Original author: angelilu, Foresight News

Original author: angelilu, Foresight News

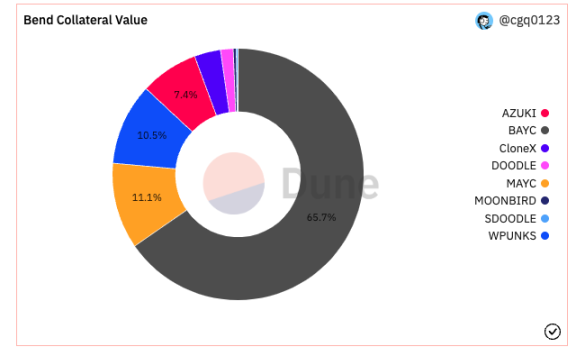

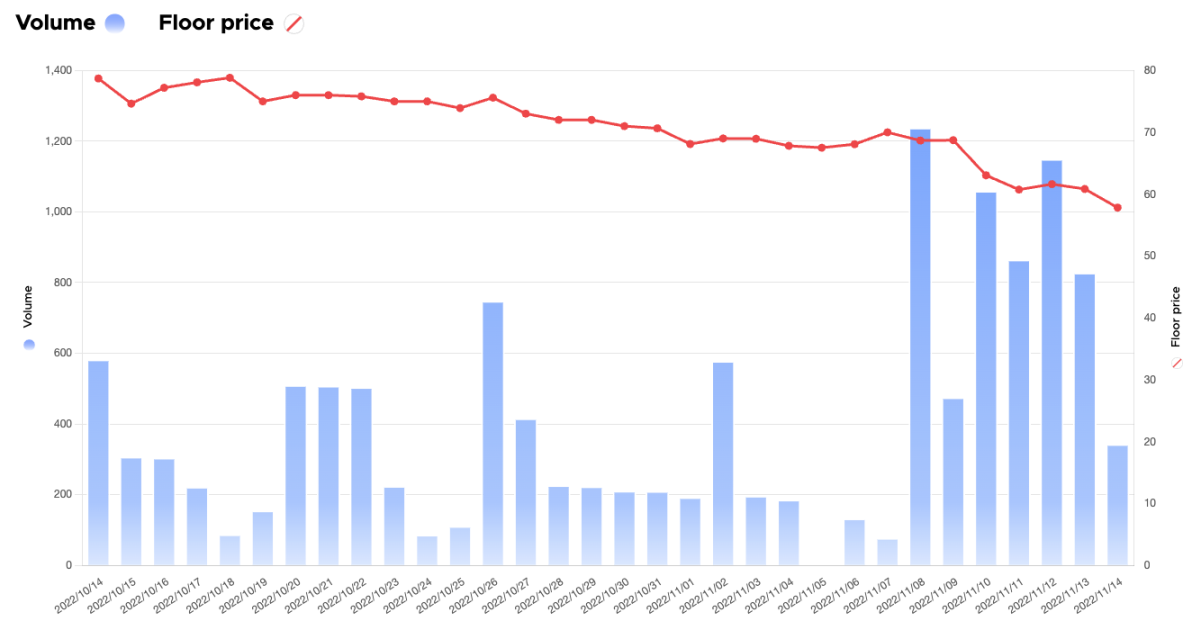

The impact of the FTX thunderstorm on the market has spread from major exchanges to the NFT market. According to OpenSea data, the floor price of the blue-chip NFT series Bored Ape Yacht Club (BAYC) has fallen below 50 ETH. It has fallen 70.1% from the historical high of 153.7 ETH in April this year, setting a new low since 2022.The fall in the floor price of BAYC is closely related to the liquidation event of BendDAO, an NFT mortgage lending platform. The NFT series with the highest collateral value in BendDAO is BAYC. Currently, BAYC accounts forTotal Collateral Value

