Looking back on the past year, we have seen many new scenarios, new applications and new changes in the NFT field. Players who buy and sell NFT also have some new actions. Therefore, we collected the data of the largest player in the NFT industry in 2022 - the giant whale, and carried out corresponding analysis and interpretation.

image description

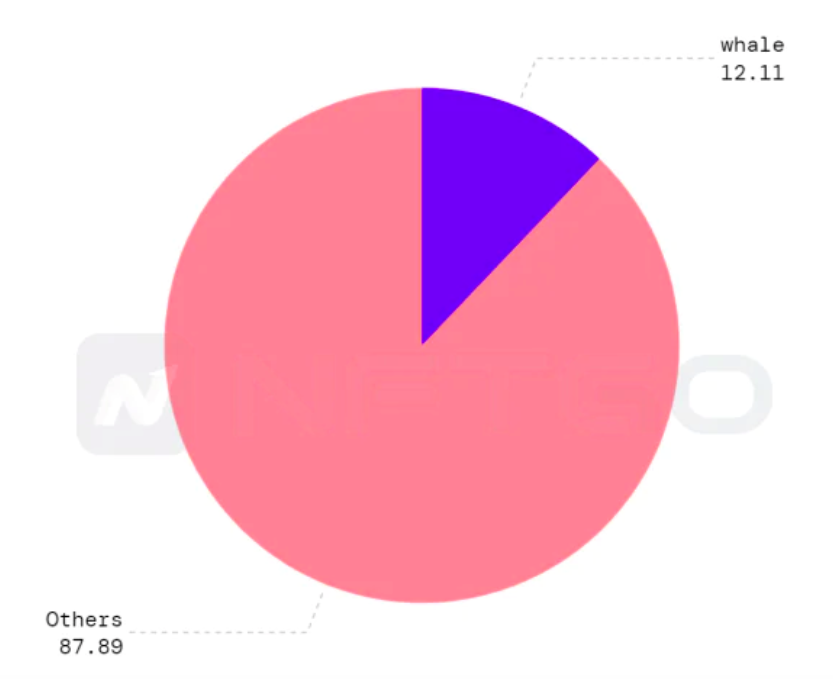

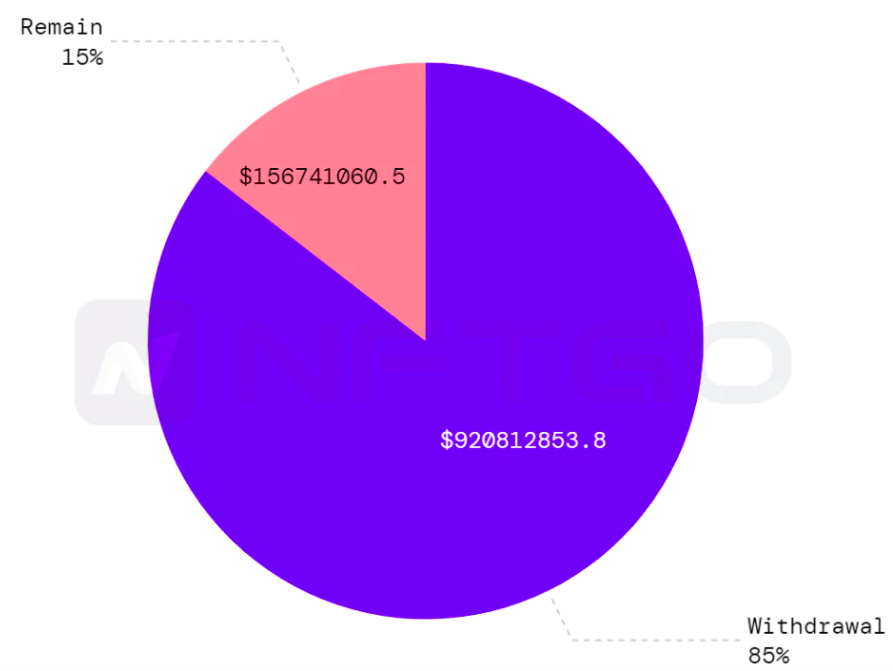

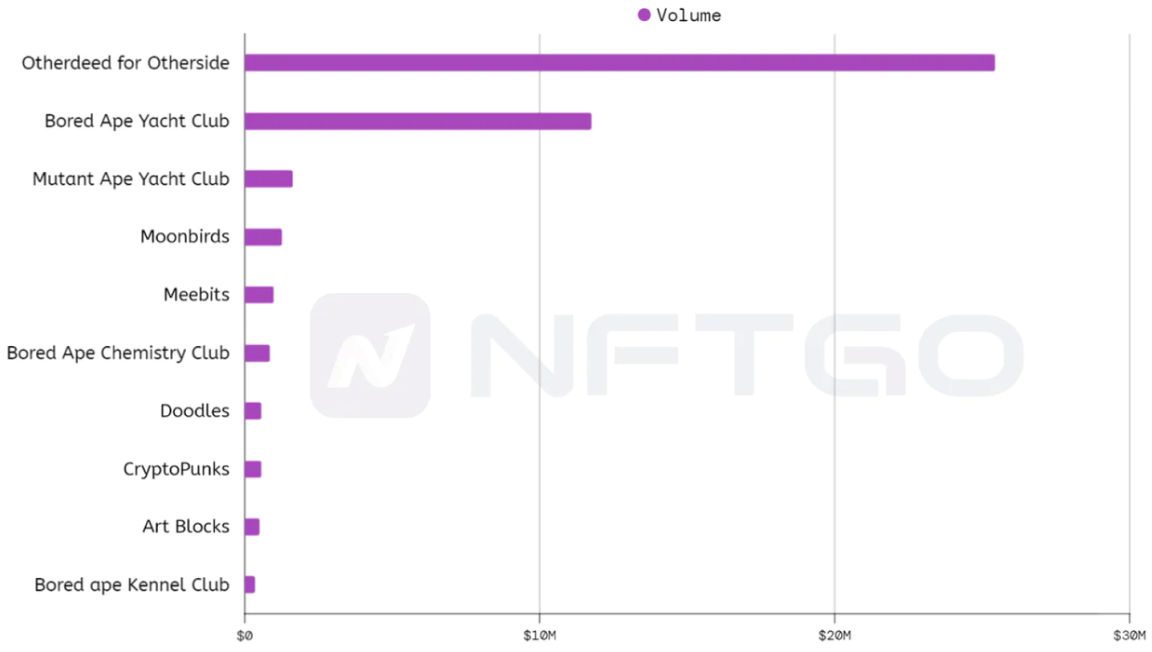

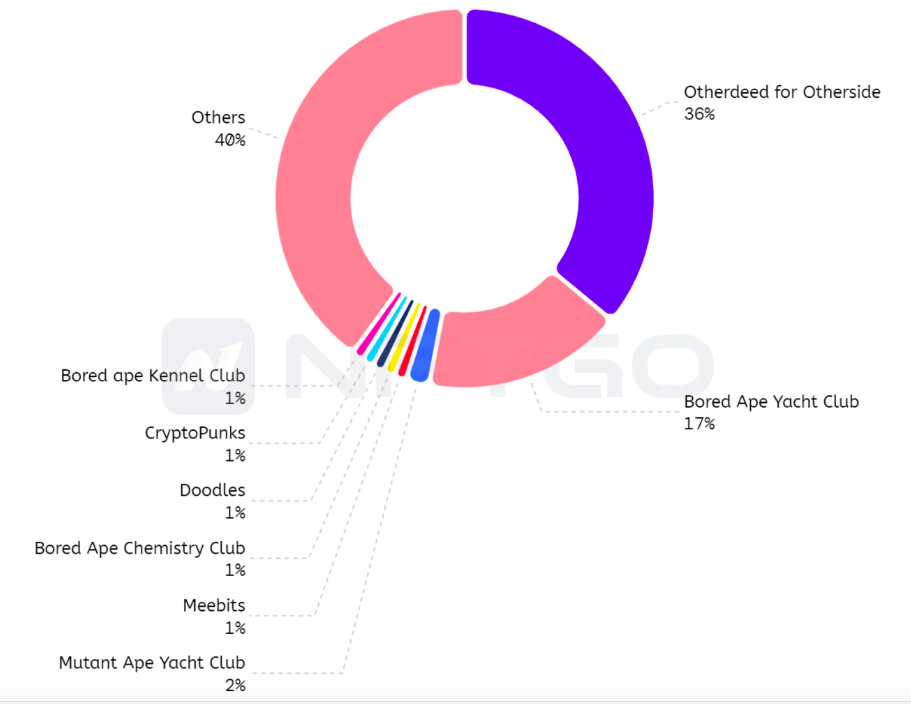

NFT Market Fund Distribution Proportion (Source: NFTGo.io)

image description

https://nftgo.io/account/ETH/0xed2ab4948ba6a909a7751dec4f34f303eb8c7236/activity

image description

https://nftgo.io/collection/ens-ethereum-name-service/overview

By analyzing the trend of giant whales, we can find the original motivation behind the market and restore the true appearance of the market.

