1. Summary of Industry Dynamics

first level title

1. Summary of Industry Dynamics

This week, the encryption market did not perform well in terms of price and trading volume. The market as a whole is weak, and it is still digesting the impact of the FTX incident two weeks ago. At the same time, it is also worried that more related incidents will occur in the future. Lending institutions such as Genesis stopped users from withdrawing cash. Centralized exchanges such as Gate.io and Crypto.com were also affected by runs and rumors. USDT also had a negative premium of more than 1%. CZ also said on the 11th that as the incident continued Fermentation, the next few weeks may see more company failures.

The impact of such events on the encryption market may be more than that. The biggest impact may be that the interest of institutional investors in cryptocurrencies will be questioned, from the collapse of Terra to the bankruptcy of Celsius to the collapse of FTX, one of the blue chips in the encryption field, Let the concept of Bitcoin as a safe-haven asset burn out in turbulent times, and there are also market rumors that Jump trading may reduce the proportion of funds in the encryption market after experiencing consecutive losses, so institutions' interest in the encryption market may take longer to repair.

As of writing, Bitcoin closed at $16,581.8, an increase of 0.04% during the week, and basically fluctuated within a narrow range of 16,500-17,000 throughout the week. Ethereum performed slightly worse, closing at $1177.24, down 4.44% within the week. The logic of the oversold Ethereum may also be that the FTX hacking incident made the hacker’s address hold more than 287 million U.S. dollars in ETH, which once became the 30th place in ETH. A large number of currency-holding addresses, and this address is selling ETH one after another, causing greater panic in the market.

Regarding the current dilemma of CEX, Binance first disclosed the proof of reserves last week, and then many exchanges followed suit. V God also shared his views on CEX security in his blog this week. He believes that through ZK SNARK and other advanced technologies, the exchange can be technically non-custodial on the premise of improving privacy and robustness. After Vitalik made his voice, CZ also said through twitter that his team would implement the ideas and open source for the industry.

At the same time, Fed officials also released hawkish speeches this week. Among them, Bullard, the eagle king, said that the interest rate will be increased to 7%, and Daly, the president of the San Francisco Fed, believes that the interest rate will increase by 1%, and has not considered suspending interest rate hikes , although she is not a voter, she will still participate in the meeting. At present, the peak interest rate predicted by CME Group is about 5.25%. The current round of interest rate hikes will be completed in the first half of 2023. In any case, the fact that the Fed has less and less room to raise interest rates has gradually become clear. The market will eventually usher in the moment of recovery.

2. Macro and technical analysis

first level title

2. Macro and technical analysis

The short-term market is still gradually trying to get rid of the haze of FTX, while the influence of the macro level gives way to the internal influence for a short time.

The short-term market is still gradually trying to get rid of the haze of FTX, while the influence of the macro level gives way to the internal influence for a short time.

BTC and ETH are in a sideways market as a whole, and the follow-up is highly likely to consolidate. Since FTX has proposed bankruptcy and reorganization, it is recommended to pay close attention to the follow-up processing results.

The two-year Treasury note rose to 4.548 bp after Eagle King's speech.

After Nasdaq stood on the 60-day line, it was restricted by the 120-day line and fell short-term.

1. Arh 999: 0.29, but it is recommended to make a fixed investment after it is stable.

first level title

3. Summary of investment and financing

1) Investment and financing review

3. Summary of investment and financing

1) Investment and financing review

During the reporting period, 13 investments and financings were disclosed, with a cumulative amount of US$252 million. Among them, the $200 million financing of Matter Labs, the parent company of Ethereum Layer 2 expansion solution zkSync, accounted for 80% of the financing scale.

