1. Summary of Industry Dynamics

secondary title

secondary title

1. Summary of Industry Dynamics

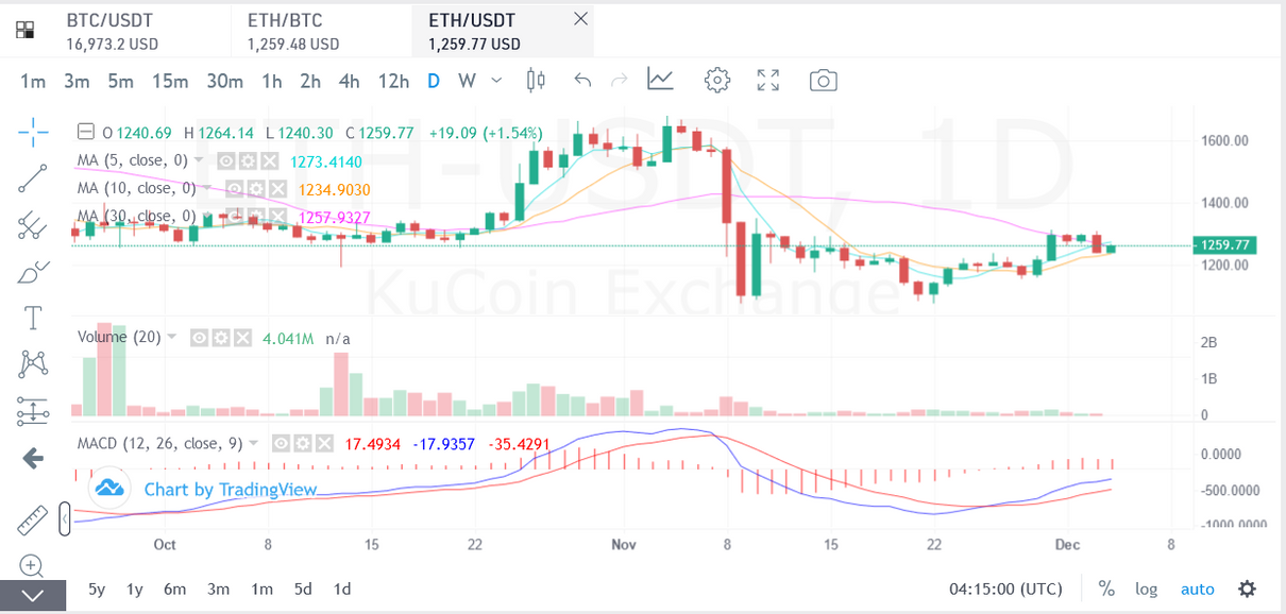

Last week, the crypto market rebounded slightly following the U.S. stock market. After Powell’s speech on Wednesday, U.S. stocks rose across the board. The crypto market also followed suit, but the overall increase was weaker than that of U.S. stocks. The lack of new capital inflows will make it difficult to continue the upward trend. As of writing, Bitcoin closed at 17030, up 2.75% during the week, with an amplitude of 8.06%; Ethereum closed at 1260.12, up 3.44% for two consecutive weeks, with an amplitude of 13.46%.

Last week, the crypto market rebounded slightly following the U.S. stock market. After Powell’s speech on Wednesday, U.S. stocks rose across the board. The crypto market also followed suit, but the overall increase was weaker than that of U.S. stocks. The lack of new capital inflows will make it difficult to continue the upward trend. As of writing, Bitcoin closed at 17030, up 2.75% during the week, with an amplitude of 8.06%; Ethereum closed at 1260.12, up 3.44% for two consecutive weeks, with an amplitude of 13.46%.

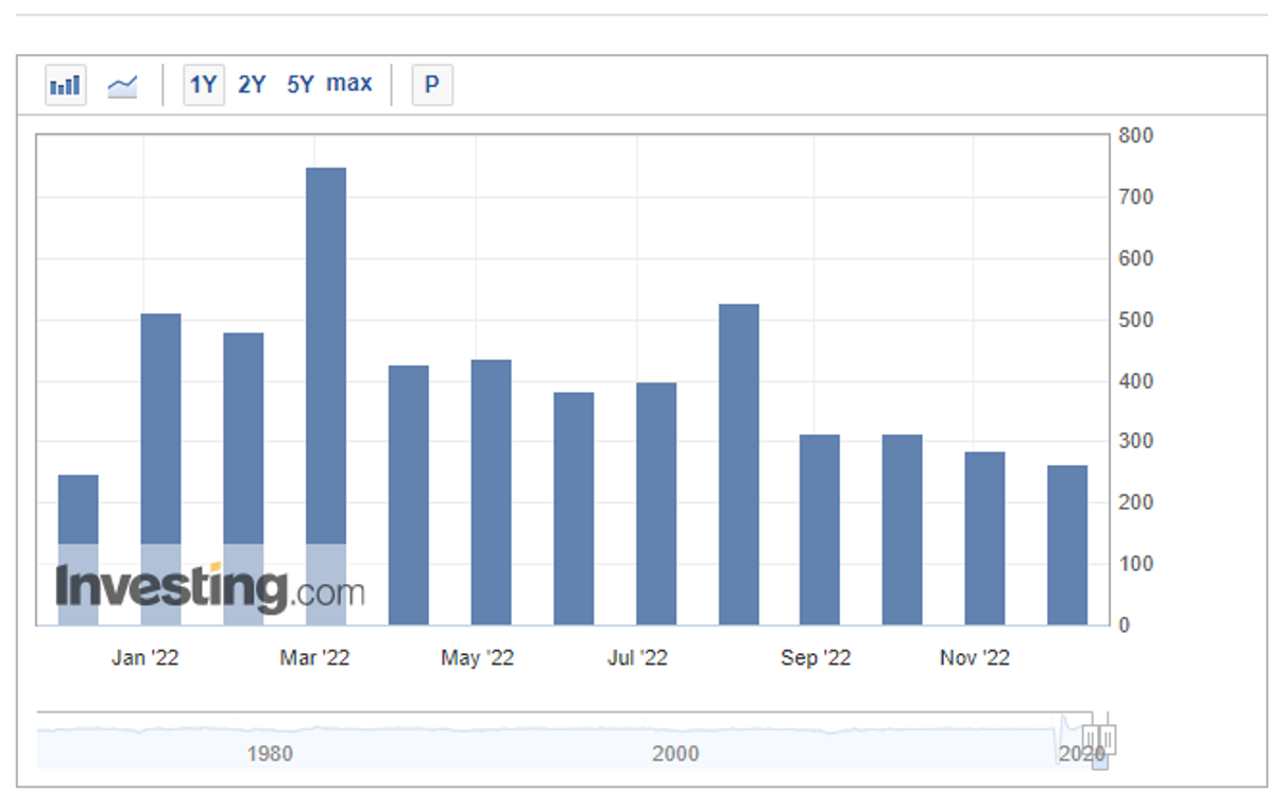

The non-agricultural data released this Friday exceeded expectations. The expected value was 200,000 and the actual value was 263,000. At the same time, the average wage rose by 5.1%, which also exceeded expectations. However, there was a contradiction between the small non-agricultural data on Wednesday and the large non-agricultural data this Friday. This is actually a normal phenomenon. It is more authoritative to say that non-farm is more authoritative. If the positive and negative directions of the two are inconsistent, then in monetary policy, we should pay more attention to today's non-farm. However, Powell has already set the tone for raising interest rates this month, and the negative impact of the large non-farm payrolls will have an impact on future interest rate peaks.

