With the fall of FTX, Solana (SOL), as a "direct project", is also experiencing its darkest moment. As of the publication, SOL was tentatively reported at $14.24, a 24-hour drop of 22.09%, and a one-week drop of up to 53.8%. What's even more frightening is that there are still a large number of SOL that are in the pledge unlocking stage and will soon return to the market.

secondary title

Total Locked Value: Continuously Decreasing

According to DeFi Llama data, as of the publication of the article, the total value of assets locked on the Solana chain is about 436 million US dollars, and the 24-hour shrinkage rate is as high as 30.39%, even exceeding the decline of SOL itself. The figure of US$10.17 billion from the peak period has shrunk by more than 95%.

secondary title

Oracles: intermittent downtime

With the rapid decline of Solana, some major oracle services on Solana chains such as Pyth have begun to experience intermittent downtime, resulting in transactions, lending and other on-chain activities that cannot be performed normally.

secondary title

DEX: Shrinking liquidity

As mentioned above, many DeFi projects, including DEX, are facing rapid shrinking TVL, which is not only affected by the decline in assets, but also related to the flight of a large amount of capital liquidity.

For DEX, this means that the user's exchange slippage will inevitably increase, and for the entire ecology, if the situation continues to deteriorate, this may affect other projects that rely on the DEX liquidity pool, such as or will As a result, the loan agreement cannot be fully liquidated, thereby creating bad debts.

secondary title

Borrowing: bad debts have already occurred

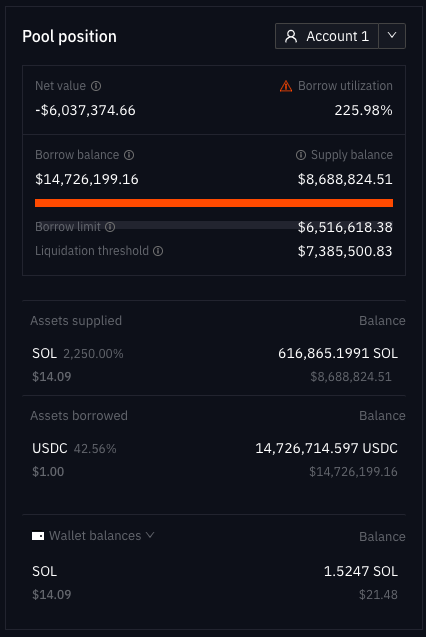

Under extreme conditions, due to network congestion, some lending agreements on Solana have already experienced bad debts.

Solend, the leading lending agreement, has previously tweeted that some positions have not been liquidated in time, and community users have discovered that only one giant whale address (3oSE9CtGMQeAdtkm2U3ENhEpkFMfvrckJMA8QwVsuRbE) currently has over $6 million in bad debts on Solend.

The data shows that the address currently has about 616,000 SOL (worth about $8,688,800) on Solend, but has lent out $14,726,000 in USDC, and the balance of the address is only 1.52 SOL.

secondary title

Potential Big Thunder: soBTC

If the above situation can still be understood as an old story under extreme market conditions (Ethereum and other ecosystems have also happened under extreme market conditions), soBTC (the main BTC encapsulation asset in the Solana ecosystem) is a problem at another level.

According to meow, a community developer who has participated in the deployment of wBTC, soBTC is the biggest potential problem currently facing the entire Solana. The reason for saying this is that the issuance mechanism of soBTC is different from other encapsulated cross-chain assets issued based on public smart contracts, but is issued independently by FTX (or Alameda), and FTX has not disclosed the formal issuance process.

soBTC is currently used in almost all mainstream DeFi protocols in the Solana ecosystem, and has long been used by the Solana community as a real BTC. All of this may be fine when FTX is running normally, but with the fall of FTX, no one knows whether the backing asset (BTC) that should exist at a 1:1 ratio behind soBTC still exists. If the answer is "no", no one can guess What kind of consequences will it cause...

Whether the price falls, shrinkage and liquidation, these are the natural results of the DeFi rules, but the evacuation of supporting assets is another matter entirely, and no one wants to see such outrageous events happen.