Original title: White Man

Author: Arthur Hayes

Related Reading:

Original Compilation: Lynn, MarsBit

Related Reading:

the feedback

Last week, I described how Sam Bankman-Fried came to be a "right white guy" and how he used that role to convince Western financial institutions and the cryptocurrency industry to ignore his flaws and not ask too many questions. Here is what he said in his own words toVoxDescribe what he did:

"Yeah. Hey. I have to. In a way, that's what reputations are made of. I feel sorry for the people who got screwed by it because of this stupid game we sober westerners play, we Say all the right dogma so everyone likes us."

Perhaps the most significant casualty in the aftermath of SBF's apparently epic fraud that we've begun to see this week is the likely insolvency and possible bankruptcy of crypto lender Genesis, which could be huge enough to also make its parent company ——The well-known venture capital firm Digital Currency Group (DCG) fell. The Genesis/DCG drama — which also includes Genesis’s sister company, digital asset fund Grayscale — is particularly impactful because it directly affects GBTC, the largest bitcoin investment product listed on any exchange. What makes the currency trader so important is that it holds one of the largest reserves of Bitcoin. If investors - whether they want to or not - are allowed to redeem their GBTC shares in BTC or USD, it could trigger the next brutal decline in the fiat price of Bitcoin and other shitcoins.

Now that SBF's image of invincibility has been shattered, investors have regained their ability to do the math and read public statements. They have started questioning everyone and giving no one the benefit of the doubt because some aspect of the social condition allows their rational brain to silence their gut or lizard brain.

The whole point of these articles is to change the way you think about the future. When the next person who says the "right" thing, wears the "right" clothes, goes to the "right" school, talks/looks the "right", hangs out with the "right" people, gets promoted by the "right" media establishment At the time, I hope you ignore all of this and focus on the math and the self-evident truths of public statements.

In this post, I'll take a deep dive into the business of digital currency management and break down the Genesis/DCG/Grayscale soap opera...GGG G-Unit! As the article wraps up, I'll lay out a scoring metric for evaluating potential means of profiting from this carnage.

first level title

Pepe Village Needs a Money Manager

Unless you want to store your wealth in physical cash or gold and do all your transactions face-to-face, it is impossible to self-custody your assets in the simulated TradFi system. You simply entrust your assets to banks and money managers. These intermediaries allow money and assets to move from point A to point B.

As we all know, there's a lot of trust involved. You trust the bank not to issue a bad loan that would impair its ability to repay your deposit. You trust the person or organization that manages your money not to steal it, or put it into dubious investments.

Given the need to trust your financial intermediary, how do you choose which person or organization to manage your money? Let's do a silly little thinking exercise.

Imagine there is a village called Pepe Village. The inhabitants of Pepe Village are green frogmen. The village of Pepe is quite isolated. They don't have many regular human visitors, but they are connected to our civilization through their meme trade with us. Selling these memes to humans can bring Pepe Village a lot of money, which they want to use to invest in the future.

Humans don't come to the village very often, but they watch a lot of TV. The program that is being aired is from Americana, so Pepe Village knows the Americana culture very well.

One day, eight salesmen visited the village of Pepe. Everyone's goal is to convince the village of Pepe to let them manage the village's wealth.

There were two salespeople, a man and a woman, who were called "white men" by the American government.

There were two salesmen, a man and a woman, who were called "blacks" by the American government.

There were two salespeople, a man and a woman, who were referred to as "Asians" by America.

There were also two salespeople, a man and a woman, who were described as "Hispanic" by the American community.

If it weren't for the fact that the villagers watch a lot of TV, these titles would be unfamiliar to them. Villagers watch enough television to know what these terms mean in American governance.

The Pepe Village Council of Elders holds a meeting to receive each salesperson and hear their presentations.

Every wave of people says exactly the same thing.

"Hello, who am I?"

"What company do I work for?"

"You should trust me because I've learned finance here, here and there".

Last (and most important):

"I charge a 2% management fee and my track record is this and that".

After the eighth person has spoken, the mayor of Pepe declares the meeting open so that the council can decide to whom to entrust the savings of the village.

"Ah, I'm confused," said the village chief Pepe. "In addition to being different genders, every salesperson has the same name, went to the same university, learned the same things, wears the same clothes, behaves the same in the market. They even charge the same price."

"Wait a minute - these people are from a different race," one of the other councilors, Wojak, interjected. "That's what they're called on TV. Each race is presented differently on TV - so if we do what it says on TV, we'll definitely get the most trustworthy people."

"That's a good offer, Wojak," replied the village chief Pepe. "I know you watch the most TV in the village. Can you tell us which race is the most trustworthy on TV?"