2. Macro and technical analysis

secondary title

2. Macro and technical analysis

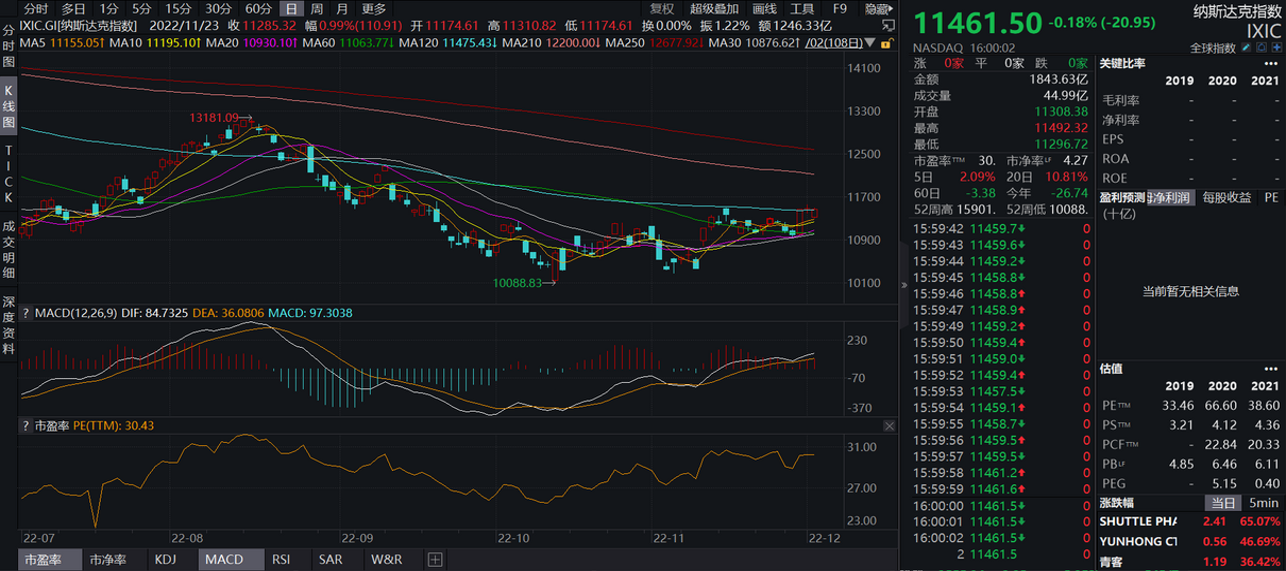

From a macro perspective, the market is facing the test of raising interest rates in December, and it is expected that 50 bp will be confirmed. However, the subsequent speeches of Fed officials are relatively important, and we must be careful of the market interpreting it as a positive situation.

The overall rebound of BTC and ETH is still limited. BTC is constrained by the integer mark of 17000 U, while ETH is constrained by the previous big negative line, which is difficult to break through for the time being.

Two-year Treasuries fall to 4.28

Nasdaq still unable to break above 120-day line

1. Ahr 999: 0.29, fixed investment can be made

Number of ETH holding addresses: all addresses are on the uplink

3. Summary of investment and financing

secondary title

3. Summary of investment and financing

1) Investment and financing review

monthly review

2) Current situation of the organization

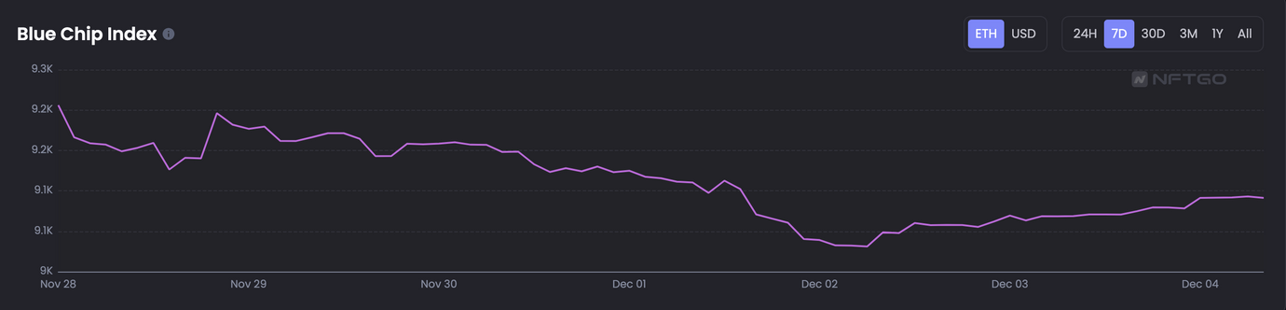

4. Encrypted ecological tracking

1. NFTs

secondary title

4. Encrypted ecological tracking

1) Market overview:

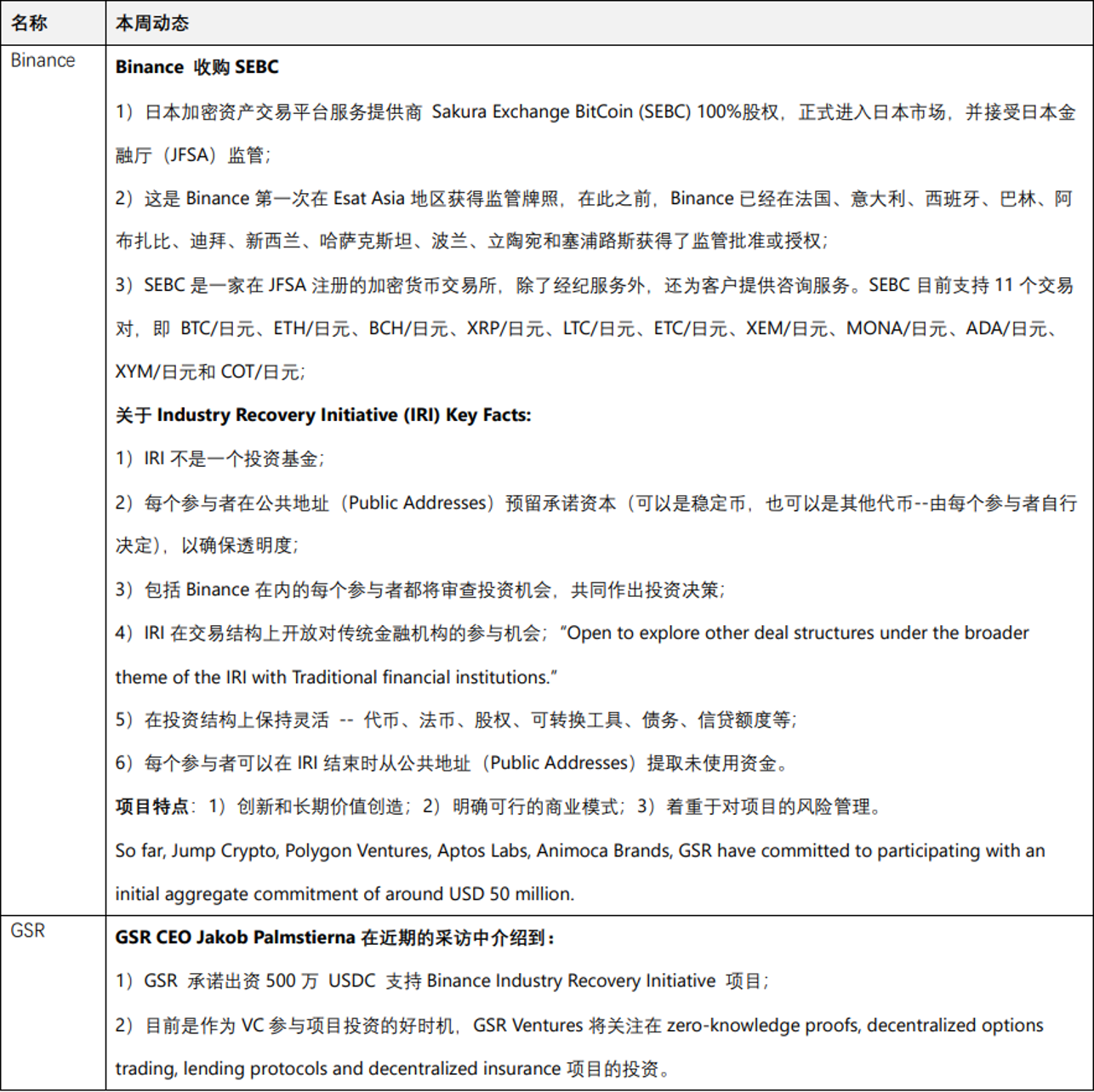

Compared with the NFT blue chip index this week, there is not much significant improvement. As of December 4, the nft blue chip market is still in a bear market recovery period. Compared with the lowest point of the market in mid-November, there has been a certain rebound, but the blue chip index Still at a low point.

