Original Author: SnapFingers DAO

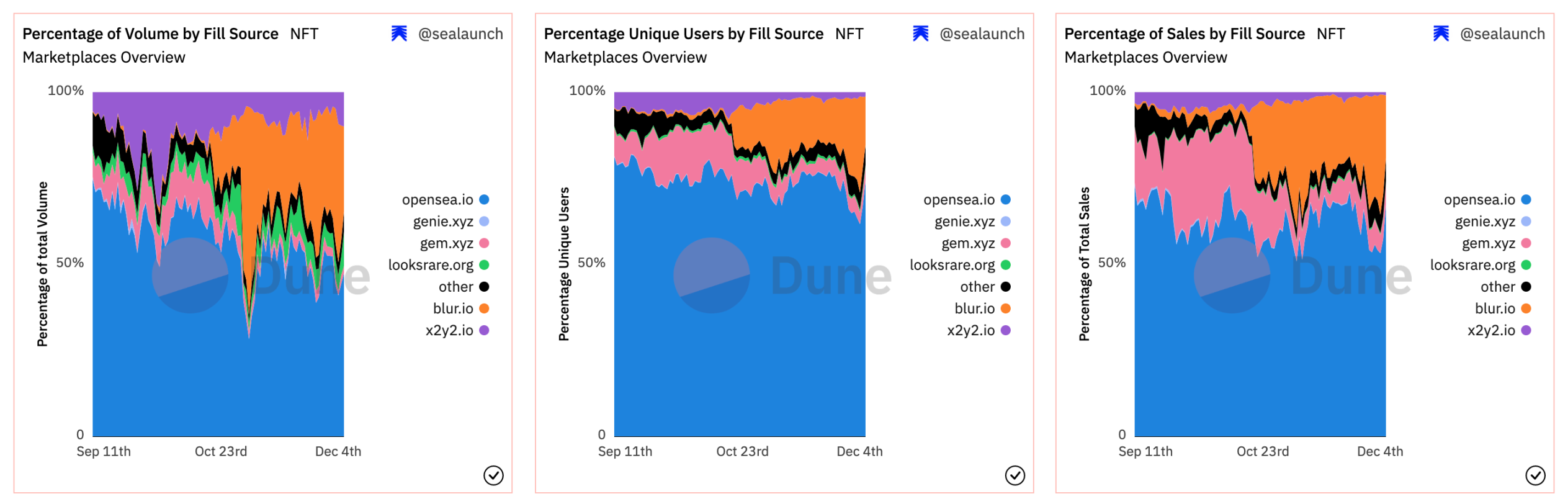

01 Comparison of emerging NFT trading markets

Since the beginning of this year, leading CEXs such as Binance, Coinbase, and Kraken have announced their entry into the NFT field. In June, Uniswap Labs acquired Genie, an NFT aggregator, and last week launched two agreements, Permit 2 and Universal Router, and airdropped 5 million USDC. Since August, SudoSwap, an NFT AMM trading protocol, and Blur, an NFT aggregator for professional traders, have been launched one after another, gaining rapid growth and widespread attention.

The NFT transaction protocol is formulated to standardize the transaction process of NFT, including the initiation, execution and conclusion of transactions.

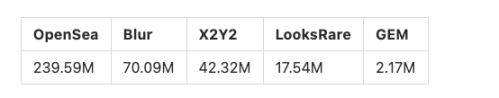

The trading volume of some NFT trading platforms in the past 30 days:

Among them, Opensea X2Y2 LooksRare adopts off-chain publishing, matching pricing, and on-chain transaction methods, combined with the auction mechanism to allow NFT prices to be reasonably evaluated. Blur, GEM, and Genie, which has been acquired by Uniswap, focus on aggregation and can meet the needs of cross-market sweeps.

As the market heat declines, the demand for NFT transactions has entered a new stage of small amount, high frequency, and winning rate from mining blue chips. Free Mint and zero royalties have become the trend of this period, and changes in the trading market model, such as aggregated transactions, are satisfied. New NFT transaction requirements.

Uniswap NFT Marketplace

In June, Uniswap Labs acquired NFT marketplace aggregator Genie. In mid-November, two new smart contracts were released: Permit 2 and Universal Router, and at the end of November, it was announced that NFT was officially launched on Uniswap. This series of actions all show Uniswap's ambition.

