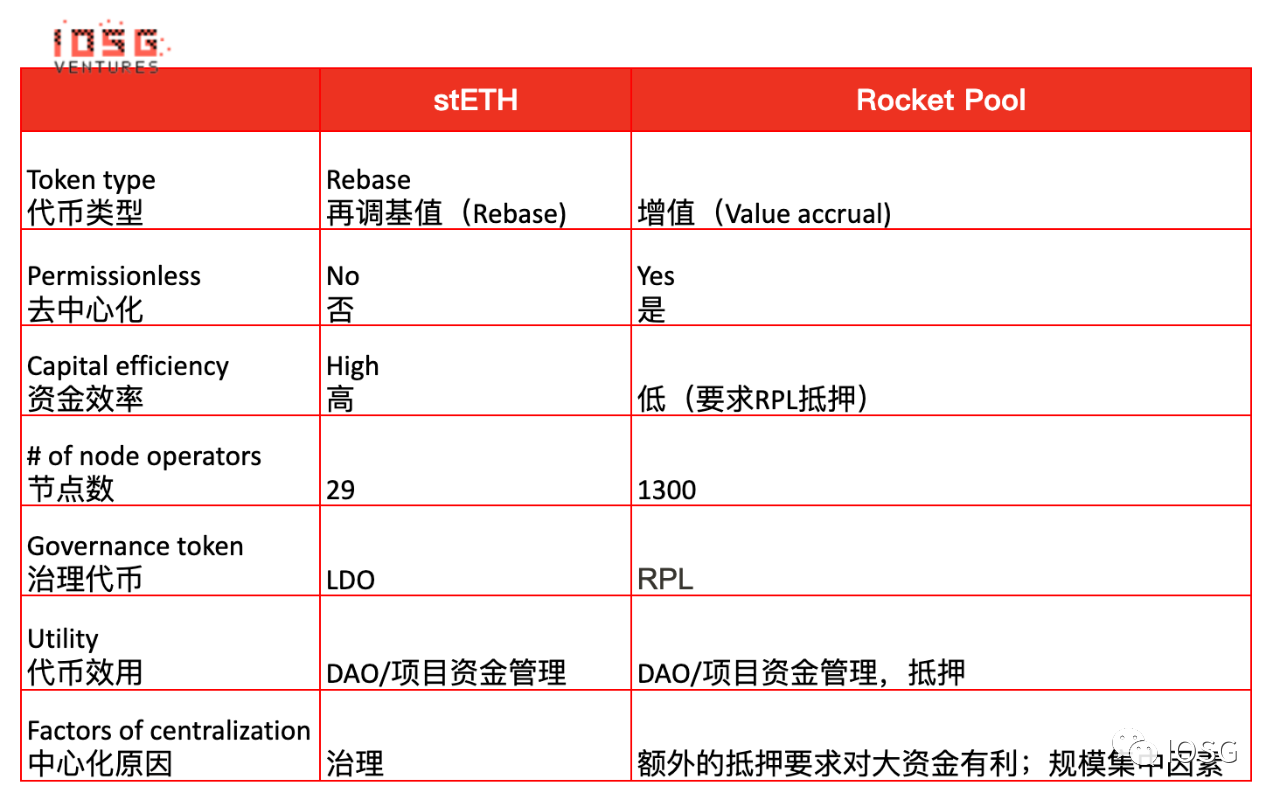

The Importance of Liquidity in LSD

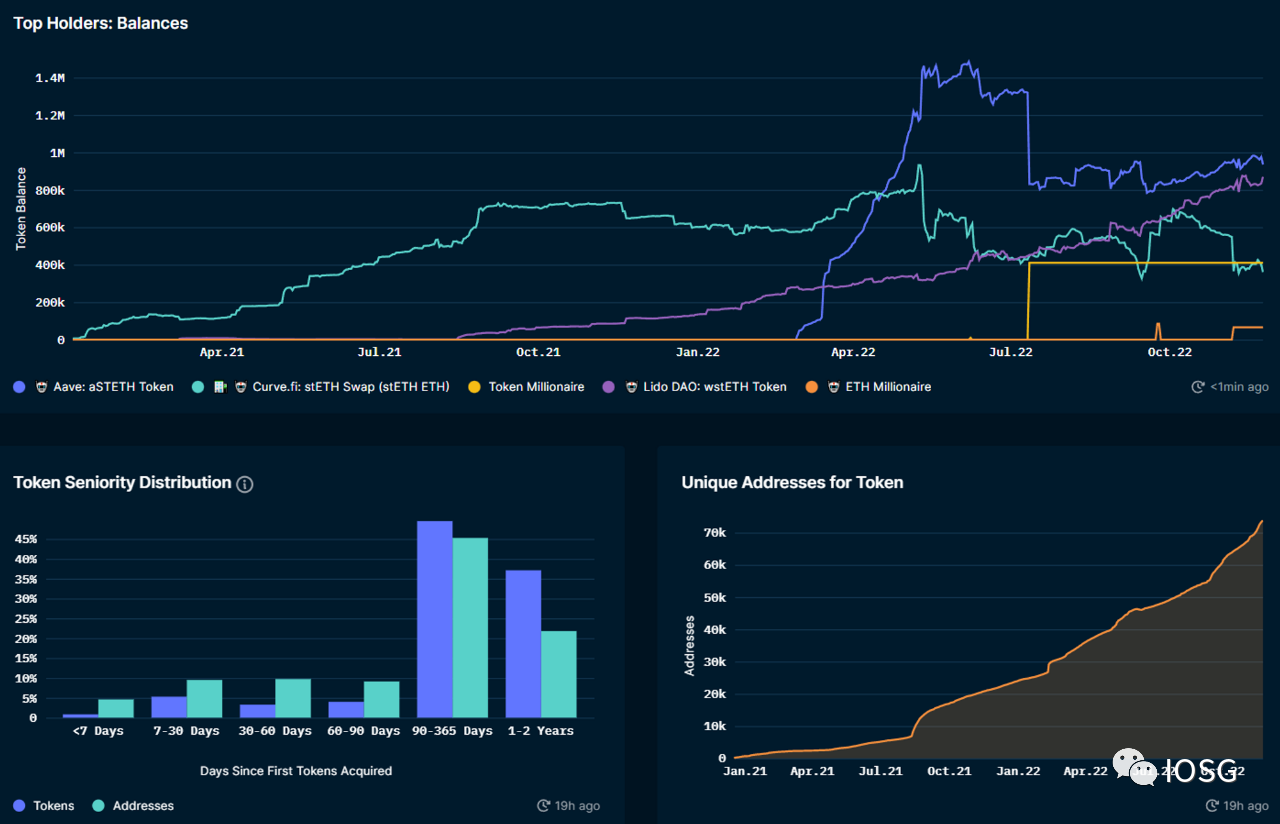

Some point to the network effects of the integration of the most liquid staking derivative, stETH, with major DeFi protocols, potentially allowing Lido to win all the market.

For example, if you want access to liquid collateralized derivatives, you might choose to:

With the best market liquidity and easy exit

Deepest liquidity makes LSD a collateral in many DeFi protocols, offering more use cases for its holders

More use cases will make such tokens more liquid

As mentioned earlier, liquidity is even more important at this moment when withdrawals are not possible due to the higher opportunity cost.

But in general, how interested are users in participating in re-staking? Or the simpler question, are users interested in using ETH in on-chain applications?

We have experienced major bull markets driven by DeFi, NFT, and gaming projects distributing massive incentives to attract new users. However, despite all these use cases and incentives, only a fraction of ETH is used in smart contracts.

