Researcher: Jessica Shen

Researcher: Jessica Shen

Research Report Highlights

Core investment logic

BendDAO's innovative peer-to-pool lending protocol is a high-market-fit (PMF) product that brings an excellent user experience in terms of capital efficiency, security, and simple operation. Blue-chip PFP occupies half of the NFT market, and BendDAO's business accurately serves the biggest "cake" of blue-chip PFP. While blue-chip NFT users are extremely sensitive to capital efficiency, BendDAO's simple and direct product logic eliminates the trouble of setting parameters for users, and greatly improves the speed and security of lending.

The protocol design enriches the NFT gameplay and becomes an arbitrage tool for NFT professional traders. The lending business provided by BendDAO became a "leverage tool" for professional NFT players during the Yuga Labs airdrop. The current liquidation auction mechanism also makes the BendDAO auction pool become the darling of blue-chip NFT value depressions and NFT Flippers. The agreement itself has created a variety of liquidity methods for the market, further enhancing its popularity in the blue-chip NFT community.

The DAO governance with user participation and the active construction of the core team cooperate with each other to jointly promote the progress of the agreement. The BendDAO core team has always encouraged the community to participate in governance and is a true practitioner of the decentralized DAO model. The team uses the IFO method to open financing to everyone, and also decentralizes voting rights and governance rights by airdropping tokens to the NFT community. The BEND mining reward mechanism enables users to participate in governance by staking BEND to obtain veBEND, make suggestions for protocol improvement, deepen the binding relationship between the protocol and users, and enhance users' sense of belonging and loyalty to the product.

Short-term BendApeStaking benefits the long-term development of the agreement. Recently, BendApeStaking, a matching function based on Yuga Labs pledge, will be launched simultaneously, which is expected to bring new business income and user growth to BendDAO.

The competition in the NFT lending track is in full swing, and new product protocols emerge one after another, but BendDAO is in a leading position in the track in terms of business data and popularity. If it can persist until the NFT-Fi track breaks out, the leading edge of the protocol will be even more prominent.

Readers who are more familiar with BendDAO's business can skip the statement of facts. For the analysis of the core investment logic, please refer to "Part II: Business Analysis of the Basic Situation of the Project.

main risk

It is recommended to pay attention to blue-chip NFT risks, track competition risks, user concentration risks, liquidation mechanism risks, and parameter model risks. At the same time, BendDAO users are reminded to pay attention to the risk of mortgage assets "black goods". For detailed analysis, please refer to the project risk of this research report: business analysis.

Valuation

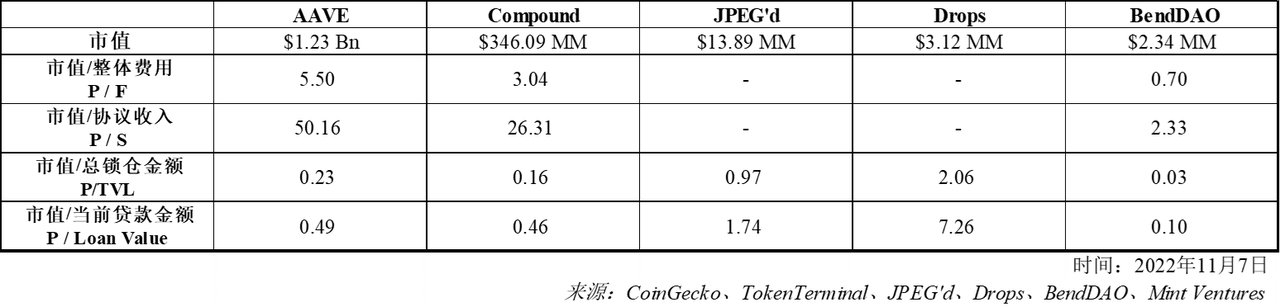

We use the comparable project valuation method to value BendDAO, using P/F multiples (market value/agreement fees), P/S multiples (market value/protocol revenue) valuations, and P/TVL multiples (market value/total lockup value) Valuation and P/Loan Value multiple (market value/loan amount) valuation method, comparing BendDAO with Aave, Compound, the leading protocols in the DeFi lending field, and Drops, JPEG'd, the NFT lending protocols that have issued coins.

We found that BendDAO's current valuation is low, which is related to the earlier stage of its protocol development, and also related to the low overall valuation level of the NFT-Fi track. Only when NFT assets continue to expand and expand, can NFT-Fi, as an NFT financial service, maintain long-term business growth, and BendDAO, as one of the leaders in the NFT-Fi field, can expect its protocol value to be further discovered by the market.

Premise assumption: The NFT lending track mentioned in this research report does not include NFT Leasing (NFT Renting) and NFT Fractionalization (NFT Fractionalization) businesses, but only for mortgage NFT lending (NFT Lending).

Basic information of the project

Project Overview

BendDAO is a "point-to-pool" NFT mortgage lending agreement, mainly serving blue-chip NFT holders. Lenders (points) can quickly lend ETH in the fund pool by mortgaging blue-chip NFTs in the protocol pool (pool), depositors (points) ) to provide Ethereum to the fund pool (pool) to obtain interest denominated in ETH, and both borrowers and lenders will receive BEND mining rewards. Currently, BendDAO supports mortgage lending NFTs including 8 mainstream blue-chip NFTs.

BendDAO is the industry's first NFT lending agreement with the "Peer-to-Pool" model (Peer-to-Pool). It is also classified as a "Peer-to-Protocol" model. It refers to the "protocol pool" concept.

The agreement has been in operation for about 8 months since its launch in March 2022. During this period, the functions in the agreement have been continuously updated and iterated, and the team has continued to develop new businesses to serve market needs. At present, in addition to the main lending business, BendDAO has also launched a built-in trading market, which supports the new functions of "buying with down payment" and "pending orders for collateral", "Peer-to-Peer" lending (Peer-to-Peer) function and pledge function for Yuga Labs The asset pairing function "BendApeStaking" is also in the process of development.

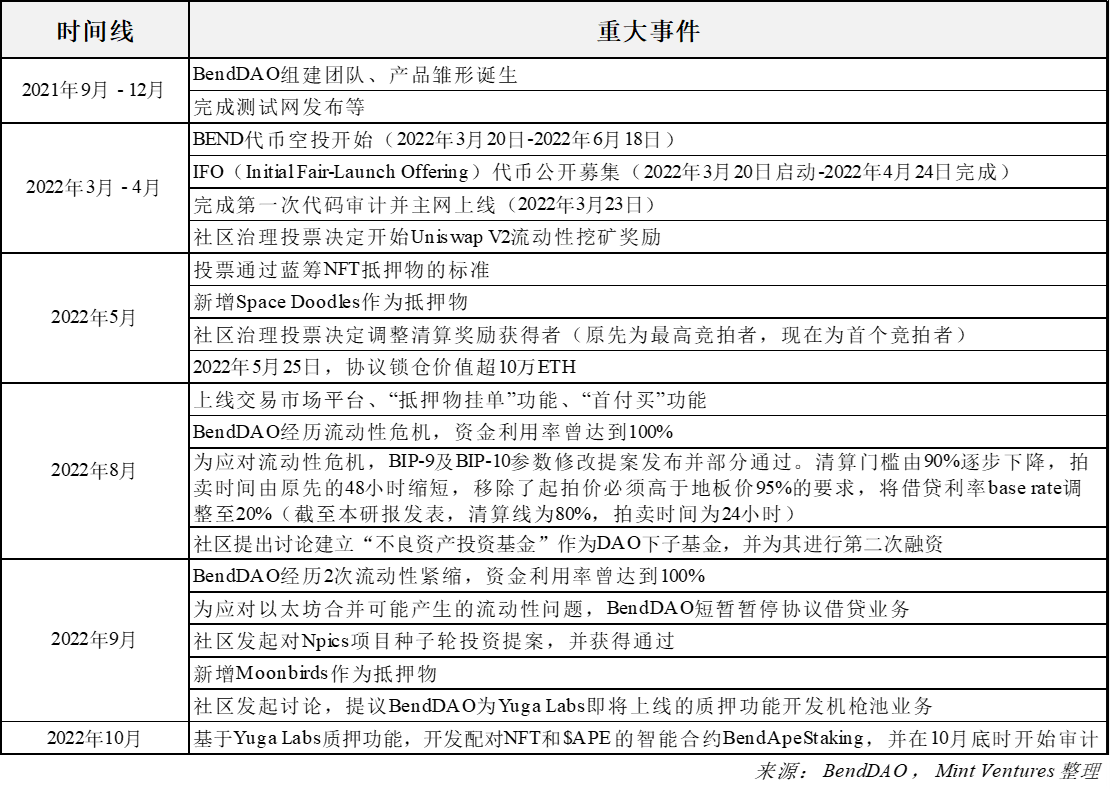

History and Roadmap

historical events

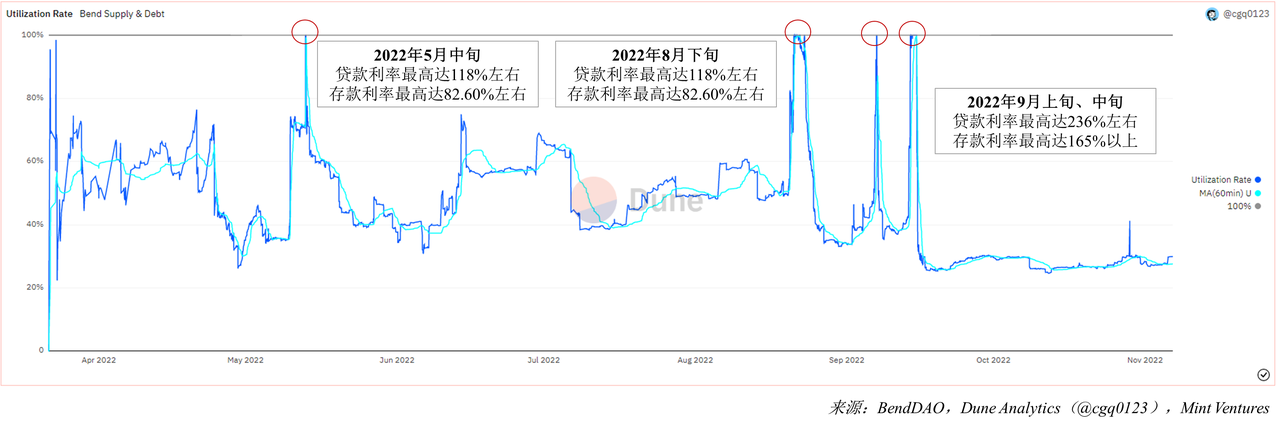

Since BendDAO had multiple liquidity crises during August-September 2022, here is a brief description of the liquidity crisis events, and readers who understand the situation can skip this part.

Liquidity crisis:

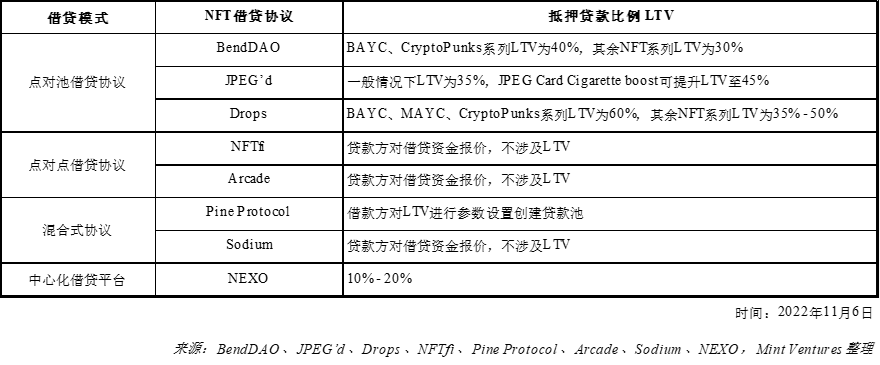

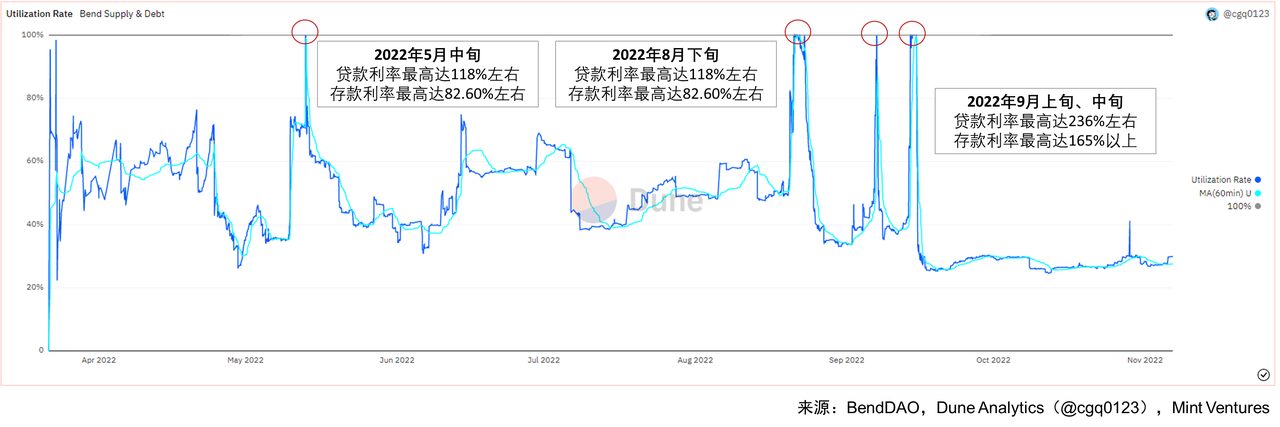

In late August 2022, the floor prices of blue-chip NFT assets all fell, and multiple collateral assets began to be liquidated after the Health Factor fell below 1, but no one participated in the auction. Depositors panicked and withdrew ETH funds from the pool; at the same time, the market It is expected that there will be a fork chain after the merger of Ethereum in September, and the demand for hoarding ETH to wait for the fork coin will increase, which will further lead to the depletion of the ETH fund pool. Under the influence of multiple factors, the withdrawable Ethereum in the BendDAO protocol pool decreased rapidly, and the capital utilization rate and loan interest rate reached a maximum value. The loan interest rate once reached more than 117%, and the deposit interest rate once reached more than 82%. Auctioned NFT assets. The originally sluggish NFT market sentiment has further deteriorated again, and there have been a lot of FUD remarks on the collapse of the BendDAO protocol in social media. A similar liquidity crisis will recur in September 2022.

