1. Summary of Industry Dynamics

secondary title

1. Summary of Industry Dynamics

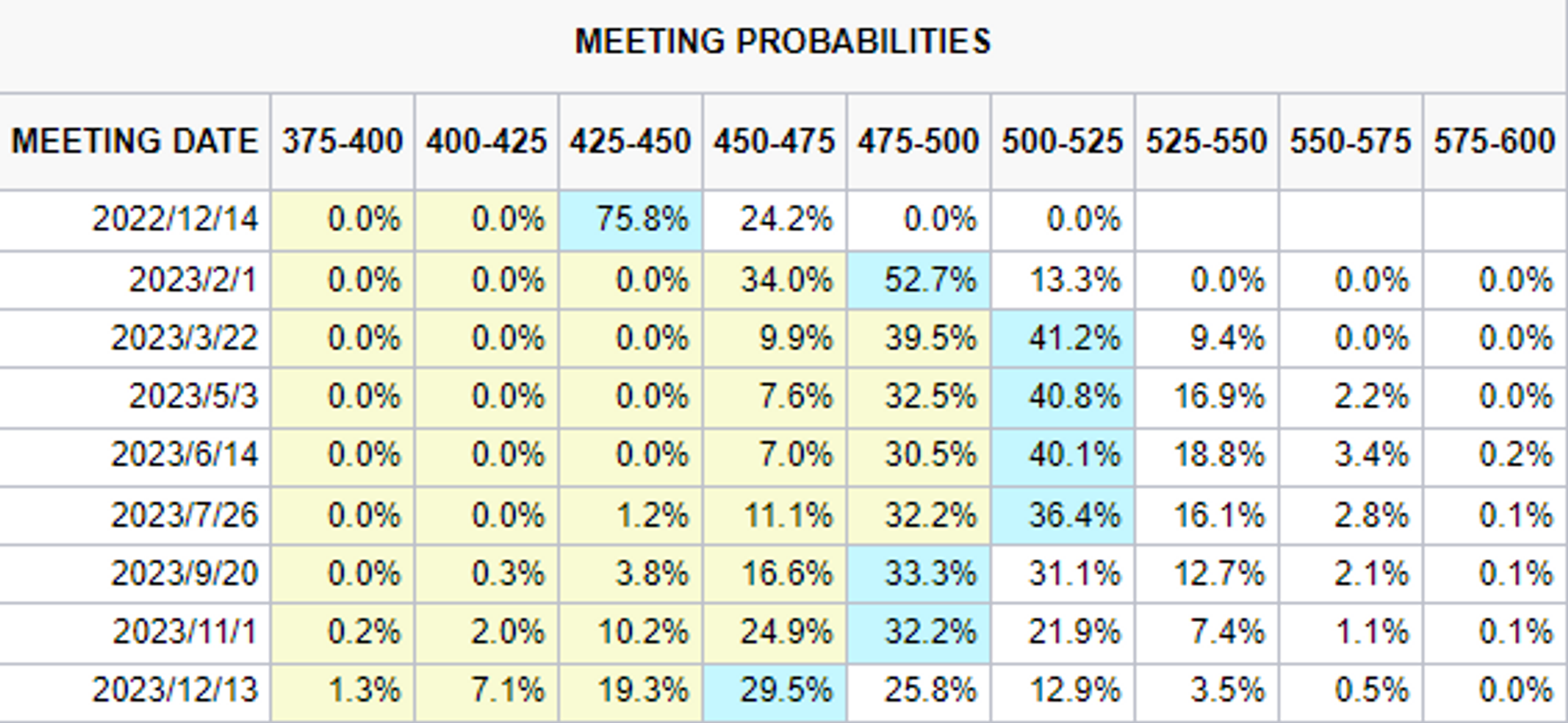

In contrast, U.S. stocks have only three trading days due to Thanksgiving this week. The Nasdaq returned to the top of the rectangular frame and rose by 1.21%. The trend of the S&P is still in the upper and lower trend lines. It is viewed from the point of view of a slight rebound in shocks. The number of people applying for unemployment benefits rose slightly at the beginning of this month. The number of people applying for unemployment benefits in the United States announced on November 23 was 240,000, and the forecast value was 225,000. The number of people receiving unemployment benefits increased slightly. Does not constitute a basis for a major shift, and as monetary policy becomes more effective, unemployment benefits should gradually increase. The focus this week is on the minutes of the Fed meeting in November. The overall direction of the minutes is dovish. The S&P had two dives before the minutes of the Fed meeting came out, and it started to rise after the meeting minutes came out. The minutes of the meeting first mentioned the moral issues of the Fed, pointing out that because the Fed holds great responsibilities and privileges, the Fed’s policies can only be effective on the basis of public trust, which basically guarantees the credibility of the Fed’s meeting minutes and speeches. Then I mentioned the important point, that is, according to the survey of financial markets and public market managers, a 50 basis point interest rate increase in December is the most likely result. can be expected. Some members at the meeting said that slowing down the pace of rate hikes can reduce the risk of financial system instability. Personally, I understand that the Fed’s rate hikes have entered a deep water area, and each subsequent rate hike may become the last straw that crushes the camel’s back. Similar to the hysteresis of monetary policy, it takes a certain amount of time to transmit such remarks. Although there is no major breakthrough, it shows that the Fed wants to take a breath and wait to see what effect it will have. Obviously, under the current situation Dovish discourse. The 2% inflation target is still unlikely to change, and the minutes also pointed out that in order to achieve the inflation target, it is appropriate to continue to increase the target range of interest rates. The dot plot provided by the FOMC meeting in early 2022 said at the time that interest rates would be raised up to 6 times this year, each time by 25 basis points. As a result, by the end of the year, the rate hike rate greatly exceeded what the Fed said at the beginning of the year. The transition from sentry to hawk. According to CME Group's forecast, the end point of the Fed's interest rate hike in 2023 will be 5.25% and will peak in the summer of 2023, which will usher in a major turning point for U.S. stocks.

