Original source: Blue Fox Notes

text

Maybe a few years later, the platform battle will not happen between the old and new public chains, but between the old and new L2.

You can first look at some current data trends and the technical evolution direction of Ethereum.

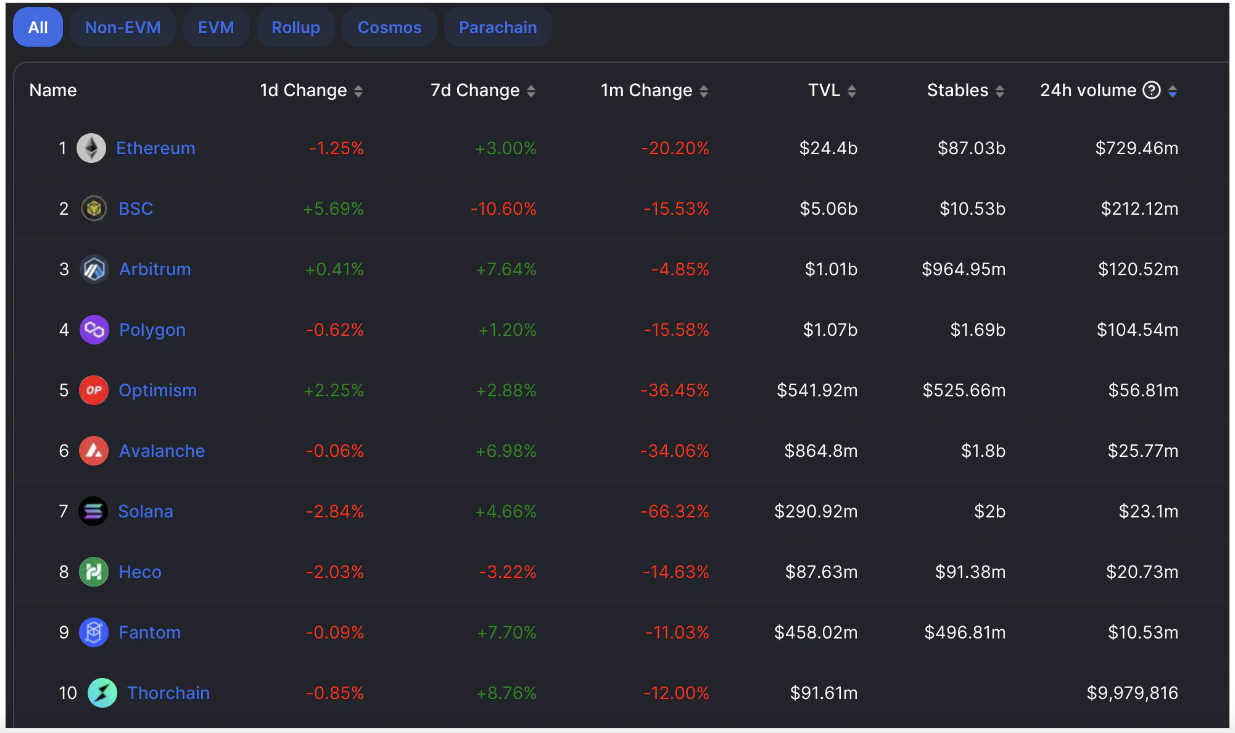

The TVL rankings of Arbitrum and Optimism have gradually entered the top ten from outside the ten.

image description

Arbitrum and Optimism’s DeFi ranks in the top five in terms of daily trading volume.

image description

(data as of writing, data from defillama)

As can be seen from the above chart, in terms of DeFi TVL, Arbitrum ranks fifth, ahead of it only Ethereum, BSC, Tron, and Polygon, surpassing Avalanche, Solana, etc., while Optimism ranks eighth, surpassing most public chains .

If you look at the 24-hour DeFi trading volume, Arbitrum ranks third and Optimism ranks fifth. Arbitrum is second only to Ethereum and BSC, the two most active public chains, and has surpassed most public chains. Optimism is second only to the three major public chains of Ethereum, BSC and Polygon, and surpasses most public chains. DeFi transaction volume reflects the activity of the chain to a certain extent.

