Original author: Arthur Hayes, founder of BitMEX

Original compilation: PANews, Wang Eryu

in the last article, I said Sam Bankman-Fried (SBF) is at least a "rare trade genius." I was slapped in the face again. I thought the Alameda team was full of great traders, but it turns out they're just another firm that's good at playing tailwinds in bull markets, and once a bear market comes, they get beaten like all overleveraged Su Zhu-style cycle believers Back to the original shape. We now know how poorly SBF’s risk management is – both for the crypto market and for the financial market as a whole. Still, I believe he has demonstrated a knack for the trading game that is unrivaled in the industry. That is to say, SBF is playing this game at the Meta (yuan) level. By trading social currency, he has played with Western financial institutions and the encryption industry in the palm of his hand.

SBF played a lullaby for two groups at the same time: believers of Satoshi Nakamoto, who believe that Bitcoin will become one of the greatest changes in human history; and TradFi (traditional finance) diehards, who believe that cryptocurrency is A huge threat to the status quo and one that could make them rich. In the face of Satoshi Nakamoto’s believers, he spread the gospel like us, as if he could successfully cross the power corridor of TradFi on behalf of us, and in the face of the fat-headed TradFi loyalists, he promised to use a way to let them sit firmly on the side of the financial system. Throne, while harvesting new sources of wealth. This is his Sunflower Collection. The FTX/Alamada ecosystem (hereafter referred to as the Death Star) juggled both groups.

This scandal, tragedy, and even blatant fraud touches on a host of geopolitical and racial issues in the American empire, and I'll dedicate a few essays to tease out what I've learned from this saga.

first level title

White Boys Can't Jump

A few notes:

A few notes:

Every nation-state or society has a culture based on different social classes and has an "other". The "other" has a different color, race, religion and/or accent. There will always be economic exploitation of the "others" below by the upper classes in society, and the upper classes will always find excuses for their cruel and inhuman behavior.

The labels white and black are misleading, even sinister, but for the sake of discussion, let's use them. White refers to people of European descent and black refers to people of African descent.

In the context of the American Empire, the caste system does not exist and does not exist. If you also believe in the fairy tale that the United States is always an exception, you don’t need to read this article.

Now on to the real chapter.

What is taught in the school is a romanticized history of the founding of the United States: a group of "patriots" were fed up with exorbitant taxes with no rights but obligations, so they revolted and created a United States of America where everyone is created equal and everyone has the right to speak.

good story. But there is another story like this.

A group of wealthy men who didn't want to pay taxes launched what would today be called domestic terrorism and persuaded the poor, landless white colonists to join them in fighting to rid King George of rule. After Independence, most of the United States was non-voting, including all women and all proletarian men. The law stipulates that blacks are only counted as three-fifths of men and belong to the property of slave owners. Aboriginal people were expelled or lost their ancestral lands through unequal treaties. What a great way to build a nation.

The so-called "land of the free" was not born with it. In 1870, nearly a century after the founding of the United States, all white males, rich and poor, were granted the right to vote for the first time under the 15th Amendment. Fifty years later, in 1919, women finally gained the right to vote through the 19th Amendment. It wasn't until 1964, when the 24th Amendment and the Voting Rights Act came into effect, that black people gained the right to vote, nearly 200 years after the founding of the United States.

These intersecting and lengthy timelines reflect the timelines of the acceptance of various groups as “equal” in American society, with years of systemic discrimination fostering a built-in system of inequality. But why, after all, did the “Founding Fathers” not rise up and launch acts of domestic terrorism against the new nation for centuries? How on earth did those in power keep poor white men, all white women, all black African slaves, and all indigenous peoples in their place?

Pre-industrial America was not a place of abundance. Cold in winter and hot in summer, lack of food, far away from their homeland (except for the aborigines), there is nothing to say. At this time, the geopolitical situation in the United States is also perilous. The British are waiting for an opportunity to regain their lost land, the Spaniards are lurking in the south, and the French are temporary allies, but they may turn their guns on themselves at any time.

At the time, most Americans were poor whites. So simply mobilizing these poor whites is enough to start a destiny-changing and equalizing uprising.

In fact, such an uprising almost happened. For details, please refer to "Whiskey Riot" and how the famous Alexander Hamilton "quelled" the chaos. In fact, Hamilton did not fully believe in democracy, but more respected meritocracy. He believes that too much equality will put the country in danger.

Recognizing the risk of revolt by poor whites, the establishment believes that as long as they feel they are not at the bottom of the pyramid, they will support the current system. Thus, to unite poor whites, the state sponsored the systematic denigration of blacks, while slavery provided free labor to the agrarian South (killing two birds with one stone).

Hatred of black people makes white people at the bottom of the white economic structure feel better about themselves.