(NFTGo.ioof Whale boards are free to viewhttps://nftgo.io/analytics/leaderboard/whales, you can also add the giant whale to the Watchlist)

Trends and analysis of giant whales this year

image description

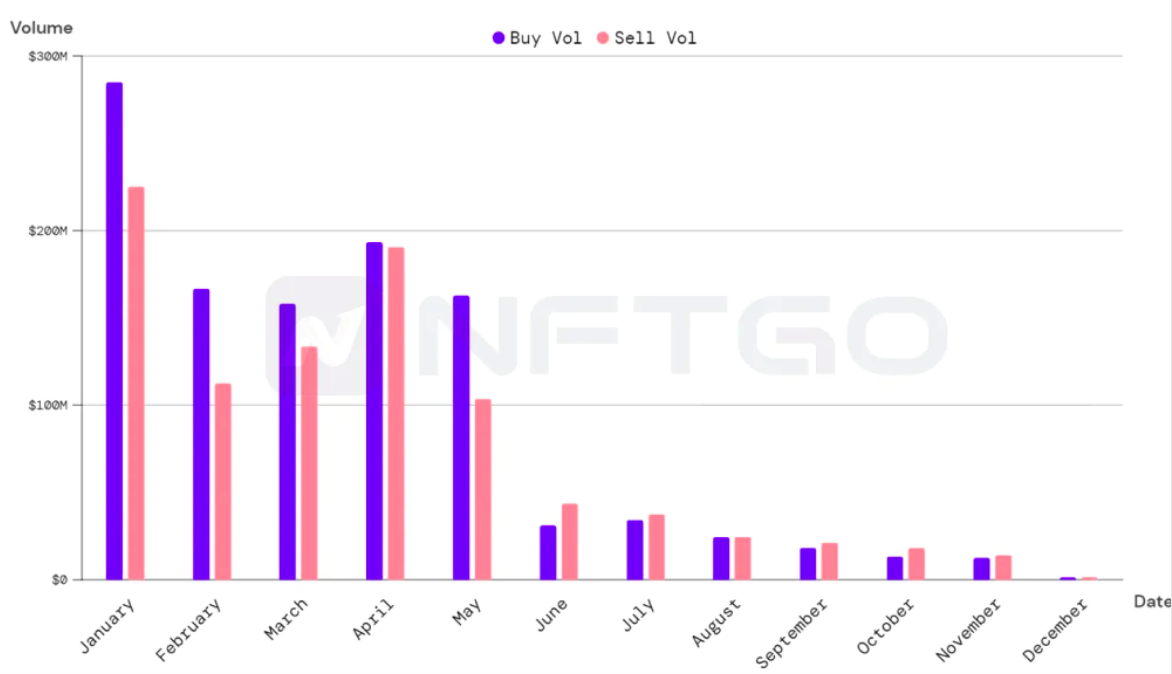

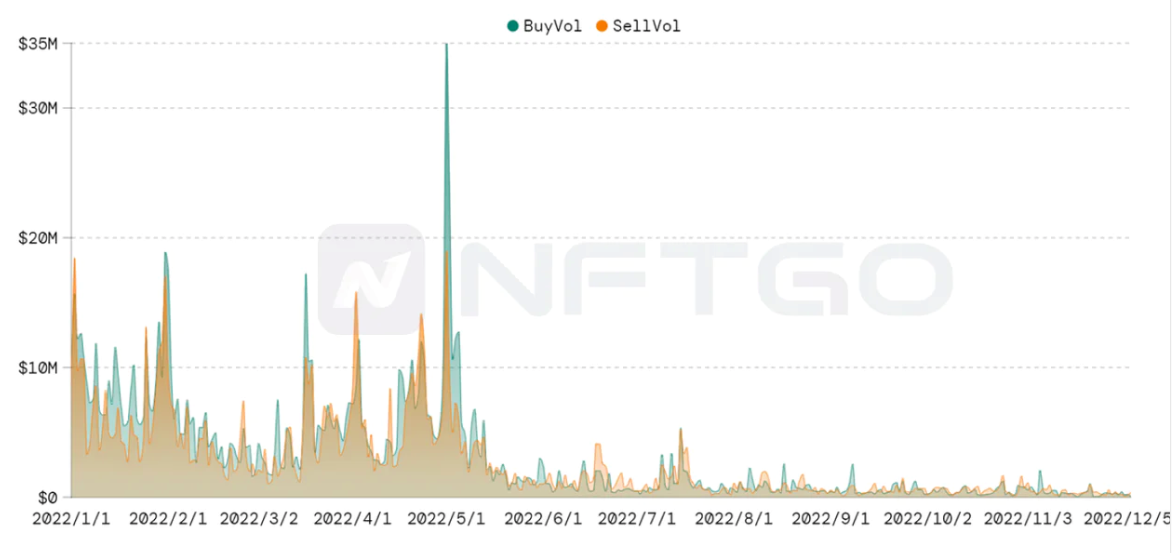

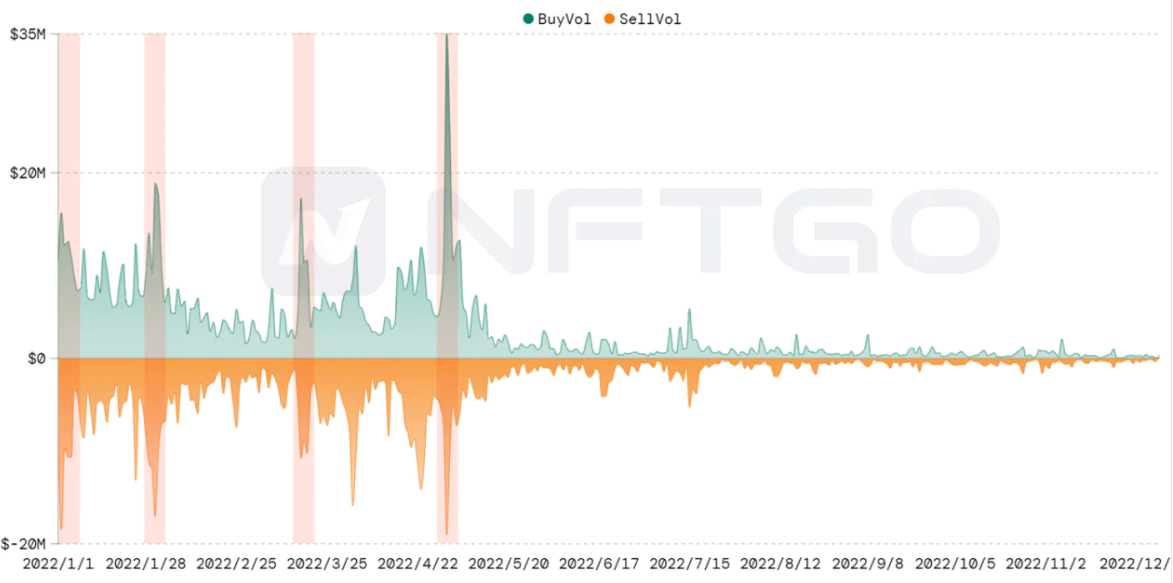

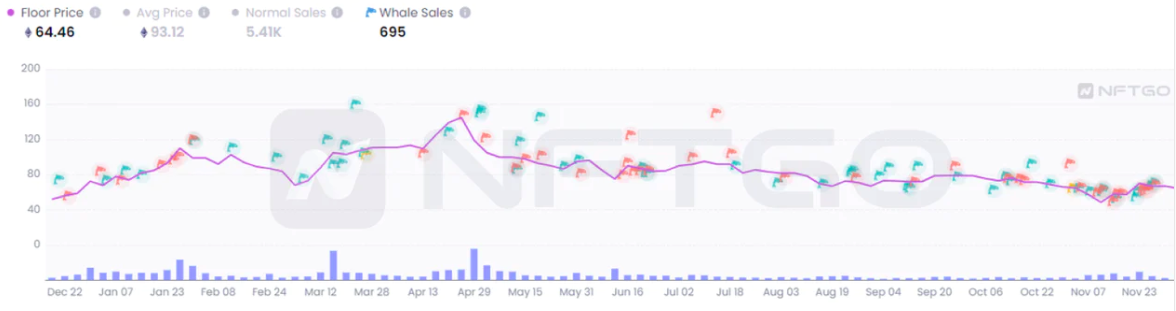

Giant whale buying and selling trend chart (by month) (Source: NFTGo.io)

