Original title: "FTX Crashes: Market Analysis"

Original compilation: Block unicorn

Original compilation: Block unicorn

First came the collapse of Terra, then the bankruptcy of centralized crypto lenders, and now, FTX, one of the largest cryptocurrency exchanges in the world (almost certainly).

The FTX debacle has shaken confidence across the industry, in part because it’s a fundamentally different type of business than crypto lenders like Celsius. FTX is a cryptocurrency exchange, and its service is to facilitate trades for traders: they earn transaction fees on every trade they execute for their customers, FTX is not a trading company, nor is it a lender, so in theory, they are in Access to 100% of the client's assets at all times.

But we now know that was not the case due to a dangerously intertwined relationship with FTX’s sister company, Alameda Research, and the inappropriate use of FTX’s native cryptocurrency, FTT.

Shortly after FTX halted withdrawals following the massive outflow, SBF (FTX’s founder and CEO) announced a “strategic transaction” with rival Binance to ensure “customers are protected.” Binance then said it would not complete the deal (some reports said FTX US would have to be included for Binance to consider the deal), saying “these issues are beyond our control or ability to help.” SBF reportedly notified investors on Wednesday that FTX would need to file for bankruptcy, with a shortfall of up to $8 billion.

Ironically, FTX extended over $750 million in lines of credit to struggling crypto companies that ultimately went bankrupt largely because of misappropriation of client funds. While we still don't know the extent of the balance sheet hole, or whether acquisitions will materialize, the cryptocurrency industry has just undergone an epochal restructuring.

FTT: A cursed hybrid

The swift bankruptcy of one of the world's largest exchanges began with an investigative report by CoinDesk that said a large portion of Alameda's balance sheet was in FTT, a cryptocurrency created by FTX. This immediately raises questions about financial transaction law, namely: what is the actual purpose of financial transaction law?

Cryptocurrency exchanges have long issued their own tokens, which often offer little benefit beyond offering holders discounts on trading fees, but have received little scrutiny. As mentioned in FTX's FAQ section, here are the utilities for FTT:

What does FTT do? FTT will be the backbone of the growing FTX ecosystem:

FTT tokens will be listed on FTX.

FTX uses one-third of the transaction fee to continuously purchase and burn FTT tokens.

FTT will be available as collateral on FTX.

FTT will receive social benefits from FTX's backing liquidity fund.

Destruction mechanism: FTT tokens are continuously purchased and destroyed until half of the total amount of FTT tokens is destroyed.

The more we learn about FTT, the more it seems like this wrapped cryptocurrency underpins a large part of the FTX/Alameda empire. This token is extremely limited, but it is widely used as collateral: in DeFi, within FTX, and on the books of Alameda.

CoinDesk’s investigation revealed that Alameda not only has a large amount of FTT on its balance sheet, but has also been using FTT as collateral for loans. That in itself should be alarming, but the bigger question is: who accepted billions of dollars worth of FTT as collateral? New reports suggest that the lender in question is none other than FTX, as we can deduce through some on-chain reconnaissance work.

Alameda and most other cryptocurrency hedge funds suffered huge losses during the May market crash, and FTX attempted to repair those losses by exchanging its own funds for FTT as collateral. Nine times out of ten, some of these funds belong to their clients.

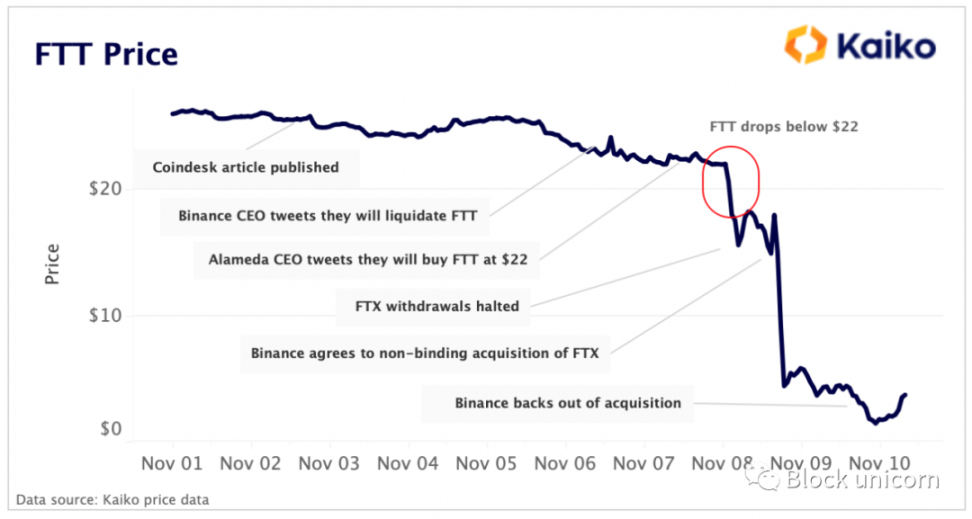

The information on Alamada’s balance sheet was sufficient for Binance CEO Changpeng Zhao (“CZ”) to announce that Binance would liquidate all of its FTT equity holdings (acquired as part of exiting FTX equity), which at the time were worth approximately 500 million Dollar. From there, things started to fall apart.

