This article comes from voxThis article comes from

, Original author: Kelsey Piper, compiled by Odaily translator Katie Koo.

I spoke with SBF earlier this summer via Zoom while I was writing his profile. So on November 13th, after news broke that his cryptocurrency exchange had crashed and billions in customer deposits disappeared, I reached out to him via DM on Twitter. I didn't expect a response from him - usually, people who are under investigation by the SEC (Securities and Exchange Commission) and the DOJ don't respond at all.

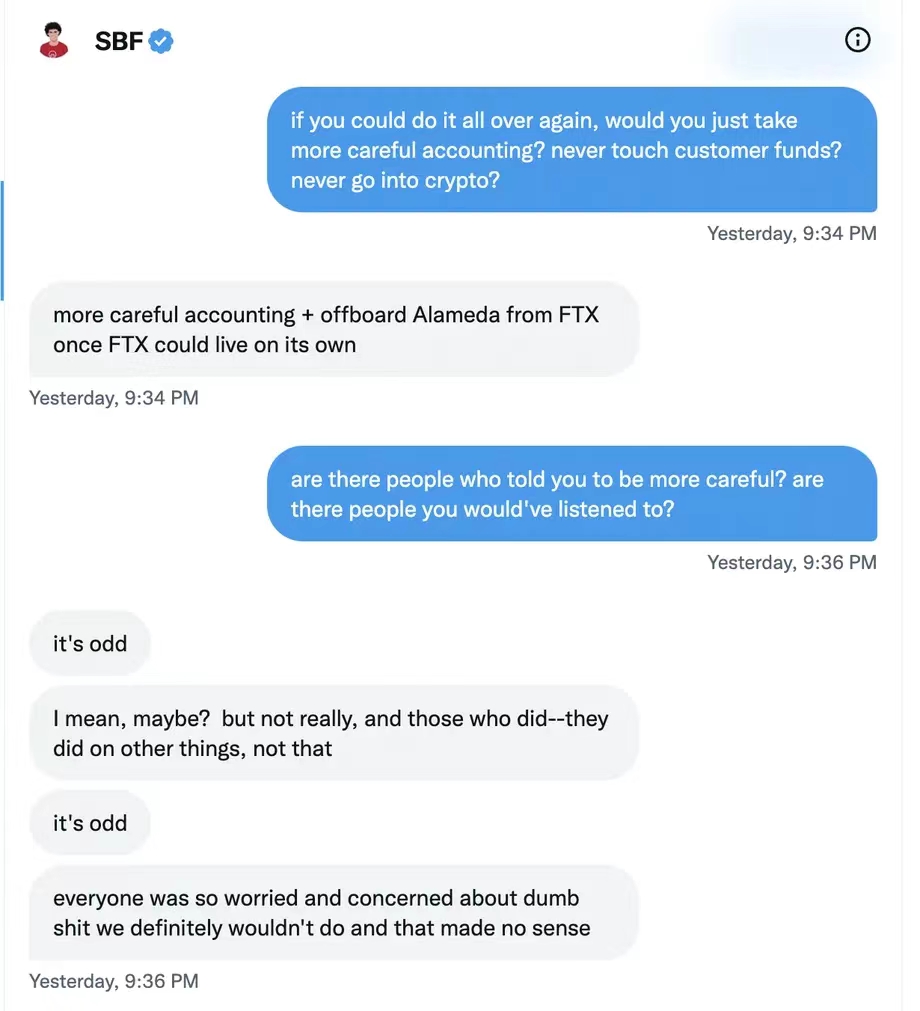

After contacting SBF, he obviously wanted to talk. Regarding how FTX and his hedge fund, Alameda Research, gambled with clients' money, he claimed, they didn't realize what they were doing. Not realizing who will be hailed as a hero and who will be a scapegoat. He also talks about regulatory issues, about things he regrets (Chapter 11, the decision to declare bankruptcy), and what he would do with FTX and Alameda (more prudent bookkeeping; break away from Alameda).

It was past midnight Bahamas time, and we chatted back and forth in private Twitter messages for over an hour. SBF said it was still working to raise the funds needed to repay all depositors.

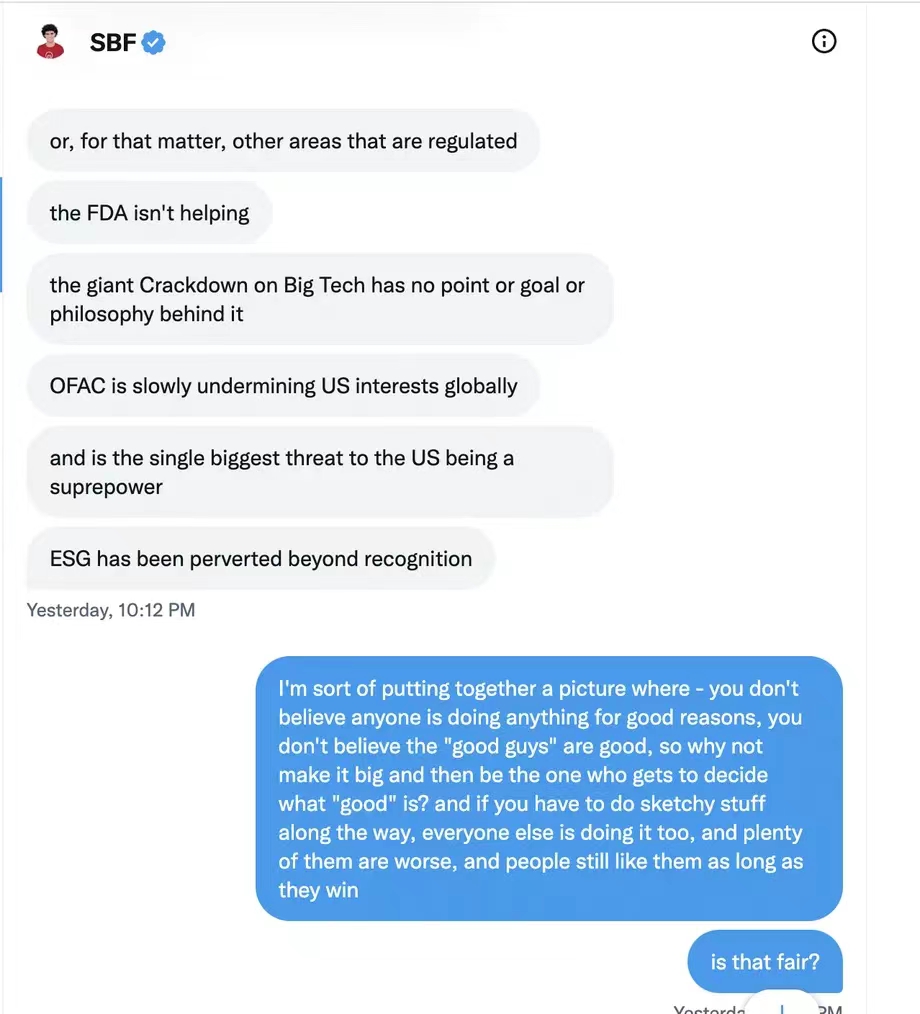

As we communicate, I try to figure out what, behind the scenes of PR, charitable donations and lobbying, SBF really believes is right and what is wrong, especially with regard to the work he does and the ethics of his industry. Our entire conversation was set against the backdrop of the loss of savings of those who had trusted him, and the immeasurable damage he had done to a commitment he had made in the first place. After our conversation, I was shocked by many of the things he said.(Odaily note:SBF in its latest "reflection post"