"I do watch a lot of TV," Wojak said. "Typically, here's what I've read. Male Spaniards always seem to be doing manual labor, like architecture or landscaping. Women are housekeepers or babysitters. Their bosses are usually Caucasian. In my opinion, None of these things say anything about what Hispanics know about managing money."

"Asians seem to be good at math and science. I always see them in roles that are good students of these subjects. I also see them running a lot of small businesses in parts of the city where big white businesses don't want to go, like black inner cities Ghetto. I don’t see them managing other people’s money to a great extent, even though they’re shown on TV as smart and hardworking. They’re also sometimes portrayed as docile and socially awkward.”

"Black people always seem to be poor. They're always fighting in run-down parts of town. Whenever I see a show featuring black people, there's a lot of violence. But sometimes I see them dribbling or throwing and catching White people seem to enjoy watching them play sports. But I never really see them manage money or run big, important companies."

“White people always seem to be in power. It doesn’t really matter what happens — white characters are always in positions of power and everyone seems to look up to them. I think they must know how to manage money best and be the most trustworthy.”

Mayor Pepe seems quite satisfied with Wojak's analysis. "Okay, now we know. Should we choose male or female white salespeople. Wojak, is it on TV that men are more trustworthy or women are more trustworthy?"

"We should definitely trust men more than women when it comes to finance," Wojak responded. "I watch these financial entertainment channels and they're always beautiful women interviewing powerful men who seem to run all the major financial businesses."

Mayor Pepe nodded and added, "Is there anyone on the council who objects to the selection of a white male salesperson to manage our property?"

first level title

Asset Management ABCs

With this little thought experiment out of the way, let me hop off my soapbox and get into the meat of the DCG/Genesis/GBTC (G-Unit) situation.

Because it is not possible to self-custody your wealth in the TradFi system, you must entrust it to an asset manager. This means that everyone in the industry can suck at their jobs and still make money. Since it is so much easier to do a bad job than a good one, asset managers must build moats around their businesses to protect their ability to continue to be mediocre.

Starting an asset management business is very difficult and expensive. There are a lot of rules you have to follow, and to make sure you meet them, you have to hire a variety of specialists, each specializing in a particular field - which can get very expensive.

The only way to win the game is to manage a large asset pool. This is because for those looking to hire an asset manager, the biggest differentiating factor tends to be the management fee—and fund managers with larger AUM have more flexibility in setting fees (as a simple To an outsider, you'd think track record and past performance would be the biggest differentiating factor - but the reality is that beating market performance over long periods of time is so difficult, asset managers' track records are often so similar it's hard to tell the difference ).

The cost of running a business does not increase substantially as the assets you manage grow. Running a fund with $1 million in assets under management is not much more expensive than running a fund with $1 trillion in assets under management.

This means that the larger their assets under management, the more managers can lower prices and still generate high profit margins. The result of this is a natural oligopoly in the market. Because costs are relatively fixed regardless of AUM size, large funds can easily drive smaller managers out of business by reducing fees below what smaller managers can afford.

Therefore, for new entrants to successfully break into the asset management space, they need to offer products that competitors will not touch. Remember, just a few short years ago, cryptocurrencies were out of reach for companies like Blackrock and Fidelity, even though there was a great demand for bitcoin tracker products.

At the time, there were many people who wanted to enjoy the financial rewards of Bitcoin, but didn't want to actually use the technology. Setting up a wallet, safely storing their private keys, and finding a trustworthy exchange to buy bitcoins is too much trouble. Like most other commodities or currencies, these investors want an exchange-traded product that they can simply buy with fiat currency in their brokerage account. For this privilege, they are willing to pay high management fees.

first level title

Always

Be

Closing

we believe in bitcoin

Despite many efforts by many different groups to gain SEC approval, it eventually became clear that exchange-traded funds (ETFs)-managers accept cash or bitcoin from investors and use it to create ETFs units, which are then traded on the stock exchange in New York, the capital of the US city of Datong - an impossibility for US investors. Recognizing the huge pent-up demand from less tech-savvy investors looking to get in on the BTC action due to the lack of ETFs, Mr. Shillbert found a way to create the next best thing.

He developed a trust — the Grayscale Bitcoin Trust (or GBTC) — in which investors can create shares by providing USD or BTC. After six to twelve months, investors can convert their shares in the trust intopink sheetsecurities traded on. Oh, I forgot to mention – this product is kind of like Hotel California. Once you check in, you can't check out. It was (and is) impossible to redeem your GBTC shares. Once you are invested, the only way out is to sell GBTC at any price in the market. If there are no buyers, you are stuck.

Although it is not listed on the main board of the New York Stock Exchange, any broker with the ability to trade US stocks can buy GBTC. With the birth of GBTC, many investors who want to benefit from Satoshi Nakamoto's vision without really believing in its teachings Participants can now take part in the action.