illiquid token

FTT is a relatively illiquid token, actively traded on only 10 exchanges, with a total of 23 spot markets. For comparison, BTC has ~370 spot trading markets, SOL has ~80 spot trading markets, and DOGE (meme token) has more than 130 spot trading markets (to learn more about FTT liquidity issues, you can check Block unicornd's For previous articles, click here).

Following CZ's tweet, Alameda CEO Caroline Ellison tweeted that her company would buy all of Binance's FTT for $22. If the solvency of the Alameda/FTX empire depends on FTT, maintaining its price may be the number one priority.

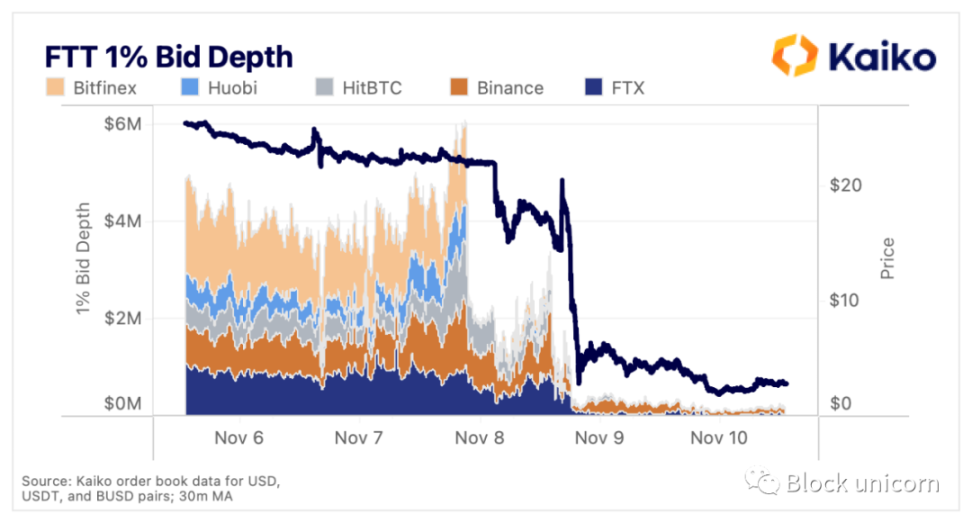

It's unclear if these off-market discussions have progressed, but at 9:15pm UTC on November 7, FTT's liquidity was quickly pulled from the order books. Bitfinex's 1% bid depth dropped from nearly $2 million to under $250, while Huobi's bid depth dropped from $1.5 million to under $3,000 in minutes. The depths of Binance and FTX remained constant over the same time frame, suggesting that a non-Alameda market maker may have decided to exit the Bitfinex and Huobi markets, perhaps after getting word that OTC talks between Binance and FTX had broken down.

Alameda likely accounted for the vast majority of market-making activity in FTT, which explains why the price of FTT only crashed a few days later when the selling pressure had already begun. At this point, before the crash, there is a sharp increase in market depth, indicating the presence of buying (if the market loses faith in an underlying, buying will plummet). But the sudden collapse in liquidity does raise the question of why Alameda didn't or couldn't do more to maintain its bid for FTT if the company's future depends on maintaining its price.

Five hours after the liquidity collapse, the price of FTT fell below $22. Liquidity seemed to improve as FTT rallied in the $15-$17 range, but disappeared again before it was announced that FTX would be acquired by Binance. The price of FTT rallied on the news, but quickly fell below $3. Since then, FTT has hovered around $200,000 deep in 1% of all markets, and it's unclear who is still making the market.