Also mentions a DM conversation with "a friend" (i.e. Kelsey Piper). )

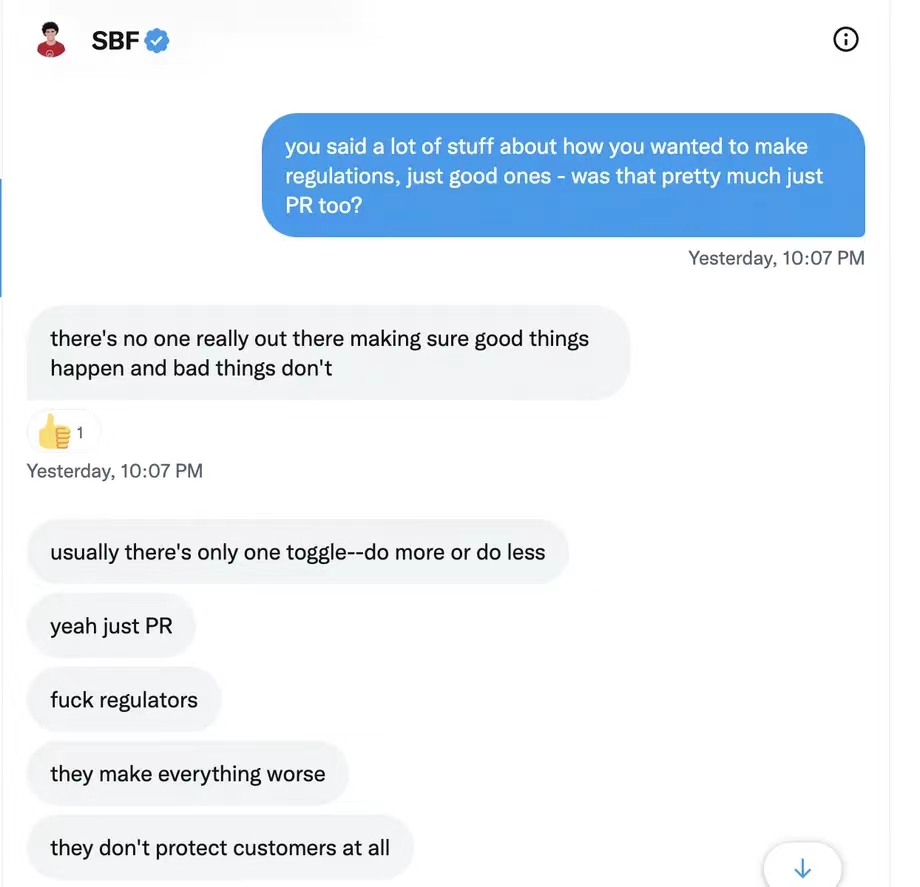

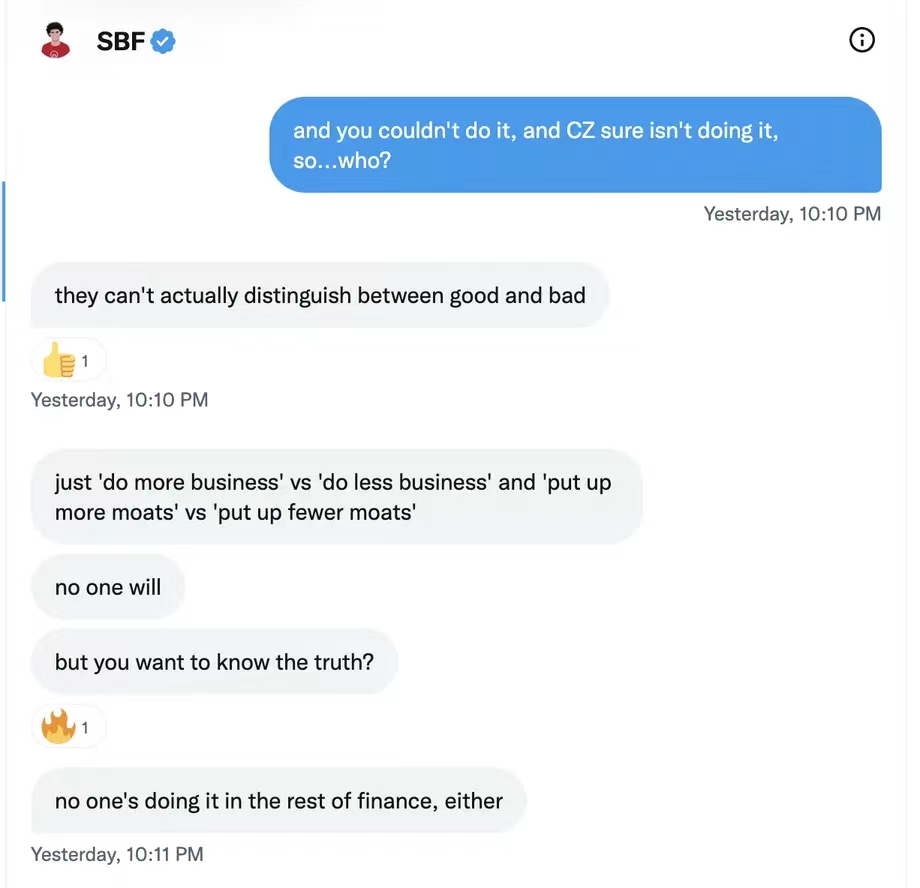

About Supervision

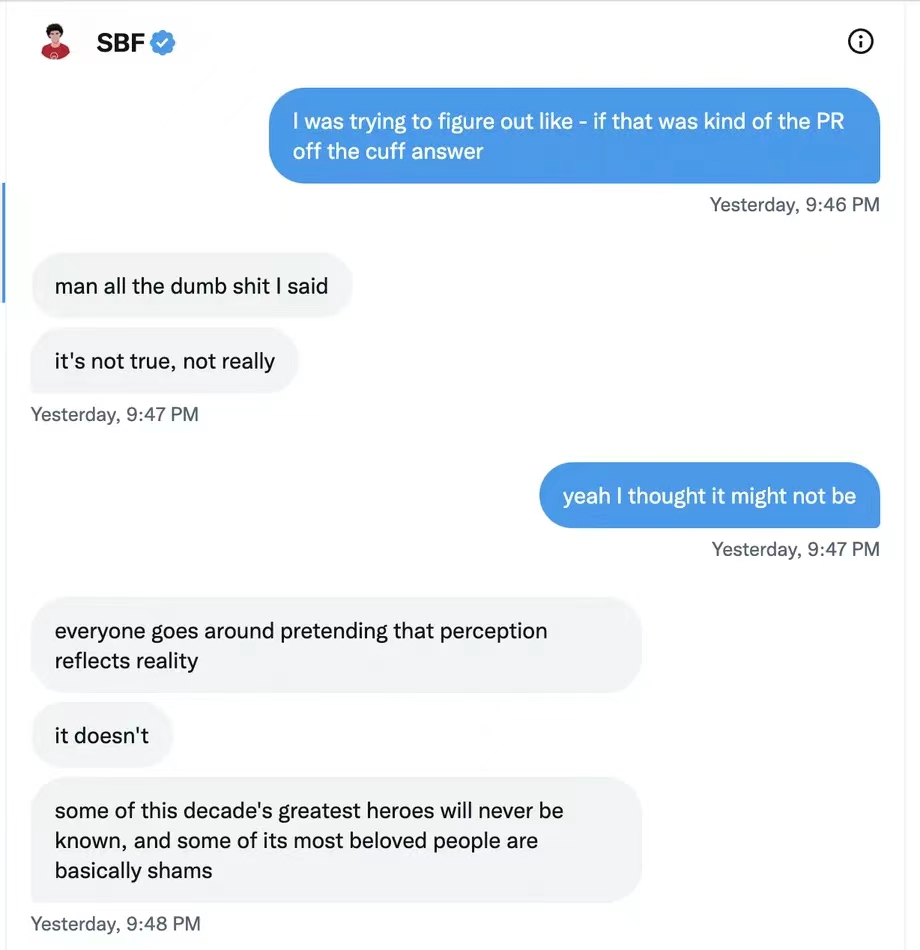

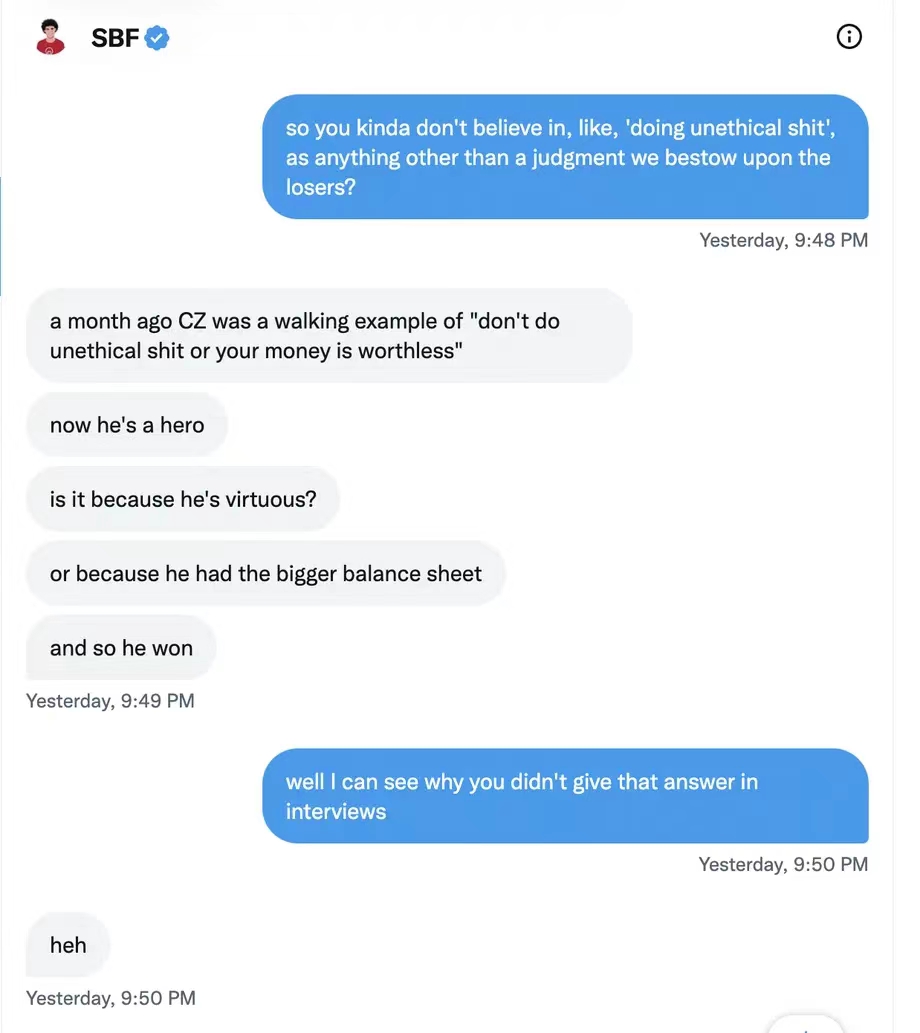

SBF was actively involved in lobbying in Washington for a regulatory framework for cryptocurrencies before its crypto empire collapsed. While many crypto industry CEOs, such as Binance’s Changpeng Zhao, are openly skeptical of government regulation, SBF has largely avoided criticizing regulators. He has described his past statements, such as last month when he said some level of cryptocurrency regulation is “absolutely fine,” as a “PR problem.” In doing so, he all but confirmed the point of his critics, who argued that his overtures to Washington were superficial rather than real.

