Original title: "Using Liquidity Mining 2.0 (LM 2) to Distribute Rewards》

Author: Henry He

Original compilation: ChinaDeFi

The DeFi craze in 2020 was sparked by the launch of Compound’s governance token, which was entirely driven by the concept of liquidity mining. There is no doubt that liquidity mining has pushed DeFi into the spotlight, allowing more people to see the potential of DeFi relative to CeFi and TradFi. On the other hand, the abuse of liquidity mining and its many unsophisticated token buyers has indeed damaged the reputation of DeFi. For DeFi as a whole, the net benefits of liquidity mining are still up in the air.

There are some novelties in liquidity mining right now, but in general, most projects are simple imitations or direct forks. Even more sadly, there are still many scams in the market.

first level title

Liquidity Mining 1.0 (LM 1) — rewards are distributed based on the size of LP positions

Liquidity mining, in simple terms, is a token incentive program designed to attract liquidity providers (LP) to provide liquidity for specific trading pairs/pools on the AMM.

Synthetix is the first to distribute reward tokens to LPs in its sETH Uniswap pool. To put it in more detail, in order to get rewards, LPs need to first provide liquidity to the sETH pool on Uniswap, and then pledge their Uniswap liquidity tokens to the pledge reward contract created in 2019. Reward tokens will be fairly distributed to LPs based on the percentage of LP's pledged liquidity tokens relative to LP's total pledged tokens.

From the perspective of token economics incentive design, the liquidity mining method pioneered by Synthetix is to allocate reward tokens according to the size of the liquidity position. We can define this method as liquidity mining 1.0 (LM 1). Judging from the results, such an incentive plan has helped Synthetix achieve its goal of attracting more users to mint more sETH.

LM 1 became the de facto design and implementation of liquidity mining. It enables many projects to solve the liquidity problem to some extent, at least initially. However, there are many problems in LM 1 that make it unsustainable.

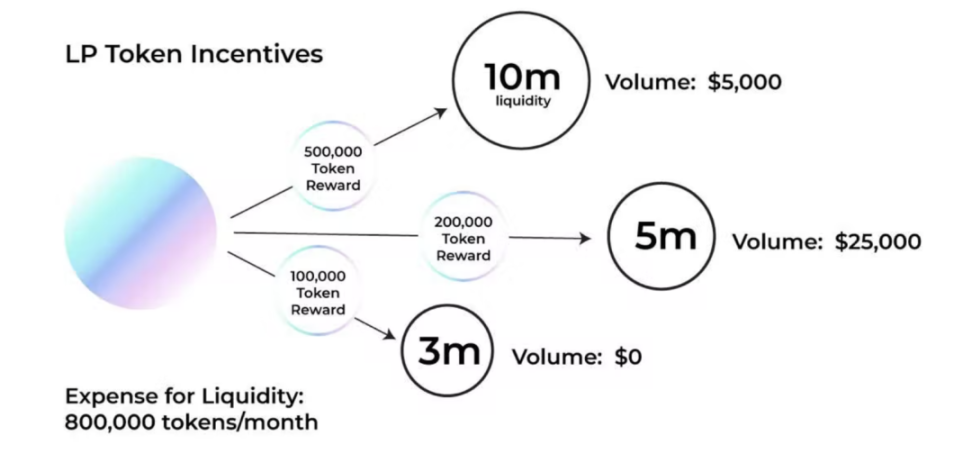

First of all, reward tokens are distributed to LPs, even if there may be no transactions or very few transactions, this actually means that liquidity is not really well utilized. From a tokenomics perspective, using project tokens to incentivize liquidity is expensive for most projects, as this incentive does not contribute much to the growth of the protocol economy. And when liquidity is not being tapped, incentive schemes get worse.

first level title

Liquidity Mining 2.0 (LM 2) - distributes rewards based on fees earned on LP positions

LM 1 can be improved. At present, a better liquidity mining incentive design should be to distribute reward tokens according to the AMM transaction fees earned by liquidity positions. This design is fundamentally different from allocating tokens based on liquidity position size, let us define this approach as Liquidity Mining 2.0 (LM 2). Clearly, LM 2 addresses the two major deficiencies in LM 1 raised in the previous section.

First, LPs will not earn AMM transaction fees if there is no transaction during the fixed token distribution interval. No reward tokens are distributed without fees. Additionally, it discourages LPs from providing more liquidity than projects need. With LM 2, projects do not waste their precious tokens on unused liquidity, reducing token inflation and downward pressure on token prices due to liquidity mining.

first level title

LM 2 implementation: a difficult problem

Typically, a project issues an ERC 20 token (mainly used as a governance token) and allocates a portion of these ERC 20 tokens to a liquidity mining program. During liquidity mining, a fixed amount of tokens are distributed at fixed time intervals.

In LM 1, a fixed amount of tokens per time interval is evenly distributed over the total number of all LP tokens used for liquidity mining. Each staked LP will receive the number of reward tokens based on the number of LP tokens it staked. During this time interval, whenever the number of LP tokens changes, the ratio will be updated accordingly and the rewards will be updated accordingly. This implementation ensures a fair distribution of reward tokens among all LPs participating in liquidity mining.

Unfortunately, distributing a fixed amount of tokens per time interval based on transaction fees charged on LP positions is practically difficult to implement. At fixed time intervals, transaction fees are driven by two dynamic and unpredictable parameters: 1) The timing of LP positions generating and earning transaction fees is dynamic and unpredictable because no one can predict when a trader will 2) The transaction fees generated and earned by LP positions are also dynamic and unpredictable, because the transaction size is also dynamic and unpredictable. Therefore, allocating a fixed amount of tokens based on two dynamic and unpredictable parameters will create an unfair distribution of reward tokens among all LPs participating in the liquidity mining scheme.

One solution is to tune the associated data distribution model for two dynamic parameters—transaction time and transaction size. An on-chain implementation is then developed that dynamically updates the model with each new transaction and distributes reward tokens accordingly. This solution will move closer to a fair distribution of reward tokens among all LPs participating in liquidity mining.

in conclusion

in conclusion

Liquidity mining has pushed DeFi into the spotlight. There are some flaws in the current liquidity mining design and implementation, which lead to the unsustainability of the liquidity mining scheme. We can improve that reward tokens should be distributed based on transaction fees earned by LP positions, not based on the size of LP positions. Distributing reward tokens based on transaction fees is a difficult task due to the current token model and reward distribution schedule. We believe innovative solutions are just around the corner.