After the liquidity crisis occurred at the end of August, in response to the crisis, the BendDAO team initiated a proposal to modify some parameters, including:

1. Auction time reduced from 48 hours to 24 hours

2. The liquidation line has been reduced from 90% to 80%

3. The base rate (base rate) of the interest rate curve is raised from 10% to 20% (the lending rate curve moves up as a whole)

4. Remove the requirement that the starting price must be greater than 95% of the floor price when the auction is liquidated

In the next few days, the ETH funds in the BendDAO protocol pool gradually recovered, the FUD sentiment eased, and the capital utilization rate and lending interest rate returned to normal levels. route map:

Asset matching business "BendApeStaking" for Yuga Labs staking function

Launched "peer-to-peer" lending business

Add blue-chip NFT mortgageable varieties

With regard to governance proposals and community discussions, recent discussions have focused on proposals such as the "Non-performing Asset Investment Fund", the second financing plan, and the development of BendApeStaking, which are expected to have an important impact on the future development of BendDAO.

business overview

Readers familiar with BendDAO's business can skip this Business Overview section.

As of the publication of this research report, BendDAO uses blue-chip NFT assets as collateral to borrow ETH as its main business. Other businesses include the built-in trading market on BendDAO, which supports users to place orders for collateral and conduct transactions while borrowing ("sell with pending orders"). It also supports users to pay a part of the funds to buy NFT (“buy with down payment”). Based on the above business, the main source of income for the agreement is the interest rate difference income generated by mortgage lending, and other income includes transaction fee income (2% rate) and down payment fee income (1% rate) brought by the trading market. As of November 6, 2022, the agreement interest income is approximately 2,065.11 ETH (30% of which is shared with veBEND holders), accounting for 98.95% of the overall income.

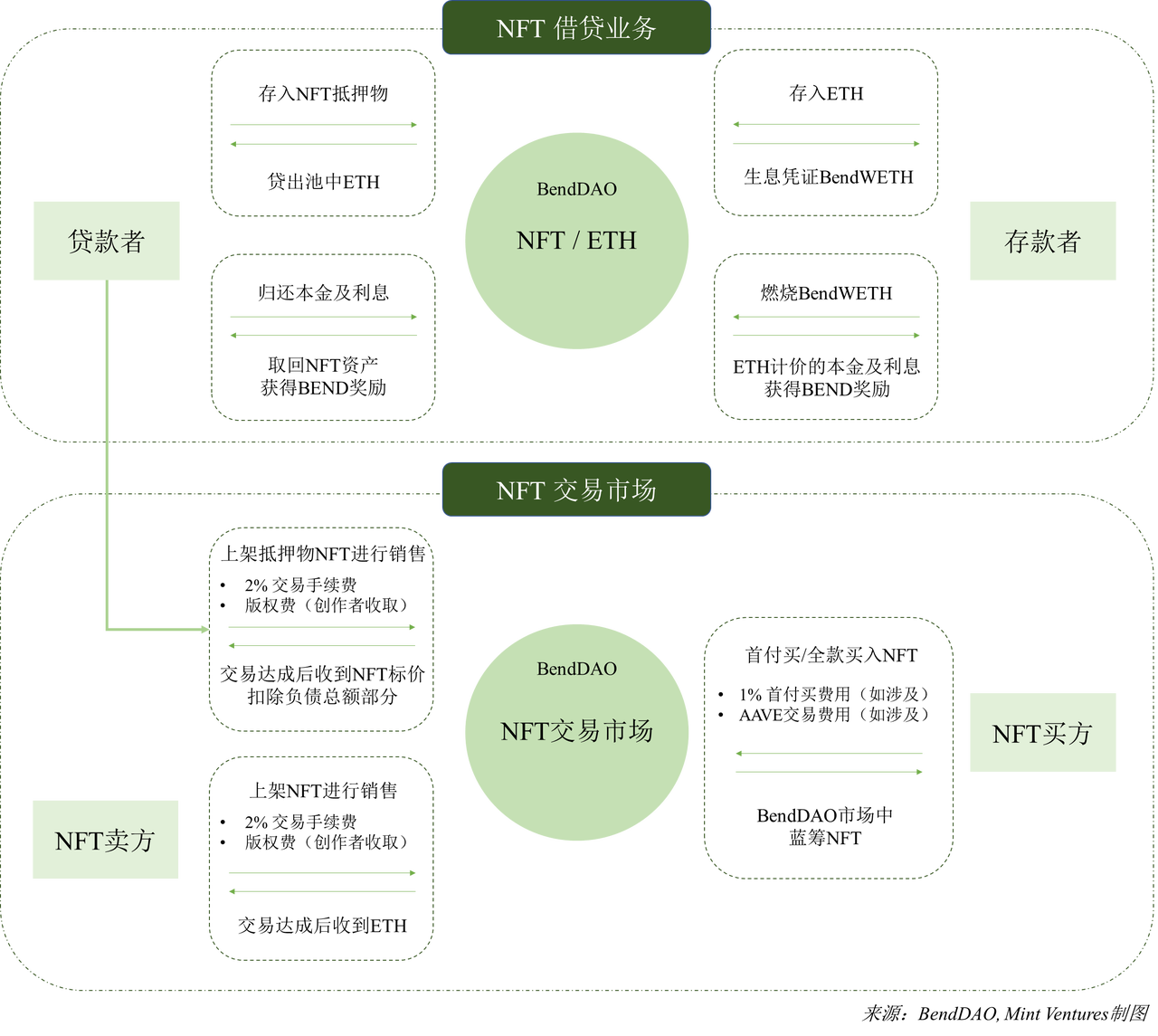

The business structure of BendDAO is as follows:

NFT lending business

BendDAO lending is carried out in the form of a peer-to-peer pool. The protocol pool concentrates NFT collateral and ETH funds. The blue-chip NFT assets held by loan users as collateral, the NFT floor price calculated according to the agreement, the fixed mortgage loan ratio LTV, and the floating interest rate APR are immediately transferred from the agreement. When lending ETH funds, the borrower of ETH funds can deposit and withdraw funds at any time according to the floating APR (when there are ETH funds in the pool that can be withdrawn).

NFT collateral varietiesimage description

Figure: BendDAO supports mortgage NFT types, source: BendDAO, Mint Ventures

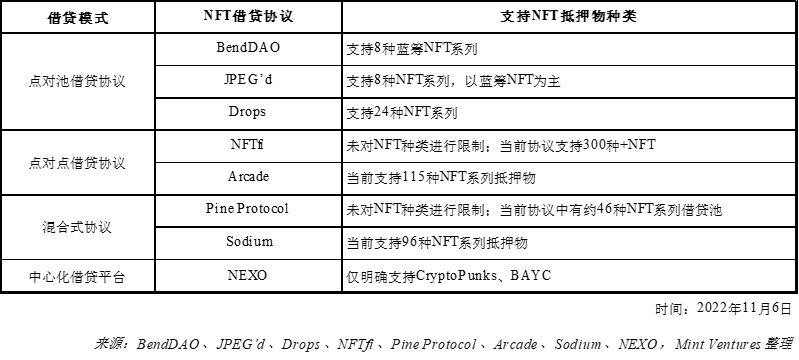

Since the peer-to-peer pool protocol sacrifices the types of NFT collateral it supports when satisfying the lending speed, BendDAO only supports some blue-chip NFTs, which is less than most peer-to-peer lending protocols (such as NFTfi, Arcade, etc.) and hybrid protocols (such as Pine Protocol, Sodium, etc. ).

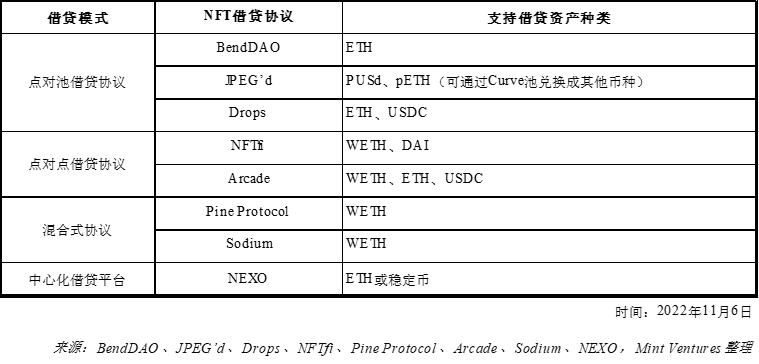

loan assets: BendDAO only supports loans and deposits of ETH assets. Compared with other NFT lending protocols, BendDAO supports a relatively single type of lending assets, but currently ETH is the main pricing method for blue-chip NFTs, and Ethereum is also in an important overlapping area of assets that both borrowers and lenders need. Using mainstream pricing units during liquidation can avoid other Currency exchange rate fluctuation risk. In addition, from the perspective of the agreement, only ETH is the loan asset to control the agreement risk in the ETH market, and the addition of multiple assets will also introduce the risk of other related agreements (such as DAI, the corresponding agreement behind it is MakerDAO). The focus of BendDAO's lending business on collateral assets and loan assets makes the product easy to understand, saves users from the trouble of setting parameters, reduces protocol risks, and creates an excellent user experience. This is one of the important reasons why it has become the current leader in NFT lending protocols one.

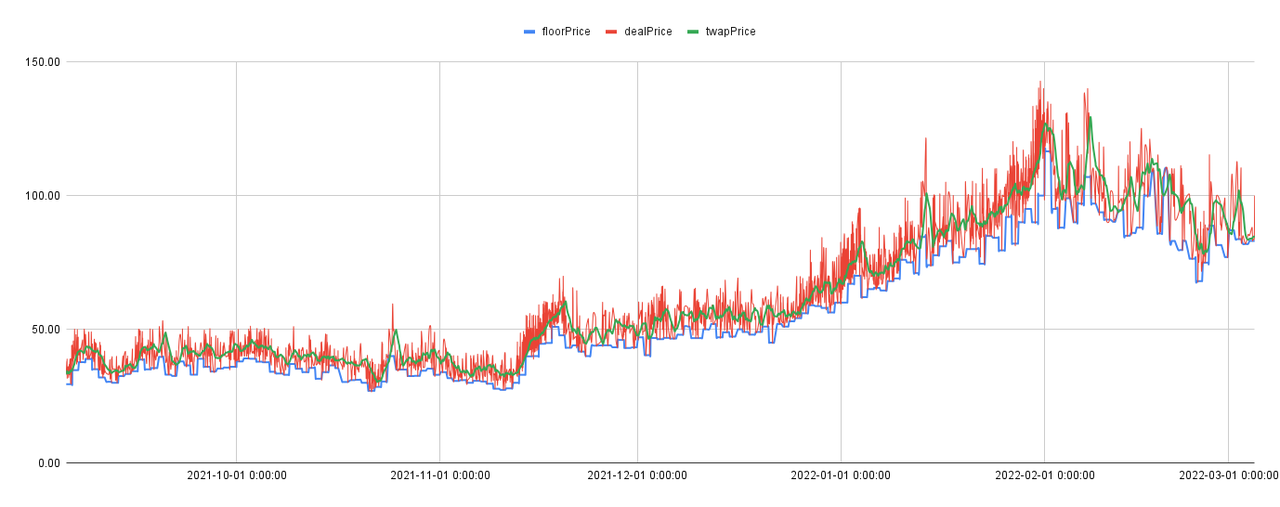

Collateral Valuation Method:NFT pricing determines the base amount of funds that can be loaned out. BendDAO’s pricing of NFT collateral is realized through a built-in price calculator. After cleaning the floor prices of OpenSea and LooksRare under the chain, the price is fed to the agreement through the oracle. The agreement adopts TWAP (time-weighted calculation method, Time -Weighted Average Price) to calculate the value of NFT. Except that the floor price of CryptoPunks comes from the price of CryptoPunks' own trading market, the floor prices of the rest of the NFT series on the shelves come from the OpenSea and LooksRare platforms.

image description

Picture: BAYC series price curve from September 2021 to February 2022, source: BendDAO