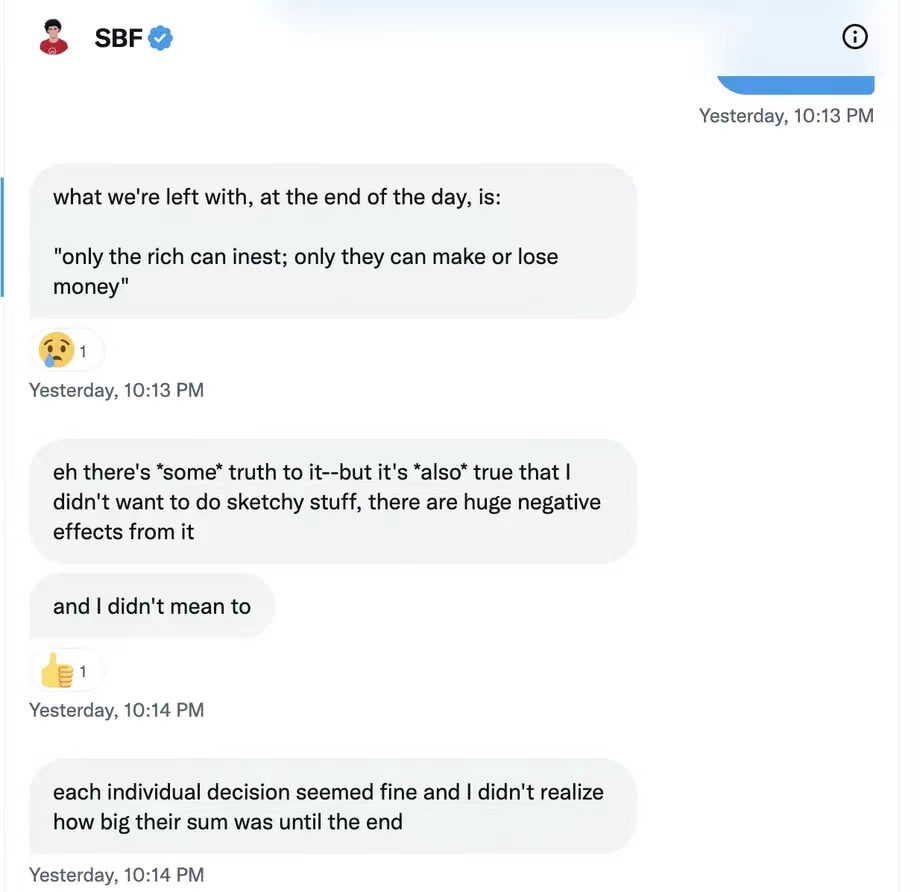

SBF is willing to do immoral things

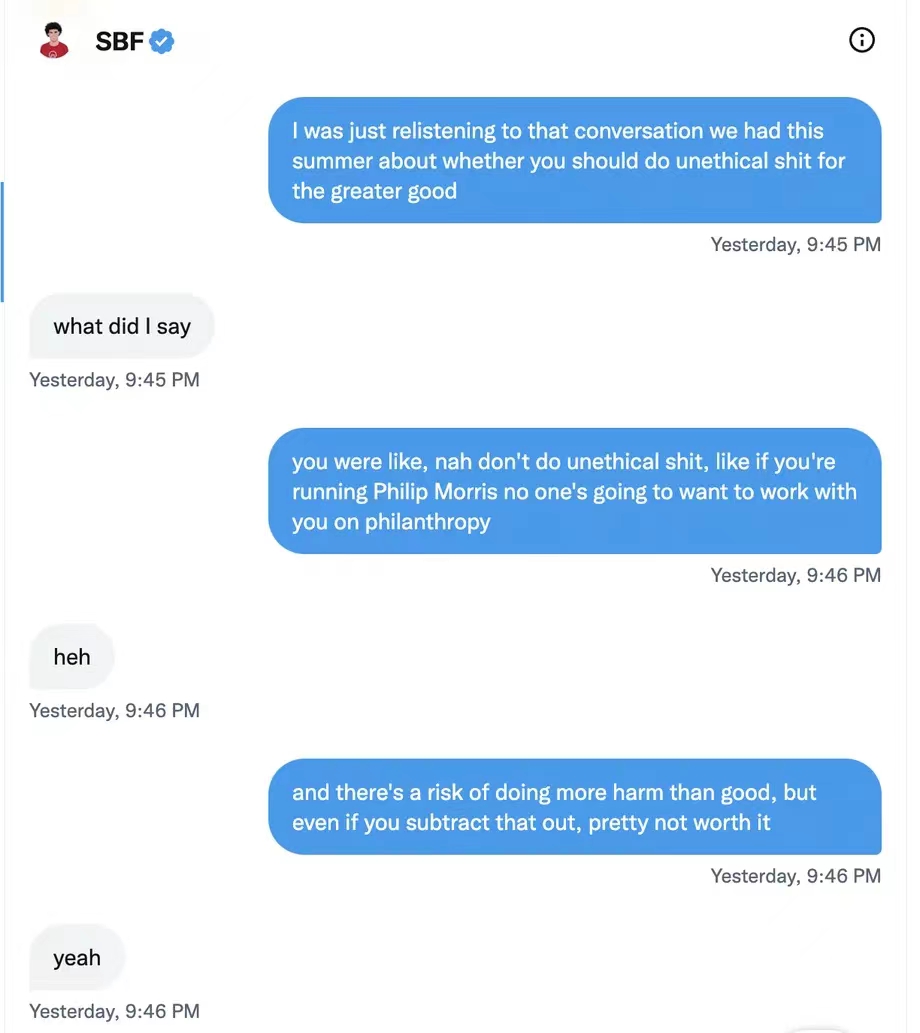

There is a question that many people are speculating about - whether the SBF considers it acceptable to do immoral things "for the greater good". This is a position that the SBF has considered in the past that a self-interested person might take.

That question happened to be one I asked him in an interview this summer that I had just re-listened to the night before our Twitter conversation.

At the time I thought SBF had an ethical dilemma to face about "crossing the line" - whether running a cryptocurrency exchange was the right thing to do in the first place, and whether the good he claimed he wanted to do could make it possible.

In a previous interview, I told SBF: “A lot of people would think that starting a cryptocurrency company and making billions is as immoral as me making billions starting a tobacco company. Suppose, there’s a line, Even with a good reason, you can’t cross the line. I’m curious if you think there’s a limit and if so, where is your limit?”

SBF replied: "There is a bottom line, and the answer cannot be that there is no bottom line. Otherwise, you may end up doing far more harm than good. But the bottom line is not so easy to draw. Because if your core business is harmful to the world, it will There are a lot of complex but serious secondary harms (such as affecting cooperation with partners)."

During our twitter conversation, I asked him again about the moral bottom line. In the summer interview, SBF believes that it is not possible to do immoral behavior for the so-called right thing. In this twitter conversation, SBF completely denied those correct moral statements at the time, and he admitted that what he said at the time was not true.