2. Macro and technical analysis

secondary title

2. Macro and technical analysis

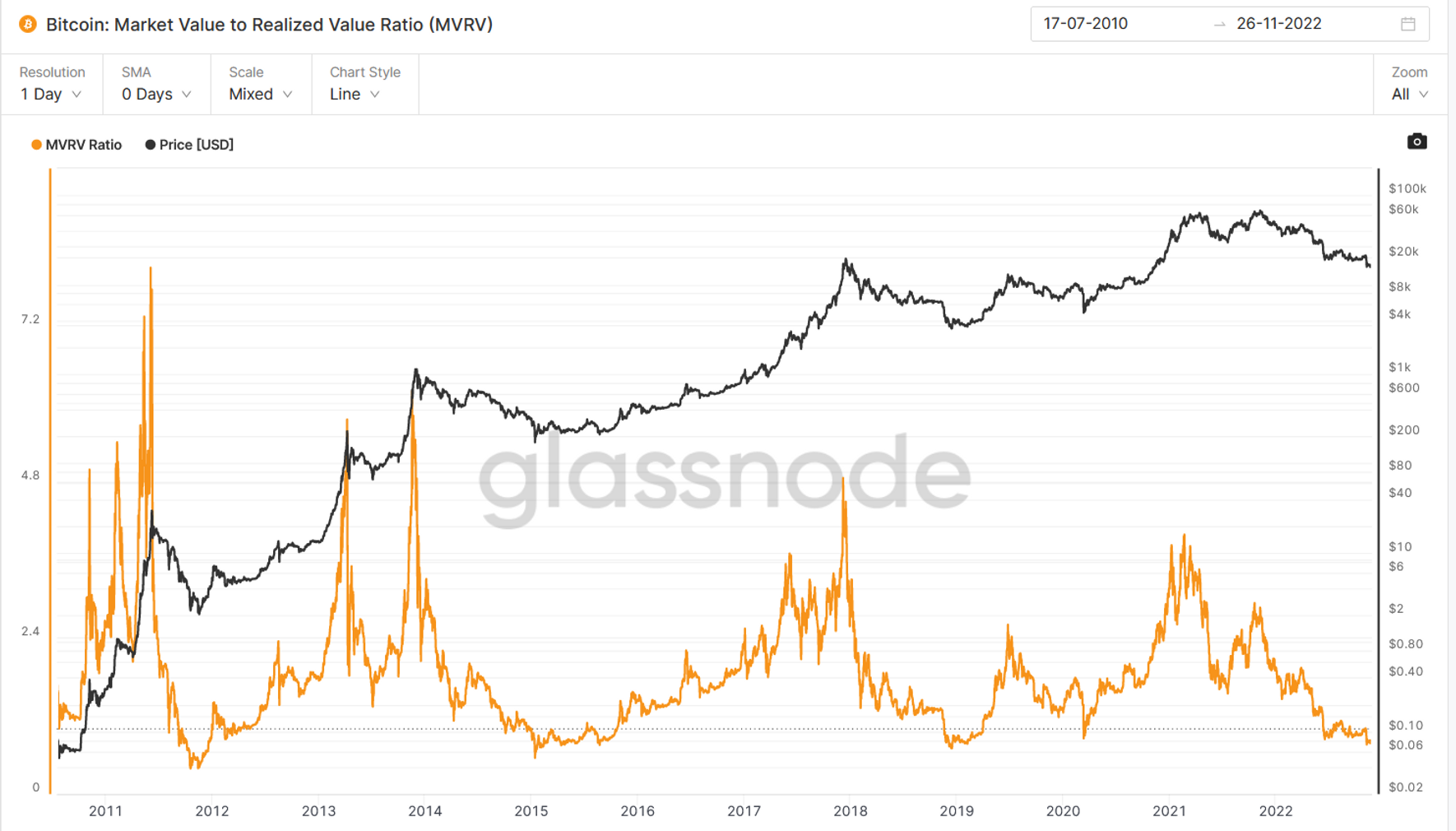

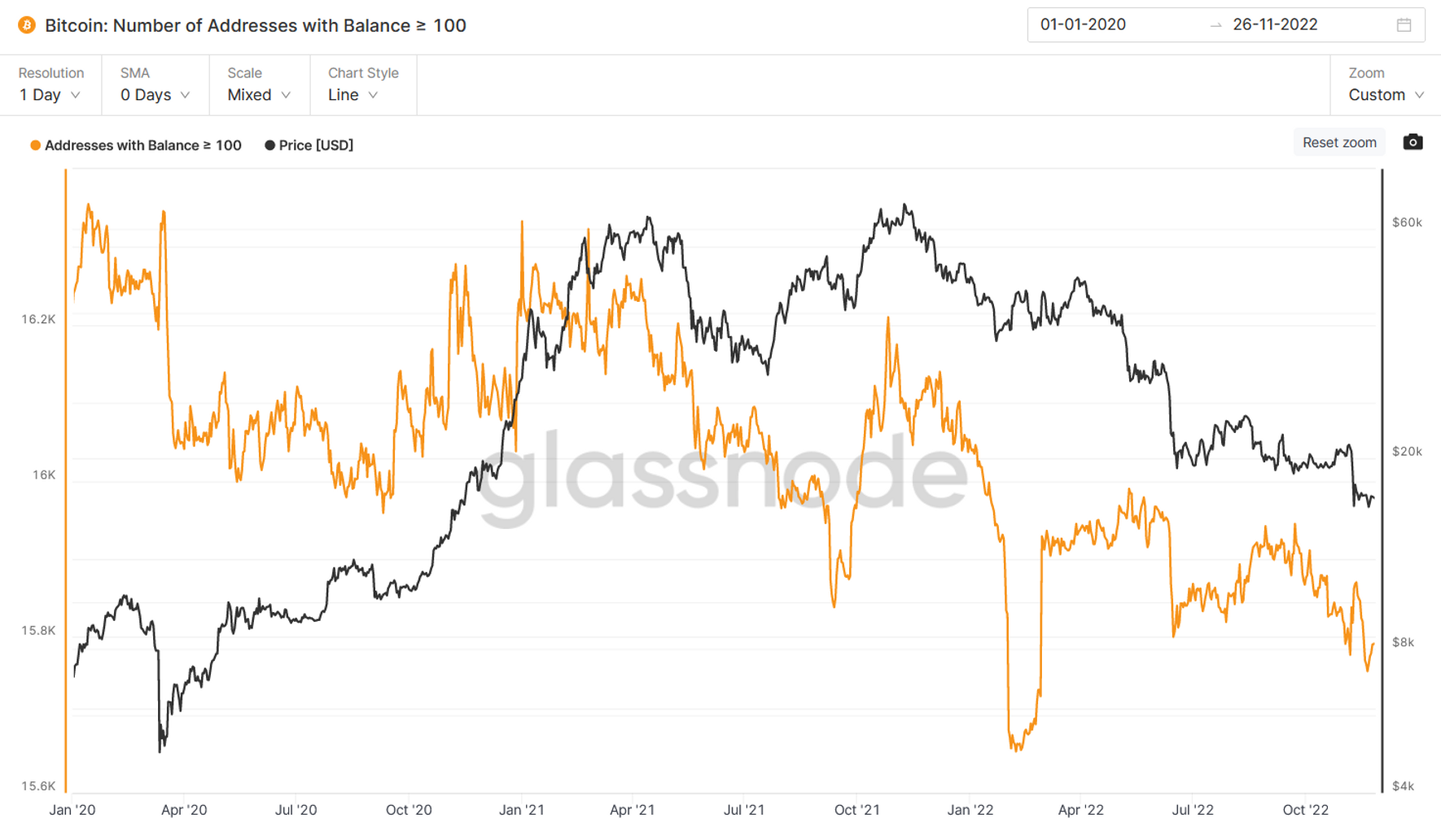

The market has come out of the shadow of FTX in the short term, which reflects the situation of the bearish landing. We believe that if BTC can go sideways, small coins with stories in the short term will have certain opportunities.

BTC and ETH are still sideways, and we judge that BTC and Nasdaq will vibrate in the same direction after the next interest rate hike meeting.

Two-year Treasuries held steady at around 4.5 bp.

After Nasdaq stood on the 60-day line, it was subject to the 120-day line, and fluctuated around the 60-day line in the short term.

1. Arh 999: 0.3, you can make regular investment.

secondary title

3. Summary of investment and financing

1) Investment and financing review

secondary title

2) Current situation of the organization

4. Encrypted ecological tracking

1. NFTs

4. Encrypted ecological tracking

text

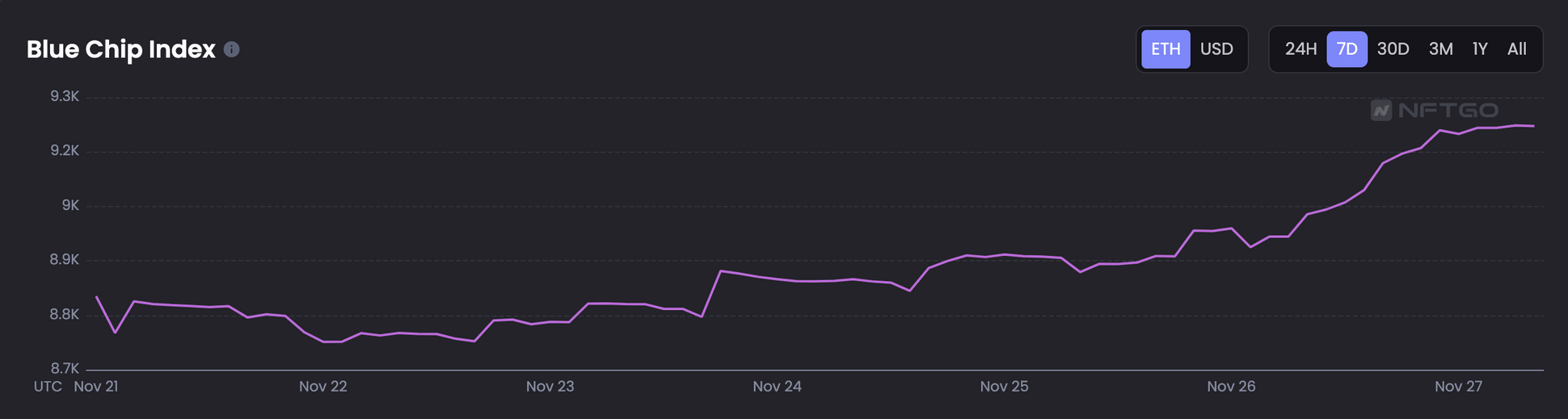

Market overview: This week's NFT blue chip index has increased significantly compared to last week. As of November 27, the blue chip index has risen sharply compared to last week. After the liquidation crisis this month, blue chip projects have rebounded sharply. FTX's crisis After that, the NFT market generally rebounded to a certain extent.