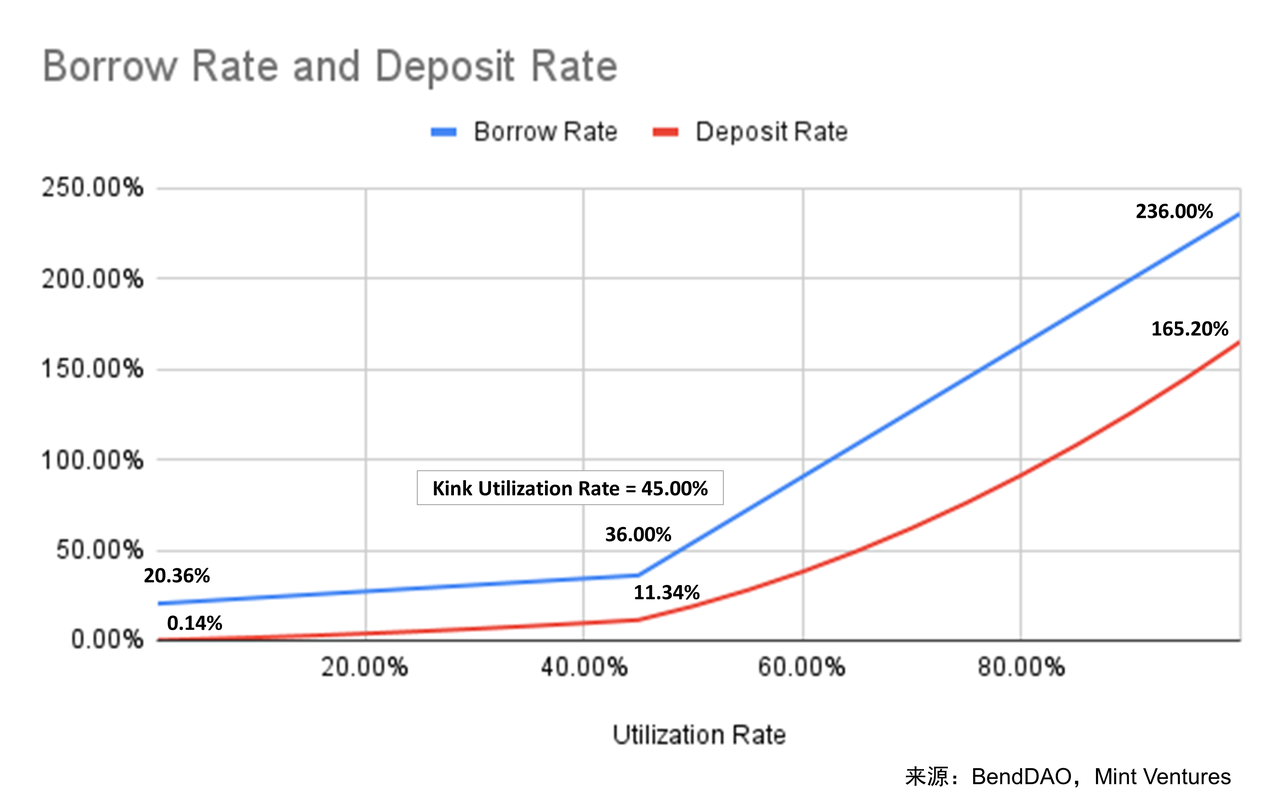

Mortgage ratio (Loan-to-Value / LTV):BendDAO has set a fixed mortgage loan ratio for each NFT collateral, the LTV of BAYC and CryptoPunks is 40%, and the LTV of the rest of the blue-chip NFTs is 30%. Less flexibility compared to peer-to-peer lending protocols, and less compared to other peer-to-pool protocols.

Lending interest rate (Annual Percentage Rate / APR)image description

Figure: BendDAO interest rate curve (November 2022)

image description

Figure: NFT lending agreement lending rate history (March 2022-October 2022)

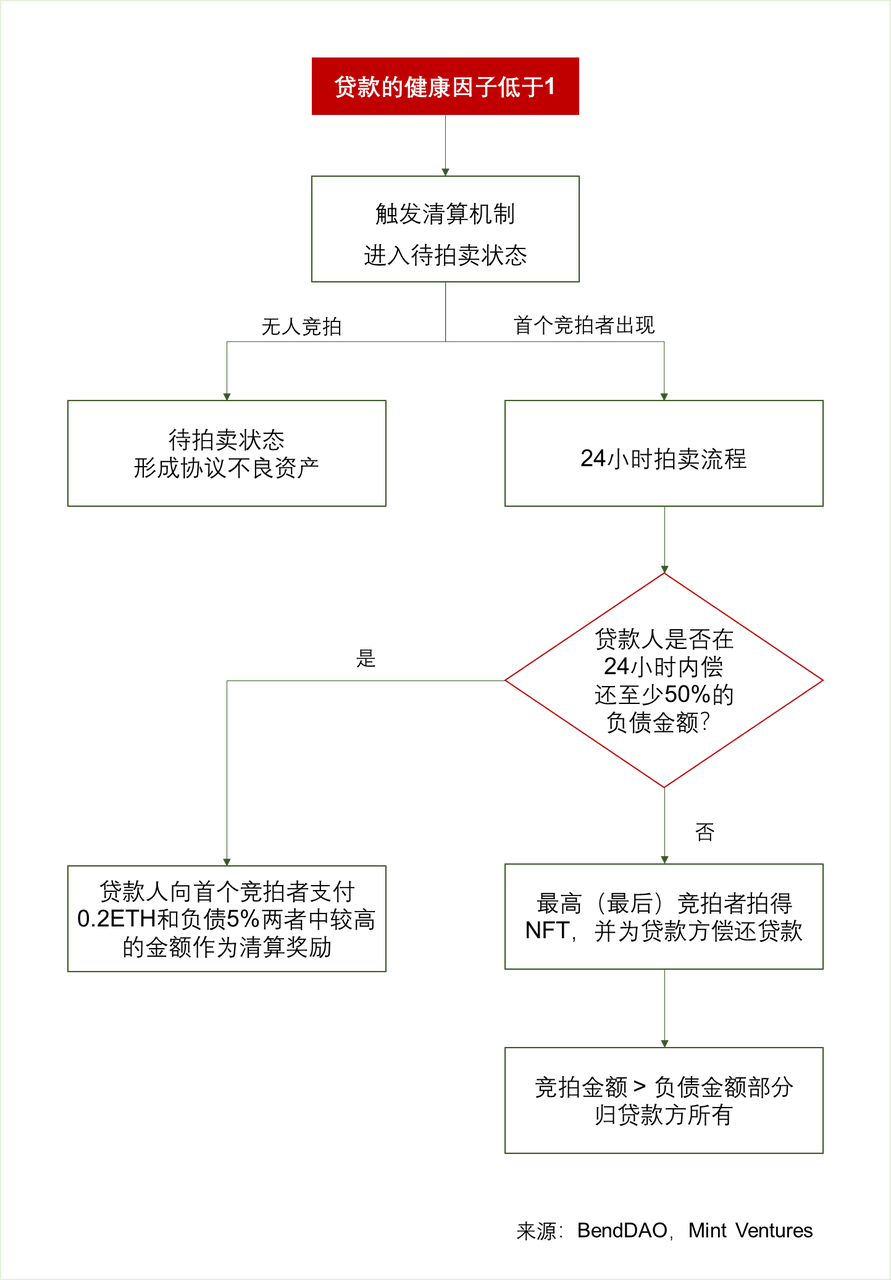

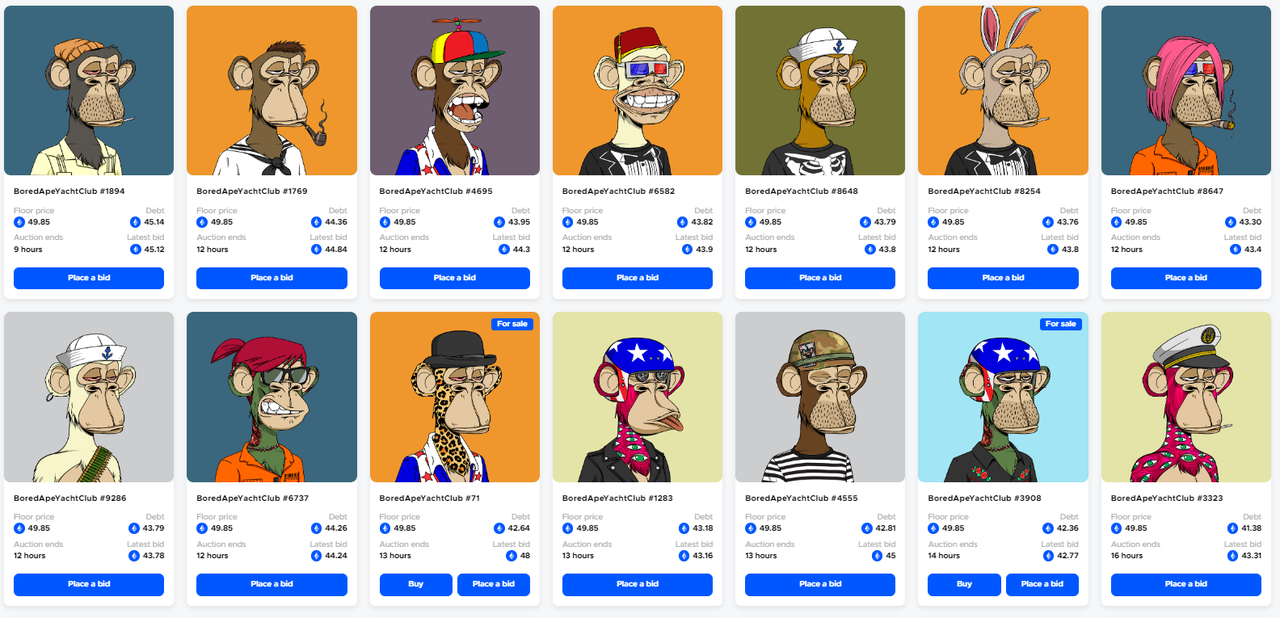

Liquidation Mechanism:The liquidation mechanism of the BendDAO protocol is a public auction. The BendDAO Liquidation Threshold is 80%, that is, when the total amount of a certain liability exceeds 80% of the agreement floor price, the health factor of the loan is lower than 1, and the collateral will enter the liquidation process. When the first bidder appears, a 24-hour auction process will start. BendDAO adopts the English auction method, and the starting price must be greater than or equal to the debt principal and interest of the loan and (before the liquidity crisis in August 2022, the starting price is the higher value between 95% of the floor price calculated by the BendDAO agreement and the total debt amount of the loan ), the subsequent auction price must be increased by at least 1% of the total debt amount. If the lender repays at least 50% of the debt amount during the 24-hour auction period, the collateral can be redeemed, but liquidation compensation must also be paid to the first bidder as a reward , the bonus is the higher value between 0.2 ETH and 5% of the debt amount; if the lender does not repay within 24 hours, the last bidder and the highest bidder will win the NFT.

Health factor calculation formula:

Health Factor = (floor price calculated by BendDAO x liquidation line) / total liabilities; Health Factor = (Floor Price * Liquidation Threshold) / Debt with Interests

As described in the "Liquidity Crisis" section, when the liquidity crisis occurred in August 2022, the BendDAO team initiated a proposal to modify the liquidation line, auction time, starting price rules, etc. to solve the liquidity crisis.

Before the crisis, the liquidation line was 90%. The lowered liquidation line aims to improve the efficiency of the liquidation mechanism, increase the sensitivity of the liquidation mechanism trigger, encourage lenders to repay loans, increase the flow of funds in the pool and the confidence of ETH depositors. .

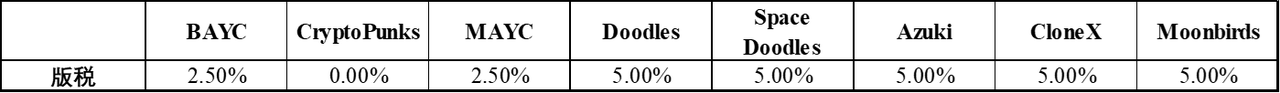

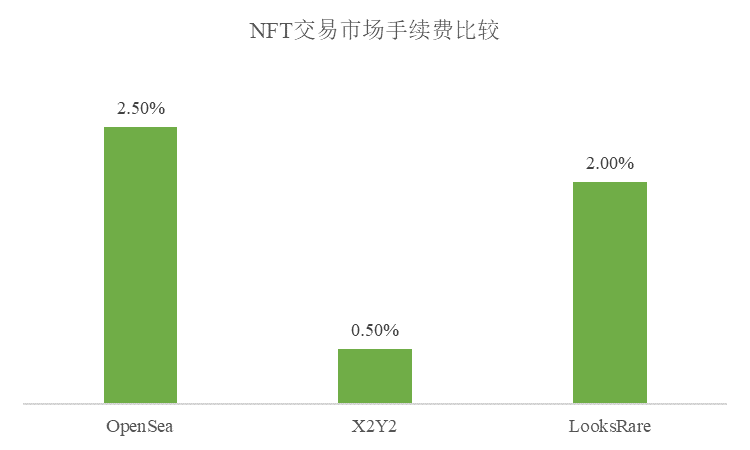

In addition, before the crisis, the starting price of the auction was 95% of the floor price or the higher value of the total debt. After the crisis, the rule was revised to only need to be greater than or equal to the total debt. This adjustment greatly encouraged market liquidation. Under the original rules, 95% of the floor price is usually higher than the total debt amount, and arbitrageurs often need to bear both royalties and transaction market fees when selling. Most blue-chip NFT royalties are between 2.50% and 5.00% (see below Table), the BendDAO protocol sets a mandatory charge for NFT series creators, the current mainstream transaction market fees are between 0.00% and 2.50% (see the table below), so whether the floor price arbitrage space of less than or equal to 5% can make arbitrageurs Profitability is the key issue.