Perhaps the most important thing about GBTC is that it has a very high management fee of 2.00%. To illustrate the point, the SPDR S&P 500 ETF - one of the most traded financial instruments in the world - charges 0.0945%. Mr. Shillbert The reason for being able to charge such a high fee is that setting up this type of trust fund is a very complicated, expensive and time-consuming process, no Bitcoin ETF product has been approved, and no traditional asset management company wanted to touch Bitcoin in the first place — which means no big company can squeeze him out of the market by offering lower fees. In short, people have been willing to pay because there is no competition and they are desperate for exposure at a time when the price of Bitcoin is appreciating.

first level title

cycle

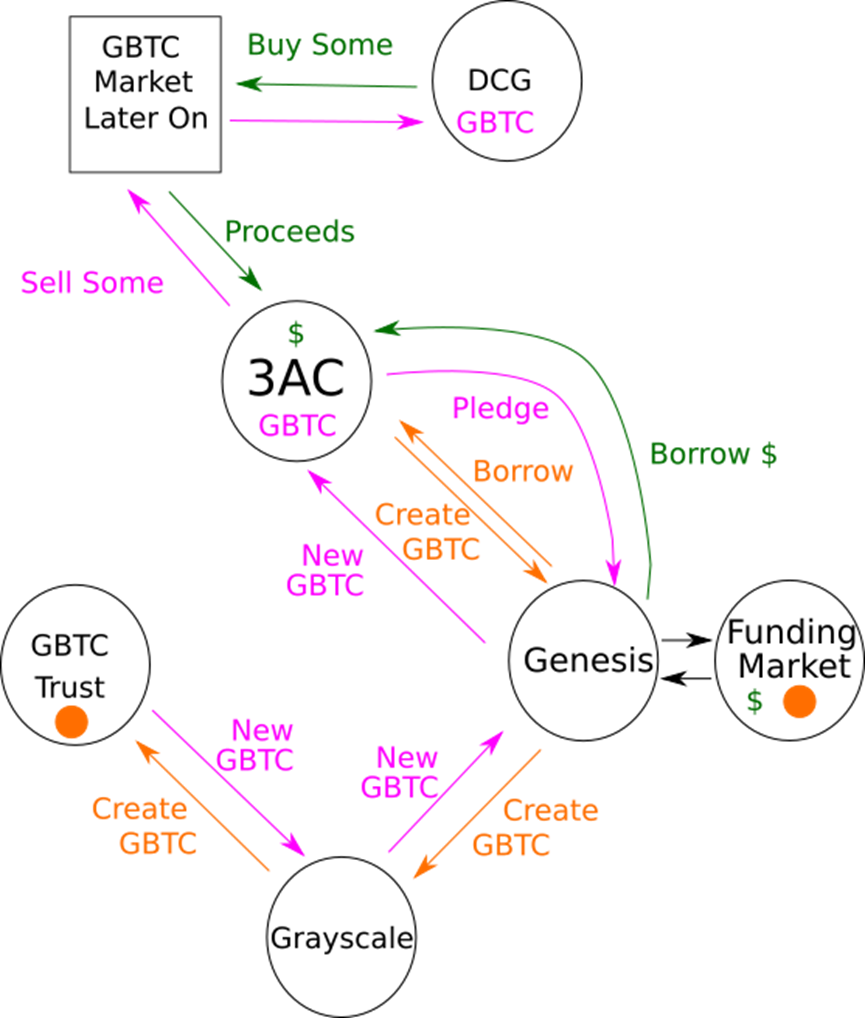

I want to thankThis article from DataFinnovation, which illustrates the little game Mr. Shillbert is likely playing with DCG, Grayscale, and Genesis.

According to them, Mr. Shillbert's little game of smoke and mirrors goes like this.

Goal: Grow GBTC's assets under management and extract a 2% management fee from stranded capital.

Let's break down what this diagram says step by step.

Step 1 - Get capital into Genesis

Genesis and Gemini have a partnership in which Gemini lends its customers' funds to Genesis for a fee. This is the so-called Gemini Earn product. As a Gemini user, you can stake your BTC or USD and earn interest from Gemini. Gemini takes these funds and lends them to Genesis at a higher rate than it pays users through Earn. Now, Genesis has a lot of funds to lend. Remember - Genesis is in the cryptocurrency lending business.

I don't know if this is the only way Genesis is funding its loan book. The job of the lender is to borrow cheaply and lend at a higher interest rate based on the perceived strength of its balance sheet/risk management acumen. I have to assume that Genesis is able to borrow from other companies at attractive rates because until recently it was the best managed and largest centralized cryptocurrency lending company.

