1. Summary of Industry Dynamics

Industry News

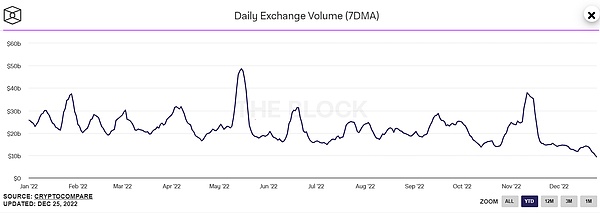

Last week, the encryption market fluctuated sideways, and the trading volume shrank. The current daily spot trading volume of the exchange is less than 10 Billion USD, which is 70% lower than that at the beginning of the year, and the market activity has dropped to freezing point. Bitcoin’s intraday fluctuations do not exceed 5%. As of writing, Bitcoin closed at 16796.95, an increase of 0.35% during the week, with an amplitude of 4.81%%; Ethereum closed at 1210.58, an increase of 2.33% within the week, with an amplitude of 7.39%.

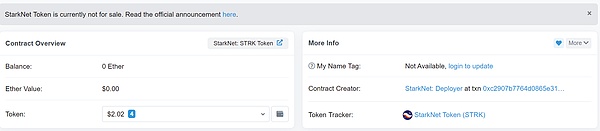

Continuously building in a bear market is the last word. Layer 2 in the infra sector, which is currently most favored by capital, made new progress last week. The first is that Optimism is testing the functions of its infrastructure Bedrock and will migrate the testnet on 1/12. Bedrock is a Rollup architecture that reuses Ethereum code, infrastructure and design patterns on a large scale. As a "clone" of Ethereum, it can It is as well compatible with the ecology of Ethereum as EVM, and provides advantages such as reducing transaction costs and increasing throughput. At the same time, the star L2 project StarkNet also began to officially deploy the contract this week, and the airdrop of its token STRK should be carried out in the near future. The current team has conducted multiple small transfer tests on Ethereum.

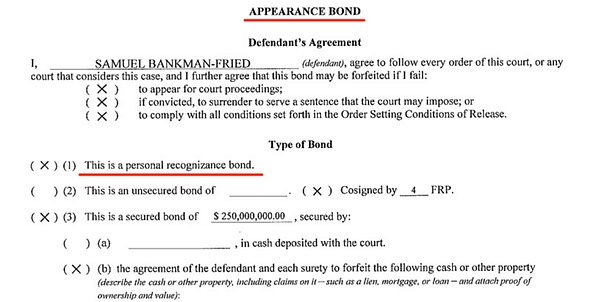

Last Wednesday, U.S. time, SBF returned to the U.S. and was detained by the FBI after accepting the extradition terms. On Friday, a New York judge approved a bail of up to 250 million U.S. dollars. ex-bail. The security deposit of SBF is in the form of Recognizance, which will be guaranteed by four guarantors, at least one of whom is not a family member of SBF. At present, only the parents of the guarantors have signed. SBF's court appearance is on 3rd January 2023, if he can appear in court on time, the surety will be exempted from paying this bail, and if he commits any violations during the SBF or fails to appear in court on time, the surety will be backed with this huge bill. Currently, SBF has returned to her parents' home in California and will be grounded there, along with other prohibitions such as wearing an electronic monitoring bracelet, limiting consumption and attending events.

