Author: Peter

Evolution is the most powerful force in the universe, the only thing that is eternal, and the driving force behind everything. ——Ray Dalio of Bridgewater Fund

As time goes on, evolution is the main theme of human beings. In the past, changes in the environment were the main cause of evolution.

Advances in technology are now playing an increasingly important role. The advancement of technology can allow quantum mechanics to impact classical theories, complex economics to subvert traditional economics, and digital gold BTC to shake the belief in physical gold for thousands of years. There is every reason to believe that the web 3 revolution driven by blockchain technology is a major evolutionary journey that will subvert many inherent models and concepts, but today we mainly discuss the impact of web 3 on value investing.

Looking back at history will allow us to better find our coordinates today. Therefore, to discuss the impact of technology on value investing, we still start with the change of technology.

1. Paradigm shift of technology

The term "paradigm shift" has been misused now, but if you trace the origin of the term, you will find that there should be very few innovations worthy of the term. Paradigm shift first appeared in the book "The Structure of Scientific Revolutions", which describes the huge changes in the basic theoretical system that can trigger scientific revolutions. What he describes is the long-term and far-reaching changes brought about by the upgrading of basic science and technology.

Since the industrial revolution, the basic technological revolution every few decades has dominated value creation, and has also profoundly affected all aspects of society, such as politics, economy, and lifestyle. This is a very typical paradigm shift:

1) Started around 1770: steam engine + textile machinery;

2) Started around 1830: steam engine + railway;

3) Started around 1875: electricity + steel;

4) Started around 1910: oil + automobile;

5) Started around 1970: communication + computer;

6) Started around 2000: Chip + Internet;

In the process of every major technological change, those industrial groups derived from the core technology will become the main body of value creation at that time. Just look at these giants with the highest market capitalization in our technology cycle: Apple, Google, Amazon, Ali, Tencent..., without exception, are built on chips and Internet technology.

2. Evolution of value investing

secondary title

1. The past (before the Internet matured)

Before the Internet became mainstream, the process of value creation was still in the category of machinery. From the perspective of value investment, the moat of an enterprise or the driving factors of value growth are mainly: brand effect and scale effect.

brand effect

Brand effect is usually seen in consumer goods, basically to meet the needs of different levels of people (Maslow model), brand effect can play different roles: convenience (reduce search costs), safety, differentiation (show different personalities), Affective attributes (social, self-satisfaction), addictiveness, etc.

A strong brand can bring very high customer stickiness, which can generate continuous growth in cash flow. This type of enterprise is very favored by Buffett-style value investment. Open Buffett's investment list, and you will see a bunch of investment targets based on brand effects: Coca-Cola, McDonald's, See's Candy, DQ... From the final results, we also know how much brand effect can contribute to the return on investment.

Implications for web 3:

If you understand the different levels of brand connotation, then you can easily distinguish the combination of NFT and brand that many people currently admire. Most brands and NFT will not collide with sparks, only those that can bring differentiation and emotion Brands with attributes (social) are likely to have a good interaction with NFT.

scale effect

Before the Internet, another driver of value creation was scale. Different from the brand effect, the scale effect is often brought about by technological progress. After the technology is continuously upgraded, the marginal cost will decrease after the efficiency is improved. We can personally feel that the best examples are cars, TVs, and air conditioners, and the product performance is getting better and better. But the price keeps getting lower and lower until it is cheaply owned by everyone.

Compared with brand effect, scale effect has higher technical content and greater social value (improving people's living standards), but unfortunately, it is not as important as brand effect in terms of investment. Because technology will continue to be upgraded iteratively, it is often difficult for a leading company to maintain its leading edge. A failure of technology upgrade may destroy the past success. From Huawei's road to the top, we can see that many giants have died. In the war of technological upgrading. Therefore, there is a phenomenon that is counterintuitive to ordinary people. Leading technology cannot create a long-term moat. This is why Buffett hardly invests in technology stocks.

