text

Original source: TokenInsight

Original source: TokenInsight

What is Genesis/DCG?

DCG is an investment firm focused on the encryption market. It was founded in 2015 by Barry Silbert. Prior to that, Barry Silber successfully founded and sold SecondMarket to NASDAQ. DCG has completed over 200 investments and has seven subsidiaries: Genesis, Grayscale, CoinDesk, Foundry, Luno, TradeBlock and HQ.

It provides four services:

trade

Through its established cooperative network, Genesis provides market-making services and bilateral liquidity for buyers and sellers of digital assets, and provides tailor-made execution solutions.

borrow money

As an institutional counterparty, Genesis facilitates two-way lending between lenders and borrowers. The minimum loan size is 100 units of BTC, 1,000 units of ETH, $2 million or the equivalent of $1 million in other currencies.

Derivatives

Derivatives

Genesis offers custom derivatives solutions. It can trade custom options OTC or through exchanges.

hosting

Genesis also offers top security infrastructure to manage, move and store digital assets with a minimum deposit of $1 million.

Another subsidiary, Grayscale, is now the world's largest digital currency asset manager, allowing traditional financial institutions to gain exposure to cryptocurrencies through vehicles such as its Bitcoin Trust (symbol: GBTC).

according to

according toOfficial AnnouncementOfficial Announcement

, Genesis' lending unit was the only business affected by recent events. The other subsidiaries are separate entities and continue to operate as normal.

There has been speculation that DCG will be forced to sell Bitcoin held in Grayscale's GBTC to cover losses incurred on the Genesis lending. This is nonsense. DCG does not own the bitcoins in GBTC, they belong to GBTC's customers and are kept by Coinbase. DCG can sell Grayscale equity in exchange for cash, but DCG cannot sell these bitcoins directly.

What happened to Genesis?

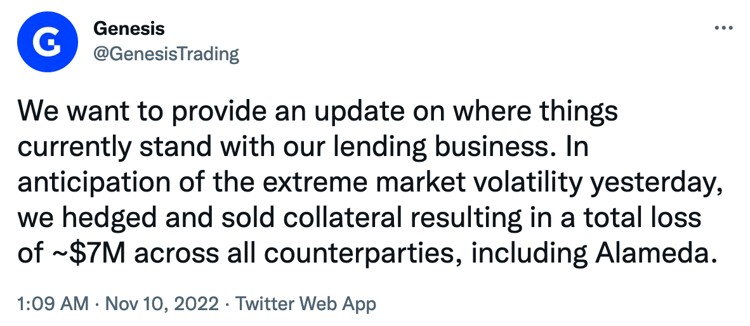

image description

source:Twitter@GenesisTrading

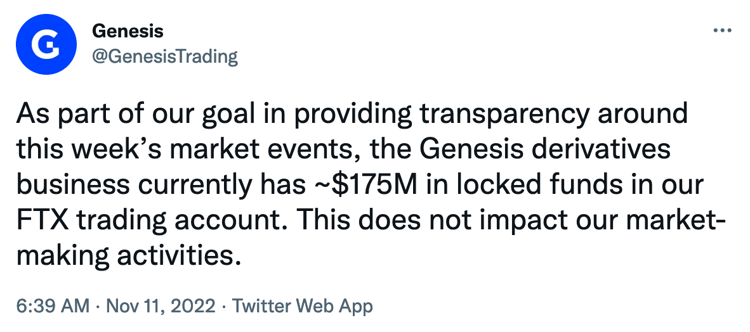

image description

source:Twitter@GenesisTrading

image description

source:Twitter@GenesisTrading

image description

source:Twitter@GenesisTrading

source:

It wasn't until five days later that Genesis finally dropped the bomb, suspending redemptions and new loan originations. Genesis acknowledged that 3 AC's default had negatively impacted the liquidity and loan maturities of its lending entity, Genesis Global Capital, while FTX had caused unprecedented market volatility, resulting in unusual withdrawal requests that exceeded its current liquidity.

They announced they would find new funding to save the business. Genesis is rumored to be seeking to raise $1 billion. But similar to FTX, Genesis' savior has yet to emerge. They promised to provide a clear resolution on the lending business this week. As of this writing, it's Friday, and Genesis has yet to announce anything. The longer you wait, the worse the news is likely to be.

The New York Times November 23reported thatreported that

, Genesis Global Capital has hired investment bank Moelis to explore remaining options including bankruptcy. On the same day, Barry Silbert disclosed in a letter to shareholders that DCG owed approximately $575 million in debt to Genesis Global Capital.

What's next? Will Genesis go bankrupt?