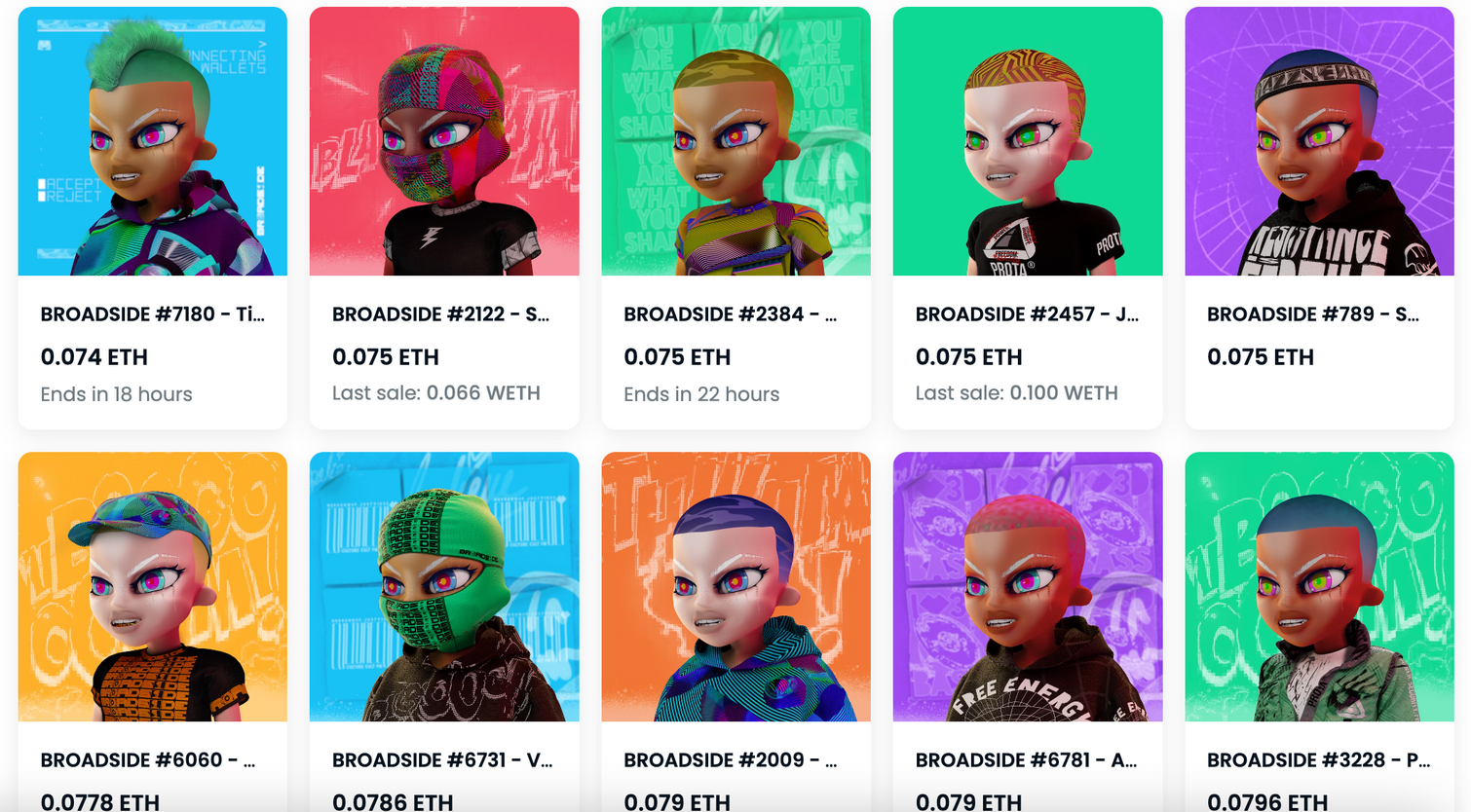

2) Current situation of the organization

2) Current situation of the organization

4. Encrypted ecological tracking

1.NFTs

first level title

4. Encrypted ecological tracking

1) Market Overview

This week, the NFT blue chip index has improved compared to last week. As of November 20, the blue chip index has risen compared with last week, but there has been no significant change. This month, BAYC was partly liquidated by BendDAO, and the giant whale Franklin Zhou caused panic in the market through arbitrage and also triggered the liquidation mechanism. BAYC rebounded this week, but because BAYC is deeply bound to the macro market, the future trend still needs to be confirmed by macro information.

This week, the total market value of the NFT market increased by 1.45% year-on-year, and the total transaction volume decreased by 7.99% year-on-year. This week's NFT trading volume continued to decline compared to last week, because of the FTX thunderstorm incident, the NFT market was also affected by liquidity, but the total market value still rose this week, so it can also be seen that the market is in the midst of the FTX incident recovering.

The activity of holders/traders in the NFT market decreased this week, buyers increased by 4.16% compared to last week, sellers increased by 3.64% year-on-year, and holders increased by 4.67%. In the state of numerous negative macro news, the market also gradually rebounded from the previous freezing point and became active this week.

