main points

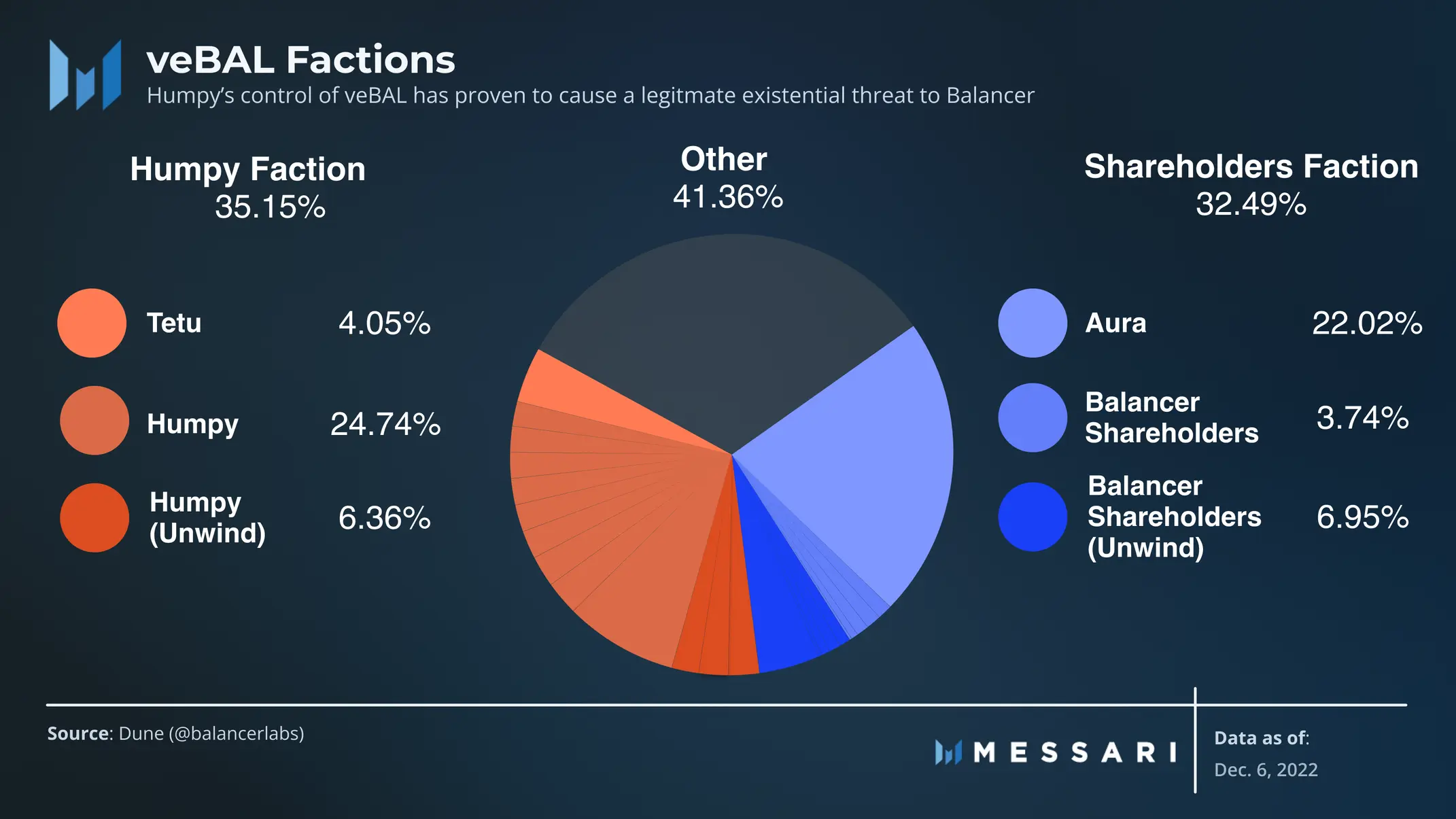

Balancer introduces voting escrow tokenomics, aligning token holders with the success and revenue of the protocol. While the veBAL experiment attracted partners, it also attracted a whale called Humpy, who amassed 35 percent control of veBAL.

Over the past eight months, Balancer has been working to align Humpy’s activities with the DAO’s goals through incentives, rather than getting caught in a cat-and-mouse game of governance to rein in the profit-seeking activities of whales.