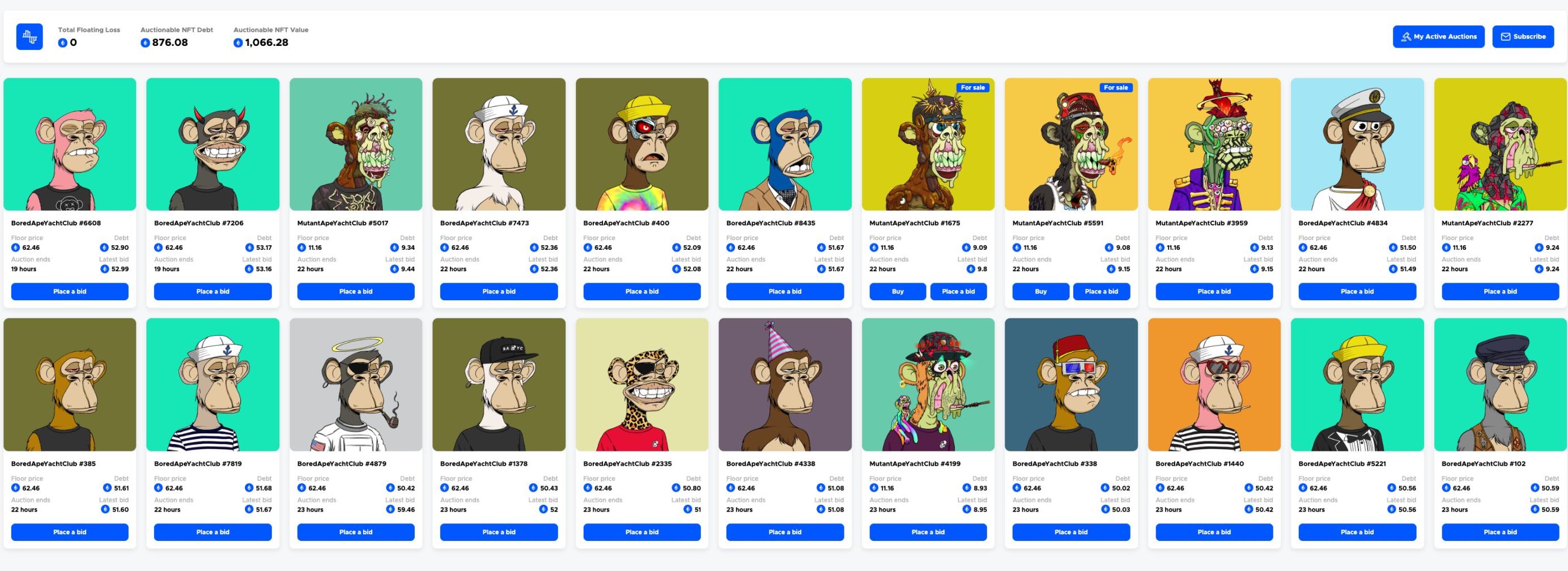

In BendDAO, the direct impact of the sharp drop in the floor price of BAYC is that a large number of mortgaged BAYC are facing liquidation. As early as November 10, the floor price of BAYC fell to 57.89 ETH, and there were already 16 BAYC NFTs in the BendDAO liquidation auction. as much.

image description

The source of the picture is a Twitter user, and the part shown in the picture includes MAYC

Since BendDAO's floor price calculation method is based on the external oracle feed price, which is slightly different from OpenSea, the floor price of BAYC in BendDAO is 51.02 ETH as of the date of publication. According to BendDAO's auction history, from November 10 to now, 40 BAYC have entered or are in liquidation auction.

Introduction to BendDAO Liquidation Mechanism

The emergence of BendDAO was originally an innovative use case of NFTFi, which aims to solve the liquidity problem during NFT transactions. This article will focus on two mechanisms related to BendDAO and its blue-chip NFT lending.

The first is the "point-to-pool" mortgage lending method, and the second is the liquidation mechanism of its NFT collateral.

Its peer-to-pool lending method mainly draws on the mortgage lending model of DeFi tokens in Aave, but it uses blue-chip NFT as collateral. Among them, blue-chip NFT holders can borrow ETH at an amount of no more than 40% of the value of the NFT after mortgaging their NFT to the agreement, and this part of ETH is put into the agreement reserve pool by the ETH holder. ETH holders also receive lending income from this.

BendDAO’s original liquidation method is to initiate liquidation of mortgaged assets when its health coefficient is less than 1. The mortgaged NFT will have a 48-hour liquidation protection time. If the borrower fails to repay the arrears in time within 48 hours, the highest bidder in the auction will Will become the new holder, and the NFT bidding requirement in the previous liquidation auction must be higher than 95% of the floor price, and the bidder's quotation amount needs to be locked in the entire auction.