Compared with the NFT blue chip index this week, there is not much significant improvement. As of December 4, the nft blue chip market is still in a bear market recovery period. Compared with the lowest point of the market in mid-November, there has been a certain rebound, but the blue chip index Still at a low point.

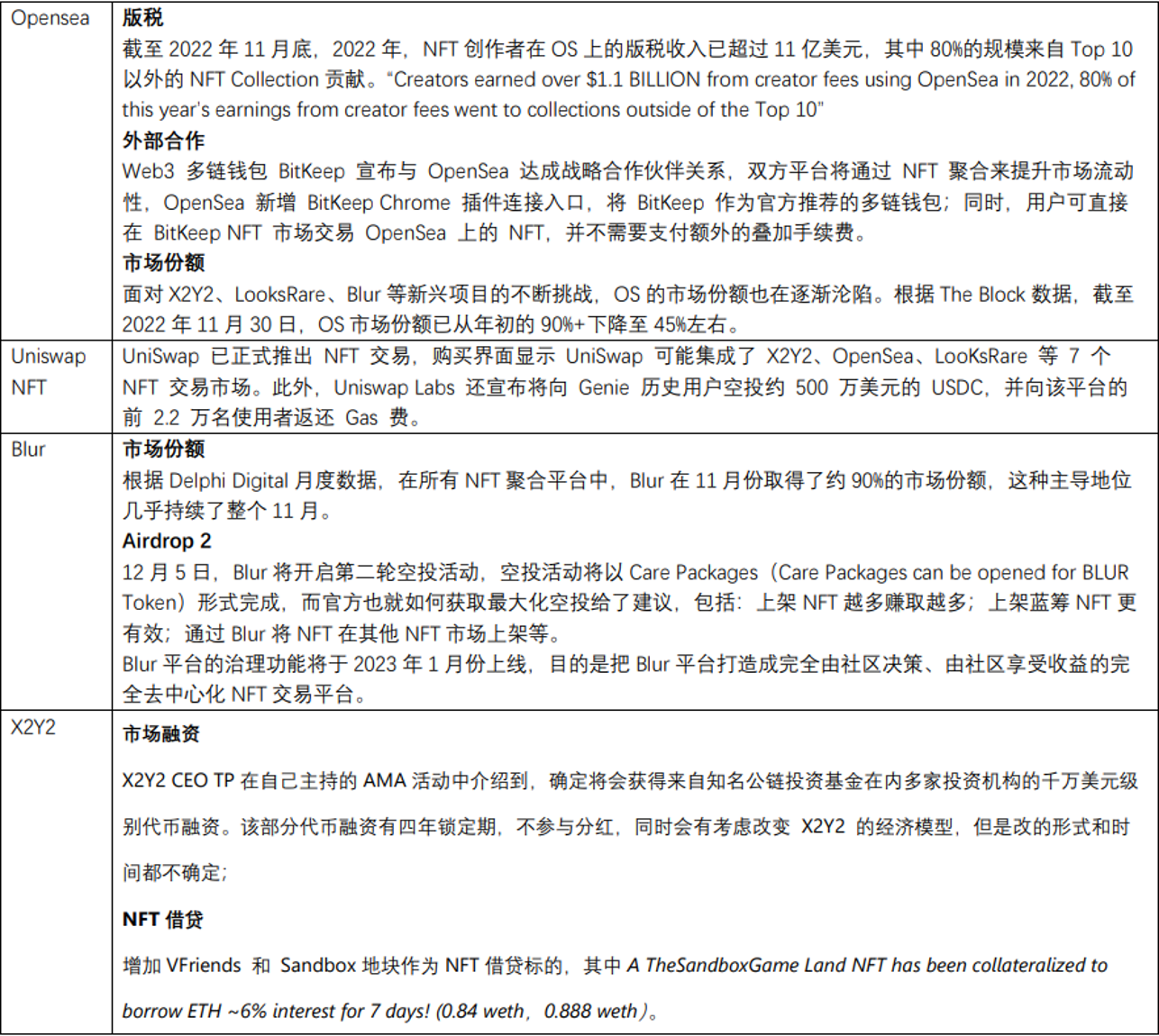

This week, the total market value of the NFT market increased by 0.65% year-on-year, and the total transaction volume decreased by 12.68% year-on-year. The total trading volume of NFT this week has decreased compared to last week, so it can also be seen that the market is still recovering from the FTX incident.

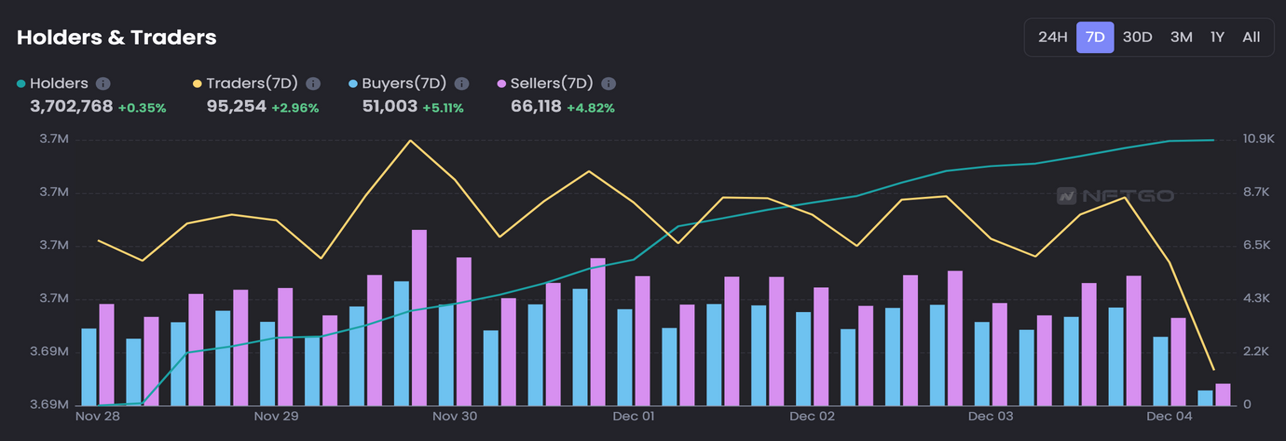

The activity of holders/traders in the NFT market this week has increased to a certain extent compared to last week. Buyers have increased by 5.11% compared to last week, sellers have increased by 4.82% year-on-year, and holders have increased by 0.35%. Overall, NFT prices are gradually returning to the right track, and the market has gradually rebounded from the previous freezing point. The overall market activity has increased this week.

