On the evening of November 28th, Beijing time, the encrypted lending company BlockFi Inc. filed a private prosecution with the New Jersey District Bankruptcy Court under Chapter 11 of the US Bankruptcy Code, applying for bankruptcy reorganization. Additionally, BlockFi International Ltd., incorporated in Bermuda, has filed a petition with the Bermuda Supreme Court seeking the appointment of joint provisional liquidators in the near future.

secondary title

according to

according toBankruptcy Application Form (click to view), A total of nine BlockFi entities filed for bankruptcy, namely: BlockFi Inc., BlockFi Services, BlockFi International, BlockFi Wallet, BlockFi Ventures, BlockFi Trading, BlockFi Lending, BlockFi Lending II and BlockFi Investment Products.

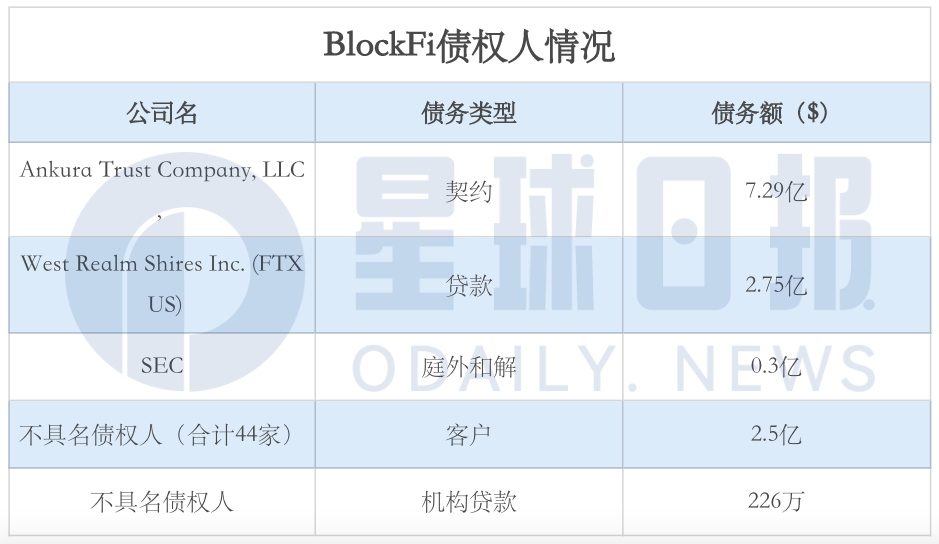

The document shows that BlockFi has more than 100,000 creditors, and the debt scale is in the range of 1 billion to 10 billion US dollars. BlockFi also listed a list of 50 creditors with a debt scale of US$1 million or more.

Among them, Ankura Trust Company, LLC is its largest creditor, with unsecured claims worth about $729 million; FTX US ranks second, with claims of $275 million (FTX US once provided a line of credit to BlockFi); a total of 44 unnamed Institutional clients, with a total claim size of USD 250 million. It is worth noting that the US Securities and Exchange Commission (SEC) has a $30 million claim on BlockFi. (Note: In February of this year, BlockFi agreed to pay the SEC$100 million fineAnd register for its cryptocurrency lending product. )

To ensure a smooth bankruptcy reorganization, BlockFi is filing a series of customary court motions to allow the company to continue operating its business. These motions include: continuing to pay employees wages and provide employee benefits, establishing a key employee retention program, thereby ensuring that the company can continue to operate. Additionally, BlockFi initiated an internal program (2/3 layoffs) to slash costs.

Currently, BlockFi has $256.9 million in cash on hand, which is expected to provide sufficient liquidity to support certain businesses during the restructuring process.

In addition to this, BlockFi will continue to pursue all debts owed to BlockFi by its counterparties, including FTX and related corporate entities. According to encrypted KOL@Ran NeunerAccording to reports, BlockFi has provided more than $600 million in loans to FTX/Alameda. Currently, the bankruptcy proceedings of FTX Group are still in progress, and it is still unknown when this asset will be recovered. But BlockFi did not sit still. The latest news is that BlockFi has sued SBF, requiring it to hand over the Robinhood (HOOD) stocks used as collateral for borrowing (note: currently, Robinhood stocks are not included in the FTX liquidation asset list).

exist

existBankruptcy Application Form (click to view)secondary title

(2) Wrong decision ruins BlockFi

Founded in 2017, BlockFi is committed to building a bridge between digital assets and traditional financial and wealth management products, focusing on cryptocurrency lending and wealth management. According to the company's figures last year, its retail customer base exceeded 450,000, and its workforce grew to 818. In the past few years, BlockFi has been favored by capital and has completed multiple rounds of financing-the most recent round is a $500 million Series E financing in August 2021 at a valuation of $4.8 billion. Its investors include Tiger Global, Jump Capital, Winklevoss Capital, Peter Thiel, Galaxy Digital, etc.

However, BlockFi has encountered setbacks in the process of business landing, mainly related to three factors: GBTC, Three Arrows Capital ( 3 AC ), and FTX.

One is to invest in GBTC. BlockFi mainly obtains a large amount of BTC deposits from investors through an annualized interest rate of 5%, and then deposits GBTC in an attempt to sell at a high premium to make a profit. As of July 2021, BlockFi held 19.85 million shares ($500 million) in the GBTC Trust, making it the second largest holder of GBTC. Unfortunately, with the launch of 3 Bitcoin ETFs in Canada, the market demand for GBTC has decreased, the GBTC premium has disappeared, and a discount will appear in March 2021 (GBTC is currently discounted by 40%). According to encrypted KOL@otterooooAccording to the analysis, investing in GBTC eventually brought BlockFi a loss of hundreds of millions of dollars; even in a bull market, it will lose $63.9 million and $221.5 million in 2020 and 2021, respectively.

The second is that the bankruptcy of 3 AC caused BlockFi to be implicated. 3 AC is one of BlockFi's largest borrowers. When it closed down, BlockFi was forced to liquidate 3 AC's mortgage assets, but still lost about $80 million. BlockFi, with insufficient liquidity, began to seek financing, and successively contacted Morgan Creek, competitors Nexo, FTX and other institutions. Ultimately, BlockFi reached an agreement with FTX US whereby FTX US would provide BlockFi with a $400 million revolving line of credit while providing FTX US with the option to acquire BlockFi at a variable price of up to $240 million.

Success is also FTX, and failure is also FTX. With the help of FTX US, BlockFi survived the crisis for a short time, but it is this agreement that also deeply binds BlockFi and FTX. In subsequent contacts, BlockFi also provided FTX/Alameda with a $680 million encrypted loan, which was not recovered as FTX crashed. On November 15, BlockFi announced that due to the bankruptcy of FTX, it will suspend customer withdrawal and loan business. Until today, BlockFi finally applied to the court for bankruptcy reorganization.