The top three NFTs with the highest transaction volume in the market this week are BAYC, MAYC, and Otherdeed. Some BAYCs are still subject to the liquidation crisis of pledges, and the floor price of BAYCs has also reached 60 ETH.

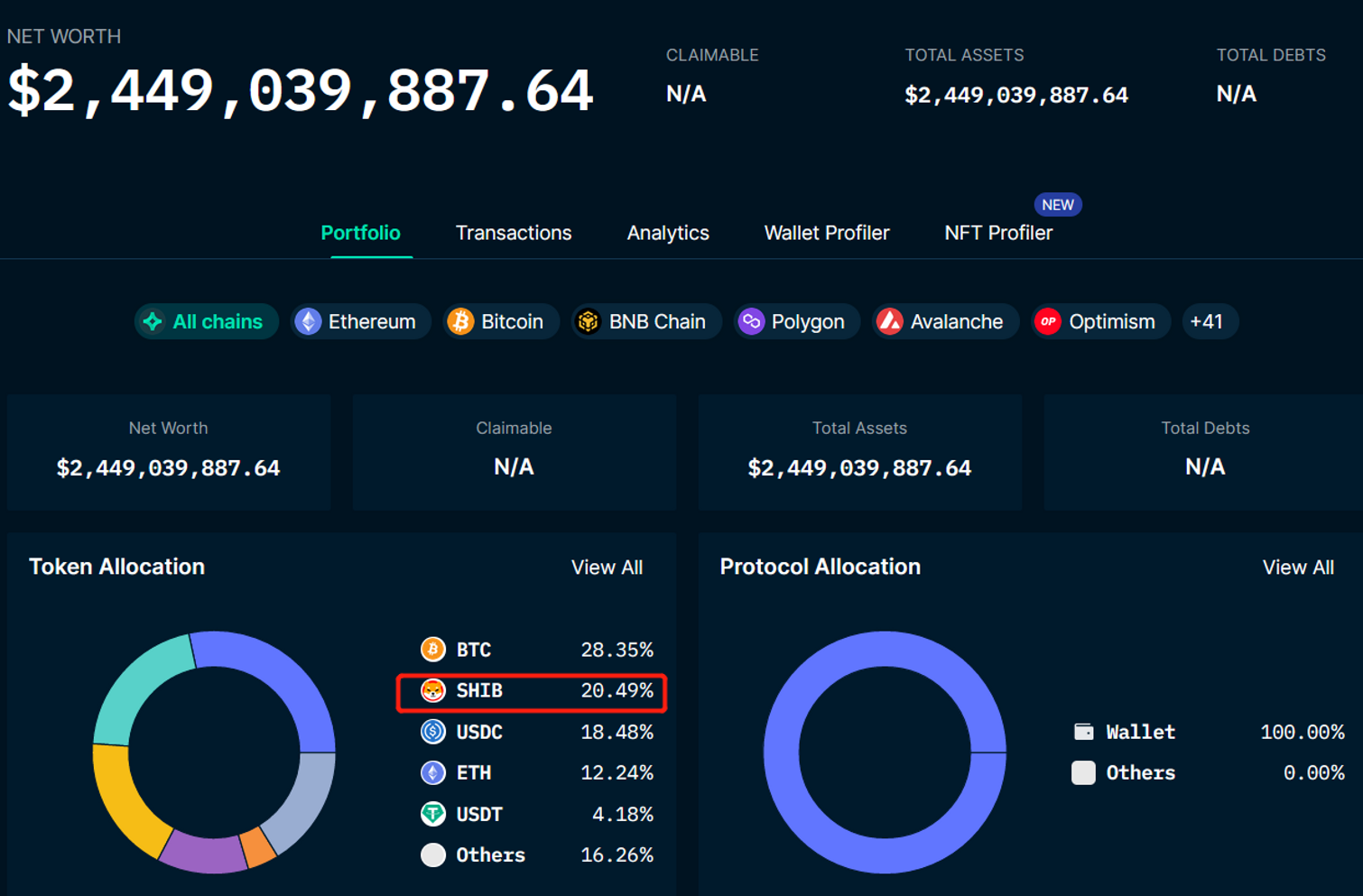

2) Dynamic focus

X 2 Y 2 Compromising royalty requirements will maintain royalty functionality

Other platforms have also faced backlash from various users and creators since OpenSea announced last week that it would continue to maintain the royalty feature. The X 2 Y 2 platform has also received a lot of backlash since its release last month of a new royalty feature, where users can vote on whether royalties should be offered. Therefore, this week, the X 2 Y 2 platform announced that it will remove the original optional scheme and maintain the original mandatory royalty function. Since then, the royalty war between platforms may gradually come to an end.