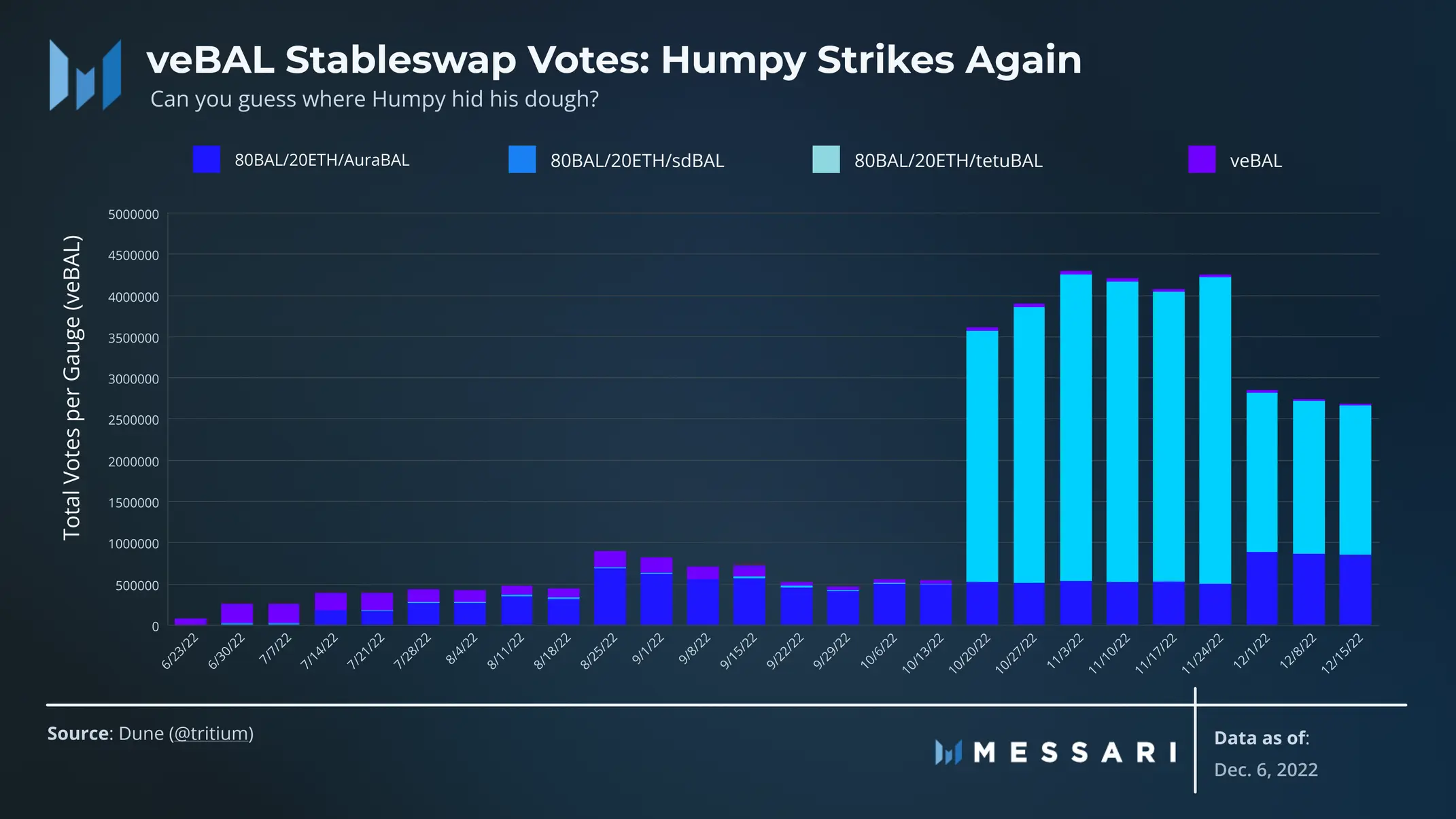

Over the past eight months, Balancer has been working to align Humpy’s activities with the DAO’s goals through incentives, rather than getting caught in a cat-and-mouse game of governance to rein in the profit-seeking activities of whales.80 BAL/20 WETH/tetuBALdue to

With positions in the Balancer pool illiquid, Humpy chose to double down on protecting their mining strategy from Balancer governance, resulting in an escalation of conflict in the Balancer ecosystem.most recent itemAiming to reach a gentleman's agreement and defuse the conflict, allow Humpy to continue limiting their most aggressive mining sizing strategy at 17.5% in exchange for Humpy aligning with the DAO strategy in all other positions.

Introduction

Introduction

This is a story about two factions of voters, each with conflicting views and intentions, fighting for control of the future of the Balancer protocol.

On one side are Balancer stakeholders (including BAL holders), core community and team members, and strategic partner Aura. They hold onto their idealistic vision for the Balancer protocol and hope to align Balancer token voters with the protocol's revenue generation.

On the other side are Humpy, the veBAL whale, Tetu, and a member of the Balancer community named Andrea. They are ignorant of protocol revenue but are savvy players in the veBAL game. They exploit the veBAL incentive framework to gain personal gain by executing clever, but potentially harmful strategies.On December 1st, Balancer was released"Peace Treaty"

proposal, an escalation in an attempt to reconcile the actions of all parties. This has become a bitter power struggle and a necessary case study in DAO governance, token economics, and design incentives.

Getting Started with veBALCurveVoting Escrow Tokenology is

veBALAn incentive adjustment mechanism launched in 2021. In early 2022, Balancer adopted this approach to attract liquidity providers (LPs) to the protocol and align token holders with the success of the protocol through revenue shares.

It is the governance token of Balancer, obtained by locking 80 BAL/20 ETH Balancer pool tokens (BPT). veBAL holders can release BAL to LPs or themselves, gain governance rights, and accumulate part of the protocol revenue.

Theoretically, the voting escrow incentive structure creates an incentive flywheel where partners can create shares in the Balancer community (veBAL), incentivized by token release to direct liquidity to LPs of their tokens. In turn, the transaction volume of these projects generates income for Balancer and other veBAL holders.

There are no bad actors, only bad design

In practice, veBAL is agnostic.Non-aligned actors pooling veBAL can direct token release to themselves (up to 10%) or to non-productive liquidity pools. It is reported that,the third quater

The amount of BAL released is more than 10 times the value of the revenue share sent to veBAL holders. Without safeguards or a high enough price wall to prevent accumulating BAL for its own benefit, the system invites a parasitic flywheel, where participants can use their veBAL holdings to steer the release of tokens to themselves LP positions in illiquid and low volume pools. This way, they are able to accumulate compound voting power with little reward flowing to the protocol/DAO. If successful, release siphoning concentrates governance power, distributes inflationary payouts unproductively, and rewards bad behavior.This creates a "whack-a-mole" phenomenon in Balancer governance, as Balancer stakeholders race to proposeRecommendations, Incentives and Strategies

, to limit extractive behavior from inconsistent parties.