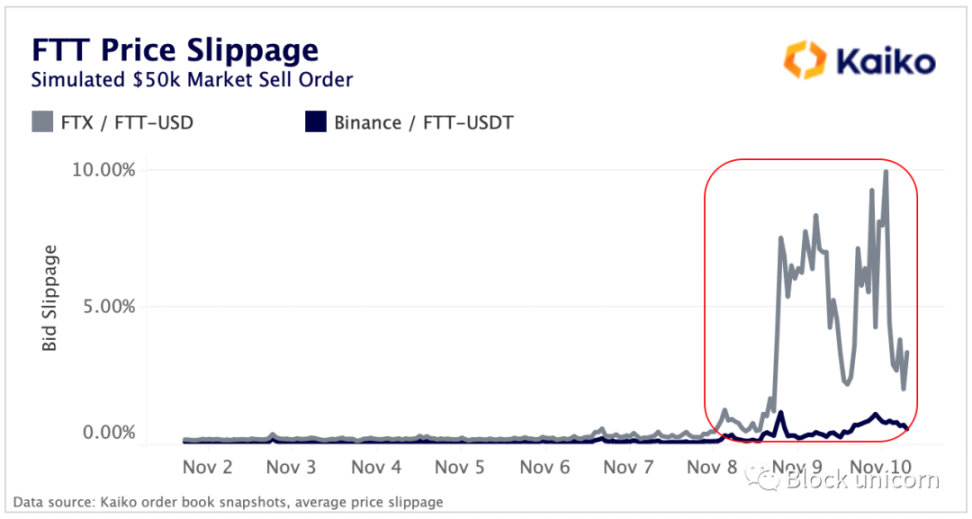

By watching the price slide, we can see how quickly FTT liquidity collapsed. By simulating a $50,000 market sell order, the two most liquid FTT pairs listed on Binance and FTX saw a sharp rise in decline. By Wednesday, a $50,000 FTT sell order on FTX will cause the FTT price to drop sharply by 8%. .

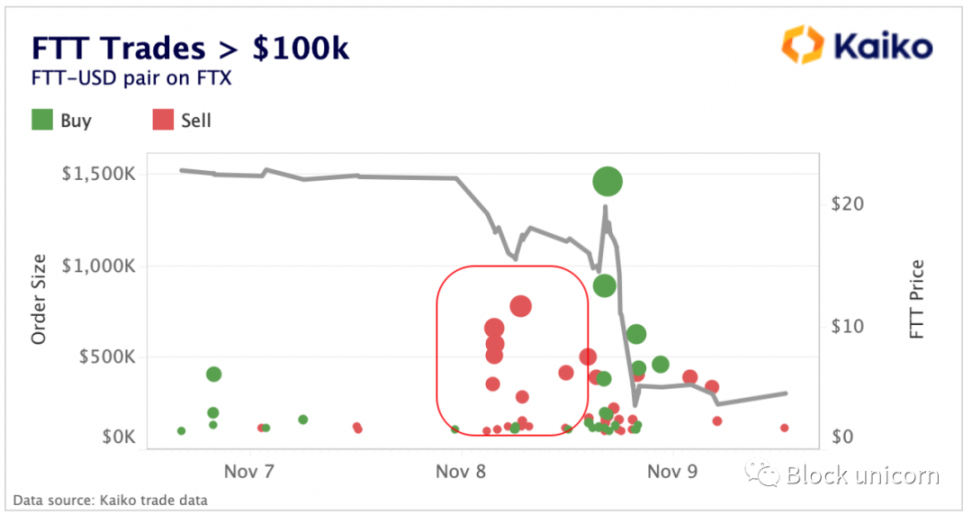

As the price fell, a large number of market sell orders poured in. Further disclosures about Multicoin Capital's exposure to FTT suggest that industry players are rapidly unwinding FTT positions as it falls below $22. Typically, traders would split their orders into smaller portions to avoid slippage, but in times of desperation, firms would accept any price they could get, with many orders exceeding $100,000.

As news of Binance’s potential acquisition spread, FTT saw a brief spike with several very large market buy orders, possibly Alameda trying to push the price higher, but the market quickly repriced the seriousness of the move.