2. Development of ecological projects

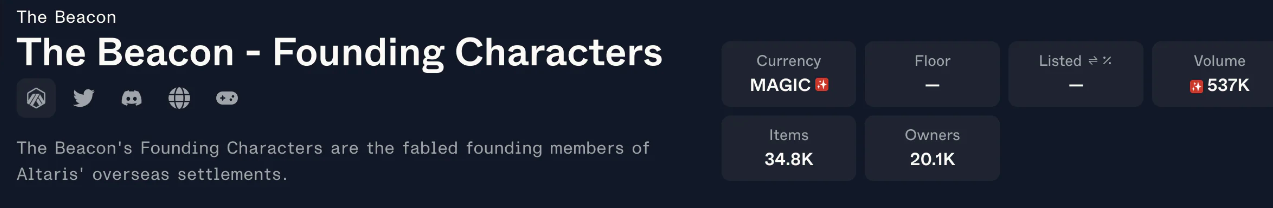

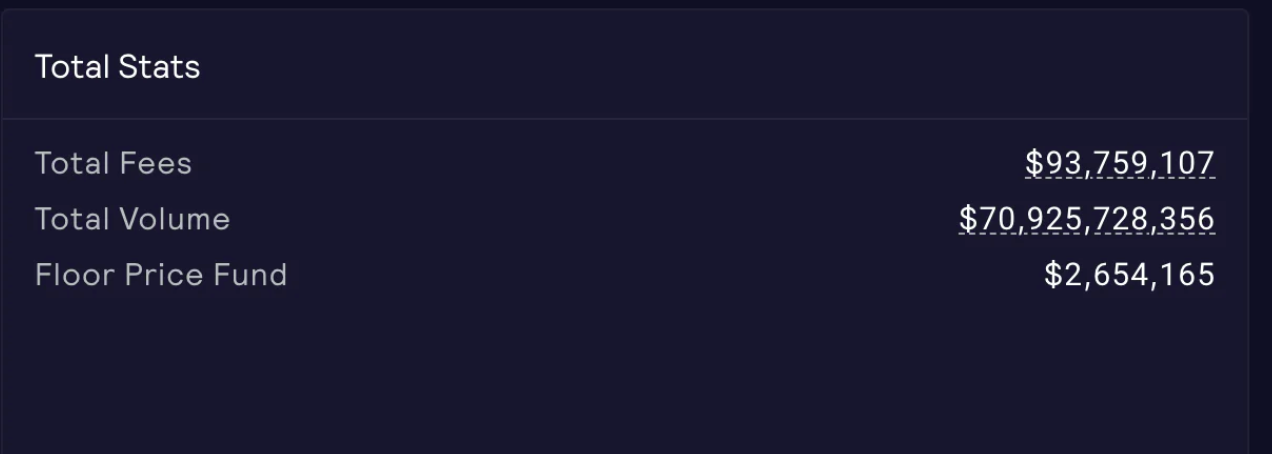

Since then, some native L2 projects have also begun to show their potential. For example, on the Arbitrum network, the game ecology project magic network (TreasureDAO) is trying to build a Nintendo on web3, providing various underlying services for different games, and initially showing the prototype of the ecology. At present, there are some games that have attracted the attention of the community (such as thebeacon, which has more than 20,000 independent addresses in less than two weeks since the initial prototype was launched); for DeFi projects, as of the time of writing, the total transaction volume of GMX on Arbitrum exceeded 70.9 billion US dollars, The total cumulative cost of the agreement exceeds $93 million.

(Data comes from TreasureDAO's NFT marketplace Trove)

image description

(data from GMX official website)

According to statistics from Orbiter, as of writing, there are 58 projects on Arbitrum with more than 1,000 user addresses, 39 projects with more than 10,000 user addresses, and 40 projects with more than 1,000 monthly active addresses. There are 24 projects with more than 10,000 monthly active addresses. On Optimism, there are 50 projects with more than 1,000 user addresses, 32 projects with more than 10,000 user addresses; 33 projects with more than 1,000 monthly active addresses, and 20 projects with more than 10,000 project.

As of the time of writing, there are currently more protocols with more monthly active addresses and interactions on Arbitrum, including Uniswap, Sushiswap, GMX, Hop, TreasureDAO, Galxe, Stargate, dopex, etc.; currently on Optimism, the number of monthly active addresses and interactions There are more Uniswap, Perpetual, synthetix, Velodrome, Rubicon, Pooltogether, Thales, etc.