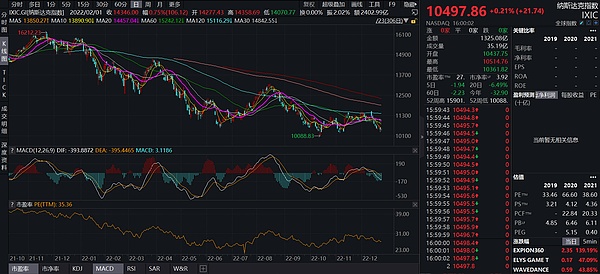

On the other hand, last week was the last week before the Christmas holiday, and the legendary Santa Claus market did not appear this year. From the perspective of historical records, in the last few trading days before the end of the year, there is always a high probability that US stocks will perform strongly , this rule will also have a performance of nearly 6% in 2021. However, this market did not continue last week. The Nasdaq reached 10313 at its lowest level during the week, and came to the lower track of the rectangular arrangement. Overall, the performance was relatively weak, and the market lacked the motivation to rise. Last Friday, it was announced that the PCE price index in the United States in November increased by 5.5% year-on-year, which was flat with expectations and lower than the previous value of 6%, which was the fifth consecutive month of slowdown, while the core PCE increased by 4.7% in November, slightly higher than expected It was 4.6 percent, a slowdown from the previous 5.0 percent and lower than the 4.8 percent forecast by the Federal Reserve in December. Fed officials expect the core PCE to fall to 3.5% by the end of next year, so the Fed is expected to keep raising rates until inflation falls to a satisfactory level. This week is the last trading week of this year. It coincides with the Christmas holiday and New Year’s Day. There are only four days of U.S. stock trading. No surprises, there will be no new lows. The market will face the market in 2023 at the low point of the year.

industry data

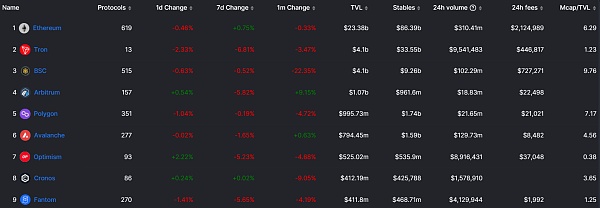

1) Public Chain & TVL

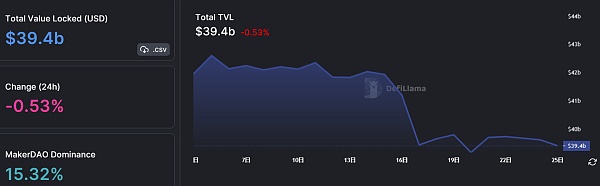

As of December 25, the overall lock-up volume of each public chain denominated in US dollars has not changed much, falling to 39.4 B from 39.73 B last week.

The TVL of each public chain has declined to varying degrees this week, and the ranking has not changed much. Among them, the TVL of Tron has relatively large decline.

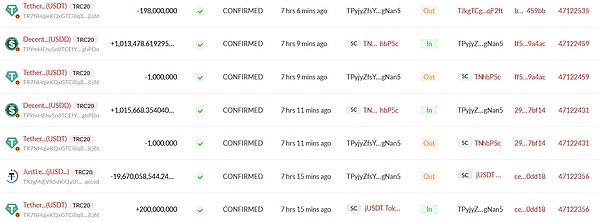

The decline in Tron’s TVL this week is mainly due to the decline in the deposit size of the lending agreement JustLend. On-chain data shows that Sun Yuchen withdrew 200 million USDT from JustLend on December 25, of which 2 million USDT was used to purchase USDD on SunSwap, and the remaining 198 million USDT was transferred to the Binance hot wallet.

Justin Sun tweeted the deal as a "Christmas gift."

However, Tron’s algorithmic stablecoin USDD has been de-anchored since the FTX incident (Alemeda was one of the early whitelisted issuers). Due to the insufficient actual stablecoin reserves of USDD, the market is worried that USDD and TRX will experience a death spiral similar to LUNA-UST. This concern has also led to Tron's recent TVL decline.

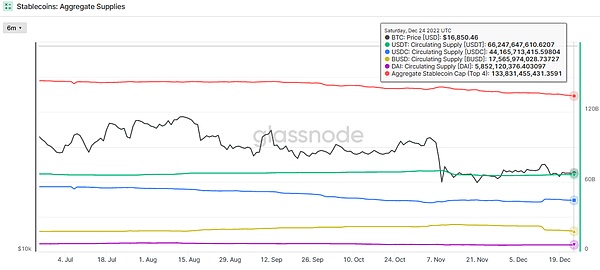

2) Stablecoins

As of December 24, the total supply of the top four stablecoins (USDT, USDC, BUSD, DAI) was approximately 133.831 billion, a significant decrease of approximately 1.421 billion (-1.05%) from 135.252 billion a week ago. The supply of stablecoins has fallen for six consecutive weeks, and funds have shown a continuous outflow trend, and the decline has accelerated again this week.

Among the three major legal currency stablecoins this week, the supply of USDT rose slightly by about 196 million pieces this week, and the rebound momentum continued; USDC’s supply decreased by about 752 million pieces this week after the supply increased by 2.2 billion last week. However, after a large outflow of 3.6 billion BUSD last week, the downward trend has slowed down this week, with a decrease of about 876 million. The supply of both USDC and BUSD has decreased. It is speculated that last week may be affected by Binance FUD. Users chose to convert a large amount of BUSD into USDC for withdrawal, and this week these funds began to be exchanged for fiat currencies.