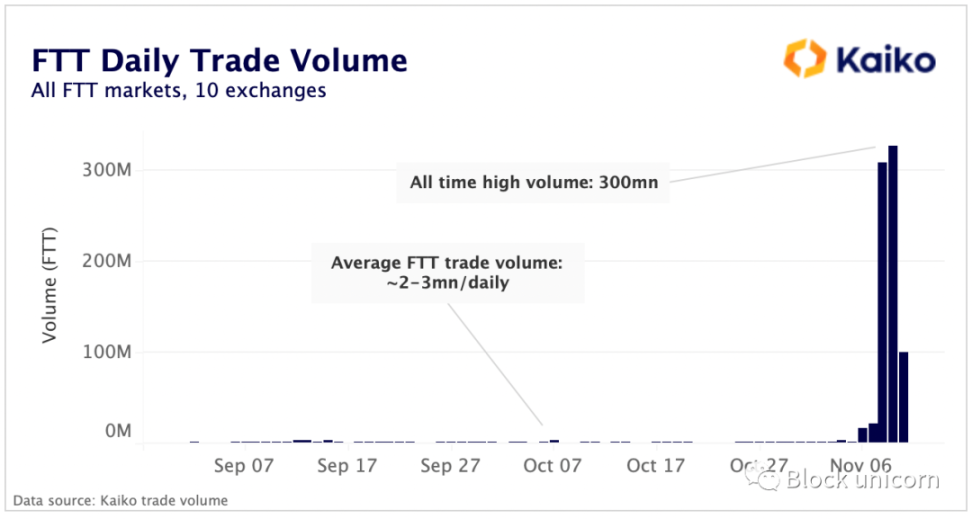

By the end of Tuesday, FTT trading volume had surged to an all-time high, with 300 million FTT traded in a single day. Trading volumes have since stabilized after Binance issued a warning to all traders on Wednesday to halt all FTT buying and selling due to the extreme risks involved.

FTT is almost worthless today, the token of an exchange with billions of dollars in holes in its books. The token has fallen nearly 90% in the past week and is currently trading below $3, with a fully diluted valuation of just over $1 billion.

Unfortunately, due to the importance of FTX and Alameda Research's intricate network of investments backed by the FTT token, the damage from this market crash was very widespread.

The knock-on effects of FTX/Alameda will take months to manifest and are too numerous to fully describe in one article. But let's start with FTX itself, and then expand to Alameda and the broader implications.

FTX in Purgatory

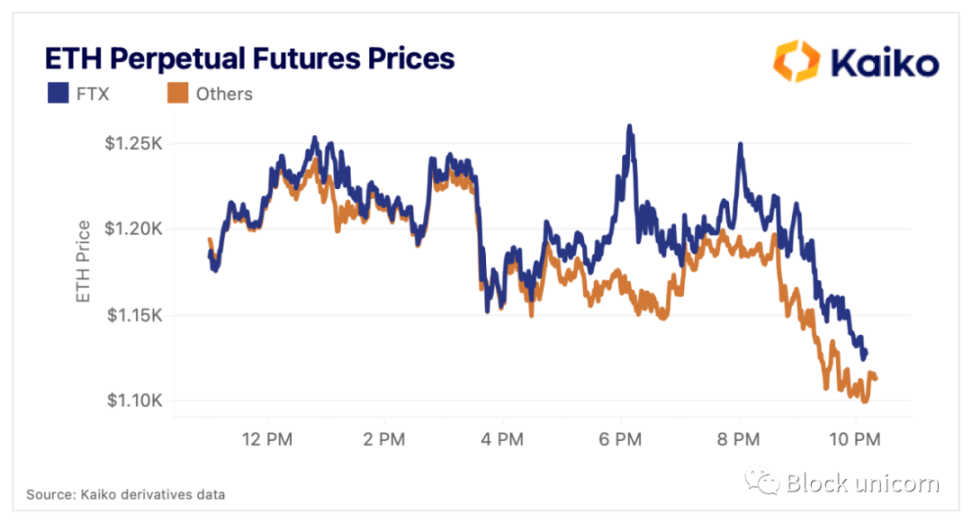

FTX is in purgatory right now, all funds on the exchange are effectively turned into Monopoly money or legal claims, depending on your time span. Both market makers and investing users are trapped on the exchange, isolated from other markets, and can only develop their own biosphere. The simplest manifestation of this is the price of the ETH perpetual contract on FTX, which started on November 9. There is a deviation from the ETH price on other exchanges.