At present, the ecological projects of Arbitrum and Optimism have already reached a preliminary scale. With the evolution of time, due to better portability, as follow-up costs decrease and throughput increases, the speed of ecological development will also accelerate accordingly.

Judging from the current development of L2's ecological projects, L2 has surpassed most public chains.

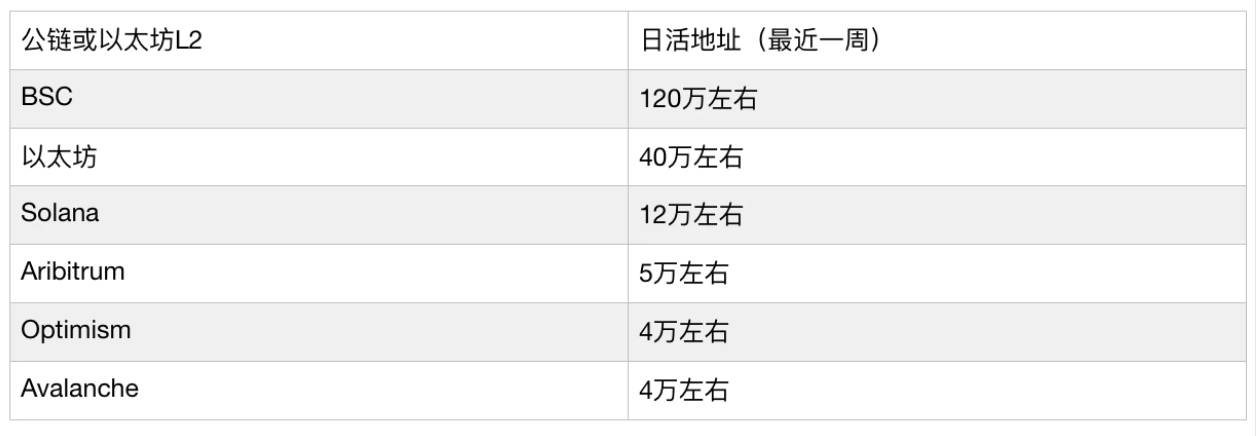

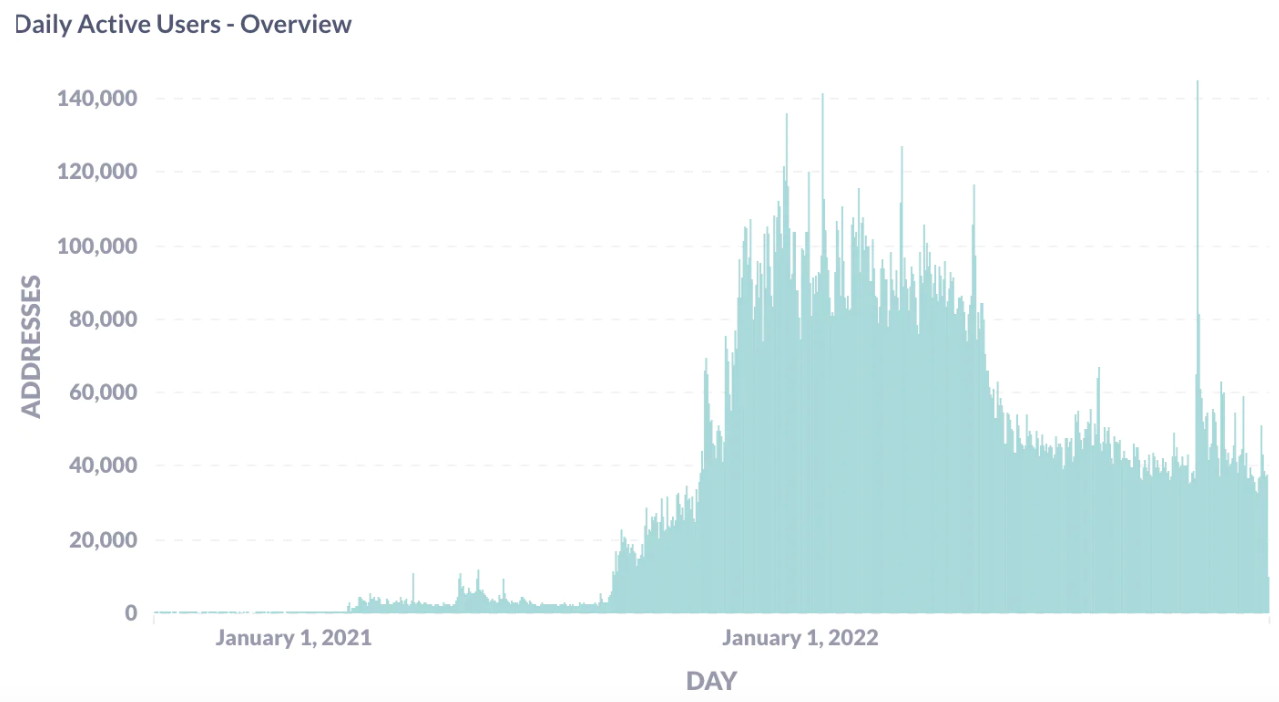

From the perspective of daily active users, as of the time of writing, the statistics are as follows (not completely accurate, approximate order of magnitude, only for rough comparison of order of magnitude):

(Data comes from browsers of different chains)

image description

(data from avax.network)

Judging from the current daily active address data, the daily active addresses of BSC, Ethereum, and Solana are all higher than Abitrum and Optimism, while Avalanche is currently at the same level as Aribitrum and Optimism.

From the trend point of view, the daily active users of Ethereum are relatively stable, with a slight upward trend in the past six months; BSC is basically in a relatively stable state; Solana is relatively stable in the early stage, but has a downward trend in the past month; Avalanche daily active users In the past six months, there has been a certain downward trend; in comparison, Optimism’s daily active users are in a relatively obvious upward trend, from less than 10,000 half a year ago, and now it is stable at around 30,000-40,000; Arbitrum’s daily active users are also on an obvious upward trend , from about 15,000 half a year ago to about 40,000 to 50,000.

With the evolution of time, especially the subsequent launch of EIP-4844, the daily active addresses of L2 have the opportunity to continue to improve. In the next 2-5 years, L2's ranking in daily active addresses will undergo major changes.

