Original Author: Peter, Anne

first level title

1. Background introduction

secondary title

Curve ecology

As we all know, Curve is undoubtedly the king of the DEX track today, and there are many factors that can make it stand out from many competitors:

Less slippage, higher depth of flow

Less fees, less impermanent loss

Unique and innovative economic model

The most critical factor may be its unique ve economic model. This economic model allows people participating in the Curve ecology to obtain regular interest and transaction fee income, and at the same time use the voting rights of CRV tokens to obtain bribery income or give Own projects attract more liquidity, so a Curve War for CRV voting rights begins.

A new phase of the Curve war

image description

Data source: Defi war

However, Convex's victory does not mean that the Curve War is over, but has entered a new stage: a new war for Convex's right to speak (token CVX) and control of Curve has begun. The two protagonists of today's article were born under the situation of this new war.

AladdinDAO

In addition to the Curve ecology, another topic that cannot be avoided by the two projects today is AladdinDAO.

Since the summer of 2020, countless dazzling projects have emerged on the Defi track. How to choose high-quality targets among these uneven projects has become a very difficult task. AladdinDAO was born under this background. They are committed to using DAO to recruit Defi experts, screen high-quality investment projects, and help community members get rich returns.

The founding members of AladdinDAO are composed of heavyweight crypto investment institutions and DeFi experts, including experts from well-known institutions such as Polychain, Digital Currency, Multicoin, CMS, and Dragonfly. Under their call, AladdinDAO formed a team of dozens of Defi masters. In the past period of time, it has provided DAO community members with high-quality investment management services, helping ordinary users to enjoy the high value of Defi income.

first level title

2. Concentrator

As a tool for income aggregation and automatic reinvestment, Concentrator aims to maximize Convex APY and obtain income in the optimal DEFI token.

operating mechanism

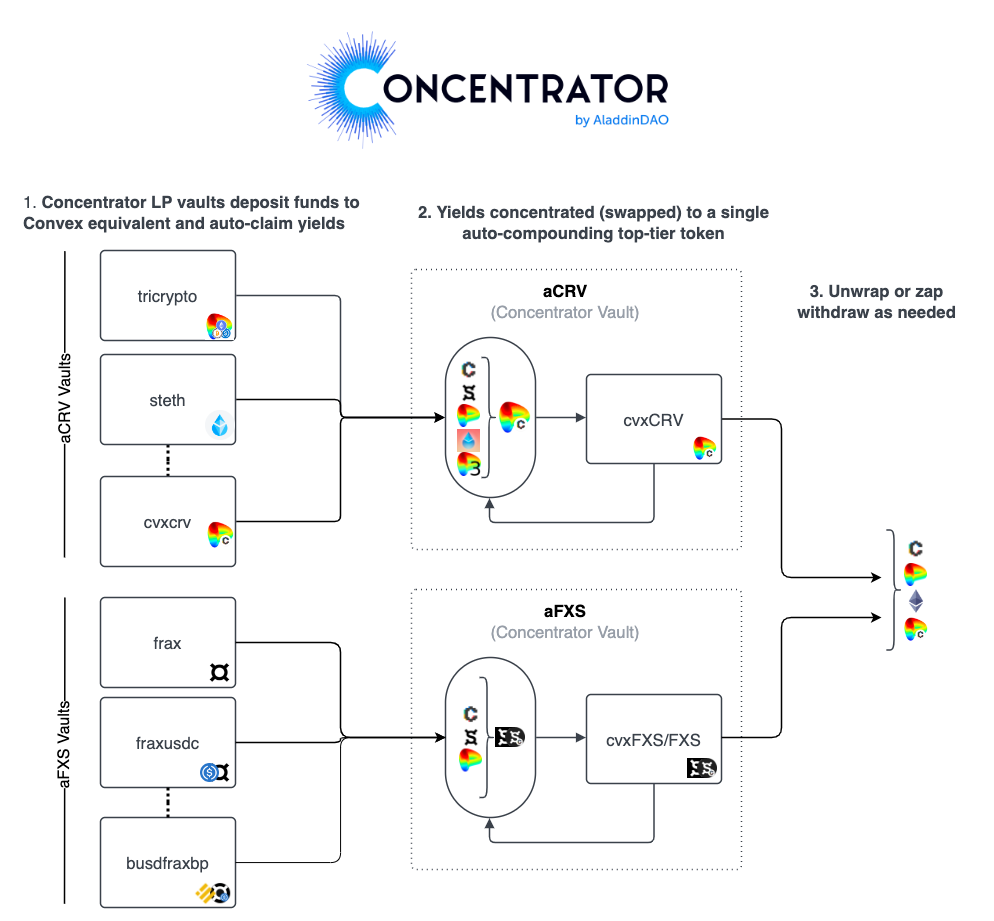

Through the above description, we know that the key words of Concentrator are: income enhancement, automatic reinvestment.