Genie is an NFT aggregation trading platform. As the pioneer of the NFT market aggregation platform, in the first month of its official launch, the total transaction volume easily exceeded 10,000 ETH, and it maintained a continuous growth of hundreds of users every day. Marketplace platforms supported by Genie Swap include OpenSea, NFTX, NFT 20, Rarible, and Larva Labs' CryptoPunks. At the same time, it focuses on NFT bulk purchase and sale functions, and reduces transaction costs by aggregating transactions.

Based on the Genie NFT transaction aggregation function, Uniswap has launched two more optimized contracts:

Permit 2 agreement

Permit 2 is a token approval contract that securely shares and manages token approvals across different smart contracts. As more projects integrate with Permit 2, Uniswap can standardize token approval across all applications. In turn, Permit 2 will improve user experience by reducing transaction costs while increasing smart contract security.

Permit 2 also comes with many exciting features:

Any token is allowed. Applications can have a single transaction flow by sending signatures and transaction data for any token, including those that do not support native permission methods.

Time-bound approval. Approvals can be time-bound, eliminating security concerns about pending approvals for a wallet's entire token balance.

Signature based transfer. Users can completely bypass setting limits by releasing tokens to licensed spenders with a one-time signature.

Bulk approval and transfer. Users can set approvals for multiple tokens or perform multiple transfers in one transaction.

Cancel quotas in batches. Remove limits on any number of tokens and consumers in one transaction.

Universal Router protocol

Universal Router is Uniswap's next-generation router, which unifies ERC 20 and NFT exchanges into one exchange router.

After Universal Router is integrated with Permit 2, users can exchange multiple Tokens and NFTs in one exchange while saving gas fees. Users approve using Permit 2 and pass their signatures to the Universal Router, abstracting the token approval process from the router contract. Developers can deploy new versions of universal routers without requiring users to send a separate approval transaction each time. This allows the general router or any integration contracts to remain unchanged, while also allowing new functionality to be added in the future.

Blur: NFT Aggregator for Professional Traders

Blur is an NFT trading market + NFT aggregator. The aggregator focuses on tool attributes and trading experience. Through the aggregator contract, multiple purchases can be completed in the same transaction, thereby saving Gas. Currently, the interfaces of OpenSea, LooksRare and x2y2 are aggregated.

In March of this year, Blur completed an $11 million seed round of financing led by Paradigm. Blur is committed to building an NFT market for professional traders, with teams from MIT, Five Rings, Brex, Square and Y Combinator, etc.

In October, Blur was officially launched, airdropping Care Packages including BLUR tokens to users who have traded in NFT markets such as Opensea, LooksRare, and X2Y2 in the past 6 months. Packs have three rarities to avoid the overwhelming advantage of giant whales.

After the Uniswap NFT transaction was launched and the airdrop was announced, Blur immediately announced the second round of airdrop, which was 10 times the size of the first one. The second round of airdrops is calculated based on the NFT listed on Blur, based on the possibility of being sold and the dynamic points of the NFT collection:

Earn 2x points for full royalties;

Traders scan goods 3 times to get 5% extra points;

Scan the goods 6 times to get 50% extra points.

Users can start earning points for the third airdrop of Blur by placing an order. Even if the user does not meet the conditions for the second airdrop, they can still earn points for the third airdrop. The third round of airdrop will end in January next year, and BLUR tokens will also be launched at that time.

Blur airdrop strategy:

Blur's airdrop adopts a blind box mechanism (Care Packages), and the airdrop packages obtained by users have different rarities.

The airdrop ratio is not announced, but the clear rules for obtaining airdrops are announced. If the interaction is successful, immediately confirm whether the airdrop conditions are met.

Blur's airdrops are divided into multiple rounds, allowing users to continue to have hope for future airdrops, thereby maintaining the enthusiasm for interaction.

Blur's airdrop strategy balances randomness and instant feedback. Judging from the data, Blur's growth strategy has achieved great success, and it is currently the second largest NFT market after OpenSea, showing a rapid growth trend in terms of transaction volume, unique user volume, and market share of transaction volume.

Transaction Fees and Royalty Policy

On November 15, after OpenSea announced the launch of a tool to enforce on-chain royalties for new NFT collectibles, Blur announced that the platform will waive market fees, support users to freely set the royalty rate, and incentivize through airdrop tokens To encourage users to pay royalties.