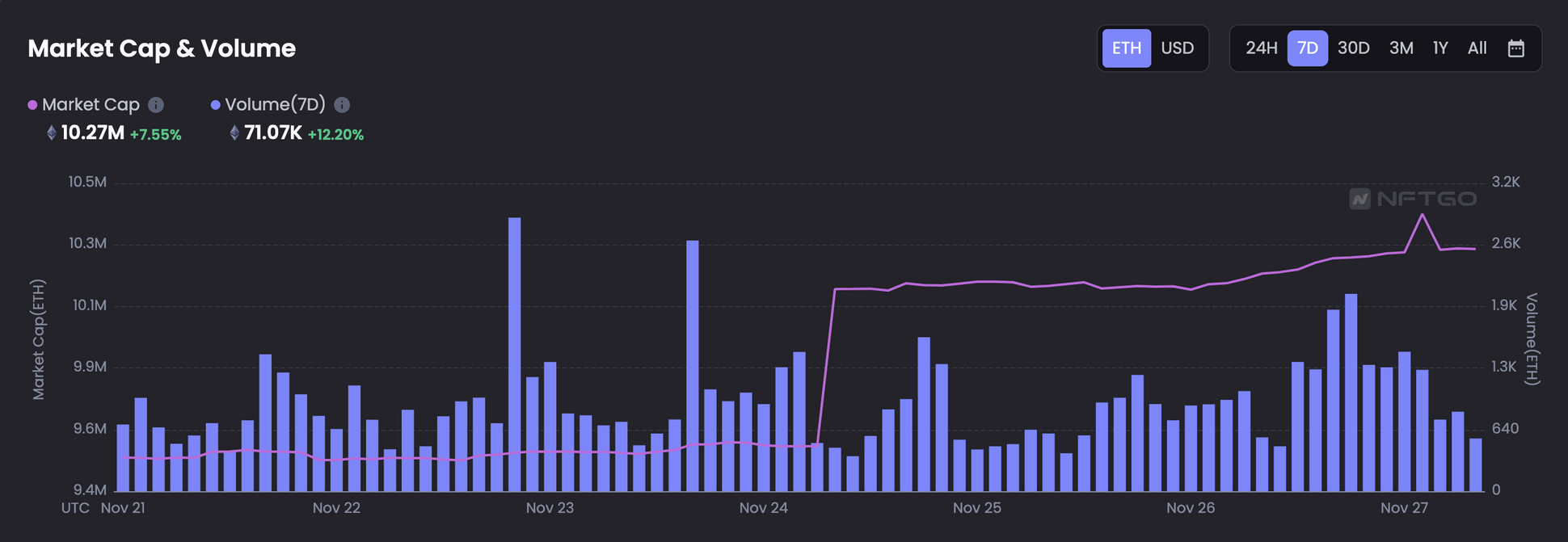

This week, the total market value of the NFT market increased by 7.55% year-on-year, and the total transaction volume increased by 12.20% year-on-year. This week’s NFT trading volume continued to climb compared to last week, and the total market value this week still rose, so it can also be seen that the market is recovering from the FTX incident.

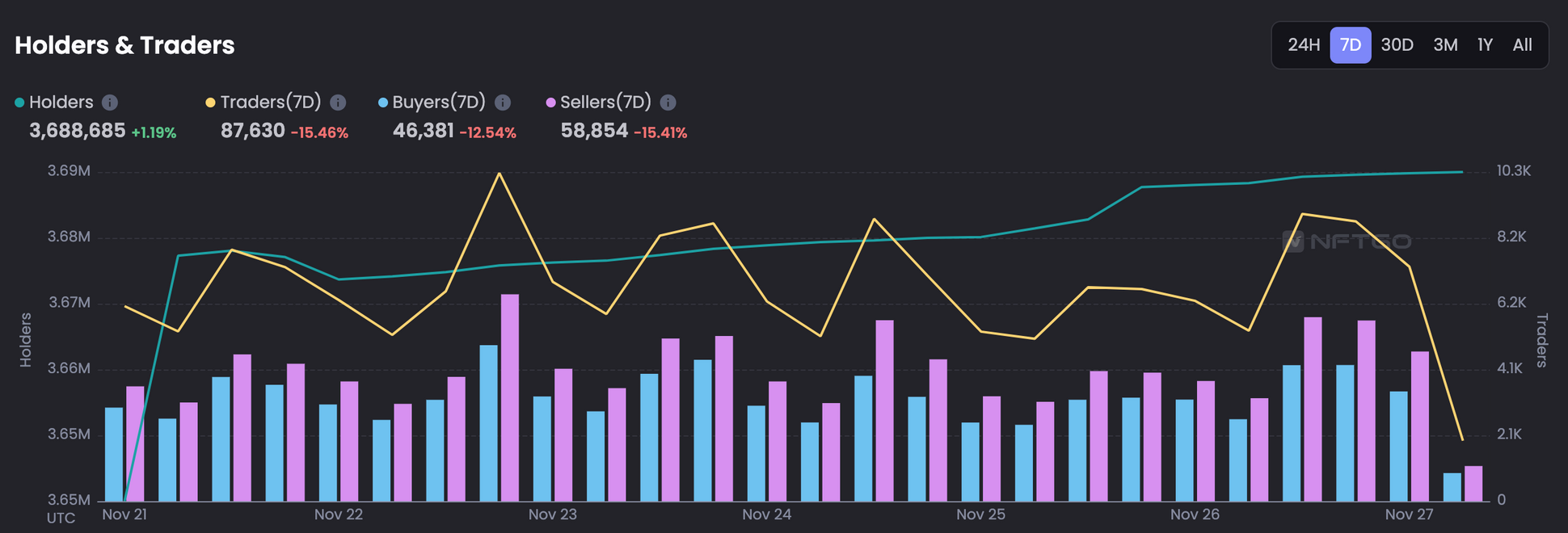

The activity of holders/traders in the NFT market decreased this week. Buyers decreased by 12.54% compared to last week, sellers decreased by 15.41% year-on-year, and holders increased by 1.19%. After last week’s low point sell-off, some NFT prices gradually returned to the right track, and BAYC also rose from 60 ETH to 70 ETH.