DAI, which is the leverage of ETH, has ended its short-term upward trend and has not changed much this week, which corresponds to the trend of convergence of market fluctuations, and the enthusiasm for long funds on the market is not high.

On the whole, the shortage of market liquidity has intensified. Affected by the negative events of the exchange, a large amount of funds chose to withdraw from the encryption market. It is expected that the market will remain volatile and bottom out in the future until confidence is re-established or macro liquidity improves.

2. Macro and technical analysis

From a macro perspective, the market is facing the suppression of risk appetite due to high interest rates in the coming year, resulting in general market liquidity. At the same time, the market is still affected by the negative aftershocks of FTX and Binance Exchange, and short-term market preferences are difficult to rise.

At present, the overall trend of BTC is weaker than that of ETH

Two-Year Treasuries Change to 4.33

Nasdaq is likely to drop to the previous low

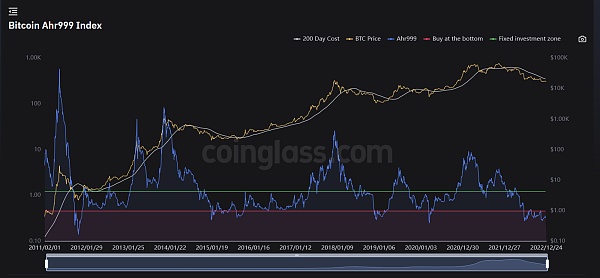

1. Ahr 999: 0.32, you can make fixed investment

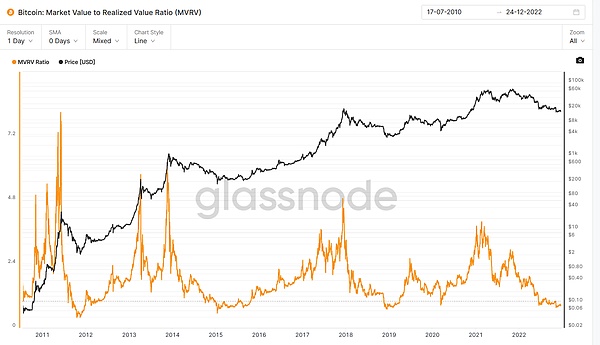

2. MVRV: 0.844, cost performance is the same as Ahr 999

Number of BTC addresses: The number of addresses holding more than 100 coins began to slow down gradually

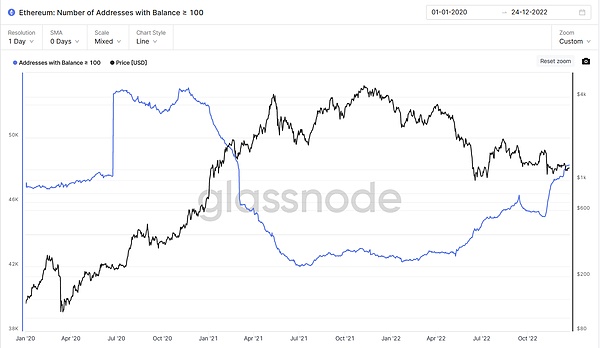

Number of ETH holding addresses: The number of addresses holding more than 100 coins is also beginning to slow down

3. Summary of investment and financing

Investment and financing review

During the reporting period, the scale of financing and the number of projects were sluggish. There were only 8 financing projects disclosed, with a total financing amount of US$30.2 million;

During the reporting period, there was no project with a financing scale exceeding US$1,000.