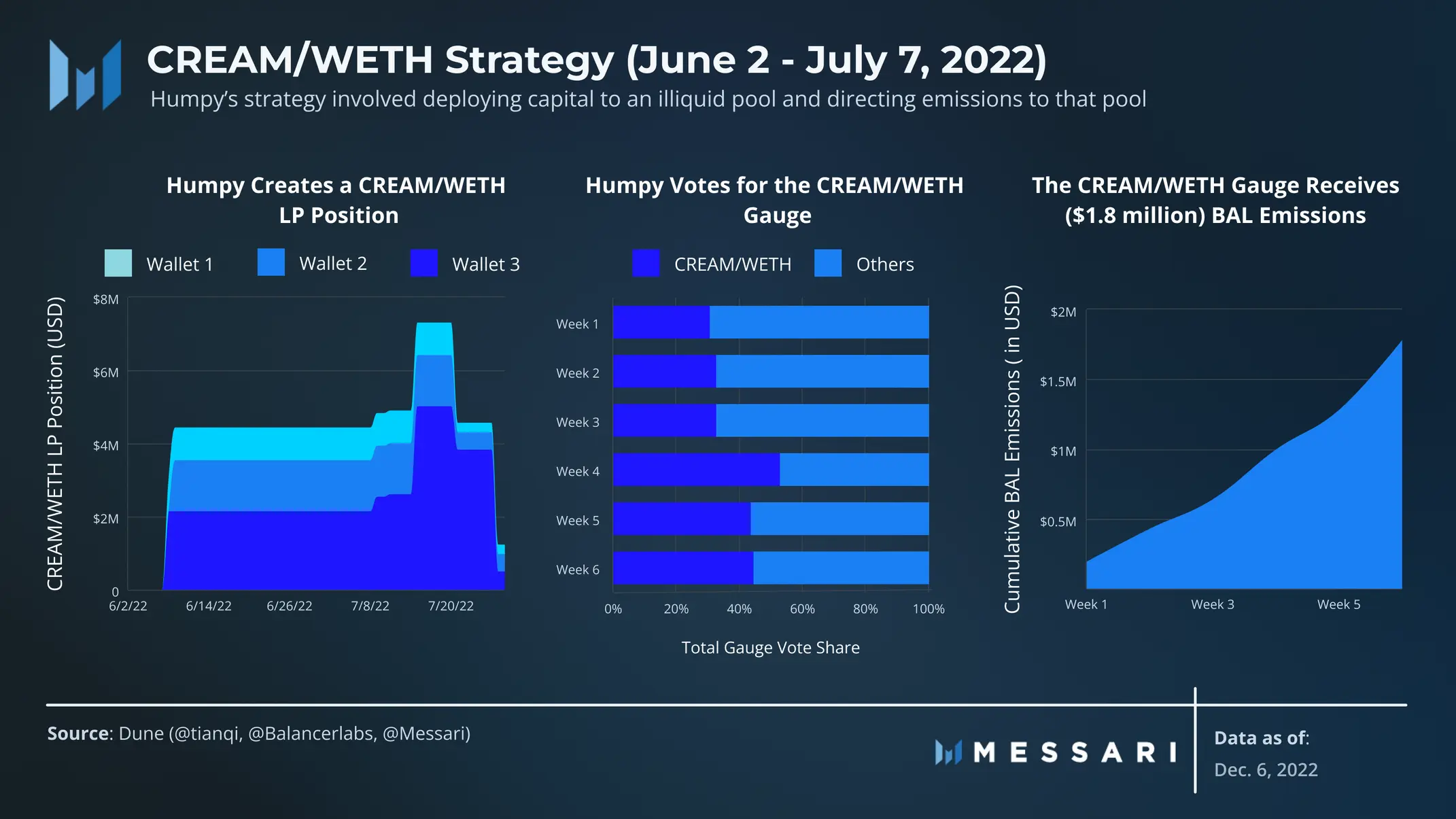

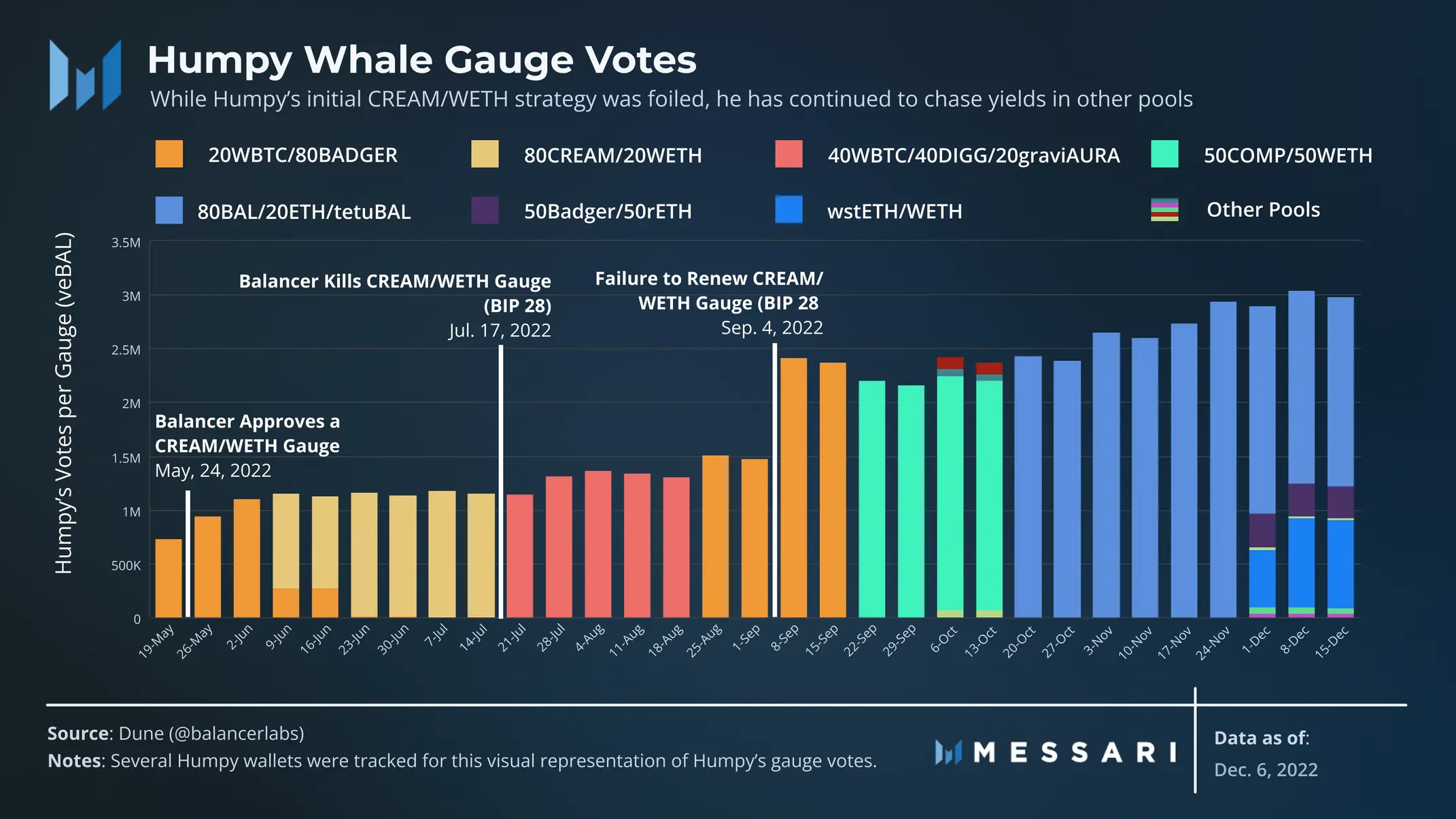

CREAM warSince Humpy first emerged as a large liquidity provider onBadger/WETH pool, the Balancer Discord has been monitoring this particular veBAL whale. Until May 2022, the whale is inCREAM/WETH POOL

The actions in it confirm its intentions.Knowing the dynamics of the veBAL system, Humpy executed an extremely profitable yield strategy using its veBAL. The strategy involves accumulating positions in CREAM, creating a CREAM/WETH pool, throughCREAM/ETH gauge proposal

The giant whale "forced the palace" and the contract ended. What happened to Balancer's veBAL governance model?

The giant whale "forced the palace" and the contract ended. What happened to Balancer's veBAL governance model?

In six weeks, Humpy used the veBAL system to direct $1.8 million worth of cumulative BAL release to the CREAM/WETH gauge, in other words, back to Humpy himself. While the gauge is profitable, the pool is not aligned with Balancer's goals, as the pool only generated $17,846.47 in protocol revenue during the same period.As a community contributor to the protocol and,Solar CurveRepresentative of BalancerAware of Balancer's oversight. To solve this problem, Solar Curve proposesBIP 19 Proposal

, aiming to align veBAL's design more closely with Balancer's revenue. The proposal proposes that the DAO reallocate 75% of the fees generated on pools of yielding tokens as a bribe to those pools.Solar Curve proposes that DAOs go one step further with a new incentive plan aligned with protocol benefits,Kill the CREAM/WETH gauge