As the American economy prospered, especially after blacks were "liberated" in the 1860s, the country desperately needed more cheap labor. Therefore, in the middle and late 19th century, the Chinese came to the United States to build railways. In the late 19th and early 20th centuries, more poor whites from depressed parts of Europe immigrated to the United States. Including Italians and Eastern Europeans. They flooded into the manufacturing base of the Northeast. On the other side, a steady stream of Central and South Americans poured in from the Mexican border.

At this point, the racial caste system needs some adjustments. It is no longer enough to compare with slaves and Chinese coolies in the past, and the hierarchical order within the white people has also begun to fission. Movies such as "Gangs of New York" and "The Godfather" vividly depict this. At the same time, almost all white subgroups, with the exception of Anglo-Saxon Protestants, faced stigma of all kinds related to their home country and religion.

In the 20th century, class lines between white subgroups began to blur in the American melting pot. The white caste system began to be reordered more around educational background, wealth, and geographic location.

But a major white rift, dating back to the Civil War, has not disappeared. It was an economic conflict between the North and the South, dominated by manufacturing (the equivalent of the current "tech" industry) and the South, dominated by the agricultural plantation economy. As we all know, the North won in the end. President Lincoln's genius strategy was to "liberate" the slaves and allow them to join the Union Army. According to the 1860 census, "colored people" made up 41 percent of the total population of the South. In one fell swoop, Lincoln reaped a corps of morale-struck soldiers while crippling the Southern workforce as blacks sought refuge in the North.

Although the war was won, the tribalism that started it lingers. Today, some southern whites still like to wave the Confederate flag in the parade, which reflects that although the war has passed for a century and a half, some white groups still have not accepted the defeat and their anger has not subsided.

The North has always been considered more progressive, better educated, more cultured, and richer than the South. In the eyes of northern whites, the Southern folks are just a bunch of ignorant farmers. Hillary Clinton called them "deplorables" when she ran for president in 2016. Basically, as long as you're not from the west coast with Los Angeles and San Francisco as the cultural and financial centers, or the east coast with New York and Boston as the cultural and financial centers, then you're an ignorant white trash.

The most prestigious high schools, universities, financial centers, technology centers, cultural and entertainment centers, and mainstream media centers in the United States are all located on the east and west coasts without exception.

Here is an example. When I first arrived in Hong Kong, some middle-class family restaurants would play dirty American gangsta rap. This kind of music came from the bottom of the American caste system. It was originally a protest against the American ruling class. Being triumphantly labeled by the latter has become a stereotype that further suppresses the lower castes. At the same time, the ruling class also exported this culture to Hong Kong and other places, thereby promoting the United States as the pinnacle of the international caste system. It perfectly captures the overwhelming influence of America's caste ruling class.

All in all, the caste system in the United States, although baptized over the years, is still standing today. If you can be born at the top of the East and West coasts and become the so-called "right kind of white person", your chances of success in the workplace will be much better.

What does all this have to do with SBF? Yes, he was just the right kind of white guy. Read a few paragraphs of SBF's biography, and you'll understand why the people and institutions that control the finance, technology, media, and culture of the American empire fall for SBF when he comes on stage and talks about cryptocurrencies.

Bankman-Fried was born in California in 1992 to parents who were professors at Stanford Law School. His parents embraced the pragmatic philosophy that an action is right when it works or benefits the majority. This moral philosophy laid the foundation for Bankman-Fried's philanthropy.

Bankman-Fried grew up hating school, thinking it was boring and rigid. He attended Canada/US Math Camp during his high school summer to receive the required intellectual challenge. He attended MIT, graduating in 2014 with a degree in physics and a minor in mathematics. Still, he dismissed formal education, saying that what he learned there would not help him in his career.

As a sophomore in college, Bankman-Fried attended a lecture by Will MacAskill, the founder of effective altruism. He sees this as a turning point in his life.

How many labels are there that the establishment likes:

Educated white people on both coasts√

Parents are professionals√

Graduated from the "head" university√

The icing on the cake: √ with handle

These traits are especially useful for people in finance, law, and tech, which are full of people who want to be great and rightly white.

So, when SBF, whose root is young and popular, starts to speak, you will listen with all your ears. You don't question why he got in. You don't question his mystification. You don't question anything because you've been preconceived by centuries of ingrained racial and social caste systems and you take every word that SBF spits out.

In short, you can't mobilize your brain's rational thinking, because in the face of a world full of information and uncertainty, we will resort to various empirical shortcuts and stereotypes to make decisions more easily, otherwise We will not be able to deal with society normally.

first level title

what is death star

The blog Milky Eggs provides an excellent dissection of the Death Star's history, and their conclusions roughly agree with my speculation. I will quote from it below.

SBF was a successful quant trader at Chicago-based Jane Street. Jane Street is one of the world's top proprietary trading firms. In 2017, SBF entered the cryptocurrency space through arbitrage trading and other high-frequency and high-frequency forecast trading.