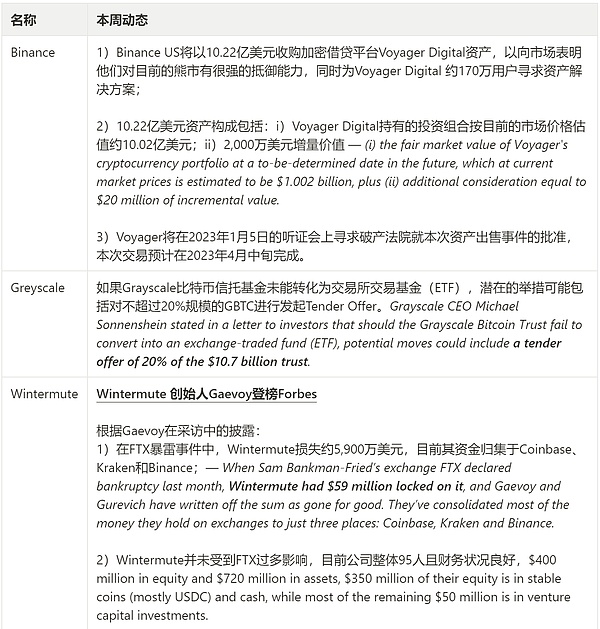

Institutional dynamics

4. Encrypted ecological tracking

1. NFTs & Metaverse

(1) NFT market this week

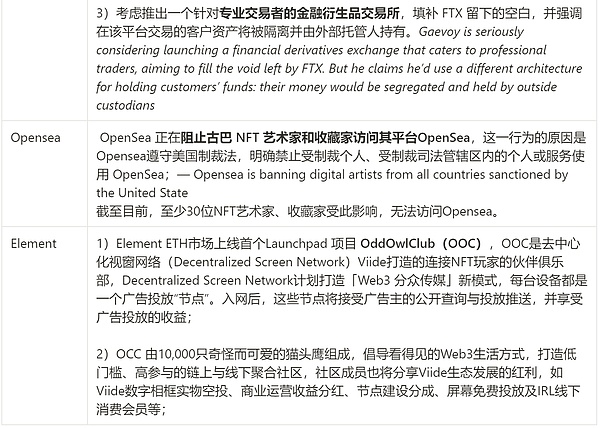

Market overview: This week, the NFT blue chip index has risen slightly compared to last week. As of December 23, the market has generally recovered, but the nft market is still at the freezing point of a bear market, and the nft blue chip index has risen in the middle of the week , the overall situation has not changed significantly, and the market is still in the recovery period.

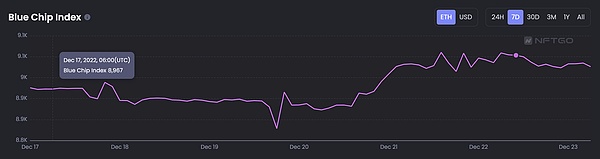

This week, the total market value of the NFT market had a significant increase before Christmas, up 5.9%. The total transaction value has declined from last week's 95% increase, but it has remained at a relatively stable position. The steady increase in the total market transaction volume also shows that the nft market has shown some signs of recovery.

The holders of the NFT market have not changed much this week. The activity of traders has increased to a certain extent compared with last week (+ 8.66%). Buyers have increased by 9.58% compared to last week, and sellers have increased by 9.44% year-on-year. Overall, , The performance of the market this week is still good.

The top three NFTs in the market trading volume this week are BAYC, BAKC, and MAYC, all of which are taken over by the Boring Ape family.

The top three NFTs in the market trading volume this week are BAYC, BAKC, and MAYC, all of which are taken over by the Boring Ape family.

A 2.5% royalty will be charged for the restart of the BAKC series of NFTs. The floor price of BAKC series NFT has risen by about 42.2% in the past three days, and the current floor price of this series on OpenSea is 8.7 ETH. The floor price of BAYC has not changed much at present and remains around 67 ETH.

(2) This week's dynamic focus:

a. Jellyfish NFT - Aquarium de Paris Paris Aquarium NFT

The Paris Aquarium (the oldest aquarium) and the Metaverse Metaseum have teamed up to launch an NFT series based on real jellyfish in the aquarium. The Paris Aquarium not only has the second largest collection of jellyfish in the world, but the NFT series it launched is also the first NFT project based on science and marine life, with a total of 1,234 issued at a price of about 0.18-0.2 ETH.

NFT design:

This collection of jellyfish contains 60 random assortments modeled from 3D jellyfish. Each one is presented in the form of a moving picture and matched with 24 unique ocean backgrounds. The most important thing is that the characteristics of each NFT are reproduced 1: 1 based on the real jellyfish in the aquarium. Each jellyfish NFT design has also been verified by a local marine biologist. The marine biology team has verified the Latin name, shape, tentacles, family and genus, danger index, geographical location and age of jellyfish in the collection. Since the characteristics of jellyfish will be permanently stored on the blockchain, this also makes the Paris Aquarium the first collection in history to use metadata to classify the scientific characteristics of creatures as NFTs. This marks a new marriage of biology and technology.