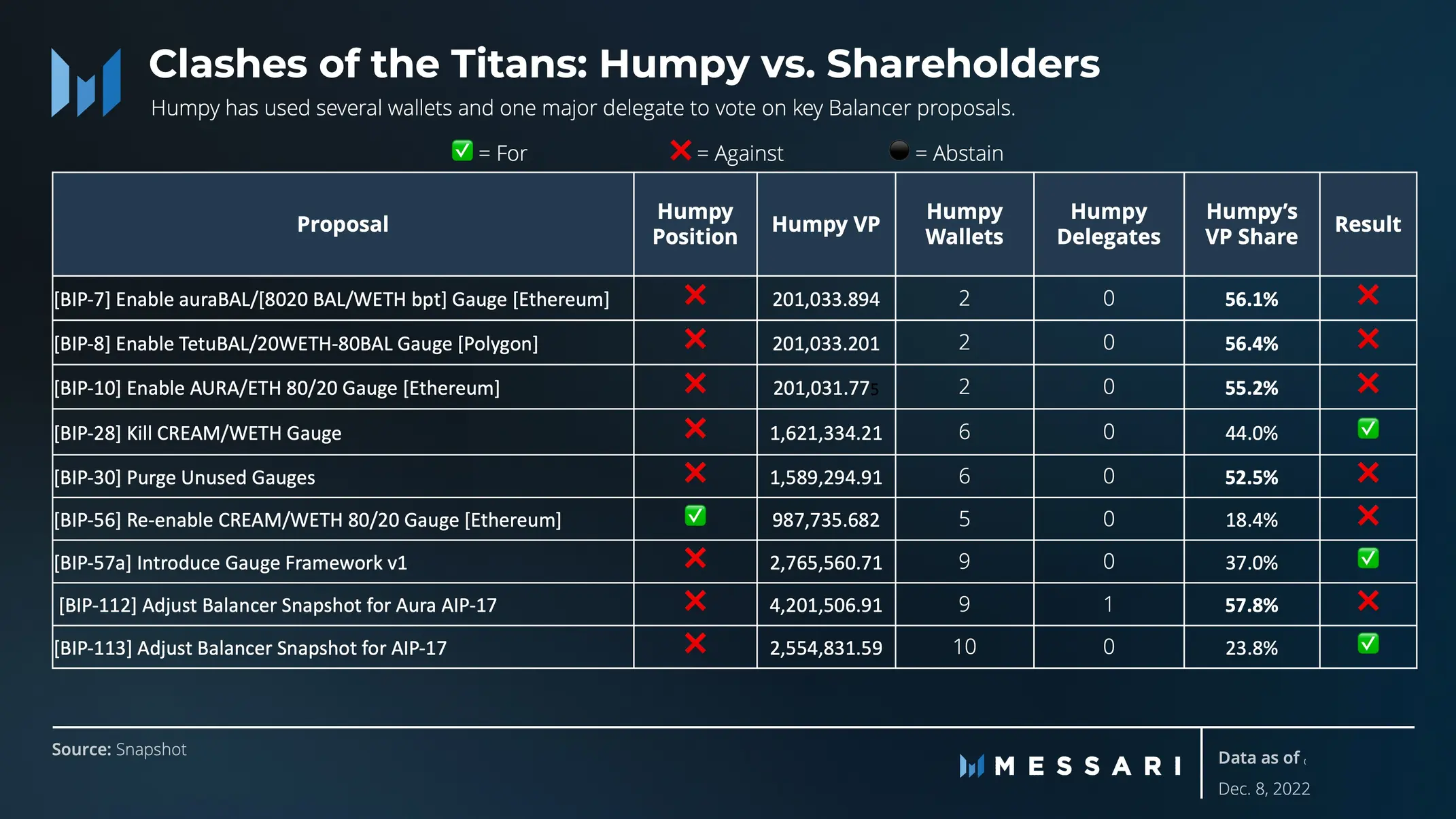

, to readjust the profitability of the veBAL system and Balancer, and to emphasize that DAO cannot tolerate inconsistent behavior.After seeing this proposal, Humpy deployed nearly 1.6 million veBAL against it, including itsthe largest addressCREAM/WETH gauge, accounting for 44% of the vote. Yet despite Humpy's efforts, the proposal eventually passed,

Also offline. And this battle started a major turning point in Balancer governance, the veBAL war.

war beginsWhile Balancer stakeholders thwarted the CREAM/WETH gauge, they continued to deploy defensive strategies, approvingGauge frame V 1

The giant whale "forced the palace" and the contract ended. What happened to Balancer's veBAL governance model?

The giant whale "forced the palace" and the contract ended. What happened to Balancer's veBAL governance model?

The giant whale "forced the palace" and the contract ended. What happened to Balancer's veBAL governance model?

out on a limb

The already tense situation intensified as Humpy and Balancer continued to consolidate their respective positions.