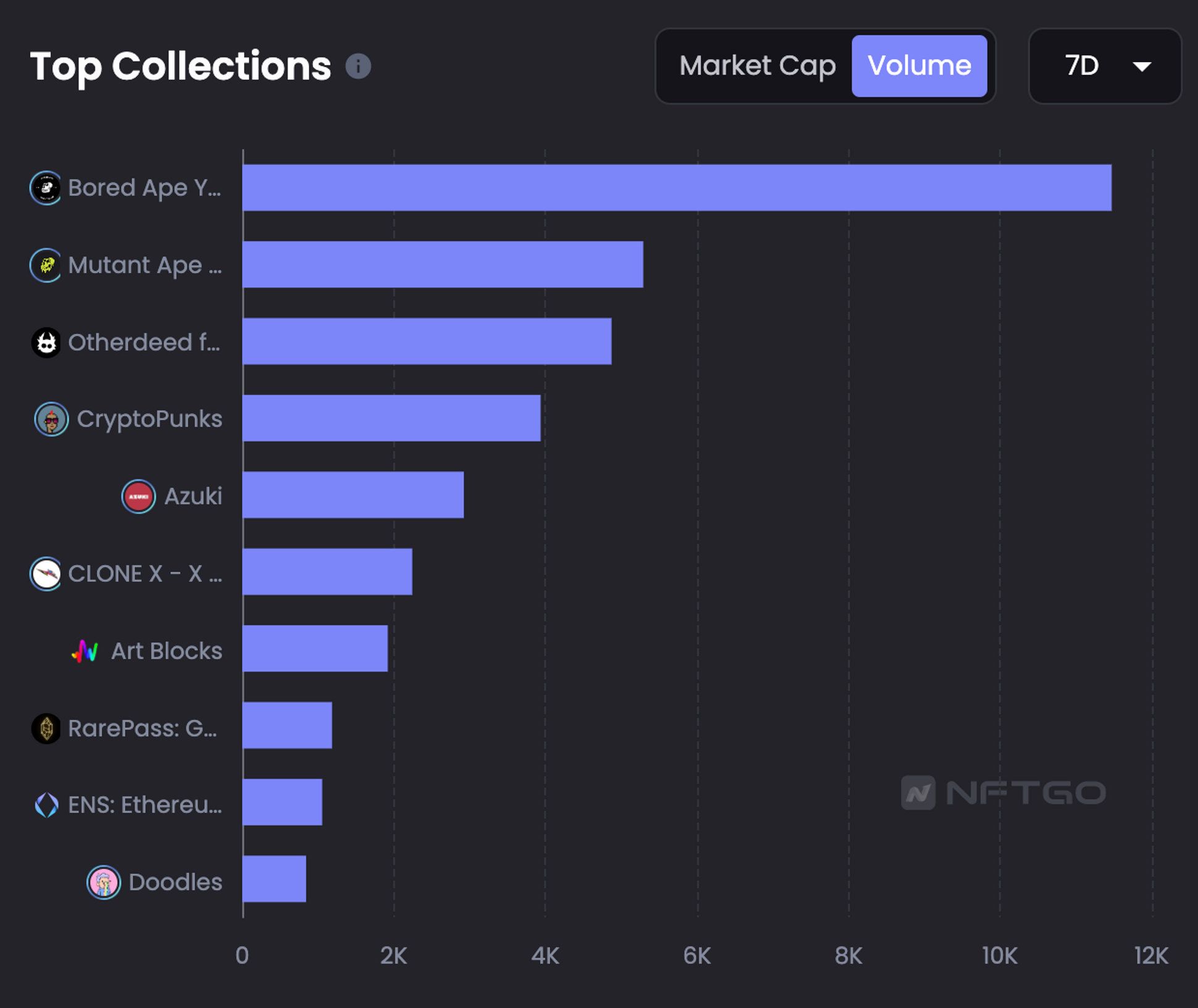

The top three NFTs in the market trading volume this week are BAYC, MAYC, and Otherdeed. The floor price of BAYC has risen from last week to 60 ETH to 70 ETH.

(2) Dynamic focus:

Cristiano Ronaldo and Binance have reached a cooperation and released Ronaldo NFT on the Binance Exchange

Last week, the NFT jointly issued by Ronaldo and Binance was launched on Binance Exchange. This cooperation is Ronaldo's first attempt to enter the blockchain and NFT. This time, four rarities are issued, including SSR, SR, R, and Normal. The SSR offering price is also 10,000 BUSD, and the remaining rarities will be issued on Binance’s Launchpad.

Saudi Arabian style NFT skyrockets because of the World Cup

Saudi Arabian NFT The Saudis surged 380% after last week's match between Argentina and Saudi Arabia. At the same time, the fan tokens of the Argentine national team also fell by 47% year-on-year, but the follow-up situation of the token may change depending on whether Argentina can qualify for the group.

Mattel, a toy manufacturer with multiple IPs, released an NFT trading platform

Cool Cats Football Club

This week, internationally renowned manufacturer Mattel released their NFT trading platform by issuing Aston Martin NFT and McLaren NFT. The opening of this trading platform also indicates that in the future, this toy company with a large number of IPs will convert more physical IPs into NFTs for sale. Mattel has a large number of IPs such as Barbie, Hot Wheel, and UNO available for use.

(3) Key projects:

Cool Cats Football Club is an NFT project co-founded by Cool Cat, Animoca Brand, and OneFootball Labs. Its narrative revolves around the 2022 World Cup in Qatar, launching an NFT in the form of football players.

There are a total of 3,000 NFTs issued this time, each of which corresponds to a different national team. Therefore, the NFT project has innovated in the gameplay design. Players will be able to redeem higher-level NFTs by upgrading and receiving rewards through the results of the World Cup.

However, the floor price is also related to the performance of the national team. Now NFTs with low land prices are characteristics of national teams that are about to be eliminated or have a high probability of being eliminated. Therefore, before the World Cup enters the knockout stage, the land price of this NFT project will bring a certain value capture after entering the knockout stage in the future.

overall review

2. GameFi blockchain games

overall review

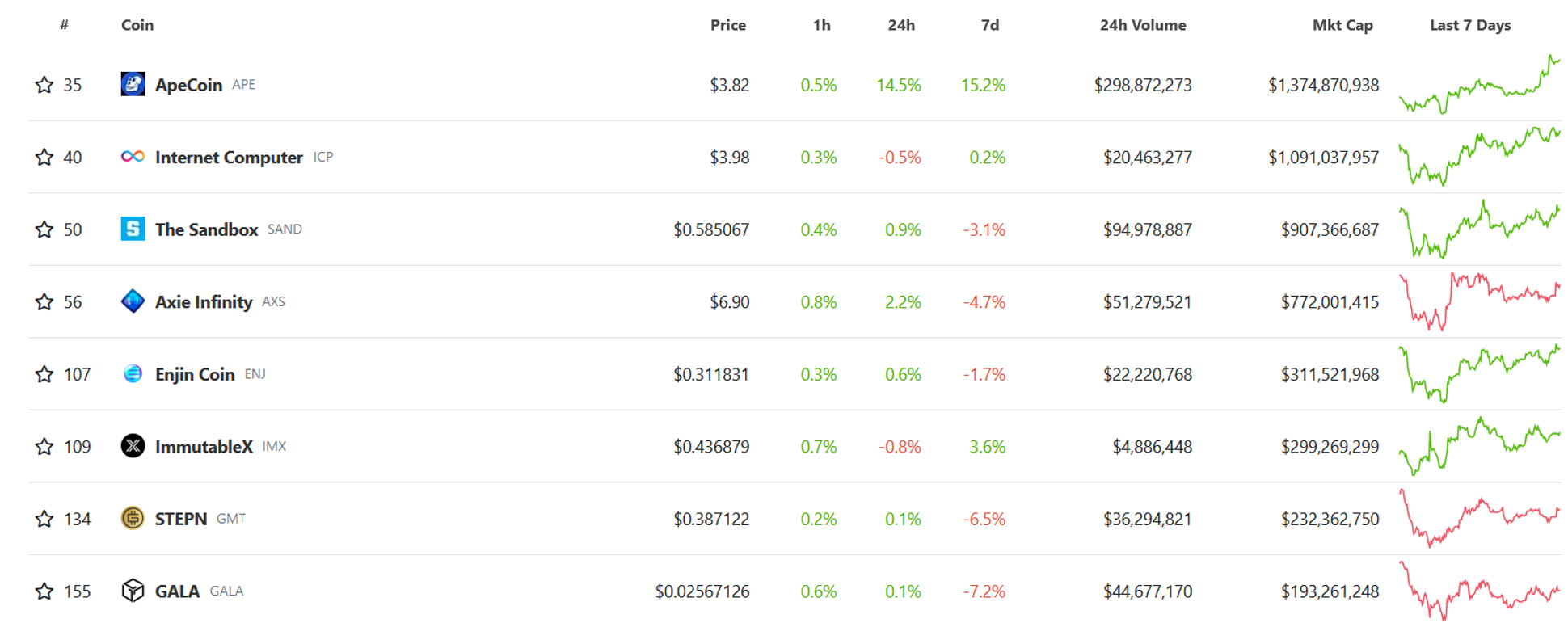

This week, mainstream tokens in the Gaming sector fluctuated with the market at low levels, showing a slight decline. In the bear market stage of the game sector, there is a lack of hot spots and popularity, and there are obvious signs of shrinking volatility and trading volume.Thirdverse

The Sandbox launched three land auctions on November 24, with the second on December 1 and the third in the first quarter of 2023. Affected by this, SAND has risen by about 10% since the low point on November 22, and the market enthusiasm is not high.

Items of the week—

Japanese game developer Thirdverse announced the completion of $15 million in financing for the development of web3 games and VR games. This round of financing was led by Japanese VC firm MZ Web3 Fund, with participation from 8 DAO, B Dash Ventures, Double Jump.tokyo, Fenbushi Capital, Flick Shot, Holdem Capital, Kusabi, OKCoin Japan, Yield Guild Games and OKX Ventures. Previously, the company reached a strategic cooperation with Polygon Studios and completed a US$20 million financing in August 2021.

The VR games under development by the company are all multiplayer combat games, including sword-like weapon fighting and gun battle types, and the three games are planned to be released after 2023 as part of Sony's PlayStationVR 2 content.

The blockchain game under development by Thirdverse is Captain Tsubasa (Captain Tsubasa). It is expected to release a beta version in December 2022 and issue the IEO token $TSUBASAGT in the first quarter of next year. Investors in this project include Animoca Brands and YGG, well-known IP With the support, it may have a better performance next year, which is worthy of attention.