The formula for calculating the health factor is: health factor = (floor price * liquidation threshold) / (loan + interest).

In this formula, the liquidation threshold is stipulated by the agreement. Before the run event occurred in August, the liquidation threshold of BendDAO was 90%.

BendDAO August Run Event

In August of this year, BendDAO provided lending services to 7 blue-chip NFT series including BAYC, CryptoPunks, MAYC, Doodles, Space Doodles, and CloneX (currently supports 8 blue-chip NFT series, and newly supports Moonbirds). Similar to the current situation, BAYC The value of collateral in BendDAO accounts for 68.8%. With the NFT market deserted, BAYC#533, the first in the series to be liquidated and auctioned on BendDAO, kicked off the crisis.

After the crisis, BendDAO made adjustments to the liquidation mechanism, aproposalproposal

The general will gradually reduce the liquidation threshold from 90% to 70%, adjust the auction cycle from 48 hours to 4 hours, and cancel the restriction that "the first bid must be higher than 95% of the floor price", and adjust the base interest rate to 20%. Then there were two proposals to vote on the specific parameters. After the adjustment, BendDAO’s capital pool reserves were increased. The current liquidation threshold is 80%, and the auction cycle is 24 hours.

BendDAO currently has 28 BAYC entered into the liquidation auctionBAYC currently staked in BendDAOThere are 329

, according to the health factor calculation formula provided above, the revised liquidation threshold and the floor price of 51.02 ETH:1 = (51.02*80%)/(loan + interest), that is, as long as the loan amount of the borrower is greater than 40.816 ETH, it will face liquidation, currently in BendDAOliquidation auction

BAYC has reached 28:

