Original Author: Mary Liu

Original source: BitpushNews

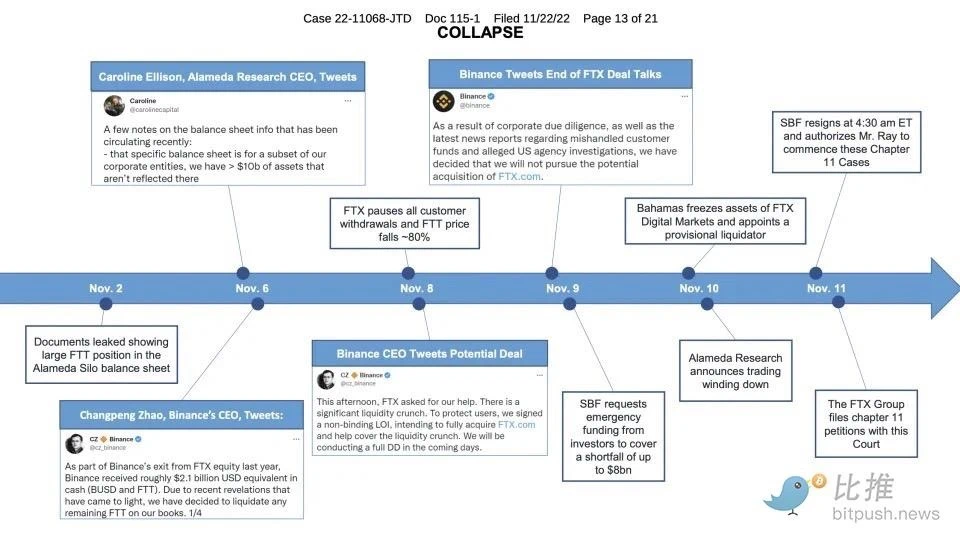

On Tuesday, November 22, local time, FTX’s first bankruptcy hearing was held in Delaware, the United States. The judge briefly described the rise and fall of FTX, as well as the timeline of the company’s collapse in just two weeks. FTX lawyers emphasized that, in addition to implementing proper corporate controls, transparency and investigations, asset protection and recovery is one of the most important core goals of FTX now.

The editorial department of Bitui will take you to review the important clues of this hearing. The following are the key points:

Lawyer Reveals 'Substantial' FTX Assets Stolen or Missing; Cash Balance Totals $1.24 Billion; Creditors Count in Millions

FTX consultants have been in communication with the Department of Justice and the Southern District of New York Cybercrime Division, which has launched a criminal investigation into FTX

Identities of FTX Top 50 Creditors Temporarily Confidential; Next Hearing Scheduled for Dec. 16

first level title

"One of the most sudden and hardest collapses in the history of corporate America and global business"

James Bromley, a partner at renowned law firm Sullivan & Cromwell and a newly appointed legal advisor to FTX's new management, described FTX's collapse as "one of the most sudden and difficult collapses in the history of American business, and in the history of corporate entities around the world," and that FTX The empire is described as "the personal domain of former CEO Sam Bankman-Fried (SBF)".

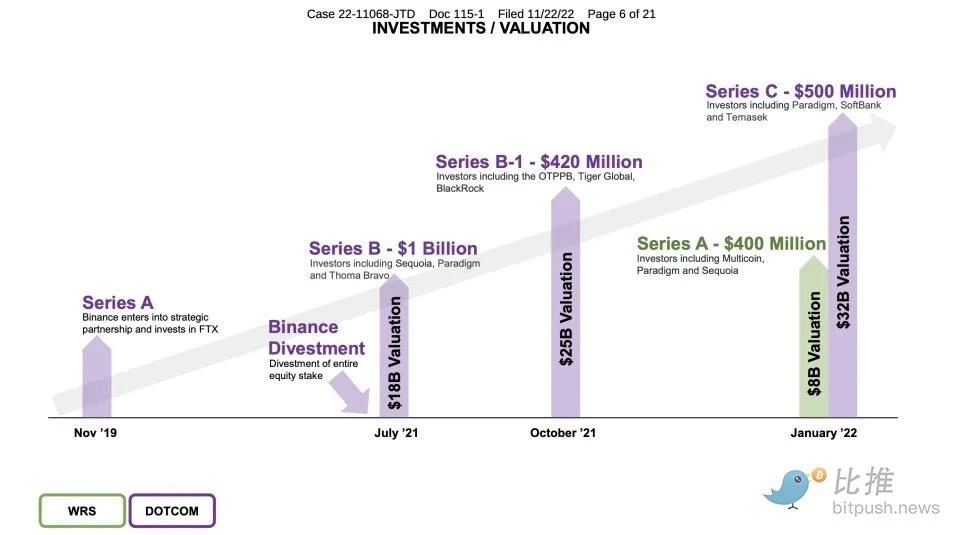

FTX was valued at $32 billion earlier this year, and SBF briefly established itself as the industry’s “white knight” during the crypto bear market.

"The FTX situation is the latest and biggest failure in the space, with a de facto bank run on its international exchanges as well as on its U.S. exchanges," said the lawyer. "While the run was happening, there was a leadership crisis...FTX was founded by Controlled by a very small number of people, led by Sam-Bankman-Fried, there was a big problem with the management, which led to his resignation."

first level title

Bahamas liquidators agree to transfer bankruptcy to US state of Delaware

While FTX filed for Chapter 11 bankruptcy in Delaware Bankruptcy Court on November 11, the Bahamas court-appointed liquidator for FTX subsequently filed a separate lawsuit against FTX Digital Markets in the Southern District of New York, which resulted in two At the hearing on Tuesday, lawyers said that the Bahamas liquidator had agreed to transfer related cases filed in New York to Delaware for consolidation.