The founder and CEO of Thirdverse is Hironao Kunimitsu, who was the founder of the Japanese mobile game company Gumi (listed in 2014). He founded Thirdverse in 2020, focusing on VR and blockchain games.

3. Infrastructure & Web3 infrastructure

1) Market Overview - Public Chain & TVL

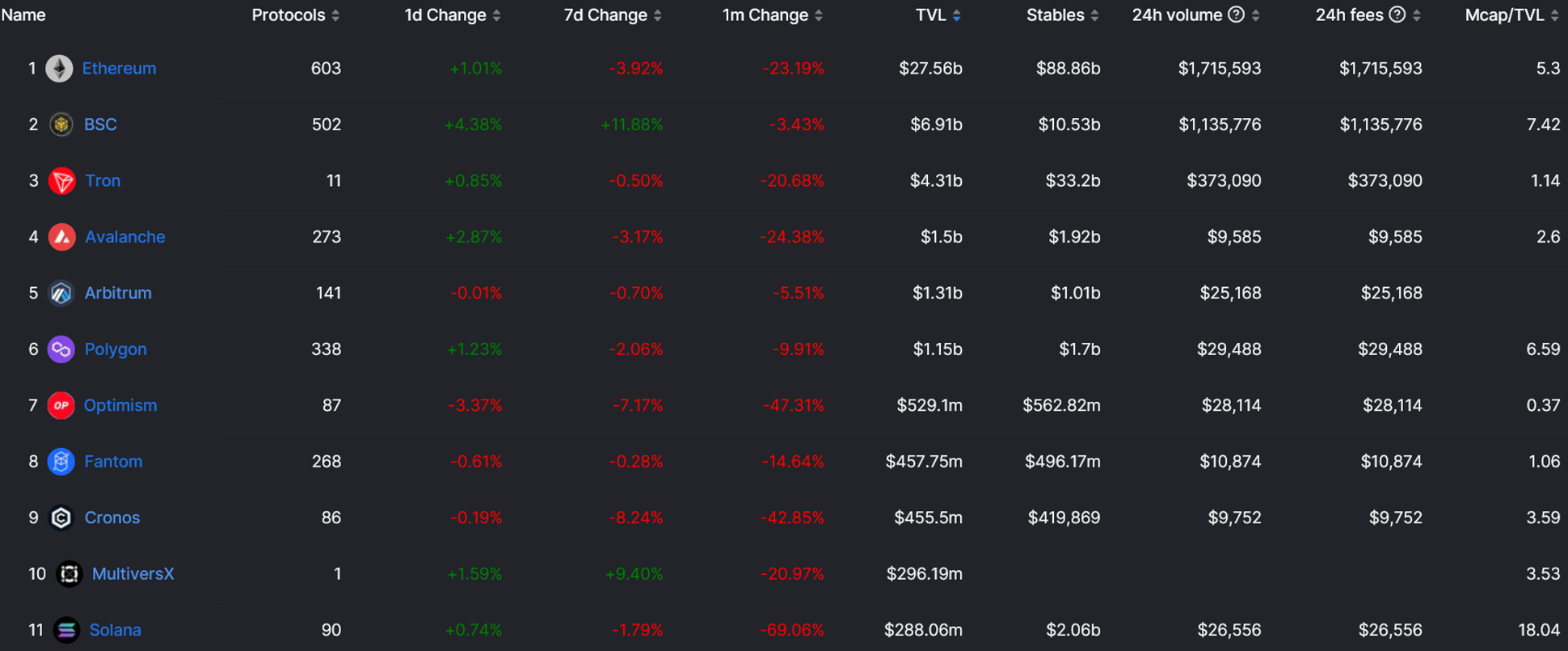

As of November 27, the overall lock-up volume (including staking) of each public chain denominated in US dollars has fallen slightly following the market, falling to 48.7 B from nearly 49 B last week, with little change.

The overall TVL of the major public chains has not changed much, and the top 7 have not changed compared to last week. Among them, BSC benefited from the impact of Binance restarting the launchpad, TVL rose a lot, and BNB rose by 18% in a single week. The launchpad launch project this time is Hooked Protocol, which will be introduced in detail below.

2) Market Overview - Stablecoin Supply

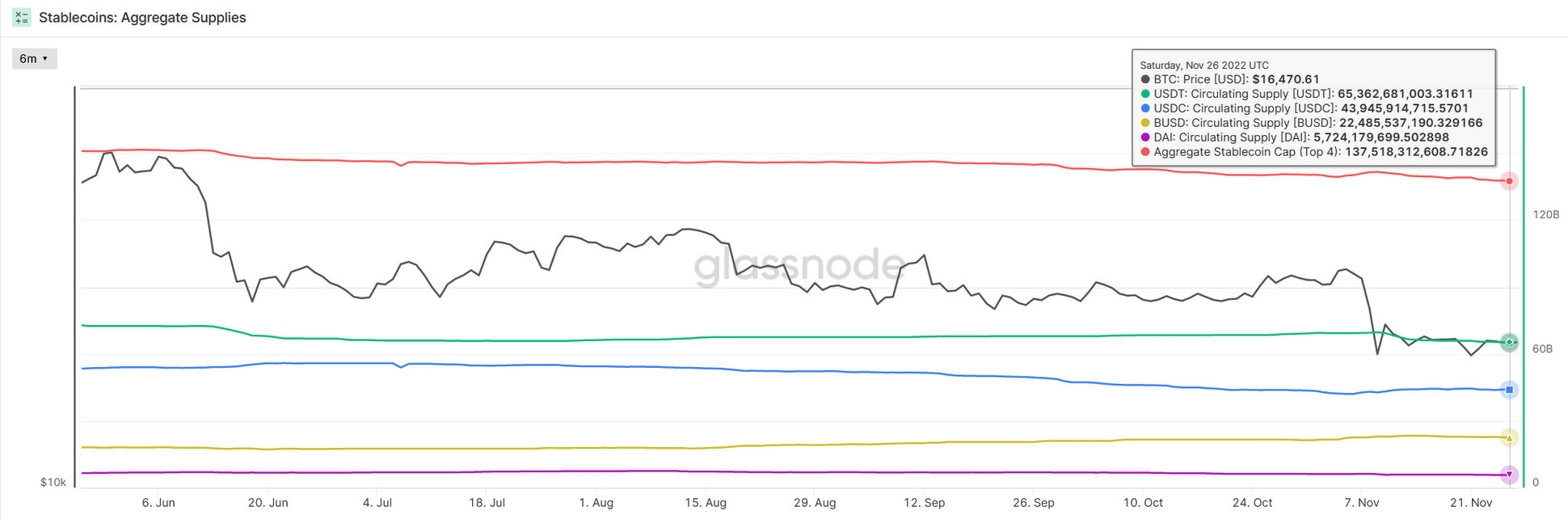

As of November 26, the total supply of the top four stablecoins (USDT, USDC, BUSD, DAI) was approximately 137.518 billion, a decrease of approximately 1.573 billion (-1%) from 139.091 billion a week ago, a large drop, and the supply of stablecoins The volume has fallen by more than 1% for two consecutive weeks, and funds continue to flow out.

Among them, the supply of USDT has continued to decline for three consecutive weeks, with a decrease of 600 million pieces this week, and the decline has slowed down slightly; the supply of USDC and BUSD have also decreased by 400 million pieces each. The three major legal currency stablecoins fell together, changing the previous situation of ebb and flow.

The stablecoin data in the past two weeks shows that the current currency market has not only received no injection of external funds under the condition of an improved macro environment, but has shown a trend of continuous outflow of funds on the market. From this point of view, the current market value of the currency market mainly depends on stock funds and A small number of long-term holders have bottomed out, and there is still a short distance away from returning to the bull market. In the environment of the game of stock funds, it is expected that the market will fluctuate at a low level, supplemented by hot speculation and rotation, and it will be difficult to see a general rise.

3) Market overview - CRV long-short battle

This week, CRV encountered a long-short battle, which ended with the short-sellers being liquidated. We will review this.

From November 14th, the on-chain address (short seller) named ponzishorter.eth began to mortgage USDC of about 39 million US dollars on the lending agreement Aave, lent CRV and sold it for short selling. From the 14th to the 16th, short sellers sold a total of 6 million CRV in multiple batches on the chain through Sushi, 1inch and other DEXs. At this stage, the short-selling behavior did not have a major impact on the CRV price, and the price fluctuated sideways at around 0.6.