Owner's rights:

Unlimited free entry to the aquarium and discounts on in-store merchandise;

Free access to future events at the aquarium (private dinners, networking receptions, etc.);

Collectors can also unlock invitations to VIP events, access to exclusive science content, and connect with the aquarium's biologists, such as Meet the Biologists.

Collectors will also be invited to participate in the metaverse space that the aquarium will build later, and enjoy future fringe benefits.

NFT holders also have the opportunity to actively participate in the management of the aquarium.

The project also hopes to take this opportunity to build a Web3 community of sea world, Web3 and art lovers.

b. Football Ape Fan Club Legendary Football NFT Collection

Football Ape Fan Club (FAFC) is a collection of NFTs on the Ethereum blockchain inspired by legendary football players from around the world. The series aims to create a sports metaverse. In addition, FAFC holders will get a whitelist of four sports-related NFT projects that will be launched later for free within one year, and have the opportunity to receive short positions on four projects. These items include Baby FAFC, Mutant FAFC, NFL NFT and NBA NFT.

How to get FAFC NFT?

The casting process took place in four stages and a total of 7,910 FAFCs were issued in tribute to iconic football players, with the numbers 7, 9 and 10 being legendary players' numbers and being the rarest. Each stage has different quantities and different prices of NFTs.

The first phase will launch 2,500 FAFC NFTs at 0.04 ETH each.

Phase 2 rolls out another 2,500 FAFC NFTs at 0.06 ETH each.

In the third phase, 955 FAFC NFTs will be launched, each at 0.08 ETH.

In the fourth phase, 955 FAFC NFTs will be launched, each with 0.1 ETH.

The Football Ape Fan Club project is also similar to many recent crazy projects. With the help of the popularity of the World Cup, it wants more groups interested in football and sports to do some impulsive consumption related to NFT. FAFC also hopes to create a sports The original universe and use this as an interface to provide various sports-related NFT items. It also provides users with the ability to participate and collect nft works related to sports. But now that the World Cup is over, it remains to be seen whether such projects can continue to develop soundly and continue to provide benefits to the community.

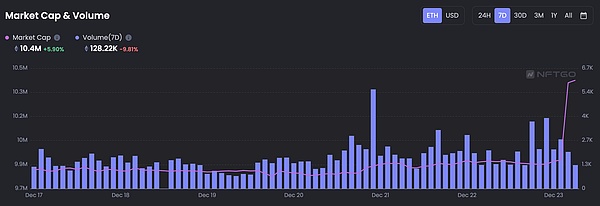

(3) Key project: Invisible Friends

Project Introduction:

Invisible Friends is a collection of 5,000 randomly generated motion pictures featuring invisible characters that differ in backgrounds, accessories, eyes, limbs, clothing, and more. It's perfect for streetwear lovers and fashion-conscious users. Each NFT presents an animated GIF of the continuous walking motion. The design team of the project also mentioned that each NFT has to draw about 40 pictures, and there are more rare ones. The series of animations are highly narrative and lively and interesting, and the characters are made more alive through character modeling. It also reflects the hard work of the project team.

The floor price of Invisible Friends soared to 12 ETH on the day it opened on February 23 this year, and the increase was 43 times when it went online, and it was directly pulled to the blue-chip level. At present, the market value of the project has exceeded 50 million US dollars, and the total transaction volume has exceeded 70 million US dollars.

Some of the most traded pieces in the NFT series include Invisible Friends#1125 (200 ETH), a look featuring a crime scene, with white lines and accessories like wrapping tape that are unique to the series.

The highest priced Invisible Friends, "Golden Friends", was sold for 496.69 ETH, setting the highest transaction record for the series, and the auction proceeds were donated to the RCC Charity Fund. The winner of the auction also received five undisclosed Invisible Friends NFTs.

Whitelist contention:

The whitelisting "struggle" for Invisible Friends is intense. Before the release of the project, there were more than 500k active users in the Discord server, and nearly 300k Twitter followers. It is very difficult to get the whitelist of this project.