Implications for web 3:

secondary title

2. Now (after the Internet matures)

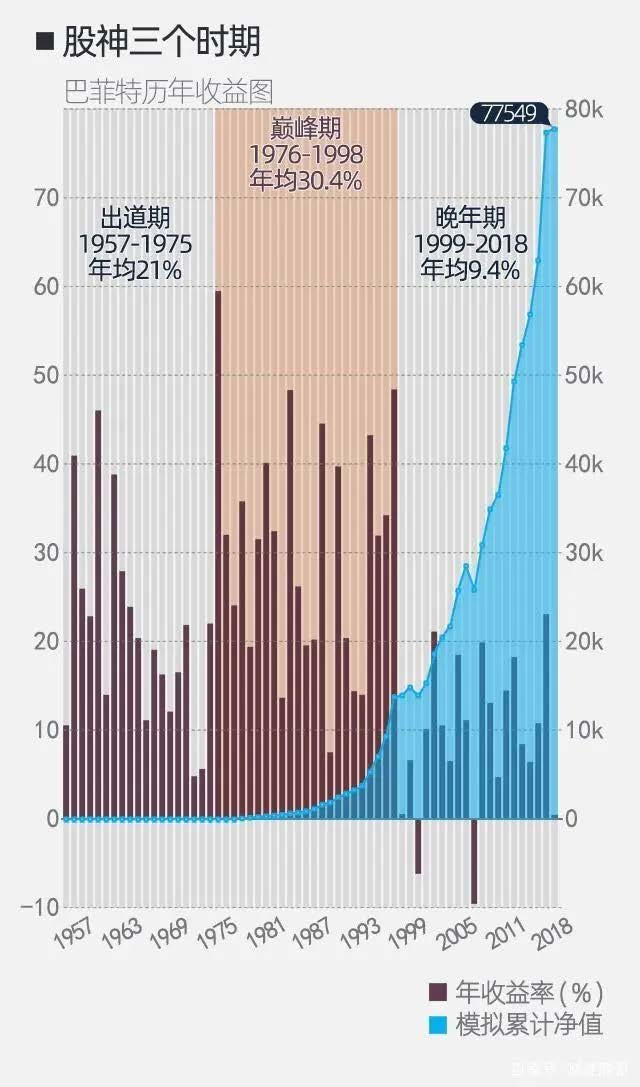

Since the Internet matured around 2000, business value creation has entered a new paradigm: network effects have become dominant. The vast majority of market capitalization growth over the past 20 years has come from technology companies that have 1 or more network effects. The network effect brought about by technology leadership has become the strongest moat, surpassing the brand effect. Buffett, who does not invest in technology stocks, has also begun to underperform the S&P 500 index (the late period in the figure below), and even in recent years Buffett has expressed interest in Apple. Personally, I think it is more out of the recognition of the Apple brand, and it is still in the category of brand effect.

network effect

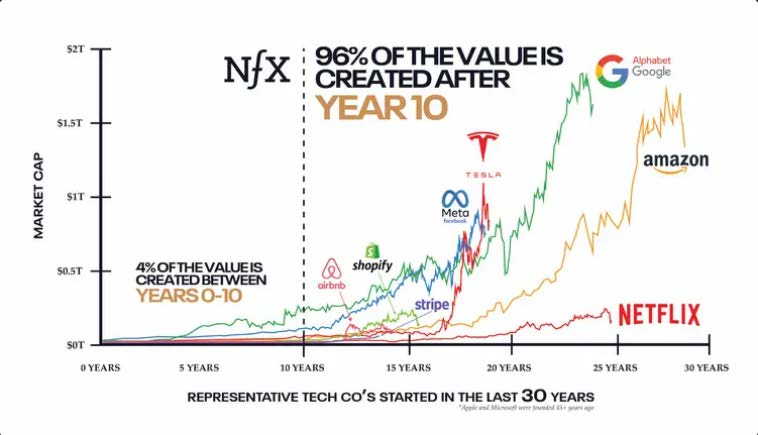

image description

SourceNFX.com

As shown in the figure above, before the critical point (10 years before its establishment), only 4% of the value of the entire network was created during this period, and after breaking through the critical point, 96% of the value of the entire network was created.

text

When will the critical point of web 3 for the entire industry come?

