Decentralized Finance (DeFi)Decentralized Finance (DeFi)encrypted factsencrypted factsrun. With the continuous development of DeFi, the market demand for new types of collateral is increasing, not only the traditional on-chain native tokens, but also cross-chain tokens, stablecoins anchored to fiat currency, and tokenized off-chain assets etc.

first level title

What is a Certificate of Reserves?

Typically, cryptocurrency holders create public proof-of-reserves to prove to depositors their solvency through independent audits. Auditing is generally done by a centralized third party. This process is often time-consuming and labor-intensive, and relies heavily on manual processes.

smart contractsmart contractfirst level title

Chainlink Proof of Reserves

Chainlink Proof of ReservesOracleOracleThe operation of the network can automatically conduct real-time audits of collateral in DeFi applications to ensure the safety of users' funds, and prevent phenomena such as insufficient reserve ratios or off-chain custodian fraud. Users no longer need to trust the "paper promise" given by the custodian, but can use the Chainlink reserve certificate to automatically conduct on-chain audits, thereby ensuring the underlying mortgage rate of assets and improving the transparency of the encrypted asset ecosystem.

Additionally, Chainlink Proof-of-Reserves is increasingly being used to provide security for the minting, redeeming, and burning process of wrapped assets. Once the Chainlink Proof of Reserve finds that the collateralization rate of the wrapped token is insufficient, it can take advantage ofChainlink Automationfirst level title

Proof of reserve for cross-chain assets

Cross-chainCross-chainsecondary title

Proof of Reserve for Bitcoin

On Ethereum, wrapped bitcoins account for a large percentage of DeFi protocol collateral assets. Chainlink Proof of Reserves Reference Feed Can Provide DeFi Apps with the Data They Need to Auditas well asas well asrenBTC by Ren ProtocolThese two types of assets together account for more than 50% of the wrapped bitcoins on Ethereum.

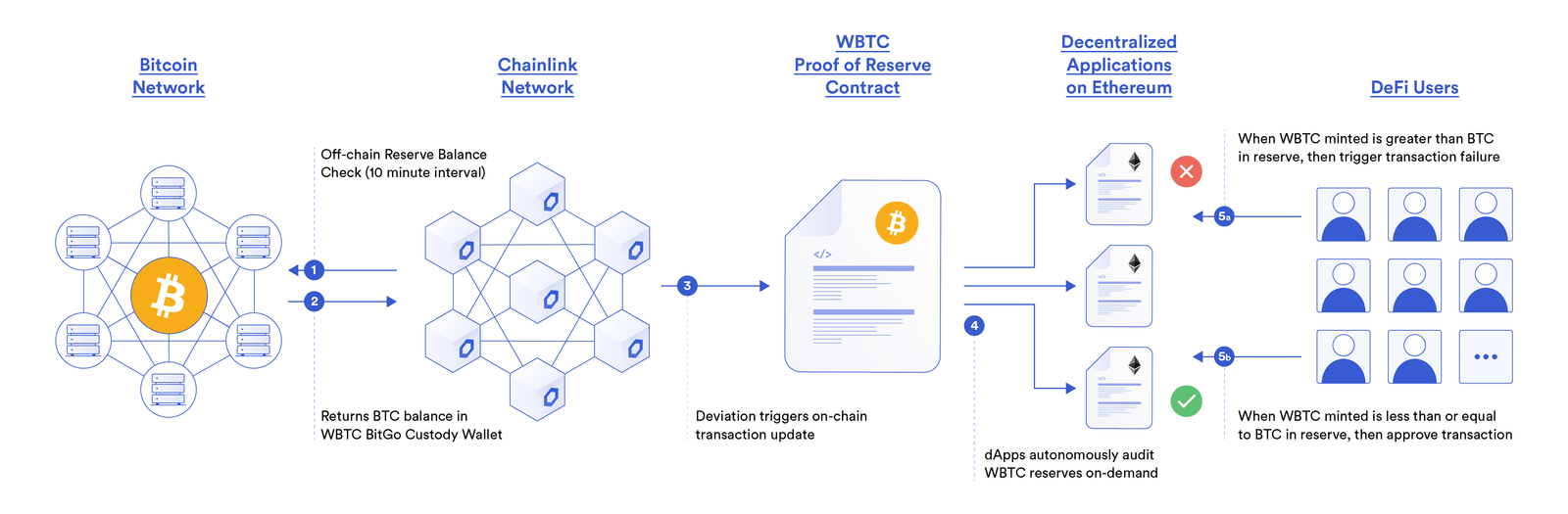

Proof of Reserve data is transmitted by the Chainlink oracle network, which checks every ten minutes for bitcoin balances in escrow addresses on the bitcoin blockchain. Whenever there is a deviation from the last balance stored on the chain, and the deviation exceeds a certain threshold, the reference data of the reserve certificate on the chain will be updated to reflect the real mortgage situation.

image description

Chainlink’s Proof-of-Reserve proves to the smart contract the amount of Bitcoin collateralized by BitGo’s WBTC.

first level title

stable currency

stable currencyIt is a crucial part of the DeFi ecosystem. Users can use relatively low-volatility currencies to trade and generate income. In addition, they can retain the key attributes of high certainty in blockchain smart contracts. Therefore, stablecoins are the most common collateral assets and have played a vital role in the development of the DeFi industry.