about distorting facts

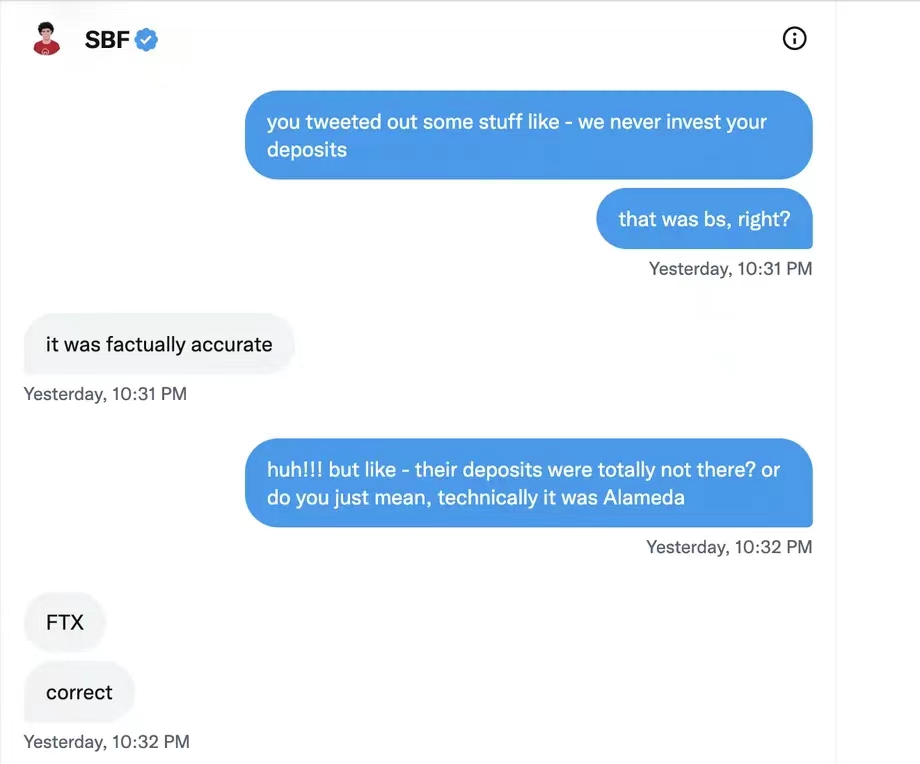

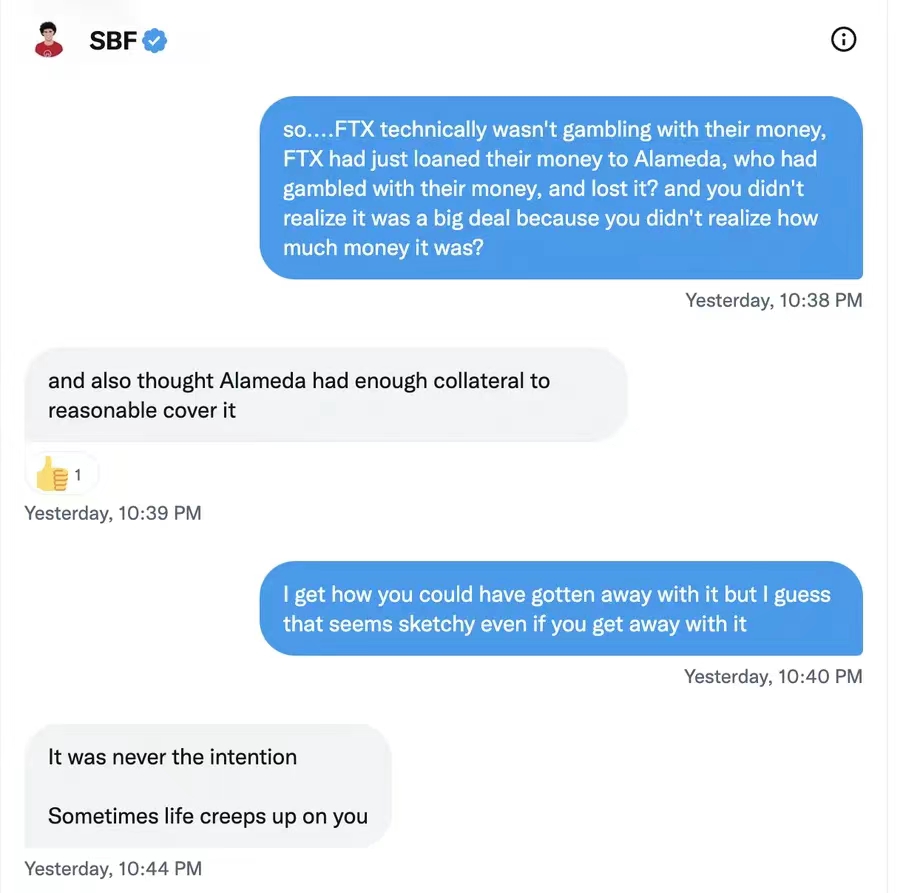

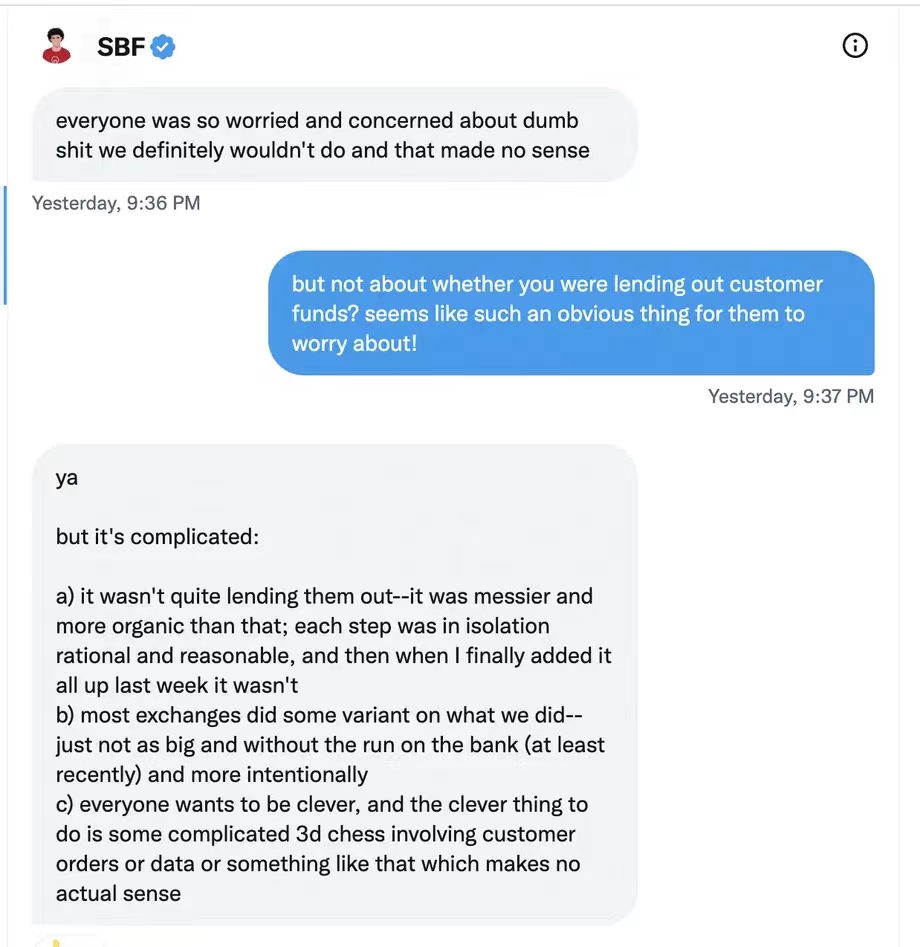

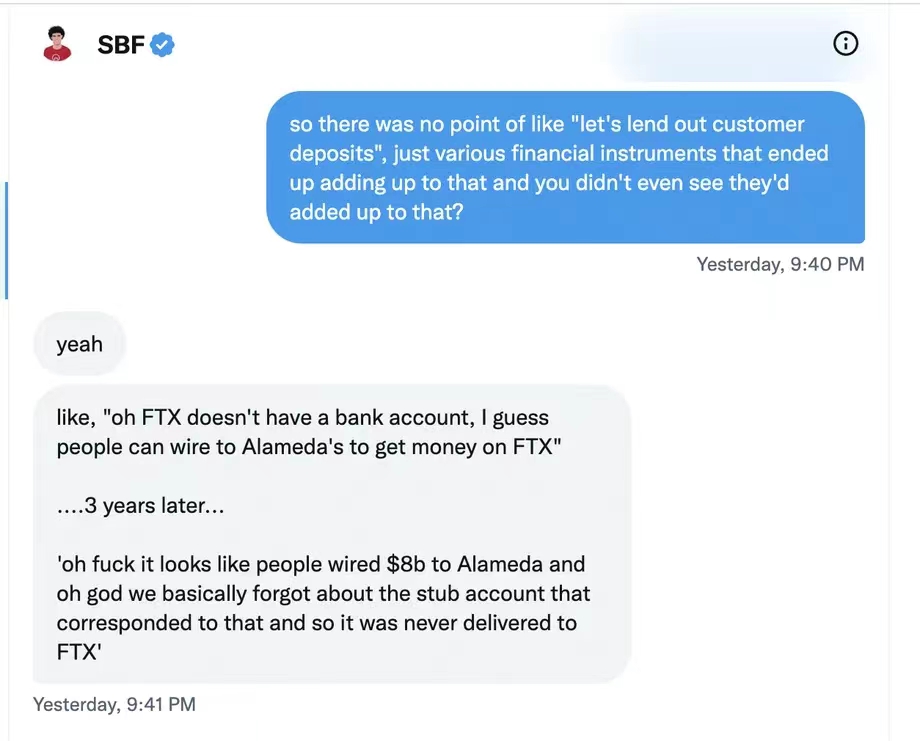

SBF insisted that FTX never invested crypto account holders’ deposits on the exchange. I pressed him on this via twitter and while he continued to insist that FTX did not use account funds directly in this way, he said that Alameda had borrowed far more money from FTX's balance sheet than he realized For investment purposes, this ultimately leaves FTX vulnerable to the cryptocurrency equivalent of a bank run.