Its implementation path is mainly as follows:

1. Users deposit their Curve LP assets into the strategy they choose on the Concentrator, and the platform will automatically deposit these assets into the Concentrator Vault, after which they can receive regular income;

2. According to the strategy you choose, the income obtained will be automatically converted into cvxCRV or cvxFXS, and enter the platform reinvestment aggregator to aggregate into aCRV or aFXS, where they are pledged to Convex to earn income.

So this process is a process of automatically reinvesting income and earning more income.

3. Users can unstake at any time and convert their assets on the platform into other blue-chip assets.

- Innovation and Advantage

The features of Concentrator income aggregation and automatic reinvestment make it easy to find PMF opportunities in the market:

1. After the bear market and various Defi Ponzi storms, the market demand for sustainable and stable income is increasing. After the epic collapse of Terra and many other DeFi Ponzi schemes in the first half of 2022, the market is looking for platforms that can really provide solid returns without Ponzi incentives, and Concentrator will undoubtedly be a good choice.

2. Provide a simple opportunity for Defi newcomers to obtain high returns. With just one operation, the platform can automatically help you capture the high returns of DeFi, which is just needed for a large number of newbies.

3. Help DAO manage treasury funds, eliminating the complicated process of multi-signature. The function of automatic reinvestment is also a boon for DAO. On the one hand, it saves a lot of gas fees, and also eliminates the multi-signature process for each treasury fund expenditure.

Token Economic Model

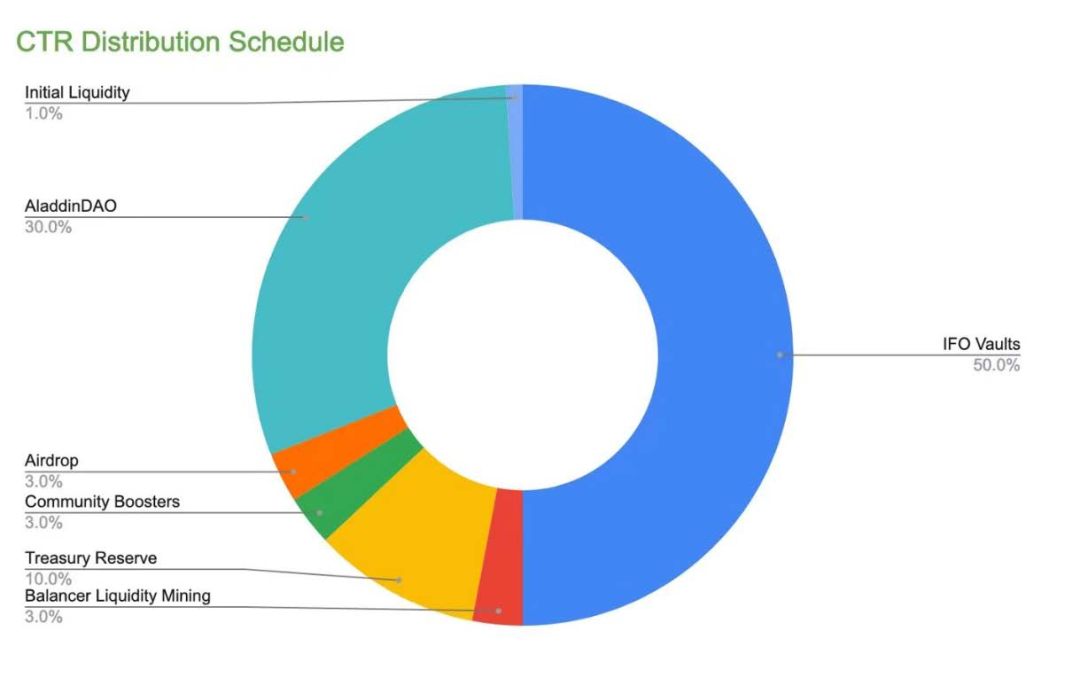

Concentrator project token CTR, the total supply (5 million) is distributed as follows:

50% to LPs participating in IFO

30% will be allocated to Aladdin DAO (distributed to the community through the DAO treasury, this part will be locked for the longest period immediately)

10% stays in state treasury

3% is used for airdrops, 3% for community contributors, 3% for Balancer liquidity mining, and 1% for initial liquidity rewards.