Half of the 5,000 NFTs are reserved for holders of the RCC project team’s previous NFT collections, projects like SlimHoods and MoodRollers; the other half is allocated to early supporters and active community members. In order to get the whitelist, many community members not only completed every task in the community, some members also designed many derivative products for the project, and even made a first-person game of invisible friends.

Why did Invisible Friends succeed?

Strong team, outstanding work

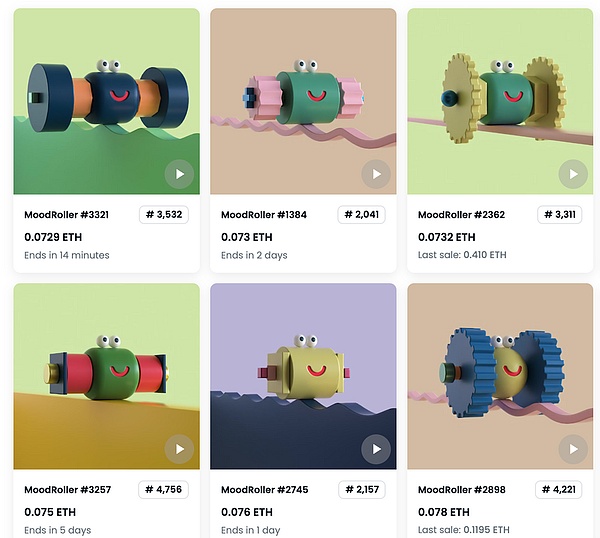

First of all, Markus Magnusson is well-known and has more than 210,000 fans on Instagram. He has cooperated with Google, YouTube, etc. before. His animations are creative, appealing, and spiritual. The two projects behind the team RCC, Slim Hoods and Mood Rollers, are still popular, and the transaction volume on OpenSea is more than 9000 ETH.

SlimHoods is a collection of 5,000 animated NFTs of characters wearing hoodies, hoods, or hats, with a current floor price of 0.7 ETH.

MoodRollers are 5,000 continuous rolling characters on different metal sheets, which are designed based on rollers.

Effective marketing strategy

The whitelist distribution method is also relatively fair and widely spread. Every time the competition initiated by the project party is very hot. In addition, the viral popularity on Instagram and TikTok is very high (15 million times).

Invite big names to cooperate: The famous American rapper Snoop Dogg bought Invisible Friends #4963 with 5.9 ETH, and released the music NFT with #4963 as the background on Twitter, limited to 500 pieces in total.

NBA star Kyrie Irving also bought Invisible Friends#4818 for 8.5 ETH to join the Invisible Friends family.

Future benefits: Invisible Friends have announced their partnership with Kith, and they will not only launch a brand new nft. Holders will also receive a physical version of the clothes worn by the corresponding Invisible Man. Try to forge the connection between entity and nft.

The RCC team will also launch a series of 3D toys for invisible people, which will reproduce 5,000 online nft works in a physical form 1:1.

2. GameFi blockchain games

Petroleum is a Gamefi project running on Arbitrum. Players can buy land, mine, refine oil, buy other concessions, guess future oil prices, etc. in the game.

As of writing, 1,800 game players have been accumulated, and a total of 2,231 plots and 1,279 oil pumps have been developed.

How to play:

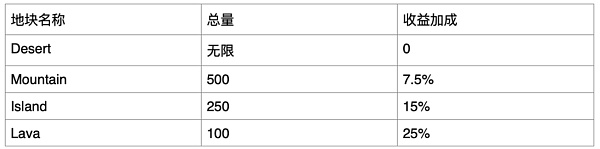

land:

The land type determines the potential income that may be obtained. There are currently four types of land: Desert, Mountain, Island, and Lava. The respective game parameters are as follows:

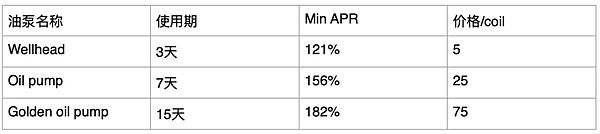

Oil pump:

Players must buy an oil pump to play the game. The oil pump itself has durability. When the durability is exhausted, the player needs to spend money to repair it, otherwise it will no longer produce oil; the oil pump will also block after the output reaches the upper limit. If the oil is not collected in time This will lead to a decrease in subsequent production. There are currently three types of oil pumps: Wellhead, Oil pump, and Golden oil pump. The respective game parameters are as follows:

control tower

Increases oil output by 5%. Only one can be built per land.

oil tanker

Store the extracted oil to buy more in-game items, enrich the experience and increase the later income.

refinery

Originally mined Coil cannot be used for circulation and exchanged into legal currency, and must be converted into OIL through an oil refinery for circulation transactions.

