Original source: BitpushNews

Original source: BitpushNews

first level title

Gemini Lianchuang sent a public letter to DCG, and the encryption market is booming again

The volatility of Bitcoin has decreased significantly recently, and even the U.S. stocks, which have been linked, have stopped following in the near future. According to market analysis, the current inactivity of long positions indicates that the bottom-hunting funds of retail investors are decreasing sharply, and the inactivity of short positions indicates that currency holders are reluctant to sell. If the main force wants to build a position, it needs a wave of panic decline to make the market hand over its chips. With Gemini Lianchuang's public letter to DCG, the encryption market was clouded again, panic was pervasive, and the volatility of Bitcoin began to increase. So, how big is the crisis of DCG? When will it come again?

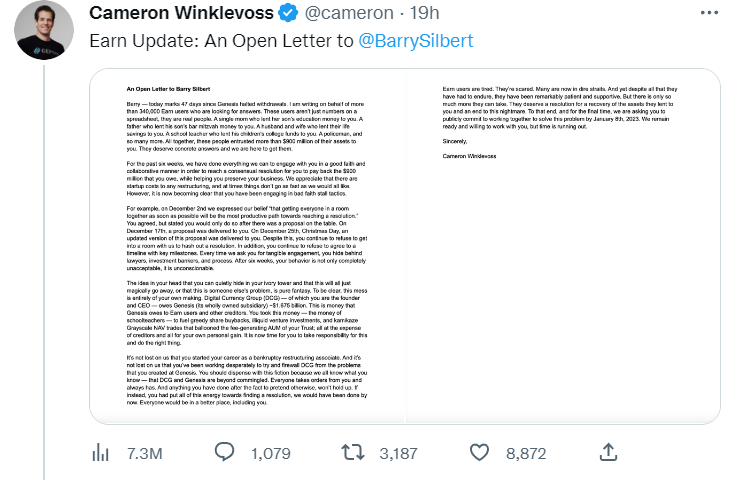

According to "Bittweet" reports, on January 2, Gemini co-founder Cameron Winklevoss, on behalf of more than 340,000 users of its Earn product, sent an open letter to DCG founder Barry Silbert, asking him to repay more than $900 million owed. Cameron said: Barry Silbert refused to cooperate in the past six weeks and adopted vicious delay tactics; DCG owes Genesis approximately $1.675 billion, which is money Genesis owes Earn users and other creditors. Barry Silbert took the money to drive greedy stock buybacks, illiquid VCs, suicidal Grayscale NAV deals (to grow its trust fund AUM); all at the expense of creditors, all for his own benefit .It asked Barry Silbert to make a public commitment to work together to resolve the issue by January 8, 2023, saying there was "not much time left".

Regarding the open letter issued by Gemini, DCG founder Barry Silbert responded that DCG did not borrow $1.675 billion from Genesis. DCG has never defaulted on interest payments to Genesis and is currently repaying all outstanding loans; the next loan due date is May 2023. DCG submitted a proposal to Genesis and Gemini's advisors on December 29, but has yet to hear back. In response to Barry Silbert's response, Gemini co-founder Cameron Winklevoss tweeted again: "You are here again, stop pretending that you and DCG are innocent bystanders and did not participate in creating this chaos. This is so hypocritical. How did DCG default on the $1.675 billion owed to Genesis if it didn't borrow the money? And that promissory note, would you like to promise to pay it when it comes due on January 8? "

first level title

The crisis is coming, how will DCG respond

The crisis of DCG did not start today. Faced with Gemini’s pressing step by step, what will DCG do next? This article sorts out some measures taken by DCG at the beginning of the crisis, which may provide some reference for the development of the encryption market later.

Regarding the crisis of DCG, it was first revealed by a Twitter user. As early as December 15, Twitter user Andrew tweeted that he had communicated with Genesis creditors, among which Genesis owed creditors more than 2 billion US dollars, and Genesis bankruptcy would trigger Over $1.5 billion in callable loans from DCG(Note: This is roughly consistent with what the Gemini co-founder claimed on Jan. 2 that DCG owes Genesis approximately $1.675 billion), and the bankruptcy of DCG will trigger a huge GBTC liquidation.

Subsequently, on December 17, a number of cryptocurrencies (FIL, ZEN, ETC, NEAR, etc.) related to DCG (the parent company of Grayscale) were sold off sharply. Will Clemente, founder of Reflexivity Research, a cryptocurrency analysis agency, issued Tweet said that this selling pressure may come from DCG itself. Adam Cochran, partner at CHEV, also said that DCG seems to be liquidating from the perspective of the decline and trading volume of certain altcoins. On the same day, Dutch cryptocurrency exchange Bitvavo said it had lost access to 280 million euros ($297 million) in assets stored in DCG, The Block reported. The risk of thunderstorms in DCG is clear.