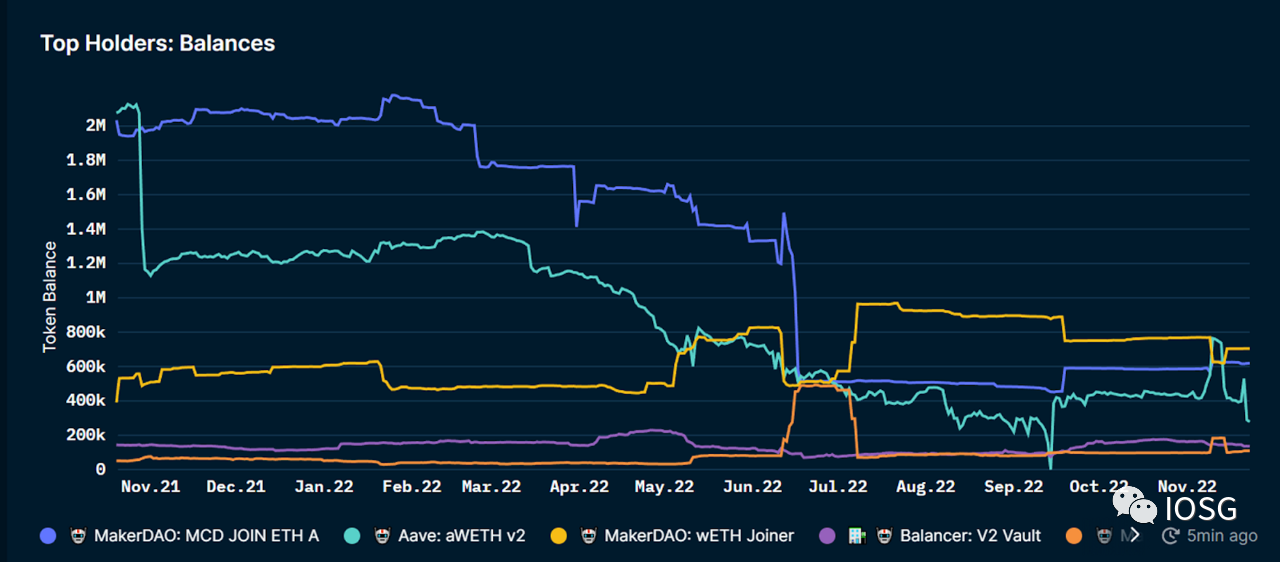

According to Nansen, in October 2021, there will be about 4.5 million wETH in use (to participate in the on-chain economy, users must wrap their ETH), which is less than 4% of the total ETH supply.

Another thing, not so worrisome but worth pointing out here: not all DeFi protocols support rebase tokens, which is why Lido essentially has two standards: stETH and wrapped stETH (the latter is usually priced higher, Because it generates rewards that can be unlocked when unwrap).