Therefore, when BendDAO removes the rule that the starting price must be at least 95% higher than the floor price, the auction mechanism becomes more profitable for liquidators,It provides more room for arbitrage, which is conducive to alleviating the liquidation accumulation of "non-performing assets" in the agreement.

image description

Figure: BendDAO liquidation mechanism

NFT trading market business

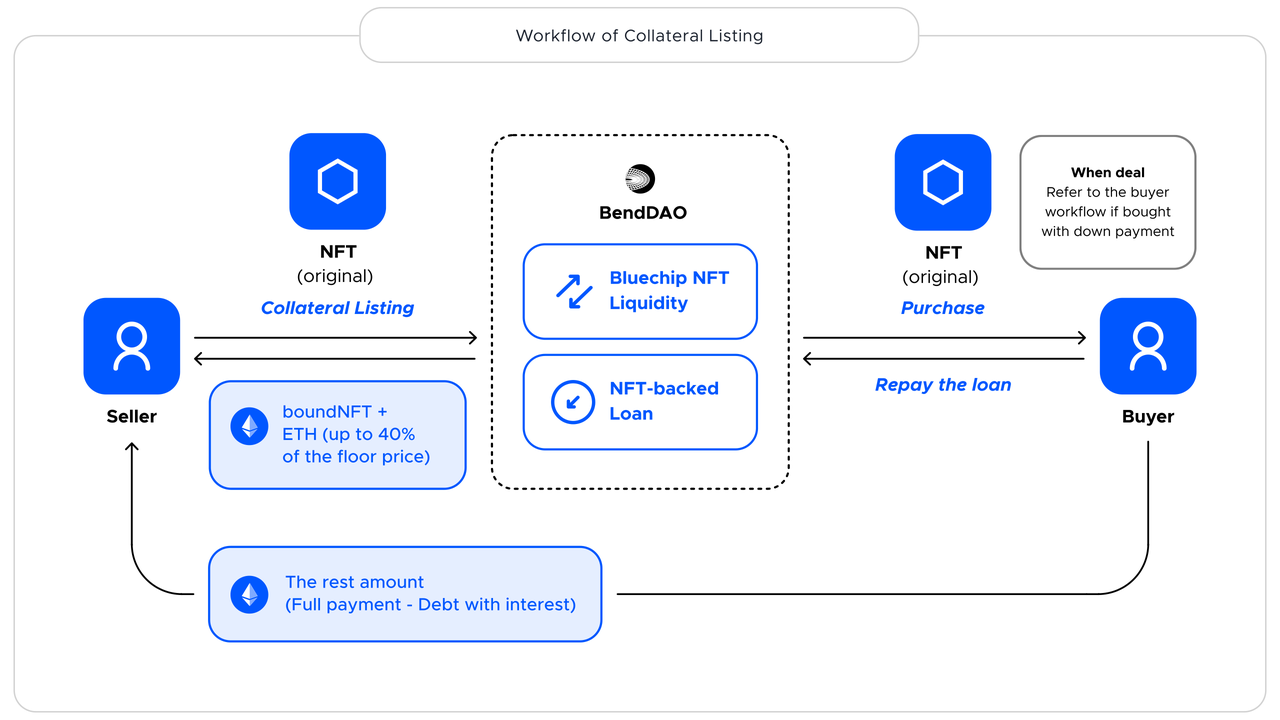

BendDAO’s built-in NFT trading market was launched in August. It mainly provides more services for lenders and NFT users, supports lenders to sell collateral while borrowing ("collateral pending order"), and also supports users who want to buy NFT to only pay NFT can be purchased with a part of the down payment ("buy with down payment"). Recently, BendDAO has also begun to support the function of buyers bidding on the NFT of the pending order, providing users with diversified functions.

Collateral pending order:image description

Figure: Flow chart of collateral pending orders, source: BendDAO

In terms of fees, BendDAO charges sellers a 2% platform transaction fee, which is a moderate level compared with other mainstream NFT trading platforms (OpenSea 2.50%, LooksRare 2.00%, X2Y2 0.50%). When trading on BendDAO, the seller also needs to pay royalties to the NFT project party.

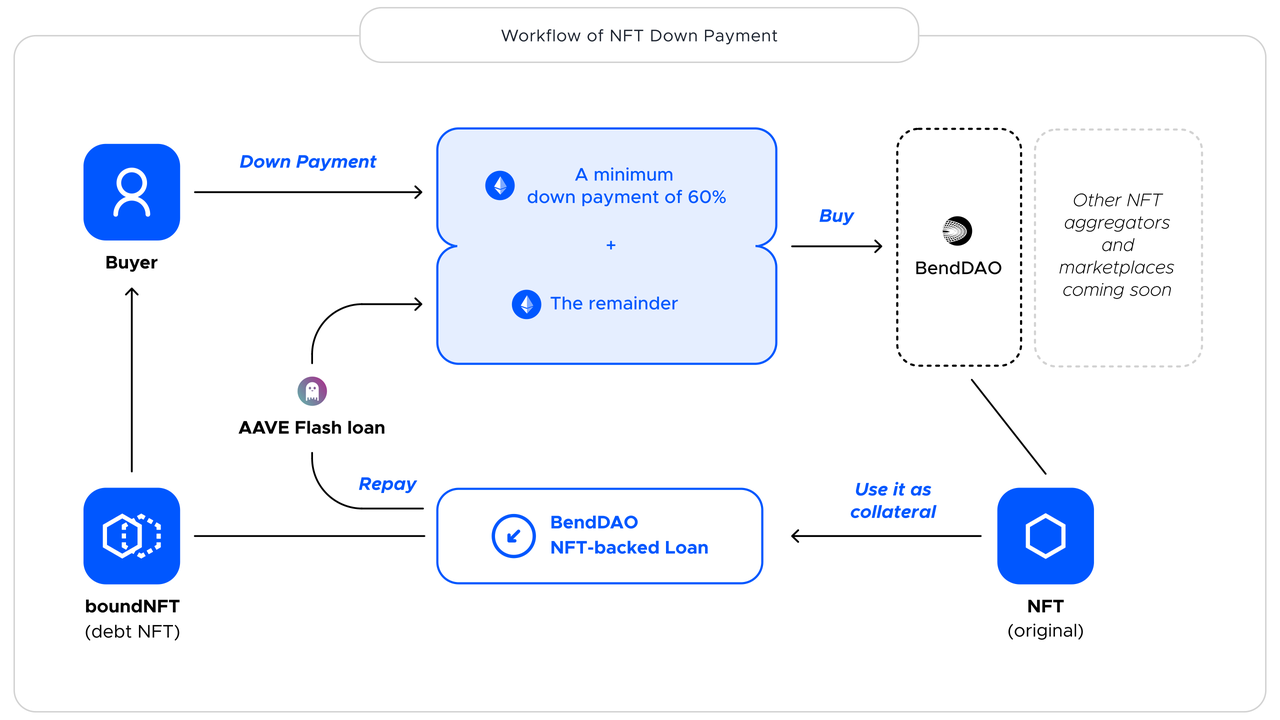

Down payment to buy:image description

Figure: Flow chart of buying with down payment, source: BendDAO

In terms of fees, BendDAO charges a 1% down payment transaction fee for the "buy with down payment" function. Since buyers also use Aave’s Flash Loan, they also need to pay the Aave Flash Loan transaction fee (0.09%).

To sum up, BendDAO's trading market provides users with pending orders, which makes up for the opportunity cost lost by users due to mortgage loans. The "buy with down payment" function uses Aave's flash loan to further reduce the financial pressure for users and open up more NFT user markets. However, judging from usage and business data, the number of users using the trading market is not large, and the current business volume is relatively small. From its launch in August to November 6, 2022, the trading market fee income has accumulated 19.38 ETH (50% of which is shared with veBEND holders), and the down payment fee income has accumulated 2.63 ETH (same as above), accounting for only 20% of the accumulated income 1.05%.

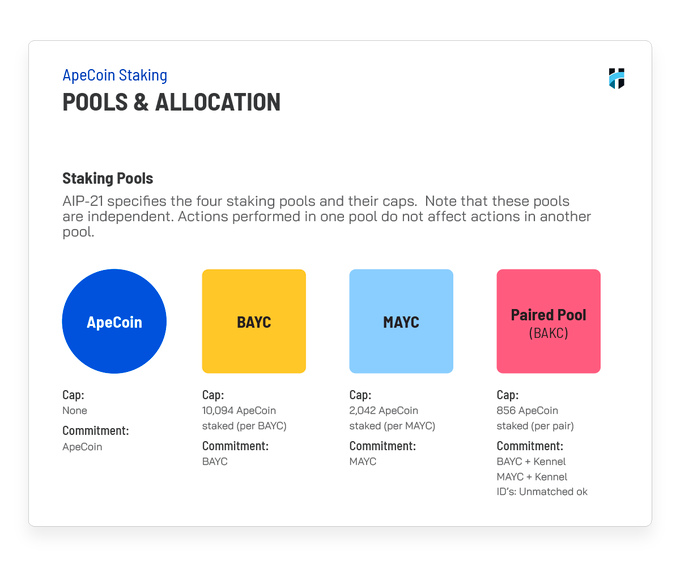

BendApeStaking business (expected to be launched by the end of 2022)

Since Yuga Labs is about to open the staking function at the end of 2022, users who hold BAYC, MAYC, BAKC and $APE are open to staking to earn income. Since some pledge pools of Yuga Labs need to hold both NFT and $APE tokens (as shown in the figure below), the BendDAO community proposes to develop asset matching business based on this pledge function, so as to solve the problem that some users only have $APE without NFT or only NFT without The problem of $APE is to combine NFT and $APE in the matching market to maximize the income, and then share the income to LP.

image description

Figure: Yuga Labs staking pool plan, source: Twitter @HorizenLabs

business data

Since the mainnet launch in March 2022, BendDAO's business volume has continued to grow, and blue-chip NFT loan users and depositors have continued to increase. The occurrence, response and mitigation of the previous liquidity crisis also greatly boosted the popularity of the agreement in the industry, and the launch of new functions has opened up a new source of income for the agreement. Judging from the various business data of BendDAO, the operation of the protocol has been relatively good since its launch. In the future, with the recovery of the blue-chip NFT market, more participants, and the enrichment of NFT categories and IPs, the NFT lending track may gain more attention. BendDAO, as the leader of the NFT-Fi track, will also give priority to harvesting with the improvement of the NFT market Dividends for market growth.

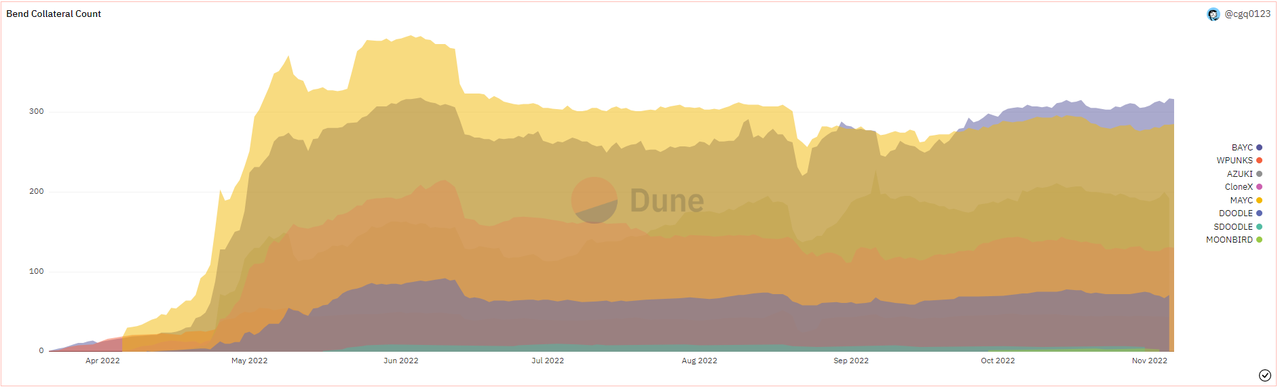

Pawn

An important parameter of the amount of collateral used is also an important asset of the lending agreement. Since the launch of the mainnet in March 2022, BendDAO's loan volume has grown rapidly from April to June.65,000ETH or moreimage description

Figure: The trend of the number of collateral NFT, source:Dune Analytics(@cgq0123)

From a horizontal comparison, the current amount of collateral in BendDAO has an overwhelming advantage over other peer-to-pool protocols. In the peer-to-peer protocol, NFTfi, which has first-mover advantages and NFT variety advantages, has more than 2,000 collaterals. BendDAO is inferior to NFTfi in quantity, but slightly better in asset quality. According to statistics, as of November 6, 2022, among the collaterals of NFTfi, there are 119 blue-chip NFTs supported by BendDAO, and the rest are more long-tail NFT assets. (Because there are a large number of waist and tail assets in multiple NFT lending agreements, it is difficult to unify the pricing, so the value of collateral is not compared here.)

