This article comes fromTwitter, original author: Jason Choi

Odaily Translator |

Odaily Translator |

In response to an SBF "washing ground" published by The New York Times today, former Spartan Group partner and senior encryption practitioner Jason Choi shared everything he knew as a witness with dozens of tweets on social media , he said that he could not accept the distorted reports of the New York Times. He knew SBF before the birth of FTX and witnessed the rise and fall of FTX, so he hoped to tell everyone what happened.

This article was translated by Odaily:

For the story of Alameda and FTX, in short, it can be summed up in one sentence: SBF is very gambling. Virtually every major decision they make has to do with using more leverage — deceptive fundraising, financial engineering, and ultimately, outright fraud.

From November 2018 to January 2019, Alameda Research, a then-small hedge fund, began raising funds from investors, promising "high returns without risk." Presumably (as far as I know) they have $5M in equity but are trying to borrow $200M at 15% APR to engage in future market making.

July 2019 is the time for the launch of the FTX plan. In August 2019, they announced the completion of a $8 million seed round of financing, with several funds participating. (Odaily Note: This round of financing is participated by Proof of Capital, Consensus Lab, FBG, Galois Capita, etc.), in an investor memo, "Alameda & FTX" is marked as risky, because SBF has to take into account both company. Sources told me that FTX was launched because Alameda was difficult to finance at that time, so FTX may just be a "by-product" to facilitate Alameda's financing.

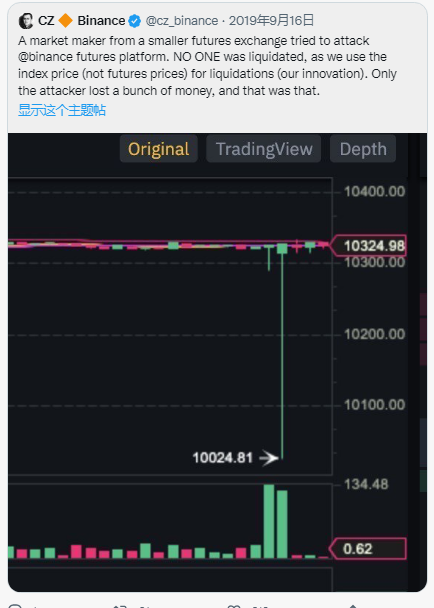

Early on, it was pretty much an "open secret" that Alameda had a FTX-specific API key that allowed access to transactions faster than other users. Around September 2019, Alameda allegedly tried to attack the Binance futures platform, but was hit hard, which may have been the beginning of the feud between Binance and FTX.

As FTX continued to grow, their appetite for capital grew, and during the “DeFi boom,” they created Serum, a decentralized exchange on the Solana chain. After that, FTX began to participate in multiple Serum/Solana ecological projects, such as FIDA, MAPS, Oxygen Protocol, etc., and these projects launched tokens in a short period of time.

According to sources, those who operate Serum are actually FTX employees. Although some Serum ecosystem projects are advertised as third-party projects, they are actually incubated/operated internally.

Why is FTX doing this? In fact, at that time (winter 2020) something changed within Alameda/FTX, and Alameda abandoned the Delta neutral strategy as their advantage was eroded and had to start expanding exposure with a lot of leverage. Tokenized assets such as Serum are likely to be used as collateral to achieve the aforementioned leverage, and liquidity transactions and prices can easily be manipulated by Alameda and FTX and used to fill their balance sheets.

As an example - let's say Alameda funds a semi-incubating project with $2M at a "fully diluted valuation" (token price * total number of tokens to be issued) of $10M. FTX then lists the token on its exchange, but only puts 1% of the total tokens on the market, Alameda can prop up the price with a few million dollars to create a "fake" fully diluted valuation, say 1 billion Dollar. All of a sudden, $2 million on *paper* becomes $200 million.

By doing this, Alameda creates the illusion of a large and diversified balance sheet that they can then borrow to fund their "directed bets." In fact, someone had already discovered this problem at that time, but they were bullied and threatened, and SBF himself kept silent about it.