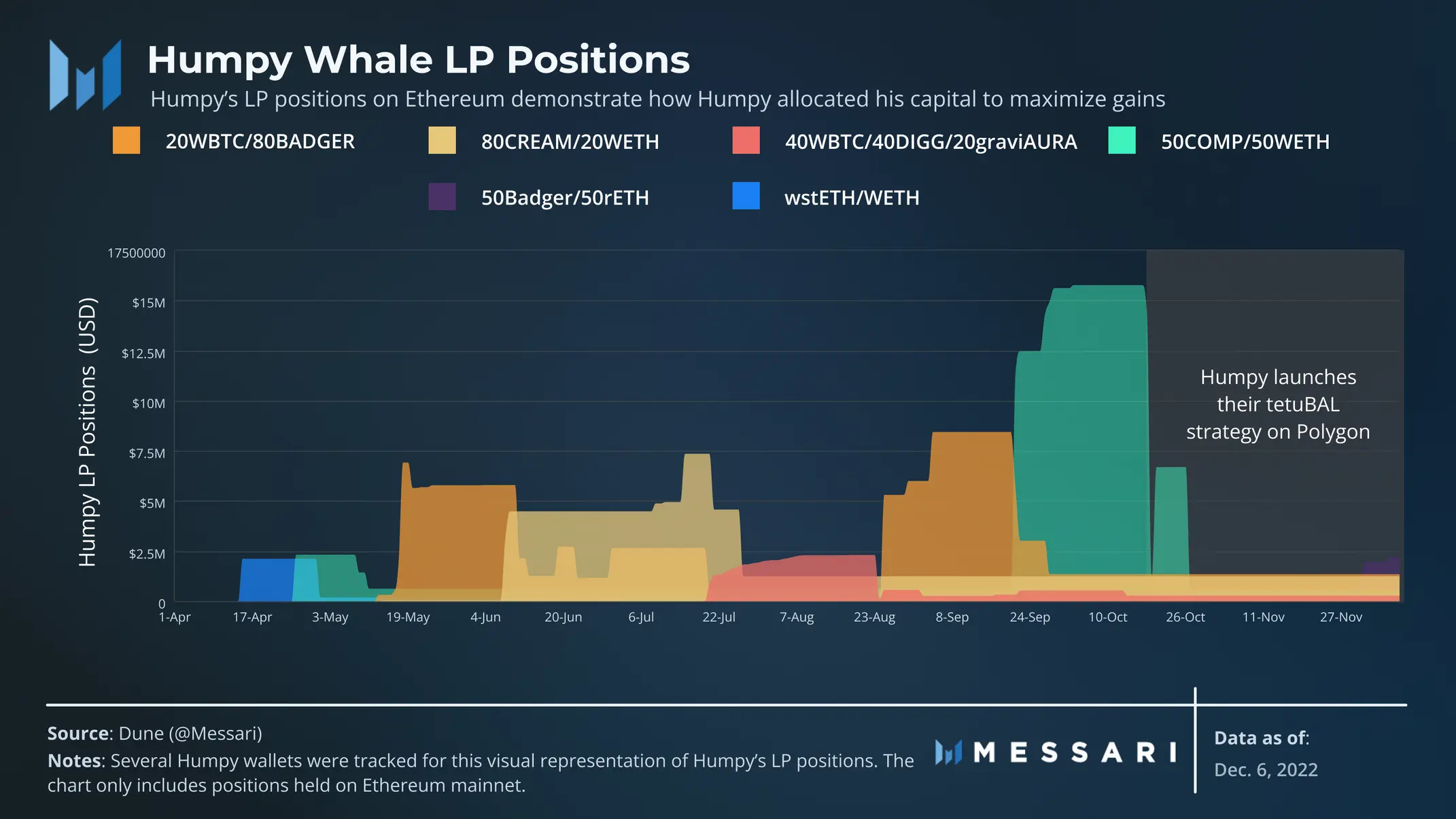

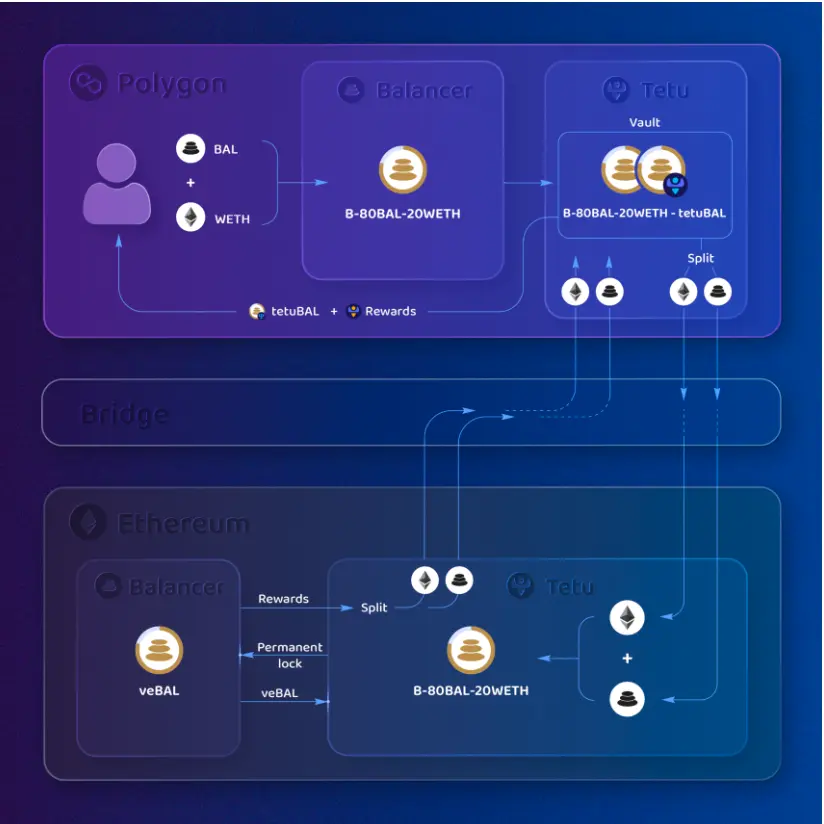

TetuBAL: The Whale's TrapTetuAs Humpy continues to optimize the strategy, the whale turns to

The giant whale "forced the palace" and the contract ended. What happened to Balancer's veBAL governance model?Tetu created a 20 WETH/80 BAL/TetuBAL pool on Balancer to provide liquidity to tetuBAL users looking to exit their positions. By observingBalancer Gauge Framework

The giant whale "forced the palace" and the contract ended. What happened to Balancer's veBAL governance model?Tetu created a 20 WETH/80 BAL/TetuBAL pool on Balancer to provide liquidity to tetuBAL users looking to exit their positions. By observingBalancer Gauge Framework

, Humpy found a loophole in the pool's conditions that made it exempt from the gauge cap requirement. Because tetuBAL is a freely mintable token, Balancer has decided to equate tetuBAL's market capitalization calculation with the entity that minted it, or Tetu itself, allowing the tetuBAL pool to exceed the upper release threshold of the MarketCap.Recognizing this opportunity, Humpy began committing to the veBAL/tetuBAL stableswap pool on October 19deposit. Through aggressive investing, Humpy increased the TVL of the pool from around $80,000 to $100,000 overnight.$8.8 million

The giant whale "forced the palace" and the contract ended. What happened to Balancer's veBAL governance model?What Humpy doesn't realize, however, is that the Tetu community has created arevolving contract, which aims to increase the position of locked tetuBAL 80 BAL/20 ETH, convert it to tetuBAL, and then re-deposit tetuBAL into the fund pool. And this results in aextremely unbalanced capital pool80% , currently, only 8% of the existing liquidity consists of 80 BAL/20 ETH BPT, while more than 90% consists of tetuBAL. This result has devastating implications for both Humpy and potentially tetuBAL hooks. Since Tetu automatically relocks its veBAL, the 80 BAL/20 ETH/tetuBAL pool represents the only opportunity for tetuBAL holders to unwind their positions. Given that Humpy accounts for the total liquidity of the pool