At present, the ecological value of stablecoins exceeds 100 billion U.S. dollars, so smart contracts increasingly need to prove that each stablecoin has a sufficient mortgage rate and is mortgaged by the same amount of off-chain assets.

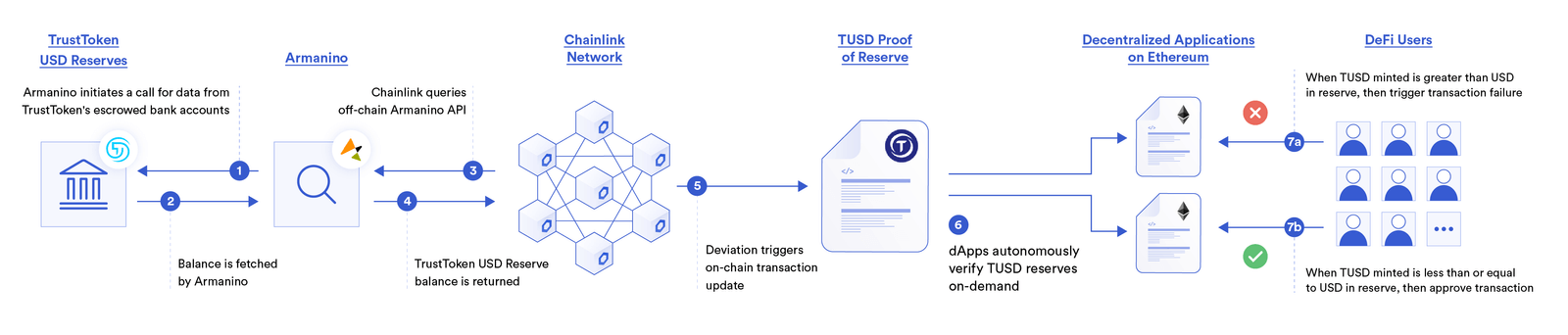

Chainlink Proof of Reserves obtains data from professional and credible audit firms, and transmits collateral data of stablecoin off-chain reserves to smart contracts. The most typical case is the use of TUSDProof of Reserves and Proof of Circulation, to prove to DeFi applications the USD reserves in the TrustToken custody bank account and the supply of TUSD tokens issued on each blockchain.

image description

text

In this model, Proof of Reserves can be used to track the off-chain fiat reserve ratio of any stablecoin. This mechanism not only improves the activity of DeFi retail users, but also attracts traditional financial institutions to participate and safely obtain income in the decentralized financial system.

In addition to USD-collateralized stablecoins (Note: USD-collateralized stablecoins are the most common anchor assets in the DeFi ecosystem), Chainlink Proof of Reserves can also provide collateral data for any type of anchor assets. These include fiat currencies such as the British pound or commodities such as gold, in order to improve the transparency of key links in the DeFi ecosystem. For example, Paxos is usingChainlink PoR price feedfirst level title

Proof of Reserves in Traditional Financial Markets

image description

How the Chainlink Reserve Proof secures the off-chain collateralization rate of wrapped tokens.

Chainlink proof of reserves can provide proof for a series of tokenized off-chain assets such as real estate, and verify the income generated by off-chain assets. The proof of reserves can check the property ownership and the custody bank account of the dollar income, and transmit the data to the chain, so that the smart contract can create a trustless token around the real estate and its income, and the mortgage rate of the token is decentralized by Chainlink network of oracle machines for verification.

In addition, Proof of Reserves can also be used in application scenarios other than DeFi and smart contracts. For example, traditional financial institutions can use this mechanism to improve the trust of customers and counterparties, access Chainlink oracle machines to send audit reports to the chain, and ensure that records cannot be tampered with.

Enterprises and institutions can use blockchain technology without changing their existing business models orEnterprise Backend SystemSummarize

Summarize

Chainlink Proof of Reserves can enhance the transparency of the DeFi ecosystem and the traditional financial system, and provide real proof of collateral for any assets on the chain. As the smart contract ecosystem continues to evolve, we must avoid market crashes caused by opaque processes and toxic collateral assets. Chainlink Proof of Reserves will further drive the DeFi ecosystem forward and secure the next generation of trust-minimized financial products.

To learn more about Chainlink Proof of Reserves, please visitOfficial Chainlink Proof-of-Reservesdeveloper documentationdeveloper documentationContact a Chainlink ExpertContact a Chainlink Expert。