Token Economics:

There are two main token modes in the game - $oil and $Coil. The functions of the two are as follows:

In short, both can be used as in-game currency to purchase items, the only difference is that COIL needs to be refined into OIL before it can be circulated and traded into legal currency.

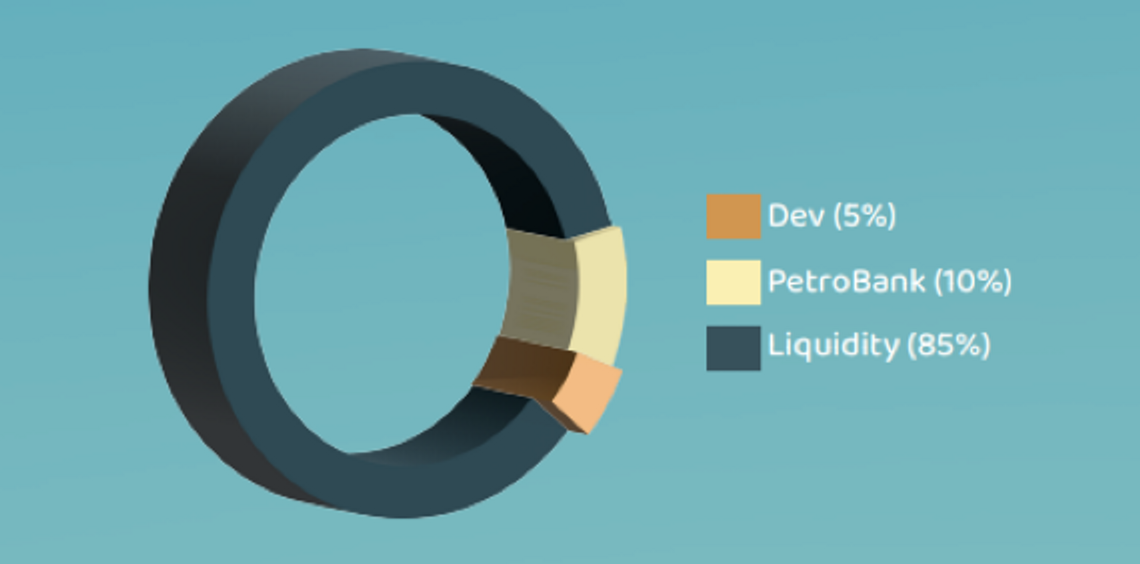

The $OIL token will start with an initial supply of 920,000 and the distribution will consist of:

$COIL will have an initial supply of 1 million, 95% will be sold in the pre-sale and 5% will be used for airdrops.

The price movement of $OIL/DAI is as follows:

Summary evaluation:

The game itself has limited playability, and the playing experience is somewhat similar to the early QQ farm, but the props in the game are far less rich than the former. Compared with other Gamifi, the entry threshold of the game is diverse, which can adapt to the participation of players with different profit expectations. What is important is that Petroleum's initial return on investment is relatively appropriate, and the consumption scenarios of tokens in the game are diverse, so that the project will not cause the early profiteers to leave the market due to excessive short-term returns and bring great selling pressure to the market.