Why didn't SBF realize what was going on until it was too late? "Sometimes life creeps up on you," he said.

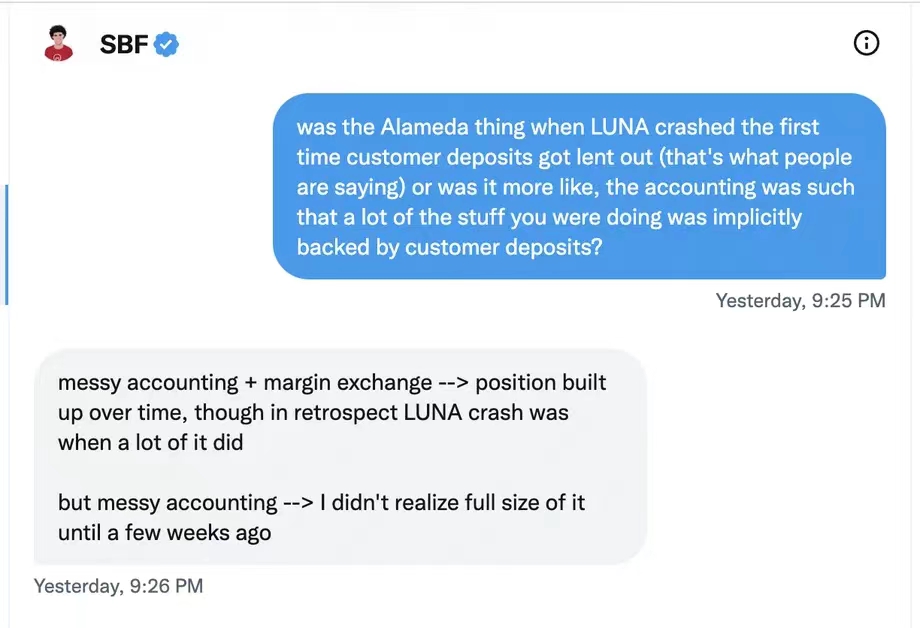

In the end what happenedThere are claims that the seeds of FTX’s downfall were already planted earlier this year, when Alameda reportedly suffered massive losses following the collapse of cryptocurrency firm Terra’s LUNA stablecoin.

SBF said he was unaware of the extent of the problem because of "terrible and confusing bookkeeping" -- billions of dollars in messy bookkeeping.