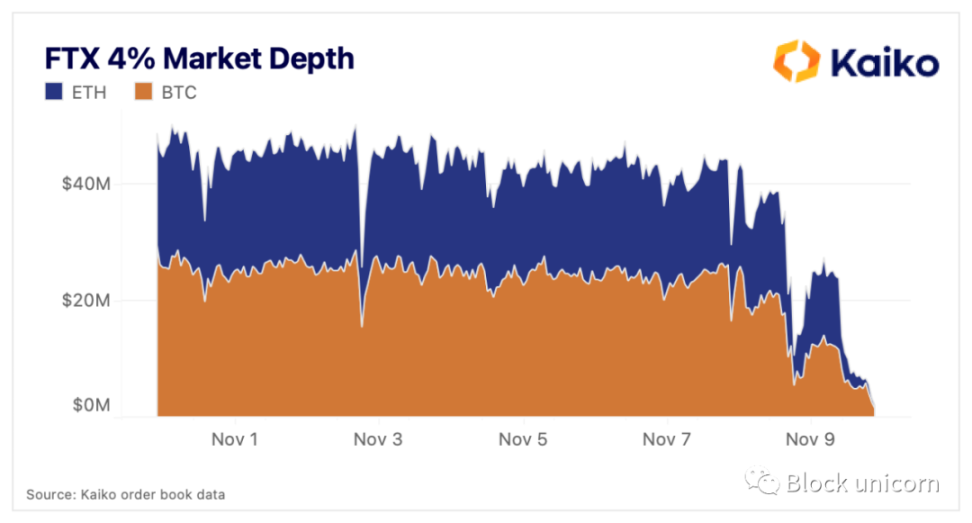

Liquidity on exchanges has evaporated, and understandably so. BTC's 4% market depth dropped from $25 million to below $2 million; ETH dropped from $17 million to below $750,000.

It is reasonable to expect that the FTX market will continue to grow stranger, with users becoming less connected to reality the longer they are stuck.

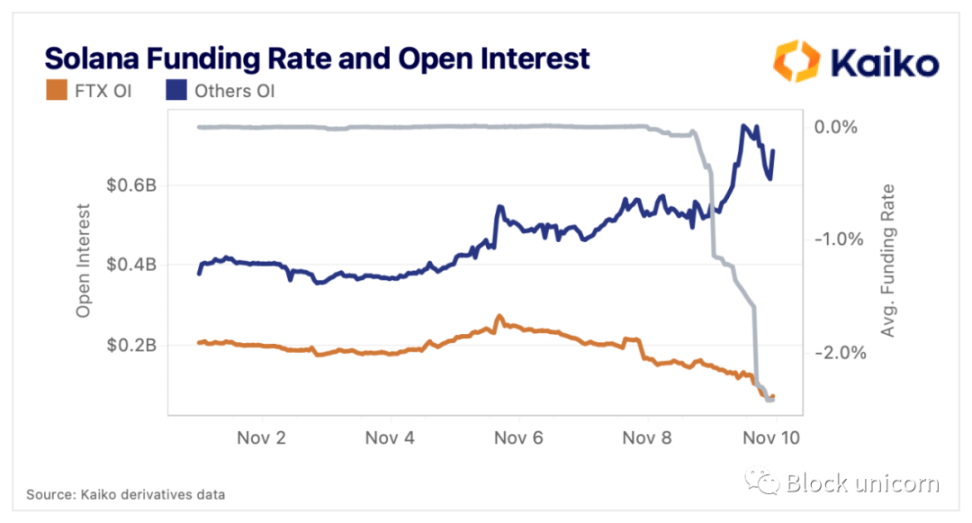

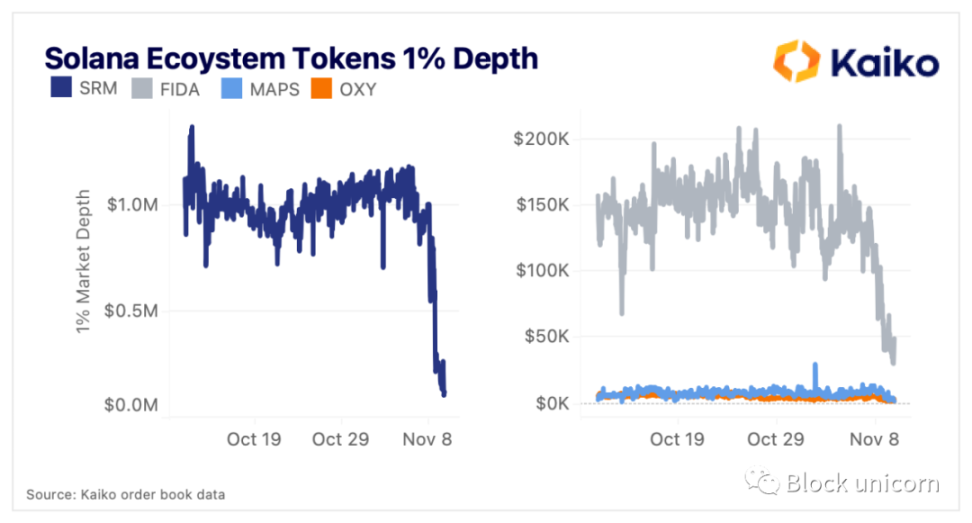

Moving on to Alameda, the company holds a significant amount of SOL and Solana ecosystem tokens. FTX was also an early supporter of the project, and SBF has often spoken highly of the network. The price of SOL plummeted in the crash, with open interest on FTX trending towards zero. A surge in open interest on other exchanges, combined with a sharp drop in funding rates, points to heavy short selling.