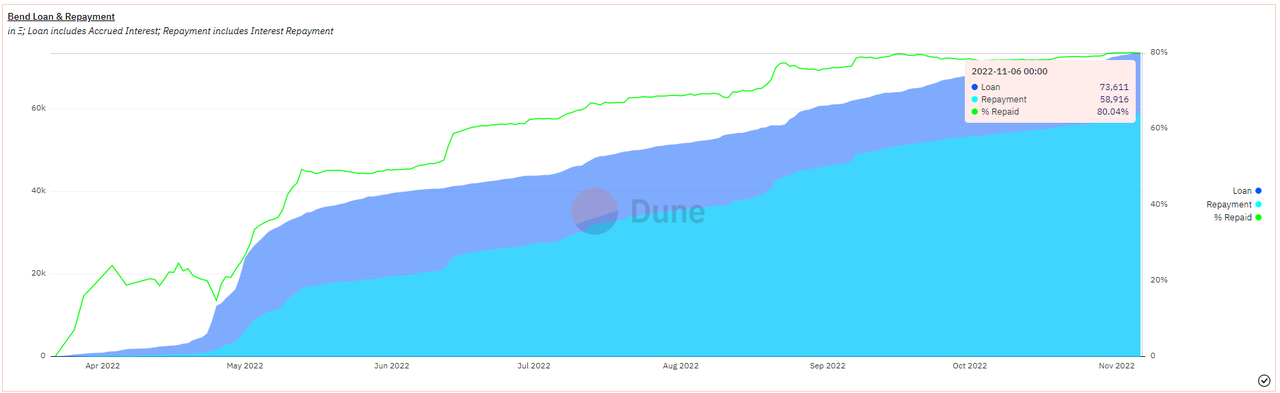

Loans and Repayments

image description

image descriptionDune Analytics(@cgq0123)

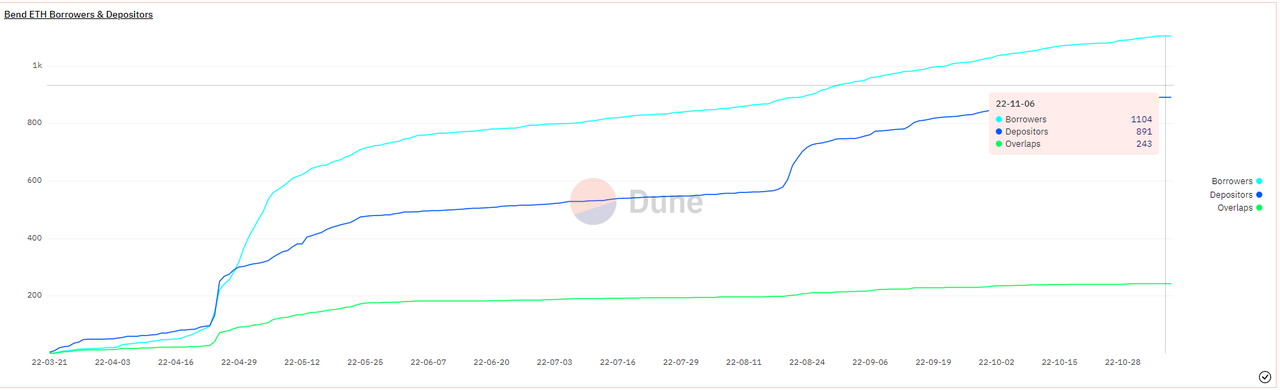

Figure: Daily loan situation of BendDAO protocol, source:Dune Analytics(@cgq0123) Number of borrowers

fromnumber of borrowersimage description

Figure: The number of historical lending participants of the BendDAO protocol, source:Dune Analytics(@cgq0123)

capital utilization

The utilization rate of funds determines the lending rate of the agreement, which is an important parameter for users and an important reference for the health and sustainability of the agreement. BendDAOcapital utilizationimage description

Figure: NFT lending agreement lending rate history (March 2022 – October 2022)

liquidation volume

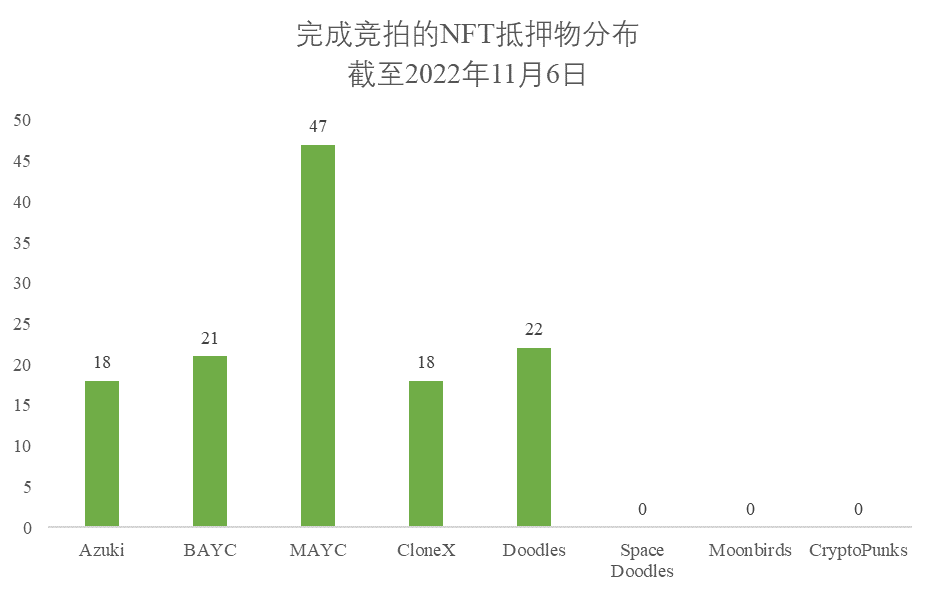

from historyLiquidationimage description

Figure: BendDAO completed the NFT collateral distribution of the liquidation auction, source:Dune Analytics(@cgq0123), organized by Mint Ventures

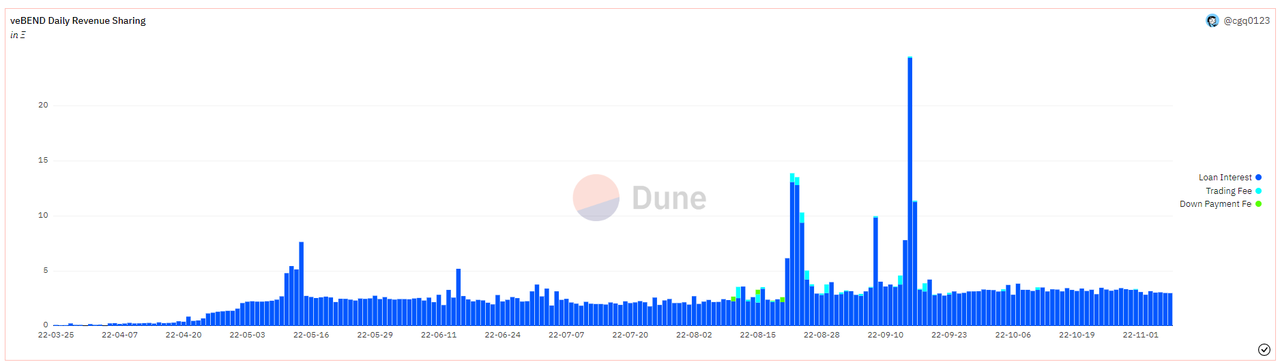

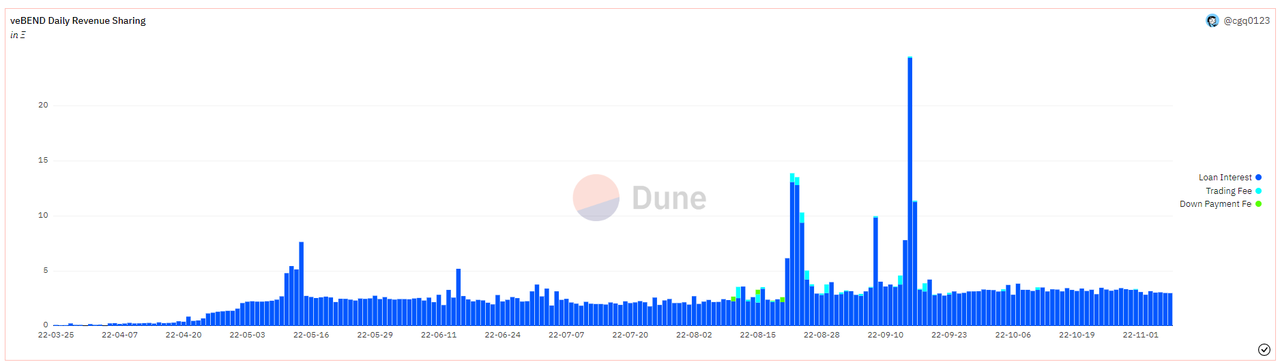

Protocol revenue distribution

Currently, the sources of the BendDAO protocol fees include (1) loan interest, (2) transaction market fee (paid by the seller, rate 2%), and (3) down payment fee for the purchase function (paid by the buyer, rate 1%). Among them, the part that goes into the national treasury as agreement income is (1) 30% of the interest paid by the lender, (2) 50% of the transaction market fee, and (3) 50% of the down payment fee. This part of the income belonging to the BendDAO treasury is also regularly and fully shared with veBEND holders according to the pledge ratio of veBEND holders.

From historical data, interest income is still the main source of income. As of November 6, 2022, loan interest expenses accounted for 98.94% of the total cumulative expenses. Accumulated only 1.06%. Calculated based on treasury revenue, loan interest income accounted for 98.25% accumulatively, and transaction fees and down payment fees accounted for only 1.75%.

image description

Figure: BendDAO protocol income (shared by veBEND holders), source: BendDAO,Dune Analytics(@cgq0123)

business analysis

Products with high market fit (PMF) bring excellent user experience in terms of capital efficiency, security and simple operation.

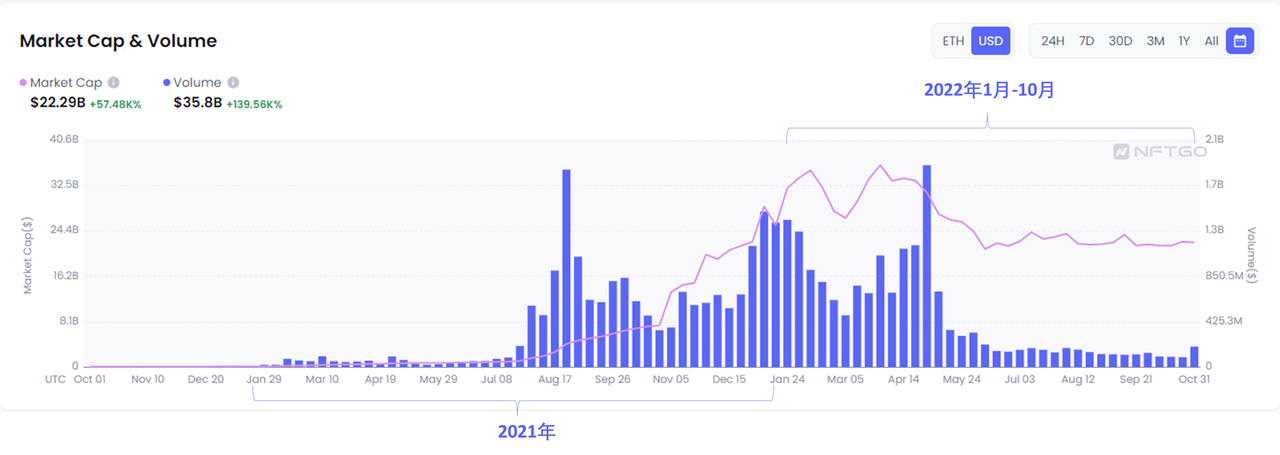

At present, blue-chip PFP accounts for half of the NFT market, and BendDAO's business accurately serves the biggest "cake" of blue-chip PFP. After the overall NFT market experienced a frenzy around PFP from the second half of 2021 to the beginning of 2022, it detonated the total amount of NFT transactions on Ethereum. During this period, a pattern of several blue-chip PFPs as the main market gradually formed, and Ethereum also therefore It has become a gathering place for blue chip NFT. From the perspective of market capacity, according to NFTGo.io statistics, as of early November 2022, PFP accounts for about 58% of the overall Ethereum NFT market. Even though we are in a cryptocurrency bear market today, the 7-day trading volume of blue-chip NFTs usually accounts for 30% to 40%, and the trading volume of PFP usually far exceeds other NFT types, such as GameFi’s NFT assets, art collections or Metaverse assets. BendDAO only supports blue-chip NFT series, focusing on serving the largest and relatively most active cake in the NFT market. Compared with lending agreements that serve head and long-tail assets at the same time, although BendDAO has given up part of the market, it only supports several types of NFT, which makes quick pricing easier and makes fixed LTV reasonable, simplifying the process of lending for users process.

Point-to-pool products win in the speed of lending. The unit price of blue-chip PFP is high, and the interest rate of funds is relatively low. Although the original point-to-point agreement in the market can give special pricing to the scarcity, the scarce and expensive blue-chip PFP will face low loan funds, high interest rates, and long-term loans in the "point-to-point" market. Uncertainty and other issues, BendDAO launched the "point-to-pool" model, which allows some blue-chip PFP holders to immediately lend funds from the fund pool according to the agreement pricing model, which greatly improves the lending speed and accurately serves blue-chip NFT users , and the agreement pricing model ensures that the floor price will not be too low and has a certain degree of resistance to manipulation. The loan interest rate is controllable to a certain extent, instead of all being handed over to the borrower to "raise the price", which is satisfied in an "unprecedented" way. Demand from blue-chip NFT users.

Protocol security is the focus of the team. Allen, one of the founders of the team, and other members have repeatedly mentioned the importance of BendDAO security in public. The protocol code has also undergone a complete code audit, and every time a new function is launched, there is also a third-party audit team agreement to check the code security. In terms of product design, BendDAO emphasizes the security of NFT assets. The NFT assets mortgaged in the agreement will be packaged into boundNFT by the agreement. The boundNFT retains the metadata and Token ID of the NFT, and has the characteristics of "non-transferable and non-approvable" (non-transferable and non-approvable). Help users "lock" the mortgaged NFT assets. There are currently no security issues in the protocol collateral asset pool and ETH pool.

