This article comes fromBloomberg、This article comes fromFinancial Times

Odaily Translator |

![]()

Bloomberg, by Jeremy Hill, Steven Church, Kadhim Shubber, et al.

Odaily Translator |

Bloomberg

Crypto lending firm BlockFi Inc. sold about $239 million in cryptocurrencies and warned its nearly 250 employees that they would lose their jobs in the run-up to a Chapter 11 bankruptcy filing, according to court documents.

BlockFi adviser Mark Renzi said in a sworn statement filed with the court on Monday that the company is selling the cryptocurrency to cover anticipated bankruptcy costs and has no plans to finance itself through loans while it is protected by the court. BlockFi has begun cutting costs in preparation for a restructuring, including warning that two-thirds of its more than 370 employees are about to be laid off.

Renzi said BlockFi intends to restructure through bankruptcy court rather than sell itself, but is open to any deal that maximizes recovery for creditors. He said that what users ultimately get back depends largely on whether other crypto companies fulfill their contracts with BlockFi and the outcome of FTX Group's bankruptcy.

“Despite debtors’ hopes, the full extent of the impact of FTX’s bankruptcy remains to be determined,” said Renzi, who said BlockFi had “no choice” but to seek creditor litigation and claim protection in court following FTX’s bankruptcy.

BlockFi allows customers to earn interest on their cryptocurrencies and allows them to borrow money against these deposits. BlockFi survived this year’s shakeup in the cryptocurrency industry related to the collapse of hedge fund Three Arrows Capital after FTX agreed to lend it $400 million, placating users scrambling to withdraw their funds.,Ankura Trust Company,But this stabilization was short-lived. On November 8, BlockFi asked to borrow $125 million under the bailout loan agreement, but FTX did not provide the funds. Shortly after, BlockFi suspended customer withdrawals and reduced other site functionality. A few days later, FTX filed for bankruptcy.

Court documents show

according toLLC is BlockFi’s largest creditor with unsecured claims worth approximately $729 million; followed by FTX US and the US SEC with unsecured claims of $275 million and $30 million, respectively. The FTX US amount appears to come from a line of credit extended to BlockFi earlier this year, while the US SEC amount is related to BlockFi’s multi-party investigation settlement with state and federal regulators in February.BlockFi will make its first appearance in bankruptcy court in New Jersey at 11:30 local time on Tuesday.Emergent Fidelity Technologiesaccording to

financial times report

, BlockFi has sued FTX founder SBF's company, requiring it to hand over the Robinhood stock it borrowed as collateral. The indictment alleges that BlockFi entered into an agreement with Emergent on Nov. 9 to secure the unnamed borrower's payment obligations by pledging certain common stock as security. But in the days before filing for bankruptcy on Nov. 11, SBF had been privately trying to sell Robinhood stock using messaging app Signal.

The documents show that the "unnamed borrower" was actually Alameda Research, which BlockFi said Alameda defaulted on on $680 million in mortgage loans in early November. It is reported that in May this year, documents submitted to the US SEC showed that SBF purchased 56 million Robinhood shares (worth 648 million US dollars) through Emergent, accounting for about 7.6% of the shares, becoming Robinhood's third largest shareholder.

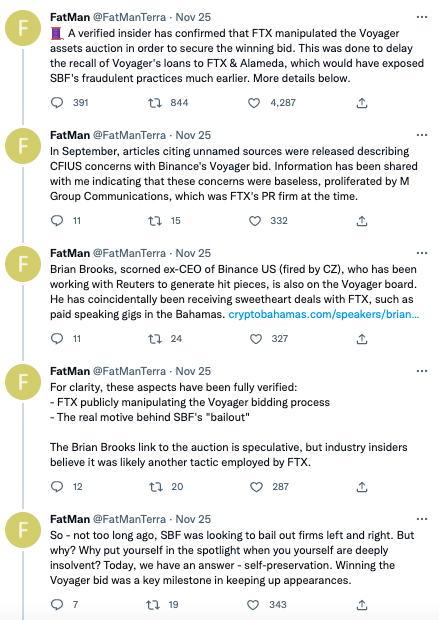

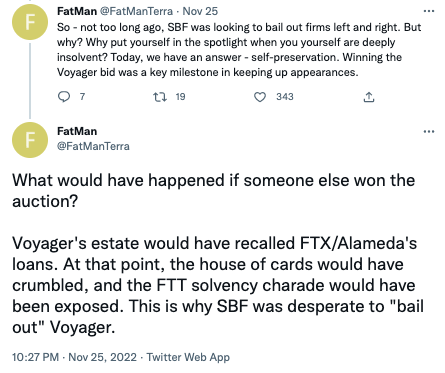

Twitter users concluded that

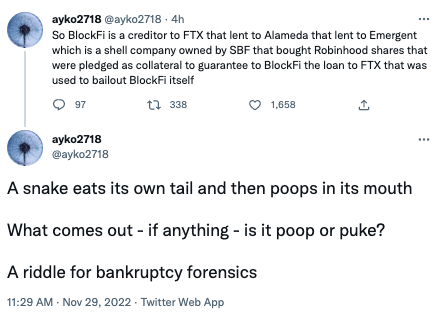

, BlockFi is a creditor of FTX, FTX lends money to Alameda, and Alameda lends money to Emergent. Emergent, a shell company owned by SBF, had purchased Robinhood shares, which had been pledged as collateral to secure loans to BlockFi for FTX, which were used to “bail out” BlockFi itself. It was a "good show".

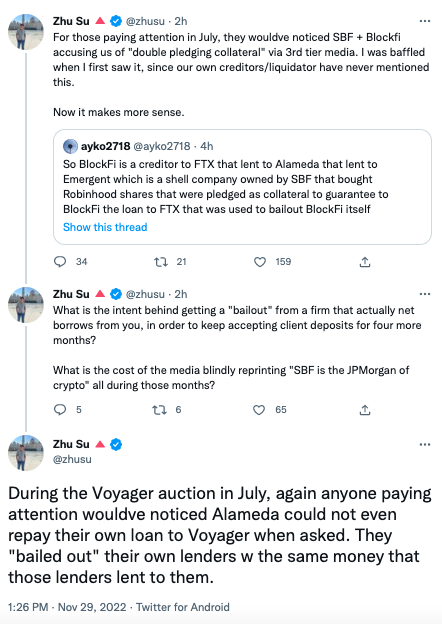

Zhu Su reposted the tweet and commented that in July, SBF and BlockFi accused Three Arrows Capital of multiple pledges through the media. At that time, he was confused because the creditors/liquidators of Three Arrows Capital never mentioned this, It now appears that these things happened for a reason.Zhu Su questioned what is the purpose of the lending institution (BlockFi) being "bailed out" in this way to continue accepting customer deposits for four months? During the Voyager asset auction in July, Alameda couldn't even repay Voyager's loan. They "bailed out" their own lenders with the money they borrowed from them.It is reported that in September this year, Voyager announced that FTX US won the auction of its assets with a bid of US$1.422 billion. But after FTX filed for bankruptcy in November, Voyager restarted the bidding process for its assets.