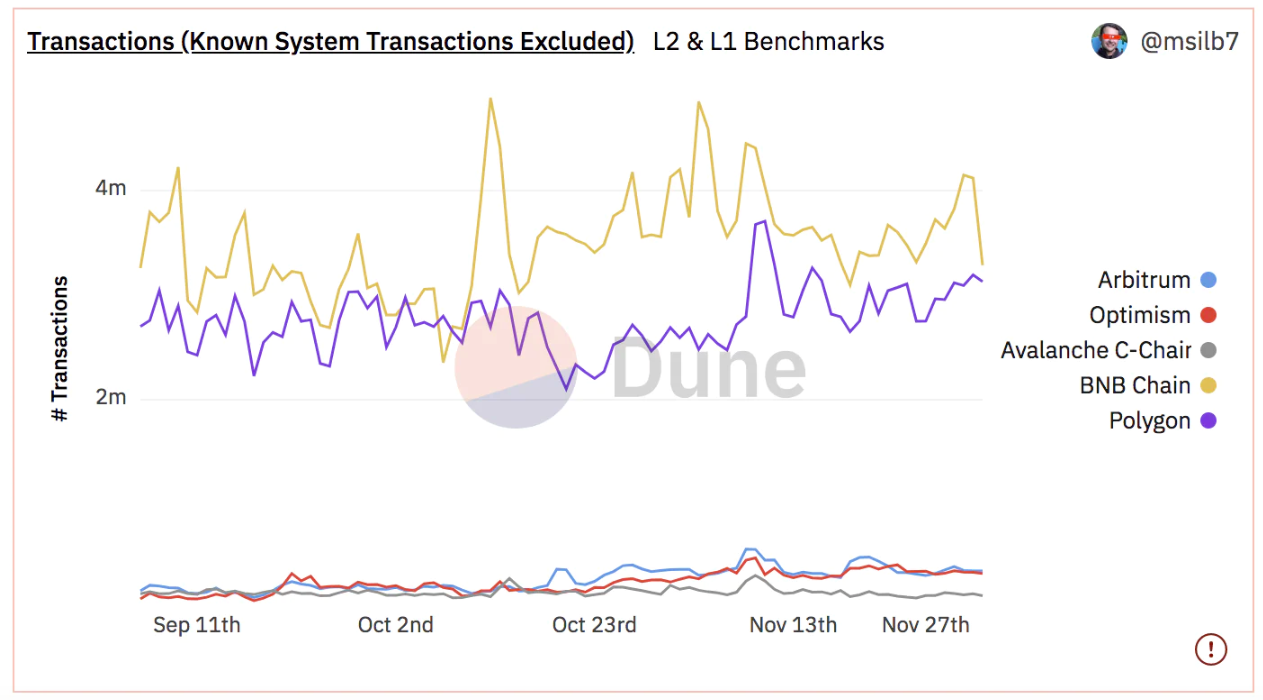

From the perspective of the number of transactions, as of the time of writing, the statistics are as follows (not completely accurate, approximate magnitude, only for rough comparison of magnitude and scale):

(The data comes from the browsers of each chain)

image description

(data source dune.com)

At present, the number of daily transactions of Ethereum is about 1 million, Arbitrum is about 360,000, and Optimism is about 350,000. From the perspective of the past year, the transaction volume of L2 has been on the rise, while the Ethereum mainnet is basically in a relatively stable state. The long-term stability of the transaction volume of subsequent L2 surpasses that of Ethereum L1, which should be realized soon. Solana internal consensus messages are also counted as transactions, with a much higher number of transactions than other chains.

Finally, it should be reminded that the number of transactions cannot fully reflect the activity of the chain. If the fee is low, there may be more low-quality transactions. Therefore, when looking at the quality of the number of transactions, it mainly depends on which dAPPs are active in the ecosystem, as well as the number of real active users and interactions on these dAPPs.

Therefore, the number of transactions needs to be screened from the perspective of the chain as a whole.