Alameda has long been involved in the Solana ecosystem and has built a reputation for investing in projects with a large number of fully diluted valuations and small market caps, allowing them to profit when early retail investors get crushed. Many of these tokens have fallen by more than 90% from their all-time highs (for OXY, the all-time token market capitalization, which always occurs immediately after the token launch). However, Alameda still holds these tokens, even though they have since become so illiquid that the company was unable to sell all of the tokens before they had returned to zero.

While this is a dark time for Solana and its ecosystem, the network will be tested as one of its most important (and predatory) supporters has withered (FTX or SBF). Both Ethereum and Bitcoin have had a similar — and possibly tougher — time to come through this holocaust and come out stronger. If SOL can survive this catastrophe, it can develop better in the future.

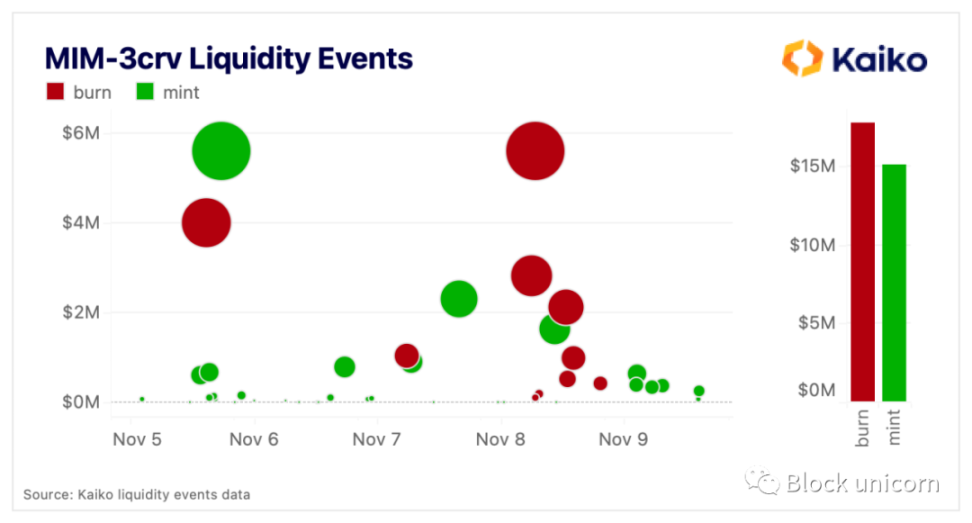

This effect has spread to Ethereum as well. People quickly realized that FTT was a major underpinning of the collateralized stablecoin MIM. On-chain investigations show that most of this is Alameda's position, which will be liquidated when FTT hits $6. On this news, MIM's peg began to falter, although the team soon announced that it was working with Alameda to reduce the size of their loans. MIM has since returned to a stable peg and has not seen strong outflows from its CRV pool, with MIM burnt just a little more than minted over the past few days.

On the other hand, the Lido Staked Ether (stETH) CRV pool has seen massive outflows over the past three days, with over $600 million in net outflows. The stETH discount has also reappeared, currently around 2%. While some have speculated that Alameda held a sizable stETH position that needed to be liquidated, the exact reason for this removal of liquidity and re-emergence of the discount is not entirely clear.

This is just one example of the countless ways this crash has shaken markets, both centralized and decentralized exchanges, and the full ramifications of SBF's arrogance really won't be fully understood for months. understand.