According to the time span, it can be divided into two stages:

image description

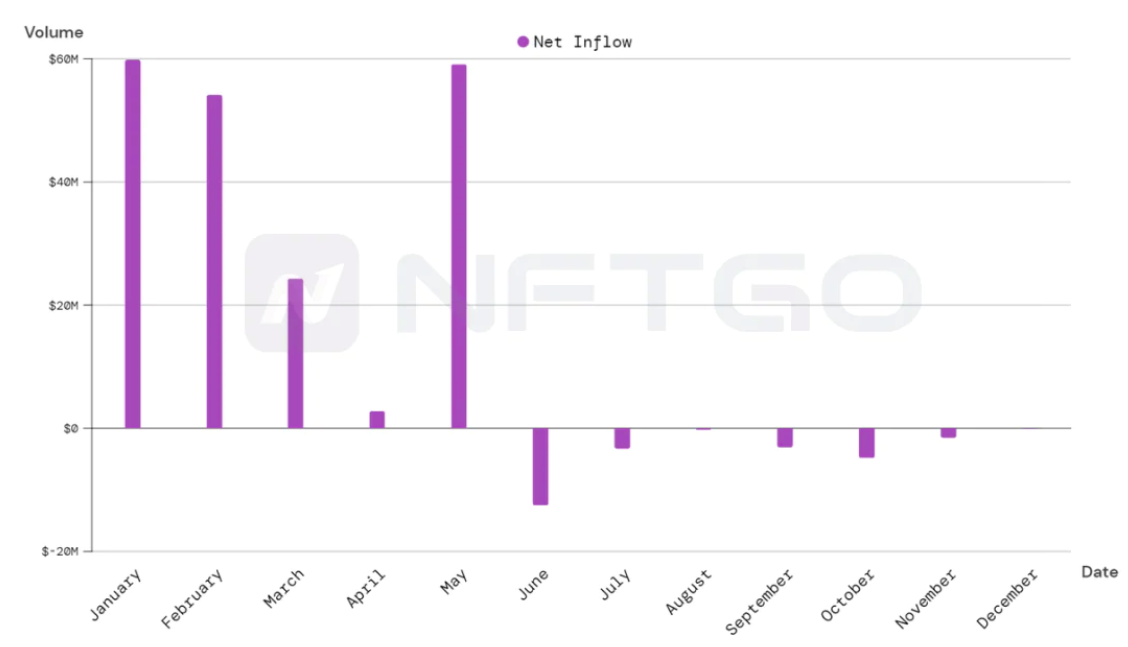

Net inflow trend chart of giant whales (by month) (Source: NFTGo.io)

This NFT trading boom continued in February, and the giant whale group still brought a net inflow of US$54.16 million to the NFT market. In March and April, there was a sharp drop in net inflows (the net inflow in March decreased by 55% compared with February, and the net inflow in April decreased by 88% compared with March), and the net inflow of giant whales will turn around. Negative risks, but this downward trend was affected by the hot events in May, which once again triggered a trading boom, allowing giant whales to bring a net inflow of US$59.13 million to the market again, which also proves from the side that the NFT market this year Highly influenced by the hype factor of the event.

From May to June, giant whales collectively fled the market

image description

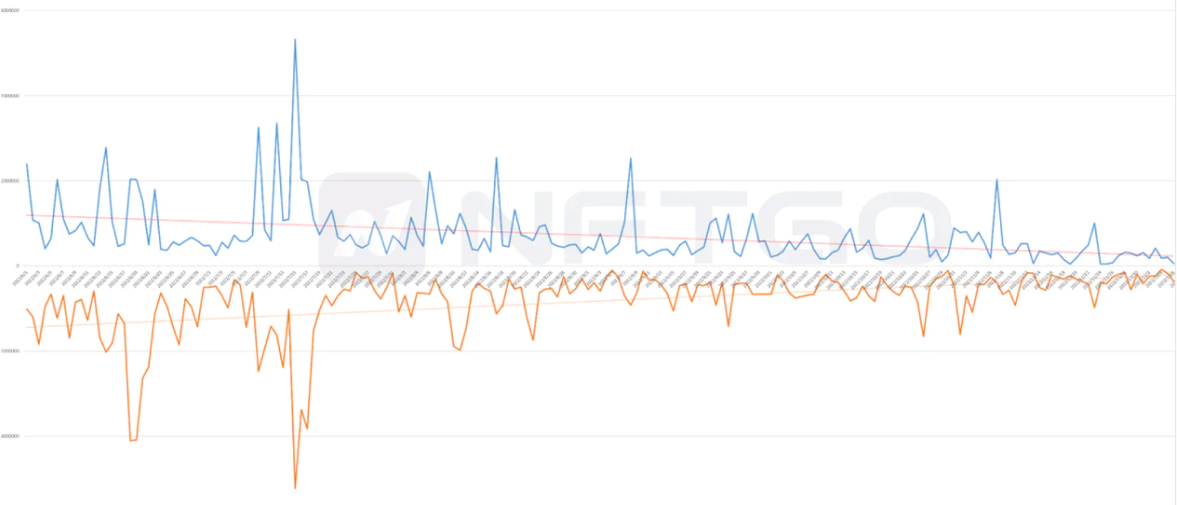

The trend line of giant whale capital scale from June to December (Source: NFTGo.io)

image description

Statistics of giant whale funds from June to December (Source: NFTGo.io)

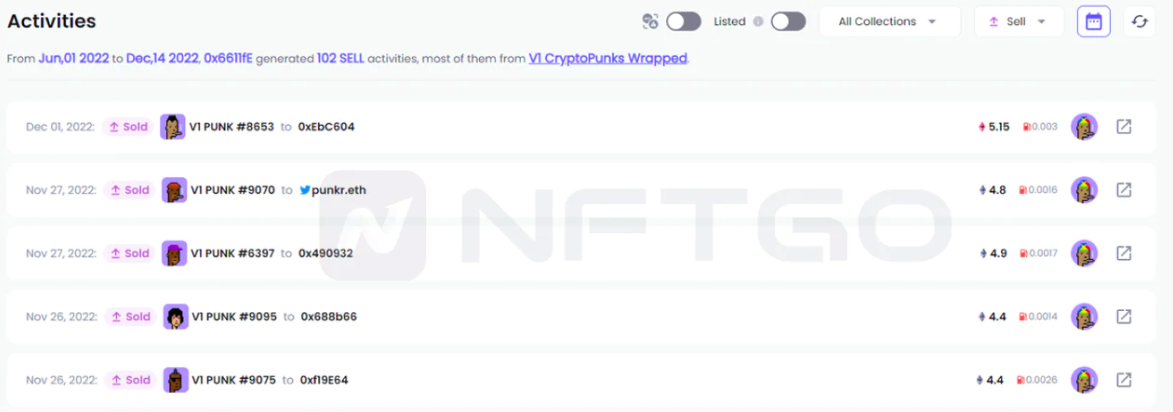

The picture below shows the giant whale0x6611fe71c233e4e7510b2795c242c9 a 57790 b 376 image description

https://nftgo.io/account/ETH/0x6611fe71c233e4e7510b2795c242c9 a 57790 b 376/activity