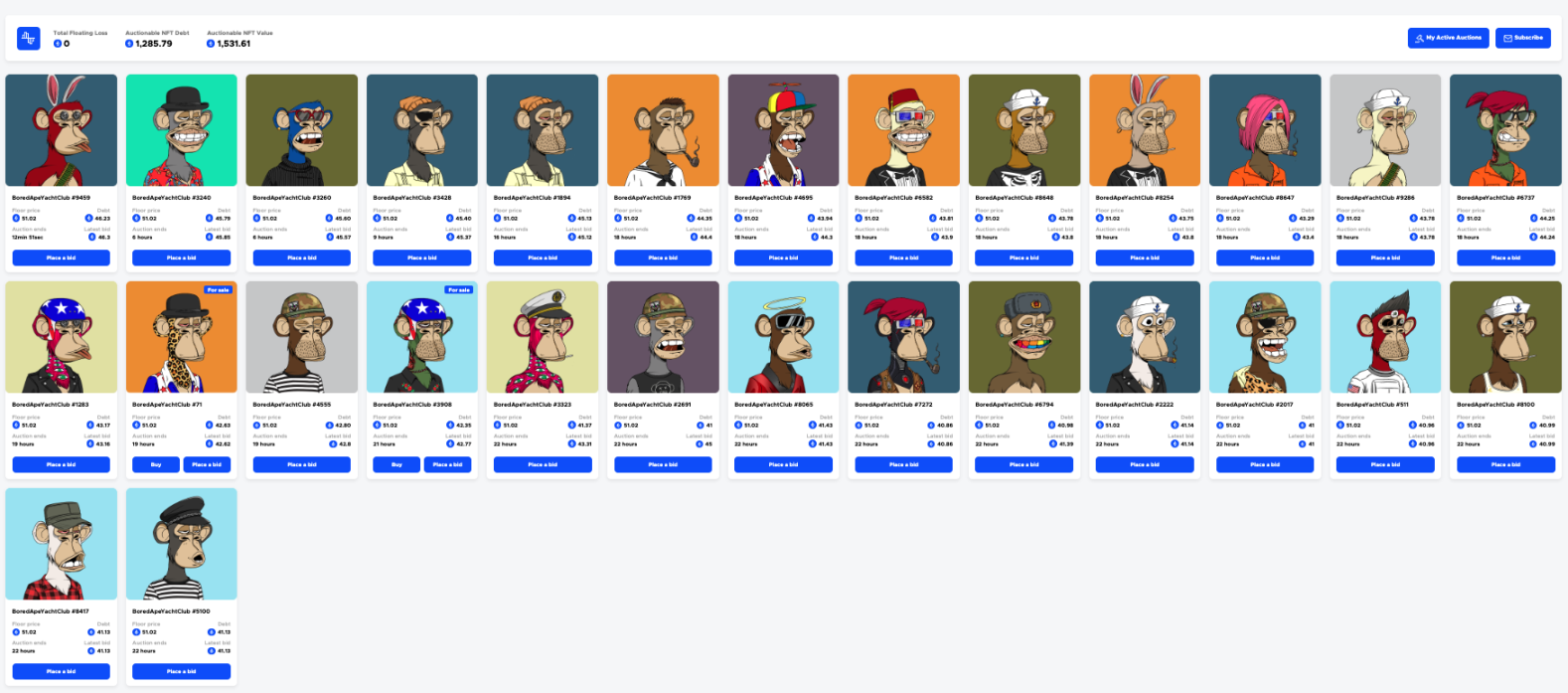

In addition to the BAYC that is currently being auctioned and liquidated, according to BendDAO's health factor alert list, there are currently 40 BAYC borrowers whose borrowing amount is between 35 - 40 ETH,

Suppose the borrower's (loan + interest) is 35, and the floor price of BAYC is a:

1 = (a*80%)/ ( 35 ), we can get a = 43.75

In other words, when the floor price of BAYC continues to drop to 43.75, 40 BAYCs will face liquidation.

51.02 * 95% = 48.469 ETH

It is worth noting that after the restriction that the minimum bid was 95% higher than the floor price was removed in August, based on the current price of 51.02 ETH,

The latest bids of the 28 NFTs that have entered the auction liquidation are all lower than the limit. If the liquidation protection period ends and the borrower has not yet repaid the arrears, BAYC that has successfully liquidated the auction may lower the floor price of the NFT series again, resulting in even more Many NFTs enter liquidation and enter a vicious circle.

Will the run happen again?

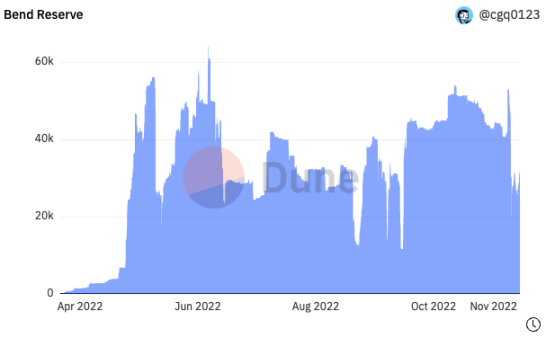

According to Dune'sdatadata

, As of November 14, BendDAO's reserves were 31387.5 WETH, which fell to 19848 WETH on November 10, a drop of 62% from the peak of 53079 on November 8.

Although the current reserve pool funds are still much higher than the level of BendDAO's liquidity crisis in August, this round of liquidation has just begun, and the market reaction is not yet obvious. The auction results of these 28 NFTs are currently being liquidated. If the floor price of BAYC continues to drop, under the influence of the "point-to-pool" mechanism, depositors' demand for liquidity may still easily lead to a run.

BendDAO's mechanism is perfect

In addition, there is another item in BendDAO's liquidation mechanism that if the borrower repays the loan during the liquidation auction, he still needs to pay a penalty to the first NFT auctioneer who bids, which is about 5% of the bid amount. PirateCode.eth, the co-founder of BendDAO, once tweeted that he was considering optimizing this rule.

The BAYC #2335 held by PirateCode.eth, the co-founder of BendDAO, also entered the liquidation auction on November 11. During the liquidation protection period, there was no repayment. Users who wanted to buy the NFT at a low price began to gear up. The auction The price pushed up to 71.03 ETH, and some community users even wondered whether the liquidity of PirateCode.eth was locked in FTX.But only 4 minutes before the 24-hour liquidation protection, PirateCode.eth repaid the arrears, BAYC#2335 automatically closed the liquidation, Twitter user Erick is still on Twittercomplain

PirateCode.eth also replied to the tweet, to the effect that his delay in repayment was testing some functions. Regarding the waste of bidders’ time, consider whether to distribute half of the borrower’s penalty during the liquidation protection period It goes to the first bidder and the other half goes to the highest bidder.

summary

summary