Without immediate fresh funding, the most likely outcome for Genesis is for its lender, Genesis Global Capital, to file for bankruptcy, while it remains unclear whether Genesis' other businesses and DCG in general will survive.

SBF had assured the community that FTX.US was an independently operated entity and had not encountered any financial problems until FTX.US was included in FTX's bankruptcy filing.But Genesis' situation is much more complicated. Since SBF moved customer deposits to Alameda, FTX.US is worthless. But many of DCG's businesses still look like good acquisition candidates. However,According to reports

, Genesis has $2.8 billion in outstanding loans on its books, about 30% of which were issued to related parties, including its parent company DCG. No further details are currently available to the public, so any predictions are unlikely to be too accurate.Ram AhluwaliaCEO of Lumida Wealth

In an interview, he stated that Genesis is the only full-service premium broker in the crypto space, playing a key role in enabling large institutions to gain access to the crypto market and managing risk. However, because Genesis is a pioneer among brokers in the crypto space, it cannot benefit from the ready-made infrastructure enjoyed by traditional brokers, such as liquidity, established standards, accumulated relationships between dealers, clearing houses and funding channels.

This has two important effects.

First, Genesis must try to match the maturity of its assets (loans) with the maturity of its liabilities (borrowing). Banks can borrow short-term loans (your savings account) and lend long-term loans (30-year mortgages). A traditional bank-backed broker can also tolerate a maturity mismatch between its assets and liabilities because it has FDIC insurance as a last resort and a standardized loan liquidity market. Instead, crypto brokers like Genesis have to try to iron out the maturity mismatch on their balance sheets, which isn't easy.

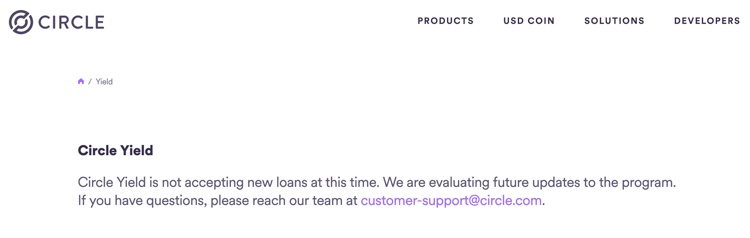

image description

source:Circle

source:

In addition, long-term loans are illiquid and cannot be redeemed at face value. This puts Genesis at risk of a "bank run". If everyone withdraws funds at the same time, Genesis cannot meet these needs due to the inability to raise funds quickly due to the terms of the lending contract or lack of liquidity. As a result, it suspended withdrawals last week.

Second, outside of the lending business, Genesis is the buyer of every seller and the seller of every buyer in the trading and derivatives space. Genesis must always seek an orderbook match. Accordingly, Genesis assumes substantial counterparty risk in the course of its business. If their counterparty, eg 3 AC, fails, then Genesis is in trouble.

Counterparty risk is also exacerbated for various reasons, such as the absence of a financial clearinghouse to sell exposure to and the absence of an inter-dealer market with high-quality participants.

The insolvency of the counterparty means that Genesis must suffer as a result and will incur a capital loss. This will lead to a loss of investor confidence and lead to bank runs.

A brokerage business is a cash cow if there is a strong ecosystem to cover unexpected losses. But in the crypto space, due to its early-stage nature, the brokerage business is fragile and prone to counterparty risk, bank runs and balance sheet mismatches, which is exactly what Genesis is experiencing.

So, where does Genesis/DCG go from here?

There are two solutions.

The first and most obvious move is to raise capital through equity sales at the parent company (DCG) level and inject new capital into the subsidiary (Genesis) to cover losses and restore confidence, this scenario has been widely covered in the news .

But Genesis is a capital-intensive business. It relies on funds to make loans, but its funding sources have dried up. It desperately needs to find new sources of cheap and reliable funding, without which Genesis cannot maintain its normal business. Fed rate hikes will only make things worse, and fewer people will be willing to hand over their money to Genesis.

Assume that there are no buyers in the market interested in DCG's equity or Genesis. In this case, the only possible outcome, as stated earlier, is that Genesis' lending subsidiary, Genesis Global Capital, declares bankruptcy.

write at the end

The collapse of FTX can be seen as the Lehman Brothers moment of the crypto market, which will ripple through the entire industry, triggering industry consolidation and greater regulatory scrutiny. We will experience prolonged financial and political uncertainty. On the bright side, however, good businesses will get cheap during this time. This is a great time to consolidate your crypto holdings into a handful of bets, focusing on sustainable business models that are gaining popularity.