Step 2 - Create GBTC with borrowed money

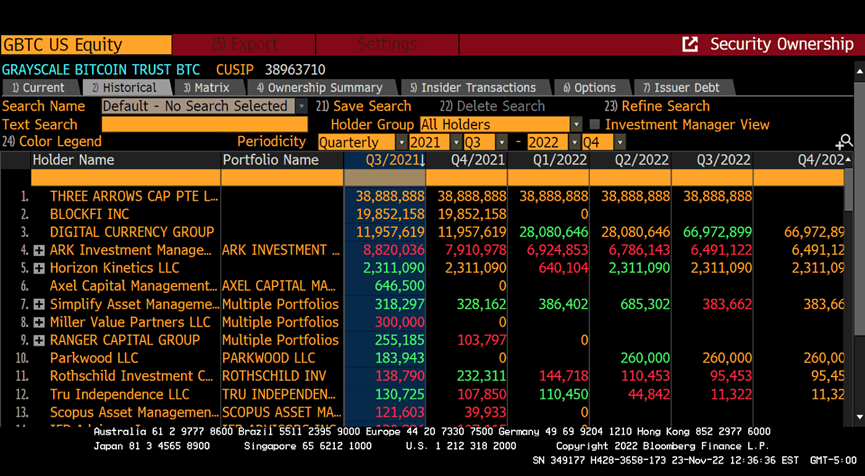

Genesis would lend bitcoin to companies like the now defunct Three Arrows Capital (3 AC) and BlockFi, which would turn around and give their borrowed bitcoin to Grayscale to create shares of GBTC (3 AC, as we know, did The largest companies with such transactions, because they hold so many shares, have to file with the SEC).

Screenshot of historical quarterly records for the largest GBTC holders

3 AC and others were involved in this transaction because the GBTC shares they created were trading at a premium on the open market. GBTC is trading at a premium because it takes six months to create a stake — meaning that, even with the increased demand for GBTC in the recent bull market, the only shares available to buy are those created six months ago. This has led to a situation where there is more demand to buy GBTC than there are people willing to sell. Buyers are thus prepared to pay more than the underlying Bitcoin asset is worth to get the little GBTC they have and gain risk without having to go through the process of buying Bitcoin itself.

Basically, the process looks like this:

3 AC Borrow BTC from Genesis.

3 AC hands BTC to Grayscal and creates GBTC shares for himself.

6 months later, 3 AC received GBTC shares and hoped to sell them in the market at a premium.

Step 3 - Lend USD against GBTC collateral

Remember, Genesis is borrowing dollars from Gemini and its Gemini Earn product. It pays for those dollars, so it needs to find someone to lend it dollars so it can turn a profit. Genesis turns to companies like 3 AC and says, "Hey, thanks for creating all these GBTC shares with my sister company Grayscale! Since they won't be profitable for you in six months, you hand them over to us as How about collateral in exchange for a dollar loan?" 3 AC agreed, and was delighted to have immediate dollar liquidity of profits it could not expect in six months. We know that 3 AC borrowed $2 billion using this round robin method, which resulted in substantial fees for Genesis. Mr. Shillbert didn't sell it for free.

And that $2 billion is how the central people behind 3 AC - Su Zhu and Kylie Davies - live out their big pimp fantasies. Unfortunately for them, like most empty dreams, they went bankrupt after waking up to the big dream, before delivering the yacht.

Step 4 - Markets, Please Don't Fall

Unfortunately, the premise of this whole circular sweepstakes is that GBTC continues to trade at a premium. With the premium turning into a discount in 2021, companies like 3 AC and BlockFi can't afford to pay the dollar loans they take out of Genesis. Since they hand over GBTC to Genesis as collateral for USD loans, when the value of GBTC drops, they may need to provide additional collateral to cover the loss in value of GBTC.

In layman's terms: when you take out this type of loan, you give the lender a certain amount of assets in return so that if you can't pay back the loan, they can at least get back what you've pledged — your collateral — — and recover some of the losses. If the value of your collateral drops, you need to provide more assets in order to maintain the agreed value of your collateral. why? Well, if lenders just allow the value of borrowers' collateral to continue to decline without requiring them to put up more, it could go to zero, which would negate the whole point of holding collateral in the first place - which is to prevent losing your Insurance for all funds lent.

Being required to invest more capital in this way is also known as being margin called. If a borrowing entity facing a margin call cannot provide more collateral, it defaults on the loan.

With the value of other assets they own exploding at the same time - see TerraLuna - 3 AC, BlockFi, etc. are all in danger of not having the necessary funds to cover margin calls.

DCG is the owner of Grayscale and Genesis and they don't want the 3 AC's and BlockFi's of the world getting margin called (because then they can't get back the money they lent to these companies). In order to avoid this, DCG tried to prevent the price of GBTC from falling further by raising funds and using the cash on the balance sheet to exert buying pressure and buy GBTC on the open market. As expected, they failed.