From November 17th to 20th, short sellers continued to access CRV and transferred to OKX, with a total of 10.95 million pieces. At this time, affected by the continuous selling pressure and FUD sentiment, the price of CRV began to fall, with the largest drop of nearly 15%, and the lowest to Around 0.5.

The most intense long-short confrontation occurred around November 22. Short sellers continued to replenish collateral to Aave, continued to lend a total of 75 million CRV, and continued to sell on the chain and centralized exchanges, trying to push the price of CRV down to Around 0.25 to trigger the liquidation of the Curve founder's loan in Aave, during which the CRV price dropped to around 0.4 at the lowest.

During this period, the founder of Curve added 20 million CRV supplementary collateral to Aave, and repaid part of the USDC loan to reduce the liquidation line. At the same time, the community began to save itself. On the one hand, by lending CRV, the short sellers lacked short-selling chips and at the same time, the lending rate was greatly increased (at one point reaching an annualized rate of nearly 250%); The clearing prices of both parties are clear data. Once the price rises to around 0.6 (about 50%), the short squeeze will start.

On the evening of the 22nd, Curve announced the new white paper and the stable currency crvUSD, the price rebounded to 0.64, and Aave’s liquidation began; by the early morning of the 23rd, the CRV price had risen to 0.74 (70% + in 7 hours), and the short sellers were liquidated about 63.65 million USDC, the event came to an end.

In this incident, due to insufficient liquidity on the chain, Aave generated about 2.64 million CRVs in liquidation (that is, the debt value is higher than the collateral). When bad debts occur, AAVE will be sold to make up the gap. This mechanism leads to AAVE price fell as low as 17% (and has since rebounded).

In the DeFi world, even if all the data on the chain is open and transparent, there is no centralized trust problem, but due to liquidity problems, bad debts will still appear.

4) Infrastructure News - crvUSD

Curve Finance is currently one of the largest decentralized exchanges, currently ranked second, with a daily trading volume second only to uniswap, and its main function is the swap of stablecoins. Total Value Locked TVL exceeds $5.8 billion. The exchange supports liquidity trading of major stablecoins such as DAI, USDC, USDT, FRAX, and TUSD. It also provides swap services between tokens, such as wBTC, wETH, and stETH, etc.

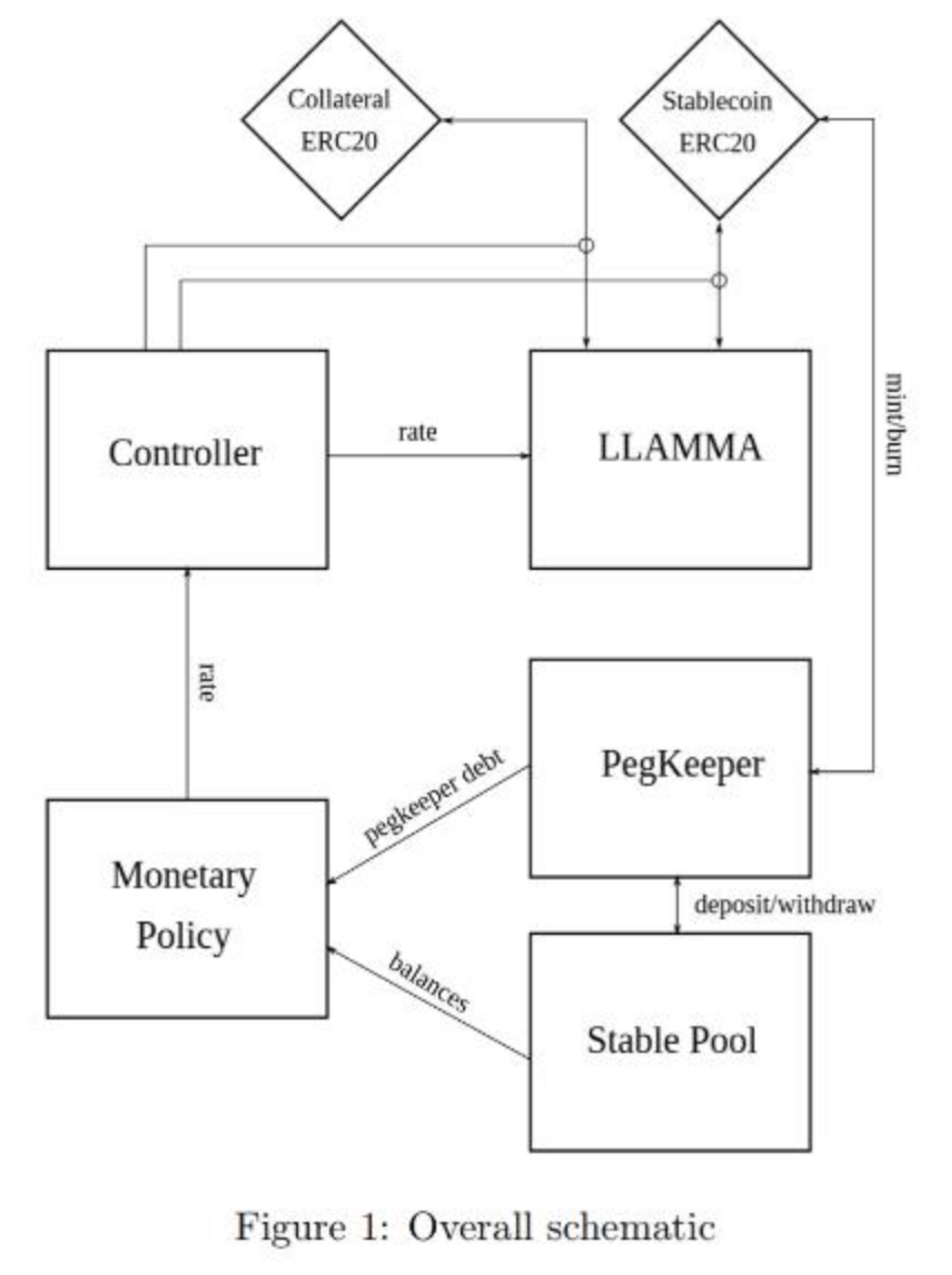

On Nov. 22, developers at Curve Finance released the code and official documentation for their upcoming decentralized stablecoin called crvUSD. While an official announcement has yet to be made, data posted on Curve’s official GitHub account shows that the project is ready to finalize the cryptographic support feature for its stablecoin, which is soft-pegged to the U.S. dollar.

Curve Finance's White Paper Summary

crvUSD will have similar functionality to MakerDAO’s stablecoin DAI. The founder compared crvUSD to an "overcollateralized with crypto assets", mainly a decentralized stable currency that uses "excess reserve guarantees", which, like DAI, will be used for decentralized exchanges protocol.

Users can exchange mint stablecoins directly on Curve by depositing excess collateral in the form of cryptocurrency loans, a mechanism known as a CDP-collateralized debt position. The concept of CDPs, a cryptographic variant of financial market derivatives such as CDOs, has been implemented in projects like MakerDAO, and some of the principles have been applied to other cryptographic protocols. Fundamentally, a CDP represents a debt position backed by an underlying pool of assets. **For Security Tokens, CDP stands for a “debt contract collateralized by a set of cryptographic securities”. The main implementation method provides the right balance between simplicity and financial incentives, and may become an important tool in the security token industry in the future.

The crvUSD ultra-collateralized stablecoin will use a new algorithm called [Loan-Liquidation AMM (LLAMMA)], which will simultaneously and continuously liquidate and sell the deposited collateral to better manage the risk in the current collateral pool .

DAI's algorithm: If the collateral exceeds a critical threshold, the collateral position will be liquidated almost all at once.

Curve's LLAMMA model: Debt Collateral Positions CDPs are gradually liquidated as the collateral pool approaches jeopardy, while allowing partial liquidation, which is automatically enforced by LLAMMA, which slowly sells collateral as the value of the collateral declines commodity assets in exchange for stablecoins.

If the price is higher than the anchor price, crvUSD will be processed using the Automatic Stabalizer (similar to Frax's AMO), and the Automatic Stabalizer (PegKeeper) will mint crvUSD stablecoins and deposit them directly into the Curve liquidity pool, thereby increasing the flow of crvUSD stablecoins and generate transaction costs.

If the price is lower than the anchor price, crvUSD will be withdrawn from the Curve liquidity pool and destroyed, thereby reducing the crvUSD stablecoin supply.