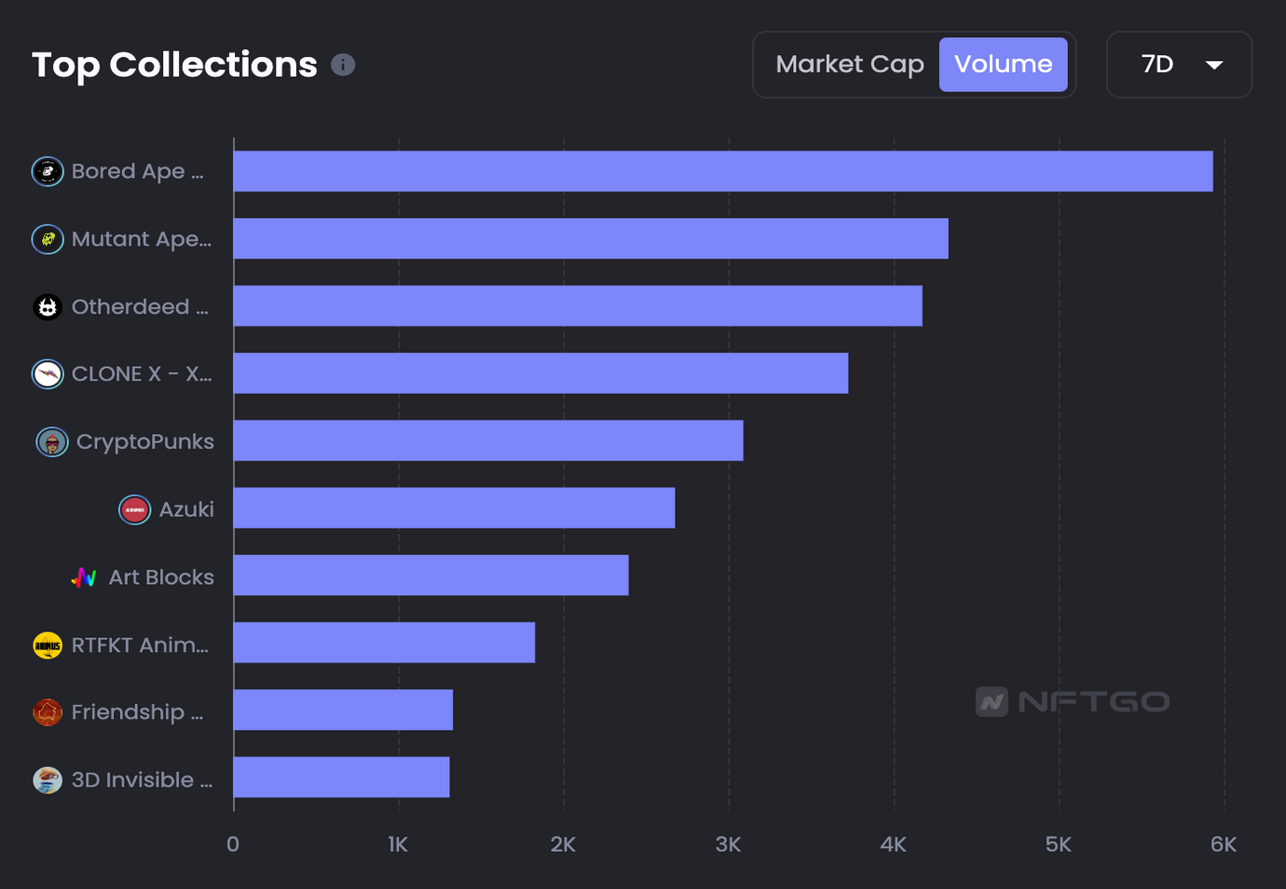

The top three NFTs in the market trading volume this week are BAYC, MAYC, and OHTERDEED. It is worth mentioning that the transaction volume of CLONE X has increased significantly this week, and it has jumped to the fourth place. The floor price of BAYC is currently in the range of 67-68 ETH.

2) Dynamic focus:

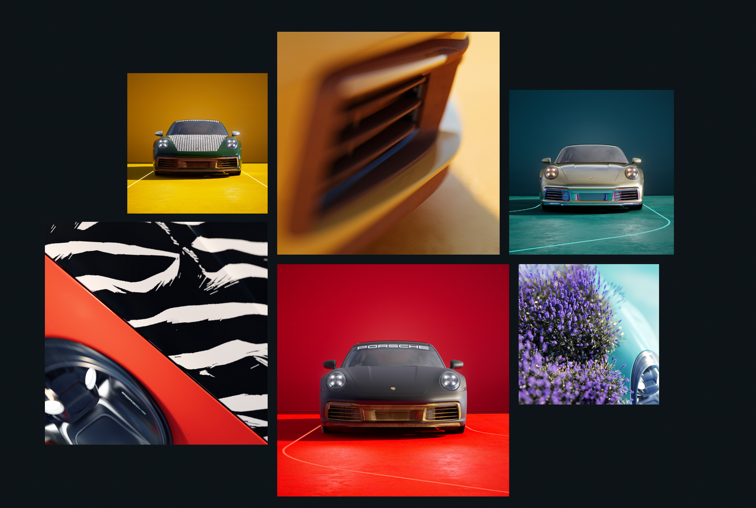

Porsche 911 - NFT

Porsche has announced plans to release a 7,500-piece NFT collection based on classic Porsche sports cars in January 2023, themed around its well-known model, the 911. The NFT whitelist will be open for registration from December 20 to January 6, 2023, and the casting date is January 2023, and the casting will be opened in four batches. Porsche surged 13,000 active users on its Discord channel the day the news was released.

Porsche attaches great importance to community co-creation, and the core of the project is the community. The goal is to involve Porsche enthusiasts in the future development of the company. "If a project is to be successful, it needs to bring people together" - Director of Porsche Brand Management.

PHASE 1: 7500 NFT on the shelves

Holders will be invited to participate in a brainstorm on what future NFT designs might look like.

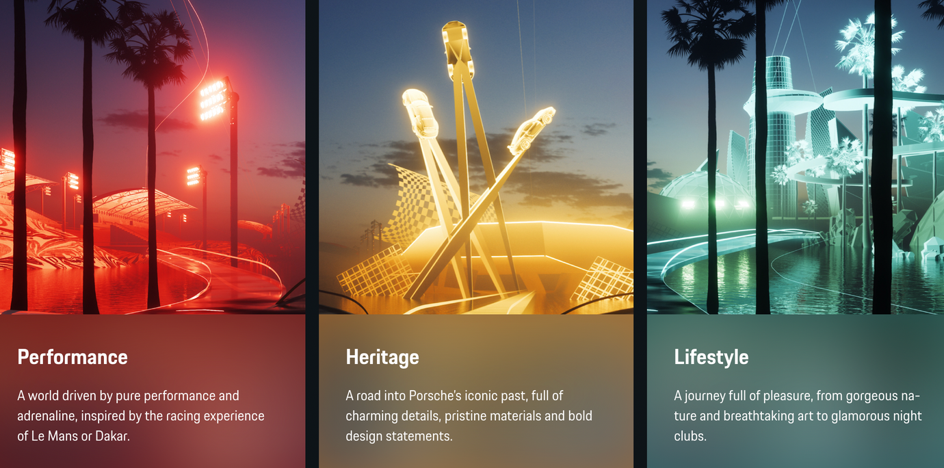

PHASE 2: Choose and design based on roads, materials, and the lifestyle of the car owner

Creation through teamwork: Porsche hopes that nft holders can provide design ideas for Porsche digital tokens through the car's performance, route, lifestyle, etc. after purchase. These lines reflect the characteristics of the company's brand identity and will modify the overall design of the NFT itself.