As can be seen from the above screenshot of GBTC holdings, DCG is now the largest holder of GBTC. The DataFinnovation article lays out a timeline of how DCG stepped in as a buyer of last resort.

One question that has been bothering me is how DCG financed the purchase of GBTC. Mr. Shillbert is an experienced financier. And in finance, you always, always, always use other people's money. Now, we know DCGBorrowed money from Genesis. Although it is not confirmed where DCG used the above funds, it is possible that DCG borrowed money from Genesis to buy GBTC. This could explain why DCG needed to borrow money from Genesis, while Grayscale threw out management fees worth hundreds of millions of dollars.

Backed by Genesis' solid reputation as the best cryptocurrency lending store, DCG is able to borrow cheaply. As an investment firm, if DCG had gone to the market to raise this capital itself, it would have been asked more questions about why it needed to borrow money, and ended up paying higher interest rates on a smaller scale.

bad debt

In order to get as much money as possible into GBTC, Mr. Shillbert and his collaborators effectively destroyed Genesis and DCG. This is because 3 AC, BlockFi and many others who invested in this transaction defaulted. The reasons for their default are:

GBTC went from a premium to a discount. GBTC is the collateral underpinning all these loans, and when GBTC loses value, the loans suck.

Terra’s debacle affected so many Genesis borrowers that any other collateral on their BTC and USD loans was also thrown in the trash. Remember, bitcoin, ethereum and the whole shitcoin herd dropped between 50% and 90% in the weeks after the Terra ecosystem collapsed.

pause

pause

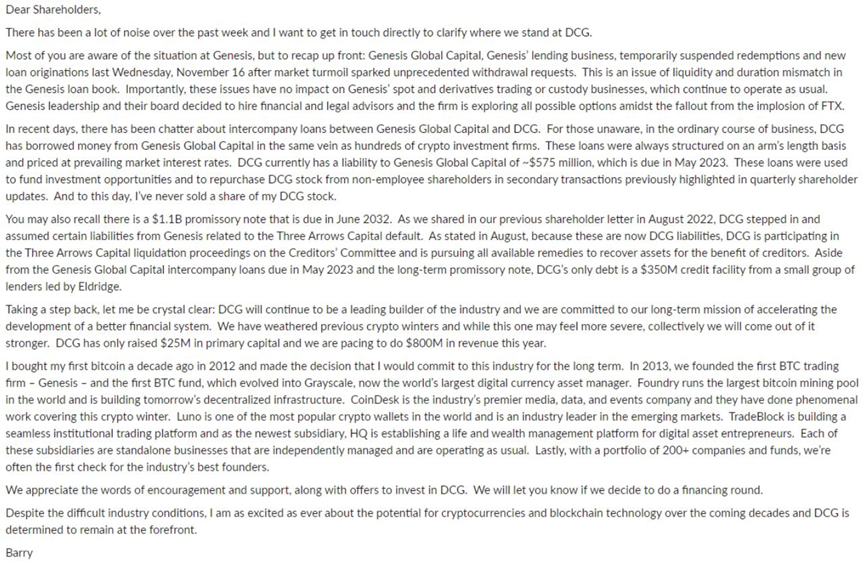

These are Genesis issues, not DCG or Grayscale issues. How did this credit contagion metastasize to stage 4 credit cancer and become life threatening for the entire G-Unit? Mr. Shillbert provided some clues in a recent update.

Remember, folks, Mr. Shillbert is an excellent financier and accountant. Here's my guess as to what those intercompany loans will look like.

In a credit crunch, non-performing loans are only recognized as non-performing after lenders stop lending. Loans to 3 AC have been poorly underwritten on Genesis' balance sheet. However, even after 3 AC went bankrupt, there was still a chance of recovery. But no one knows what the percentage of recovery will be - so the percentage of recovery is what price someone is willing to trade for. For example, if DCG is willing to purchase a 3 AC loan at face value, and DCG assumes that over a ten-year time frame, 3 AC will be able to repay the loan in full due to cryptocurrency price increases. Well, Genesis is able to sell 3 AC of its debt assets to DCG for 100 cents (instead of say 0 or 10 or 20 cents).

Mr. Shillbert told us that DCG took on 3 AC loans from Genesis' loan book - so the only question is, what did DCG pay for them? In a purely accounting sense, Genesis would be solvent if DCG had paid face value. That's good... right? However, how did DCG pay for this asset? Mr. Shillbert told us that the money Genesis lent to DCG was used to purchase assets on Genesis' balance sheet, which I believe is the most favorable valuation (ie face value) for Genesis. It's a bit like a Fugazi trade with left handed and right handed. Bad debts are simply laundered from one member of the G-Unit to another. However, if you want to maintain the image of Genesis as a reliable lender, performing this accounting sleight of hand will do the trick.