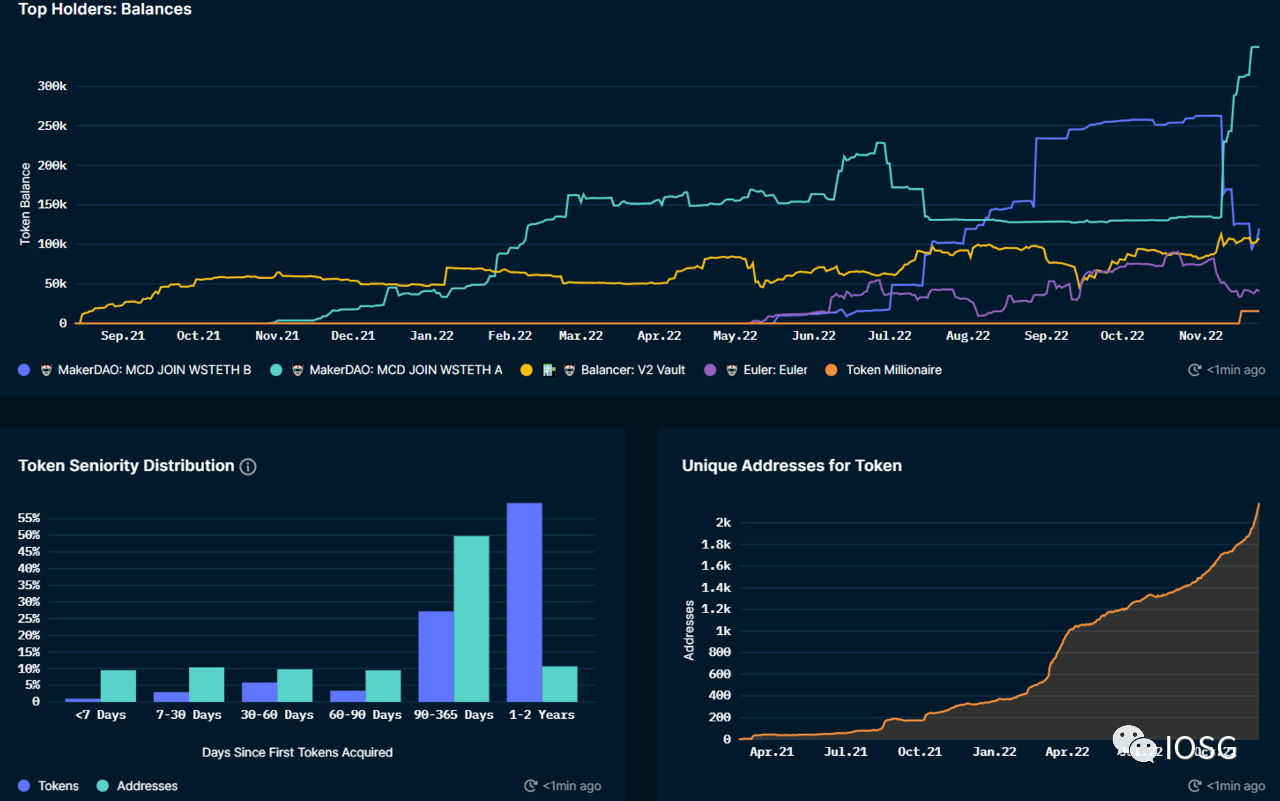

The graph below shows that some of the largest DeFi protocols do not support the stETH standard, which is why we can see Wrap's stETH being used in MakerDAO, Balancer, Euler, etc. Although Wrap and Unwrap is not a major obstacle, it does affect the user experience.