CTR has a ve economic model similar to Curve, locking CTR (up to 4 years) to obtain veCTR with voting rights:

Allow users to participate in the governance of the agreement through a time-weighted voting mechanism, including voting to determine the distribution of 50% of platform revenue;

Facilitate various liquidity pools through a value capture mechanism with additional rewards;

As a locking mechanism for LP to earn value over time; in addition, in the process of income extraction, Concentrator will charge a standard rate of 10% for user income (if there is no income, it will not be charged), and the fee will be charged to CTR pledgers and Concentrator Treasury.

first level title

3. Clever

What is Clever? On the AladdinDAO official website, there is a high-level summary: CLever provides CVX holders with a continuous and automated way to earn bribes and rewards, and allows users to withdraw their future governance benefits in advance.

How does a magical protocol that provides such convenient services and improves the efficiency of capital use do it?

operating mechanism

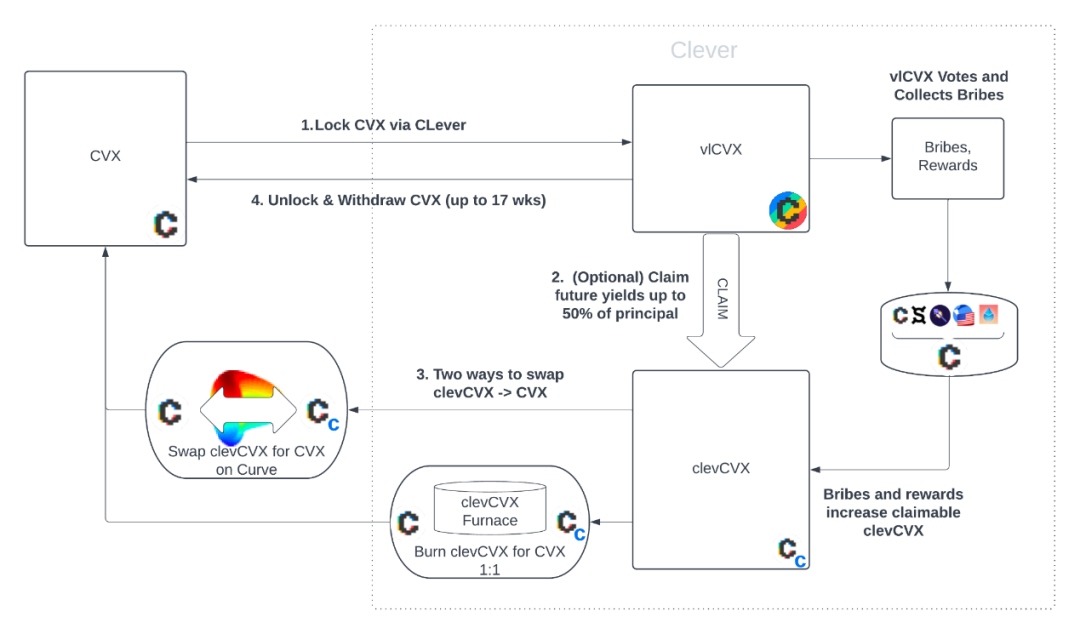

Clever ensures the realization of the previous functions through the following series of settings:

1. Users deposit their CVX into Convex through Clever to participate in governance;

2. Withdraw future income up to 50% of the principal (in the form of clevCVX);

3. The clevCVX extracted by the user can be converted into CVX in two ways: exchange through the Curve liquidity pool, or burn clevCVX in the clevCVX furnace to generate CVX;

4. The generated CVX can be re-deposited into Convex through Clever as further collateral to obtain more bribes and rewards; the future income clevCVX withdrawn in advance is essentially a loan, and this part of the loan is generated by depositing in Convex. Rewards are automatically repaid;

Innovation and Advantage

As mentioned earlier, Clever’s early withdrawal of future income is still a loan in essence, that is, mortgaged CVX and lent clevCVX, but because of the unique design, Clever’s model still has many advantages and highlights compared with general over-collateralized loans:

1. The utilization rate of funds has been improved, which is mainly reflected in two aspects: one is that the mortgaged CVX is still generating bribes and rewards, and the other is that the loaned clevCVX can be further mortgaged, and more assets can be lent to obtain more bribes and rewards. thereby maximizing leverage.