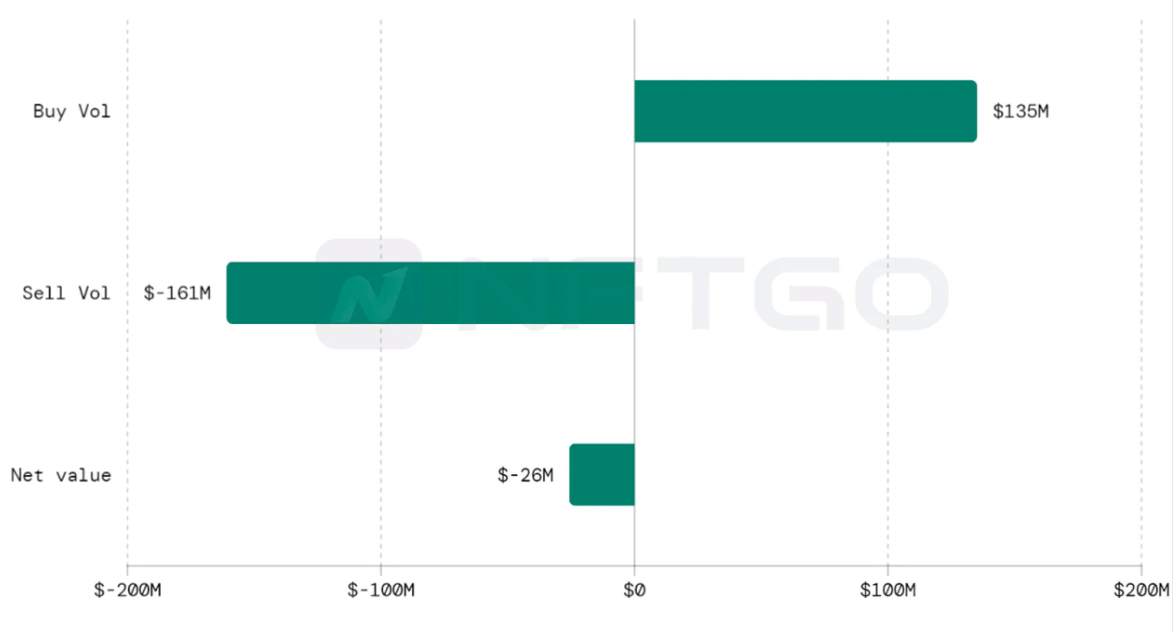

Still leaving $160 million in the NFT market

image description

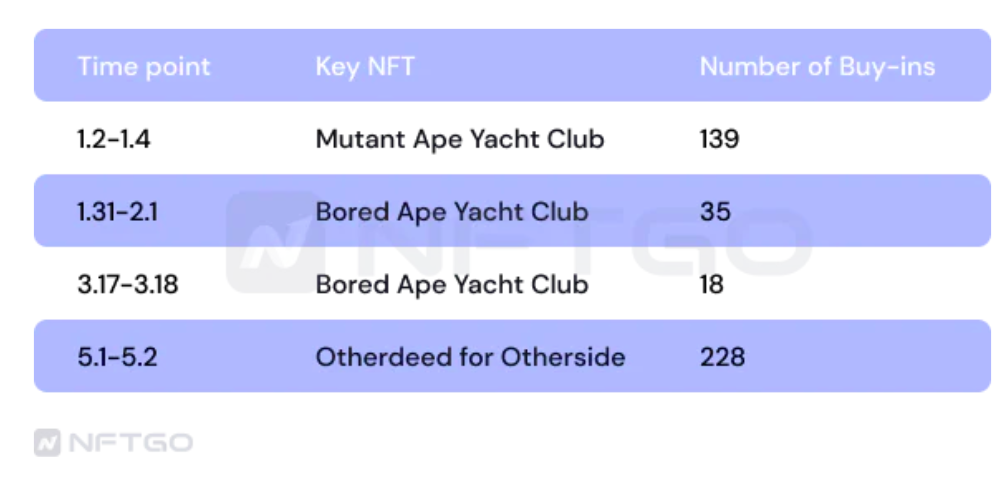

Giant whale trading strength comparison chart (Source: NFTGo.io)

image description

The proportion of giant whales’ investment funds this year (Source: NFTGo.io)

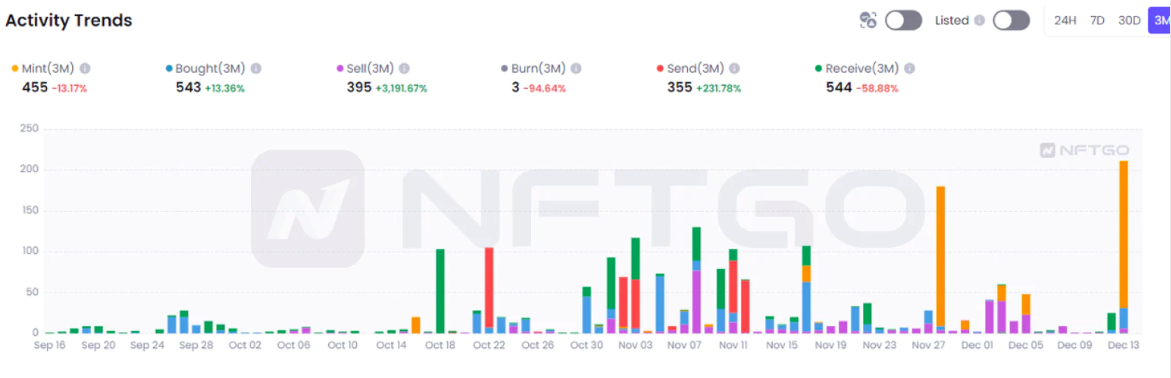

Analysis of Behavioral Characteristics of Giant Whales

image description

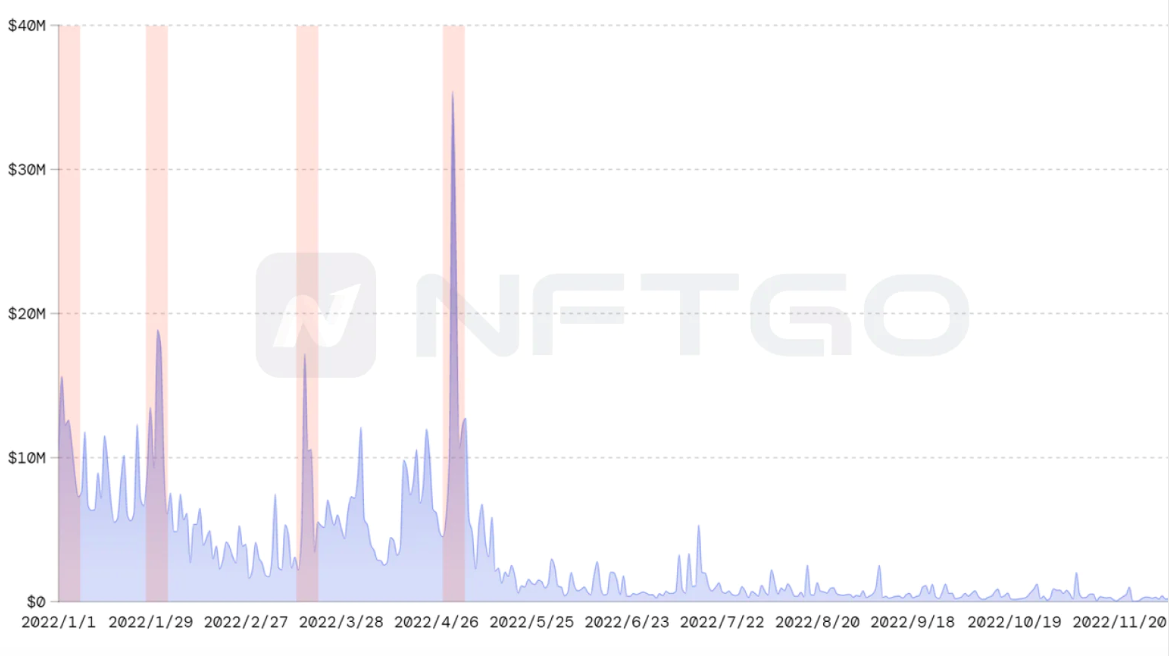

Buying chart of giant whale funds (Source: NFTGo.io)

The picture shows the buying trend chart of giant whale funds from 2022.1 to 2022.12. From January to April this year, the giant whale funds reached"Intermittent outbreak"It is characterized by buying a huge amount of transactions many times. This behavior characteristic is mainly based on the hype events in the market at that time. The time periods marked in the figure are the peak intervals of transactions. Into the number one NFT and quantity.