image description

first level title

LDO vs ETH

LDO price is largely influenced by Ethereum activity and ETH price

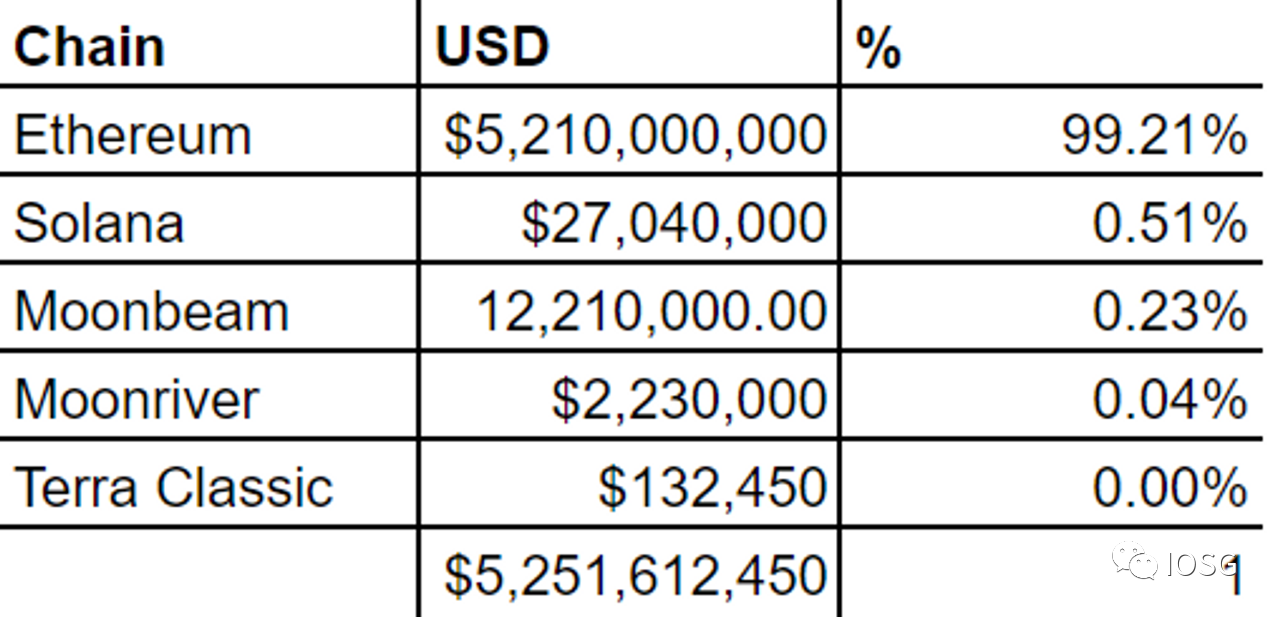

Ethereum is Lido's target market. More than 99% of Lido is locked on Ethereum

Lido's handling fee comes from Ethereum inflation rewards and transaction fees (Priority Fees)

Lido rewards equal to 5% of total staking rewards collected on Lido (90% allocated to stETH providers, 5% allocated to node operators)

Ethereum allocates 1700 ETH per day as staking rewards (roughly 0.5% of ETH supply), of which about 30% goes to Lido (based on their market share, assuming all else is equal)

first level title

Ethereum Inflation Rewards

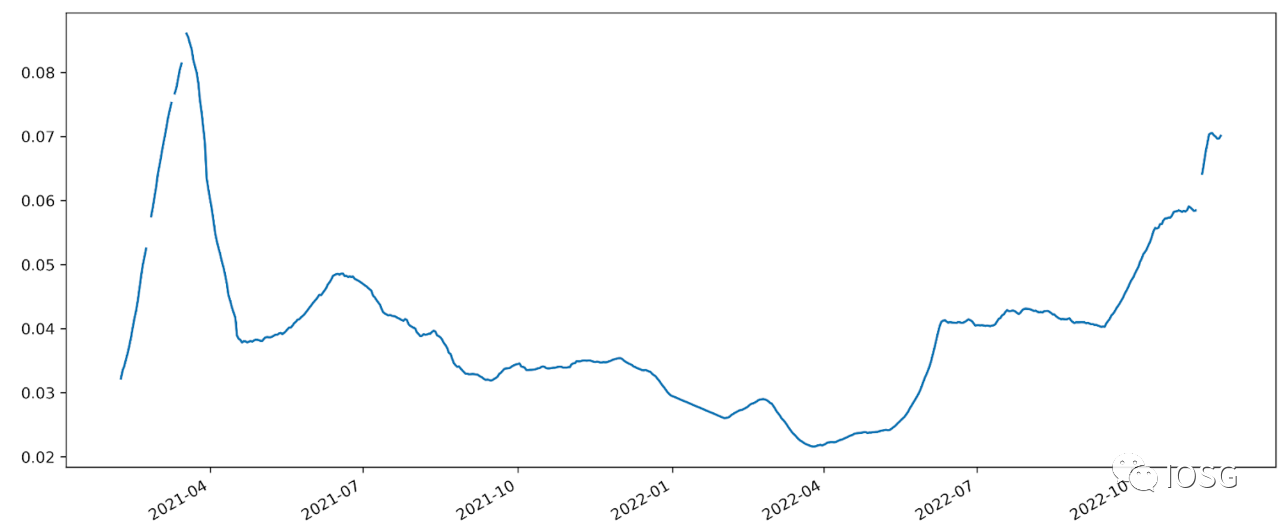

Since ETH inflation typically accounts for the majority of Lido's revenue, it's also important to understand its dynamics.