KEY 3.id

PHASE 3: Let nft holders participate in future design & additional offline rights

"We want to reach out to you and co-create. That's the goal. I'm looking forward to the first co-creation session with the holders in the future. We can test the artist's designs in the future and bring you together with the artist and our whole team together."

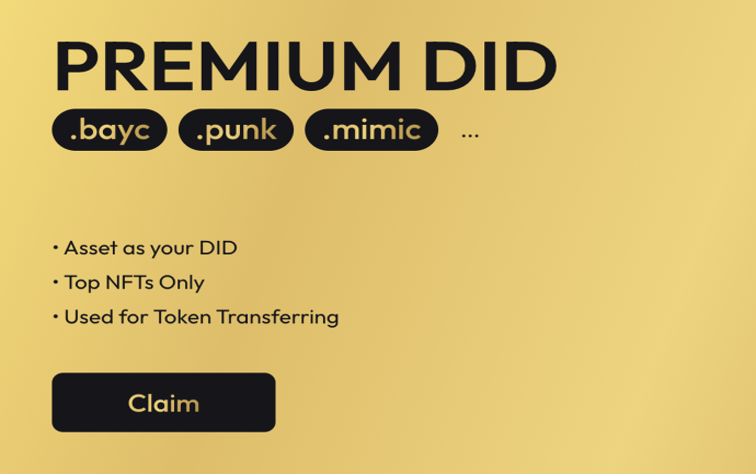

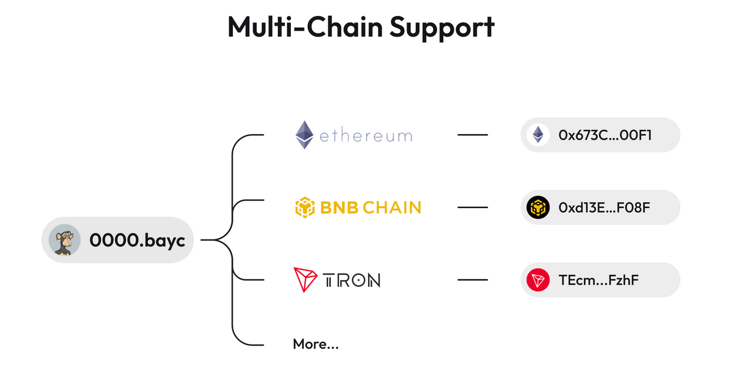

DID app KEY 3.id has launched a .bayc digital identity (DID) tied to a blue-chip NFT and opened mint to all Boring Ape (BAYC) NFT holders. BAYC NFT holders can claim the corresponding DID for free at KEY 3.id, such as 0000.bayc. .bayc is bound one-to-one with the Boring Ape NFT, and the total number is also 10,000.

3) Key projects

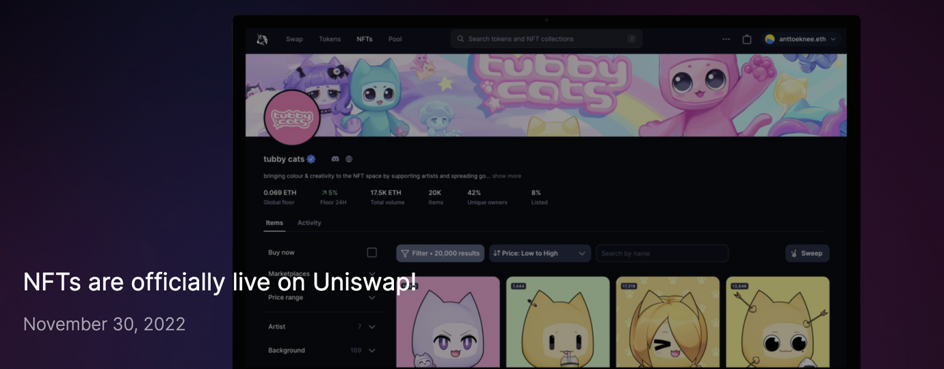

Uniswap Labs will launch an NFT aggregation trading platform,

The platform will aggregate NFT orders on OpenSea, X2Y2, LooksRare, sudoswap, Larva Labs, Foundation, and NFT 20. And open cross-market transactions

Compared with other NFT aggregation trading platforms, it can save up to 15% of Gas costs.

In addition, because Uniswap Labs has acquired the NFT platform Genie in June this year, Uniswap will also airdrop approximately US$5 million in USDC to Genie’s historical users, and return Gas fees to the first 22,000 users of the platform.

The reasons for Uniswap Labs' layout:

a. Decentralized exchange dex users are growing slowly, hoping to use this as an interface to convert more NFT users into DeFi users on the chain.

b. Uniswap, as the largest user traffic portal in DeFi, combined with Sudoswap’s transaction aggregation function, theoretically has the ability to compete directly with Opensea. (However, uniswap's current resource depth in the NFT industry is not yet comparable to that of traditional NFT platforms).

c. As a software development company, Uniswap Labs cannot obtain additional cash flow income from Uniswap’s main operations. The strong cash flow income business model represented by Opensea in the NFT field is very attractive to the Uniswap Labs team.

Influence and prospect on the future development of NFT and DeFi:

Compared with defi, NFT itself has a better understanding of users, and the threshold for getting started is lower. DeFi, as a financial investment sector with a higher threshold, is extremely difficult to directly attract external users. Therefore, how to use players in the nft market and convert them into defi users is also an important development indicator of uniswap.

Although the poor liquidity of NFT is a problem that everyone has been criticizing, the liquidity market of NFT still has a lot of room for development in the future, and the early layout is generally a very good strategic strategy.

2. GameFi blockchain games

Project of the Week—The Beacon

Introduction: A pixel game incubated by Treasure DAO. Treasure DAO can be understood as "Nintendo of Web3", and many of its games use $magic as the ecological token

Game modes: The Beacon has three modes: single player PvE, multiplayer PvE (still in development), and house system

Single-player mode: Players will enter the dungeon battle alone, try to stay undead, and finally clear the level. After clearing the level, they will get NFT and treasure chests as rewards.

House system: Players can collect various house decorations to personalize and customize the house. When creating a character at the beginning, the system will automatically generate a blank house. Only by playing the game continuously can you get more furniture accessories. Finally, players can show and share your house with friends.Role classification:

free character: Players can participate in the game experience without spending any money.

paid role: Players can choose to spend a certain amount of money to go to Mint for a paid character (about 40 US dollars). The paid character will come with a set of initial character skins, house decorations and some small benefits. Paid characters can get more accessories after clearing the level.

blessing role

: A whitelist is required to obtain permission, and the specific content is unknown

$magic Token

Already listed on OKX, but the main liquidity is in SushiSwap, which will soon be listed on Coinbase;

Thanks to the recent popularity of The Beacon game, Magic Token has soared by nearly 130% in recent days. Investors should pay attention to risks and be wary of the selling pressure brought by the upper pressure level of 0.71https://twitter.com/leansmith 001/status/1599039117522001921 Summarize:

At present, the popularity of the community is high, and the daily activity on the chain has reached 20,000. Refer to professional game reviewers

According to the conclusion, the reasons for the explosion may be as follows:

Low threshold: You don’t need to spend money at the beginning, you can use free characters to experience, and you can also get props (the difference is that you can’t sell them). Compared with many blockchain games, you can’t play without buying NFT, and the conversion rate of natural users is higher. If you want to pay to play, the cost of 40 U for a single character is still acceptable.

Type of game—rougelike: The randomness is high, which keeps the game fresh every day. At the same time, the game time is controlled at about 3 minutes, which will not take up too much time.