SudoSwap: NFT AMM Trading Protocol

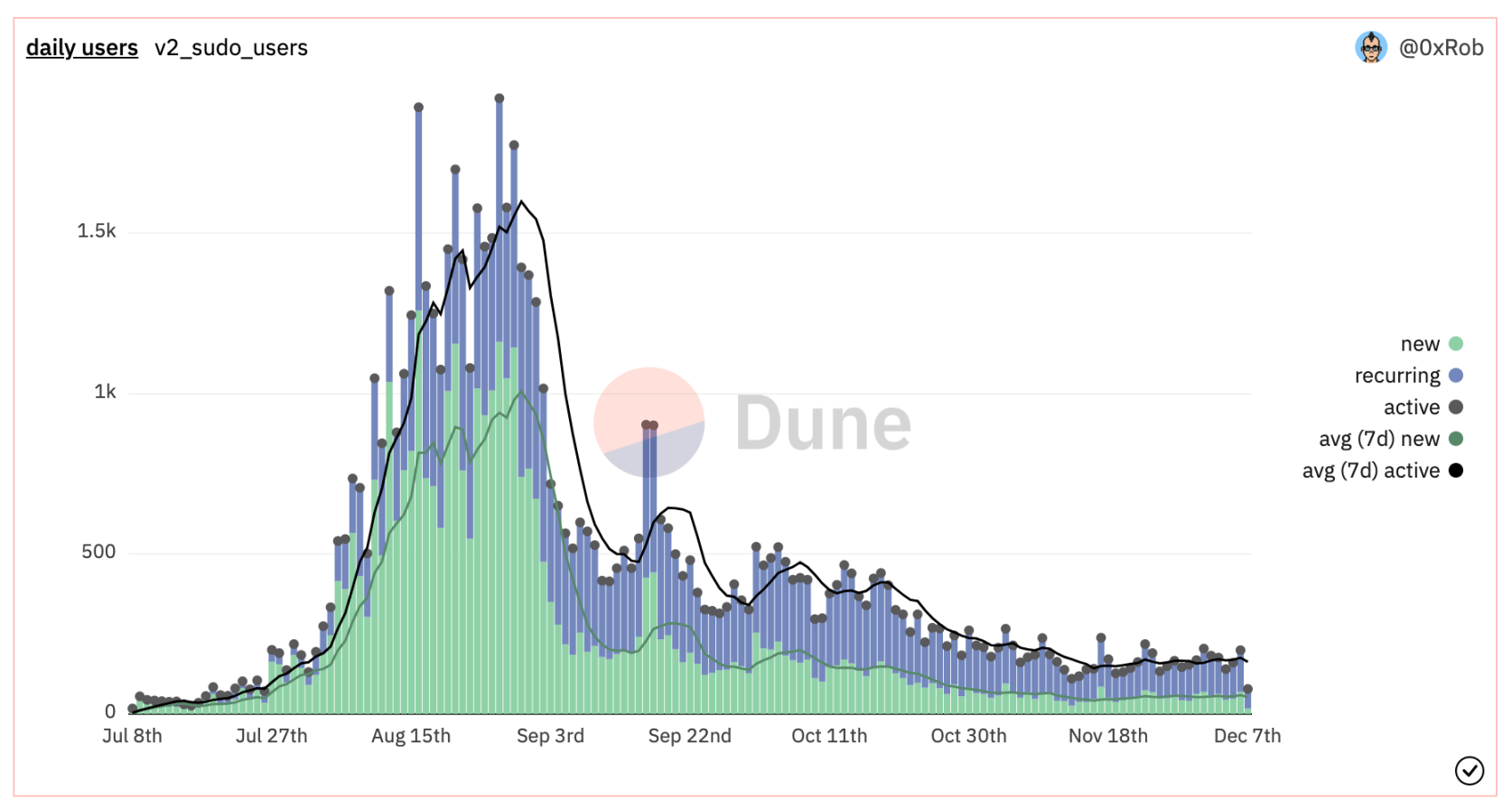

SudoSwap, which emerged suddenly in August, brought the trading market based on the AMM mechanism into the public eye with its strong growth data.

SudoSwap is an NFT DEX based on the AMM transaction protocol to realize fast value exchange from ERC 721s to ERC 20. SudoAMM regards NFT as TokenA and ETH as TokenB, allowing LPs to provide one-way or two-way liquidity injection, and make market for NFT-ETH within the specified price, so as to obtain fee income. The operation model of the SudoSwap trading market adopts the method of publishing on the chain, pricing according to the AMM mechanism, and trading on the chain.

AMM allows sellers to sell immediately to obtain instant liquidity, while LP can fully control the pricing of the fund pool. This mechanism makes the value of the same series of NFTs converge, and is suitable for long-tail, or NFT projects with high homogeneity and a large number.

Transaction Fees and Royalty Policy

Original link