NFT card trading platform Sorare gets regulatory approval

Manchester United released the first issue of NFT

3) Key projects

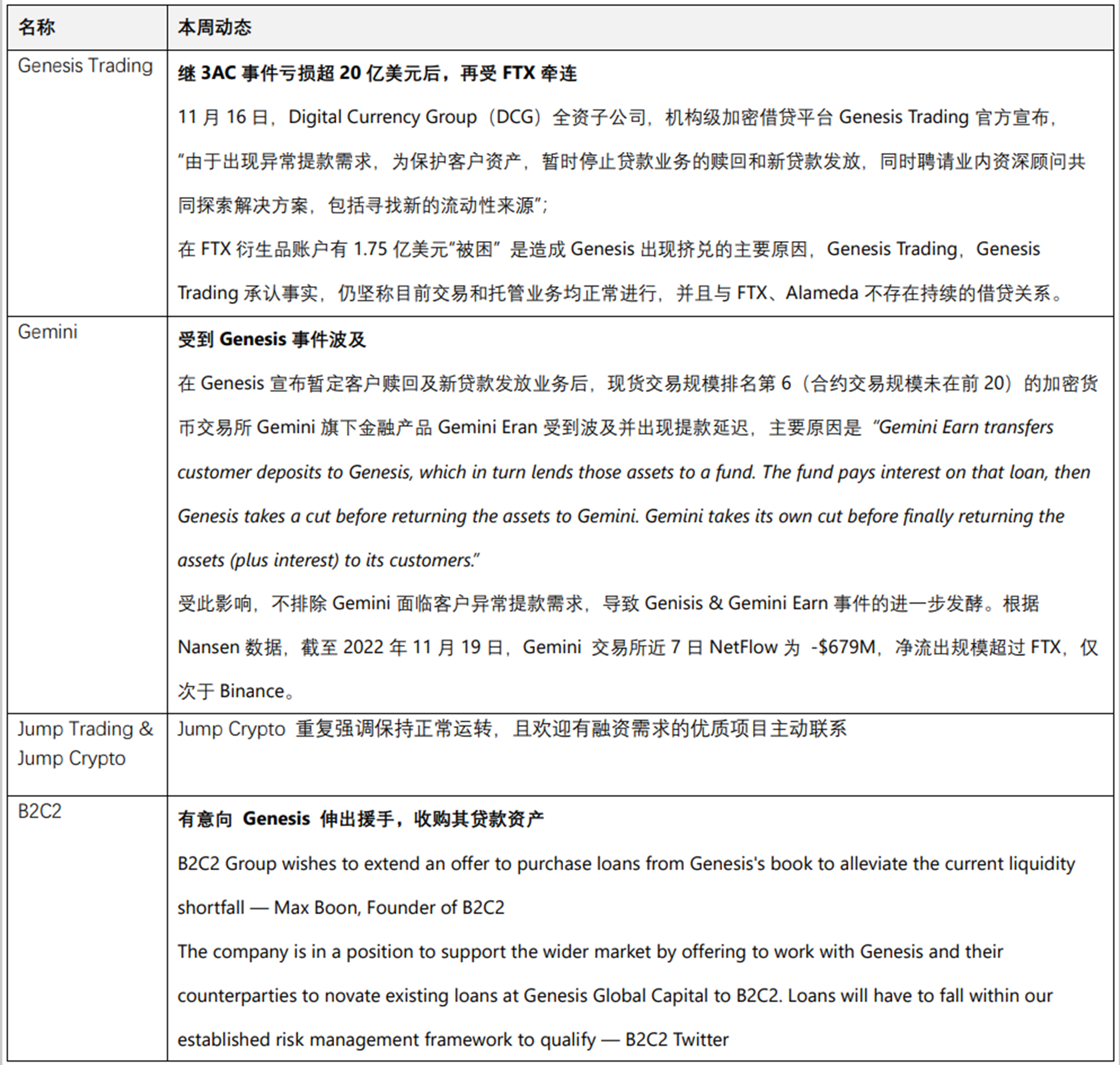

Broadside

The well-known British club Manchester United recently released the first phase of NFT. The NFT is distributed to fans for free, and its purpose is to "educate, reward, and unite" Manchester United's global fan groups through the Web 3 digital community. This release is hailed by Manchester United as an experience in which fans can own a part of Manchester United. This release also heralds that the sport of football will generate more and greater value from NFT. ,

3) Key projects

At present, all 7290 NFTs have been sold to the public, and the casting price of this project is 0.07 ETH. At present, the floor price of the NFT is also between 0.074 - 0.08 ETH, which is in a state of not going up or down.