The simple and plain design brings a good user experience. BendDAO's important customer acquisition point lies in its simple product form. Protocols/products that reduce the difficulty of user cognition and operation can often win users faster. BendDAO's operation process is streamlined, and the product usage logic is easy to understand. The protocol is positioned in the blue-chip NFT market, and only supports 8 blue-chip NFT series, and the loan assets only support ETH. From NFT pricing, LTV to lending interest rates, both the loan and the deposit do not need to think too much, and it only takes a few minutes to complete the loan and deposit. Compared with other lending agreements, the use is simpler and easier to understand, which saves users The trouble of setting parameters is extremely friendly to junior NFT players. Although the focus of business has weakened the flexibility of choice, BendDAO can currently meet the needs of "important" users in the market because it targets the blue-chip NFT market with a large market value and active transactions and ETH, the main pricing unit of PFP.

BendDAO's first-mover advantage has helped it gain customers. BendDAO pioneered the "peer-to-pool" lending model. Among the many agreements classified as "point-to-pool", the more well-known ones are Drops and JPEG'd. Drops' products supporting NFT mortgages will be launched on the main network in May 2022, and JPEG'd will be launched in April 2022. Officially released products in January, slightly later than BendDAO. Before the launch of BendDAO (March 2022), the NFT liquidity solutions that appeared in the market were mainly peer-to-peer protocols, such as NFTfi, Pine Protocol, Arcade.xyz, etc., but none of them really solved the pain point of "loan speed". Users of the agreement often need to wait for a long time for matching. Blue-chip NFT holders may need to accept excessively high interest rates and low loan amounts. Users open access to fast liquidity.

The protocol design enriches the NFT gameplay and becomes a tool for professional NFT traders.

Simple lending becomes a "leverage tool" for professional players, further enhancing BendDAO's popularity in the blue-chip community. From April to May 2022, Yuga Labs launched the metaverse land Otherdeed, which will airdrop land to BAYC and MAYC holders. The design of the BendDAO protocol hides the understanding of NFT holders and protects the rights of NFT holders to receive airdrops. Therefore, many blue-chip NFT users borrow funds through BendDAO mortgage NFT to purchase BAYC/MAYC. After receiving the airdropped land, they return the loan and get back the collateral NFT. If the collateral itself is BAYC/MAYC, they also enjoy the airdropped land in the field s right. The land airdrop activity of Yuga Labs has a positive effect on enhancing the influence of the BendDAO protocol in the Boring Ape community, allowing many target users to experience the advantages of the product’s capital efficiency for the first time and improving the popularity of the protocol.

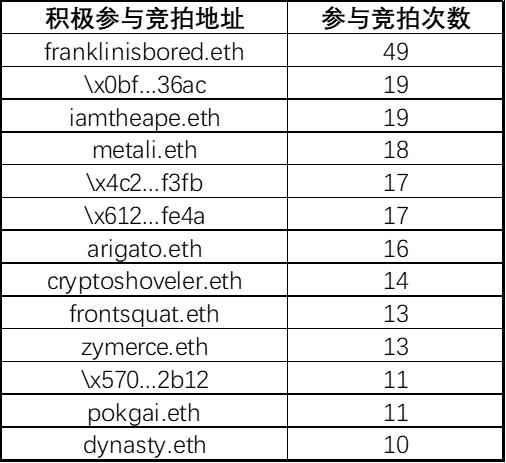

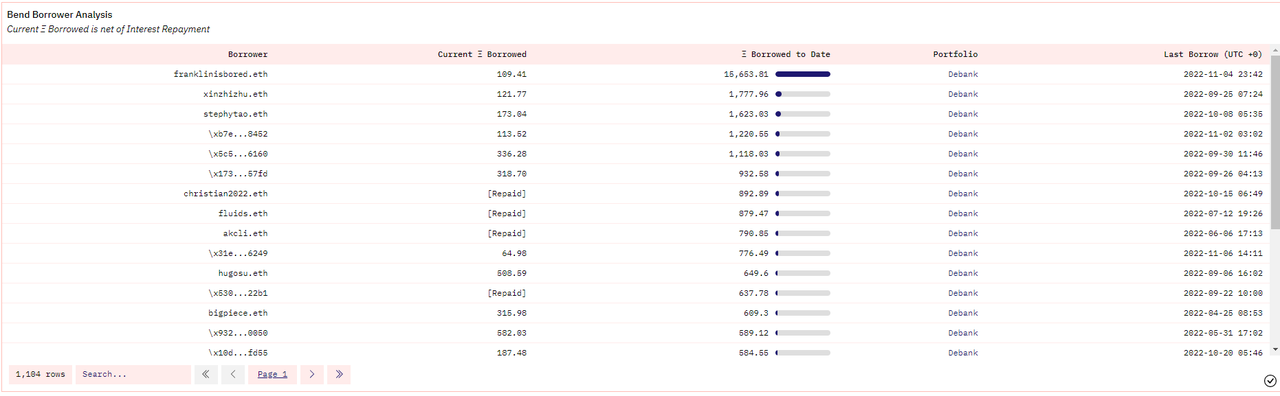

The liquidation auction market has become a blue-chip NFT value depression, gathering NFT Flippers and enriching the liquidity of the NFT market. Since BendDAO's liquidation auction mechanism makes it profitable for traders who are optimistic about the NFT market, traders can find good-priced blue-chip NFTs in the auctioned NFTs and then sell them for a profit, so there are a group of people in the market who specialize in clearing pools Twitter KOL @Franlinkisbored is one of them. Franklinisbored is the sixth largest BAYC holder in the world, and as of November 6, 2022, he owns 61 Boring Ape NFTs. In addition, he has also become a well-known NFT Flipper by repeatedly buying low and selling BAYC and MAYC series NFTs for profit. We can see from the BendDAO liquidation auction records that Franklinisbored is extremely active on BendDAO, and has participated in bidding 49 times in history. He is also the user with the highest accumulative loan amount on BendDAO, accumulatively borrowing more than 15,000 ETH through mortgage NFT. There are also many other professional NFT players like Franklinisbored who actively participate in bidding for relatively low-priced blue-chip NFTs. According to the auction records, as of November 6, 2022, we found that 42 different addresses actively participated in the auction (accumulative participation >= 5 auctions), of which 13 addresses have accumulated more than 10 auctions, as shown in the table below. The existence of BendDAO makes the circulation of expensive blue-chip NFTs more frequent, bringing a variety of gameplay to the market.

Around November 15, 2022, due to the decline in the floor price, a large number of BAYC collaterals with high value will trigger liquidation. However, unlike in the past, the participation in this liquidation auction is more active, and the first bidder appears soon. After experiencing the previous crises, the market has a clearer consensus on the short-term decline of NFT floor prices to form an "arbitrage opportunity". BendDAO's liquidation auction market allows bidding with the total debt of the lender as the starting price, providing the market with blue-chip NFT The value depression has become the darling of many NFT Flippers.

The core team and DAO decentralized governance cooperate with each other to jointly promote the progress of the agreement

The BendDAO core team has always encouraged the community to participate in governance and is a practitioner of the decentralized DAO model. As can be observed on various social media, core team members have been encouraging community members to participate in governance and brainstorm ideas for protocol development. Some of these efforts include opening periodic working meetings to the public and hosting a weekly industry hotspot on The Big Bend Theory Discussions on Twitter Space, public encouragement of community members to participate in forum discussions, etc. In the process of communication on various occasions, the team showed an open and accepting attitude towards community opinions and suggestions. In addition, it is worth mentioning that before the mainnet launch of BendDAO, the team adopted the IFO (Initial Fair Offering) method to open financing to everyone, instead of using common private equity funds, and also airdropped tokens to the NFT community. form, decentralize voting rights and governance rights, and encourage NFT participants to join BendDAO's governance. It can be seen that BendDAO has implemented the spirit of decentralization from the time of agreement financing.

The DAO model of "Participation to Governance" helps the protocol to continuously improve and strengthen the binding relationship between users and the protocol. The lending business using the agreement will receive BEND token mining rewards. After locking the BEND tokens, you will get veBEND, and enjoy governance rights, voting rights and the right to share the income of the agreement. The subtlety of the Voting Escrow model originated from Curve is that it gives protocol users governance rights and realizes "governance through participation". The binding relationship of the product enhances the user's sense of belonging and loyalty to the product.

We can see from the following proposals/discussions that the DAO community participates in protocol governance and effectively promotes the development of the protocol:

① Parameter modification proposal after the liquidity crisis: The parameters after the liquidity crisis are the result of core member guidance and community voting. The team members proposed to implement gradual changes to the four important parameters (bidding time, liquidation line, starting price rules, and lending interest rates) in stages, and gradually increase the intensity. However, in terms of some parameters, the community voted to settle in the moderate area. If the final vote of the liquidation line is determined to be 80% instead of the more radical 70%, the auction time is determined to be 24 hours instead of 4 hours. Currently the protocol is running normally with the modified parameters.

②Discussion on "non-performing asset investment fund" and secondary financing: After the liquidity crisis, community members proposed that measures should be taken to prevent the next FUD sentiment from causing the liquidity of the agreement to dry up. The NFT to be liquidated and auctioned at 0.8, and the second financing for this fund will be publicly conducted, open to institutions, NFT project parties, etc. This proposal is still in the discussion stage, but the addition of new capital is expected to bring more high-quality resources to BendDAO and help it expand the global market.

③ BendApeStaking, a pledged asset matching business: When the pledge function of Yuga Labs is about to be launched, community members proposed that BendDAO develop a pledged asset matching business ("BendApeStaking") to maximize revenue from matching market resources, develop new businesses for the protocol, and attract more users .

From a more macro perspective, BendDAO encourages and supports the community to participate in governance. In fact, together with other protocols that support DAO governance, it has assumed the responsibility of educating the Tuquan community (especially the Chinese community) about DAO governance, and is improving the protocol’s ability to serve the market. At the same time, a good brand image has also been established, and the binding relationship between users and the agreement has been subtly enhanced.

Team and financing

Team situation

BendDAO does not disclose information about the relevant team members on its official website, but we can learn about the progress of the development team and the operation team on social media (Twitter, Discord communities, etc.). In August 2022, team members will conduct a weekly Twitter Space event called "The Big Bend Theory" on social media, and actively participate in discussions on topics related to the NFT market on social media; in addition, regular internal meetings of the team are also oriented to It is open to the public and anyone can attend the meeting. Therefore, BendDAO's "anonymous team" is not actually anonymous, and has been continuously iteratively updating the product and actively operating the community.

financing

Unlike most other Web3 projects, BendDAO has not carried out private financing, has not set up a whitelist, and has no pre-sale list. Instead, it only adopts IFO (Initial Fair-Launch Offering) to raise funds from the public, in late March 2022 Started IFO financing. Due to the "sweeping" share of a giant whale address, it ended early at the end of April. A total of 3,000 ETH was raised (unit price 1 ETH = 333,333 $BEND), and a total of 1 billion pieces were issued to the public participating in IFO $BEND tokens. 66% of the raised funds will be used to establish the BendDAO loan pool, and 34% will be used for the development team operations.

Latest Financing Plan

During the liquidity crisis in the BendDAO community, there was a discussion on the establishment of a "distressed asset investment fund" and its second financing. The new round of financing plans to use 50% for the establishment of a "non-performing asset investment fund" to purchase discounted NFTs that have been accumulated in the agreement and no one is bidding to digest this part of the "non-performing assets", and the remaining 50% is used to establish an ecological fund. Invest in and incubate BendDAO-related ecological projects. The new round of financing valued the BendDAO agreement at 80 million US dollars, targeting institutions, NFT project parties and communities, financing 6,208 ETH, and providing investors with 1 billion BEND tokens from the treasury (accounting for 10% of the total). The distribution of token holdings will have corresponding requirements. As of the publication of this research report, the discussion has not yet formed a formal voting proposal.

business analysis

NFT loan track situation

2021NFT Boomimage description

Figure: Ethereum NFT transaction volume from October 2021 to October 2022, data source: NFTGo.io, Mint Ventures

Regarding the development of the NFT market in the future, we believe that the blue-chip PFP market, GameFi assets and NFT assets with high value of Utility will continue to bring vitality to the industry.At present, the blue-chip PFP pattern has been initially formed, and the NFT project team behind it has also carried out financing activities to reserve food and grass for the planning of IP construction such as NFT empowerment and community activities. GameFi projects are emerging one after another, and the track narrative is constantly iteratively updated while accumulating many NFT assets, which will also become important elements of the SBT (Soul-Bound Token) on the chain in the future. As the early NFT bubble diminishes, users gradually realize the essence of NFT and its core significance to the cryptocurrency field. NFTs with high utility value will be more adopted in real life. Many web2 brand owners are gradually developing the NFT field. products and features. For example, the new membership system "Starbucks Odyssey" released by Starbucks integrates NFT products, bringing customers a new web3 experience, and grafting the bridge between web2 and web3. As more and more people enter the field of cryptocurrency, web3 education The degree gradually deepens, and utility NFT will be penetrated into all aspects of life more and more. Although there are both pessimistic and bullish voices about the development of the market outlook, we believe that the NFT market will further expand, and has the potential to further explode under the empowerment and value-added of the NFT-Fi industry.