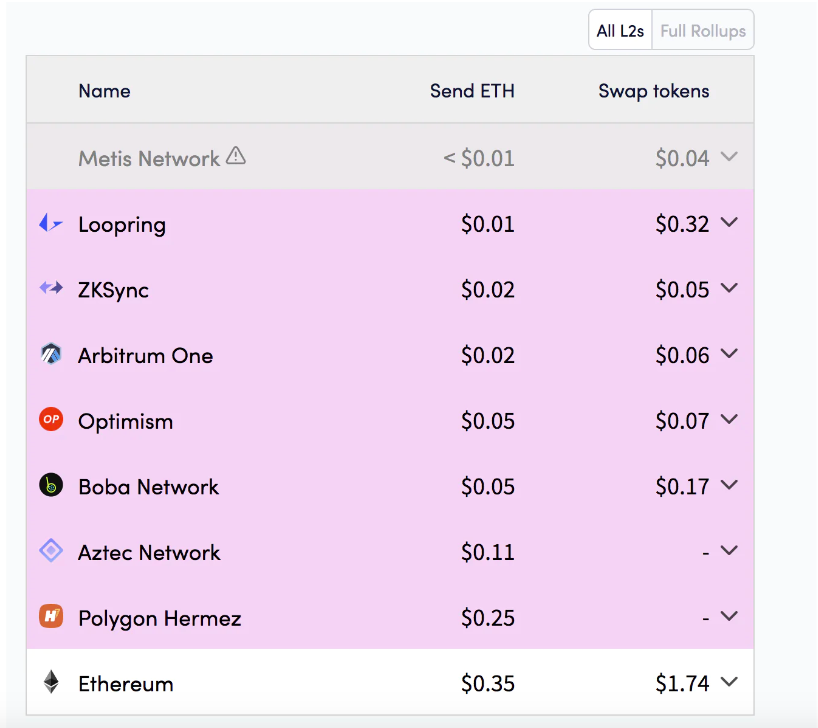

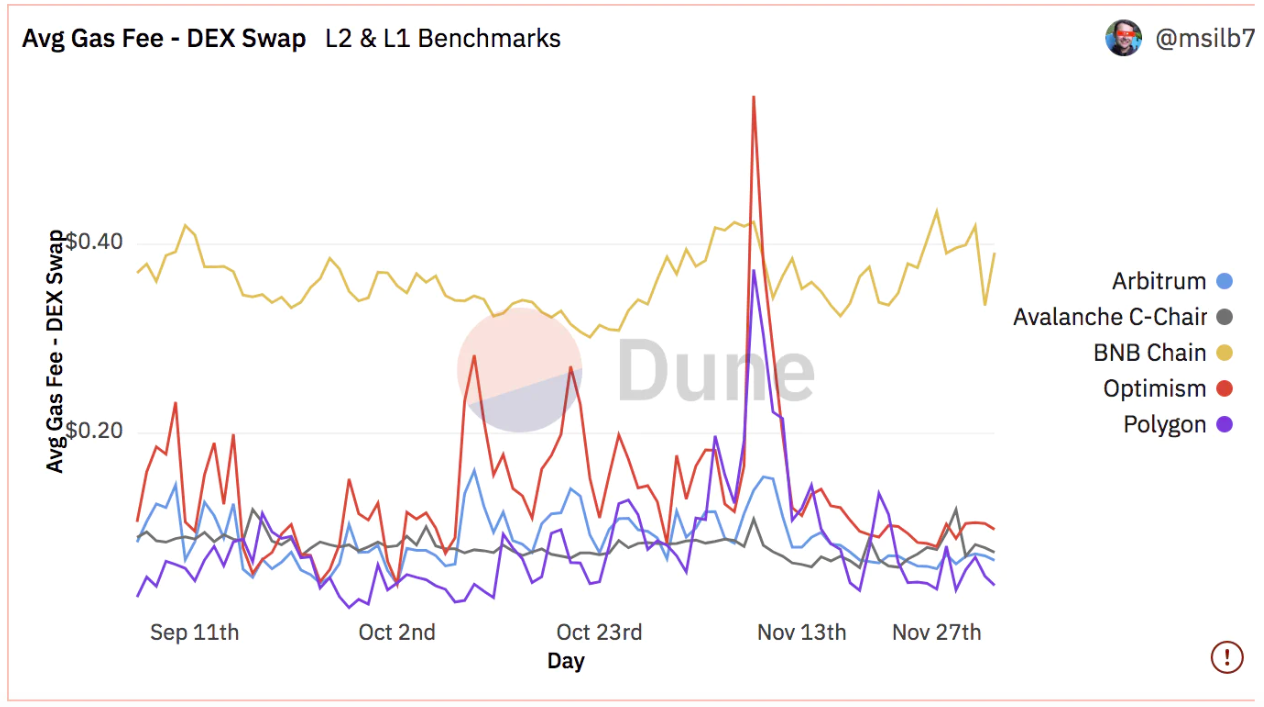

In terms of L2 fees, the fees for sending ETH and exchanging tokens are already relatively cheap, currently ranging from a few cents to a few cents. According to the data at the time of writing, arbitrum sends ETH for about a few cents, and exchanges for tokens range from a few cents to a few cents. The cost has been greatly reduced compared to before, and the cost of sending ETH is currently more than 10 times lower than that of L1.

(Data source l2fees.info)

image description

(data source solscan.io)

Overall, from the perspective of transaction costs, except for Solana, other public chains have no obvious advantages compared with L2. According to the cost comparison between L1 and L2, Arbitrum and Optimism are currently at the same level as Avalanche, and surpass many other public chains.