So, surely Genesis charges market rates to members of its G-Unit family? Again, we don't actually know because Mr. Shillbert didn't tell us the exact rate, nor did he say it was a "fair deal". But Mr. Shillbert has a T-Rex weapon, so I wouldn't take too much comfort with that statement.

Contrary to what we believed a few months ago, DCG has not committed any new hard currency to Genesis. The radioactive 3 AC loan was just moved out of sight and unnoticed before the FTX/Alameda exploded. Genesis also has risks there.

Other DCG liabilities include:

$575 million borrowed from Genesis for "investment" and repurchase of DCG stock.

$375 millioncredit facilities.

3. DCG is definitely loading a lot of debt - about $2 billion in total. Now, when your crown jewel, GBTC, is throwing out $400 million in management fees a year, it's not a big deal because it was on schedule before the summer crypto crisis when BTC was at $30,000. But now, with a $200 million run rate at $16,000 in BTC, DCG's Jenga game is a bit wobbly.

Now, Lil Wayn will tell us what to do:

https://www.youtube.com/watch?v=WpQrAbkM 3 dI

They wobble, wobble, wobble.

first level title

Let go of this hot potato

Apparently, further declines in Bitcoin, Ether and shitcoin collateral - combined with the possibility of a Jupiter-sized hole in Genesis' balance sheet following the FTX/Alameda explosion - are a rip off for Mr. Shillbert of his financial engineering is inescapable. If it were any other way, Mr. Shillbert would definitely play the same trick, having DCG buy Genesis' bad debts by borrowing money from Genesis.

The above is just speculation on my part - but I suspect that whoever was providing Genesis with the loaned funds may have turned off the taps. With no external dry powder available, G-Unit's movie credits roll.

In the end, grim math and excessive leverage force society's conditioned puppets to pull themselves together and become discerning investors again. There are so many questions about what exactly happens inside G-Unit. But I do know one thing, from what I've read about it, in my head, DCG and Genesis shouldn't be touched. Apparently, my views are shared, otherwise Genesis wouldn't be teetering on the brink of bankruptcy.

The upshot of all this is that DCG has some tough choices to make. Will Mr. Shillbert allow the new funds to take a portion of his GBTC management fee income stream? Will Mr. Shillbert dump more GBTC into the market to raise cash to fill the G-Unit's capital hole? So far, Mr Shillbert has been cleverly using other people's money. Will he save his empire by pulling money out of his own pocket?

All roads lead to GBTC and Grayscale Trust. Grayscale is the only good asset inside G-Unit that can throw a lot of cash. Will the GBTC discount widen as DCG is forced to sell GBTC? Could something happen to Grayscale that would dissolve the trust allowing holders of GBTC to take advantage of the 40% discount?

trade

trade

GBTC is at a discount. There are two transactions here that we must evaluate.

Trade 1 (BTC/USD price neutral):

Sell USD, buy GBTC.

Hedging against Bitcoin/USD by entering into a short Bitcoin/USD perpetual swap or short Bitcoin/USD futures position.

Wait until the discount becomes a premium or GBTC can be redeemed at face value.

If GBTC fluctuates to a premium, sell GBTC and buy USD. The short derivative position is then closed.

If GBTC can be exchanged for BTC or USD, redeem GBTC. If you receive BTC, sell it for USD. The short derivative position is then closed.

Trade 2 (long BTC/USD):

Sell USD, buy GBTC.

Wait until the discount becomes a premium or GBTC can be redeemed at face value.

If GBTC fluctuates to a premium, sell GBTC and buy USD.

If GBTC can be exchanged for BTC or USD, redeem GBTC. If you receive BTC, sell it for USD.