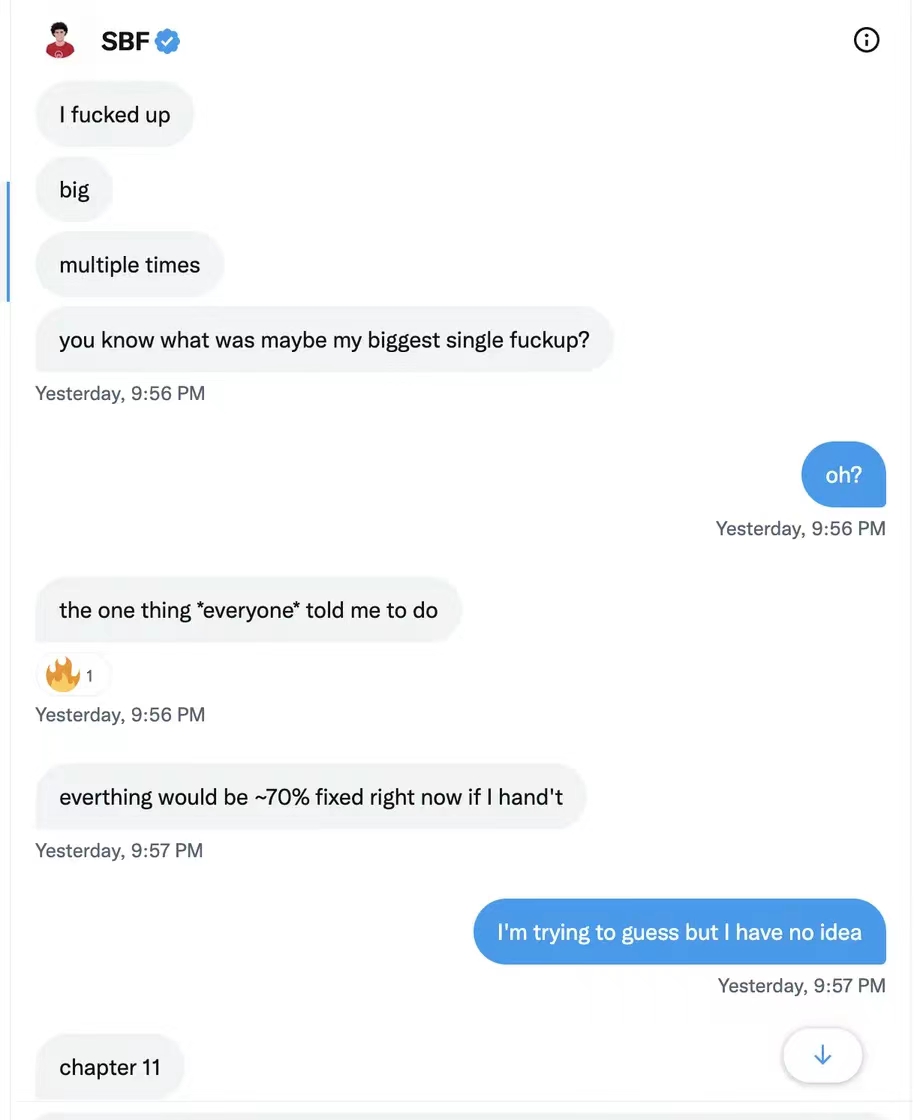

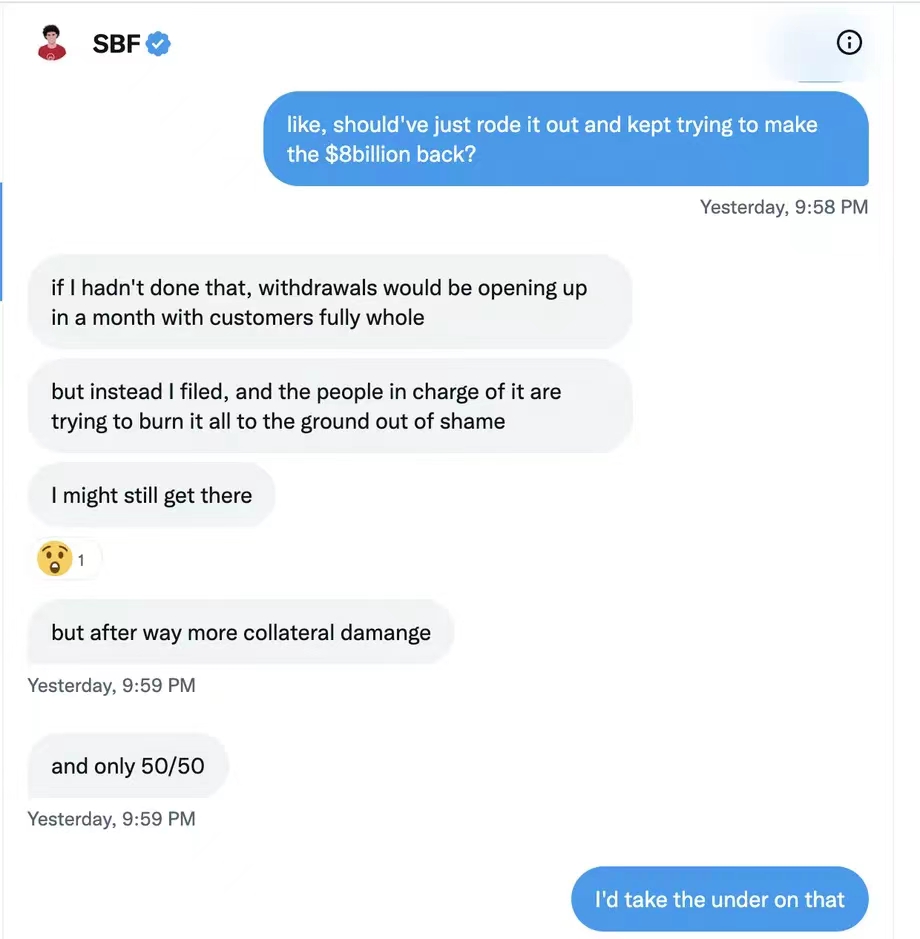

SBF's regretSBF admits that he “blew it up.” But he also insists that much of the trouble could have been avoided had FTX not declared bankruptcy. Bankruptcy has largely taken money matters out of his control.

(In the process, SBF's CEO position was replaced by John J. Ray III, a lawyer who helped creditors recover billions of dollars after energy trading firm Enron collapsed.) SBF told me: "(Company ) are trying to burn it all to the ground out of shame."SBF argued that he should continue trying to raise more funds and insisted that if he did, customers could start withdrawing their funds within a month.