As the crypto industry has matured, it has become increasingly difficult for so-called market-neutral traders to make money. The reason is that the big companies that dominate the global stock and foreign exchange markets are starting to allow small internal teams to experiment with trading cryptocurrencies. Their skills and intelligence have been perfectly honed in the hyper-competitive TradFi market, where they can easily challenge slower, less agile crypto trading firms.

I'm guessing Alameda finds their trade advantage dwindling. SBF knew Alameda needed better market information to overwhelm other big trading firms. And the best way to get the best information is to own an exchange and trade with its clients. Later, they decided to abandon strict market neutrality and small time scale trading, and degenerated into altcoin bulls.

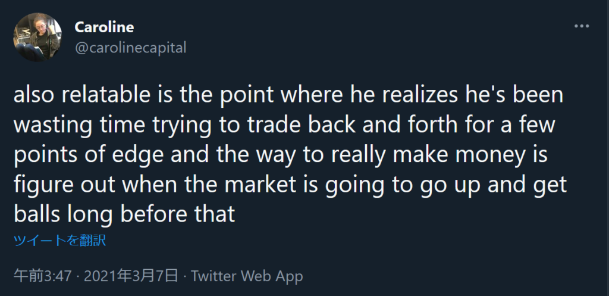

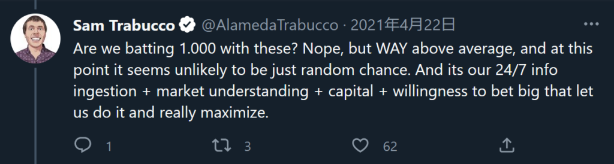

The Alameda team's social media statements make it clear that staying on top of the flow and being a full-on gambler is their core trading strategy. Take the following tweets, for example, from Sam Trabuco and Caroline Ellison, who manage Alameda.

Sam Trabuco on information-driven investment decisions

Sam Trabuco Talks Bet on Dogecoin

Caroline Ellison on the Most Profitable Long Strategies

Sam Trabuco brags about information flow + gambler's spirit to grasp investment opportunities beyond chance

(Sam is right, not by chance, because all kinds of shit followed the Fed's balance sheet to record highs. From 2018 to the end of 2021, everyone thinks they are a genius.)

FTX has been very transparent from the beginning, and everyone knows that Alameda Research, an offshoot trading company of its founder, is the main market maker of FTX. Assuming FTX didn't grant Alameda any privileges, this arrangement seems understandable. Alameda provides an invaluable service by providing liquidity to FTX clients 24/7 with impressive spreads.

Alameda’s ability to offer extremely tight pricing on FTX is one of the reasons why FTX was able to quickly steal the market from more established exchanges. Another reason is that FTX provides features that are extremely difficult to implement safely, such as providing multi-currency collateral leverage in record time. We now know that they were able to provide such functionality not because of superior technical prowess, but because Alameda took the risk and counted on market volatility to be their golden bell, rather than specifically creating a safe technical solution .

With FTX and Alameda growing side by side, everyone is starting to think SBF is one of the best traders of all time, because Alameda seems to be returning amazingly. Year after year, I often hear how many billions of dollars this trading firm has made. But based on news that has come to light in recent days, Alameda seems to have some secret weapons. One of them could be their ability to borrow money directly through FTX from pools of customer deposits. Regardless of whether collateral is provided, it is at least unethical to lend client funds to Alameda without the client's express consent. Another secret sauce is that they may be able to achieve faster transaction speeds on FTX than their competitors. If it does have this latency advantage, Alameda's trading signals can be super profitable. To achieve this, FTX can allow Alameda to call more of FTX's trading engine API. The more calls you make, the more frequently you can submit, update or cancel orders and the faster your transactions will be than your competitors.

Once the product takes off, FTX may aim to attract as many retail and institutional clients as possible in order to grow its trading volume and deposit base. Alameda can then borrow against these deposits and trade with FTX clients. If these assumptions are true, it’s almost as if FTX’s customers had deposited their own hanging ropes in exchange for deposits at FTX, and slowly tightened that rope by trading with Alameda.

Alameda could be making money before the Fed starts raising rates in early 2022. But as the crypto market peaks in November 2021, Alameda becomes the liquidity provider of last resort. When the market started to run all the way to the bottom, the other side of all the huge liquidation lists was Alameda.

If Alameda does use FTX customer funds to buy a large number of altcoins, when the altcoins plummet, Alameda will be unable to repay FTX's loan. We don’t know exactly what happened, but we do know that Alameda did use FTX’s native token, FTT, as collateral for borrowing from deposit pools of FTX clients. It is not difficult to guess that Alameda may also involve circular lending, that is, borrowing funds to buy altcoins, and then pledging altcoins to borrow more funds. We know that Alameda is a major participant in the FTT ICO. Did Alameda obtain funds to participate in the subscription through FTX's customer deposits?