On the evening of December 19, the Wall Street Journal (WSJ) reported that Grayscale CEO Michael Sonnenshein stated in a letter to investors that if the Grayscale Bitcoin Trust (GBTC) cannot be converted into a Bitcoin ETF in the end, A tender offer for the outstanding shares issued will be considered. In our previous article "What is the plan behind the grayscale offer buyback? Can DCG Survive the Crisis” has analyzed that Grayscale’s move may be at the behest of DCG, through the funds on Grayscale’s account to repurchase GBTC in tradable shares, to help the parent company DCG dispose of part of the GBTC held, thereby increasing the assets of DCG fluidity. In short, Grayscale uses the money in the account to buy GBTC in the hands of DCG, thereby injecting liquidity into it.

So judging from the current situation, there is a high probability that DCG will further liquidate encrypted assets, thereby improving its own liquidity. Last time, DCG liquidated some encrypted assets around December 15th. At that time, the encryption market as a whole followed the rebound of US stocks, and the market conditions were relatively good. However, DCG chose to sell heavily at this time, perhaps mainly because of its own excessive size. From a short-term perspective, before January 8, the overall risk of the encryption market is relatively large, and even if it rises, it is very likely to encounter selling pressure from DCG liquidation. With the passage of time and Gemini's pressing step by step, DCG and Genesis may choose to continue to liquidate in desperation, regardless of the market situation, and this is gradually confirmed by the data on the chain.

From the data on the chain, on January 3, PeckShield monitoring showed that 2 days ago, the dormant address marked Genesis (starting with 0 x 815 c) transferred 20,000 ETH (about 24 million U.S. dollars) to 0 The address starting with x 0 e 77, and then nearly 20,000 ETHs were converted into wstETH. During the period, the stETH/ETH exchange rate once fell to 0.985 on December 31. (https://twitter.com/PeckShieldAlert/status/1610134187583082499)

first level title

Where will DCG end up? How do you see the big Vs from all walks of life?

With the confrontation between DCG and Gemini on Twitter, the nerves of the encryption market began to tighten again. So, how did the crisis of DCG come about? Where will DCG end up going?

On January 3, encrypted KOL Andrew said on social media:“Crypto trading platform Gemini is expected to soon force Genesis Trading into bankruptcy, with Genesis bankruptcy triggering liquidation of DCG assets(Based on redeemable loans), DCG may go bankrupt, and Grayscale Trust assets will face significant risks. "

Zhu Su, co-founder of Three Arrows Capital, tweeted: “Last summer,DCG suffered huge losses due to the bankruptcy of Sanjian Capital, as did Babel Finance and other companies involved in GBTC.They could have soberly chosen to restructure, instead they filled the hole with a 'left handed right handed' callable promissory note. It's like a kid losing poker and saying 'my dad will pay you to keep playing' when 'dad' is himself. DCG, like FTX, has been misleading customers for the past few months, no one asked how Genesis plugged the hole; and has been taking more deposits during this time and hoping that the market price will rise. Genesis creditors, who will push it into bankruptcy and take over the remaining DCG assets in the next few days, will likely demand that Barry pay off his cash the easy way instead of waiting for a criminal case and restitution penalty from the DOJ. "

Gabor Gurbacs, director of digital asset strategy at New York-based investment management firm VanEck, commented: “In my personal opinion,The solution is that DCG should sell the stake and get Genesis creditors compensated.This is an honest and sensible approach. My guess is,first level title

What "butterfly effects" might the DCG crisis trigger?

The co-founder of Gemini’s public letter to DCG has once again pushed the crisis in the encryption market to a cusp. The above has talked a lot about the possible crisis and future direction caused by the DCG thunderstorm; but, what else is the "butterfly effect" caused by DCG? This article believes that the most important thing is to trigger the default of mining companies, which will once again impact encrypted financial institutions and deepen the recession of encrypted finance.

In this bull-bear cycle, many bitcoin mining companies have mismanaged funds and hold a large amount of bitcoins in their accounts. For example, Core Scientific, which filed for bankruptcy, kept almost all bitcoins on its balance sheet until the market collapsed in May Only then began selling its bitcoins. With the outbreak of the DCG crisis, there is a high probability that the price of Bitcoin will fall; and in this round of bear market, the already difficult mining companies are likely to further sell Bitcoin to survive, causing the price of Bitcoin to spiral down. At present, mining companies that have gone bankrupt or have plummeted in stock prices include: Compute North (bankruptcy), Argo (stock price plummeted 50%), Bitfarms (Nasdaq issued a delisting warning), Core Scientific (stock price nearly zero), etc. According to CoinDesk estimates, mining companies still have at least $1 billion to $2 billion in debt stock that has not yet been exposed.

Original link