2. GameFi blockchain games

overall review

2. GameFi blockchain games

This week, mainstream tokens in the Gaming sector fluctuated within a narrow range following the market, with little overall change; entering the deep bear stage, both volatility and trading volume showed signs of shrinking significantly.

Items of the week—Heroic Story

Last week, the AXS token on Binance had a hacking event, and the price of the token rose by 200% within 15 minutes, and then returned to normal in a short period of time. It is reported that this incident was caused by the theft of the API key of the third-party quantitative trading platform used by Binance users. CZ tweeted that he has sent notices to Skyrex and 3 commas users to urge them to reset the API key and will try to disable All API keys used on Skyrex. Previously, FTX had similar incidents, but FTX compensated users for their losses.

Items of the week—

Game developer Heroic Story announced the completion of a $6 million seed round of financing, which will be used to build a Web 3 version of the tabletop role-playing game (TTRPG). This round of financing was led by Upfront Venture, with participation from Multicoin Capital and Polygon Technology, as well as individual investor Jonathan Lai (GP at Andreessen Horowitz).

Heroic Story was incubated by Y Combinator in 2019, aiming to bring traditional desktop role-playing games similar to "Dungeons & Dragons" (commonly known as "running groups", similar to domestic script killing) to the Web 3 era. This type of game is usually highly social, with multiple players acting as game characters (customized) with different identities, backgrounds, occupations, and abilities. play. These games often have a great deal of freedom in decision-making, while using dice points to introduce randomness and drama.

The first series launched by Heroic Story is called Fortunata, which is a world background of medieval swords and magic. There are several story plots based on this world view. Players can create game characters to join the community and participate in online games organized by professional DMs.

This type of game is relatively popular in European and American countries (the D&D series was born in 1974). The main pain point is that the threshold is usually high. Players who want to participate need to understand a lot of rules and backgrounds, and spend 3 to 4 hours to participate in the game simultaneously with several other players , and requires a professional moderator to operate. In the future, Heroic Story needs to further lower the threshold for participation, and use the technological innovation of Web 3 to empower the game.

1) Market Overview - Public Chain & TVL

3. Infrastructure & Web 3 infrastructure

1) Market Overview - Public Chain & TVL

Among the major public chains, ETH, BSC, Tron, and Avalanche rank among the top 4, with little overall change; Arbitrum benefited from the rise of the decentralized derivatives trading platform GMX, surpassing Polygon to reach the fifth place.