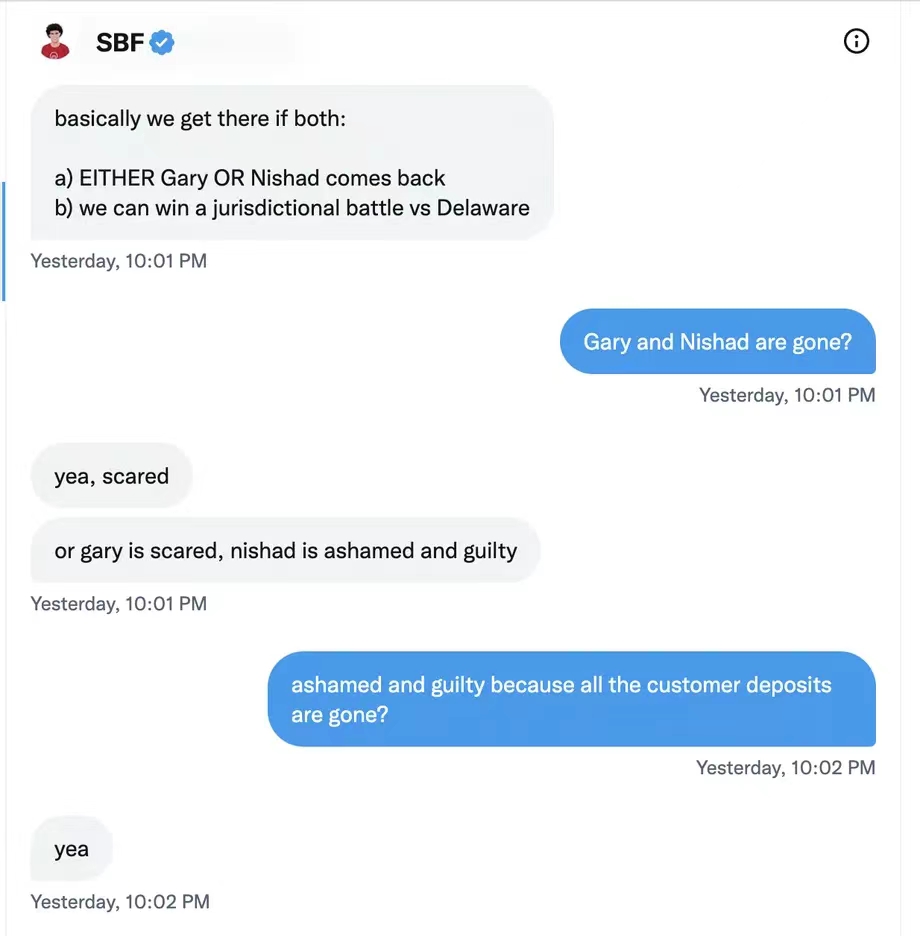

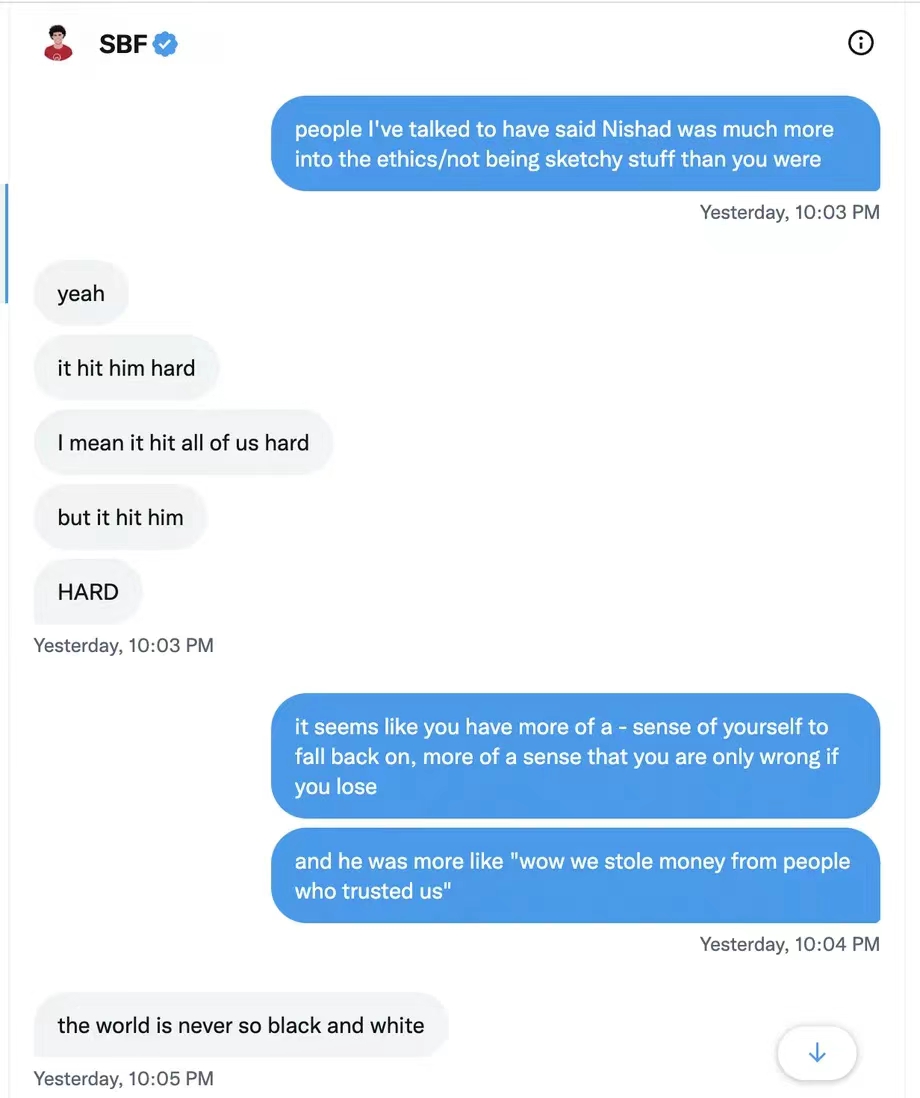

The Wall Street Journal reported earlier this week that SBF was trying to raise money, but found no sign of any investors committing to funding. Even securing new financing would require negotiations with foreign exchange creditors and approval from the bankruptcy court, the document also said.While SBF said some of his colleagues - co-founder Gary Wang and engineering director Nishad Sing - were "scared" and Nishad Sing in particular felt "ashamed and guilty",

But SBF seems to be maintaining a certain attitude towards this debacle - the world has never been so black and white.

FTX was hackedShortly after FTX filed for bankruptcy, users following blockchain transactions noticed hundreds of millions of dollars being moved out of the company. I asked SBF what happened.

He replied that FTX was hacked, and it was either done by ex-employees, or by malware on ex-employees' computers, there are hundreds of malware operating.

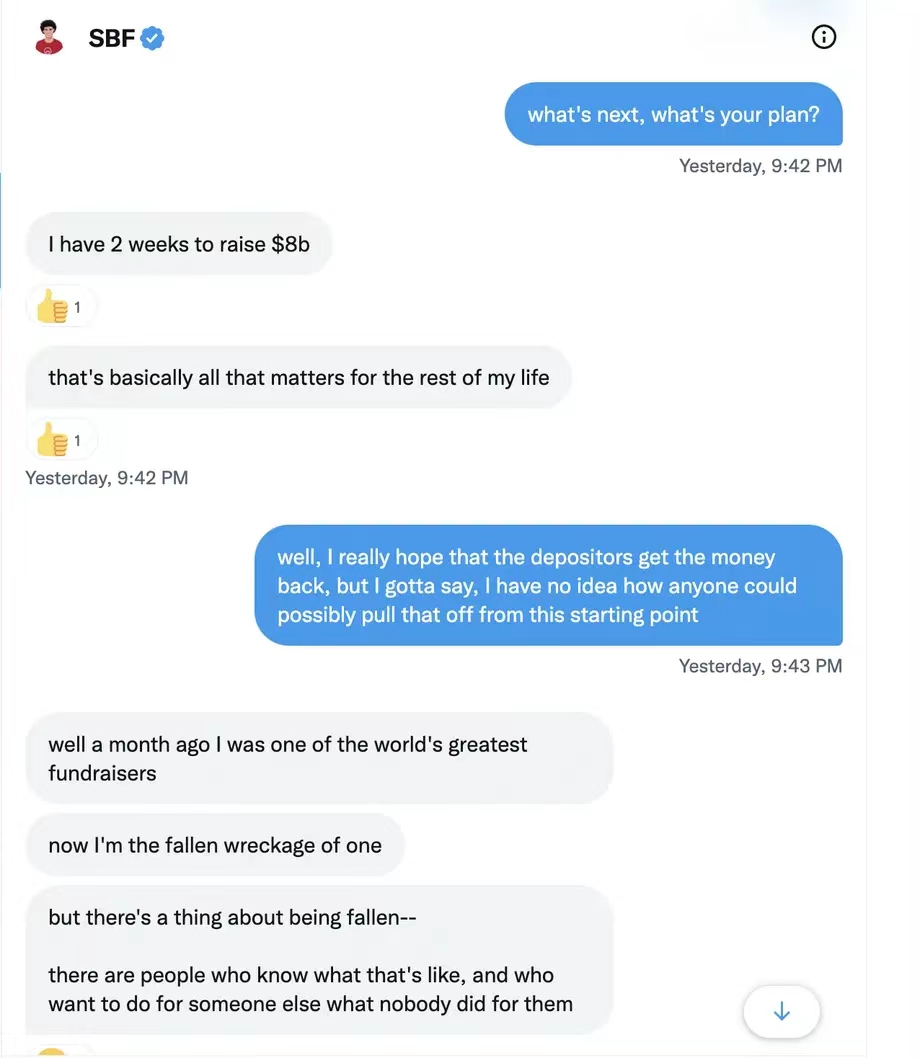

SBF's next planSBF said his priority now is to try to raise $8 billion so that account holders are protected. He told me it was basically the most important thing for the rest of his life.But despite saying he was one of the world's greatest fundraisers a month ago,

But as of now, the amount of money FTX has been able to raise remains paltry, and there is no sign that any investors will take the bait. Even if he can secure financing, it may require the approval of creditors and the bankruptcy court.