How Crazy Are Giant Whales on May 1st?

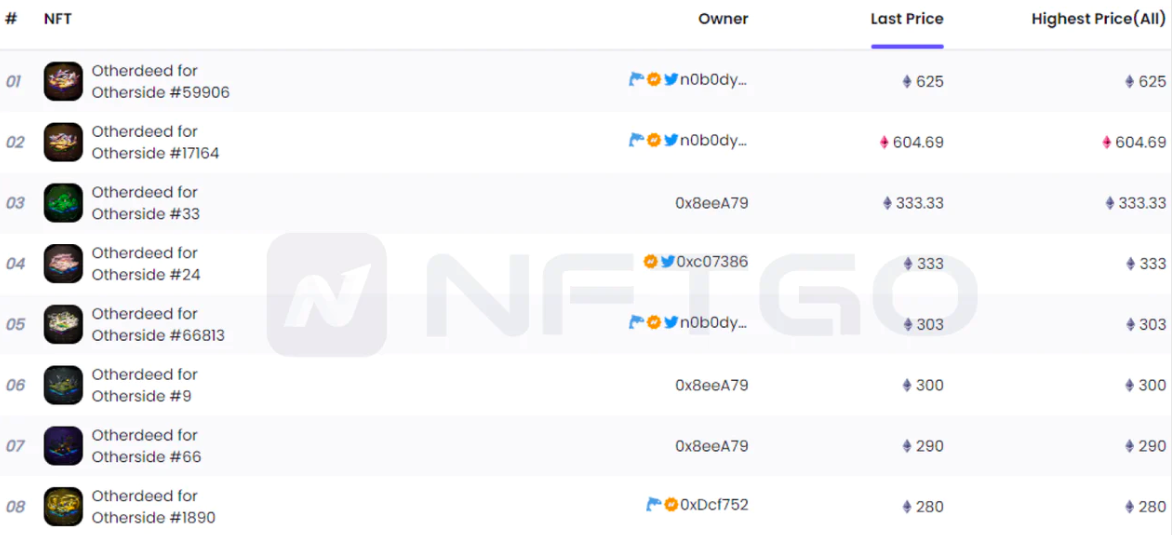

May 1, 2022 is the most active trading time for giant whales this year. On this day, giant whales conducted frequent buying and selling transactions, buying $70,909,493 of NFT assets, including $25,439,910 of Otherdeed for Otherside , in addition to the YugaLabs series of NFT portfolios totaling $46,148,230, includingBored Ape Yacht Club、Mutant Ape Yacht Club、Meebits、Doodles、Bored ape Kennel Club、CryptoPunksimage description

2022.5.1 Giant Whale Buying Ranking Chart (Source: NFTGo.io)

image description

Otherdeed's transaction price list in May (Source: NFTGo.io) https://nftgo.io/collection/otherdeed/analytics/general

image description

4.30-5.2 Giant whales buy NFT composition (Source: NFTGo.io)

image description

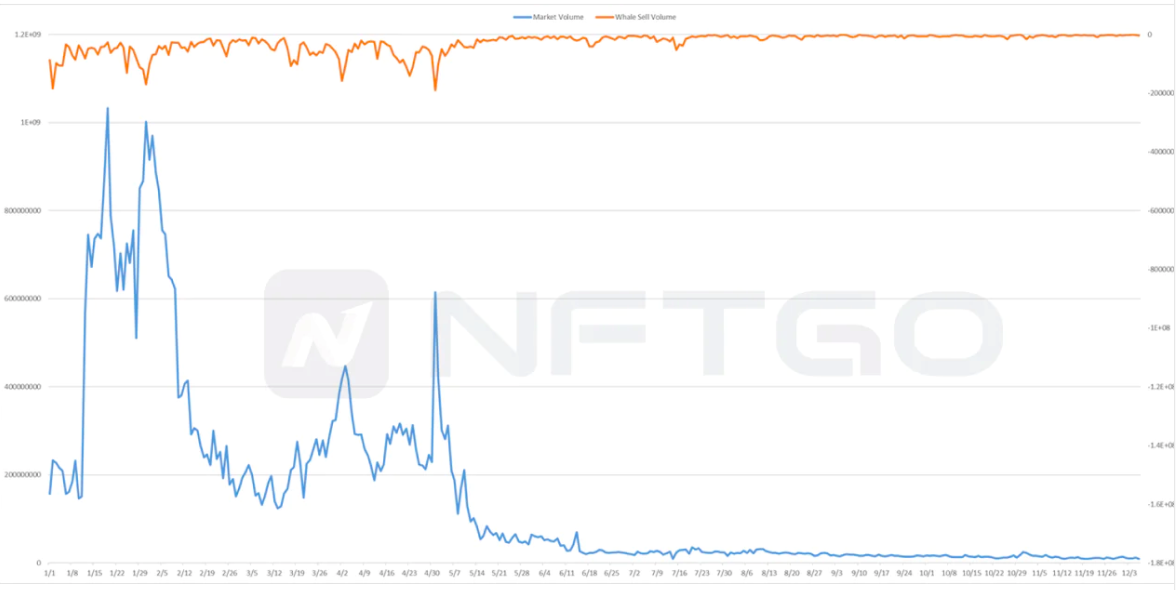

Comparison of market trading volume and giant whale selling volume (Source: NFTGo.io)

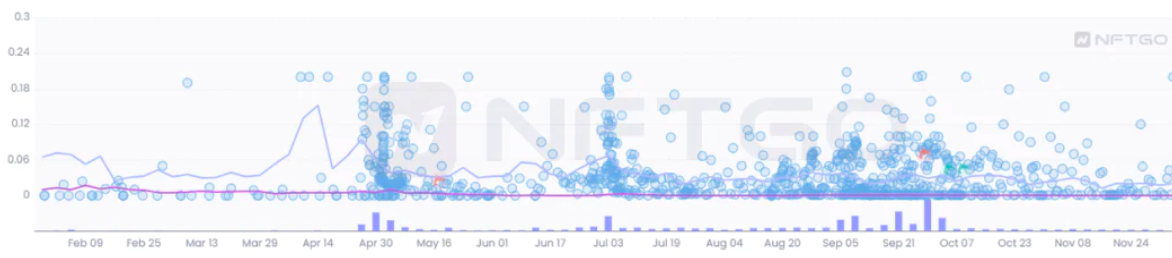

The picture above shows the market trading volume and the sales volume of giant whales. By comparison, it is found that when the NFT trading volume of this year was at its peak, the giant whales all had huge trading behaviors, such as January 31, April 3, and May On the 1st, they all sold NFTs before the market's downward trend, and caused panic selling in the market, resulting in a "stampede effect". Before the market is at an inflection point, giant whales often carry out corresponding operations more decisively to avoid risks, which usually attracts more users to follow and gradually enlarge the market situation.

