Original compilation: 0x11, Foresight News

Original compilation: 0x11, Foresight News

Stephen Covey once said that there are three constants in life: change, choice and principle. However, we're adding a fourth: taxes. Almost everyone in the crypto world is talking about mergers, how does the merger affect ETH holders? What does it mean for the environment? Another key question is, will there be more taxes to be paid after the merger? We will examine the taxability of merged ETH and its impact on stakers.

How does a merger affect your income and taxes?

We'll look at this question for a different scenario: what happens to unstaked ETH in your wallet before it's merged? What happens when you stake ETH?

None of the countries have specific tax regulations or guidelines for what to do with your ETH post-merger. Mergers may be classified as soft forks for tax purposes. The U.S. tax law has rules on defining soft forks, according toIRS FAQ 30 , a soft fork occurs when there is a protocol update (such as a merger) that does not produce a new cryptocurrency.

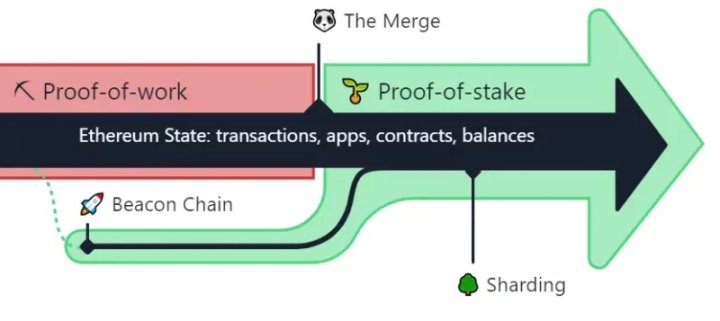

According to the IRS guidelines, a "soft fork" occurs when a distributed ledger is updated by agreement without resulting in a transfer of the ledger or creation of new tokens. You won’t get any new coins as a result of the soft fork; instead, you’ll stay where you were before the fork, which means you won’t get paid anything. The fact that a soft fork leaves you in the same position as before and generates no more income means it is not a taxable event. This fits perfectly with what happens during ethereum mergers, which do not form a new ethereum chain. It makes Ethereum faster, more scalable and less harmful to the environment. The old chain will be combined with the Beacon chain; no new revenue is created; all transaction history is preserved.

Assuming you have 5 ETH in your wallet, no new income is generated; instead, the Ethereum ecosystem converts your PoW ETH to PoS ETH after the merger.

What happens if ETH is staked before the merger?

You might be wondering how you can stake ETH before merging. Isn’t the purpose of the merger to introduce a staking mechanism? Before the merger, some exchanges offered staking services; however, the merger completely eliminated the PoW mechanism and converted all ETH to PoS ETH, requiring you to lock your ETH to get rewards, so you need to stake your PoW ETH (before the merger) ETH). To lock your ETH, you have to convert it to "ETH 2" or "ETH 2.S", these designations stand for staked ETH.

Note that different exchanges provide different names for staking ETH. Coinbase, Binance, and many other exchanges refer to them as "ETH 2," while Kraken refers to them as "ETH 2.S." Because "ETH 2" is only used as a "label", this pledge before the merger is also a soft fork. The tokens are essentially the same, but they are distinguished by a new name, and no new cryptocurrency is generated. For example, let’s say you spent $200 on 5 ETH in 2019, and then a year later you staked them on Binance by converting them to ETH 2. The converted ETH is worth $5000. Regardless of the price, the transaction is not taxable because it generates no new revenue.

How do pledge types and jurisdictional differences affect taxation?

Stakers will not have access to deposited raw ETH or staking rewards until supported by the Ethereum 2.0 network. This means that ETH 2 rewards are illiquid.

Should these illiquid rewards be taxed?

There are no clear rules defining the nature of PoS ETH staking income, so we will use the closest guide to determine how staking taxes will be applied. We will refer to some jurisdictions, but each country has different tax laws and guidelines.

The closest guide in the US is the Mining Tax Guide:Notice 2014 - 21 . Although earning staking rewards on ETH 2 is a taxable event, you do not need to file an income tax return until you can use, manage, and redeem your rewards. If you stake 5 ETH on Binance this year and receive 0.5 ETH as a staking reward a month later. You do not need to report income because it cannot yet be spent. But let's say Binance allows you to get 0.5 ETH as a staking reward in 2025, the price of 0.5 ETH is now $350, you are now entitled to handle that $350, so you can claim it as income (you can spend it). Before such a feature is enabled for PoS ETH, most stakers generally cannot earn rewards.