In the period dominated by brand effect and scale effect, cash flow has become a very important indicator in value investment. For this type of investment method, there is a sentence that highly summarizes "free cash flow growth driven by high ROE and high ROIC".

But in the era of network effects, cash flow is no longer the most important indicator, and network nodes, links, clusters, etc. have become more important indicators.

secondary title

3. The Dilemma of Network Effects

In the past 20 years, the Internet has greatly improved social efficiency, brought convenience to countless people, and created huge wealth at the same time. However, with the growth of major network users, it seems that the ceiling of users has been reached. Facebook's global users have reached 3 billion. It is obviously impossible to achieve rapid growth on such a large basis.

For society, the "first-mover advantage, winner-take-all" brought about by the network effect exponential growth model has become the root cause of many social problems today.

Involve

As mentioned above, once the network effect crosses the critical point, the growth curve will be very steep, and there will be a huge first-mover advantage. If you are a few months ahead, the scale of your business may be several times ahead. eBay entered the Japanese e-commerce market only two months later than Yahoo. The time gap between these two months has become a hurdle that eBay will never be able to overcome, and finally surrendered the Japanese market.

At the same time, the phenomenon of the network effect that the winner takes all or eats more will make the market share of the ultimate leader far ahead or even complete monopoly. The most typical example is the monopoly position of WeChat in social networks. Such a huge market is monopolized by one company. , There is almost no living space for the second place.

Therefore, under the blessing of "first-mover advantage" and "winner takes all", players in the Internet industry can only pursue the ultimate speed and try their best to make themselves the leader. This kind of fierce competition is especially obvious in China. 996 has become the standard in the Internet industry.

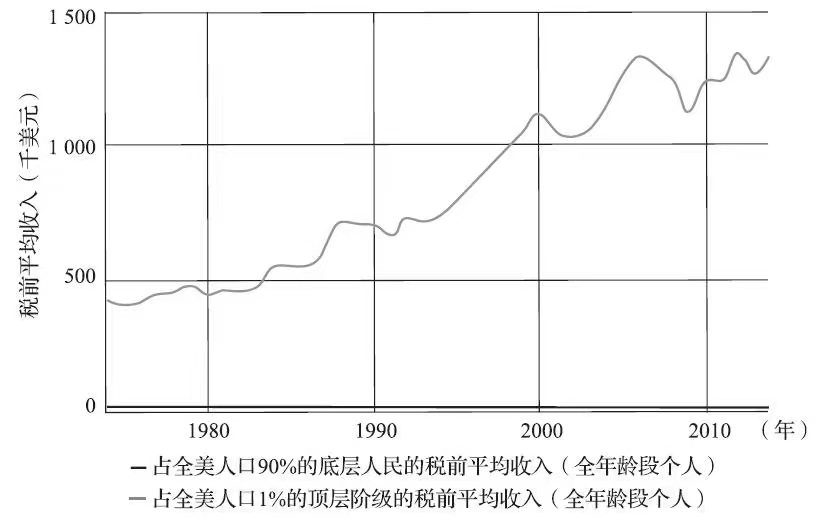

The gap between rich and poor

The winner-take-all network effect allows the leaders to capture the vast majority of the industry's value, which is only shared by a few stakeholders. At the same time, the rapidly growing network economy has given birth to an increasingly radical financial system, and the currency is going through the entire cycle faster and faster from the central bank to venture capital institutions and then to the capital market.

SPAC allows the shell company to be listed first and then acquire the entity, which accelerates the cash-out of start-ups.

image description

secondary title

Future Paradigm: AI + Blockchain

The gap between rich and poor brought about by network effects will become more serious in the case of economic slowdown. There is a very apt analogy. If a tunnel has two lanes, fast and slow, when the overall speed of the tunnel is okay, the gap in the perception of the slow lane (the poor) is not so obvious, but when the overall speed of the tunnel drops, the slow lane (the poor) The perceived gap will become more obvious, and the contradictions between the two lanes (classes) will become increasingly irreconcilable.