The Securities Commission of the Bahamas, the lead local authority investigating FTX’s collapse, last week ordered the transfer of assets held in FTX’s encrypted wallets to government-controlled wallets for an undisclosed amount. Bahamas liquidators have said that FTX’s entire business is run through its local arm, so disagreements remain over who is entitled to control the company’s assets and how they are distributed.

first level title

"Substantial" amount of FTX assets stolen or lost; cash balances total $1.24B; creditors in the millions

A key aspect of the FTX crisis is Alameda and the FTT token, which is a token issued by FTX. The lawyers reviewed the history of FTX and its affiliates, pointing to the creation of the FTT token in April 2019 and the formation of the Alameda entity in November 2017. In addition to the $477 million hack that occurred shortly after FTX entered Chapter 11 bankruptcy, there have been multiple attacks, the lawyer said: "Substantial assets were either stolen or lost"。

The latest bankruptcy application shows that FTX has 36 banks and more than 200 bank accounts. The total cash balance of FTX Group is 1.24 billion US dollars, of which Alameda has the largest cash balance. However, the scope of this case seems to be far beyond people's expectations. Glueckstein, the company's attorney, said FTX expects "there will be millions of creditors" in bankruptcy.

While FTX has invested in cryptocurrencies and tech ventures, it also spent nearly $300 million on real estate in the Bahamas, mostly residential and vacation homes for executives, a figure higher than previously reported.

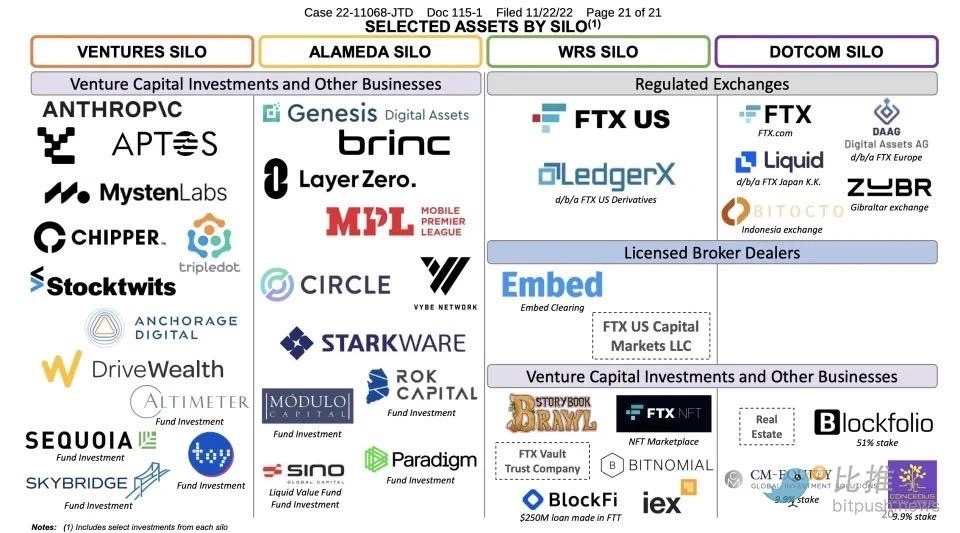

FTX lawyers stated that they divided FTX’s assets and various entities into four silos (Silos), namely:

WRS (West Realm Shires) silos, which control and contain assets in the United States.

Alameda silos, which included Alameda Research, a now-defunct hedge fund.

Venture capital silos that invest in crypto companies and startups.

Dotcom silos, which include international operations, hold most of FTX's deposits.

FTX's clients are all over the world, and the proportion of clients' geographic regions disclosed by lawyers is:

Cayman Islands - 22% of registered customers.

US Virgin Islands - 11% of registered customers.

China - 8 % of registered customers.

first level title

New FTX Leadership Is Working With US Law Enforcement, Regulators

Bromley said at the hearing that the new company leadership is cooperating with investigators from the U.S. government and regulators: “We also maintain ongoing communication with the U.S. Department of Justice, including the Southern District of New York’s Cybercrime Unit, and with the SEC and CFTC. In addition, FTX's new CEO John Ray III and other members of the leadership team are coordinating with "the U.S. government and various regulatory agencies around the world who are very interested in this situation."

first level title

Identities of FTX Top 50 Creditors Temporarily Confidential; Next Hearing Scheduled for Dec. 16

Some major cryptocurrency firms, including Genesis, Galaxy Digital, Wintermute, and crypto hedge fund Galois Capital, have voluntarily disclosed their exposure to FTX. Documents filed by FTX over the weekend show that the company owes more than $3 billion to the top 50 creditors alone, with the top 10 companies each claiming more than $100 million in claims, with many of the major creditors still unknown. There are still concerns that the risk will continue to spread.

Delaware District Judge John Dorsey granted a provisional motion at Tuesday's hearing to allow FTX to withhold the identities of creditors for the time being, with future hearings to discuss the issue further.

The Office of the U.S. Trustee (the department of the Justice Department that oversees bankruptcy proceedings) opposed some of the motions, arguing that transparency is a necessary part of the process, but FTX lawyers countered that it was important to protect FTX’s clients from being involuntarily disclosed as investors, and that FTX Your customer list is one of your company's most valuable assets and should be protected from competitors.

Dorsey also ruled that FTX should continue to pay the remaining employees and suppliers it deems essential to the business. The former leadership of FTX, including SBF, co-founder Gary Wang, engineering director Nishad Singh, Alameda Research CEO Caroline Ellison, etc. are not allowed to receive any further compensation.

The next hearing is scheduled for December 16.