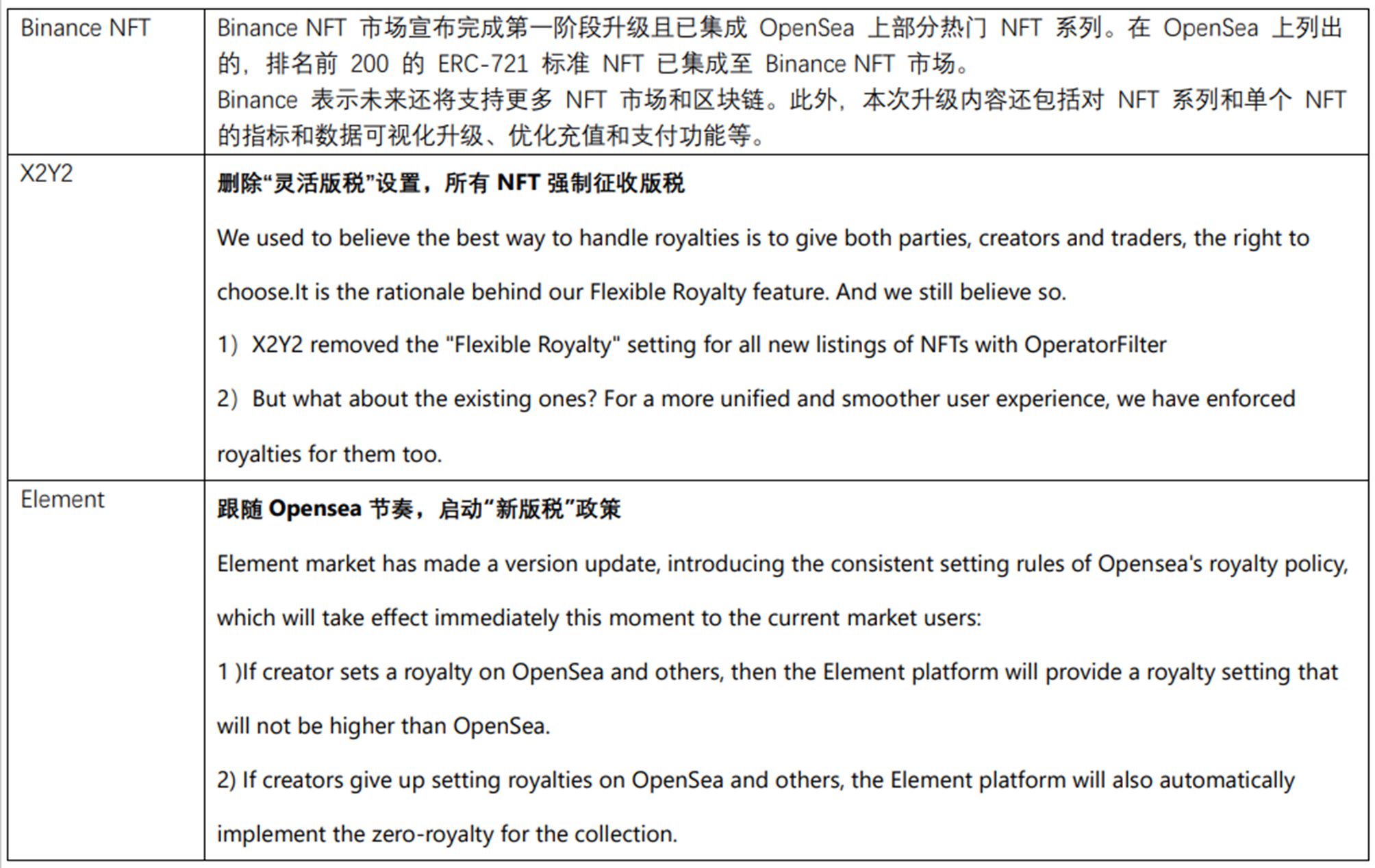

2) Market Overview - Stablecoin Supply

Among the rest of the public chains, the TVL of Cronos plummeted in a single week, mainly due to the poor quality of assets disclosed by the centralized exchange Crypto.com (SHIB accounted for more than 20%). In the panic caused by FTX, Crypto.com experienced partial runs and It is difficult to withdraw funds. Currently, Nansen portfolio discloses that its asset balance is about 2.4 billion US dollars. Affected by this, Cronos (Crypto.com’s EVM blockchain) TVL and token CRO saw a sharp drop. In addition, Solana is weaker and its TVL is showing a continuous downward trend.