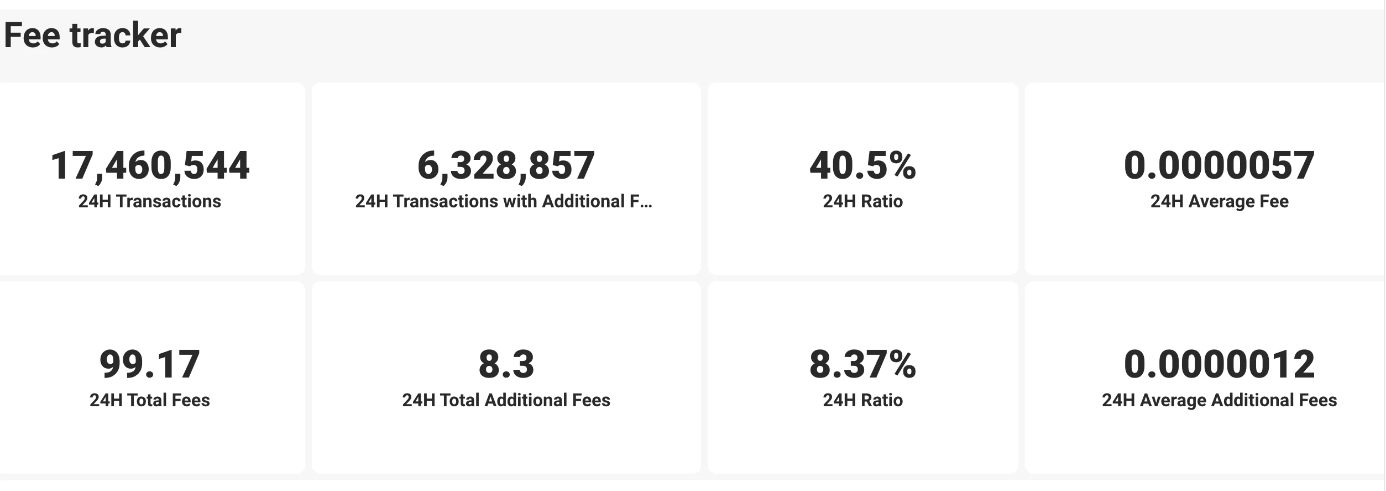

image description

(data source dune.com)

More importantly, the cost of Optimistic Rollup and Zk Rollup still has room to drop dozens of times. This is mainly related to the implementation of subsequent Proto-danksharding (EIP-4844) and danksharding.

If there is an opportunity in the future, Blue Fox Notes will introduce EIP-4844 more. In simple terms, Pro-danksharding (EIP-4844) introduces dedicated space for rollups data. It brings new transaction data types and a fee transaction market specifically for rollups data. Calldata is not used, transactions carrying blobs are introduced, and executed independently of the EVM, the stored data is pruned after a period of time (such as two weeks) to reduce node overhead.

The blob can carry a large amount of data, and the blob transaction can not compete with the current ordinary transaction for gas usage, avoiding the competition of the current block space. Compared with calldata, the gas cost is cheaper. EIP-4844 and danksharding turn Ethereum into a unified settlement layer and data availability layer. Judging from the current roadmap of Ethereum, it has begun to build a scalable path centered on Rollups.

After the implementation of EIP-4844, the transaction cost of rollup will be greatly reduced. Theoretically, there is room for a hundred-fold cost reduction. Even if it is only a few dozen or more, it means that the cost of L2 will be greatly reduced on the current basis. This also means that most of the current cost advantages of single public chains will disappear. At the same time, Rollup has advantages in consensus and security bridges, which will have a substantial impact on the subsequent competition of L2 and other public chains.

When EIP-4844 lands, the Optimistic Rollups solution will have an advantage in the early stage, and its cost may be lower than that of ZK Rollup. Also, early on for ZK Rollups, they need to redesign their rollups to issue proofs with new transaction types. Of course, with the reduction of the cost of validity proof (current technological innovation is in progress, there is still room for hundreds of times of optimization), and with the gradual implementation of ZK Rollup technology, this situation may gradually change. When everything is mature At that time, ZK Rollup fees are expected to be lower than Optimistic Rollup fees. In addition, the data compression technology will be gradually implemented on the rollup. Once it is implemented, theoretically, there is room for a 100-fold increase in rollup on the current basis.

If the above-mentioned technologies can be implemented, the daily transaction volume of L2 has the opportunity to accommodate a scale of more than 10 million. For defi and early games, there is already enough room for display.

6.TPS

All in all, in terms of cost, once the subsequent proto-danksharding and danksharding are implemented, the cost of Rollup may be lower than that of most other monomer public chains. This means that cost-sensitive groups will migrate to Rollup on a large scale based on security advantages. Previously, the rise of BSC, Solana, and Avalanche was due to the high cost of Ethereum L1. If the cost of L2 can be greatly reduced in the future, users and developers will also have the willingness and motivation to enter the Ethereum network ecology.

Most of the tps advertised in the market now are suspected of exaggeration, and an external third-party measurement is needed here. Strictly speaking, the tps of token sending and token exchange are also different tps. The tps in the test network or developer network environment is also different from the tps in real operation.

TPS and decentralization are also related. The higher the degree of decentralization, the safer it is, and tps will often be sacrificed. So simply high tps is not entirely a good thing, the tps of web2 is the highest.

Dragonfly Capital once conducted a tps benchmark comparison based on the token exchange (swap eth for tokens) in Uniswap V2, and then calculated the approximate tps through the block gas limit and block generation time. Friends can also conduct tests by themselves and draw their own conclusions.