image description

first level title

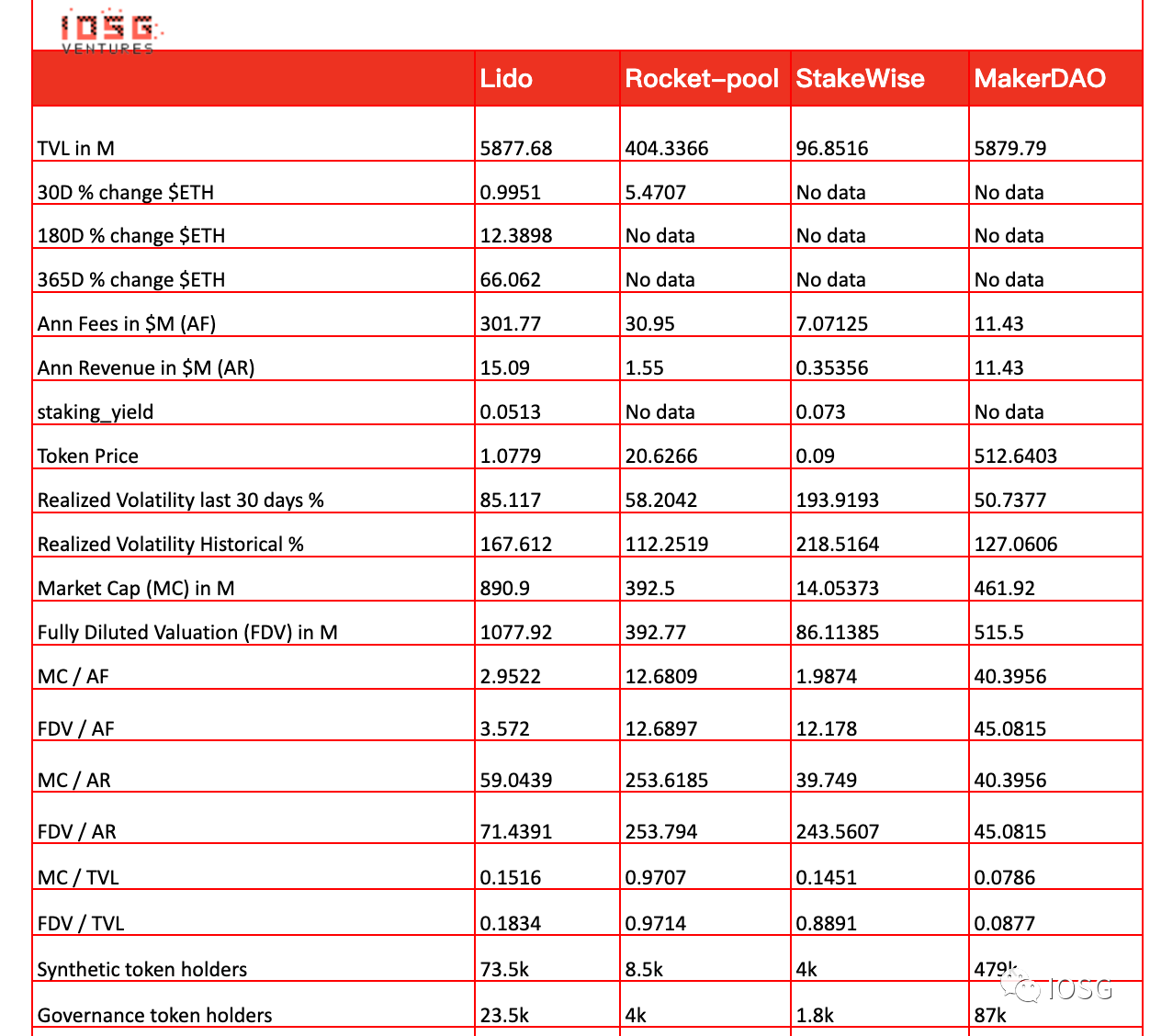

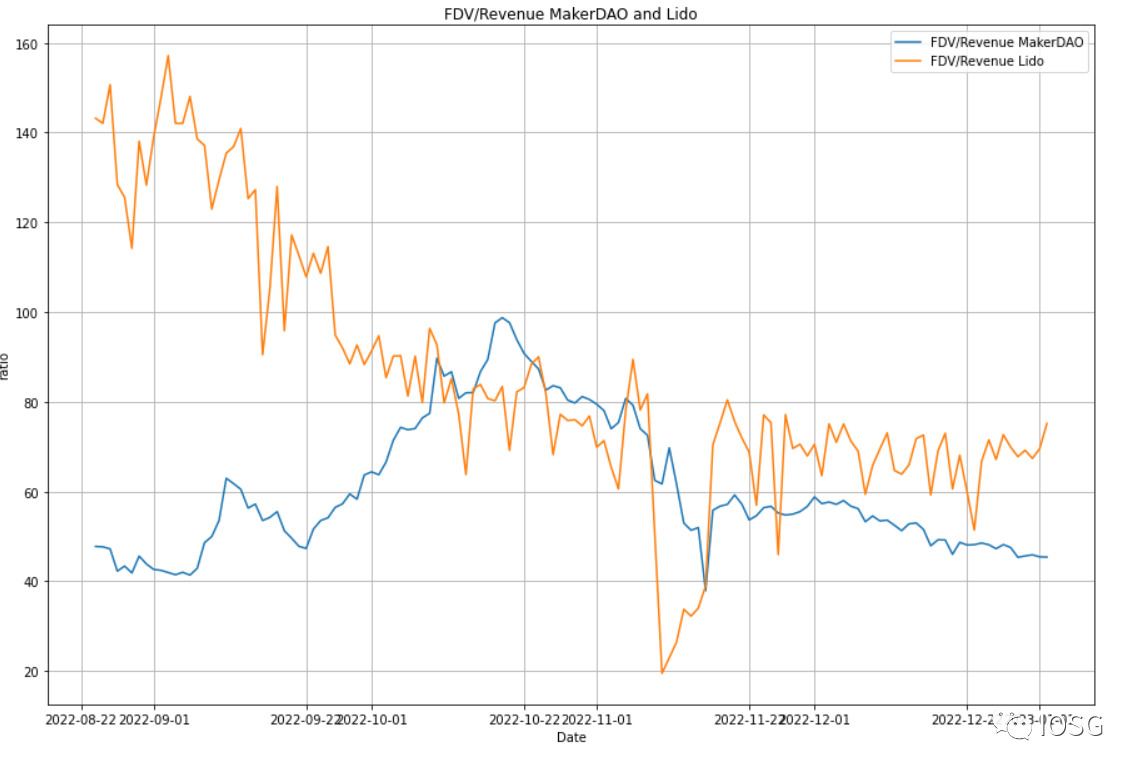

Benchmark against competitors

first level title

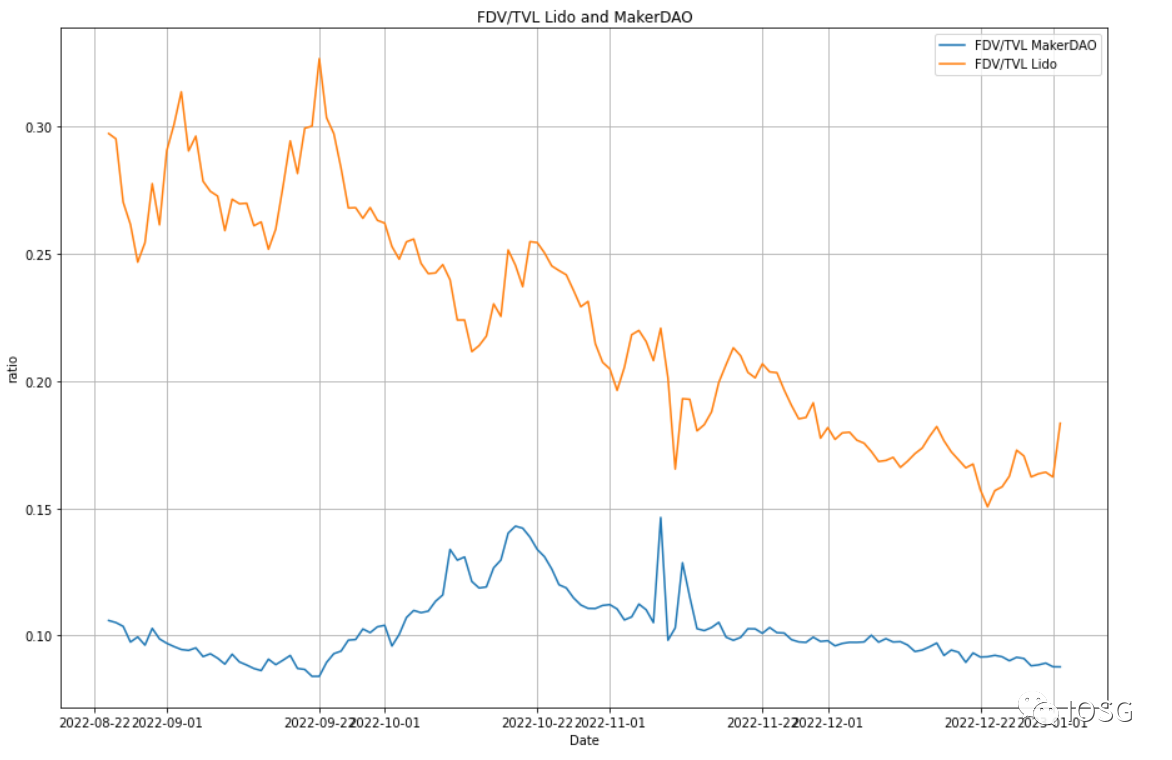

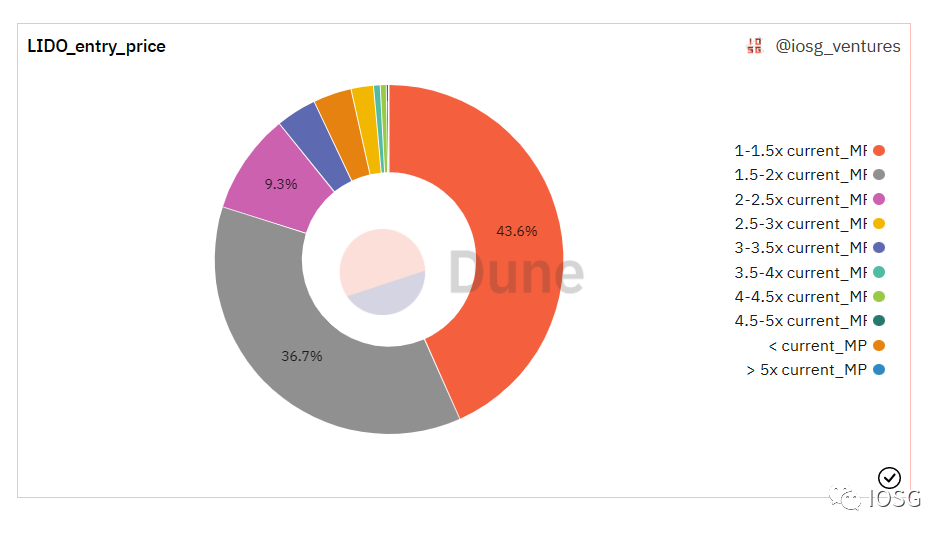

image description

Note: This data lacks insight into the usage of LDO tokens on centralized exchanges

How to interpret these data?

Honest answer: Not sure.

first level title

Summarize

Summarize

We estimate that pledged ETH will account for at most 50% of total ETH

Due to challenges from the community and the emergence of competitors, we reasonably estimate that Lido's liquidity staking market share will be around 35%

After Lido opens liquid withdrawals, we expect leveraged traders and mining participants to withdraw ETH, although withdrawals in general should create an environment for increased staking interest. Smooth withdrawals also reduce the value proposition of LSD

secondary title

Advantages

ETH liquidity staking #1 project, first mover advantage and solid moat

Compared with competing projects, Lido has security, liquidity, composability, network effects, specialization/efficiency advantages. Lido has a high probability of maintaining its status as the most important decentralized liquidity staking platform

historically uncensored record

secondary title

Disadvantages of Lido

Governance attacks are not very expensive if Lido does not introduce certain restrictions

There is a risk of validators manipulating the reward sharing mechanism by participating in LDO token wars

LDO tokens are not decentralized enough

A long bear market will result in low staking yields and less staked ETH

The significance of liquidity may be overestimated: many ETH holders are simply not interested in remortgaging and using on-chain assets; once withdrawals are enabled, LSD will lose some of its value proposition

A Lido fork is inevitable, it's uncertain how much of a threat it is

Lido's target market size is largely determined by ETH market cap. Lido is an indirect bet on ETH, however, on a risk-adjusted basis, ETH may be a better investment choice than Lido