giants get bigger

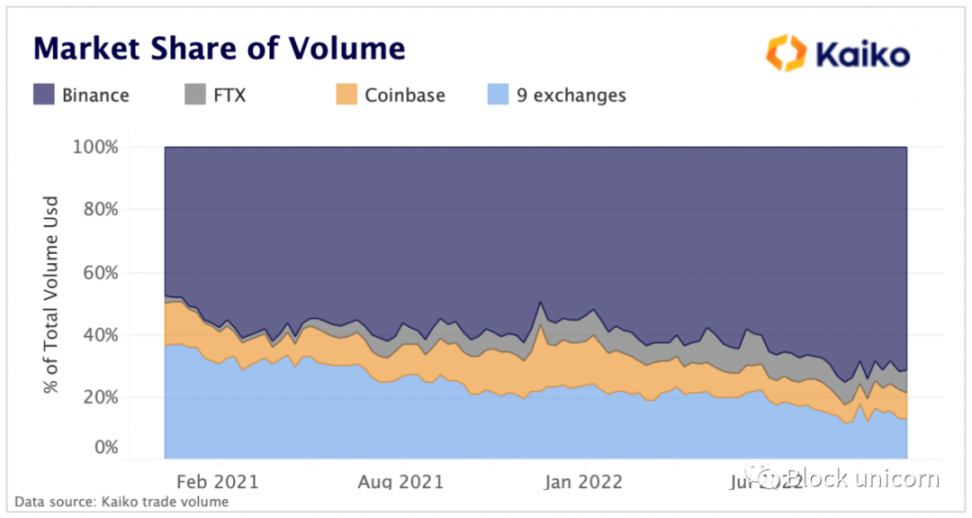

Although the acquisition seems to have all died down, what would a Binance+FTX giant look like? Since the start of 2021, Binance's market volume share has climbed from 47% to 71% relative to the 11 most liquid exchanges, and its total volume is greater than all other exchanges combined.

While FTX’s trading volume is a fraction of Binance’s, the exchange has experienced considerable growth at the expense of other exchanges. During the same period, FTX’s market share climbed from 2.5% to 7.5%, making the exchange Binance’s strongest competitor after Coinbase.

(The other 9 exchanges include FTX.US -- 0.8% -- and Binance.US -- 1.7% -- so the total market share is even larger when these US entities are taken into account.)

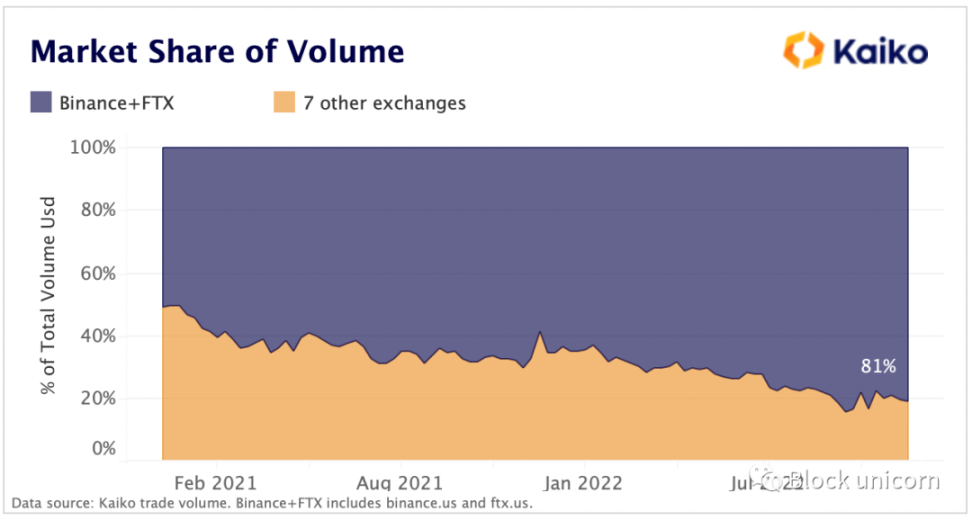

Now let's look at the market share post-acquisition, or very likely post-bankruptcy, assuming Binance claims any ex-traders using FTX.US, those traders' market share would increase.

Combine Binance.US and FTX US into the new Binance behemoth, and the exchange will claim over 80% of the total market share. In either case -- takeover or bankruptcy -- Binance's market share will almost certainly explode.

Loss of liquidity in Alameda

Alameda is one of the largest market makers in the cryptocurrency industry, along with Wintermute, B2C2, Genesis, and Cumberland. While it is impossible to know how much they contribute to overall market liquidity, their balance sheets clearly demonstrate that the firm is a systemically important market maker.