All told, Alameda quickly created hundreds of millions of dollars in false liquidity and equity value, as the outflowing FTX balance sheet shows, but even that pales in comparison to FTT.

Serum and FTT may be the only tokens that can be used as collateral on FTX, which is likely the reason for the multi-billion dollar hole in Alameda/FTX: Alameda pledged to borrow money against illiquid collateral to finance, as With the market down this year, those deposits have been chased, resulting in FTX user funds being stolen (or used by them to fight fires).

This means that FTX's liquid reserve amount may be lower than user deposits. Of course, if there is enough time, this loophole is likely to be controllable, but CZ disclosed this fact, which in turn triggered a run on FTX.

With this all brewing behind the scenes, SBF is aggressively pushing for mainstream legitimacy and building a regulatory moat... ensuring FTX and FTT stake values can be treated differently. In the process, SBF had to step up publicity and promotion efforts, so we saw that FTX announced that it would name the NBA Miami Heat stadium with US$135 million, and SBF also became the second largest donor of US President Biden, and even wanted to participate In Elon Musk's acquisition of Twitter.

When the time came to January 2022, several rounds of financing transactions pushed the valuation of FTX to $32 billion, attracting participation from Sequoia Capital, Temasek, and Paradigm. In this context, SBF is also trying to promote policy transformation. Don't forget that SBF's parents are both Stanford law professors and have close ties with the Democratic Party of the United States.

In October 2022, FTX proposed a regulatory draft "Digital Asset Industry Standard", if the draft is passed, FTX will benefit a lot. (It should be noted that Sam Trabucco, co-CEO of Alameda, left suddenly in August 2022. At that time, he did not receive much attention, but the water behind it was actually very deep.)

A month later, FTX bid for Voyage, why they did this, in fact, it is likely to rescue a large number of people who hold FTT to prevent them from dumping FTT.

At that time, SBF was still very aggressive, and even mocked that he could go in and out of Washington at will, but Zhao Changpeng could not, but he later deleted related tweets.

Soon, Coindesk published an article about Alameda's balance sheet, noting that a significant portion of its $14.6 billion in assets was issued by the FTX team itself — the sharks smell blood.

On November 6, 2022, Changpeng Zhao announced the liquidation of all FTT assets held by Binance, which were worth as much as $584 million at the time. Ironically, Caroline, the remaining co-CEO of Alameda at the time, announced that she would buy FTT from Changpeng Zhao at a price of $22. The market reacted in panic. As of November 7, 2022, according to Nansen data, approximately $450 million worth of stablecoins have left FTX within 7 days - and a run has begun.

Shortly after, SBF publicly claimed that FTX does not invest client assets and has sufficient funds to cover all withdrawals, but he later deleted the tweet. However, while withdrawals were frozen, Alameda was still able to withdraw funds from the exchange. When asked why, Caroline quibbled that it was FTX US, which was self-defeating again, but made people realize that the parent company FTX must have liquidity problems.

Shortly after, FTX appeared to resume withdrawals (Odaily note: a small outflow of assets was detected from its wallet at the time), but there was speculation that insiders were cashing out and mixing their withdrawals with other Bahamian users. On November 11, 2022, Justin Sun announced the launch of a cooperative arrangement that would allow some users of FTX to withdraw funds on TRON through assets related to the project.

so far,so far,

FTX officials and SBF never answered questions about Bahamian withdrawals and whether insiders cashed out.

Withdrawals were finally suspended after the bankruptcy declaration, yet hundreds of millions have already flowed out of FTX.

On November 14, 2022, after a brief silence, SBF began tweeting "Letter Tweets" (What Happened) to taunt the public. Crypto investor @ercwl revealed that SBF is likely using these tweets to fool bots designed to detect deleted tweets, but this is unconfirmed and unlikely.

According to internal sources from FTX, only 4-5 senior managers know the real situation of FTX, these people are: SBF, Caroline Ellison, Gary Wang, Ramnik Arora, Constance Wang, Nishad Singh, and ordinary employees are almost completely unaware Affection.