4. Web3 Social & DAO & DID

Last month, I followed up the project Hooked Protocol in detail on the topic of DID track scanning. At that time, it clearly stated that its "capitalist has a luxurious background" and had strong expectations for currency issuance. In the past 1 month, this project has undergone major changes.

Last week (November 23), Binance announced that Binance is about to launch the 29th Launchpad project Hooked Protocol ($HOOK), which is also the new round of IEO that Binance started after 8 months.

This issue will introduce Hooked Protocol's product logic, team background, and opportunities to participate in the IEO process in detail.

4.1 Project Introduction

Hooked Protocol, positioned as "for massive Web3 adoption", provides "tailored Learn and Earn" products.https://www.panewslab.com/zh/articledetails/soh 52 w 4 p.html

At present, the pilot product Wild Cash, a Quiz to earn product, has been launched. The current users are in Indonesia and Brazil, mainly for Web2 users. Recently, it has won the first place in the list of Google Play in Indonesia.

The methods of earning coins in Wild Cash include earning coins by answering questions (rewards for correct answers), earning coins by invitation (invitation rewards + rebates), POWT mining (upgradable equipment), and earning coins by staking (20% annualized). For detailed gameplay introduction, please refer to the article:

At present, this product has harvested more than 2 million users and diverted more than 100,000+ users to Binance Chain.

The attributes of this product are similar to "rabbithole", which provides web3 learning channels for web2 users. The gameplay is similar to "stepn", and users make money by learning and using Web3 applications. The main narrative is "Web2 to Web3", which is also the most important narrative for us to judge the future of Web3 social networking. "Hooked" will serve as a traffic portal, and will continue to introduce Web2 users in the future, and continue to divert traffic to Binance's applications.

4.2 Team Background

team

According to the disclosure of A&T Capital, the members of the Hooked agreement team come from the text growth platform of Midu (subsidiary of China Reading Group) invested by Tencent. The core team has rich experience in 2C marketing and product capabilities.

Jason Y: CEO of the Hooked protocol. He once worked for Uber and Meta. He has been engaged in consumer Internet and strategic growth for more than 10 years. He has created a variety of products and has experience in operating web2 users with over 100 million users.

Jess L: The chief marketing officer of the Hooked protocol. He once worked for Uber and Google. According to the information on LinkedIn, the two of them were colleagues at Uber.

Investment agency

Hooked Protocol has completed its seed round of financing. Investors include Binance Labs, Sequoia Seed Fund, and A&T Capital. The financing amount is undisclosed. But Hooked Protocol has raised about $6 million from two rounds of token sales earlier this year, with FDV ranging from $30 million to $60 million.

4.3 Token economy

Dual Token Model: HOOK, HGT

HOOK Tokens:

supply:

The hard cap is 500 million, and the specific distribution is as follows; the price of private placement and Lauchpad is around 0.1 US dollars, and it is not sure whether there will be an airdrop, but the Halloween event distributed more than 40,000 Hooked Party Passes to the community (in the form of SBT, non-transferable). If there is an airdrop, there will be new selling pressure;

12.1 When it goes online, the market value of the circulating disk is about 5 million US dollars, and it is relatively easy to control the disk

need:

Community Governance: Reflected in the rights and votes in the Hooked ecosystem proposals, actions that are beneficial to the platform will receive initial airdrops.

Gas token for economic activities on the chain within the protocol: $HOOK will be used as the gas token for all basic economic activities built on the Hookde protocol. In the future, all DApps in the ecosystem built on the Hooked platform will also use $HOOK as the gas token for on-chain transactions (make a Roll-up yourself)

Access tokens for exclusive NFT and community event privileges: Community members will be incentivized to hold tokens for the privilege of participating in exclusive community events, purchasing limited-edition platform NFTs, and at the same time reflecting the status and influence of members within the community.

HGT Token:

$HGT is designed to be the only utility token within the ecosystem, with an infinite supply and continuous minting and spending mechanism. Users can get $HGT tokens by completing in-app tasks, but they cannot participate in exchange circulation transactions.

supply:

Earn coins by answering questions (rewards for correct answers), earn coins by invitation (invitation rewards + rebates), POWT mining (upgradeable equipment), earn coins by staking (20% annualized)

need:

in-app consumption

Swap with $Hook tokens, not live yet

Unlock and convert to $uHGT for circulation with other cryptocurrencies (currently only convertible to BUSD)

4.4 Future development plan:

On the white paper:

The Hooked protocol was announced on October 24 to be launched on the BNB Chain mainnet. It is expected to expand to other Layer 1 networks (such as Solana, Avalanche, etc.) in the fourth quarter of 2022. At the same time, it will expand the global market and launch quiz projects in more regions.

In the first half of 2023, a more diversified gamified learning experience will be launched, continuous cooperation and partnerships will be established with more Web3 projects, and wallet solutions for Hooked community users will be launched at the same time. In the second half of 2023, it will become one of the largest Web3 explorer communities and launch the exploration of the DAO governance structure of the Hooked protocol. At the same time, use the Hooked ecosystem infrastructure to launch more different applications, launch application middleware solutions (wallets, DID, etc.) for ecosystem developers, and explore business models.

The two stages given by the employer A&T

Phase 1: Single product platform: Hooked The goal of the first phase is to first establish a crowdsourcing application with a built-in incentive mechanism. Through the combination of entertainment applications and incentives with gamified experience, guide users outside the circle to enter Web3 smoothly and attract traffic for Web3 applications ;Learn & Earn task case: Integrate key concepts of cryptocurrency such as staking & claiming, NFT minting into casual games. On the one hand, users complete the game content, on the other hand, answer questions, and participate in earning rewards every day;

Phase 2: X-to-Earn aggregator: As more and more users participate and receive education on the Hooked platform, other types of x-to-earn are also willing to cooperate with Hooked to further expand Hooked's user base, and eventually The platform will have the ability to direct these users to other web3 projects, including exchanges, Gamefi, NFTs, DAOs, and more.

4.5 Participation strategies

( 1 )GAL

Taking Binance's two IEO projects GAL and GMT as typical examples, through the analysis of the currency price trend of the two, try to conduct a technical analysis and preview of $Hook, and give a participation strategy after $Hook goes online.

As shown in the figure above, there is a significant difference in the price trend of GMT and GAL after the IEO. GMT showed a typical five-wave rising structure, while GAL showed a trend of buying and holding. In my opinion, the main reason is due to market sentiment.