The closest guide for Canada is the Mining Tax Guide:Guide for Cryptocurrency Users. Generally, in Canada, unless you mine on a commercial scale, you don't pay taxes on it. What does this mean for Canadians' illiquid staking rewards? As in the US, you don't pay taxes until you have full control over the funds, and as mentioned, you don't need to file an income tax return until you can use, manage and exchange your rewards. The main difference is that if this staking is done as a "hobby" or "fun," you don't have to declare any income tax, even though you can spend the staking rewards.

Note: Both "hobbyist miners" and "commercial miners" pay capital gains taxes, but income taxes are different.

Say you staked 5 ETH on Binance this year and received 0.5 ETH next month, it can't be spent yet, but it's in your wallet. It's 2025 and Binance allows you to withdraw 0.5 ETH which is now priced at $350 and you don't pay income tax on that $350 because you can't be called a "commercial staker".

Now think about Almorok ventures staking 300 ETH and getting 30 ETH reward. It's 2025 and Binance has allowed Amorok ventures to earn staking rewards, and they have to pay taxes on staking rewards because they are staking for "commercial purposes".

Note: The terms "commercial purpose" and "pleasure" are often determined by a variety of factors.

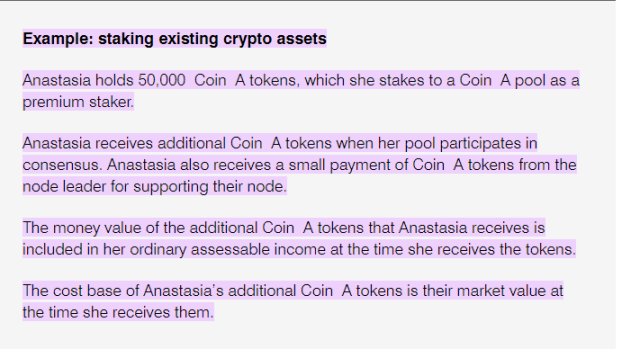

Australia has regulated staking rewards guidelines, and the ATO specifies how staking rewards should be reported:Staking Rewards and the Roles of Forgers. In Australia, you can fully access staking rewards without filing a tax return. Once you have access to the funds, you will have to report other taxes for awards and capital gains taxes (after the sale) at your disposal.

In the UK, there are also staking reward regulations stipulated by HMRC:Crypto Assets Manual. The exact facts will depend on whether such staking constitutes a taxable transaction (crypto assets as transaction income), taking into account various variables, including:

Activity scale

risk

risk

Commercial

Liquidity pledge

Liquidity pledge

Staking protocols such as Lido, RPL, and Marinade Finance also provide liquid staking derivative tokens. Liquidity staking not only provides the ability to earn rewards by staking cryptocurrencies, but also allows stakers to continue to use their locked assets to invest and earn in other activities. Therefore, both the ETH staked and the staking rewards received, you control and can invest them in other activities. Rewards earned in liquid staking are taxable income.

This means you don't have to wait a while to gain full access to your staking rewards. So once you get your staking reward, you can dispose of (sell, exchange, etc.) it.

Converting ETH to stETH is a taxable event because it is different from ETH you own, it allows you to earn staking rewards that you can use and control, and the stETH price is not exactly pegged to ETH, stETH should be paid when received be taxed. Report it immediately after you receive incentive income. Also, when you sell stETH, another taxable event is triggered.

For example, you exchange 5 stETH worth $5500 for your 5 ETH (cost is $5000). Over the next year, you will receive 0.5 stETH worth $500. Your taxes will be $500 (5500-5000) in capital gains and $500 in ordinary income (subsequent rewards to stETH).

How does this differ from the illiquid pledge tax in each of the jurisdictions mentioned?

In the above jurisdictions for illiquid staking rewards, you have to wait to get access before filing your taxes, but in liquid staking, you declare your staking rewards when you receive them (you receive them immediately) and when you sell them Income tax, you also trigger another taxable event and file it in the US.

In Canada you have to be a "business" stakeholder to file income tax, and everyone files capital gains tax (CGT) on disposition.

image description

An Australian Example of How Your Taxes Work After Liquid Staking Incentives

The UK situation will depend on factors such as commerciality, risk, scale of activity and organisation. Any cryptoasset rewards given for mining and staking (when received) are generally taxed as income, with any necessary fees reducing the taxable amount if the mining activity does not constitute a transaction.

in conclusion

in conclusion

Original link