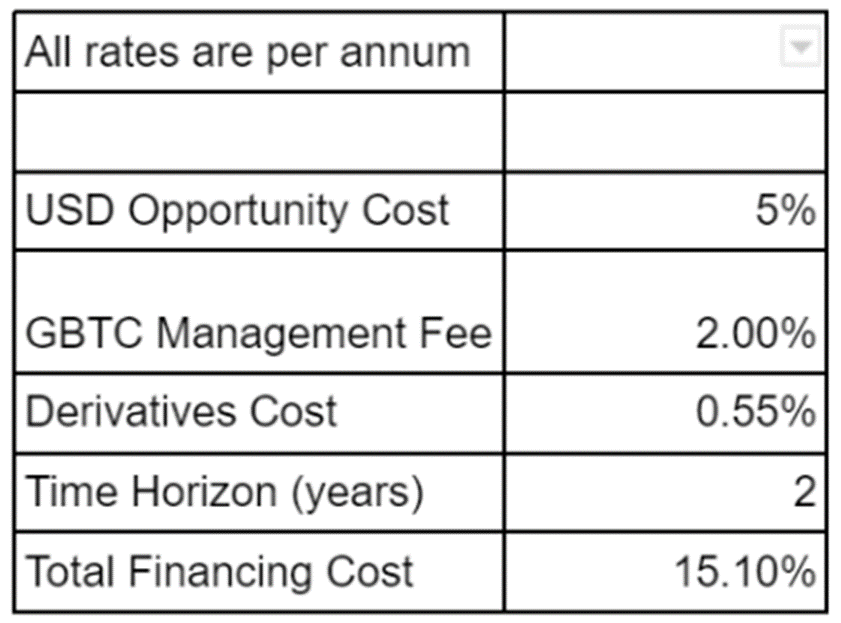

Financing/hedging costs

Derivatives cost is November 23, 2022BitMEX June 30, 2023 BTC/USD Futures Contract, XBTM 23annualized discount.

Whenever we evaluate carry trades, we must consider the financing and opportunity cost of capital.

GBTC must have sufficient funds. Your broker won't give you leverage. Therefore, you need to borrow USD, or use USD capital that you own directly. In either case, there is a cost. Let's assume, you'd buy GBTC with the dollars you own outright. Given that I can buy two-year US Treasuries (PA) for about 5% per annum, that's my cost of capital (or opportunity cost).

Next, we have to consider how much it would cost us to hedge our BTC/USD exposure if we were to enter into this price (or delta) neutral trade. Trading in perpetual swaps and futures contracts is now on the back foot. This means that the futures price is lower than the spot price. So, as a short contract holder, we pay for the privilege of profiting when the BTC/USD price falls.

Unfortunately, futures contracts with maturities longer than 6 months are not very liquid. This means that the financing costs of derivatives cannot be known in advance. If the GBTC discount takes a long time to turn into a premium, or if GBTC is redeemed at par, then we are subject to the rolling price of the futures contract.

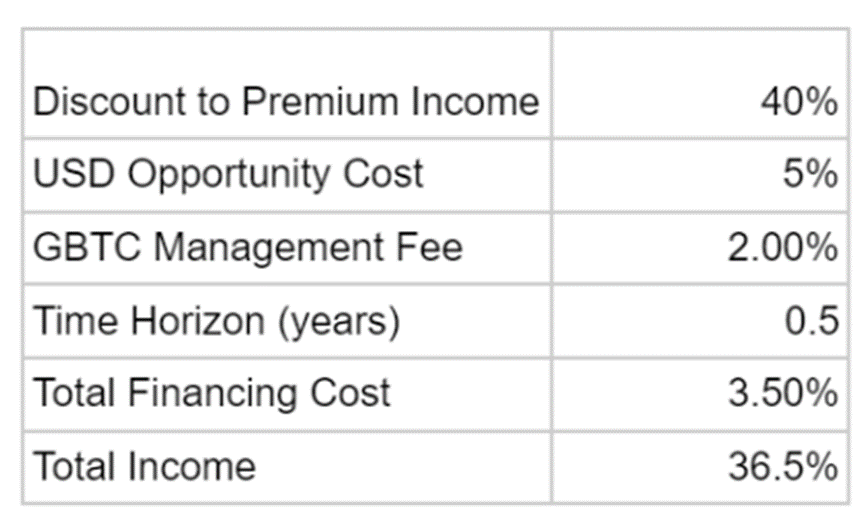

If we are conservative and assume it takes two years to achieve an acceptable exit, the table above shows the cost of the deal. Earnings are a 40% discount on GBTC on the market (as of 23 November 2022), or whatever your execution level is. At current levels, the deal has a 25% yield (40% proceeds from buying at a discount and eventually selling at face value vs. 15% financing and hedging costs).

The premium or discount of GBTC is positively correlated with the rate of change of Bitcoin price. If the price of Bitcoin accelerates upwards rapidly, GBTC will trade at a premium. If the price of Bitcoin accelerates downward rapidly, GBTC will trade at a discount. It is important to understand that the nominal price of Bitcoin is irrelevant. GBTC at $16,000 Bitcoin is at a discount today as Bitcoin comes down from a high of $69,000. In 2020, when Bitcoin comes down from the lows of $3,000 to $4,000, GBTC is at a premium at $10,000. This is a path dependent variable.

BTC/USD (yellow) to GBTC premium/discount (white)

Therefore, if you believe that the price of Bitcoin has reached a bottom, all it takes is a change in the direction of the price to turn GBTC into a premium. So for those who believe we're at a bottom, this is a great way to add a long-biased trade. This is because you get the added incentive of a GBTC discount. Financing costs still apply. Assuming you believe that sentiment will change over the next 6 months, Bitcoin will bounce quickly from $16k to $30k, and GBTC will swing from a 40% discount to a slight premium.