The giant whale "forced the palace" and the contract ended. What happened to Balancer's veBAL governance model?What Humpy doesn't realize, however, is that the Tetu community has created arevolving contract, which aims to increase the position of locked tetuBAL 80 BAL/20 ETH, convert it to tetuBAL, and then re-deposit tetuBAL into the fund pool. And this results in aextremely unbalanced capital pool80% , currently, only 8% of the existing liquidity consists of 80 BAL/20 ETH BPT, while more than 90% consists of tetuBAL. This result has devastating implications for both Humpy and potentially tetuBAL hooks. Since Tetu automatically relocks its veBAL, the 80 BAL/20 ETH/tetuBAL pool represents the only opportunity for tetuBAL holders to unwind their positions. Given that Humpy accounts for the total liquidity of the pool

Or so, Humpy's over $8 million position is essentially locked in illiquid tetuBAL.

As a capital allocator, Humpy has two options: Either accept tetuBAL with an illiquid veBAL position, or utilize illiquid LP investments for yield farming for returns. The latter will absorb the release of BAL tokens and start an all-out war to defend Humpy's strategy in Balancer governance.

To Andrea Cianfriglia (aka ilconsigliere.eth), current Humpy representative and former Llama and Balancer contributor. Cianfriglia will defend Humpy on the forum, suggesting compassionate strategies and debating with Balancer stakeholders.

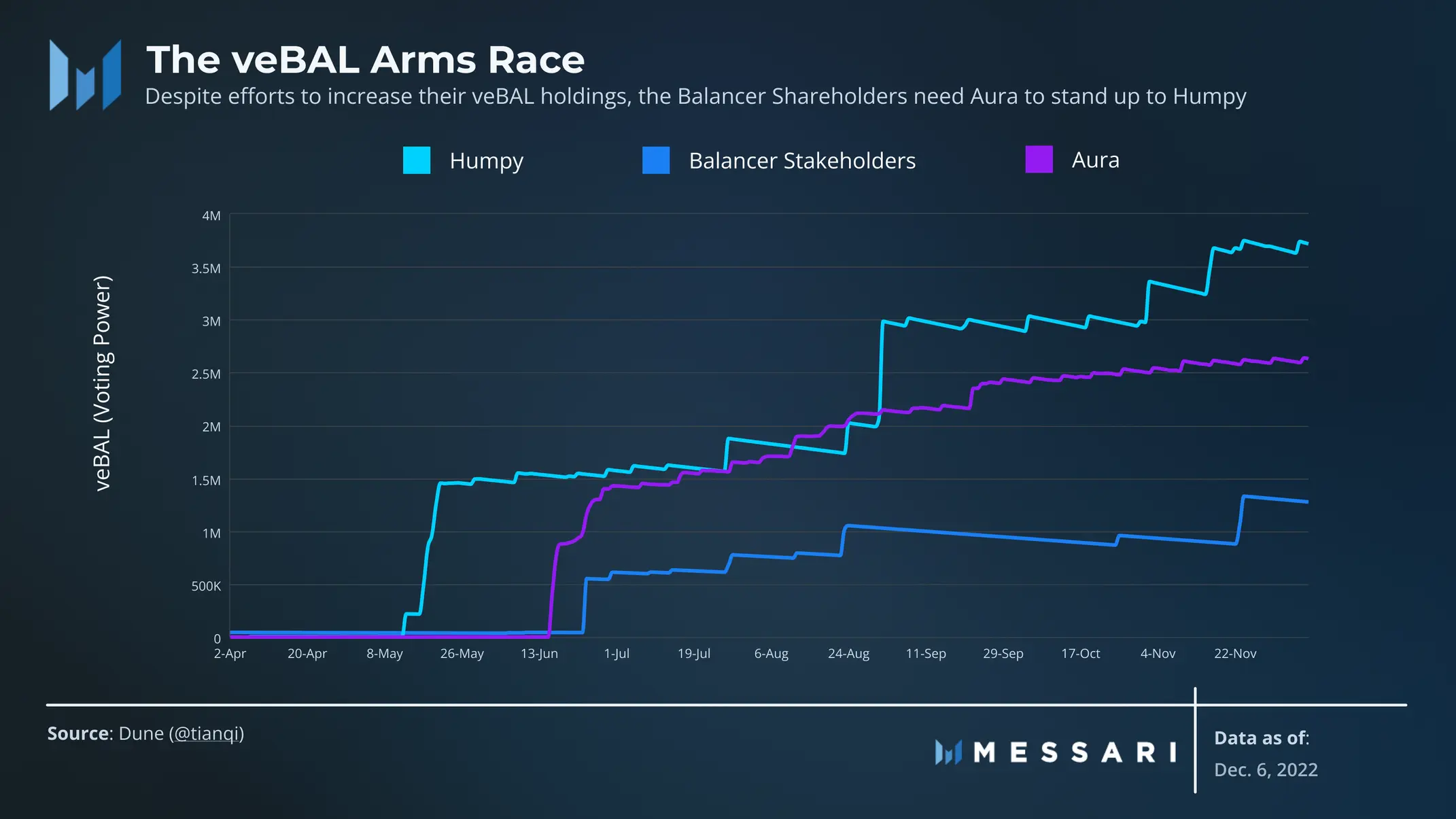

As Humpy's politics developed, Balancer's stakeholders were left with nowhere to go. To maintain firepower against the whales, they need to fight back.