2) Market Overview - Stablecoin Supply

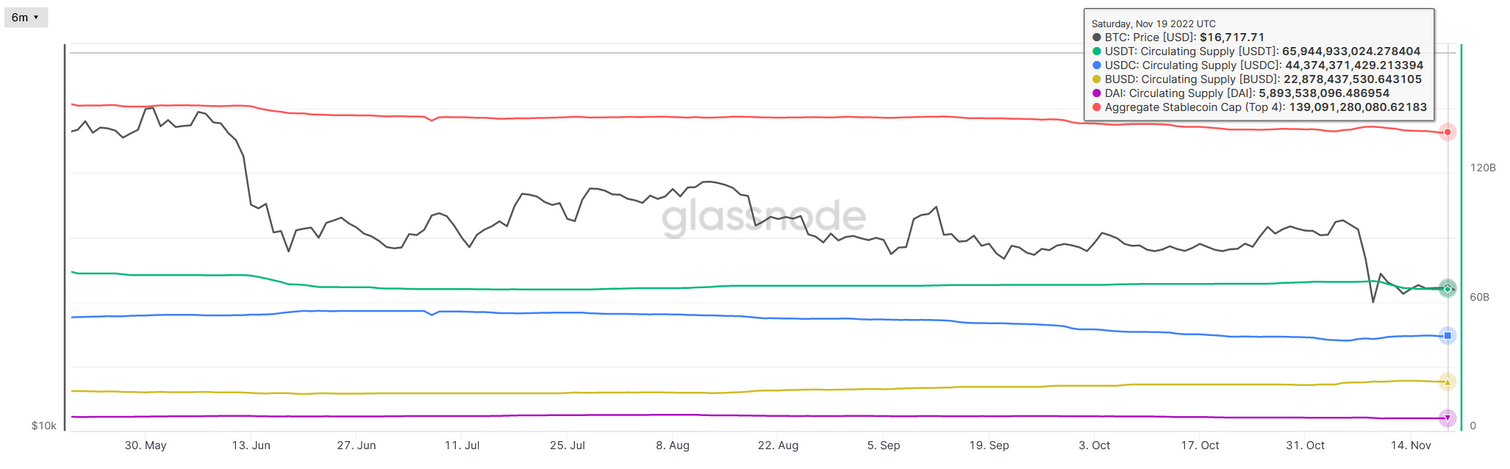

As of November 19, the total supply of the top four stablecoins (USDT, USDC, BUSD, DAI) was approximately 139.091 billion, a decrease of approximately 1.514 billion (- 1%) from 140.605 billion a week ago, a large drop. Among them, the supply of USDT has continued to decline for the past two weeks, reversing the upward trend since September (affected by the delisting of USDC by Binance), and has decreased by more than 3 billion pieces from the high point of this month. In addition, the supply of BUSD has also declined, which may be due to FUD comments in the market worrying that BUSD may lack sufficient collateral, resulting in oversupply. The supply of USDC continued to rise this week, and during the period of market turmoil, the preference for security and compliance increased.

1.Buildspace raise $ 10 M

This week's stable currency data is poor. Compared with last week's slight recovery, funds are showing a trend of outflow and departure. This may be due to the difficulty in exchanging large-capital digital currencies and legal currencies, so there is a lag. In addition, due to USDT price fluctuations last week, there was a slight unanchor (as low as 0.98), and there may be some arbitrage behaviors that will be cashed out this week.

3) Infrastructure financing news

2.Ethereum Climate Platform

Buildspace is a learning platform focusing on cutting-edge fields such as Web 3, machine learning, artificial intelligence, etc. Last week, it announced the completion of financing of 10 million US dollars. This round of financing was led by a 16 z, Founders Inc, Weekend Fund, Y Combinator, Vayner Fund, Protocol Labs, OrangeDAO, Solana Ventures, OpenSea Ventures, Alchemy Ventures, DreamerVC, etc. participated in the investment. Buildspace is currently designed as a network for Web 3 builders, a platform that helps developers build their own Web 3 projects.

Buildspace hopes that users can learn and explore their career development in the field of web 3 development on the platform. The current learning projects on Buildspace include Solidity, Ethereum NFT, various Web 3 dApps on the Solana chain, etc. Buildspace is free and provides teaching on many high-quality content in the field of encryption, mainly for developers. Developers can build NFT mint pages on it, build DAO and various dApps, and also set up the Ethereum development environment. For example, learn how to write smart contracts in Solidity on the local blockchain, and at the same time, you can send ETH tokens from smart contracts to designated users. Buildspace is primarily intended to allow web 3 developers to learn by doing. The platform already has the support of thousands of developers.

The alliance is led by software company ConsenSys and climate change-focused blockchain company Allinfra, and includes founding members such as Microsoft, Polygon, the Ethereum Alliance, the Global Blockchain Business Council, Huobi and Laser Digital.

ConsenSys, an Ethereum software company that helped design Ethereum-based Merge, at the just-concluded COP 27 climate conference. The United Nations Climate Change Institute joined 18 other companies in launching the Ethereum Climate Platform (ECP), the Ethereum Climate Platform. The aim is to offset the carbon footprint left by the ethereum network since its launch in 2015. It also hopes to reduce excess energy consumption used by the blockchain before its adoption of the merger in September.

The purpose of the ECP is to fund high-quality green projects, an initiative the co-founders believe is important to slowing man-made global warming. He believes that there is a great lack of transparency, efficiency and timeliness in the past review process of such projects. Therefore, the founder of ECP also said that it is very successful to design and launch a better Web 3 climate financing platform. The UN Climate Innovation Center is also looking forward to the opportunity for the platform to further collaborate with strategic leaders in the climate and Web 3 space in the coming years.