The NFT Boom in 2021 will also detonateThe Road to NFT Financialization。competitive landscape

competitive landscape

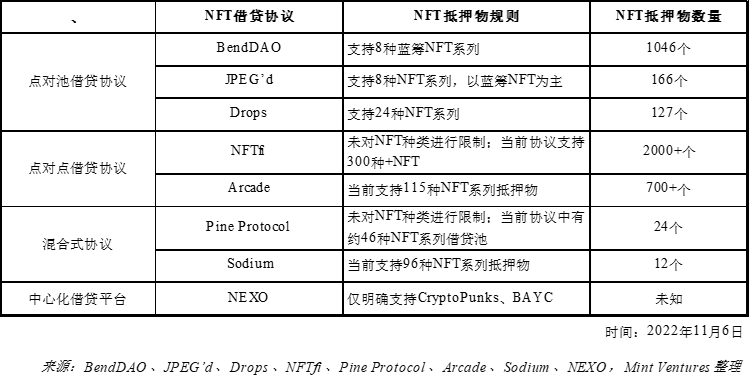

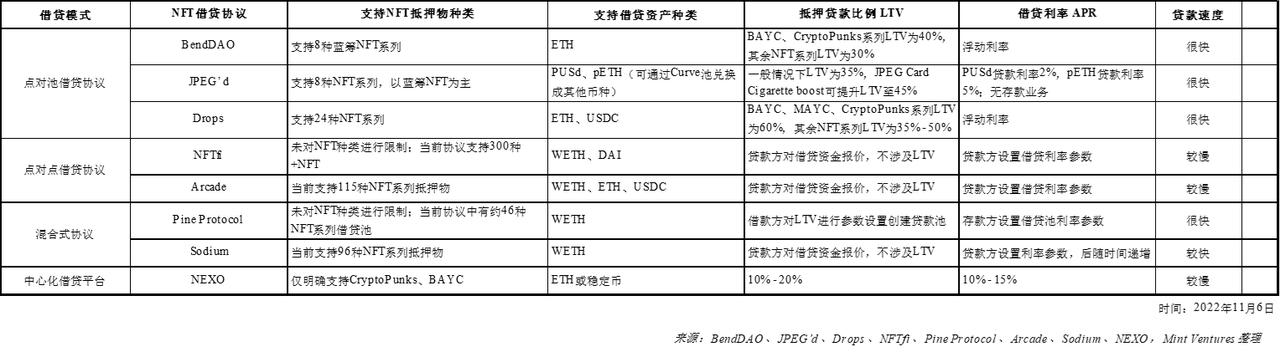

The NFT lending track is currently in the early stages of contention among a hundred schools of thought, and new competitors are emerging in an endless stream. Looking at the mainstream lending agreements in the track, there are mainly 4 lending methods:

(1) Point-to-point (Peer-2-Peer, P2P) lending, that is, the model of matching between users and users to achieve a loan. The lender and the borrower match in terms of interest rate, term, and NFT collateral type, etc., and the demand is matched. lending transactions.

(2) Peer-2-Pool/Peer-2-Protocol (Peer-2-Pool/Peer-2-Protocol) lending, that is, a loan model is reached between the user and the protocol pool. The lender pledges NFT to the protocol pool to obtain loans quickly, and the deposit is directed to the protocol The pool provides funds to earn interest income (in some "peer-to-pool" protocols, such as JPEG'd, there is no depositor).

(3) Hybrid lending, that is, an agreement that combines the peer-to-peer and peer-to-pool models. Sodium, which was launched recently, is a typical example of this type. In this model, the lender sets a series of parameters such as interest rate, term, and loan amount. When requesting a loan on the platform, it is equivalent to establishing a separate agreement pool. Multiple Borrowers can deposit funds into the protocol pool to earn interest income.

(4) Centralized NFT lending platform, that is, the lender mortgages NFT to the centralized platform, and the platform issues loans after evaluating the collateral.

Based on the above categories, we have sorted out the main players in the current market, as shown in the table below.

From the chart above, we can see that the current NFT lending platforms are slightly different in terms of the types of NFT collateral supported, the type of loan assets supported, the mortgage loan rate LTV, the loan interest rate APR, and the loan speed. We can also see that the loan speed, loanable funds, loan interest rates, and the types of collateral NFT supported are often difficult to take into account at the same time. Each platform strives to meet market demand as much as possible in all dimensions and find a balance among multiple restrictions. BendDAO is unattractive in terms of mortgage loan ratio LTV and loan interest rate, but it has obvious advantages in terms of loan speed and collateral asset quality. With its easy-to-understand product logic and excellent user experience, it is more important in the NFT lending agreement. Advantage.

Token Economics Model

basic situation

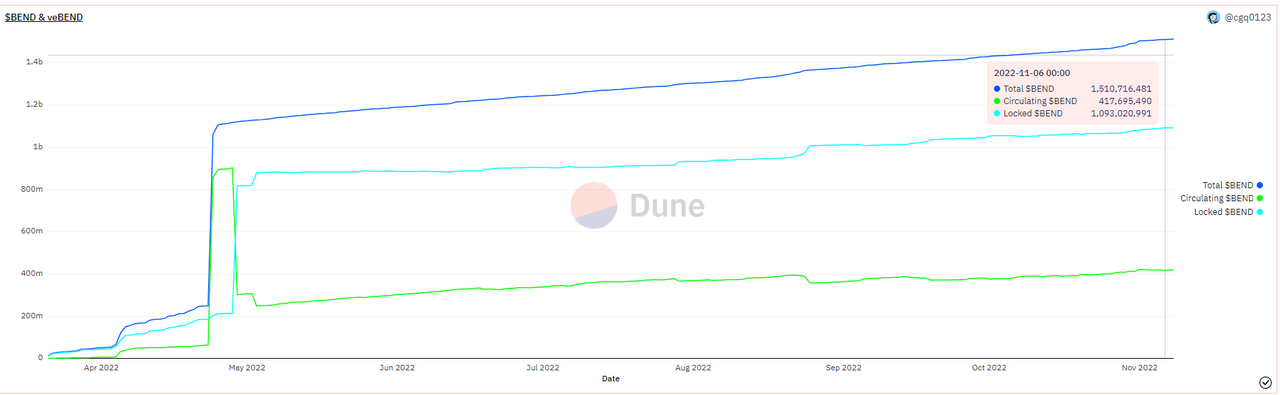

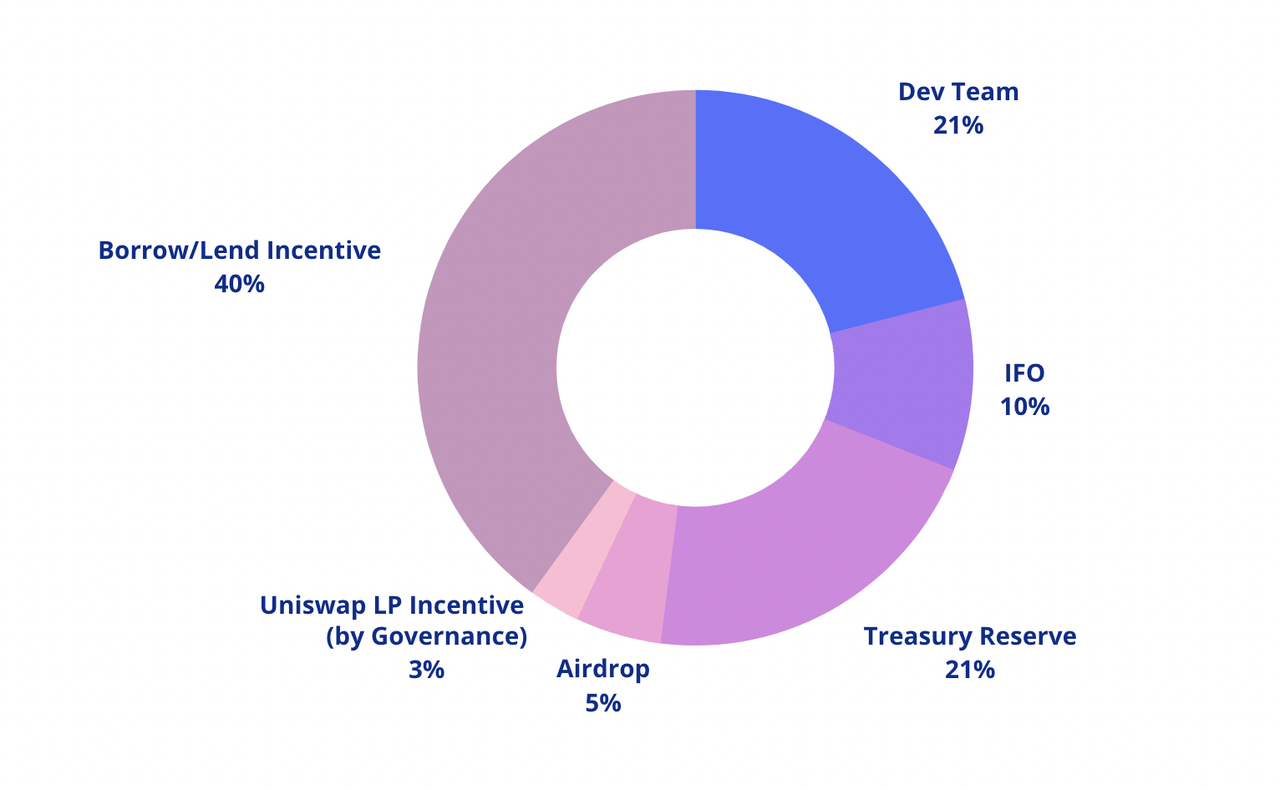

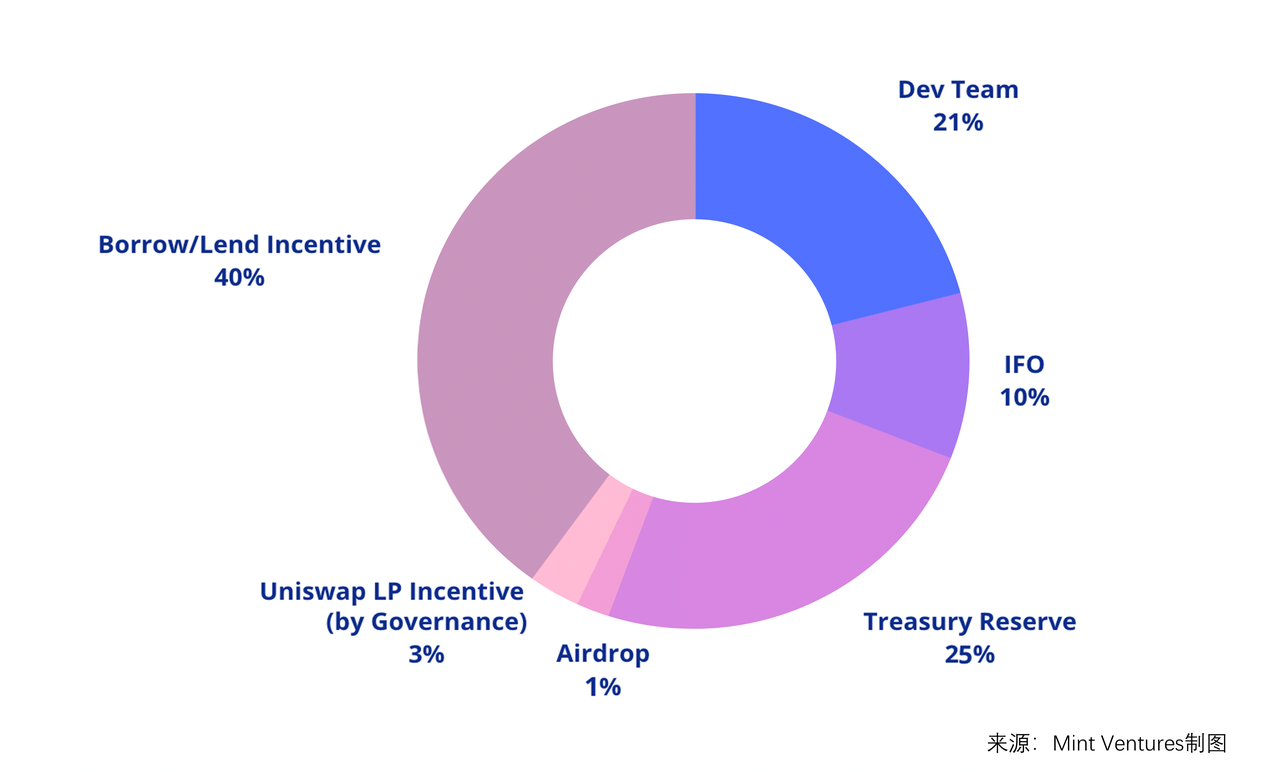

The $BEND token is the governance token of BendDAO with a circulation of 10 billion. Fundraising is open to the public through IFO (Initial Fair-Launch Offering) (for details, please refer to "5.2 Financing Situation" of "V. Team and Financing Situation" in "Part II: Basic Situation of the Project"), accounting for 10% of the total circulation. % (1 billion pieces). IFO will start in March 2022, and IFO fundraising will be completed in April. A total of 3,000 ETH will be raised, of which 1,980 ETH (66%) will be used as the basic capital of the loan pool, and 1,020 ETH (34%) will be used as the development team's operating funds.

Main usage scenarios of $BEND token

LinkLink)。

The protocol supports liquidity mining of the BEND/ETH trading pair on Uniswap V2, and LPs can get $BEND rewards.