2. Clever does not use the oracle machine, thus avoiding the risk of liquidation, because under this mechanism, there is no collapse in the price of collateral or being used to affect the borrowed assets.

3. Stable cost of capital, Clever's charging model is to borrow assets with zero interest, but charge 20% of the customer's income as a fee (these fees are between the liquidity providers in the clevCVX/CVX pool and the (final) revenue sharing system distribution). In a typical over-collateralized loan, the loan interest rate may fluctuate greatly with changes in liquidity, and Clever avoids this drawback well.

4. Great convenience, users can enjoy the automatic re-investment function when using Clever, without having to re-operate every cycle.

Token Economic Model

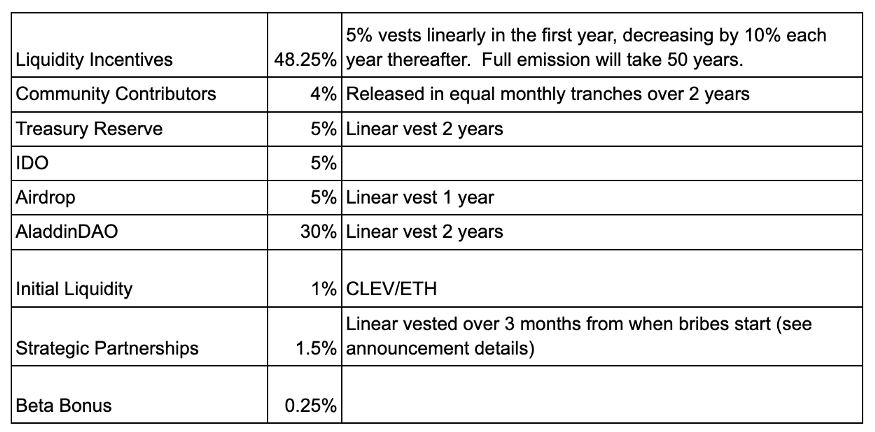

The token of the Clever project is CLEV, with a total of 2 million pieces. The progress of distribution and emission is roughly as follows:

Liquidity reward 48.25%, discharge 5% in the first year, and reduce by 10% every year thereafter, and it will take 50 years to complete all discharges;

Community contributors will be rewarded with 4%, treasury reserves with 5%, both of which will be discharged within the next 2 years;

IDO5% will be launched on October 5, 2022. Users can purchase it with CVX1:1. The scheduled release period is 7 days, but the actual situation is that it will be sold out as soon as it goes online;

Airdrop 5%, emission in the next 1 year;

AladdinDAO30%, linear emission in the next two years;

Others total 2.75%;

From the above emission arrangement, we can see the sincerity of the project party. Before IDO, there is no project party allocation, no pre-sale and VC's early participation, and all users will participate in a fair way.

At the same time, CLEV also draws on Curve's ve model. Users who lock CLEV can enjoy governance voting and protocol revenue sharing (at least 75% of the protocol revenue will be distributed to the locker). The longer the lock-up time (up to 4 years), the more benefits. The history of Curve has shown us that the ve model can stabilize the currency price very well, and there is almost no selling pressure in the market. At the same time, it is still unknown whether there will be competition for CLEV resources in the future.

combination

The Lego magic of Defi has attracted continuous innovation and combination. The Concentrator and Clever from the same source naturally also have room for operation to combine and magnify the benefits:

CLever can provide leveraged income opportunities for Concentrator's aCRV tokens;

Concentrator can use CVX-clevCVX as an aggregate target to put LP income, allowing users to choose to keep CVX to create compound interest instead of selling;

first level title

4. Outlook

As mentioned earlier, Curve War has entered a new stage---competition for Convex (CVX) resources and discourse power. Unlike Convex, which occupies the absolute leadership of CRV, there has not yet been an absolute leader in the battle for CVX .

appendix:

This article is for research and analysis only, not investment advice. Respect originality, please contact MarsDAO if you need to reprint.

appendix:

AladdinDAO official website

https://docs.aladdin.club/

Concentrator project official website

https://concentrator.aladdin.club/#/vault

Clever project official website

https://clever.aladdin.club/#/clever