Blind box gameplay: It is in line with the gambling nature of users. When I see others offering golden props, I always think that I can have the same luck. If you drive high-quality props, sending them out in the group will also attract everyone's attention and give you a sense of accomplishment.

The power of dissemination: Why are there discussions in various groups? Because the answers in the tavern and the videos of customs clearance are all new content every day, everyone will find and spread them spontaneously. This process is also equivalent to interacting with group friends, providing a certain emotional value

Difficulty control of the game itself: novice players can get rewards (exit on the second floor, ultra-low difficulty), master players can get more (challenge mechanism on the third floor)

shortcoming:

The current NFT has not yet found a consumption scenario, and the income is constantly decreasing

shortcoming:

On the second day after the heat was sparked, the community began to complain about the serious lag of the game. At present, it is also a big problem for the Web3 project, and the cultivation of basic skills is too poor.

There may be cases where the middle part uses scripts to cheat for gold

think:

The mature gamefi model in the future needs to be highly attractive to traditional game users, so as to establish a closed loop in which the project side makes games well and earns commissions, gold-making users earnestly sell items, and consumer users spend money to enjoy games

3. Infrastructure & Web3 infrastructure

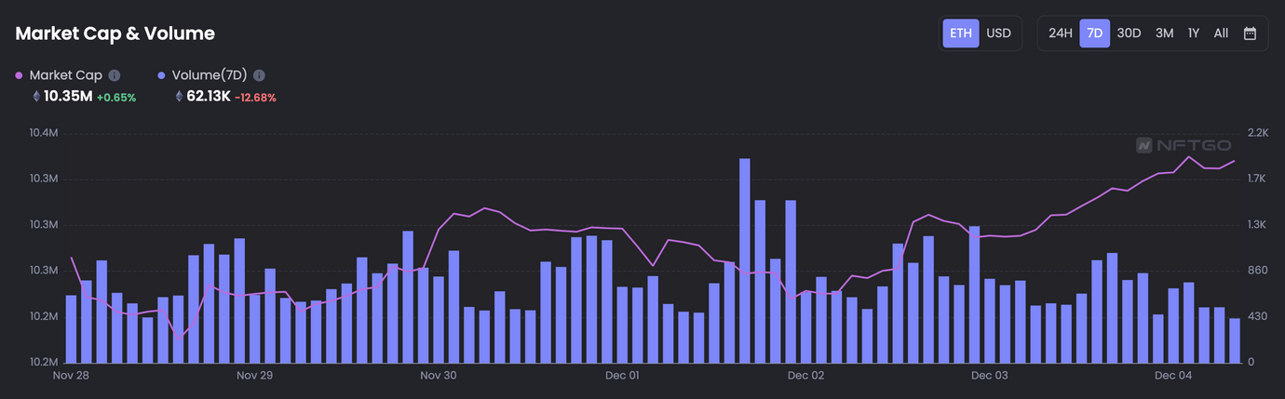

1) Market Overview - TVL

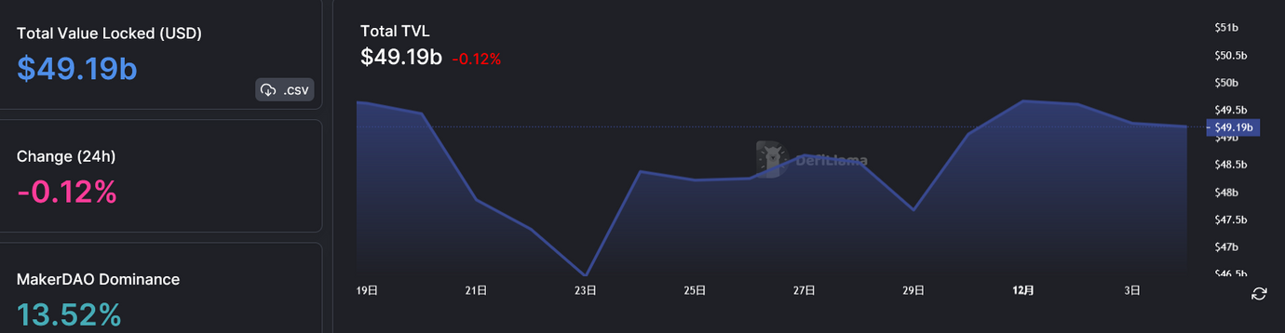

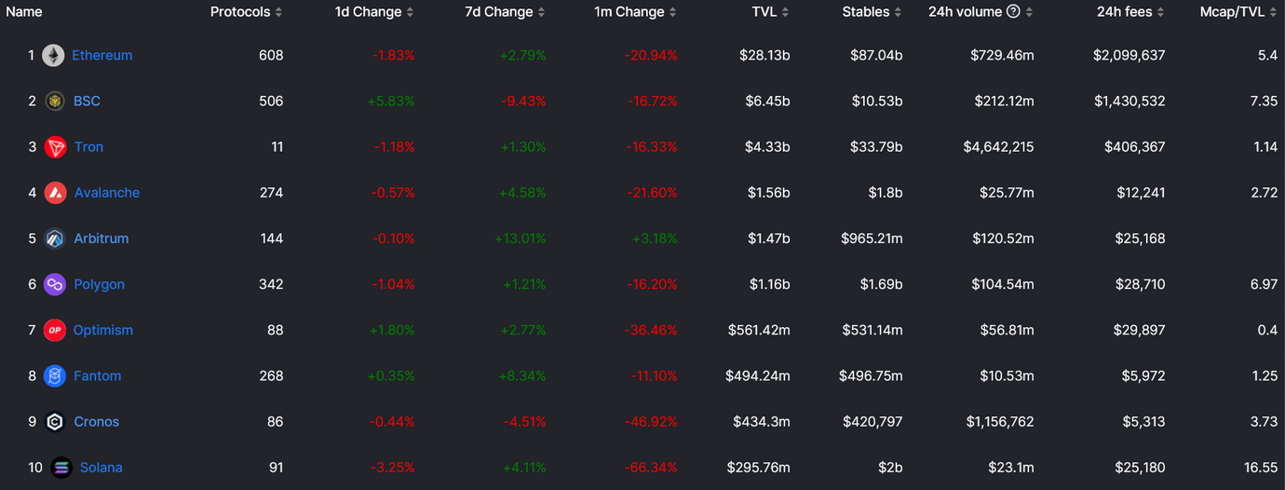

As of December 4, the overall lock-up volume of all public chains (including Staking) denominated in US dollars rebounded slightly following the market, rising to 49.19 B from nearly 48.7 B last week, with little change.

The TVL rankings of the major public chains have not changed much, except for BSC and Cronos, which have risen to varying degrees. Among them, Arbitrum benefited from the popularity of the new game The Beacon launched by the GameFi&NFT project TreasureDAO (token MAGIC rose by nearly 100% within a week); in addition, the price of GMX continued to perform strongly this week, with an increase of more than 20%.