Among them, around May 1, the giant whales sold nearly 20 million NFT assets, and then the NFT market also entered a long bear market. It is not so much that they acted ahead of the market, as it is their behavior that affected the market trend. , Changing the order of market transmission into "giant whale operation-retail investor operation-triggering the market".

image description

Daily inflow and outflow trends of giant whale funds (Source: NFTGo.io)

image description

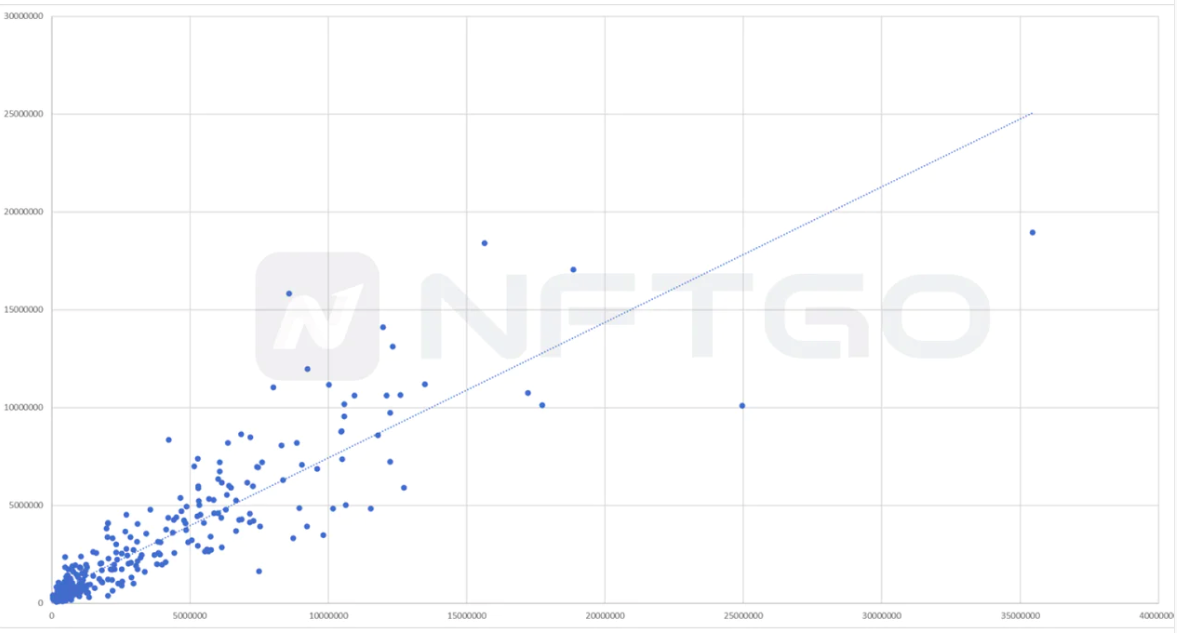

Buy/Sell Volume Scatter Chart

Among the giant whales that have made profits this year, many of their trading records show that their trading strategy is to buy quickly and sell quickly, and many even buy on the same day and sell on the same day, and this feature is more prominent in the second half of the year when the market conditions are not optimistic.