The New York Times revealed how the money-losing Alameda stole FTX client funds:

In a meeting with Alameda employees on Wednesday, Ms Ellison explained the reasons for the collapse, according to people familiar with the matter. She apologized tremblingly, saying that she had let everyone down. In recent months, Alameda has drawn down loans and used the money to make venture capital investments, among other expenses, she said.

Ellison said that around the time the crypto market crashed this spring, lenders started calling in loans. But the money Alameda spent was difficult to recoup, so the company tapped FTX's client funds to pay off the debt. She said that apart from her and SBF, there were two other people who knew about it: Mr Singh and Mr Wang.

Assuming that Alameda has revolving lending behavior, when altcoins fall, Alameda will be unable to repay its debts. When LUNA/TerraUSD crashes, Alameda may be in the red, or barely in the black. LUNA is the governance token of the Terra ecosystem, and UST is an algorithmic stablecoin pegged to the US dollar. Both LUNA and UST have huge trading volumes on FTX.

As LUNA and UST entered a mathematically determined death spiral, clients scrambled to sell everything they had. And Alameda can only bear all this in silence. SBF may not be too lazy to read or understand Terra's white paper. Of course, with his supposed mathematical aptitude, he should understand that once Terra starts to decouple, the entire ecosystem will be doomed to zero. Nevertheless, SBF has been unable to stop the car. Alameda had to continue to provide liquidity, otherwise it would jeopardize the value of FTX. There would be no FTX without Alameda providing 24/7 liquidity. Because without the possible perks of Alameda, no other company is serious about providing this level of liquidity, especially when trouble strikes.

Milky Eggs compiled a list of the Death Star's losses, most of which can be traced back to Terra's debacle and the cascading damage it did to the entire industry.

Acquisition of Voyager/BlockFi: $1.5 billion

LUNA exposure: $1 billion

KCG-Style Algorithm Crash: $1 Billion

FTT/SRM Collateral Maintenance: $2 billion

Venture capital: $2 billion

Real estate, branding and other miscellaneous expenses: $2 billion

FTT falls from $22 to $4: $4 billion

Discretionary long fund crash: $2 billion

TOTAL: $15.5 BILLION

Also point out that Alameda likely used its portfolio of altcoins (including altcoins in which Alameda is the largest holder, which is key) as collateral for the loan. After the Terra/Three Arrows/Celsius/Voyager crash, all crypto assets fell 50-75% and Alameda got a double whammy. Alameda lost billions trying to provide liquidity to the altcoins held heavily on FTX, and the company owes FTX and others money that was also funded by the same worthless altcoin portfolio mortgaged.

And let's not forget that due to Alameda's dominance on the FTX platform, it is difficult for other large trading houses to provide liquidity to FTX under adverse conditions, which is not financially viable. So once Alameda falls, no other company can step up and provide FTX with the liquidity it needs to keep going.

With things at this point, SBF may have no choice but to go their own way. He may have to borrow most of FTX's client deposits to cover Alameda's huge shortfall.

That's how lending crises always end. When a lender stops lending, past loans are never collected. It was not financially viable to begin with, and as a result, these loans remained non-performing. The only reason we consider Alameda to be a solid entity is because FTX's client deposits provide it with a steady stream of credit.

Don't get too complicated, the story is actually very simple: Alameda lost money, and instead of accepting the loss, SBF and other management decided to use FTX's customer deposits. This is what led to the death star's demise.

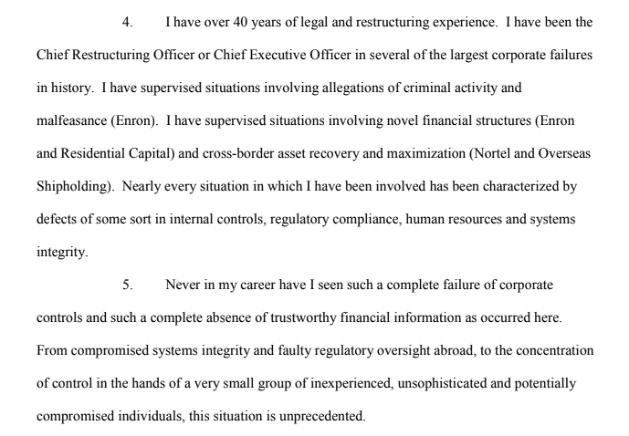

Before I jump to conclusions, here's a quote from John Ray, the successor CEO of the bankrupt Death Star:

first level title

to be continued

This article presents my theory of the caste system in Imperial American society and how the Death Star was built. I should have made it clear why SBF needed to use his social skills to coax the entire western dominated financial elite system into falling into his and FTX's trap and how he did it.

Original link