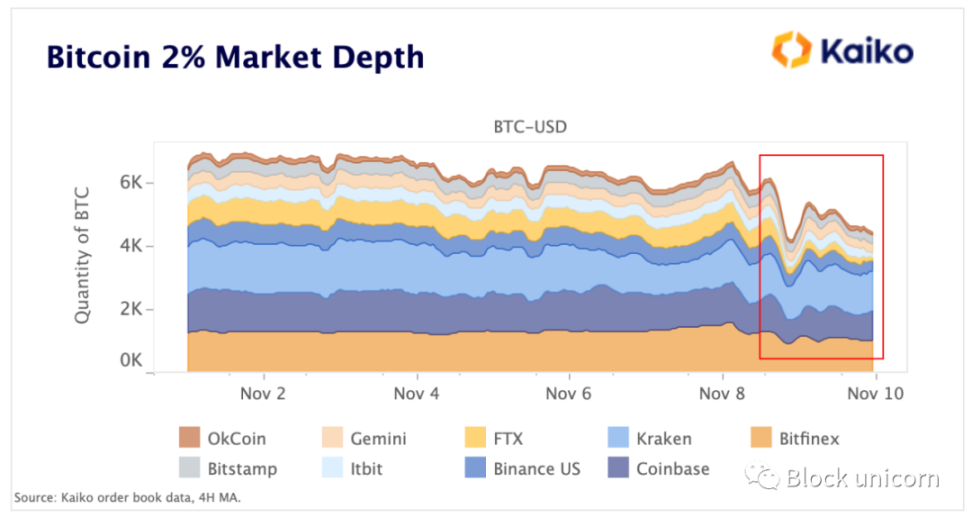

Alameda’s bankruptcy may have affected liquidity, with the number of BTC on BTC-USD orders falling from about 6,000 across all markets to 4,000 in the past two days.

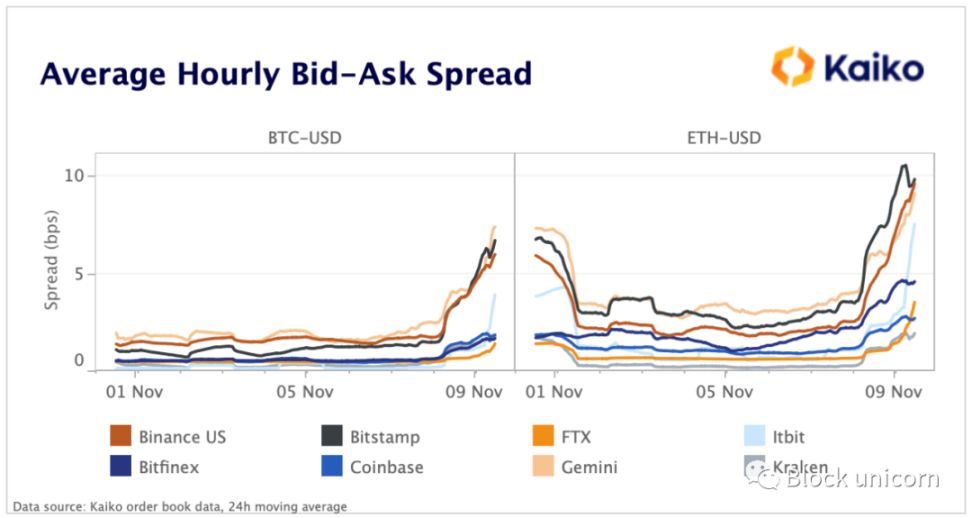

BTC and ETH spreads are at yearly highs on every exchange, suggesting that all market makers are extremely price sensitive amidst extreme volatility.

what to do now

Earlier this month, SBF came under fire for proposing to regulate the front-end of DeFi protocols. Instead of DeFi, regulators should focus directly on centralized entities that engage in serious risk mismanagement at the expense of their customers.

A three-pronged approach to the regulation of cryptocurrency centralized entities should include the following:

Proof of Reserve for exchanges and centralized lenders to prove they can match deposits at least 1:1.

Separation between the firm's trading/startup arm and their exchange business.

Disclosure of significant positions in these trading desks that could lead to market-wide contagion, as Alameda disclosed to FTT.

But even if all three were implemented, there would still be two major problems: (1) proof of reserves would not reveal liabilities; and (2) regulatory arbitrage. There is no way to guarantee that institutions will act honestly, even if they broadcast assets on the blockchain. There will always be jurisdictions that allow companies to play fast and play well; that's why SBF has bad news for investors at the same time in the Bahamas. (Although those in the cryptocurrency space are painful to admit, US regulations do protect customers in this situation, as FTX.US can continue to process withdrawals).

These two problems are very difficult to solve, but what not to face these two problems? DeFi can do without facing these two difficult problems. This crash, caused by a tangled, opaque web of deceit and greed — is DeFi’s greatest ad ever.

Now the question naturally turns to Binance, how risky is Binance to BNB and what happens if it goes to $0? Did Binance embezzle customer assets to invest, and if a similar bank run happened, could they match withdrawals 1:1 on the exchange? Hopefully Binance will do everything in its power to establish a transparent, solid financial position to avoid this type of bank run.

The collapse of FTX was a brutal blow to the industry, and we sympathize with all hurting investors, consumers and users. FTX's 7% market share will be displaced, but rebuilding lost trust will be the industry's toughest challenge right now. But we believe that the industry will recover. Ultimately, cryptocurrencies have proven their resilience time and time again, thanks to the countless builders and innovators who are committed to building a decentralized and transparent financial future.