likepranksy.ethimage description

https://nftgo.io/account/ETH/0xd387a6e4e84a6c86bd90c158c6028a58cc8ac459/NFT

Whale Investment Preferences

Long-term blue chips + short-term hot spots

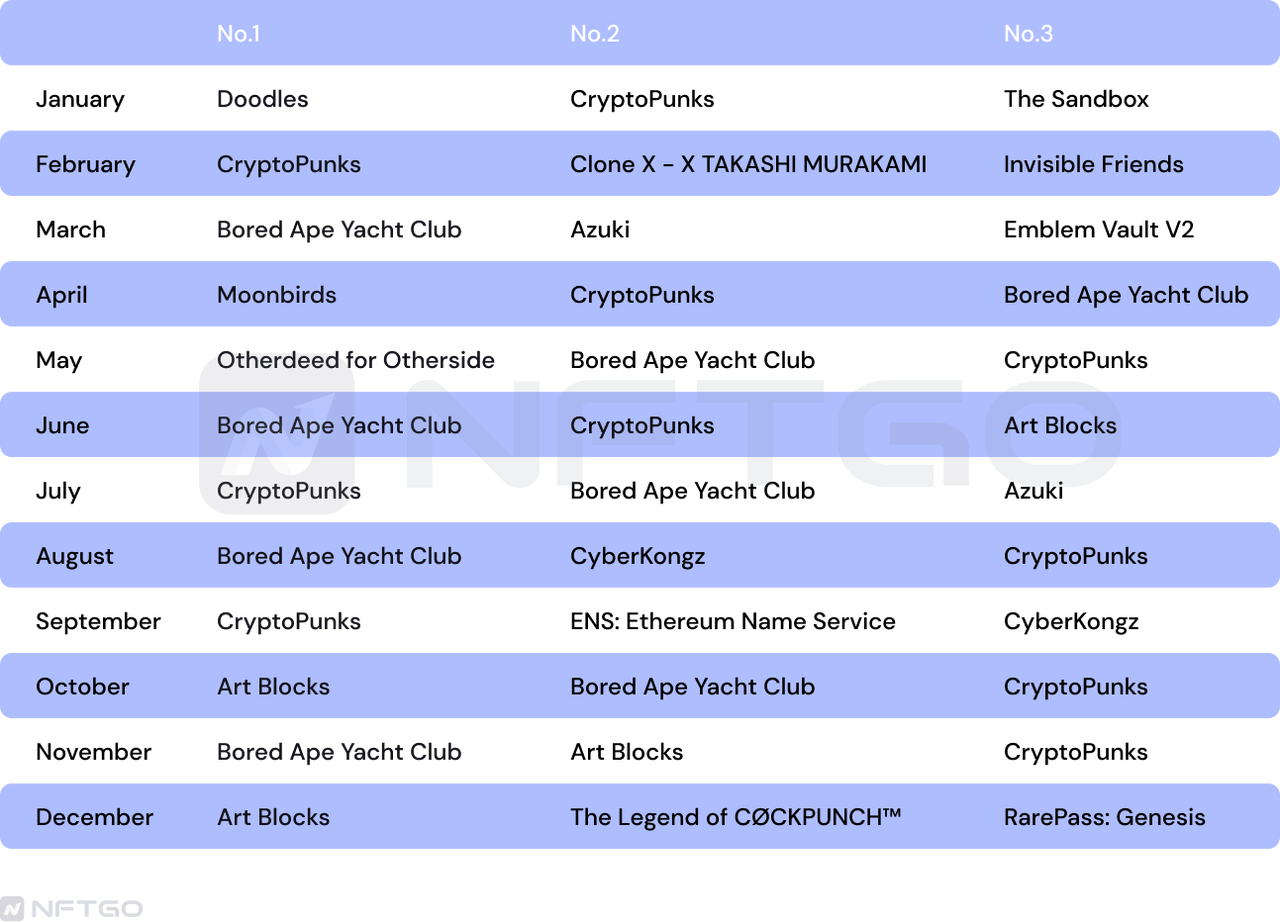

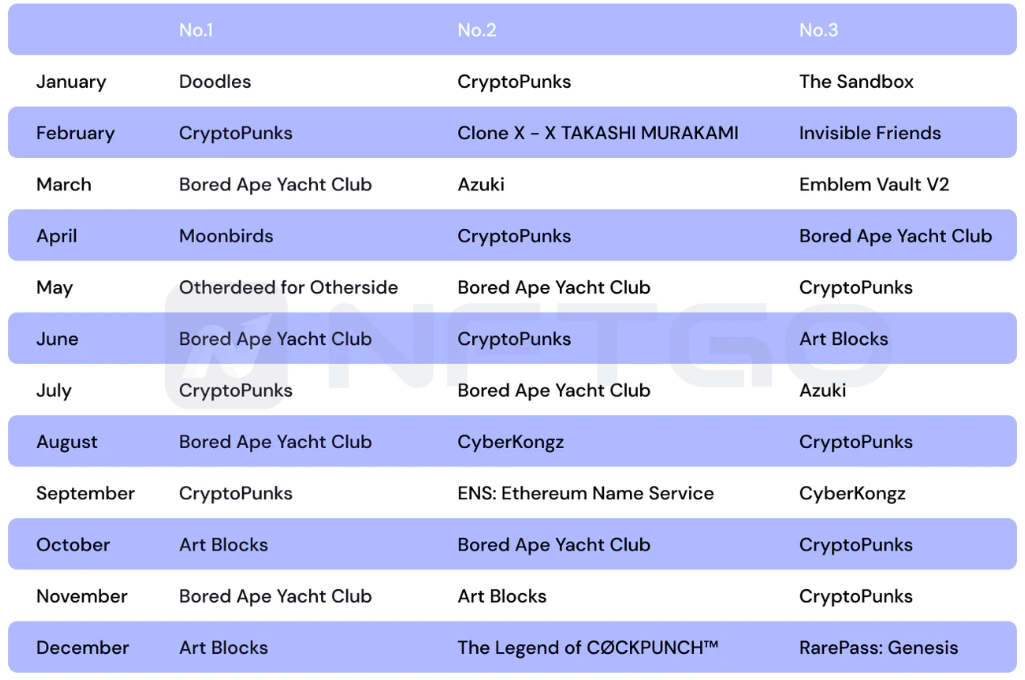

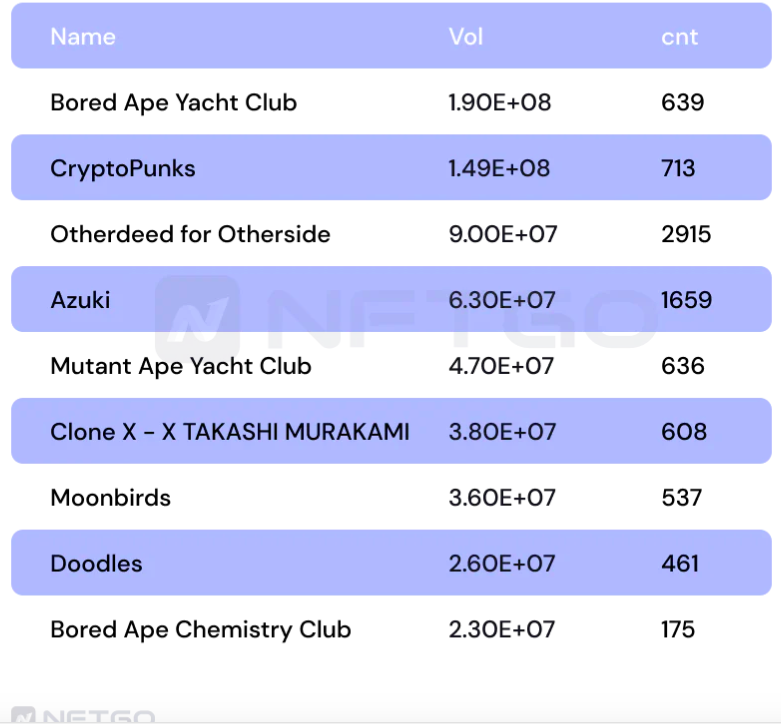

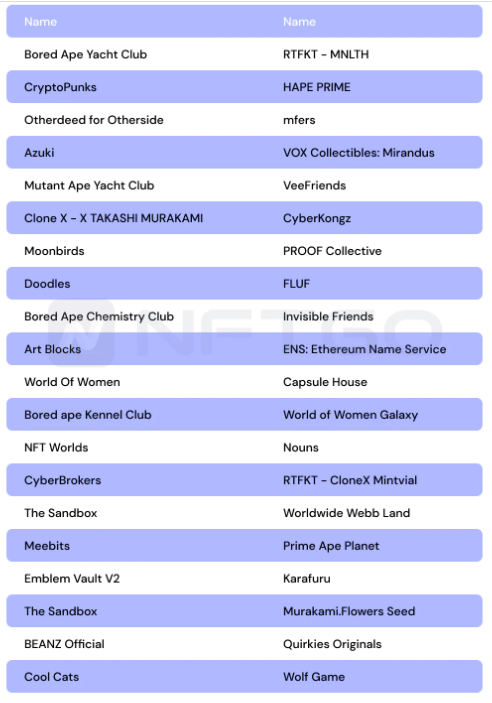

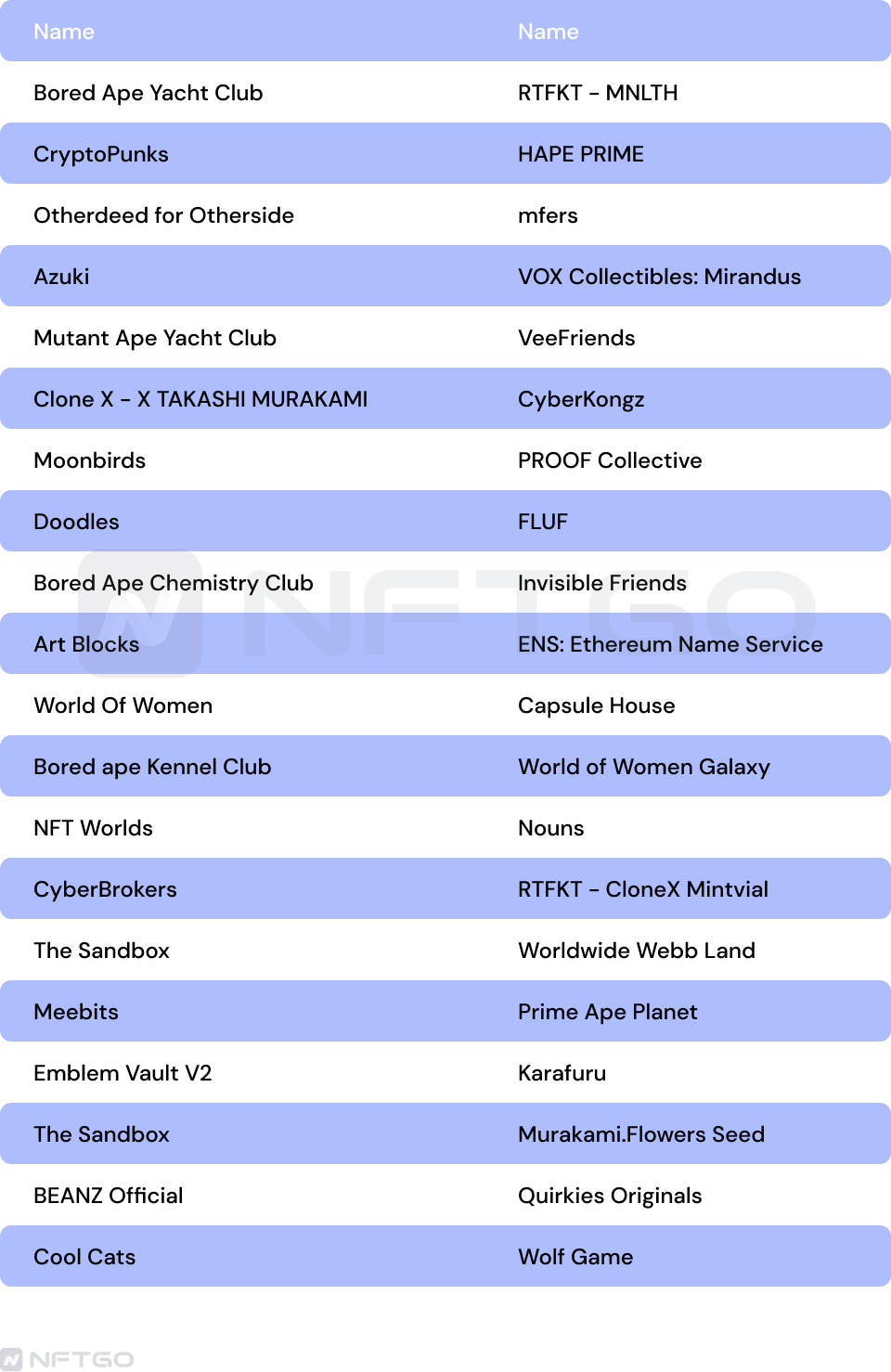

The above picture shows the NFT statistics of the top 3 giant whales buying funds in each month of 2022. We can find that the preferences of giant whales are divided into two categories from the capital trend. The first category is long-term purchased NFTs: such as CryptoPunks, Bored Ape Yacht Club, and the second category is NFTs that detonate the market in the short term: such as Moonbirds, Otherdeed for Otherside, etc.