Aura is the leading veBAL liquidity locking protocol in the Balancer ecosystem, and its success depends on the success of Balancer. Recognizing the seriousness of the situation, the Balancer community will likely need to exploit the potential of the Aura wallet to defend against Humpy's actions.

at present,Auraat present,

The giant whale "forced the palace" and the contract ended. What happened to Balancer's veBAL governance model?Recognizing that Humpy's veBAL position is a growing threat to Balancer stakeholders, on November 15th Aura voted to set aDirect Meta Governance System. The proposal aims to capture Aura's governance weight at scale, allowing the Aura DAO to conduct meta-governance voting for each Balancer snapshot vote and deploy its combined power as a whole. Although the proposal was made on Aura's snapshot, one of Humpy's wallets voted on the proposalbe opposed to

The giant whale "forced the palace" and the contract ended. What happened to Balancer's veBAL governance model?Recognizing that Humpy's veBAL position is a growing threat to Balancer stakeholders, on November 15th Aura voted to set aDirect Meta Governance System. The proposal aims to capture Aura's governance weight at scale, allowing the Aura DAO to conduct meta-governance voting for each Balancer snapshot vote and deploy its combined power as a whole. Although the proposal was made on Aura's snapshot, one of Humpy's wallets voted on the proposalbe opposed to

vote, but was unsuccessful.BIP 112 However, in order to achieve this strategy, Balancer's governance had to adapt.BIP 113 Designed to give Aura voters enough time to vote on meta-governance, but was actually sniped by nine Humpy wallets (and a delegate). whenWhen the vote was re-voted, the ensuing discussion encapsulated thehighest aggressivenessand Strength, Humpy and Cianfriglia propose powers to the Balancer Governance Council. Specifically, Balancer re-voted several proposals after Humpy successfully repelled them (BIP 7 、BIP 8 andBIP 30 and

). Finally, BIP 113 was passed and an informal coalition was formed between Aura and Balancer stakeholders.

hand in hand

The giant whale "forced the palace" and the contract ended. What happened to Balancer's veBAL governance model?

The giant whale "forced the palace" and the contract ended. What happened to Balancer's veBAL governance model?

To avoid further escalation of the war, the two sides worked out peace terms. The peace treaty proposal is intended to achieve a balanced outcome where both parties agree to moderate their positions in Balancer governance. The treaty allows Humpy to peacefully use its tetuBAL position for liquidity mining. In exchange, Humpy promised to moderate their tactics and acknowledge Aura's right to use their governance power.

TetuBAL: Compromise

Additionally, Balancer stakeholders will also agree to no longer support the paper written by Stablenode's Bobby Bolaproposalproposal

, the proposal aims to solve Humpy's tetuBAL gauge policy problem by limiting the release of Stableswap to 5%. The proposal has met with fierce opposition from both Cianfriglia and Humpy, likely because Humpy's financial fate is directly tied to the 80 ETH/20 BAL/tetuBAL LP.

Aura: Hope of the KingdomOn November 20th and 22nd, Andrea Cianfriglia created two proposals aimed at 1) limiting Aura's ability to vote as a whole, supporting"Winner takes all"AIP 17 strategy; 2) due to vlAURA holders and Aura'sThere may be a problem of double voting between, so Aura multi-signature should be included in the governanceblacklist

. The peace treaty ensures that neither proposal is voted on, thus confirming Aura's ability to vote on the Balancer proposal as a whole.

While AURA has thus far been aligned with Balancer's stakeholders, the centralized power wielded by AURA will certainly introduce new governance risks. Assuming a 51% attack on Aura, captured Balancer voting power could sit on a quarter of the veBAL supply, posing a significant threat to the Balancer ecosystem.

gentleman's agreement

As a measure of confidence, Humpy has pledged to use their remaining voting power to support pools that are "beneficial to Balancer's long-term development." They also agreed to use voting incentives only when the cost of bribing per veBAL is greater than the dollar value released per veBAL. This commitment is intended to ensure that the gauge's liquidity cost is greater than the value of the BAL incentive. As part of the agreement, Aura agrees to build custom distribution scripts for Humpy to optimize its vote distribution.

detente

In order to avoid a 51% attack on both sides, Balancer stakeholders and the whale Humpy have agreed to release approximately 750,000 veBAL each in several wallets.

The giant whale "forced the palace" and the contract ended. What happened to Balancer's veBAL governance model?

After the AURA/BAL unlock period, Humpy agrees that AURA/BALancer has 14 days to assist him in finding OTC transactions within 10% of the market price (similar to the OTC veBAL transactions between Aave and FEI after FEI Unwind).

Humpy has agreed to withdraw their representation in Andrea Cianfriglia and the proposal calls for Tetu to do the same.

in conclusion

in conclusion

Temporary peace has been restored to the Balancer community, an opportunity for reflection and evolution. There are lessons to be learned both in the design and execution of voting escrow tokenology and the nature of token governance.

Voting escrow tokenology is often considered the leading solution for keeping governance token holders aligned with the protocol. But in retrospect, we can question whether the DAO's aggressive behavior after BIP 19 inspired Humpy to double down on counterattacks, further intensifying whale activity and staking veBAL. Whether or not DAOs rely strictly on design mechanics rather than a punitive game of whack-a-mole, it’s clear that veTokenomics is far from a “set it and forget it” solution. In the case of veBAL, it requires an active governance role to defend defined goals, lest self-interest incentives deprive the protocol of its growth engine.