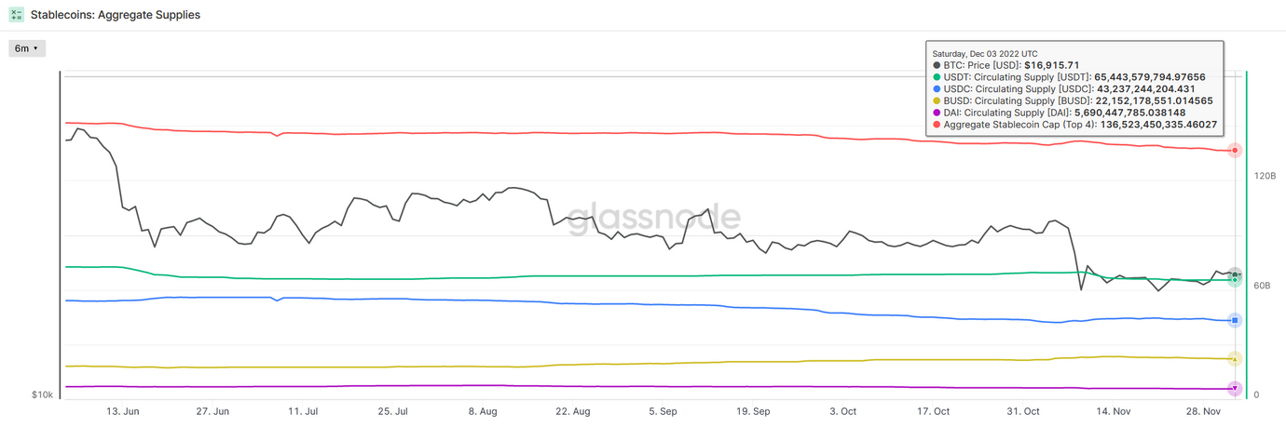

2) Market Overview - Stablecoin Supply

As of December 3, the total supply of the top four stablecoins (USDT, USDC, BUSD, DAI) was about 136.523 billion, which was about 995 million (-0.7%) lower than the 137.518 billion a week ago. The supply of stablecoins has declined for three consecutive weeks, and funds continue to flow out.

The three major fiat currency stablecoins continued to fall together this week. Among them, the supply of USDT has continued to decline for 4 consecutive weeks, with a slight decrease of about 65 million pieces this week, and the downward trend shows signs of slowing down; USDC has experienced a large outflow, with a supply reduction of about 800 million pieces this week, and funds in the US market continue to flow out; The supply of BUSD has fallen for two consecutive weeks, with a decrease of 600 million this week.

Since the FTX incident, the recent stablecoin data has continued to decline, and the signs of capital outflow have not improved. In the absence of incremental funds and only relying on stock funds to play games, it is expected that the rebound will be difficult to continue, and the market outlook will remain volatile.

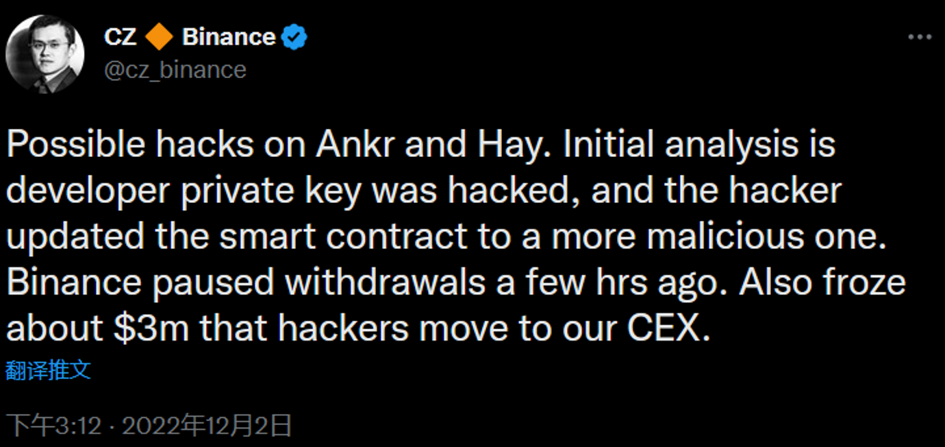

3) Market Overview - Ankr Hacking Incident

Hacking incidents occurred frequently during the bear market, and another hacking incident occurred this week.

Liquidity staking service Ankr Staking has been hacked, and CZ tweeted that the preliminary analysis shows that the private key of the smart contract deployed by Ankr Staking was leaked, and the hacker obtained the function call authority to mint tokens.

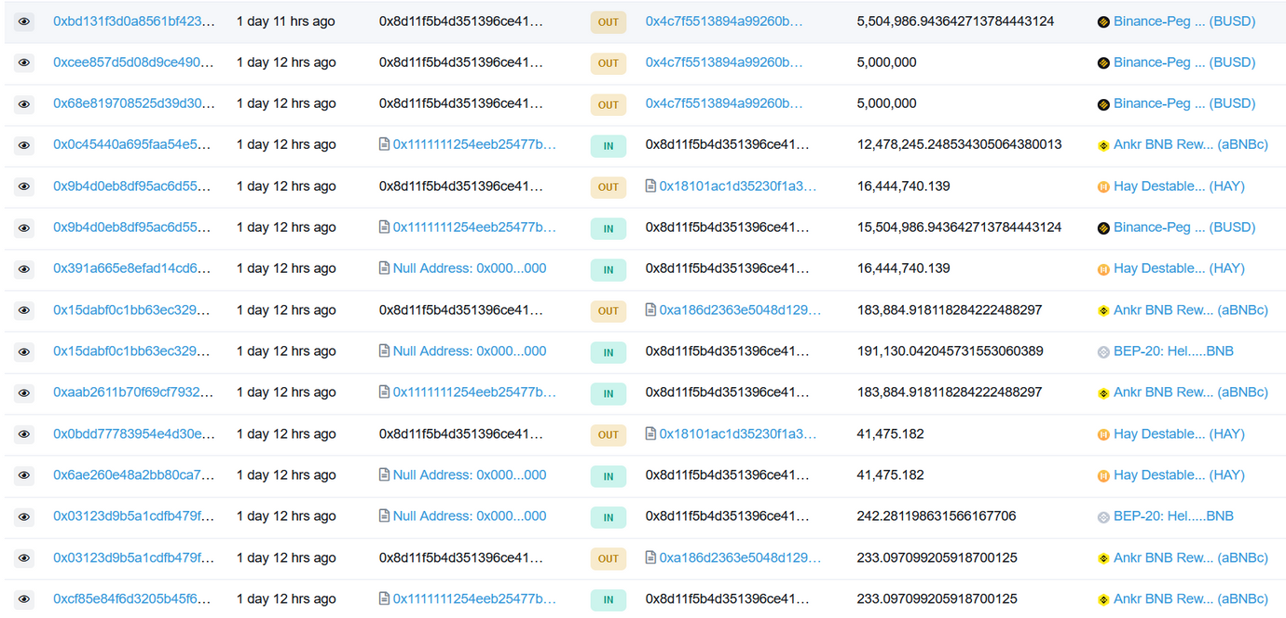

On December 2, on-chain data monitoring showed that the Ankr Staking: aBNBc Token contract was suspected to have been attacked, and the liquid staking token aBNBc was issued in a large amount (Ankr BNB Reward Bearing Certificate is the proof that users provide liquid staking in Ankr Staking, The underlying BNB Staking was not affected), and sold on DEX in exchange for BNB and USDC, which caused the liquidity pool to be drained, and the price of aBNBc was almost zero.

The hacker made a total profit of 5,000 BNB (approximately US$1.5 million) and 4.05 million USDC, and then transferred 900 BNB to Tornado Cash, cross-chained USDC to Ethereum and exchanged it for ETH. There are over 50 addresses flagged as Ankr Exploiter.