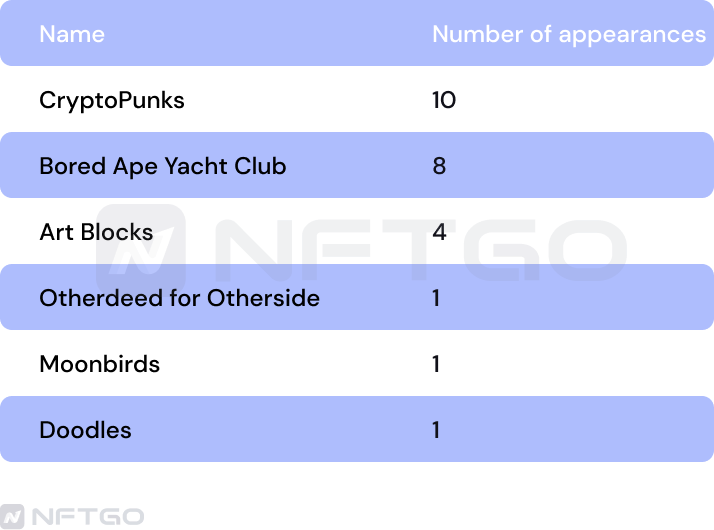

In terms of frequency of occurrence, CryptoPunks appears 10 times in the table, Bored Ape Yacht Club appears 8 times, and Art Blocks appears 4 times. They appear in each month on average, and they are NFTs that whales will give priority to buying every month.

Followed by Doodles, Moonbirds, Otherdeed for Otherside, and ENS are the reference standards for the purchase of giant whales in January, April, May, and September respectively. They also represent the hot categories in the NFT market at that time: PFP, PASS, land, Domain Name.

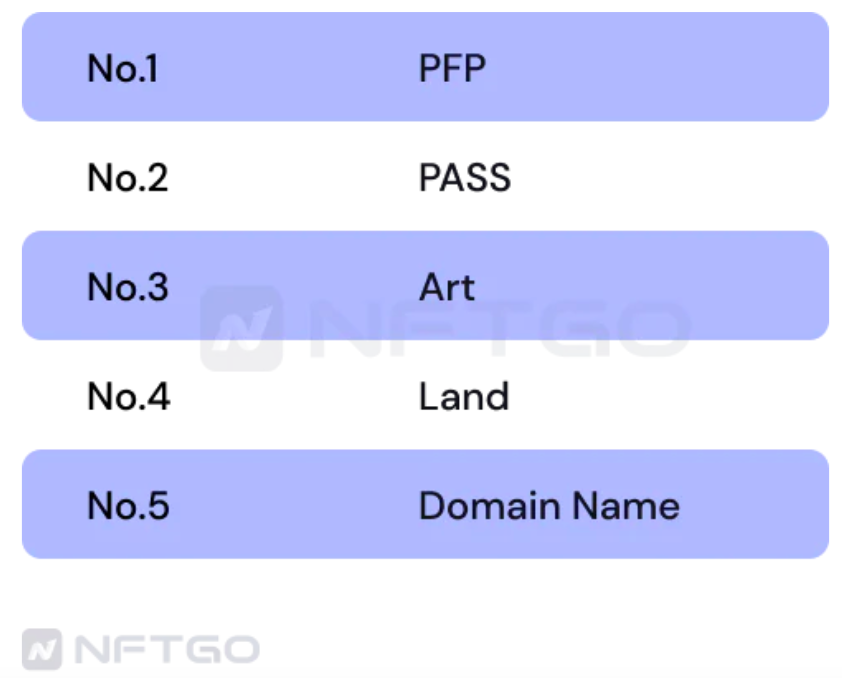

Looking at the investment characteristics of giant whales in terms of categories

By categorizing bought NFT assets, we can come up with the top 5 NFT categories preferred by giant whales. At the same time, we can also see the process of giant whales repeating the real-world consumption and investment concept in NFT.

PFP is still the favorite NFT category of giant whales, accounting for a large proportion of funds of giant whales this year.

The social attributes of the PFP category have allowed some giant whales to form a binding relationship with the NFT they hold. This is reflected in the fact that many KOLs choose PFP-type NFTs as their social avatars. We also found that giant whale accounts will have at least one PFP-type NFT has not had any transactions for a long time, and this group behavior has also allowed some of the giant whale's funds to settle in the NFT market.

The second is the PASS category. PASS cards cater to the preferences of giant whales to a certain extent. Just as the membership cards of celebrity clubs are given to celebrities in real life, this consumption preference also occurs in the NFT market.

Many giant whales' purchases of Art NFTs are more like investments in collectibles. They are mainly selected based on the creator's past works and related backgrounds. Once purchased, they will be held for a long time.

For the purchase of Land-type NFTs, giant whales have more obvious behavioral characteristics, which are generally summarized as hierarchical purchases based on the attributes of the land, such as the distance from certain markers and the resource output of the land. These are more inclined to "real estate "The location and timing of investment should be considered.

The capital movement of giant whales investing in domain name NFTs shows two behaviors. One is to register or purchase a domain name with potential value and hold it until a suitable buyer appears or "domain name monetization". It is to register or buy it for actual use, and use it as a long-term possession.

Favorite NFT Ranking

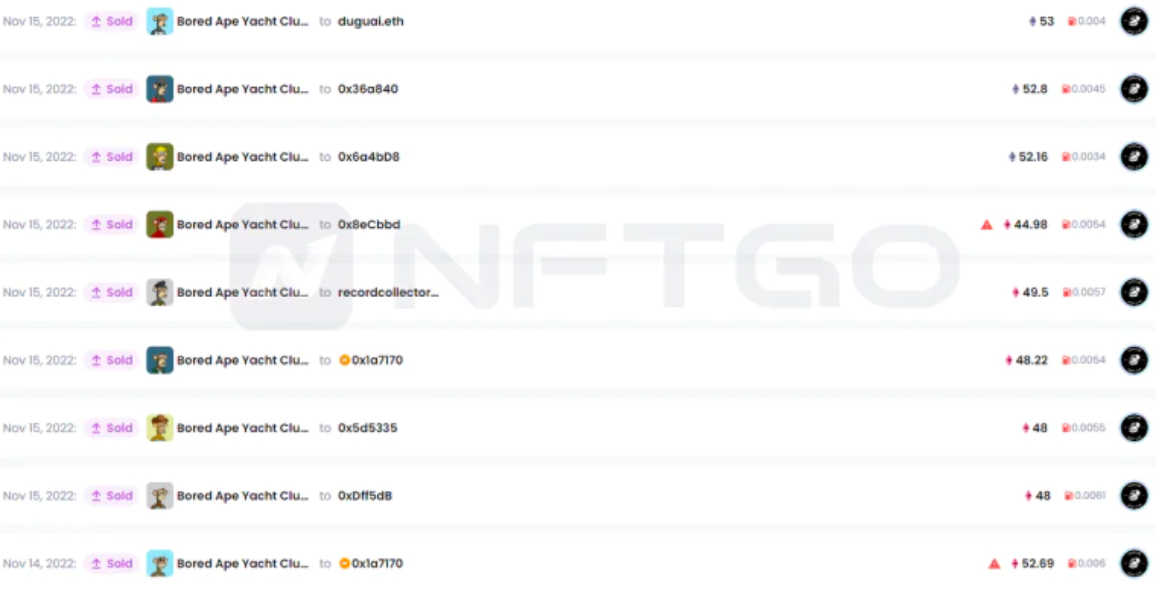

image description

https://nftgo.io/collection/bored-ape-yacht-club/overview

https://nftgo.io/collection/cryptopunks/overview

In addition to blue chips, there are NFTs that giant whales love

The following is the top 40 NFTs sorted according to the funds actually bought by giant whales. We found that in addition to blue-chip NFTs, giant whales are also keen to buy other NFTs.

There is no doubt that giant whales are gaining popularity throughout the NFT world. The number of whale holders is one of the standard indicators for evaluating NFT projects. Giant whales bring capital and reputation to NFT projects, and the leverage of giant whales can accelerate the growth of NFT projects. with the help ofNFTGo.ioWith its whale tracking function, you can ride the wind and waves with NFT whales in 2023.

Disclaimer: The above information is for reference only. Investing in digital assets (e.g. NFTs, cryptocurrencies) carries a high degree of risk. Please consult a financial advisor before making any investment decisions.NFTGo.ioOriginal link