ECP platform introduction and participation methods:

The ECP platform is built for and within the Ethereum ecosystem, but its purpose is for the ECP to serve as a model for the global technology and business community to reduce and offset their own historical carbon footprint. Polygon co-founder Sandeep naiwal also mentioned the Ethereum climate platform as an important cross-collaboration plan to solve the climate crisis. Working together, we can reduce energy consumption and provide a better real life for all. This is also very consistent with the philosophy of our JZL Garden.

The promise of the platform is to correct and offset the carbon footprint based on Ethereum since 2015. The way this will be achieved is that ECP will invest in ongoing science-based climate projects that promise to reduce Ethereum's past emissions by leveraging Web 3 native technologies, infrastructure, financing mechanisms, and governance protocols. In addition to providing financing and other support for projects to achieve decarbonization at scale, the ECP will support innovative solutions that require market validation to ensure they deliver real impact. JZL Garden also has the opportunity to apply to join.

4. Web 3 Social & DAO & DID

This week, I will briefly introduce the concept of the recently popular account abstraction.

The wallet is the core infrastructure for all actions of Web 3 users. However, the wallet still faces problems such as poor user experience and high barriers to use. It is difficult to undertake the hundreds of millions of users brought by the future Mass Adoption. The abstract concept of accounts that has been hotly discussed recently may subvert the logic of future wallets.

There are two types of wallets at this stage:

EOA Wallet (Externally Owned Account):

Technical principle: private key control. The standard ECDSA signature is performed by the user with his private key, and then sent to the Ethereum Mempool, where the miner packs it into the next block.

Example: Metamask

Smart contract wallet (Smart Contract Account):

Technical principle: code control. is a smart contract that behaves like a wallet, i.e. an interface that allows users to manage funds, do web 3 logins and interact with dApps. To build & operate a replayer to send user information to the final smart contract wallet. The contract account is controlled by the code, it cannot actively initiate a transaction, only executes the transaction according to the pre-written code after being triggered, and once the code is generated, it cannot be modified.Example: Safe, Argent

Compared

: The EOA wallet is like an ATM machine, which only supports basic services such as access, transfer, and balance inquiry. The contract wallet is more like an intelligent banking system. Users can set whitelist accounts and maximum withdrawal limits; they are more lenient in transfer operations, allowing project parties (subsidies), good friends to pay on their behalf, and so on.

Account abstraction:

V God said in an interview in October this year that he hopes to achieve four key goals next year, including scalability, privacy, base layer anti-censorship and account abstraction.

ERC- 4337

The account abstraction is an improvement on the above two accounts, trying to blur the boundary between the two, and turn it into a general-purpose account with complex logic, so that the account can have the functions of contract account and external account at the same time. This approach is equivalent to allowing users to define external accounts in the format of contract accounts, and users can include any logic verification in the smart contract wallet. Accounts controlled by keys can also be supported by codes.

Many explorations have been carried out in the past. EIP-86 and EIP-2938 are explorations of account abstraction, hoping to enable contract accounts to initiate transactions like external accounts, but there are various problems. For example, EIP-2938 requires Changes to the Ethereum protocol at the consensus layer, so it didn't start being used on a large scale.

The recently popular ERC-4337 provides a solution that does not need to change the consensus protocol, which has attracted attention and is generally more secure.

In simple terms, ERC-4337 replicates the function of mempool in the system. By establishing a common module Useroperation Mempool & Bundler to replace the modules independently developed by each project.

The user sends a UserOperation, which includes the user's intent, signature, and other data. UserOperation has a separate mempool storage pool, and nodes connected to this storage pool will perform ERC-4337 specific verification. The miners package UserOperation in batches, package it into a bundle transaction, and include it in the Ethereum block.

Compared with the previous smart contract wallet, ERC-4337 provides a general function module, which can greatly save the cost of reinventing the wheel for developers, and adopts the Bundler mode of packaging the same type of transactions to amortize the fixed costs of user transactions.

At this stage, the progress in the non-complete EVM environment is relatively rapid, and the progress of account abstraction has almost reached the production level that can be promoted on a large scale. For example, Starkware has released StarkNet Alpha 0.10.0 that covers the improvement of account abstraction. Fully EVM compatible, the core contracts have been reserved, and there will be molding products coming out soon.

Infrastructure such as wallets still mainly use functions such as access to swap for traffic realization, and further exploration of its value capture is needed.

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment.

The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.

Website www.jzlcapital.xyz

Twitter @jzlcapital

contact us

The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.

contact us