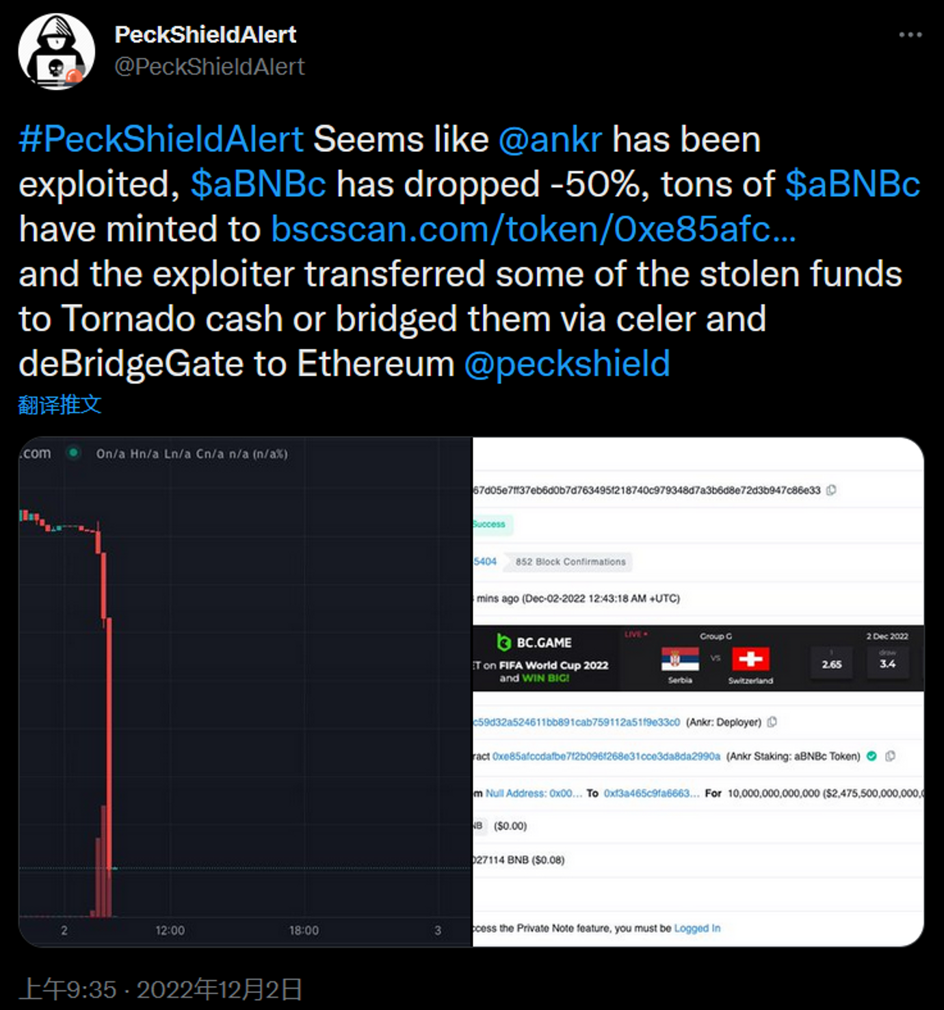

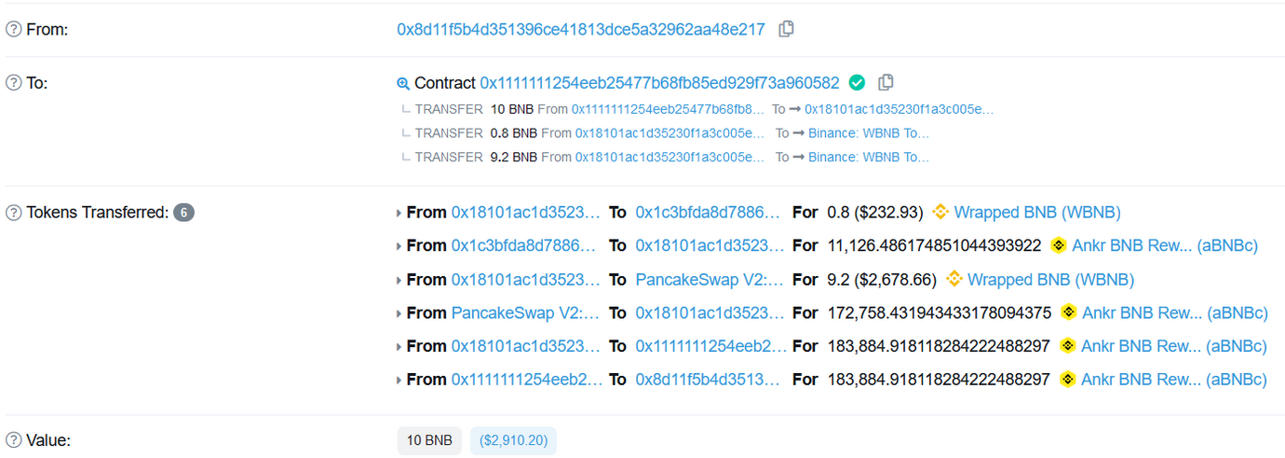

After the hack, some arbitrageurs ( 0 x 8 d 11 F 5 b 4 D 351396 CE 41813 DCE 5 A 32962 AA 48 e 217 ) made nearly $15 million in profit through the DeFi protocol Helio Protocol arbitrage. Helio Protocol is a lending protocol (similar to MakerDAO) that generates stable currency HAY based on BNB overcollateralization.

At the time of the attack, the arbitrageur exchanged 180,000 aBNBc on PancakeSwap with 10 BNB (costing about $3,000).

After several attempts (the account does not seem to be the hacker himself), the arbitrageur mortgaged aBNBc on Helio Protocol to borrow 16.44 million stablecoins HAY, and converted all of them into about 15 million BUSD, and then transferred these BUSD through The intermediate addresses are all transferred to Binance.

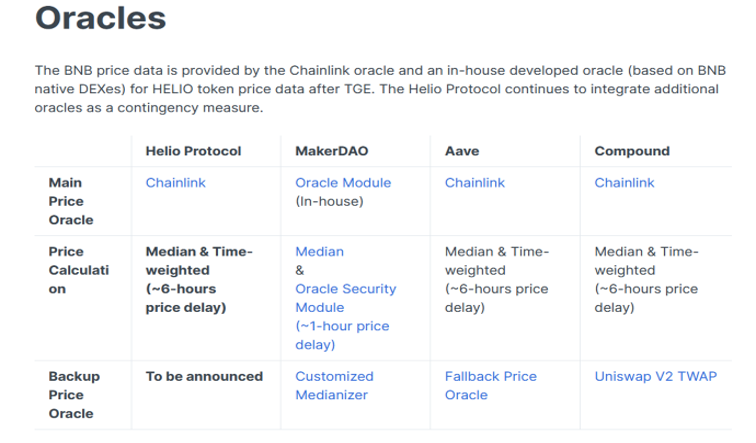

The profit of arbitrageurs is mainly due to the large delay in Helio Protocol's oracle price feeding mechanism, which failed to update the price of aBNBc in time; in addition, after the hacking incident, the project party was also slow to respond to it, exposing risk control problems.

In this incident, the hacker made a profit of more than 5 million U.S. dollars, and the arbitrageur made a profit of about 15 million U.S. dollars, and the part transferred to Binance has been frozen. Ankr’s official Twitter stated that the resulting bad debts will be covered by Ankr, and the excess issued HAY will be repurchased to promote its anchoring; in addition, Ankr will also compensate all losses of BNB-aBNBc LP before the incident.

4) Infrastructure News - Fleek

secondary title

5. About us

team news

team news

team introduction

JZL Garden planned the schedule for NFT issuance in 2023 last week. In the future, it plans to incubate 1-2 NFT projects every month in 2023. We will also update the development of all projects in the Garden community in time. In addition, JZL Garden will On this Thursday (December 8), the Garden project's first NFT series "Dandelion" to Upstairs NFT will be launched, with a total of 1,000 issued. We will continue to release relevant information on the media matrix this week, so please pay attention.

team introduction