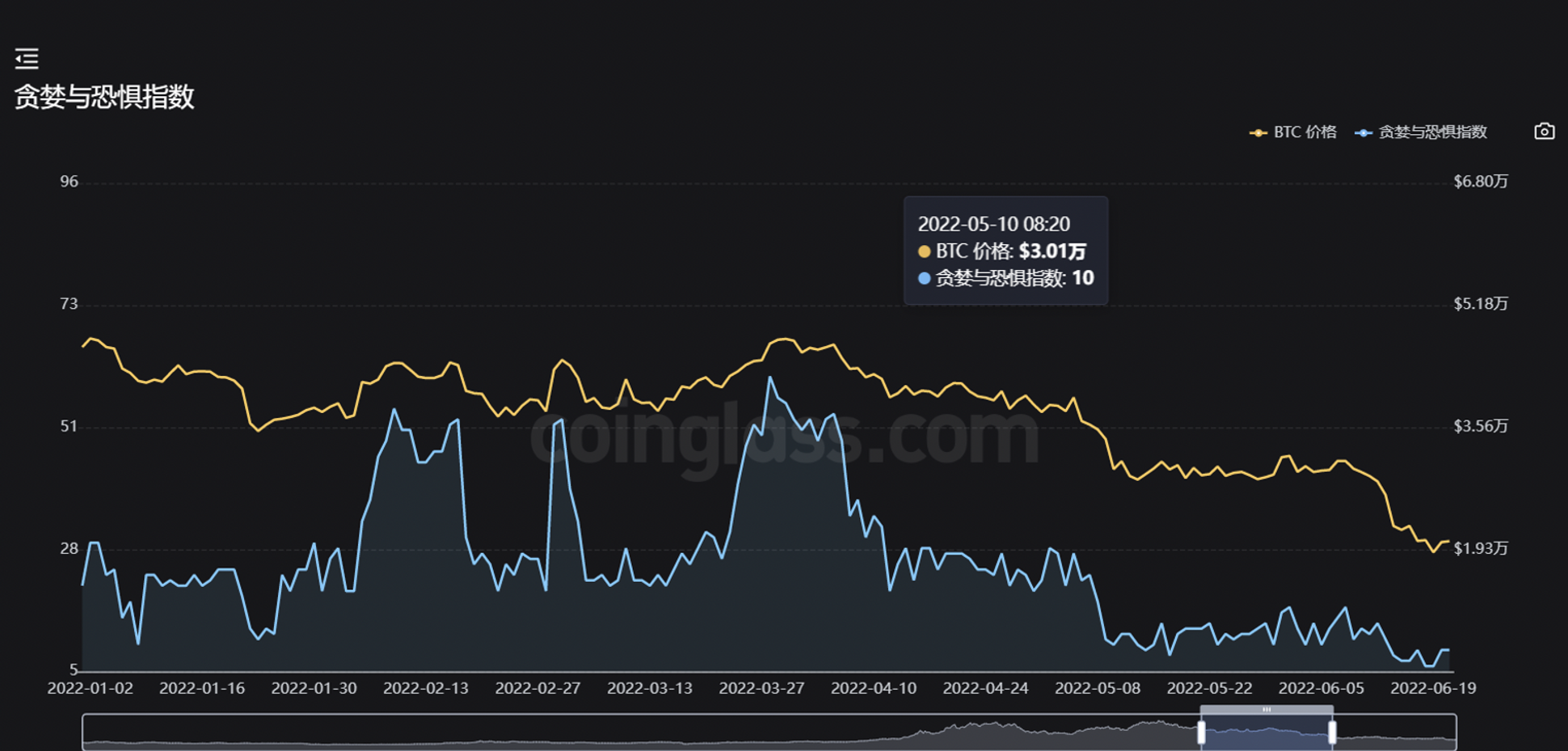

GAL2 was officially listed on May 6, 2022. At that time, BTC was in a heavy-volume driven decline after falling below the key trend line. The short-term market panic index was as low as 10, and the market funds lacked the desire to speculate. GAL followed and fell.

However, as can be seen from the figure below, when the release of market sentiment is over and the market stops plummeting, GAL presents a period of sideways volatility and reduced trading volume after a sharp drop, and there is often a wave of heavy rebound after that, reaching the previous high, the last time Continue to fall after the intensive trading area.

( 2 )GMT

For the platform shock in the above picture, have sufficient patience, wait for the sideways cycle, pay close attention to the previous low and do not break below, and close the lower shadow line and positive line accompanied by a certain increase in trading volume, which can be regarded as a signal for the bulls in the game.

Take-profit strategy, in terms of space, you can refer to the platform support area that broke down in the previous period, and the K-line signal can refer to the long upper shadow line after a few days of obvious and continuous heavy volume.

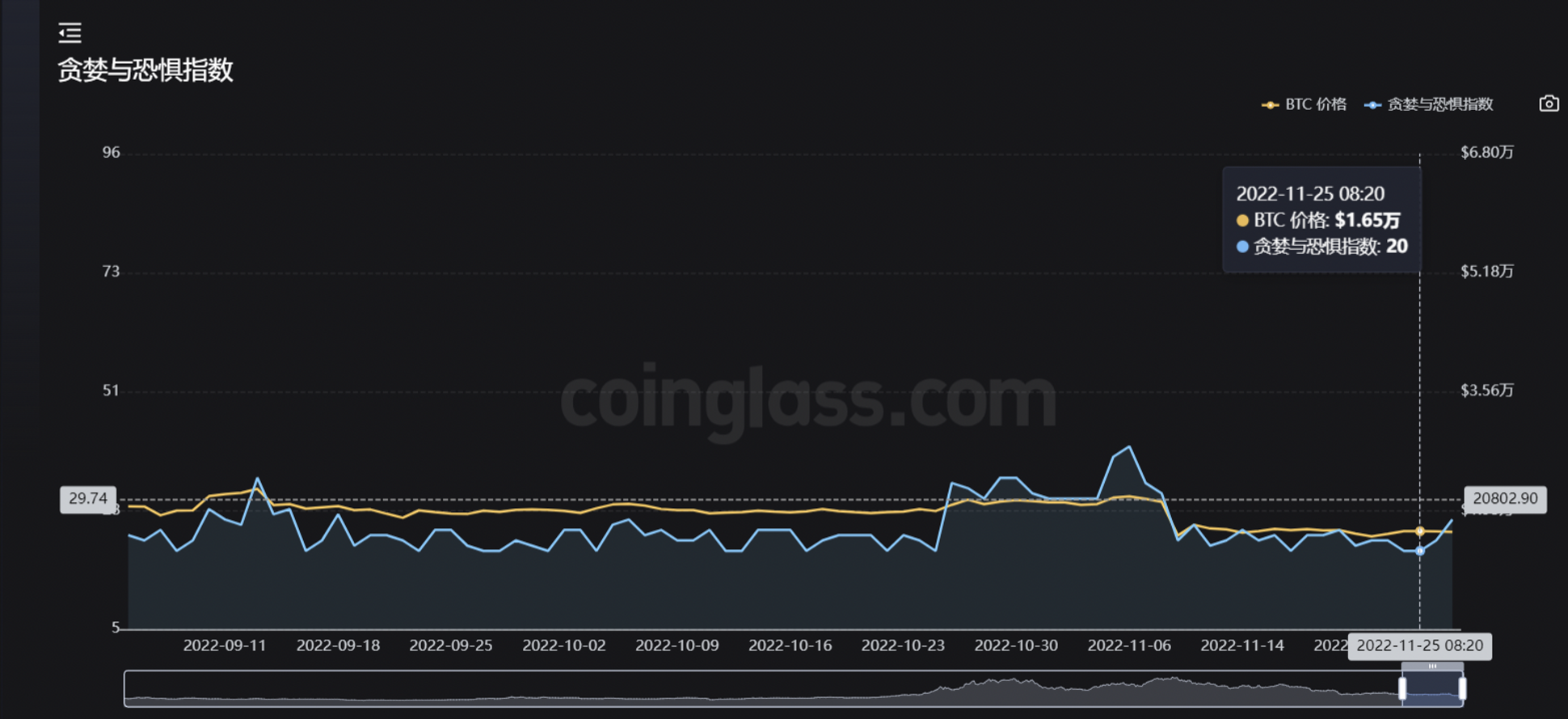

GMT benefited from the fact that the market sentiment was in the rebound period of the platform correction wave at that time, and the market panic index was recovering and rising. After the IEO, it showed a standard breakthrough + shrinking sideways oscillation + heavy volume breakthrough and rising. The wave structure presents a standard five-wave pattern - driven by three waves and adjusted by two waves. However, it is worth noting that the volume and price here continue to diverge, and the increase in each wave gradually shrinks.

The buying point can refer to the vertical arrow in the figure below, that is, after the driver is determined to rise, the pullback should be long. The K-line signal includes the shrinking cross star, the lower shadow line of the heavy volume, etc. It can be regarded as dangerous if the new round of driver rise cannot reach a new high Signal.

(3) Participation suggestion of $Hook

Based on the current mainstream market conditions, the market panic index shows signs of rising. You can properly refer to the trend of GMT tokens, pay close attention to whether there is any sign of Hook forming a shocking platform to attract funds, pay attention to the appropriate callback point after confirming the drive to rise, and seek the winning rate+ The profit and loss ratio is suitable for trading opportunities. However, it is worth noting that IEO new coins tend to fluctuate violently, so you should be cautious and participate in small positions. In addition, users who hold BNB need to weigh the share they can get and the loss caused by BNB selling pressure after IEO.

4.6 SummaryMain questionable points:

Project Discord and Twitter no traffic: Communicating with other Indonesian project parties, it is said that Twitter and Discord have a small user base in Indonesia, and it is normal to lack Twitter and Discord operations before.

Questioning the founder's "Zhejiang University" education

: Believe in the DD capabilities of Binance and Sequoia

Fundamentals - good, but very early stages of development (few months from launch)

The gameplay of X to earn focuses on storytelling from Web2 to Web3. The pilot product already has a user base of millions and can be used as a traffic portal for a large number of web3 applications. The future development is promising;

Dual tokens, $HOOK has a hard-cap deflation model;

The project continues to pay attention, and it has a certain participation value in the short term after it goes online, but the long-term status is still unclear

5. About us

secondary title

5. About us

Website www.jzlcapital.xyz

Twitter @jzlcapital

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment.

The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.

contact us