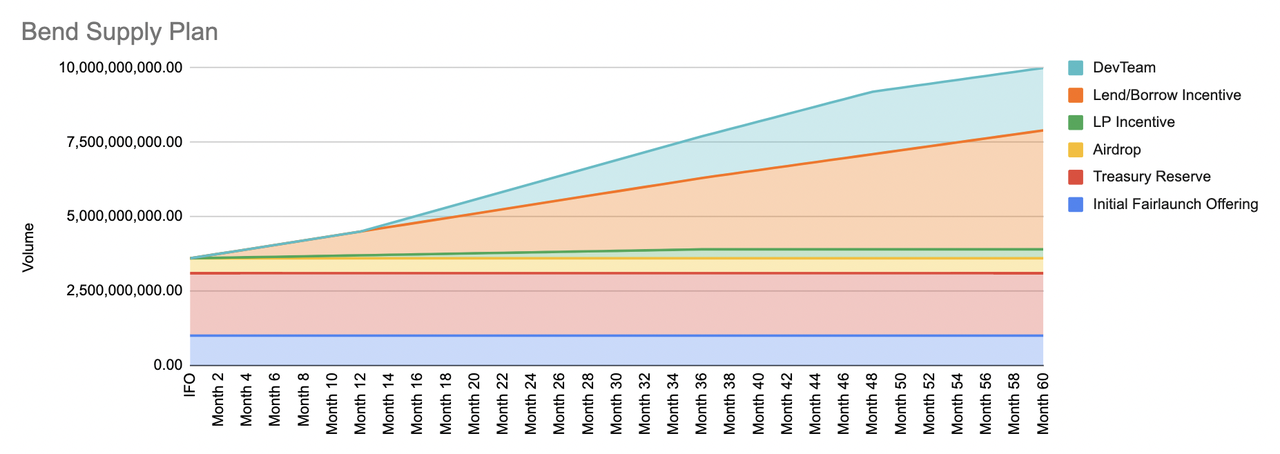

Main Release Channels of $BEND Tokens

The current main release channel for $BEND tokens is the distribution of $BEND token rewards to lenders, depositors, and liquidity providers (LPs) on Uniswap V2 (accounting for 43% of the total tokens in total). It is expected that starting from March 2023, the developer team tokens will begin to be unlocked linearly over a three-year period, which will also be the main release channel for tokens. According to the current release rate of BEND, the developer team’s monthly release of tokens (if released on a monthly basis) will account for about 3% of the current circulation.

Token Distribution Arrangement

image description

Figure: BEND token distribution plan, source: BendDAO

image description

Picture: BEND token distribution (after adjustment of the remaining unallocated part of Airdrop), source: BendDAO, Mint Ventures unlocking and circulation

After the IFO fundraising, most of the $BEND tokens have no lock-up period and enter the circulation state directly.

IFO part: The public can choose to lock their BEND for 1 week to 4 years during IFO;

Airdrop: The tokens that BendDAO airdropped to some target users directly entered the circulation state, but only 11% of the airdrops were received, and the remaining unclaimed airdrop tokens before the deadline were managed by the treasury, and how to use them was decided by community governance;

Borrowing incentives: After the mainnet goes online (that is, in late March 2022), it will be unlocked linearly in 5 years;

Developer team part: 1-year lock-up period after IFO fundraising, followed by 3-year linear unlocking;

National treasury reserve part: Community governance voting is required to determine the use of this part of the token. As of the publication of this research report, part of the treasury amount has been allocated to the bug bounty reward fund and the builders of the Dune Analytics data analysis dashboard through community governance voting.

Uniswap LP rewards: community governance votes to decide on the unlocking arrangement, starting from April 27, 2022, 273,972.60 $BEND tokens will be released every week.

image description

Figure: BEND token unlocking situation, source: BendDAO

current holdings

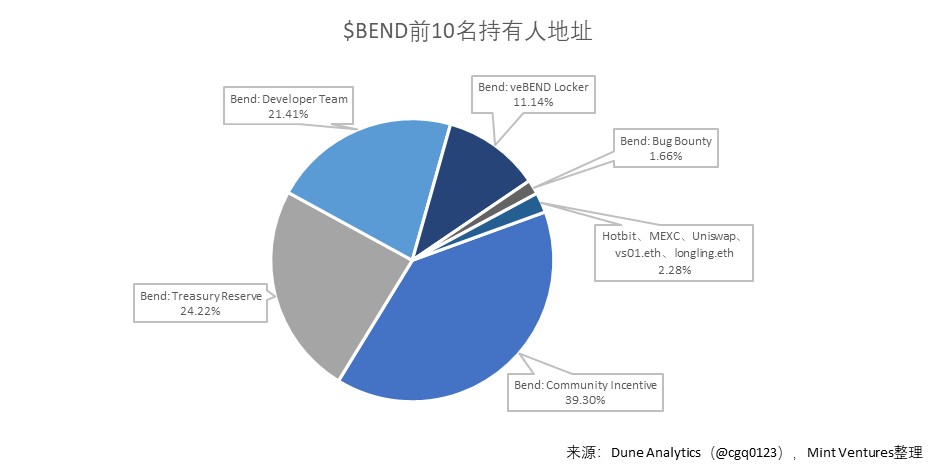

image description

Figure: Addresses of top 10 holders of $BEND

Among them, most of the tokens in the BendDAO community reward wallet, treasury reserve wallet, developer team, and Bug Bounty pool are slowly released or completely locked, accounting for about 96% of the total tokens of BEND. Currently, the overall selling pressure of BEND tokens is relatively small. The developer team tokens are expected to be unlocked linearly for 3 years starting from March 2023. According to the current BEND release rate, the monthly release amount of developer team tokens (if released on a monthly basis) will account for about 3% of the circulation at that time.

image description

Figure: BEND Token Circulation Quantity, Locked Quantity, Source:Dune Analytics(@cgq0123), organized by Mint Ventures

project risk

The author believes that the risks of BendDAO mainly include blue-chip NFT risks, competition risks, user concentration risks, liquidation mechanism risks, parametric model risks, and NFT black goods risks.

Blue Chip NFT Risks

The BendDAO protocol is "a blue chip for success, and a blue chip for failure". For the agreement, in the worst case, the liquidity of the ETH fund pool dries up, and the lenders who mortgage the NFT cannot repay. This situation has been similar to the previous liquidity crisis, but there has been no vicious event of collective default. The agreement is highly dependent on the quality and quantity of blue-chip PFP collateral assets. In terms of quality, the collapse of any blue-chip PFP project will directly lead to batch defaults in the agreement. When the floor price of blue-chip PFP drops sharply (or almost returns to zero), lenders can completely abandon NFT assets and choose to default and not repay the loan, and Under the current liquidation mechanism, no one will bid for the blue-chip NFT of Honkai. In terms of quantity, the number of blue-chip collateral is an important parameter for the vitality of the protocol. Under normal circumstances, the quality of collateral assets is good, but when extreme events occur, BendDAO, which is highly dependent on blue-chip projects, will face greater challenges.

The market capacity of stock blue chips is limited, and incremental blue chips are "unavailable but not available". Another blue-chip NFT risk point is that although BendDAO focuses on serving the biggest "cake" of the blue-chip NFT market, there are only a handful of blue-chip NFTs in the market. The 8 types of NFTs that have been launched so far are almost the majority of the entire blue-chip market. . During the current bear market, the expansion speed of the blue-chip NFT market has not been as fast as that of the PFP narrative frenzy in the second half of 2021. At present, the number of blue-chip PFP issuances is mostly fixed, and the floor price is blocked during the bear market, which means that the market stock of the overall service of the BendDAO protocol is limited. Even if the competition situation does not deteriorate in the short term, BendDAO has to expand from the perspective of innovative functions and new business development protocol. There is a ceiling in the blue-chip NFT market capacity, which may be another resistance to the BendDAO protocol.

Race track intensifies

NFT-Fi protocols are emerging one after another, and the homogeneous competition in the lending track is becoming increasingly fierce. At oncecurrent marketFrom the perspective of the competition landscape, the trend of differentiated competition in NFT lending agreements is obvious. Point-to-point agreements, point-to-pool agreements, hybrid agreements, centralized platforms, etc. provide solutions for different users, and the competition is becoming increasingly fierce. For example, the recently launched hybrid lending Sodium has attracted the attention of many NFT users and users outside the graph circle due to its increasing lending rate. JPEG'd and other mainstream lending protocols are constantly updating products, adding pETH lending options, and increasing pledge income to attract more Multi-user. With the increase of new participants in the track and the continuous improvement and optimization of existing protocols, BendDAO will face more intense competition in the future.

High business concentration

image description

Figure: Cumulative ranking of loan amount, source: Dune Analytics (@cgq0123), compiled by Mint Ventures

Clearing Mechanism Risk

BendDAO's liquidation mechanism has been a module that users have discussed improving. During the previous liquidity crisis, due to the downturn of the NFT market, many collaterals entered the liquidation state, but no one participated in the auction, which led to the accumulation of more "bad debts" in the agreement. The increase in lending interest rates stimulated deposits, lenders actively repaid loans, and removed the rule that the liquidation starting price must be greater than 95% of the floor price, which greatly encouraged arbitrageurs to participate in the auction.

In essence, BendDAO's liquidation mechanism uses an auction method to transfer risks from the agreement to bidders. When there are no bidders, the agreement itself bears more bad debt risks. In order to avoid the hot potato of "bad debt" from bringing a liquidity crisis to the agreement again when the market goes down in the future, community members proposed to establish a "non-performing loan investment fund" under the DAO treasury to purchase collateral with a health factor of less than 0.8 at a 20% discount , and then choose an opportunity to sell it for a profit. This proposal essentially transfers the risk of bad debts from the agreement to the treasury sub-fund, and when the auction mechanism fails, the treasury sub-fund bears the final responsibility. At present, the proposal is still in the discussion stage, and the final implementation plan remains to be seen. Its impact on the agreement.

image description

secondary title

Agreement risk

Parametric Model Risk

As a lending agreement, BendDAO does not use third-party agency services like other DeFi lending agreements. The risk assessment of the parameter model mainly relies on its own team's stress testing of the parameters and control of the risk model. There is a lack of NFT-related agreements in the market. Service organizations that conduct risk assessments are the main reason.

After the BendDAO liquidity crisis occurred in August 2022, the community initiated a proposal to modify some key parameters (including liquidation line, auction time, interest rate curve, etc.). The adjustment of parameters helps to clear the backlog of NFTs to be liquidated and alleviate the FUD sentiment in the market, but it also makes it easier for NFT liquidation to occur. The shortened auction time also caused some users to miss the repayment time window, and NFT collateral assets were auctioned off. It can be seen that the change of parameters has a great impact on the experience of using the protocol. On the other hand, the rationality of the parameter setting mainly depends on the model built by the BendDAO team. It does not use a third-party institution to evaluate the risk model like Aave, Compound and other lending agreements, and it also lacks the assessment of the quality of NFT collateral assets (such as being The actual value assessment of stolen NFT assets), for users and veBend holders who can participate in voting parameter modification proposals, the parameter model is a "black box". Robustness is evaluated.

Despite this, third-party service agencies that conduct risk modeling for NFT-related agreements have gradually appeared in the market. Judging from the forum information, the BendDAO team and the Cenit Finance team have already started communicating in relevant aspects.

Mortgage assets "black goods" problem

secondary title

valuation calculation

We use the comparable project valuation method to value BendDAO, using P/F multiples (market value/agreement fees), P/S multiples (market value/protocol revenue) valuations, and P/TVL multiples (market value/total lockup value) Valuation and P/Loan Value multiple (market value/loan amount) valuation method, comparing BendDAO with Aave, Compound, the leading protocols in the DeFi lending field, and Drops, JPEG'd, the NFT lending protocols that have issued coins. Due to the lack of statistical data, no statistics and multiple calculations were made on the agreement fees and income of JPEG'd and Drops.

Judging from the above multiples, we found that the value of BendDAO in the comparison is in the lower valuation range, which is related to the earlier stage of protocol development and the lower overall valuation level of the NFT-Fi track. The potential driving force for future upward valuation lies more in the fact that more and more entrepreneurial projects, new users, and funds enter NFT. NFT has more application scenarios and has become a value carrier for more assets. Only when NFT assets continue to expand and expand, can NFT-Fi, as an NFT financial service, maintain long-term business growth, and BendDAO, as one of the leaders in the NFT-Fi field, can expect its protocol value to be further discovered by the market.

References and Acknowledgments

reference content

《In-depth analysis of NFTFi——from the current market to see the future development of NFTFi》- Cobo Ventures

"BendDAO Investment Research Report" – First Class Position Report

《Half-Year Report 2022》– Binance Research

《State of Crypto 2022》– A16Z

《Road to Financialization of NFTs》– Ishanee Nagpurkar at IOSG

《Digital Asset 2022 Outlook》– The Block Research

"NFT Alchemy: Pricing 101"– IOSG

@alexgedevani's tidy Tweet of 250 NFT projects – Twitter@alexgedevani

@0xminion Tweet about NFT-Fi Ecosystem – Twitter@0xminion

"Discussion on the Loan Agreement Model Using NFT as Collateral"– The SeeDAO

BendDAO official website、BendDAO Documentationand other official information

Dune Analytics (@developerbend)

Dialogue with the co-founder of BendDAO: Our review and reflection on the liquidity crisis– chain catcher

Thanks to the BendDAO team for correcting the relevant facts and exchanging opinions in the industry. Thanks to @cqg0123 for setting up the Dune Analytics Kanban about BendDAO numbers and providing a lot of data support for the writing of this research report!