In fact, doubling Bitcoin is not an extra income. This is because you can buy physical bitcoins directly without engaging in this strategy. Therefore, the incremental incremental revenue for a directional long bet on Bitcoin is 36.5%.

"Cryptohayes, are you doing these deals?"

you ask me? My answer is, not at this time. There is also the risk of an unquantifiable opportunity cost of capital, evident in both cases - locking up scarce dollar capital in transactions of uncertain timing. I don't know when Bitcoin's price action will reverse, or when (if ever) I will be able to redeem my GBTC shares at par.

I'm happy to sit on US Treasuries with my spare fiat currency. That's because the Treasury market is the most liquid in the world. If there is a seriously bad cryptoasset being spit out of one of these bankruptcies, I want to be ready with dry powder. GBTC trading will now be liquid as the volatility of its price and discount increases on the way down. With the onset of crypto winter, with volatility plummeting along with trading volumes, all types of crypto assets and derivatives will become illiquid, and GBTC will not be an exception. In short, it's a big door to get in and a small door to get out. And as an experienced emerging market equity trader, I know to avoid these trade setups.

first level title

how to redeem

The inability to exit GBTC's cockroach hotel is both a good and a bad thing for the crypto capital markets. This is a good thing, because if there were an easy way to redeem GBTC at these heavily discounted levels, it would mean there would be a lot of physical BTC for sale. Holders of GBTC either redeem their stake for a premium and dump the BTC they received, or the trust dumps the BTC on their behalf, giving investors dollars in exchange for their GBTC. Either way is bad for a bear market information.

secondary title

Redemption route 1: 75% or more of shareholders vote to dissolve the trust

This is a very high barrier and can be forced off. Therefore, I think it is highly unlikely that a different number of shareholders will be persuaded to vote to redeem the trust. Given that not all shares are publicly traded in the trust, even if you wanted to buy up all public GBTC and vote for dissolution, you still wouldn't be able to accumulate enough to meet the 75% threshold.

secondary title

Redemption route 2: The sponsor elects to dissolve the trust

secondary title

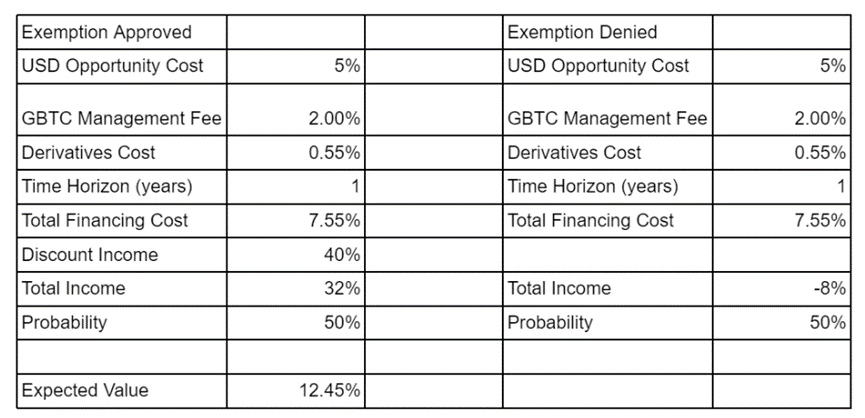

Redemption Route 3: SEC Grants Regulation M Exemption

This exemption essentially allows holders of GBTC to redeem at the fund's net asset value. Grayscale is currently suing the SEC to obtain this exemption for the trust. Their reason is simple, because the SEC does not allow GBTC to be converted into an ETF, so the SEC should grant an exemption. I can't take stock of the odds that this lawsuit will win, but in any case, we won't know much more about what the courts think until the first quarter of 2023. Therefore, it is impossible to know how likely this approach is to succeed, and if so, how long it will take.

But let's assume there is a 50% chance of success within the next year. This means that you paid all the financing and management fees for one year, and the chance of being able to redeem is 50%-conversely, there is also a 50% possibility that you paid all the financing and management fees for one year, but the chance of being able to redeem is 50%. Cannot be redeemed.

first level title

Mature

Our cucumber-eating jerk is just a little boy because his deceit is so blatant. As a parasite, you don't want to kill the host. It's even better if the host is alive and you slowly bleed them.

And that white man was once a boy, but he learned the value of patience. GBTC's management fee scheme is far better than blatantly stealing $10 billion of customers' money. Much better to earn your daily bread from willing participants. Mr. Shillbert has never forced anyone to invest in GBTC. Every owner of this product has done so willingly. While they may clamor about why delaying the redemption process is not in the best interest of GBTC investors, at the end of the day, everyone who owns this product buys knowing they can't get out. Additionally, if they want to exit, they can turn to a public market where there are buyers, albeit low prices, willing to buy GBTC if they want to sell.

Original link