According to dragonfly's test under the above conditions (Uniswap V2 token exchange), Ethereum's tps is about 9.19; polygon is about 47.67, avalanche is about 31.65, BSC is about 194.6; Solana is about 273.34 (CU has a computing unit similar to gas, each block can only contain about 48 million CU). It shows around 3000 tps on the Solana block explorer, which treats internal consensus messages as transactions, where about 80% of the throughput is consensus messages, leaving about 600 or so tps.

From this benchmark calculation, Solana’s tps should be the pinnacle of all the current single-chip chains. Most of the other chains’ tps are between tens and hundreds, which is about several times to dozens of times compared to Ethereum L1. Still less than a hundred times the space.

The tps of Ethereum L2, according to Vitalik's calculations, theoretically rollup can reach 1000-4000 tps, if Pro-danksharding and danksharding can be implemented, the tps of Ethereum L2 is expected to exceed 100,000 tps.

In the early actual operation, it may not be able to achieve the theoretically expected tps, but it is possible to achieve it comparable to other high-performance monomer public chains, and with the follow-up Pro-danksharding (estimated to take at least 1 year) and darksharding With the implementation of Ethereum (estimated at least 2-3 years), the tps of L2 will be greatly improved. Coupled with the security and network effects of Ethereum itself, L2 may end the public chain dispute in a certain period of time in the future. Of course, there is still a long time to be specific, everything is evolving dynamically, and other variables will also arise, so you can continue to pay attention.

In addition, L2 does not need a lot of subsidy incentives like new public chains (such as Aptos, Sui, etc.) to support its security. It only needs to use subsidies to attract more developers to build products on it and promote ecological development.

The battle between Ethereum L2 and the public chain structure is expected to end within 5 to 10 years

At present, various projects are entering the Arbitrum and Optimism ecology, and the transaction activity of some projects on L2 has exceeded their activity on L1. For example, the transaction activity of Synthetix on Optimism has exceeded its transaction activity on Ethereum L1. Activity. A similar phenomenon will appear in other DeFi or encrypted games in the future.

As the L2 ecosystem gradually matures, the TVL (total locked value), active users, and real transaction volume of Arbitrum and optimism will surpass most public chains step by step. It is hard to say whether it can surpass the very few mainstream non-Ethereum public chain networks, but in terms of the evolution trend, there is a high probability of surpassing it at the overall ecological level. There will be new public chains in the future, and there will be certain opportunities due to certain breakthroughs or differentiations in narrative or technology. But if the new public chain has no way to improve by more than ten times in terms of cost, speed, and user experience, then it will not be easy to surpass L2.

Of course, the future pattern will be an era of multiple chains. It is impossible for one chain to cover everything, and Ethereum cannot take over the entire market. As far as the current situation is concerned, Ethereum and the L2 based on it have the greatest probability of becoming the primary network. At the same time, there will be a few relatively large chains and ecology, as well as many smaller chains (currently the L1 blockchain Already more than 100), niche chains will focus more on certain areas, such as game chains, and even carbon application chains.

Judging only by the current trend, L2 will become an important opponent of other public chains. And if L2 finally stands out, it will further enhance the network effect of the Ethereum ecosystem (wallets, developer tools, protocols, liquidity, developers, user groups, etc.), thereby consolidating its position in the field of blockchain smart contracts (even web3) supremacy.

To sum up, just looking at the current trend, L2 and some non-Ethereum public chains will form a direct competitive relationship. Due to the advantages of L2 in terms of security, there is still a possibility of a substantial reduction in costs and a large increase in throughput. , and can take advantage of Ethereum’s traditional network ecological advantages (developers, development tools, wallets, protocols, user base, user inertia, etc.), L2 will occupy a favorable position in the competition with other public chains, so there is a greater probability gain an advantage.

Potential Variables in the Pattern Controversy

In addition, there is also a possible unexpected situation, that is, a new technological paradigm suddenly emerges, starting from a different path, and completely subverting the scalability of the current blockchain. Although the probability of this situation is not high, it is worthy of attention, because no one can predict the future.

Risk warning: All the above analysis is only a one-sided observation of the market, not necessarily correct, please be sure to keep your own judgment and do a good job of risk control.