3. Social&DID&DAO

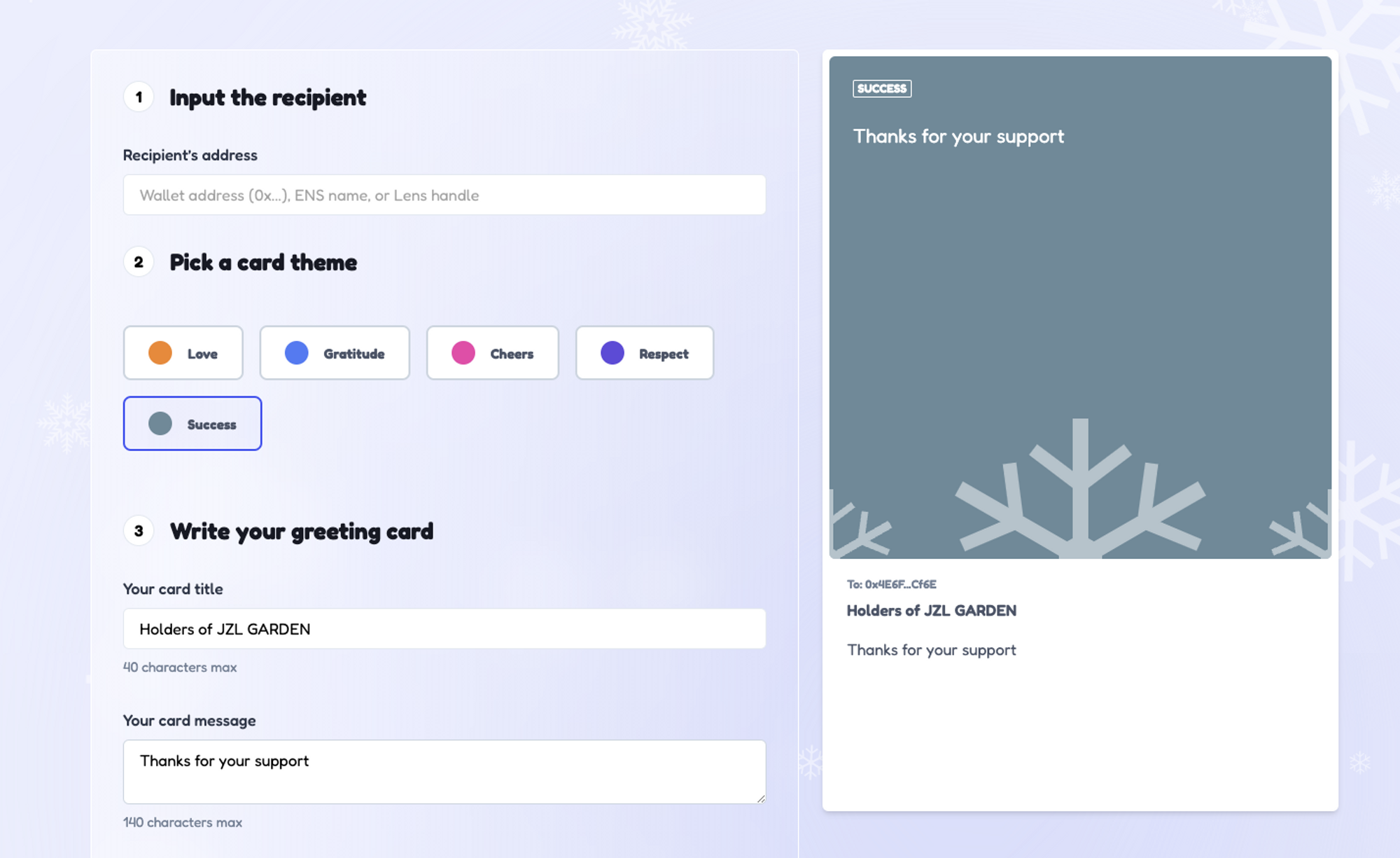

Soulflake is a Web3 greeting card application developed by ConsenSys Innovation Lab on the Polygon chain.

The word Soulflake is a combination of Soul (soul) and Snowflake (snowflake). The former Soul represents the NFT greeting card sent with soulbound characteristics, and the latter Snowflake is the logo and main theme of this platform.

Greeting cards can be issued to users through wallet address, ENS, LENS, and red envelopes with a fixed amount can also be sent.

The dApp is free to use, but it requires senders to pay a small amount up front as an anti-spam mechanism.

After sending, the greeting card will appear in the user's wallet as an NFT. Due to the characteristics of soul binding, the greeting card cannot be traded, but for unwanted greeting cards, users can choose to burn (burn).

5. Team news

JZL Garden Progress

This month, JZL Garden has launched the first NFT series "Dandelion" of the Garden project to the Upstairs platform, and it was completely sold out within one hour of the public sale. This is an important milestone moment for JZL Garden, thank you for your witness.

Last week, we collected the wallets and mailboxes of the Holders of the first phase of JZL GARDEN project "Dandelion", and have started to continuously empower the Holders.

External cooperation: discuss cooperation plans with Bybit, OKX, Element NFT, and Binance NFT

about Us

about Us

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment. The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.