Perhaps many people's attention is attracted by more eye-catching issues such as epidemics, wars, and racial conflicts, but the gap between the rich and the poor is the biggest disease of this era. If the above are severe outbreaks, then the gap between the rich and the poor is cancer, which is slow but the most difficult to cure.

first level title

4. web 3: ecological effect

secondary title

Ecological Effect VS Network Effect

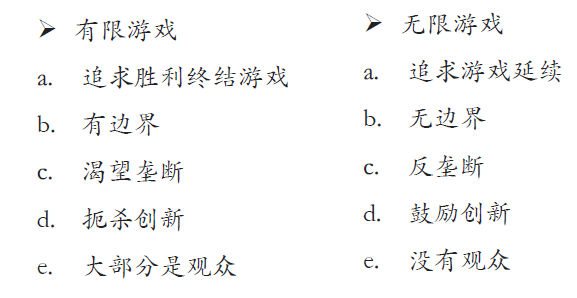

Although the network effect has been extremely powerful in the past 20 years and has dominated value creation, it is playing a limited game. It naturally has a strong desire for monopoly and pursues becoming the king of the game, thus ending the game. Based on the ecological effect generated by web 3, the reason why it can surpass the network effect in the future is that it is playing an infinite game. What the ecological effect pursues is to allow the ecological prosperity and the game to continue, not to end the game.

The characteristics of infinite games: no boundaries, encourage innovation, no audience, everyone is a participant. These features will promote web 3 to transform more scenarios, create a more prosperous ecology, and allow more people to participate in value sharing on the basis of the past Internet.

secondary title

BTC Network Effects

BTC, the original species in the Crypto world, has a very strong network effect: the network effect of consensus. The consensus of one person is insignificant, and the consensus of a group of people becomes belief. The consensus network effect is like a desert. A few sands are easily blown away by the wind, but when countless sands gather into a desert, no amount of wind can shake it. This is why the BTC moat is so strong.

secondary title

Ecological effects of ETH

The best case for the ecological effect of web 3 is ETH. If we analyze the ecological effect of ETH with the framework of infinite games:

a) Boundless, all project owners can participate in the ETH ecology;

b) Encourage innovation. Every innovation outbreak of the application will bring a substantial increase in the value of ETH, and even ETH is absorbing innovative technologies from other public chains to complete its own upgrade;

c) Without an audience, everyone can participate in the construction of the ETH ecosystem, not just users.

If the ecological effect of ETH is analyzed with the frame class of dissipative structure:

a) An open system that continuously exchanges assets, energy, and information with the outside world. Defi exchanges financial assets, NFT represented by PFP exchanges social assets, DAO allows outsiders to come in to do work to exchange energy, and oracles exchange information. The more assets, energy, and information interaction scenarios that can be created, the stronger the ecosystem.

b) Positive feedback. The application ecology grows, the price of ETH currency rises, and more and more stakeholders participate in the construction. The security and performance of ETH continue to improve, which can support more application ecology.

first level title

V. Conclusion

Human society is always overcoming difficulties one by one, thus entering the next cycle of prosperity. When the current cycle has come to an end, and all problems can no longer be solved by the original methods (money release, fiscal stimulus), subversive changes must be carried out. The development paradigm dominated by AI and blockchain is not the choice of a person or an organization, but a necessity of the times.

Just as Ren Zhengfei said, "Don't be opportunistic in front of the big era." Faced with such a historical opportunity, any timing is short-sighted and speculative. Only early investment and embrace of construction is the right choice.

Buffett-style traditional value investing has formed a very complete system after decades of research by countless people, and many people have a deep understanding of it, but the downside is that it is difficult for you to earn the recognition Money is more about the game of information and trading psychology; only a few people have thoroughly studied the modern value investment of network effects, but at least you can find a formed framework.

During the development of the web 3 industry, the ecological effect will become the most important moat in value investing. Everything is still in a state of chaos, and more people with aspirations are still waiting to dig and build.

This article is for research and analysis only, not investment advice. Respect originality, please contact MarsDAO if you need to reprint.